Certified Public Accountant Core Responsibilities

A Certified Public Accountant (CPA) plays a pivotal role in an organization by ensuring financial accuracy and compliance. Key responsibilities include preparing and analyzing financial statements, conducting audits, and advising on tax strategies. CPAs must possess strong technical skills in accounting software, operational understanding across departments, and problem-solving abilities to navigate complex financial challenges. These skills contribute significantly to an organization’s overall goals, and a well-structured resume can effectively highlight these qualifications, showcasing a CPA's value to potential employers.

Common Responsibilities Listed on Certified Public Accountant Resume

- Prepare and review financial statements in accordance with GAAP.

- Conduct audits to ensure compliance with financial regulations.

- Develop and implement tax strategies for clients and organizations.

- Provide financial consulting services to improve operational efficiency.

- Analyze financial data to identify trends and provide insights.

- Collaborate with management to develop budgets and forecasts.

- Maintain up-to-date knowledge of accounting laws and regulations.

- Assist in the preparation of quarterly and annual tax returns.

- Supervise junior accounting staff and provide training as needed.

- Prepare reports for stakeholders on financial performance.

- Manage accounts payable and receivable processes.

- Ensure timely and accurate financial reporting to management.

High-Level Resume Tips for Certified Public Accountant Professionals

In the competitive field of accounting, a well-crafted resume is essential for Certified Public Accountant (CPA) professionals seeking to make a strong impression on potential employers. Your resume often serves as the first point of contact, representing your professional identity and showcasing your skills and achievements. It is crucial to present a document that not only highlights your technical expertise but also reflects your unique contributions and value to prospective employers. This guide will provide practical and actionable resume tips specifically tailored for CPA professionals, ensuring your application stands out in a crowded job market.

Top Resume Tips for Certified Public Accountant Professionals

- Tailor your resume to the specific job description, using keywords and phrases that match the employer's requirements.

- Highlight your relevant experience, focusing on roles that demonstrate your capabilities in accounting, auditing, and tax preparation.

- Quantify your achievements with specific numbers and metrics, such as percentage increases in efficiency or savings generated for clients.

- Showcase industry-specific skills, including proficiency in accounting software, compliance knowledge, and financial analysis.

- Include a strong summary statement at the top of your resume that encapsulates your experience and career goals.

- Utilize bullet points for easy readability, ensuring each point succinctly describes your responsibilities and accomplishments.

- Incorporate relevant certifications and licenses prominently, such as your CPA designation and any specialized training.

- Keep the formatting clean and professional, using consistent fonts and sizes to enhance the overall presentation.

- Proofread for errors and ensure clarity, as attention to detail is a crucial skill for CPAs.

- Consider including a section for professional affiliations and memberships in accounting organizations to further demonstrate your commitment to the field.

By implementing these tips, CPA professionals can significantly increase their chances of landing a job in the competitive accounting landscape. A polished and targeted resume not only showcases your qualifications but also conveys your professionalism and dedication, making you a more attractive candidate to potential employers.

Why Resume Headlines & Titles are Important for Certified Public Accountant

In the competitive field of accounting, a Certified Public Accountant (CPA) must present themselves effectively to stand out in a pool of applicants. A strong resume headline or title plays a crucial role in this endeavor by immediately capturing the attention of hiring managers. It serves as a snapshot of the candidate's key qualifications, skills, or accomplishments, allowing recruiters to quickly assess their suitability for the role. A well-crafted headline should be concise, relevant, and tailored specifically to the job being applied for, ensuring it resonates with the employer's needs and expectations.

Best Practices for Crafting Resume Headlines for Certified Public Accountant

- Keep it concise—aim for one impactful phrase.

- Use role-specific keywords to align with the job description.

- Highlight your most relevant skills or certifications.

- Focus on your unique selling points, such as years of experience or specialized expertise.

- Avoid vague language; be specific about your qualifications.

- Use action-oriented language to convey your impact.

- Consider including quantifiable achievements when possible.

- Tailor your headline for each application to reflect the job requirements.

Example Resume Headlines for Certified Public Accountant

Strong Resume Headlines

Results-Driven CPA with 10+ Years of Experience in Tax Strategy and Compliance

Detail-Oriented CPA Specializing in Financial Auditing and Risk Management

Dynamic CPA with Proven Record in Cost Reduction and Financial Forecasting

Weak Resume Headlines

Accountant Seeking Job

Experienced Professional Looking for Opportunities

The strong headlines are effective because they convey specific qualifications and accomplishments, immediately indicating the candidate's value to potential employers. They incorporate relevant keywords and focus on the unique strengths that set the candidate apart. In contrast, the weak headlines lack specificity and fail to provide any meaningful information about the candidate's skills or experience, rendering them forgettable and ineffective in capturing the attention of hiring managers.

Writing an Exceptional Certified Public Accountant Resume Summary

A resume summary is a crucial component for Certified Public Accountants (CPAs) looking to stand out in a competitive job market. This brief yet impactful section serves as a snapshot of your professional qualifications, allowing hiring managers to quickly gauge your suitability for the role. A well-crafted summary highlights key skills, relevant experience, and notable accomplishments, making it easier for potential employers to see the value you bring to their organization. Given the demanding nature of the accounting profession, your summary should be concise and tailored specifically to the job you are applying for, ensuring that it captures attention immediately.

Best Practices for Writing a Certified Public Accountant Resume Summary

- Quantify achievements: Use numbers to demonstrate your impact, such as cost savings or revenue growth.

- Focus on relevant skills: Highlight skills that are directly applicable to the job, such as tax preparation or financial analysis.

- Tailor the summary: Customize your summary for each job application, integrating keywords from the job description.

- Keep it concise: Limit your summary to 2-4 sentences to maintain clarity and focus.

- Use strong action verbs: Start sentences with powerful verbs to convey your accomplishments effectively.

- Showcase certifications: Mention your CPA certification and any additional relevant qualifications.

- Include industry-specific terminology: Use jargon that resonates with accountants and financial professionals.

- Emphasize soft skills: Incorporate interpersonal skills such as communication and teamwork that are essential in the accounting field.

Example Certified Public Accountant Resume Summaries

Strong Resume Summaries

Detail-oriented CPA with over 8 years of experience in tax planning and compliance, successfully reducing client tax liabilities by up to 30%. Proficient in QuickBooks and SAP, with a strong focus on delivering high-quality financial reporting and analysis.

Results-driven CPA with a decade of experience in auditing and financial consulting, recognized for improving operational efficiencies that resulted in a 25% increase in audit accuracy. Expert in GAAP and IFRS standards with a strong commitment to ethical financial practices.

Dynamic CPA with extensive experience in managing multi-million dollar budgets and forecasting, achieving a 40% reduction in operational costs through strategic financial planning. Adept at leading cross-functional teams to enhance financial performance and compliance.

Weak Resume Summaries

Experienced accountant looking for a new opportunity to use my skills and knowledge in a challenging environment.

Detail-oriented professional with experience in finance and accounting seeking to contribute to a reputable company.

The examples of strong resume summaries are effective because they quantify achievements, directly relate to the job role, and demonstrate specific skills and experiences that set the candidate apart. In contrast, the weak resume summaries lack detail and do not provide measurable outcomes or specific skills, making them less impactful and memorable to hiring managers.

Work Experience Section for Certified Public Accountant Resume

The work experience section of a Certified Public Accountant (CPA) resume is critical as it provides a comprehensive overview of the candidate's professional journey, showcasing their technical skills and expertise in the field. This section reflects the candidate's ability to manage teams, adhere to compliance standards, and deliver high-quality financial products and services. By quantifying achievements and aligning experience with industry standards, candidates can effectively demonstrate their value to potential employers, making a compelling case for their employment.

Best Practices for Certified Public Accountant Work Experience

- Focus on quantifiable results, such as percentage improvements or cost savings achieved.

- Highlight specific technical skills and software proficiency relevant to accounting practices.

- Include leadership experiences that showcase your ability to manage teams or projects.

- Align your experience with industry standards and regulatory requirements.

- Use action verbs to convey a sense of proactivity and impact.

- Tailor your descriptions to the job description, emphasizing relevant experiences.

- Incorporate keywords from the accounting profession to enhance visibility in applicant tracking systems.

- Keep descriptions concise while ensuring clarity and detail in your accomplishments.

Example Work Experiences for Certified Public Accountant

Strong Experiences

- Successfully led a team of 5 accountants in a project that reduced audit discrepancies by 30%, enhancing overall compliance and accuracy.

- Implemented a new financial reporting system that increased reporting efficiency by 25%, saving the company over $50,000 annually.

- Conducted comprehensive audits for 10+ clients, resulting in an average client satisfaction score of 95% and a 15% increase in client retention.

Weak Experiences

- Worked on various accounting tasks without specifying the impact or results achieved.

- Assisted in audits and financial reporting with no quantifiable outcomes mentioned.

- Participated in team meetings to discuss accounting topics without detailing contributions or successes.

The examples presented highlight the distinction between strong and weak experiences based on their specificity and impact. Strong experiences effectively quantify achievements and demonstrate leadership and collaboration, showcasing the candidate's value to potential employers. In contrast, weak experiences lack detail and measurable outcomes, failing to convey the candidate's contributions and expertise in the accounting field.

Education and Certifications Section for Certified Public Accountant Resume

The education and certifications section of a Certified Public Accountant (CPA) resume is crucial for establishing a candidate's qualifications and expertise in the field. This section serves as a reflection of the candidate's academic background, showcasing their commitment to mastering accounting principles and practices. By including relevant coursework, industry-recognized certifications, and ongoing professional development, candidates can significantly enhance their credibility and demonstrate their alignment with the specific requirements of the CPA role. A well-structured education and certifications section not only highlights a candidate's foundational knowledge but also underscores their dedication to continuous learning and professional growth within the accounting profession.

Best Practices for Certified Public Accountant Education and Certifications

- List degrees in reverse chronological order, starting with the most recent.

- Include relevant coursework that aligns with CPA responsibilities, such as taxation, auditing, and financial reporting.

- Highlight certifications such as CPA, CMA, or EA, ensuring they are current and recognized in the industry.

- Provide details on specialized training or workshops attended that enhance your skills.

- Use clear and concise formatting to improve readability and highlight important credentials.

- Incorporate academic honors or distinctions to showcase outstanding achievements.

- Only include relevant certifications that specifically pertain to accounting and finance roles.

- Consider adding membership in professional organizations, such as the AICPA, to further demonstrate commitment to the profession.

Example Education and Certifications for Certified Public Accountant

Strong Examples

- M.S. in Accounting, University of Illinois, 2022

- Certified Public Accountant (CPA), licensed in California, 2021

- Bachelor of Science in Accounting, University of Florida, 2020

- Completed Advanced Taxation Workshop, National Association of Tax Professionals, 2023

Weak Examples

- Bachelor of Arts in History, University of Texas, 2010

- Certified Financial Planner (CFP), 2015 (not relevant for CPA role)

- Attended a seminar on Personal Finance, 2018 (too vague and not accounting-specific)

- High School Diploma, 2005 (not sufficient for CPA qualifications)

The strong examples are considered effective because they directly relate to the requirements and expectations of a Certified Public Accountant, showcasing relevant degrees, certifications, and specialized training that enhance the candidate's qualifications. In contrast, the weak examples highlight irrelevant or outdated educational qualifications and certifications that do not align with the CPA role, diminishing the candidate's appeal in a competitive job market. Including only pertinent information ensures that the resume clearly communicates the candidate's readiness and capability for the CPA position.

Top Skills & Keywords for Certified Public Accountant Resume

As a Certified Public Accountant (CPA), showcasing your skills effectively on your resume is crucial for standing out in a competitive job market. Employers seek candidates who not only possess technical knowledge but also demonstrate strong interpersonal skills. The right combination of hard and soft skills can significantly enhance your employability and highlight your suitability for the role. A well-crafted resume that emphasizes these competencies can make a significant difference in your job application process, leading you to opportunities that match your expertise and career aspirations.

Top Hard & Soft Skills for Certified Public Accountant

Soft Skills

- Communication Skills

- Attention to Detail

- Analytical Thinking

- Problem-Solving

- Time Management

- Team Collaboration

- Adaptability

- Ethics and Integrity

- Customer Service Orientation

- Critical Thinking

Hard Skills

- Financial Reporting

- Tax Preparation and Planning

- Auditing

- Budgeting and Forecasting

- Accounting Software Proficiency (e.g., QuickBooks, SAP)

- Regulatory Compliance

- Data Analysis

- Cost Accounting

- Financial Statement Analysis

- Risk Management

For more insights on relevant skills and how to effectively present your work experience, consider tailoring your resume to reflect both your technical capabilities and personal attributes.

Stand Out with a Winning Certified Public Accountant Cover Letter

As a dedicated and detail-oriented Certified Public Accountant with over five years of experience in financial reporting, tax preparation, and auditing, I am excited to apply for the CPA position at [Company Name]. My comprehensive knowledge of accounting principles and my commitment to delivering accurate financial analysis have consistently contributed to the fiscal health of my previous employers. I am eager to bring my expertise and proactive approach to your esteemed organization, ensuring compliance and strategic financial planning.

In my previous role at [Previous Company Name], I successfully managed a diverse portfolio of clients, conducting thorough audits and providing insightful recommendations that led to a 15% reduction in operational costs. I pride myself on my ability to communicate complex financial information clearly and effectively to clients and stakeholders, enabling them to make informed decisions. My proficiency in accounting software, including QuickBooks and SAP, combined with my rigorous analytical skills, allows me to streamline processes and enhance productivity.

I am particularly drawn to [Company Name] because of your commitment to integrity and excellence in financial management. I am excited about the opportunity to contribute to your team by leveraging my skills in tax strategy, budgeting, and financial forecasting. My goal is to help [Company Name] achieve its financial objectives while maintaining the highest standards of service and compliance. I am looking forward to the possibility of discussing how my background, skills, and enthusiasms align with the needs of your team.

Thank you for considering my application. I am eager to bring my strong work ethic and passion for accounting to [Company Name]. I look forward to the opportunity to discuss my application in more detail and explore how I can contribute to your organization’s success. Please feel free to contact me at your earliest convenience to arrange a meeting.

Common Mistakes to Avoid in a Certified Public Accountant Resume

When crafting a resume for a Certified Public Accountant (CPA) position, it's crucial to present your qualifications and experience effectively. Many candidates unknowingly make mistakes that can undermine their chances of landing an interview. A well-structured resume is essential in showcasing your skills, relevant experience, and professional attributes. Here are some common mistakes to avoid to ensure your resume stands out positively to potential employers:

Typos and Grammatical Errors: Attention to detail is critical in accounting. Errors in your resume can signal carelessness, making employers question your competency.

Generic Objective Statements: Using a one-size-fits-all objective statement can make your resume feel impersonal. Tailor your objective to reflect your specific goals and how they align with the company's needs.

Lack of Quantifiable Achievements: Simply listing job duties without quantifying your accomplishments can make your experience seem less impactful. Use numbers to demonstrate your contributions, such as "increased efficiency by 20%."

Overly Complicated Language: While you may want to showcase your expertise, using jargon or overly complex language can confuse hiring managers. Aim for clarity and conciseness.

Ignoring Relevant Skills: Failing to highlight skills relevant to the CPA role, such as tax preparation, auditing, or financial analysis, can lead to missed opportunities. Make sure to include skills that match the job description.

Inconsistent Formatting: A resume with inconsistent fonts, sizes, or spacing can look unprofessional. Stick to a clean, uniform format to enhance readability.

Too Much Personal Information: Including excessive personal details, such as age, marital status, or hobbies, is unnecessary and can lead to bias. Focus on professional qualifications and experiences.

Not Customizing for Different Positions: Sending out the same resume for various CPA roles can be detrimental. Customize your resume for each application to highlight the most relevant experiences and skills for that specific position.

Conclusion

As a Certified Public Accountant (CPA), your resume is a crucial tool in showcasing your qualifications, skills, and experience in the competitive accounting field. Throughout this article, we've explored the essential components of an effective CPA resume, including the importance of highlighting your educational background, relevant certifications, and professional experience. We also discussed the value of tailoring your resume to specific job descriptions and incorporating keywords that resonate with potential employers.

Additionally, we emphasized the need for clarity and conciseness in your resume, ensuring that it presents your accomplishments in a way that stands out. Remember to include quantifiable achievements that demonstrate your ability to drive results, whether through tax preparation, auditing, or financial consulting.

Now that you have a clearer understanding of how to craft an impactful CPA resume, it's time to take action. Review your current resume and consider how you can enhance it to better reflect your skills and experiences. Utilize available tools to streamline the process:

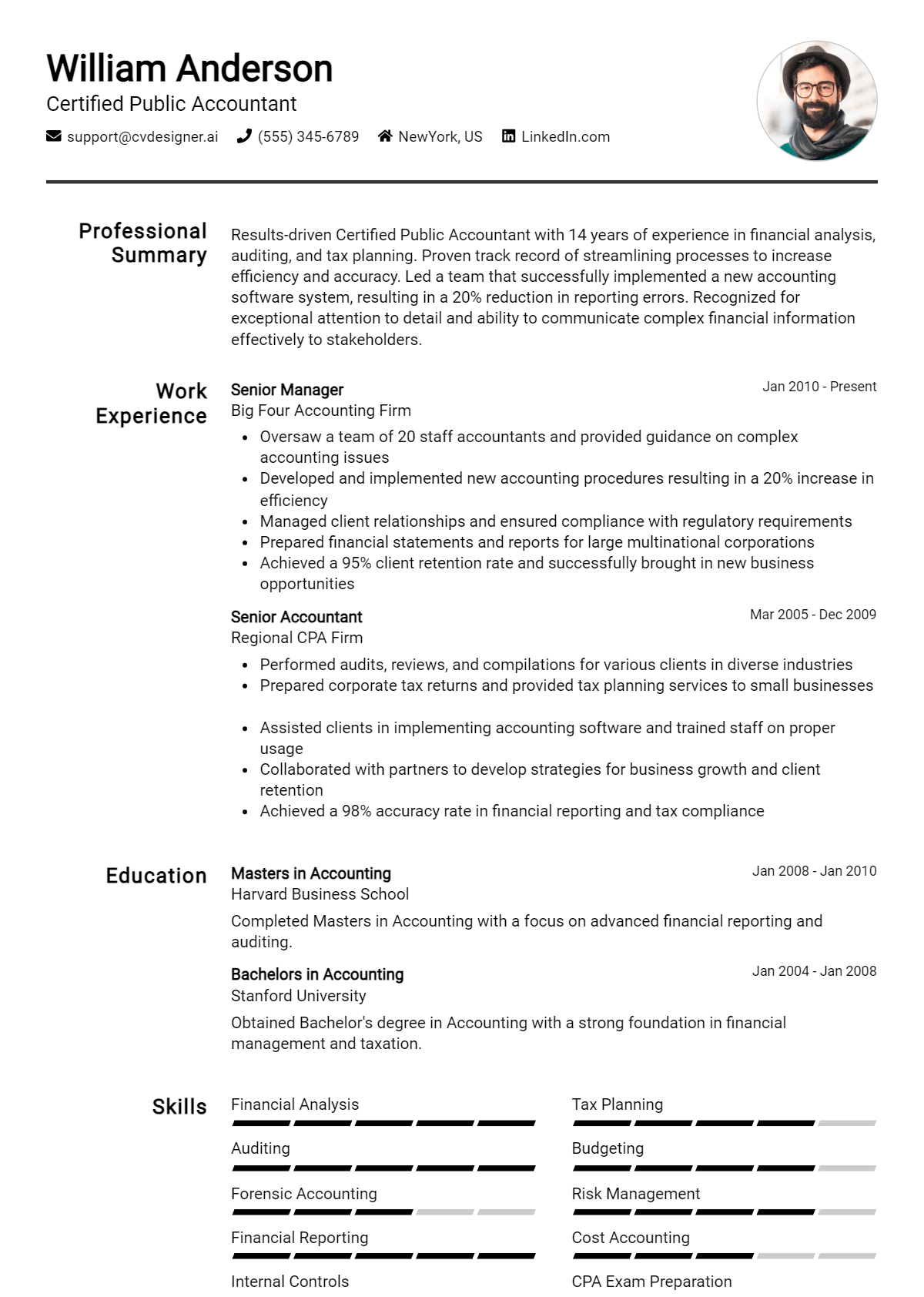

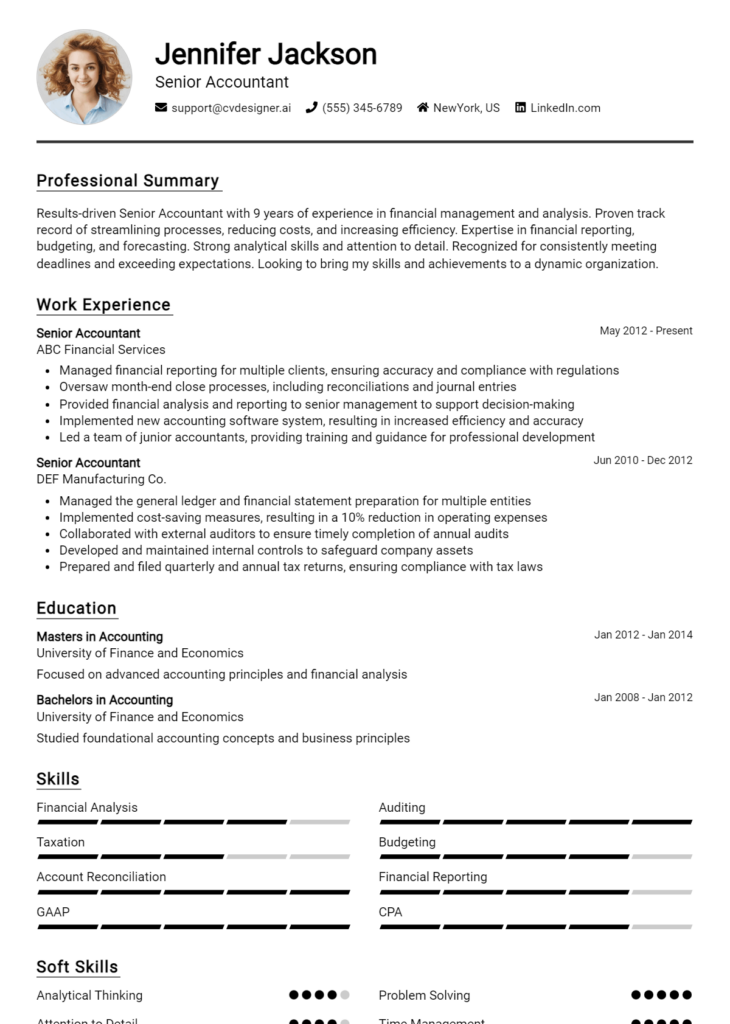

- Explore resume templates to find a professional layout that suits your style.

- Try our resume builder for easy, step-by-step guidance in creating a standout resume.

- Check out resume examples for inspiration and ideas on how to present your qualifications effectively.

- Don't forget about the importance of a strong introduction; use our cover letter templates to complement your resume.

By investing the time to refine your resume, you can improve your chances of landing that desired CPA position. Start today!