Corporate Controller Core Responsibilities

A Corporate Controller plays a vital role in an organization by overseeing financial reporting, budgeting, and compliance, while bridging gaps between accounting, finance, and operational departments. This position requires strong technical skills in financial analysis, operational knowledge for effective budget management, and problem-solving abilities to address complex financial challenges. These competencies are crucial in driving the organization towards its strategic goals. A well-structured resume that highlights these qualifications can significantly enhance job prospects for aspiring Corporate Controllers.

Common Responsibilities Listed on Corporate Controller Resume

- Oversee the preparation of financial statements and reports.

- Manage budgeting processes and financial forecasting.

- Ensure compliance with accounting standards and regulations.

- Conduct financial analysis to support strategic decision-making.

- Coordinate audits and liaise with external auditors.

- Implement and maintain internal controls to safeguard assets.

- Supervise accounting staff and provide training as needed.

- Collaborate with other departments on financial strategies.

- Monitor cash flow and working capital management.

- Evaluate and recommend improvements in financial systems and processes.

- Prepare and present financial performance metrics to senior management.

High-Level Resume Tips for Corporate Controller Professionals

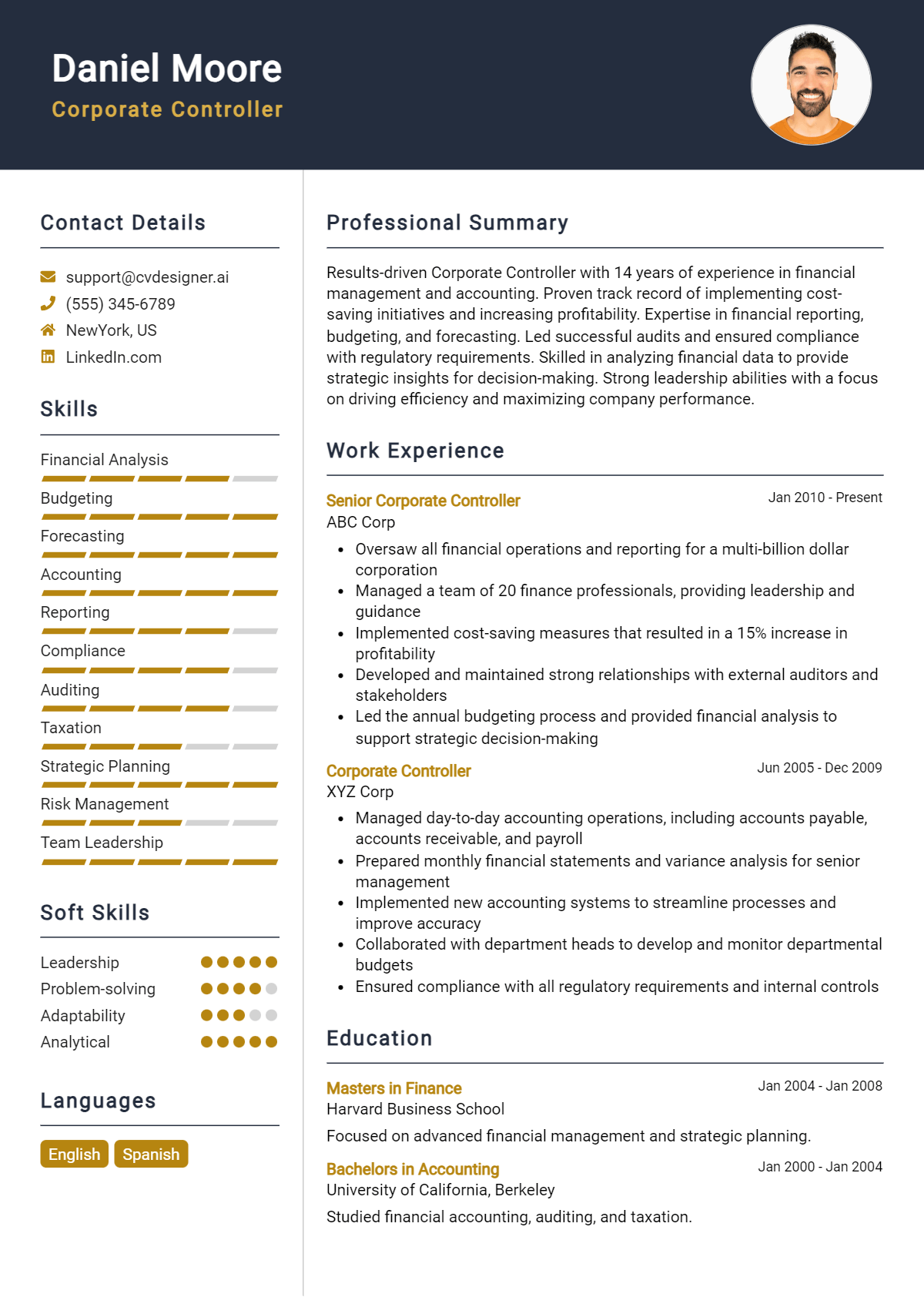

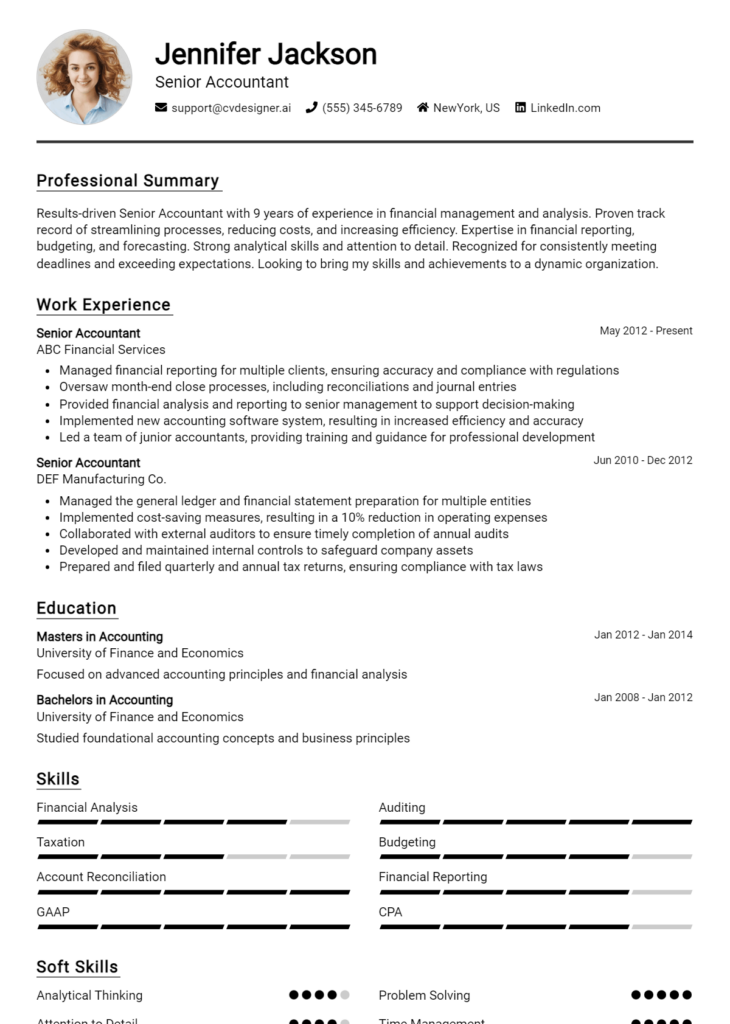

In today's competitive job market, a well-crafted resume is crucial for Corporate Controller professionals seeking to make a lasting impression on potential employers. As the first point of contact between a candidate and a company, the resume must effectively communicate not only the candidate's skills and qualifications but also their achievements and contributions in previous roles. For Corporate Controllers, whose responsibilities include overseeing financial reporting, managing budgets, and ensuring compliance, it is imperative that their resumes reflect both their technical expertise and strategic prowess. This guide will provide practical and actionable resume tips specifically tailored for Corporate Controller professionals to help them stand out in the hiring process.

Top Resume Tips for Corporate Controller Professionals

- Tailor your resume to the specific job description, emphasizing the most relevant skills and experiences that align with the role.

- Highlight your relevant work experience prominently, focusing on positions that involved financial management, reporting, and compliance.

- Quantify your achievements with specific metrics, such as cost savings, budget management, and efficiency improvements, to demonstrate your impact.

- Showcase your industry-specific skills, such as knowledge of relevant regulations, financial software, and accounting principles.

- Include keywords from the job posting to pass through applicant tracking systems and make your resume stand out to hiring managers.

- Utilize a clean and professional format, ensuring that your resume is easy to read and navigate.

- Incorporate a summary statement at the top of your resume that encapsulates your experience, expertise, and career goals.

- List relevant certifications, such as CPA or CMA, to establish your credibility and commitment to the field.

- Include examples of leadership and teamwork, as Corporate Controllers often collaborate with various departments to achieve organizational goals.

By implementing these tips, Corporate Controller professionals can significantly enhance their resumes, making them more appealing to hiring managers and increasing their chances of landing a job in this competitive field. A well-structured and targeted resume not only highlights individual qualifications but also conveys a candidate's potential to contribute effectively to an organization's financial success.

Why Resume Headlines & Titles are Important for Corporate Controller

In the competitive landscape of corporate finance, the role of a Corporate Controller is pivotal for maintaining financial integrity and guiding strategic decision-making. A well-crafted resume headline or title serves as the first impression a candidate makes on hiring managers, encapsulating their key qualifications in a succinct and impactful manner. A strong headline can immediately grab attention, allowing candidates to stand out in a sea of applicants. Therefore, it is crucial that the headline is concise, relevant, and directly aligned with the job being sought, effectively summarizing the candidate’s expertise and unique value proposition.

Best Practices for Crafting Resume Headlines for Corporate Controller

- Keep it concise: Limit your headline to one or two impactful phrases.

- Be role-specific: Use industry-related terminology that resonates with the Corporate Controller position.

- Highlight key skills: Focus on the most relevant skills or achievements that align with the job description.

- Use strong action verbs: Start with action-oriented words that convey leadership and initiative.

- Quantify achievements: Whenever possible, include metrics that showcase your impact on previous organizations.

- Tailor for each application: Customize the headline for each job application to reflect specific job requirements.

- Avoid jargon: Use clear language that is easily understood by hiring managers.

- Maintain professionalism: Ensure the tone is formal and suits the corporate environment.

Example Resume Headlines for Corporate Controller

Strong Resume Headlines

Results-Driven Corporate Controller with Over 10 Years of Experience in Financial Strategy and Compliance

Transformational Leader in Financial Operations, Achieving 30% Cost Reduction through Strategic Budgeting

Experienced Corporate Controller Specializing in Mergers & Acquisitions with Proven Track Record of Successful Integration

Weak Resume Headlines

Corporate Controller Looking for a Job

Finance Professional with Many Skills

The strong headlines are effective because they clearly communicate the candidate’s expertise, experience, and accomplishments, making them appealing to hiring managers looking for specific qualifications. In contrast, the weak headlines fail to impress due to their vagueness and lack of focus, leaving hiring managers uncertain about the candidate's actual capabilities and suitability for the Corporate Controller role.

Writing an Exceptional Corporate Controller Resume Summary

A well-crafted resume summary is crucial for a Corporate Controller, as it serves as the first impression for hiring managers. This concise yet impactful paragraph should encapsulate the candidate's key skills, relevant experience, and notable accomplishments in financial management. A strong summary quickly captures the attention of potential employers by highlighting specific qualifications that align with the job description, allowing the candidate to stand out in a competitive job market. By tailoring the summary to the specific position applied for, candidates can effectively convey their fit for the role while encouraging hiring managers to delve deeper into their resumes.

Best Practices for Writing a Corporate Controller Resume Summary

- Quantify achievements: Use specific numbers to highlight your accomplishments, such as increased revenue percentages or cost savings.

- Focus on relevant skills: Highlight key skills that are directly applicable to the Corporate Controller role, such as financial analysis, budgeting, and compliance.

- Tailor for the job description: Customize your summary to reflect the qualifications and requirements listed in the job posting.

- Be concise: Keep your summary to 3-5 sentences to ensure it's easy to read and impactful.

- Use strong action verbs: Begin sentences with powerful verbs to convey confidence and capability.

- Highlight leadership experience: Mention any management roles or team leadership to showcase your ability to lead financial teams.

- Include industry-specific terminology: Use language that is relevant to the finance and accounting sectors to demonstrate your familiarity with the field.

- Showcase problem-solving abilities: Highlight instances where you successfully identified and resolved financial issues.

Example Corporate Controller Resume Summaries

Strong Resume Summaries

Dynamic Corporate Controller with over 10 years of experience in financial reporting and compliance management, leading teams to achieve a 20% reduction in operating costs while enhancing efficiency. Proven track record in implementing financial strategies that drove a 15% increase in annual revenue.

Detail-oriented Corporate Controller skilled in developing and overseeing budgeting processes, resulting in a 30% improvement in forecast accuracy. Adept at collaborating with cross-functional teams to align financial goals with organizational objectives, contributing to a 25% growth in profit margins.

Results-driven Corporate Controller with expertise in financial analysis and risk management, successfully leading audits that resulted in zero compliance issues for three consecutive years. Recognized for enhancing financial reporting accuracy by 40% through the implementation of advanced software solutions.

Weak Resume Summaries

Experienced finance professional seeking a position as a Corporate Controller. Good with numbers and financial statements.

Corporate Controller with some experience in managing budgets and financial reports. Looking for new opportunities to grow in the field.

The strong resume summaries are considered effective because they provide specific, quantifiable results that demonstrate the candidate's impact on previous organizations. They also incorporate relevant skills and experience while tailoring the content to the role of a Corporate Controller. In contrast, the weak summaries are vague and lack measurable outcomes, failing to highlight the candidate's qualifications or how they can contribute to a potential employer's success. This makes them less compelling and memorable in a competitive job market.

Work Experience Section for Corporate Controller Resume

The work experience section of a Corporate Controller resume is pivotal in demonstrating a candidate's technical expertise, leadership capabilities, and commitment to delivering high-quality financial products. It serves as a narrative that highlights not only the responsibilities held but also the tangible results achieved. By quantifying achievements and aligning experiences with industry standards, candidates can effectively showcase their ability to manage teams, implement financial strategies, and contribute to the overall success of the organization. This section allows potential employers to gauge the candidate's fit for the role based on proven outcomes and relevant skills.

Best Practices for Corporate Controller Work Experience

- Focus on quantifiable achievements, such as cost savings, revenue growth, and efficiency improvements.

- Highlight specific technical skills relevant to financial reporting, compliance, and accounting systems.

- Emphasize leadership roles and teamwork experiences that demonstrate your ability to manage and develop finance teams.

- Use action verbs to describe your contributions and make your experiences more dynamic.

- Align your experiences with industry standards and benchmarks to show familiarity with best practices.

- Include notable projects or initiatives that had a significant impact on the organization.

- Tailor your work experience descriptions to match the job description of the Corporate Controller role you are applying for.

- Consider using metrics and KPIs to provide context and clarity to your accomplishments.

Example Work Experiences for Corporate Controller

Strong Experiences

- Directed a team of 10 finance professionals to streamline the monthly close process, reducing closing time by 30% and increasing overall accuracy by implementing new software solutions.

- Developed and executed a cost-reduction strategy that resulted in a savings of $1.2 million annually through process optimization and renegotiation of vendor contracts.

- Led a cross-functional team in the implementation of a new ERP system, enhancing reporting capabilities and achieving a 25% reduction in reporting errors.

- Managed compliance audits and financial reporting, resulting in zero discrepancies over three consecutive years, and improved stakeholder confidence.

Weak Experiences

- Responsible for overseeing financial operations.

- Worked on various projects to improve processes.

- Participated in team meetings and contributed to discussions.

- Assisted in preparing financial reports and budgets.

The examples provided are considered strong or weak based on their clarity and measurable impact. Strong experiences articulate specific achievements with quantifiable outcomes, showcasing the candidate's ability to lead, innovate, and deliver results. In contrast, weak experiences lack detail and do not demonstrate significant contributions or results, making it difficult for employers to assess the candidate's true value and impact within previous roles.

Education and Certifications Section for Corporate Controller Resume

The education and certifications section of a Corporate Controller resume plays a pivotal role in establishing the candidate's qualifications and expertise in financial management. This section not only highlights the academic background, including degrees in finance, accounting, or business administration, but also emphasizes industry-relevant certifications such as CPA or CMA. By showcasing relevant coursework and specialized training, candidates can demonstrate their commitment to continuous learning and professional development, significantly enhancing their credibility and alignment with the responsibilities of a Corporate Controller.

Best Practices for Corporate Controller Education and Certifications

- Prioritize degrees in accounting, finance, or business-related fields that are directly relevant to the role.

- Include industry-recognized certifications such as CPA, CMA, or CFA to showcase professional expertise.

- List relevant coursework that aligns with the skills required for a Corporate Controller, such as financial analysis, tax law, and auditing.

- Highlight any specialized training or workshops that demonstrate advanced knowledge of financial regulations or accounting software.

- Keep the information concise and focused; avoid listing irrelevant or outdated qualifications.

- Ensure the education and certifications section is formatted clearly for easy readability.

Example Education and Certifications for Corporate Controller

Strong Examples

- MBA in Finance, University of XYZ, 2020

- Certified Public Accountant (CPA), 2021

- Certified Management Accountant (CMA), 2022

- Advanced Financial Reporting Course, ABC Institute, 2019

Weak Examples

- Bachelor of Arts in English Literature, University of ABC, 2018

- Certification in Basic Accounting (Online Course), 2015

- High School Diploma, 2010

- Outdated certification: QuickBooks Pro Advisor, 2016

The strong examples listed above are considered effective because they demonstrate relevant academic credentials and certifications that align directly with the responsibilities and expectations of a Corporate Controller. In contrast, the weak examples reflect qualifications that are either irrelevant to the financial domain, outdated, or do not contribute to the candidate’s suitability for the role, potentially diminishing their overall credibility in a competitive job market.

Top Skills & Keywords for Corporate Controller Resume

In the competitive landscape of corporate finance, a Corporate Controller plays a pivotal role in ensuring the financial health and compliance of an organization. Crafting a standout resume for this position requires a keen emphasis on both hard and soft skills. These skills not only highlight the candidate's expertise in financial management but also showcase their ability to lead teams, communicate effectively, and adapt to changing regulatory environments. By showcasing the right blend of skills, candidates can demonstrate their suitability for the role, making it essential to curate a resume that reflects their competencies in both areas. For more insights on how to effectively present these skills, you can explore resources on skills and work experience.

Top Hard & Soft Skills for Corporate Controller

Soft Skills

- Leadership

- Communication

- Problem-solving

- Critical thinking

- Team collaboration

- Time management

- Adaptability

- Attention to detail

- Negotiation

- Strategic planning

- Interpersonal skills

- Conflict resolution

- Emotional intelligence

- Decision-making

- Analytical thinking

Hard Skills

- Financial reporting

- Budgeting and forecasting

- Tax compliance

- Auditing

- Financial analysis

- Regulatory compliance

- ERP systems proficiency

- GAAP knowledge

- Cash flow management

- Cost accounting

- Risk management

- Financial modeling

- Variance analysis

- Month-end closing

- Data analysis

- Performance metrics development

- Accounting software expertise

- Internal controls implementation

Stand Out with a Winning Corporate Controller Cover Letter

I am excited to apply for the Corporate Controller position at [Company Name], as advertised on [where you found the job listing]. With over [X years] of progressive experience in financial management and accounting, coupled with my comprehensive expertise in regulatory compliance and financial reporting, I am confident in my ability to contribute effectively to your team. My background includes a proven track record in overseeing financial operations, optimizing internal controls, and leading financial audits, all of which align seamlessly with the responsibilities outlined in the job description.

At my previous position with [Previous Company Name], I successfully led a team of [number of team members] finance professionals in implementing a new financial management system that improved reporting accuracy by [percentage] and reduced month-end close time by [number of days]. My proactive approach to problem-solving and my ability to analyze complex financial data have been instrumental in driving strategic financial planning and forecasting. Additionally, my commitment to fostering a collaborative team environment has enabled me to mentor junior staff and enhance overall team performance.

I am particularly drawn to [Company Name] because of its reputation for [mention any specific reasons related to the company, such as innovation, growth, or community involvement]. I am eager to bring my expertise in financial strategy and compliance to your organization, ensuring that your financial practices not only meet current regulatory standards but also support your long-term goals. I am enthusiastic about the opportunity to contribute to [specific project or value related to the company] and help drive [Company Name] forward as a leader in the industry.

Thank you for considering my application. I look forward to the opportunity to discuss how my skills and experiences align with the goals of [Company Name]. I am eager to contribute to your team and help foster a culture of financial excellence and integrity. Please feel free to contact me at [your phone number] or [your email address] to schedule a conversation.

Common Mistakes to Avoid in a Corporate Controller Resume

Crafting a resume for a Corporate Controller position requires careful attention to detail, as this role demands a high level of financial acumen and organizational skills. However, many candidates make common mistakes that can hinder their chances of securing an interview. Avoiding these pitfalls can significantly enhance the effectiveness of your resume, allowing you to present your qualifications in the best light possible.

Generic Objective Statements: Using a vague or generic objective statement can make your resume blend in with others. Instead, tailor your objective to highlight specific skills and experiences relevant to the Corporate Controller role.

Lack of Quantifiable Achievements: Failing to include quantifiable achievements makes it difficult for employers to assess your contributions. Highlight specific metrics, such as cost savings or revenue growth, to showcase your impact.

Omitting Relevant Skills: Not listing key skills that are crucial for the role, such as financial reporting, compliance knowledge, and team leadership, can leave employers questioning your qualifications. Ensure your skills section includes industry-specific competencies.

Poor Formatting: A cluttered or inconsistent format can distract from your content. Use clear headings, bullet points, and a professional font to create an easy-to-read layout that emphasizes your strengths.

Too Much Focus on Duties: Listing job responsibilities without emphasizing accomplishments can make your resume seem monotonous. Focus on what you achieved in each role rather than merely stating what you were responsible for.

Ignoring Industry Keywords: Not incorporating relevant industry keywords can hinder your resume's chances of passing through Applicant Tracking Systems (ATS). Research common terms used in job descriptions and include them where applicable.

Lengthy Resume: Submitting a resume that is overly long can deter hiring managers, who often prefer concise documents. Aim for a one to two-page resume that highlights your most relevant experiences and achievements.

Neglecting Professional Development: Failing to mention certifications or continued education relevant to finance and accounting can make you appear stagnant. Include any relevant certifications such as CPA or CMA to demonstrate your commitment to professional growth.

Conclusion

As we've explored the critical responsibilities and skills required for a Corporate Controller role, it's clear that this position demands a unique blend of financial acumen, leadership, and strategic vision. Corporate Controllers play a pivotal role in driving financial performance, ensuring compliance, and guiding decision-making processes within an organization. Key competencies include expertise in financial reporting, budgeting, forecasting, and team management, along with a strong understanding of regulatory requirements and risk management.

Given the competitive nature of finance roles, it’s essential to present a compelling resume that highlights your qualifications effectively. Take a moment to review your Corporate Controller resume and ensure it reflects your experience and skills accurately.

To help you get started, consider utilizing the following resources:

- Explore a variety of resume templates to find a design that suits your style.

- Use the resume builder for a step-by-step guide in crafting your professional profile.

- Check out resume examples for inspiration on how to showcase your accomplishments.

- Don’t forget to create a strong first impression with a tailored cover letter template that complements your resume.

By leveraging these tools, you can enhance your resume and significantly improve your chances of landing your desired Corporate Controller position. Take action today to elevate your career!