Mortgage Reporting Analyst Core Responsibilities

A Mortgage Reporting Analyst plays a crucial role in bridging various departments by analyzing and reporting mortgage data to support decision-making processes. Key responsibilities include preparing detailed reports, ensuring data accuracy, and collaborating with operations, compliance, and finance teams. Essential skills encompass strong analytical capabilities, technical proficiency in reporting tools, and effective problem-solving abilities. These competencies contribute significantly to the organization’s goals by driving informed strategies, while a well-structured resume effectively highlights these qualifications to potential employers.

Common Responsibilities Listed on Mortgage Reporting Analyst Resume

- Compile and analyze mortgage data for reporting purposes.

- Prepare detailed financial reports for management review.

- Ensure compliance with regulatory requirements and company policies.

- Collaborate with cross-functional teams to improve reporting processes.

- Identify trends and anomalies in mortgage data.

- Develop and maintain reporting dashboards and visualizations.

- Assist in the reconciliation of mortgage accounts.

- Provide insights to enhance operational efficiency.

- Perform quality checks to ensure data integrity.

- Support ad-hoc reporting requests from senior management.

- Document processes and procedures for reporting activities.

- Stay updated on industry trends and reporting technologies.

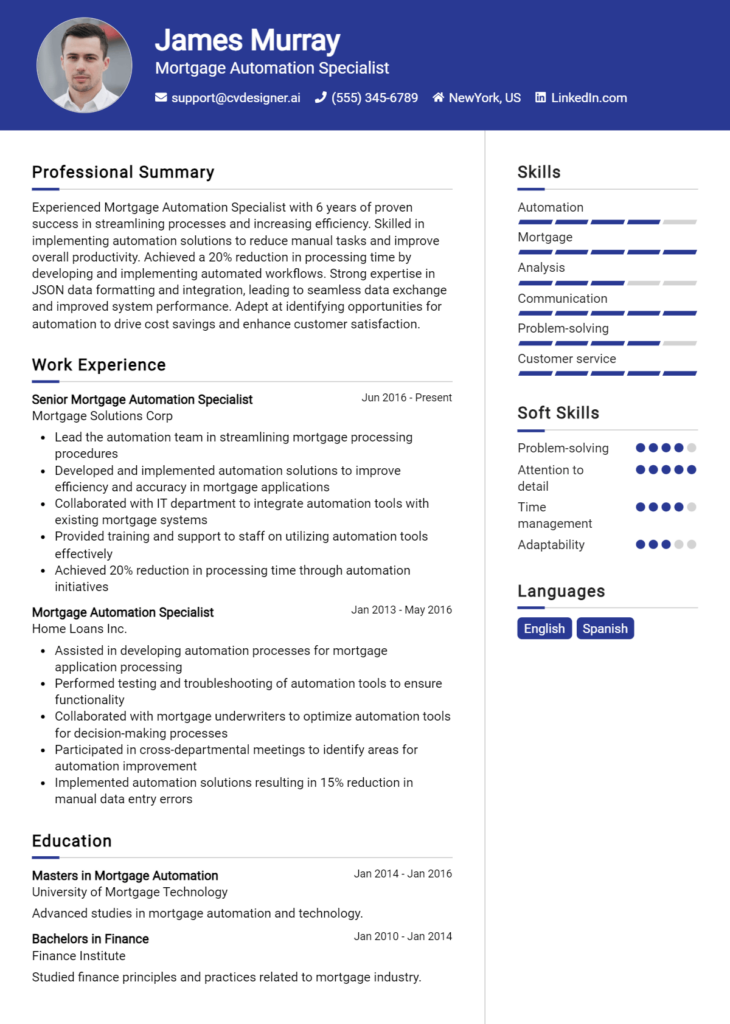

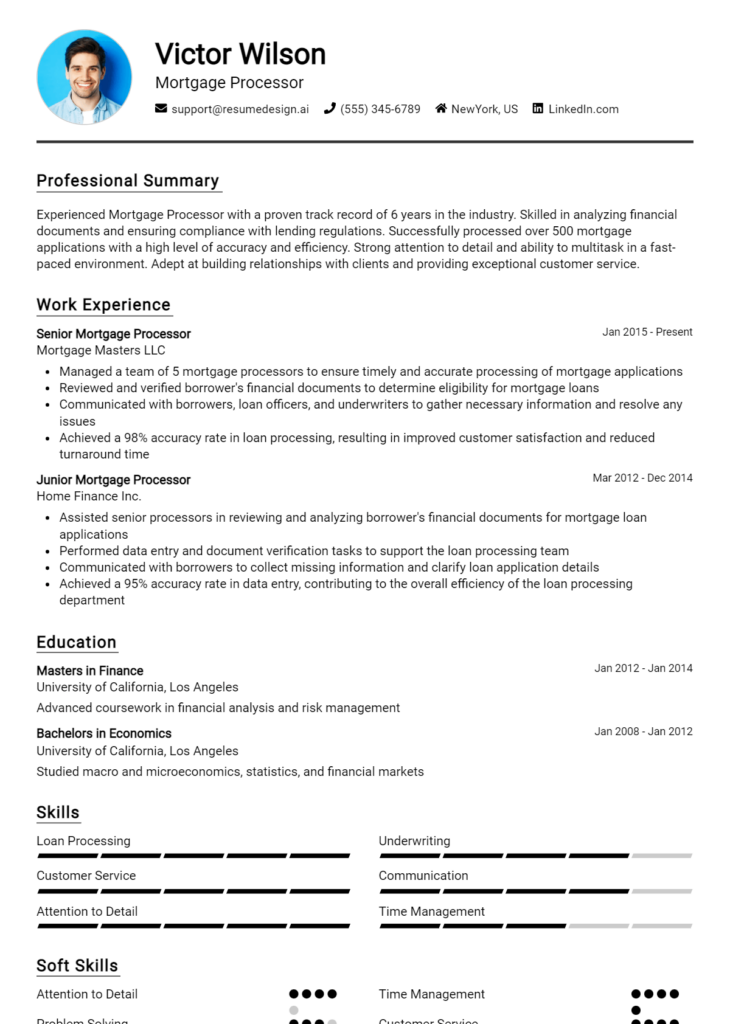

High-Level Resume Tips for Mortgage Reporting Analyst Professionals

In the competitive landscape of the mortgage industry, a well-crafted resume is an essential tool for Mortgage Reporting Analyst professionals. Often, your resume serves as the first impression you make on potential employers, making it crucial that it effectively showcases your skills, experience, and achievements. A tailored resume not only highlights your qualifications but also reflects your understanding of the industry and the specific demands of the role. This guide aims to provide practical and actionable resume tips specifically designed for Mortgage Reporting Analyst professionals, ensuring you stand out in a crowded job market.

Top Resume Tips for Mortgage Reporting Analyst Professionals

- Tailor your resume to each job description, emphasizing the specific skills and experiences that align with the role.

- Start with a strong summary statement that encapsulates your key qualifications and career objectives.

- Highlight relevant work experience in mortgage reporting, compliance, and data analysis to demonstrate your expertise.

- Quantify your achievements, using metrics to illustrate your contributions, such as improving reporting accuracy or reducing processing times.

- Showcase your proficiency in industry-specific software and tools, such as loan origination systems or reporting platforms.

- Incorporate keywords from the job posting to help your resume pass through automated screening systems.

- Include any relevant certifications or licenses that enhance your qualifications, like the Mortgage Bankers Association (MBA) certification.

- Demonstrate strong analytical and problem-solving skills by providing examples of how you've addressed challenges in previous roles.

- Keep the layout clean and professional, using bullet points for easy readability and ensuring consistent formatting.

By implementing these tips, Mortgage Reporting Analyst professionals can significantly enhance their resumes, increasing their chances of landing interviews and securing jobs in this specialized field. A focused and polished resume not only reflects your capabilities but also conveys your commitment to excellence in the mortgage industry.

Why Resume Headlines & Titles are Important for Mortgage Reporting Analyst

In the competitive job market for Mortgage Reporting Analysts, a well-crafted resume headline or title plays a crucial role in capturing the attention of hiring managers. A strong headline not only serves as the first impression but also succinctly encapsulates a candidate's key qualifications and strengths in a single impactful phrase. It should be concise, relevant, and directly related to the position being applied for, ensuring that it resonates with the specific needs of the hiring organization. A compelling title can set the tone for the resume, compelling hiring managers to delve deeper into the candidate's qualifications and experience.

Best Practices for Crafting Resume Headlines for Mortgage Reporting Analyst

- Keep it concise: Aim for one to two impactful phrases.

- Be role-specific: Tailor the headline to the Mortgage Reporting Analyst position.

- Highlight key qualifications: Focus on the most relevant skills or achievements.

- Use action-oriented language: Begin with strong verbs that convey competence.

- Incorporate industry keywords: Use terms and phrases commonly found in job descriptions.

- Avoid jargon: Ensure clarity and accessibility for all readers.

- Showcase measurable achievements: If applicable, include quantifiable results.

- Match the tone of the job description: Align with the company’s culture and language style.

Example Resume Headlines for Mortgage Reporting Analyst

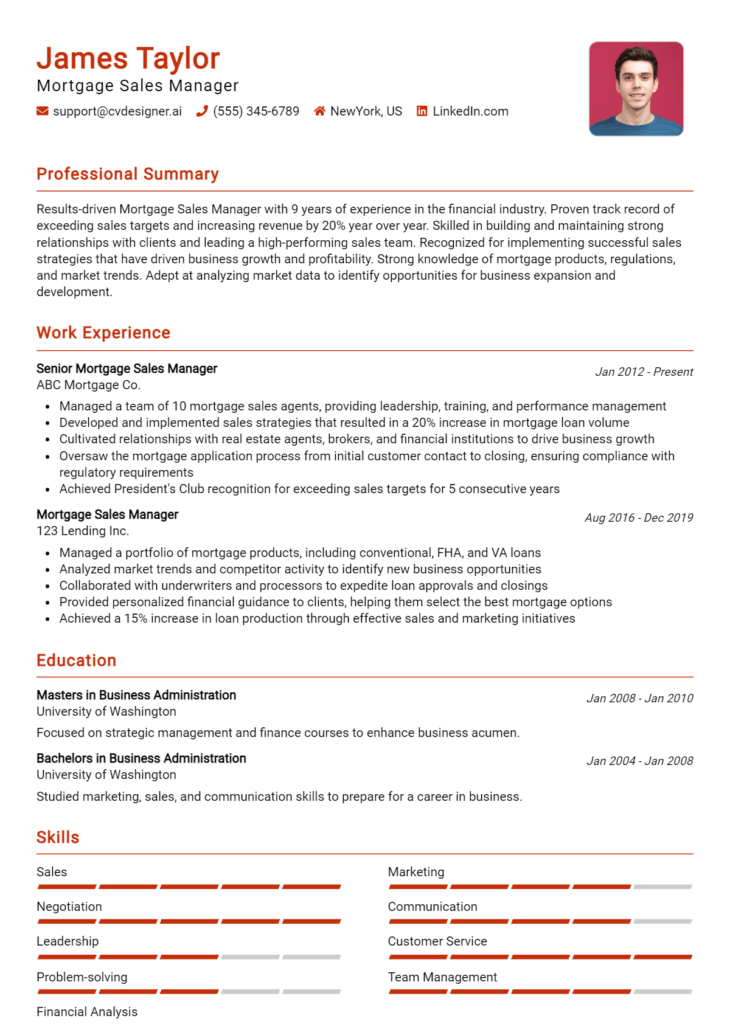

Strong Resume Headlines

"Detail-Oriented Mortgage Reporting Analyst with 5+ Years of Experience in Data Analysis and Compliance"

"Results-Driven Analyst Specializing in Mortgage Risk Assessment and Financial Reporting"

“Certified Mortgage Reporting Specialist with Proven Track Record in Enhancing Reporting Accuracy”

"Skilled Analyst in Mortgage Data Management with Expertise in Regulatory Compliance and Reporting"

Weak Resume Headlines

“Mortgage Analyst”

“Experienced Professional Looking for Opportunities”

Strong resume headlines are effective because they convey specific skills, experience, and accomplishments that directly relate to the Mortgage Reporting Analyst role, making a powerful first impression. They capture the essence of the candidate’s qualifications in a way that is both relevant and enticing to hiring managers. In contrast, weak headlines tend to be vague and generic, failing to provide insight into the candidate's unique qualifications or the value they can bring to the organization. This lack of specificity can result in the resume being overlooked in favor of those with more compelling and targeted headlines.

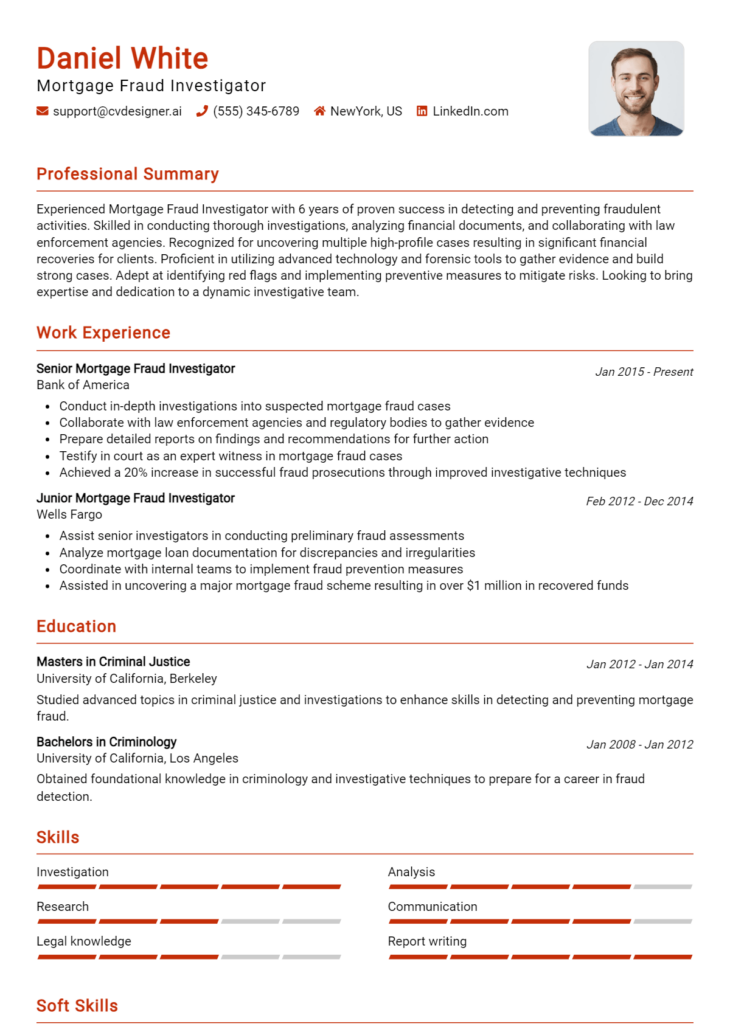

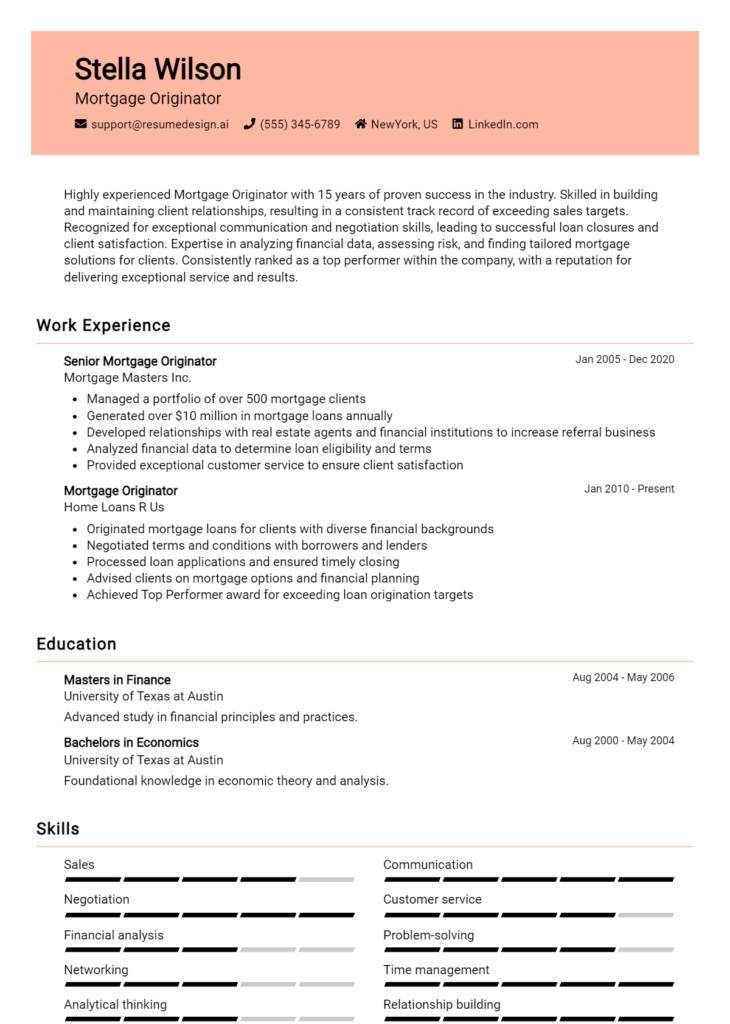

Writing an Exceptional Mortgage Reporting Analyst Resume Summary

A well-crafted resume summary is crucial for a Mortgage Reporting Analyst, as it serves as the first impression a hiring manager has of a candidate. This brief yet impactful paragraph allows candidates to showcase their key skills, relevant experience, and notable accomplishments right at the beginning of their resume. A strong summary not only grabs attention but also effectively communicates the candidate's fit for the role by aligning their background with the specific requirements of the job. It should be concise, engaging, and tailored to the position being applied for, ensuring that it highlights the candidate's strengths in a way that resonates with potential employers.

Best Practices for Writing a Mortgage Reporting Analyst Resume Summary

- Quantify achievements where possible to demonstrate impact (e.g., "increased reporting efficiency by 30%").

- Focus on key skills such as data analysis, financial reporting, and regulatory compliance.

- Tailor the summary specifically to the job description to align with employer expectations.

- Use action-oriented language to convey a sense of dynamism and initiative.

- Highlight relevant technologies or tools you are proficient in (e.g., Excel, SQL, reporting software).

- Keep it concise, ideally within 2-4 sentences, to maintain the reader's attention.

- Include certifications or credentials pertinent to mortgage reporting to enhance credibility.

- Showcase soft skills that are vital for the role, such as attention to detail and analytical thinking.

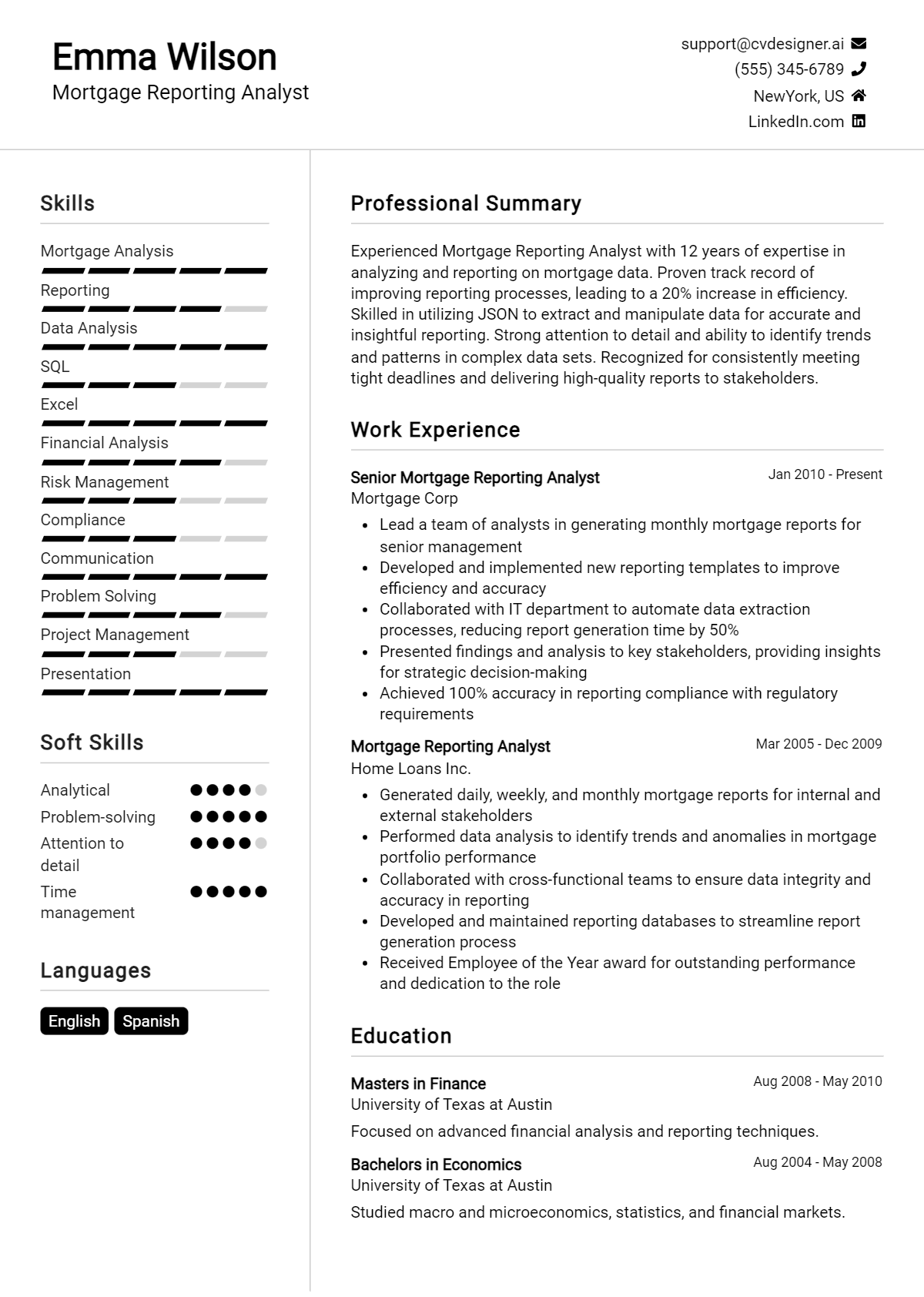

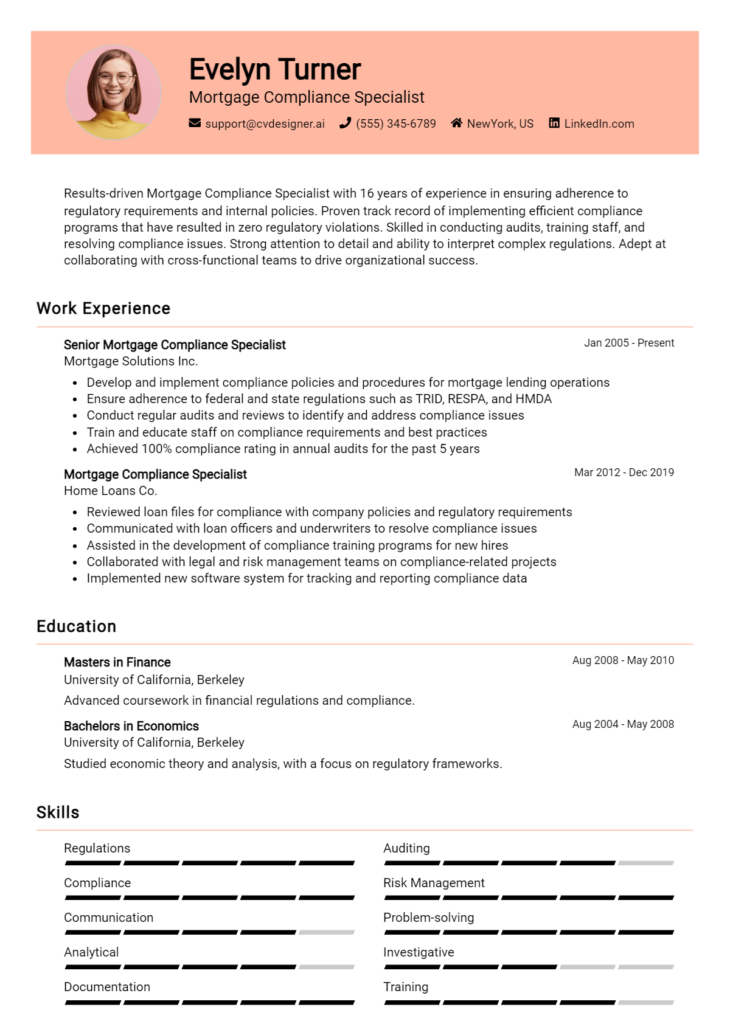

Example Mortgage Reporting Analyst Resume Summaries

Strong Resume Summaries

Detail-oriented Mortgage Reporting Analyst with over 5 years of experience in generating high-quality financial reports. Successfully increased reporting efficiency by 25% through process improvements and automation of data collection methods.

Results-driven analyst with a proven track record of delivering accurate mortgage reports under tight deadlines. Adept at using SQL and Excel to analyze data trends, contributing to a 15% reduction in reporting errors in 2022.

Analytical Mortgage Reporting Analyst with expertise in regulatory compliance and financial analysis. Recognized for enhancing reporting accuracy by 30% while managing a portfolio of over 1,000 loans.

Weak Resume Summaries

Experienced analyst looking for a position in mortgage reporting. I have worked with data and reports.

Motivated individual with some knowledge of mortgage reporting and data analysis. Eager to learn and grow in the field.

The examples provided illustrate the difference between strong and weak resume summaries. Strong summaries are specific, quantifiable, and directly relevant to the Mortgage Reporting Analyst role, demonstrating clear achievements and essential skills. In contrast, weak summaries lack detail, are overly generic, and fail to convey the candidate's qualifications or impact, making them less appealing to hiring managers.

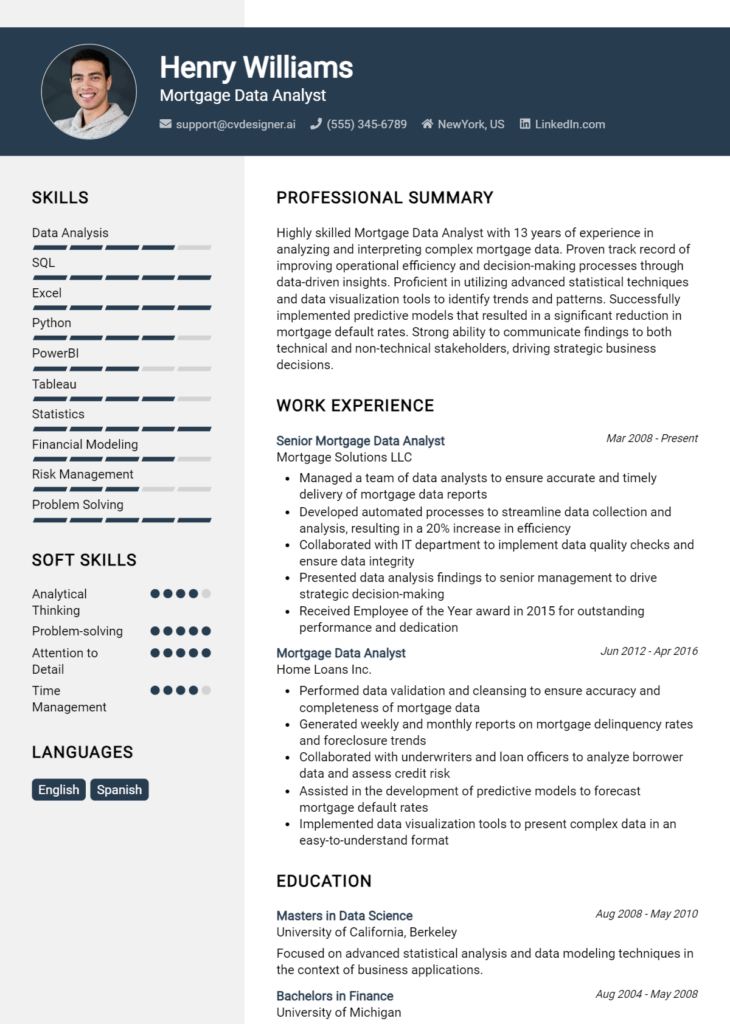

Work Experience Section for Mortgage Reporting Analyst Resume

The work experience section of a Mortgage Reporting Analyst resume is critical as it provides potential employers with a comprehensive view of the candidate's technical skills, leadership capabilities, and track record of delivering high-quality products. This section not only highlights the candidate's proficiency in data analysis, reporting tools, and mortgage compliance but also showcases their ability to effectively manage teams and collaborate with various stakeholders. By quantifying achievements and aligning experiences with industry standards, candidates can demonstrate their value and readiness to contribute to the organization's success.

Best Practices for Mortgage Reporting Analyst Work Experience

- Highlight technical skills specific to mortgage reporting, such as proficiency in SQL, data visualization tools, and reporting software.

- Quantify achievements with metrics, like percentage improvements in reporting accuracy or time saved in processes.

- Showcase collaboration and teamwork experiences, detailing interactions with cross-functional teams or stakeholders.

- Use action verbs to describe accomplishments, emphasizing initiative and leadership.

- Align experience descriptions with industry standards and best practices to demonstrate knowledge of current trends.

- Incorporate relevant certifications or training that enhance technical expertise in mortgage reporting.

- Focus on continuous improvement initiatives that led to enhanced reporting processes or systems.

- Provide context for each role, including the scope of responsibilities and the impact of your contributions.

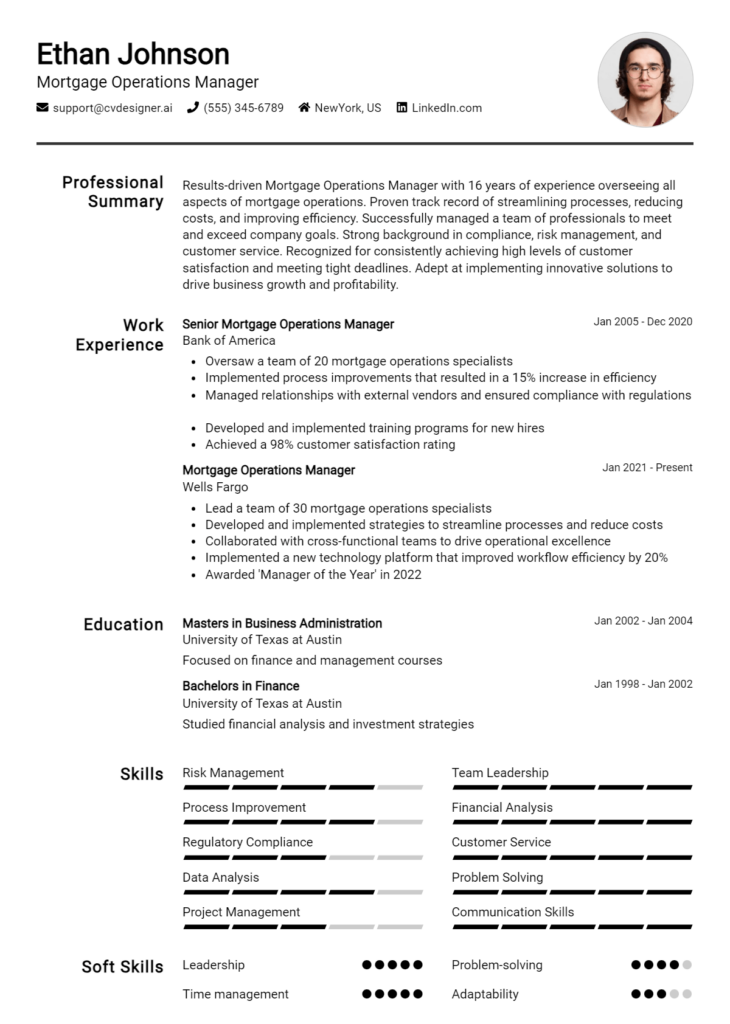

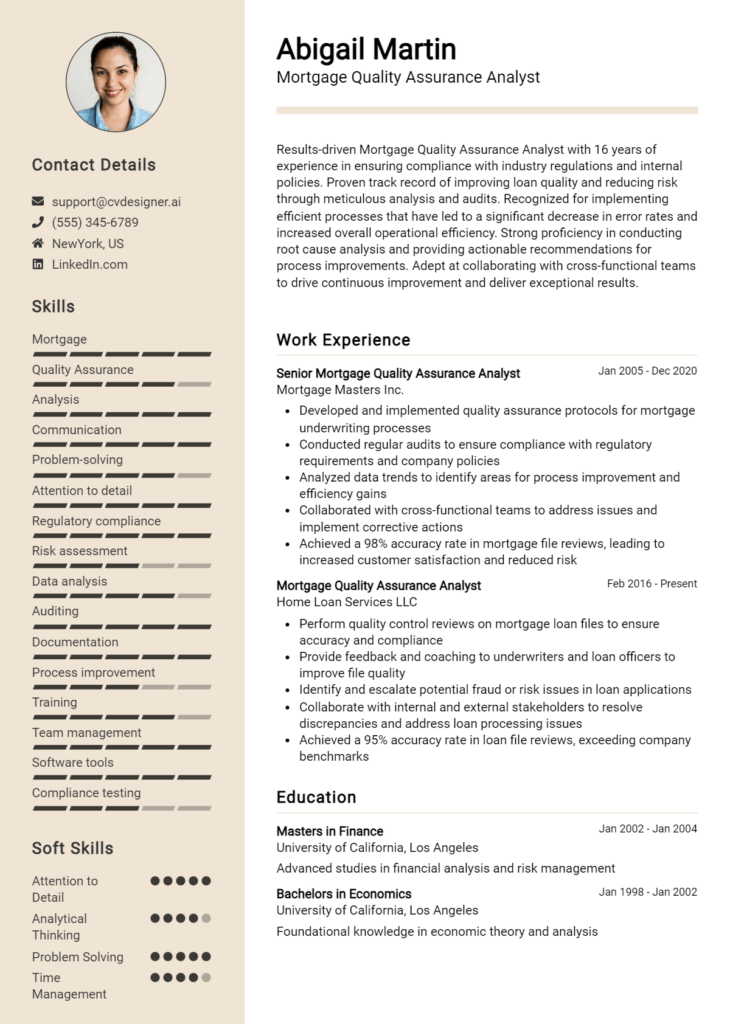

Example Work Experiences for Mortgage Reporting Analyst

Strong Experiences

- Led a team of 5 analysts in developing a new reporting framework that improved data accuracy by 30%, resulting in more informed decision-making for loan originators.

- Implemented automated reporting tools that reduced manual report generation time by 50%, driving efficiency and allowing the team to focus on strategic analysis.

- Collaborated with IT and compliance teams to enhance the reporting infrastructure, ensuring adherence to regulatory standards and improving report delivery speed by 40%.

- Developed key performance indicators (KPIs) to assess reporting effectiveness, leading to a 20% increase in stakeholder satisfaction ratings over one year.

Weak Experiences

- Worked on various reporting tasks as part of a team.

- Assisted in the development of reports with minimal input.

- Handled data entry and documentation for mortgage applications.

- Participated in meetings to discuss reporting issues.

The examples of strong experiences are considered effective because they clearly quantify achievements, demonstrate leadership and technical expertise, and illustrate collaborative efforts that led to significant improvements in processes and outcomes. In contrast, the weak experiences lack specificity, measurable results, and impactful contributions, making them less compelling to potential employers.

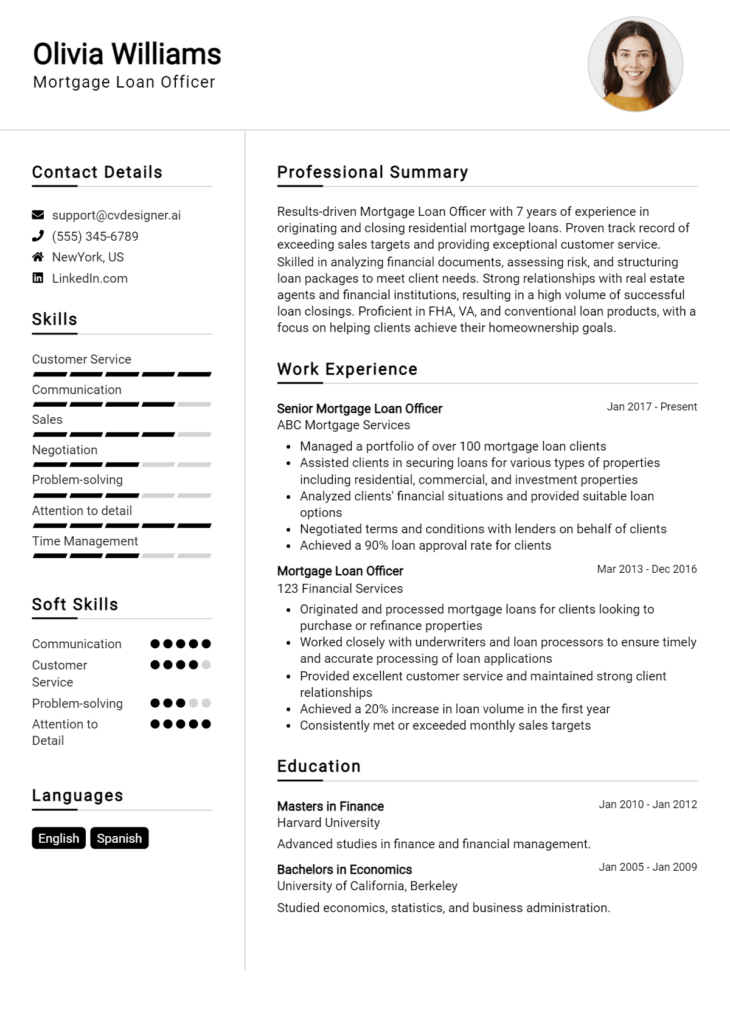

Education and Certifications Section for Mortgage Reporting Analyst Resume

The education and certifications section of a Mortgage Reporting Analyst resume is crucial as it showcases the candidate's academic achievements, professional qualifications, and commitment to ongoing education within the mortgage industry. This section not only highlights relevant degrees and certifications but also demonstrates the candidate's dedication to continuous learning and staying updated with industry standards and practices. By including pertinent coursework, specialized training, and recognized certifications, candidates can significantly enhance their credibility and better align themselves with the demands of the job role, making a strong case for their expertise and suitability for the position.

Best Practices for Mortgage Reporting Analyst Education and Certifications

- Prioritize relevant degrees, such as a Bachelor's in Finance, Business Administration, or Economics.

- Include industry-recognized certifications like the Mortgage Bankers Association (MBA) Certified Mortgage Banker (CMB) or the Certified Mortgage Specialist (CMS).

- List specific coursework related to mortgage reporting, financial analysis, or data analytics.

- Detail any continuing education courses or workshops attended that pertain to mortgage reporting and compliance.

- Highlight any specialized training in software tools commonly used in mortgage reporting, such as Excel or mortgage analysis software.

- Ensure that all information is current and reflects the most relevant qualifications for the position.

- Consider including honors or awards received during your education that demonstrate a strong academic performance.

- Use clear and concise formatting to enhance readability and professionalism.

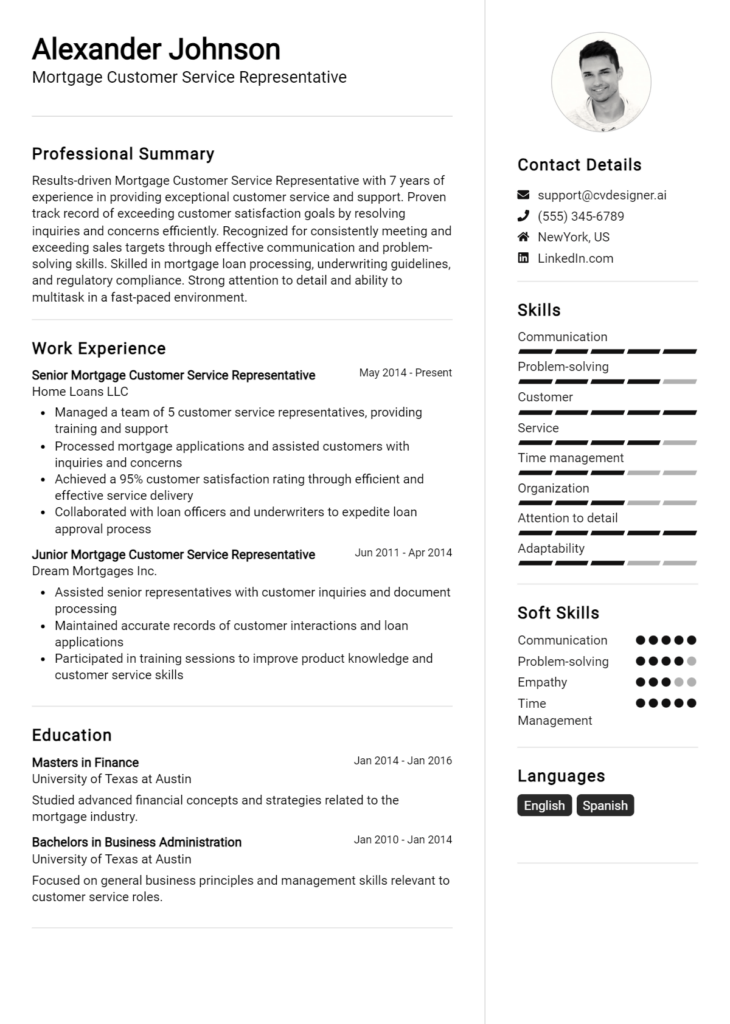

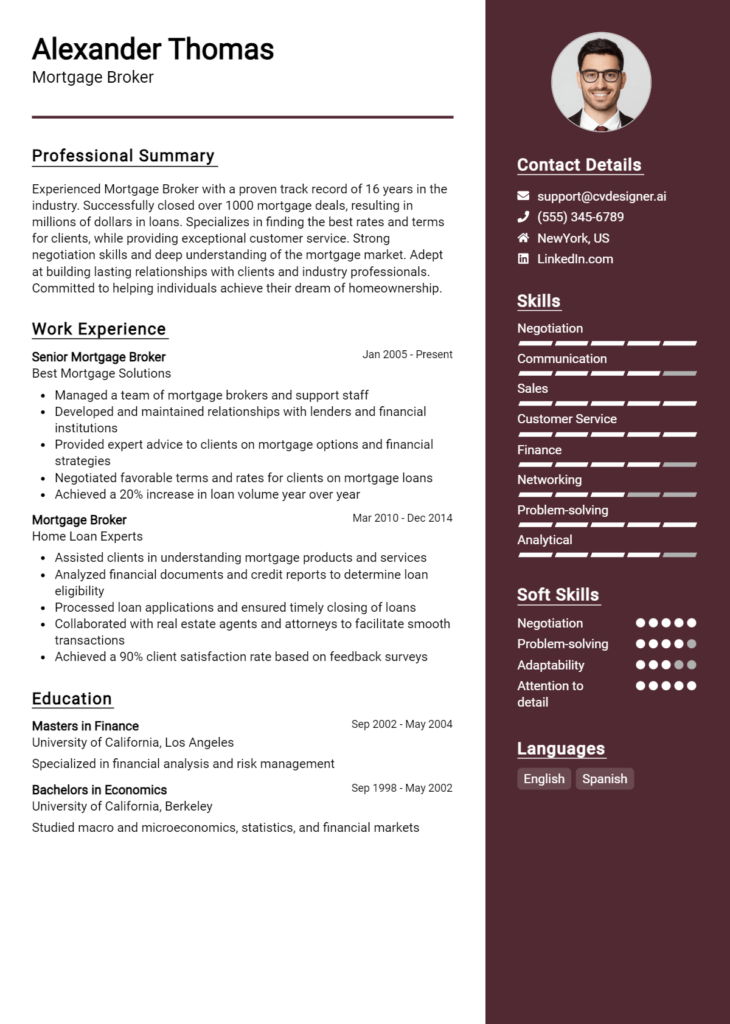

Example Education and Certifications for Mortgage Reporting Analyst

Strong Examples

- Bachelor of Science in Finance, University of XYZ, Graduated May 2021

- Certified Mortgage Banker (CMB), Mortgage Bankers Association, 2022

- Coursework in Advanced Financial Analysis, Data Analytics for Finance, and Risk Management

- Completed a workshop on Mortgage Reporting Compliance, January 2023

Weak Examples

- Associate Degree in General Studies, Community College of ABC, Graduated 2019

- Certificate in Basic Computer Skills, 2018

- Bachelor’s in Arts (not related to finance or mortgage), University of DEF, 2020

- Outdated certification in Basic Accounting, 2015

The strong examples are considered effective as they directly relate to the Mortgage Reporting Analyst role, showcasing relevant degrees, certifications, and coursework that enhance the candidate's qualifications. In contrast, the weak examples lack relevance and specificity to the mortgage industry, with degrees and certificates that do not contribute to the necessary skill set for the position, thereby diminishing the candidate's appeal to potential employers.

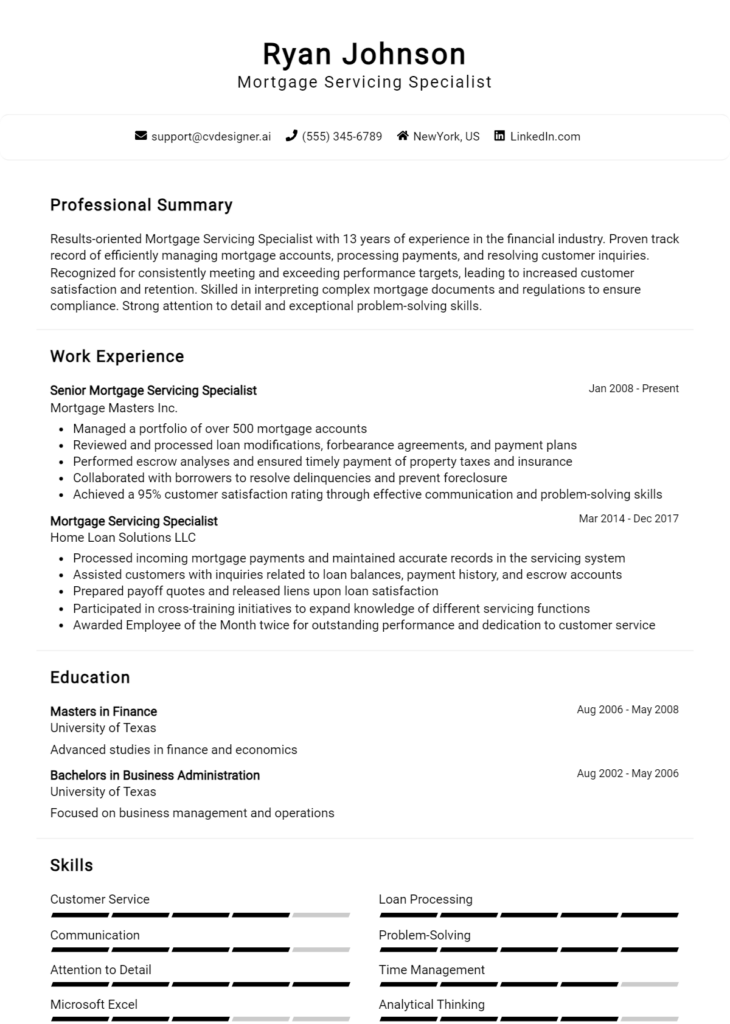

Top Skills & Keywords for Mortgage Reporting Analyst Resume

As a Mortgage Reporting Analyst, possessing the right skills is crucial in ensuring accuracy and efficiency in reporting and data management within the mortgage industry. A well-crafted resume that highlights both hard and soft skills can set candidates apart in a competitive job market. Employers seek individuals who not only have the technical expertise to analyze complex data but also possess the interpersonal skills necessary to communicate findings effectively and collaborate with various stakeholders. In this context, showcasing a balanced mix of skills can significantly enhance a candidate's profile, making it more appealing to potential employers.

Top Hard & Soft Skills for Mortgage Reporting Analyst

Soft Skills

- Strong Analytical Thinking

- Effective Communication

- Attention to Detail

- Problem-Solving Abilities

- Time Management

- Team Collaboration

- Adaptability

- Critical Thinking

- Customer Service Orientation

- Conflict Resolution

Hard Skills

- Proficient in Mortgage Software (e.g., Encompass, Ellie Mae)

- Advanced Excel Skills

- Data Visualization Tools (e.g., Tableau, Power BI)

- SQL and Database Management

- Knowledge of Mortgage Industry Regulations

- Reporting Tools (e.g., Crystal Reports, SSRS)

- Financial Analysis

- Risk Assessment and Management

- Statistical Analysis

- Experience with Data Mining Techniques

For a deeper dive into the essential skills and how to effectively showcase your work experience, consider tailoring your resume to reflect these competencies, ensuring that your application stands out in the hiring process.

Stand Out with a Winning Mortgage Reporting Analyst Cover Letter

I am writing to express my interest in the Mortgage Reporting Analyst position at [Company Name], as advertised on [Job Board/Company Website]. With a strong background in data analysis and reporting within the mortgage sector, coupled with my keen attention to detail and analytical mindset, I am excited about the opportunity to contribute to your team. My experience has equipped me with the necessary skills to analyze complex datasets and generate insightful reports that facilitate strategic decision-making.

In my previous role at [Previous Company Name], I successfully managed the reporting process for various mortgage portfolios, ensuring accuracy and compliance with regulatory standards. I utilized advanced Excel functions and data visualization tools to present findings to stakeholders, which enhanced our team's understanding of market trends and performance metrics. My ability to collaborate across departments allowed for the implementation of more efficient reporting processes that reduced turnaround time by 30%. I am confident that my proactive approach and problem-solving skills will be an asset to [Company Name].

Moreover, I am adept at utilizing various reporting software and database management systems, which enables me to streamline data collection and enhance reporting accuracy. My commitment to continuous improvement means I consistently seek new ways to optimize current methodologies. I am also passionate about staying updated with industry trends and regulations, ensuring that my reports are not only insightful but also compliant with changing guidelines.

I am excited about the prospect of joining [Company Name] and contributing to your mission of providing exceptional service in the mortgage industry. I look forward to the opportunity to discuss how my skills and experiences align with the needs of your team. Thank you for considering my application.

Common Mistakes to Avoid in a Mortgage Reporting Analyst Resume

When crafting a resume for the role of a Mortgage Reporting Analyst, it's essential to present your skills and experiences effectively. Many applicants make avoidable mistakes that can hinder their chances of landing an interview. To stand out in a competitive job market, it's critical to recognize and rectify these common pitfalls. Here are some mistakes to avoid when creating your resume:

Vague Job Descriptions: Using generic terms like "responsible for" without detailing specific achievements can make your contributions seem less impactful. Be precise about your role and results.

Ignoring Relevant Skills: Failing to highlight key skills such as data analysis, reporting software proficiency, or regulatory knowledge can lead to missed opportunities. Tailor your skills section to reflect the job requirements.

Overloading with Jargon: While industry-specific terminology is important, using too much jargon can alienate hiring managers. Aim for clarity and conciseness in your language.

Neglecting Quantifiable Achievements: Not including metrics or outcomes related to your reporting work can make your resume less compelling. Use numbers to demonstrate your impact, such as the percentage of improved reporting accuracy.

Poor Formatting: A cluttered or overly complex layout can distract from your qualifications. Ensure your resume is easy to read with clear headings, bullet points, and consistent font choices.

Typos and Grammatical Errors: Submitting a resume with spelling or grammatical mistakes can create a negative impression. Always proofread your document or have someone else review it before submission.

Lack of Customization: Using a one-size-fits-all resume can be detrimental. Tailor your resume for each job application to reflect the specific requirements and preferences outlined in the job description.

Ignoring Soft Skills: Focusing solely on technical skills while neglecting important soft skills like communication, teamwork, and problem-solving can weaken your application. Highlight how you effectively collaborate with others and present findings.

Conclusion

As we wrap up our exploration of the Mortgage Reporting Analyst role, it is crucial to highlight the essential skills and qualifications that can significantly enhance your career prospects in this competitive field. Key responsibilities include analyzing mortgage data, preparing detailed reports, and ensuring compliance with regulatory standards. Proficiency in data management software, strong analytical skills, and attention to detail are vital for success in this position.

To position yourself effectively in the job market, it’s important to ensure your resume reflects these competencies and experiences accurately. A well-crafted resume can make a substantial difference in catching the attention of hiring managers.

We encourage you to take action now by reviewing your Mortgage Reporting Analyst resume. Make sure it aligns with the skills and experiences that employers are looking for. To assist you in this process, consider utilizing various resources available to enhance your application materials:

- Explore a variety of resume templates designed specifically for the finance and analytics sectors.

- Use our resume builder to create a polished and professional resume tailored to the Mortgage Reporting Analyst role.

- Review resume examples that showcase effective formats and content to inspire your own resume.

- Don’t forget about the importance of a strong introduction; check out our cover letter templates to complement your resume.

Now is the time to refine your application materials and stand out in the job market. Take advantage of these tools to ensure your resume and cover letter represent the best version of you!