Mortgage Data Analyst Core Responsibilities

A Mortgage Data Analyst is crucial in bridging various departments within an organization, leveraging technical and operational skills to analyze market trends, evaluate loan performance, and ensure compliance with regulations. This role necessitates strong problem-solving abilities, enabling analysts to interpret data effectively and provide actionable insights that drive strategic decisions. A well-structured resume that highlights these competencies not only showcases individual qualifications but also illustrates how the analyst contributes to achieving the organization’s financial goals.

Common Responsibilities Listed on Mortgage Data Analyst Resume

- Analyze mortgage data to identify trends and patterns.

- Prepare detailed reports for stakeholders on loan performance.

- Collaborate with underwriting and risk management teams.

- Monitor and ensure compliance with industry regulations.

- Develop and maintain databases for mortgage data analysis.

- Utilize statistical tools for predictive modeling.

- Conduct market research to inform lending strategies.

- Assist in creating dashboards for real-time data visualization.

- Perform data validation and quality assurance checks.

- Provide recommendations based on data findings.

- Support senior analysts in ad hoc projects and reporting.

High-Level Resume Tips for Mortgage Data Analyst Professionals

A well-crafted resume is crucial for Mortgage Data Analyst professionals, as it serves as the first impression a candidate makes on potential employers. In a competitive job market, your resume must not only showcase your technical skills and industry knowledge but also highlight your achievements in a way that resonates with hiring managers. A compelling resume can open doors to interviews and opportunities that align with your career goals. This guide will provide practical and actionable resume tips specifically tailored for Mortgage Data Analyst professionals to help you stand out in the crowded job landscape.

Top Resume Tips for Mortgage Data Analyst Professionals

- Tailor your resume to match the job description by using relevant keywords and phrases.

- Highlight your experience with mortgage data analysis tools and software, such as SQL, Excel, and data visualization platforms.

- Quantify your achievements by including specific metrics, such as the percentage of process improvement or cost savings you contributed to.

- Showcase your understanding of mortgage regulations and compliance standards that impact data analysis.

- Include relevant certifications, such as Certified Mortgage Banker (CMB) or data analysis credentials, to bolster your qualifications.

- Demonstrate your problem-solving skills by citing examples where your analysis led to actionable insights or strategic recommendations.

- Utilize a clean and professional format that enhances readability, making it easy for hiring managers to navigate your qualifications.

- Incorporate soft skills, such as communication and teamwork, as they are vital for collaborating with cross-functional teams.

- Keep your resume concise, ideally one page, focusing on the most relevant information to the Mortgage Data Analyst role.

- Regularly update your resume to reflect new skills, experiences, and industry trends that can make you a more attractive candidate.

By implementing these resume tips, you can significantly enhance your chances of landing a job in the Mortgage Data Analyst field. A well-structured and tailored resume not only showcases your qualifications but also demonstrates your commitment to professionalism and attention to detail, qualities that employers value highly in this competitive sector.

Why Resume Headlines & Titles are Important for Mortgage Data Analyst

In the competitive field of mortgage data analysis, crafting an impactful resume headline or title is crucial for making a positive first impression on hiring managers. A well-thought-out headline immediately captures attention and succinctly summarizes a candidate's key qualifications, setting the tone for the rest of the resume. This concise phrase should directly relate to the job being applied for, showcasing relevant skills and experience that align with the employer's needs. A strong headline not only stands out but also acts as a powerful marketing tool, compelling recruiters to delve deeper into the candidate's qualifications.

Best Practices for Crafting Resume Headlines for Mortgage Data Analyst

- Keep it concise: Aim for one impactful phrase that summarizes your qualifications.

- Be role-specific: Tailor your headline to reflect the specific job title you are applying for.

- Highlight key skills: Include essential skills relevant to mortgage data analysis, such as data management or analytical abilities.

- Showcase experience: If applicable, reference years of experience or notable achievements in your field.

- Use action words: Start with strong action verbs to convey your effectiveness and impact.

- Incorporate industry keywords: Utilize terminology and keywords from the job description to pass through applicant tracking systems.

- Stay professional: Avoid casual language; maintain a tone appropriate for the finance and data analysis sectors.

- Make it memorable: Craft a headline that sticks in the mind of the reader, prompting them to consider you as a serious candidate.

Example Resume Headlines for Mortgage Data Analyst

Strong Resume Headlines

"Detail-Oriented Mortgage Data Analyst with 5+ Years of Experience in Predictive Modeling"

“Results-Driven Analyst Specializing in Mortgage Risk Assessment and Data Visualization”

“Skilled Mortgage Data Analyst with Expertise in Data Mining and Market Trends Analysis”

Weak Resume Headlines

“Data Analyst Looking for Opportunities”

“Professional in Finance”

The strong headlines effectively convey the candidate’s key strengths, including specific skills, years of experience, and areas of expertise, making them relevant and appealing to hiring managers. In contrast, the weak headlines fall short because they are vague and generic, failing to provide any substantive information that would distinguish the candidate from others. A strong headline should serve as a compelling snapshot that encourages employers to explore the resume further, while weak headlines do not capture interest or convey the unique value a candidate brings to the table.

Writing an Exceptional Mortgage Data Analyst Resume Summary

A resume summary serves as a crucial introduction for a Mortgage Data Analyst, effectively setting the stage for the rest of the application. In a competitive job market, hiring managers often sift through numerous resumes quickly, making it essential for candidates to present a strong summary that highlights their key skills, relevant experience, and notable accomplishments. A well-crafted summary not only captures attention but also provides a snapshot of the candidate's qualifications, demonstrating their fit for the specific role. It should be concise, impactful, and tailored to align with the job description, ensuring that the candidate stands out in a pool of applicants.

Best Practices for Writing a Mortgage Data Analyst Resume Summary

- Quantify achievements: Use numbers to illustrate your impact, such as percentages and dollar amounts.

- Focus on relevant skills: Highlight technical and analytical skills pertinent to mortgage data analysis.

- Tailor the summary: Customize your summary for each job application to reflect the specific requirements of the role.

- Be concise: Keep it to 2-4 sentences, making every word count.

- Use action verbs: Start sentences with strong action verbs to convey confidence and proactivity.

- Include industry keywords: Incorporate terms commonly used in the mortgage and financial services sectors to pass Applicant Tracking Systems (ATS).

- Emphasize problem-solving abilities: Showcase your capacity to analyze data and derive actionable insights.

- Highlight software proficiency: Mention familiarity with relevant tools and software used in mortgage data analysis.

Example Mortgage Data Analyst Resume Summaries

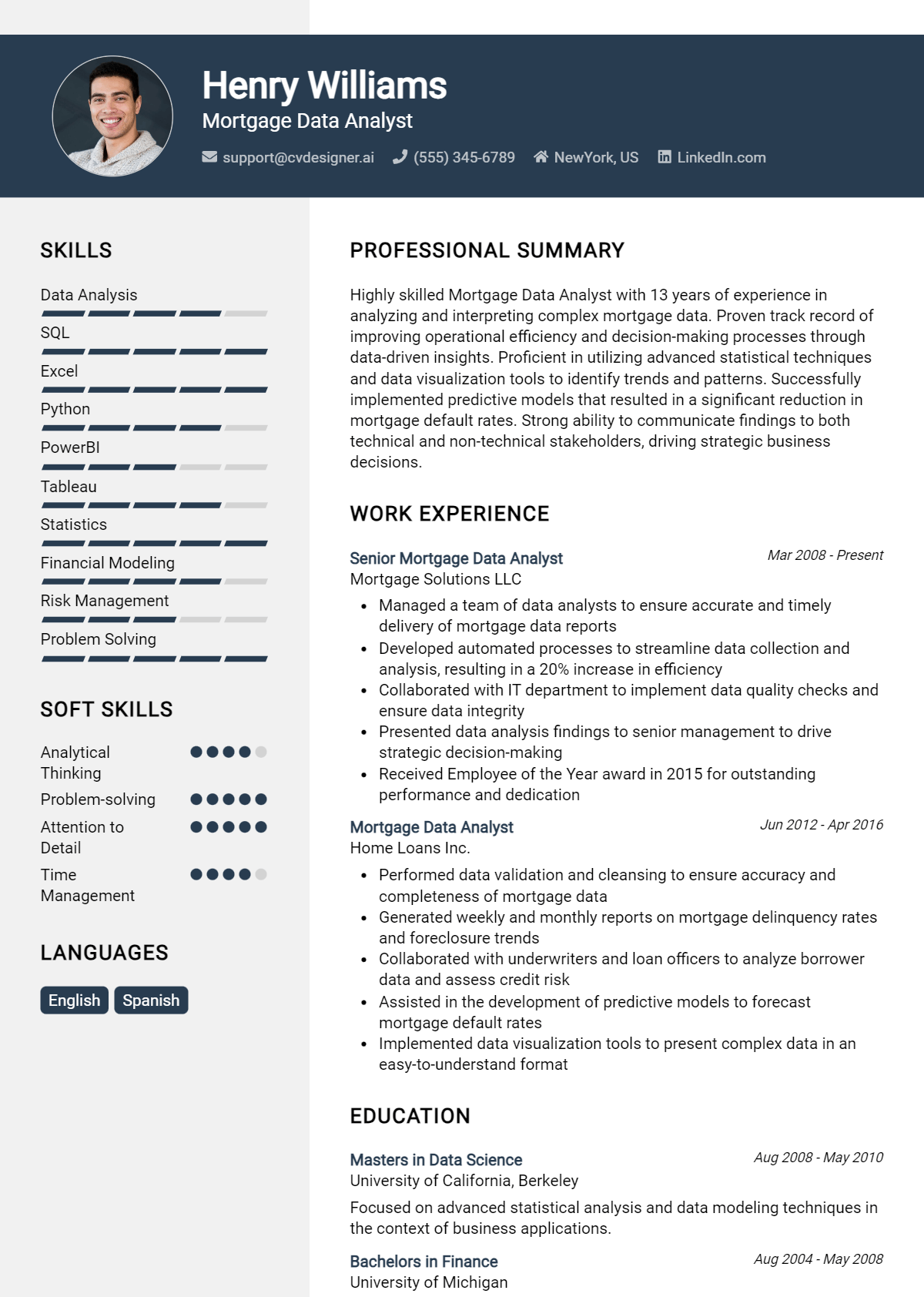

Strong Resume Summaries

Detail-oriented Mortgage Data Analyst with over 5 years of experience optimizing mortgage processes. Achieved a 20% reduction in processing time by implementing data-driven strategies. Proficient in SQL and Python, with a proven track record of leveraging analytical skills to enhance operational efficiency.

Results-driven Mortgage Data Analyst with expertise in predictive modeling and risk assessment. Successfully analyzed over $100 million in mortgage data, identifying trends that led to a 15% increase in loan approval rates. Adept at using Tableau and Excel for data visualization and reporting.

Accomplished Mortgage Data Analyst with a solid background in financial analysis and reporting. Played a key role in a team that improved data accuracy by 30%, significantly reducing compliance issues. Skilled in SQL, SAS, and advanced Excel functions.

Weak Resume Summaries

Experienced professional looking for a position in data analysis. I have worked in various roles and have some knowledge of mortgage processes.

Motivated individual with a strong background in finance. Seeking to leverage skills in mortgage data analysis.

The examples considered strong are effective because they contain quantifiable achievements, relevant skills, and demonstrate a clear connection to the Mortgage Data Analyst role. They use specific metrics to showcase the candidate's impact in previous positions and highlight their technical expertise. In contrast, the weak summaries lack detail and specificity. They fail to provide concrete examples of accomplishments or skills, making them too generic and less appealing to hiring managers seeking qualified candidates.

Work Experience Section for Mortgage Data Analyst Resume

The work experience section of a Mortgage Data Analyst resume is critical in demonstrating a candidate's qualifications and suitability for the role. This section serves as a platform to showcase not only technical skills, such as proficiency in data analysis tools and methodologies, but also the ability to manage teams effectively and deliver high-quality products that align with industry standards. By quantifying achievements and detailing relevant experiences, candidates can provide potential employers with clear evidence of their capabilities and contributions in previous roles, making it easier to assess their fit for the position.

Best Practices for Mortgage Data Analyst Work Experience

- Highlight relevant technical skills, such as proficiency in SQL, Excel, and data visualization tools.

- Quantify achievements with specific metrics, like percentage improvements or dollar amounts saved.

- Emphasize collaboration and team leadership by detailing cross-functional projects or initiatives.

- Use industry-standard terminology to align with job descriptions and demonstrate familiarity with the field.

- Focus on results-driven narratives that show how your contributions impacted business goals.

- Include relevant certifications or training that enhance your qualifications.

- Tailor your experience to showcase skills that are most applicable to the mortgage industry.

- Keep descriptions concise while ensuring they are descriptive enough to convey your impact.

Example Work Experiences for Mortgage Data Analyst

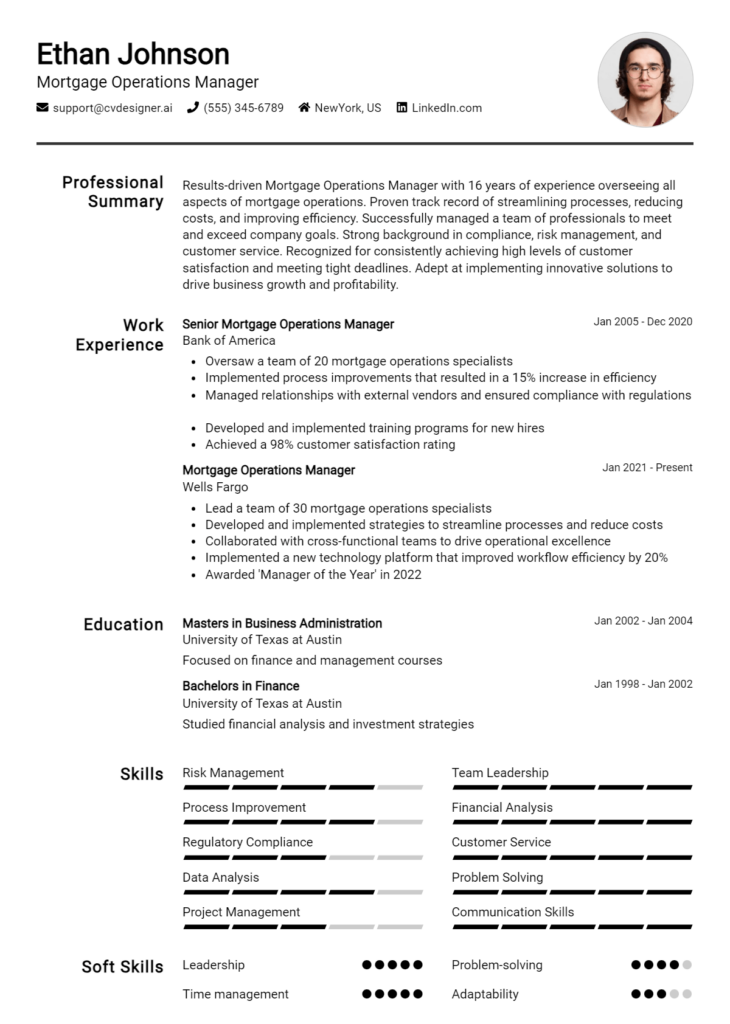

Strong Experiences

- Led a team of analysts in a project that reduced loan processing time by 30%, resulting in a $500,000 increase in annual revenue.

- Developed a predictive model using SQL and Python that accurately forecasted mortgage defaults, improving risk assessment processes by 25%.

- Collaborated with cross-functional teams to implement a new data management system that streamlined reporting processes, enhancing efficiency by 40%.

- Generated comprehensive data visualizations that informed executive decision-making, leading to a strategic shift that improved market share by 15% over two years.

Weak Experiences

- Assisted in data entry tasks for mortgage applications.

- Participated in team meetings to discuss project updates.

- Worked on various projects without specific outcomes or measurable results.

- Helped with reporting but did not specify the tools or methods used.

The examples of strong experiences are considered effective because they provide clear, quantifiable outcomes that demonstrate the candidate's technical expertise and leadership skills while aligning with the needs of the mortgage industry. In contrast, the weak experiences lack specificity and measurable results, making it difficult for potential employers to gauge the candidate's impact or contributions. Strong experiences tell a compelling story of success and capability, while weak experiences do not convey a clear value proposition to prospective employers.

Education and Certifications Section for Mortgage Data Analyst Resume

The education and certifications section is a crucial element of a Mortgage Data Analyst resume as it showcases the candidate's academic credentials and industry-specific qualifications. This section underscores the individual's commitment to continuous learning and their preparedness for the role. By detailing relevant coursework, recognized certifications, and specialized training programs, candidates can significantly enhance their credibility and demonstrate alignment with the expectations of potential employers in the mortgage industry.

Best Practices for Mortgage Data Analyst Education and Certifications

- Prioritize relevant degrees such as Finance, Economics, or Data Science.

- Include industry-recognized certifications like Certified Mortgage Banker (CMB) or Certified Financial Analyst (CFA).

- List relevant coursework that directly pertains to mortgage analytics, data analysis, or risk assessment.

- Highlight any specialized training in data analysis tools such as SQL, Python, or Excel.

- Provide the dates of completion for certifications to show recent engagement with the field.

- Tailor the education and certifications section to align with the specific job description and requirements.

- Consider including any honors or distinctions received during academic pursuits.

- Use clear and concise formatting to enhance readability and professionalism.

Example Education and Certifications for Mortgage Data Analyst

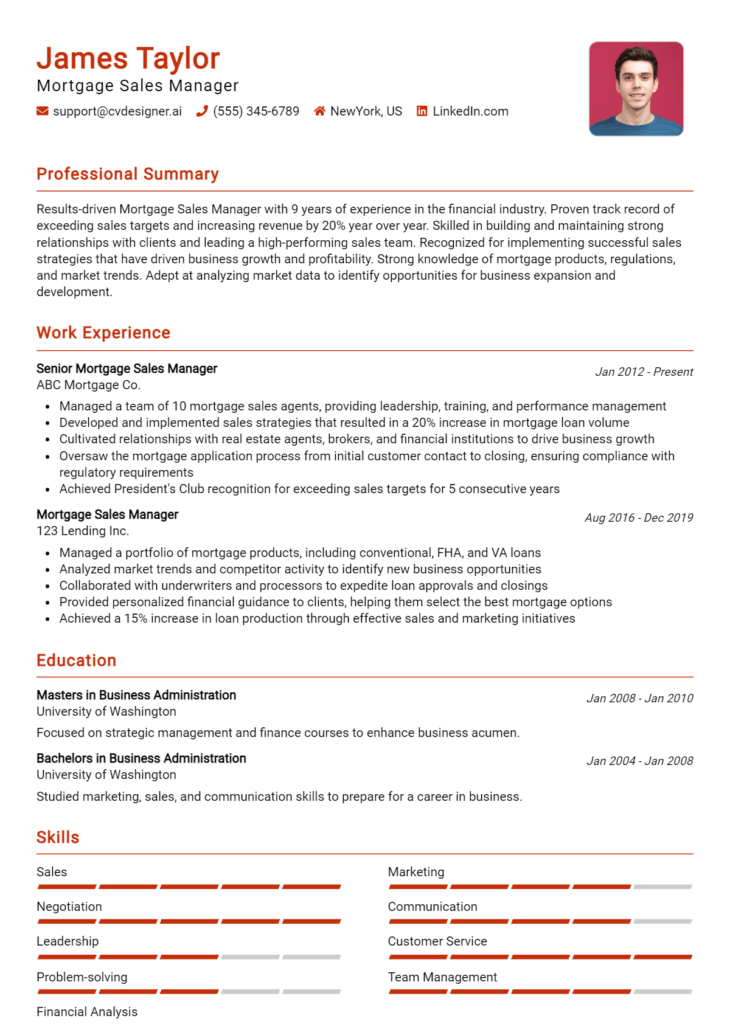

Strong Examples

- Bachelor of Science in Finance, University of XYZ, Graduated May 2020

- Certified Mortgage Banker (CMB), Mortgage Bankers Association, Completed June 2022

- Advanced Data Analytics Certificate, ABC Institute, Completed August 2021

- Relevant Coursework: Mortgage Risk Assessment, Data Analysis for Financial Services, Advanced Statistics

Weak Examples

- Associate Degree in General Studies, Community College of ABC, Graduated May 2018

- Certification in Basic Computer Skills, Online Academy, Completed January 2019

- High School Diploma, XYZ High School, Graduated June 2016

- Outdated Certification in Mortgage Brokering, Expired 2018

The examples are considered strong because they align closely with the responsibilities and skills required for a Mortgage Data Analyst role, showcasing relevant degrees, recognized certifications, and applicable coursework. In contrast, the weak examples lack direct relevance to the position, include outdated qualifications, and do not demonstrate the specialized knowledge necessary for success in the mortgage analytics field.

Top Skills & Keywords for Mortgage Data Analyst Resume

In the competitive field of mortgage data analysis, having a well-crafted resume that highlights both hard and soft skills is crucial for standing out to potential employers. A strong set of skills not only demonstrates your technical proficiency but also showcases your ability to navigate complex data environments and collaborate effectively with cross-functional teams. As a Mortgage Data Analyst, your skills will play a pivotal role in analyzing financial data, generating accurate reports, and contributing to strategic decision-making. By emphasizing your skills on your resume, you can illustrate your value and readiness to make a significant impact in this dynamic industry.

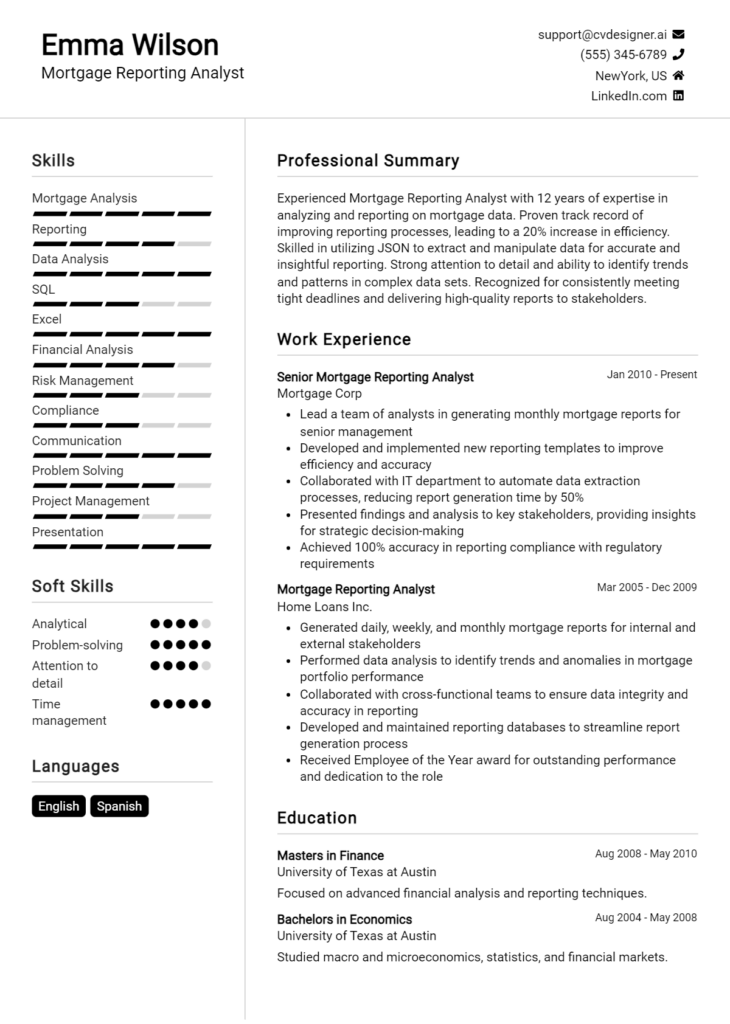

Top Hard & Soft Skills for Mortgage Data Analyst

Soft Skills

- Analytical Thinking

- Attention to Detail

- Problem-Solving Skills

- Communication Skills

- Team Collaboration

- Time Management

- Adaptability

- Critical Thinking

- Customer Service Orientation

- Project Management

Hard Skills

- Proficiency in SQL

- Data Visualization Tools (e.g., Tableau, Power BI)

- Advanced Excel Skills

- Statistical Analysis

- Knowledge of Mortgage Regulations

- Experience with Data Warehousing

- Familiarity with CRM Software

- Data Mining Techniques

- Reporting and Dashboard Creation

- Programming Languages (e.g., Python, R)

For further insights on the essential skills needed for success in this role, check out this skills resource. Additionally, you can enhance your resume by focusing on relevant work experience that aligns with these skills.

Stand Out with a Winning Mortgage Data Analyst Cover Letter

Dear Hiring Manager,

I am writing to express my interest in the Mortgage Data Analyst position at [Company Name], as advertised on [Job Board/Company Website]. With a strong background in data analysis and a deep understanding of the mortgage industry, I am excited about the opportunity to contribute to your team. My experience in analyzing complex datasets, coupled with my proficiency in various analytical tools, positions me well to support [Company Name] in making data-driven decisions that enhance operations and improve customer satisfaction.

In my previous role at [Previous Company Name], I successfully managed a range of mortgage data projects, where I utilized SQL and Python to extract, clean, and analyze large datasets. I developed detailed reports that provided insights into loan performance, customer demographics, and market trends, enabling the team to identify opportunities for growth and risk mitigation. My ability to visualize data using Tableau not only streamlined reporting processes but also facilitated clearer communication of findings to stakeholders. I am particularly proud of a project where I identified key factors contributing to loan defaults, which led to the implementation of more effective risk assessment strategies.

I am particularly drawn to [Company Name] because of its commitment to innovation and excellence in the mortgage sector. I admire your focus on leveraging technology to enhance the customer experience and streamline operations. I am eager to bring my skills in data analysis and mortgage market knowledge to your team, contributing to the development of strategies that align with your goals. I am confident that my analytical mindset and attention to detail will make me a valuable asset to your organization.

Thank you for considering my application. I look forward to the opportunity to discuss how my background, skills, and enthusiasms align with the needs of your team. I am excited about the possibility of contributing to [Company Name] and helping drive data-informed decisions that lead to continued success.

Sincerely,

[Your Name]

[Your Phone Number]

[Your Email Address]

Common Mistakes to Avoid in a Mortgage Data Analyst Resume

When crafting a resume for a Mortgage Data Analyst position, it’s essential to present your skills and experience effectively. However, many candidates fall into common pitfalls that can undermine their chances of landing an interview. Identifying and avoiding these mistakes can make a significant difference in how your resume is perceived by hiring managers. Below are some common missteps to watch out for:

Using Generic Language: Failing to tailor your resume to the Mortgage Data Analyst role can make it seem like you’re not genuinely interested in the position. Use specific language related to the mortgage industry and data analysis.

Neglecting Quantifiable Achievements: Simply listing job responsibilities without quantifying your accomplishments can weaken your resume. Use numbers to highlight your achievements, such as “increased data processing efficiency by 30%.”

Poor Formatting: A cluttered or overly complex format can distract from your qualifications. Ensure your resume is clean, organized, and easy to read, using consistent font sizes and bullet points.

Including Irrelevant Experience: Listing every job you’ve ever had dilutes the impact of your relevant experience. Focus on positions that relate directly to data analysis or the mortgage industry.

Omitting Technical Skills: As a Mortgage Data Analyst, technical proficiency is crucial. Make sure to include relevant software and tools (like SQL, Excel, and data visualization software) prominently on your resume.

Using Passive Language: Passive language can make your accomplishments sound less impactful. Use active verbs to convey your contributions, such as “analyzed,” “developed,” or “optimized.”

Ignoring Keywords: Many companies use applicant tracking systems (ATS) to filter resumes. Failing to include industry-specific keywords can result in your resume being overlooked. Research the job description and incorporate relevant terms.

Not Proofreading: Spelling and grammatical errors can create a negative impression and suggest a lack of attention to detail. Always proofread your resume multiple times or have someone else review it before submission.

Conclusion

As we’ve explored the critical role of a Mortgage Data Analyst, it’s evident that this position requires a unique blend of analytical skills, attention to detail, and a solid understanding of mortgage processes. Key responsibilities include analyzing mortgage data trends, ensuring compliance with regulations, and providing actionable insights to improve lending practices. With the evolving landscape of the mortgage industry, staying updated on the latest technologies and data analysis tools is essential for success in this role.

If you're looking to stand out in the competitive job market of mortgage data analysis, now is the perfect time to revisit your resume. Highlight your relevant skills and experiences that align with the demands of the role. To aid in this process, take advantage of the following resources:

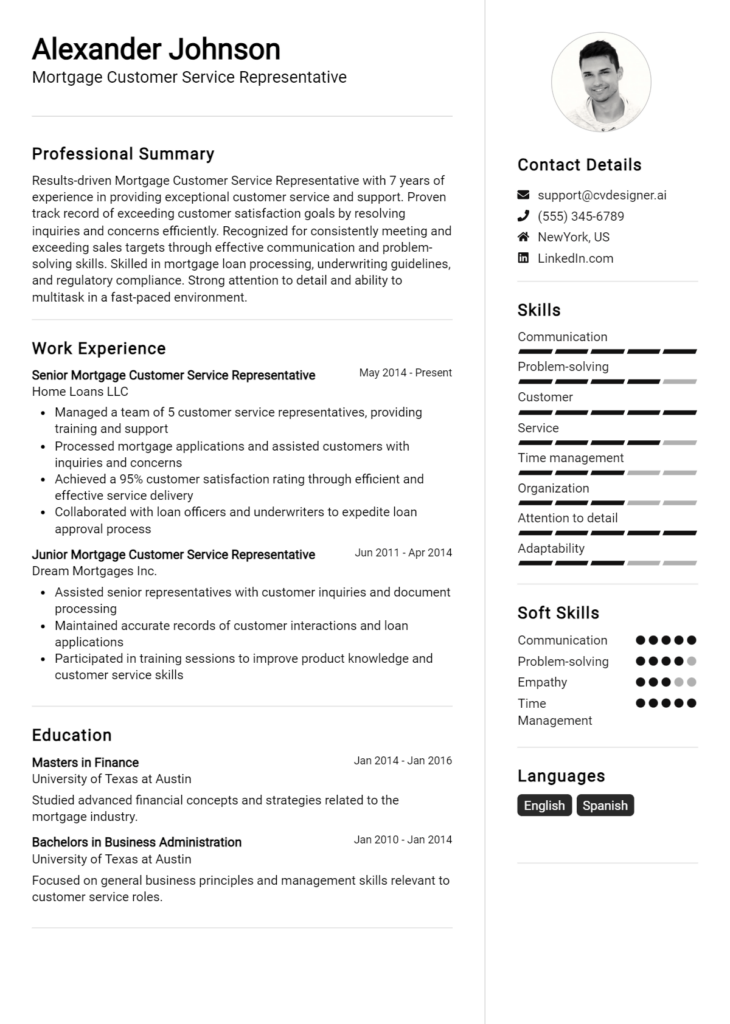

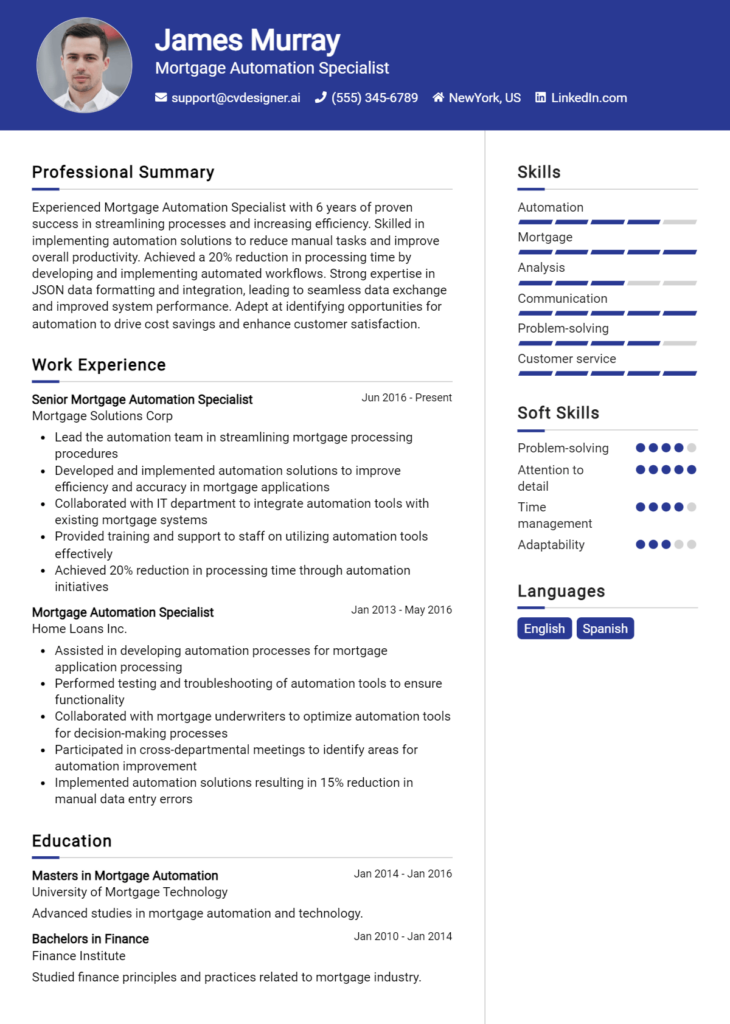

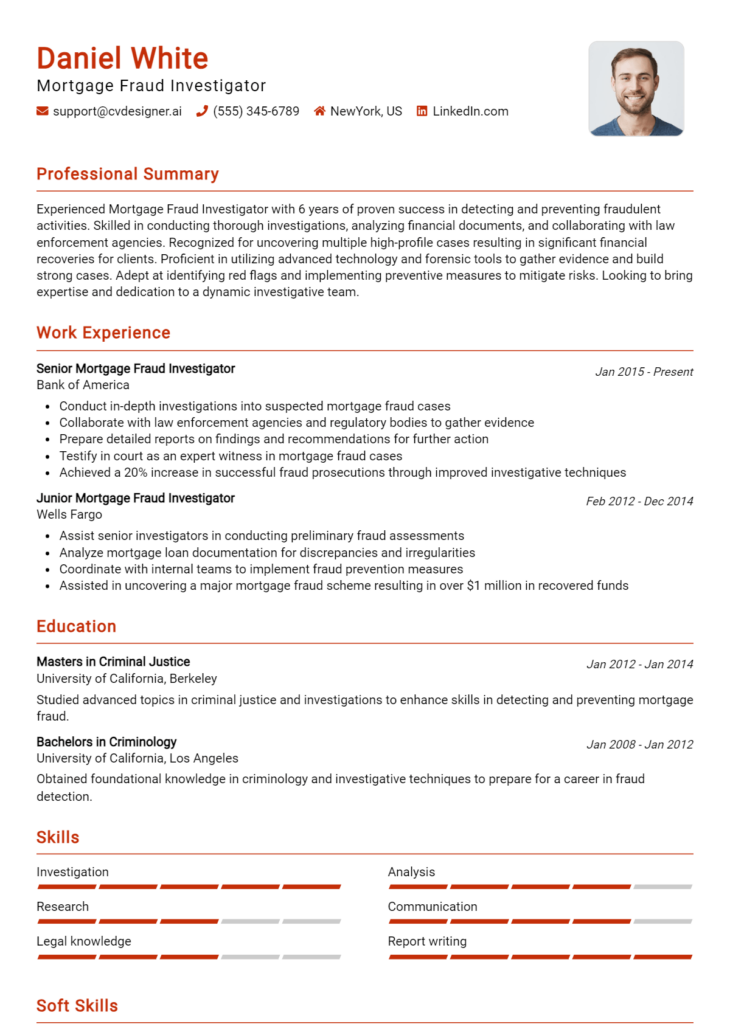

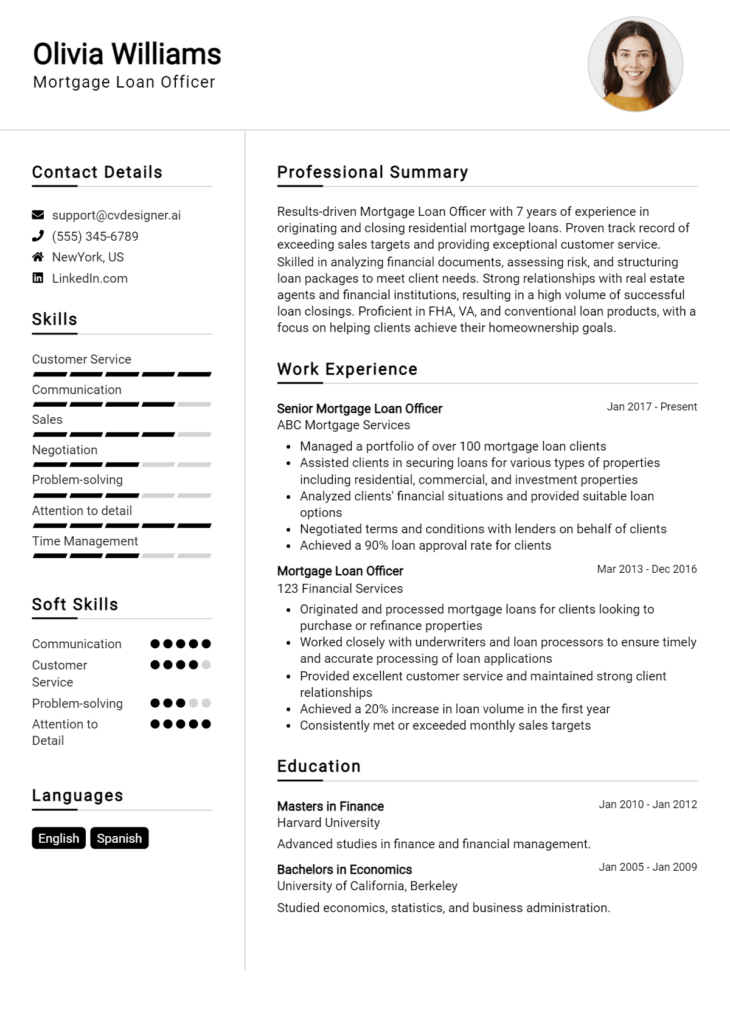

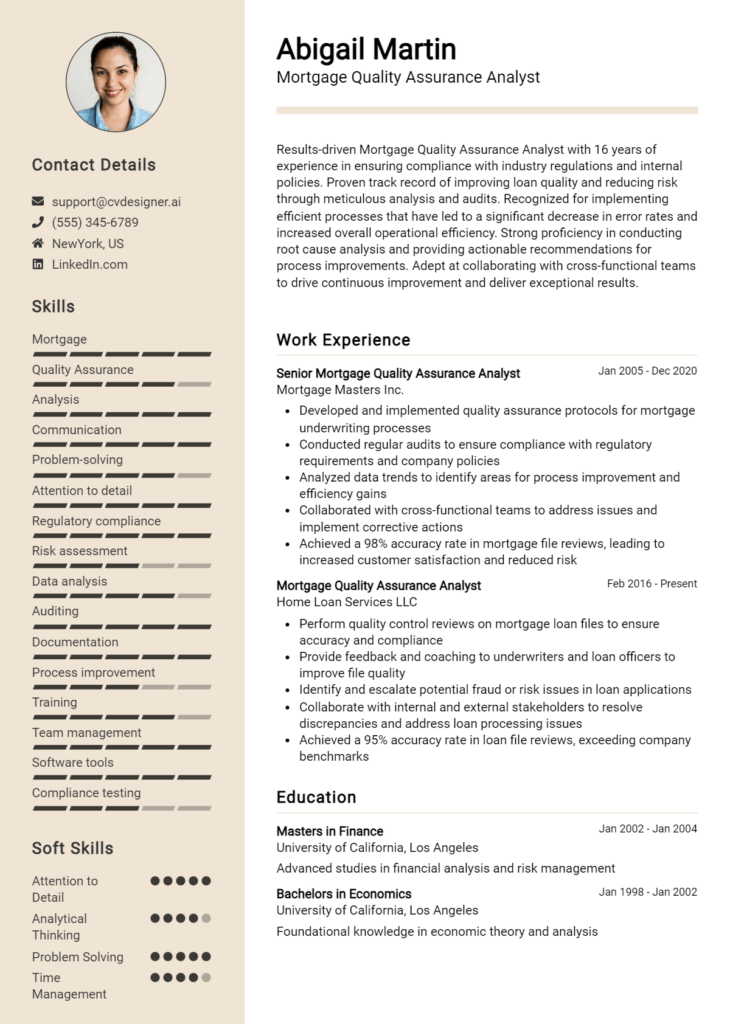

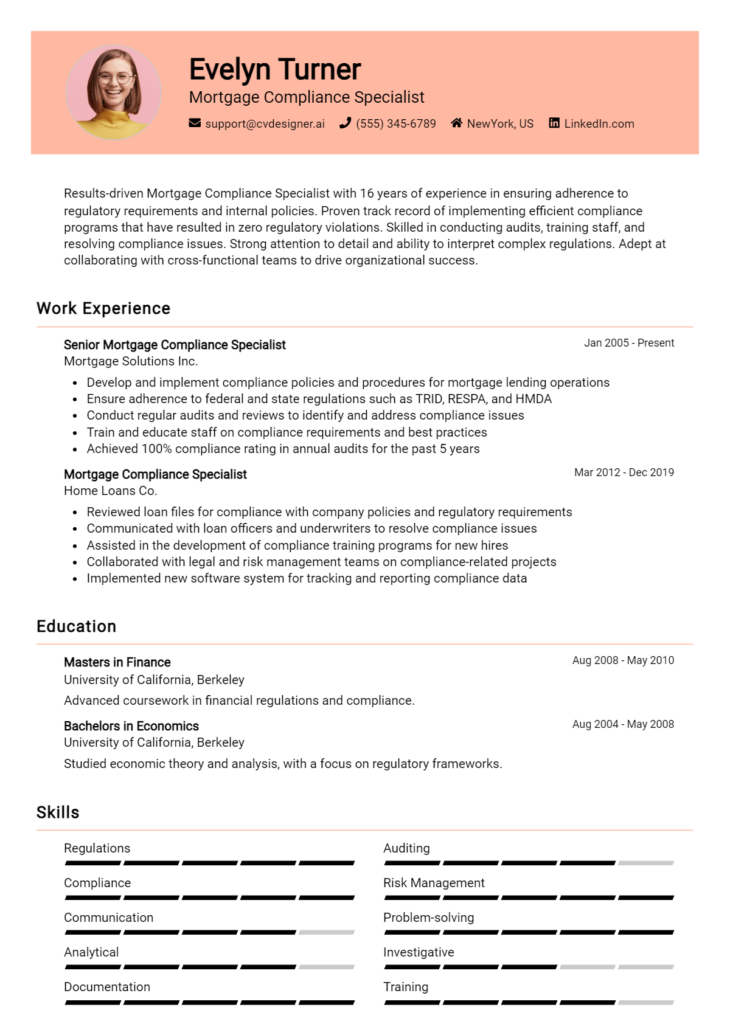

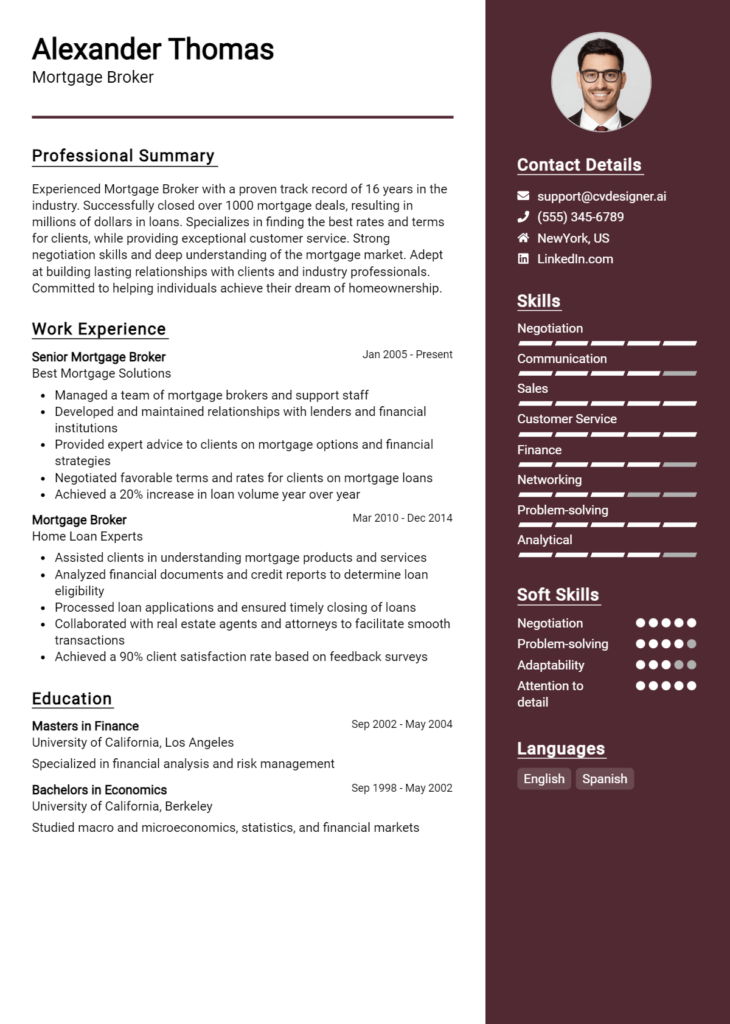

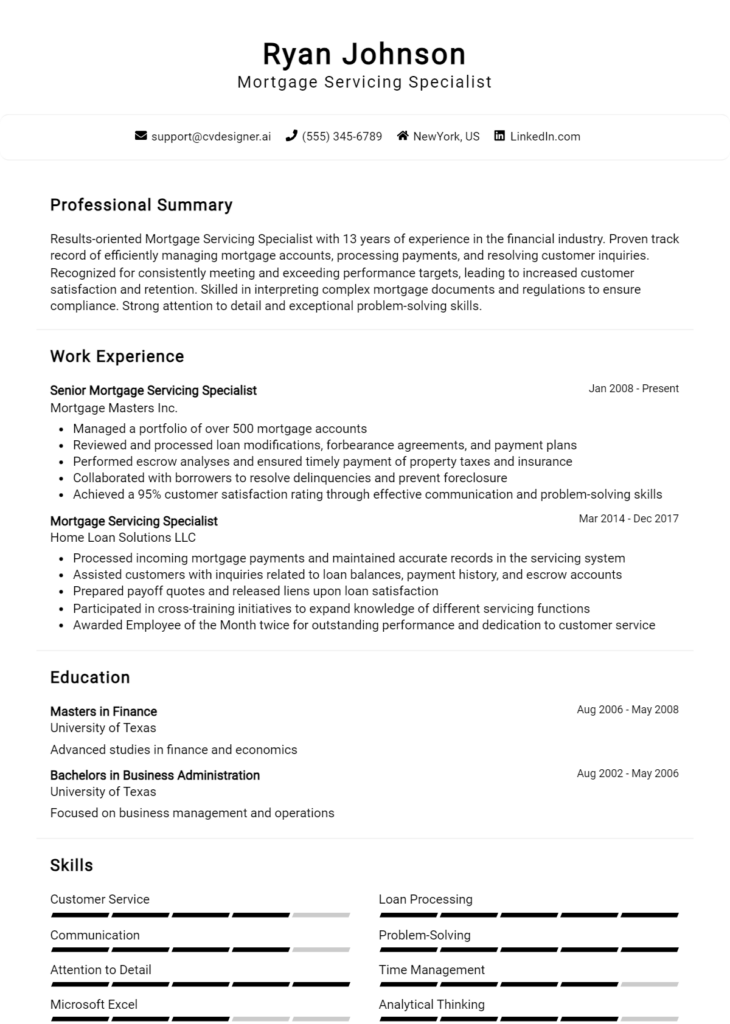

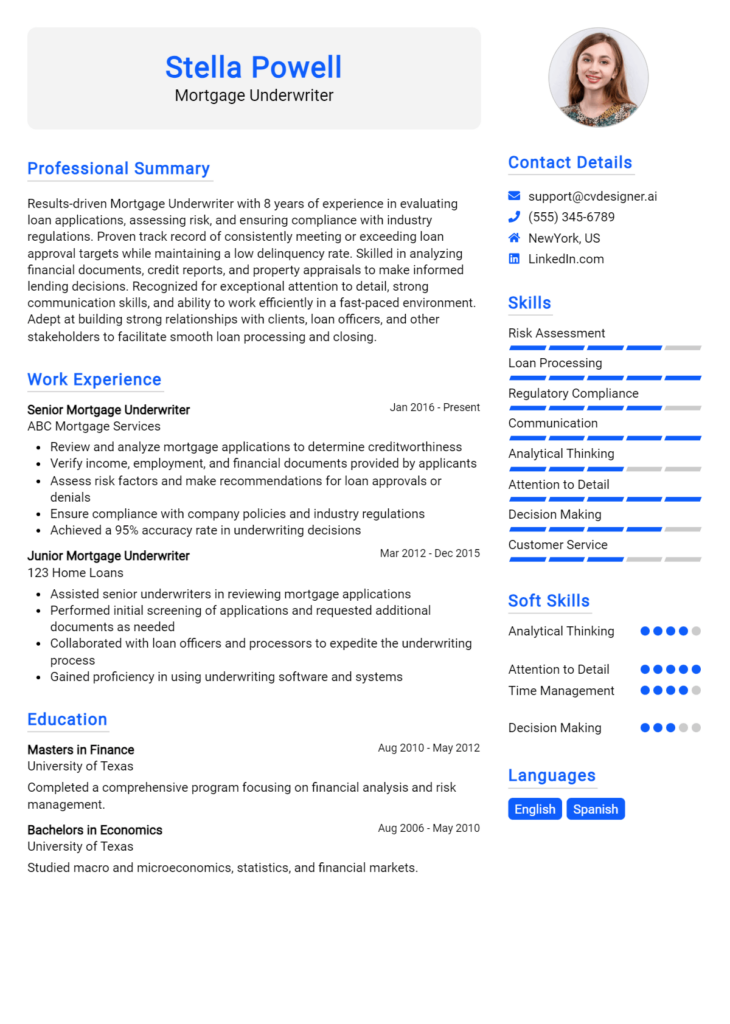

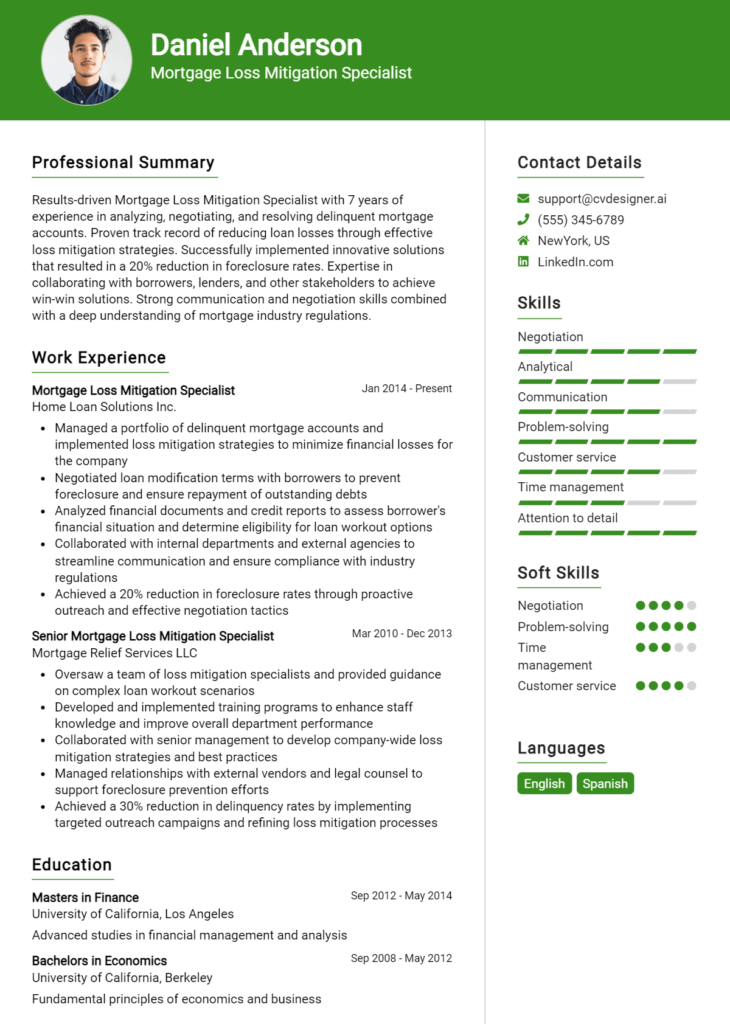

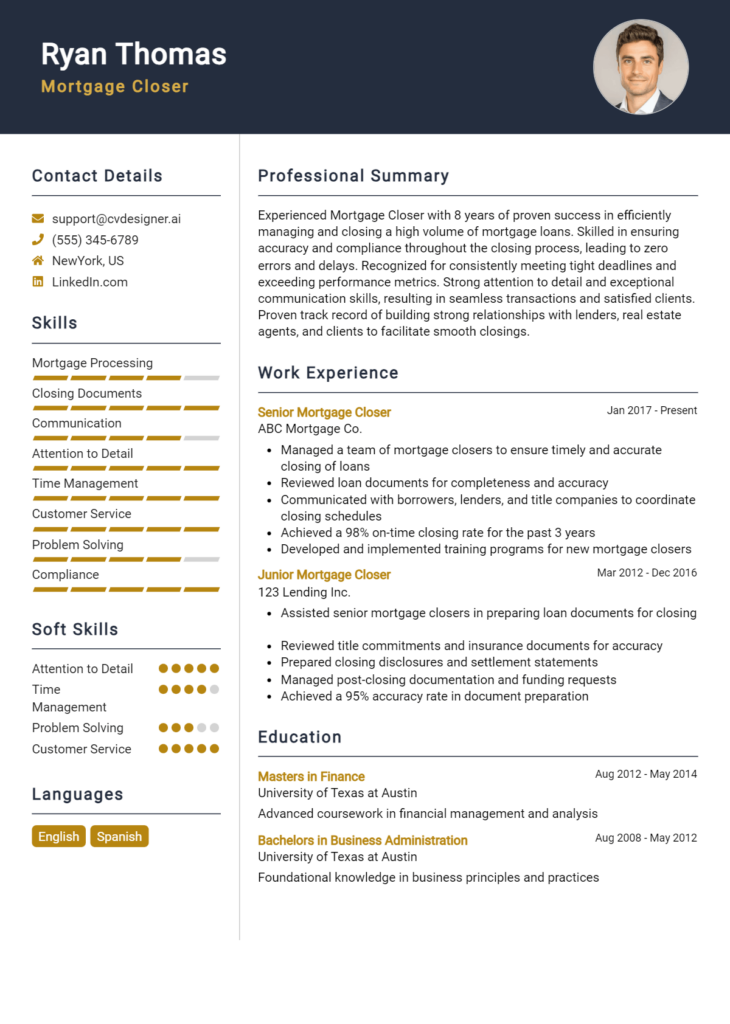

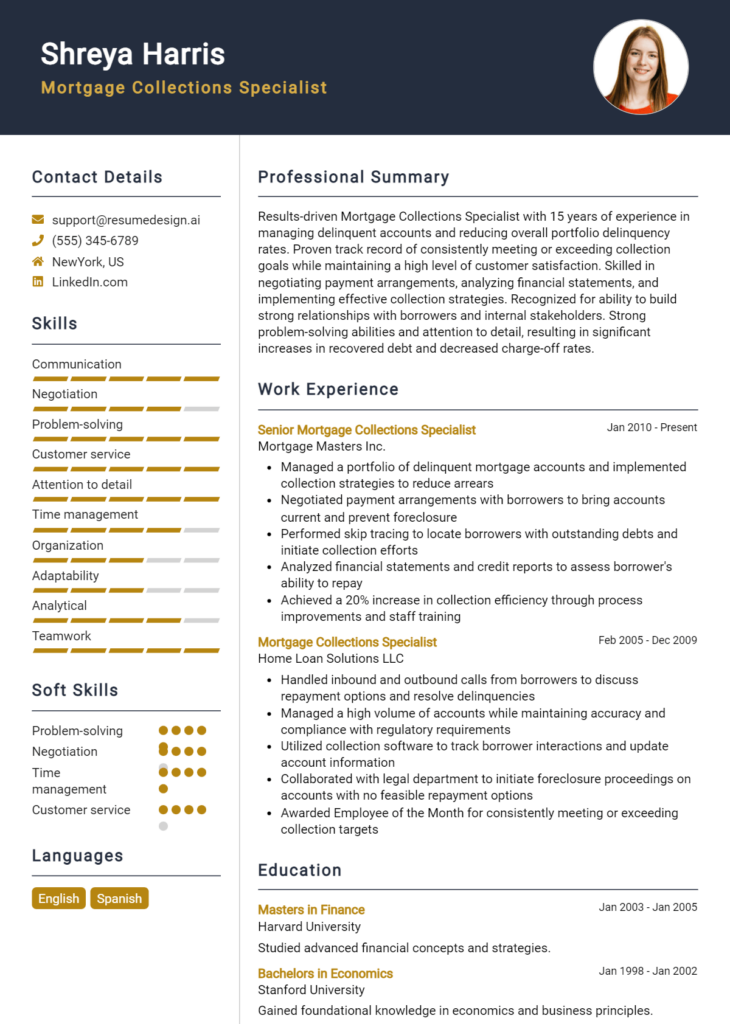

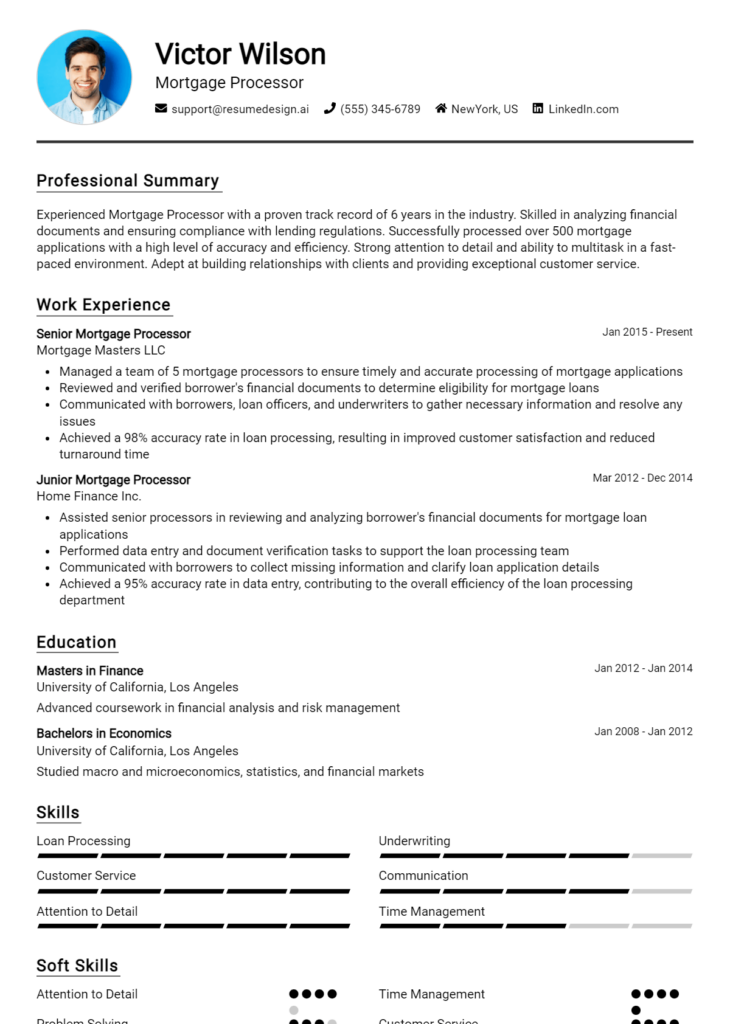

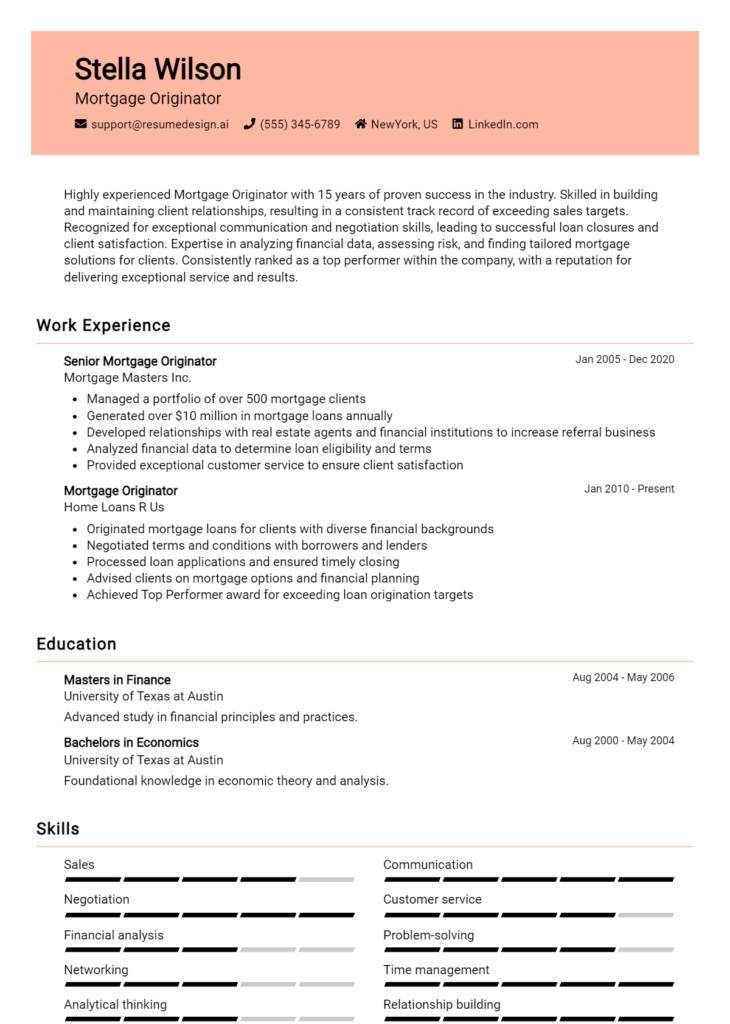

- Explore resume templates to find a design that suits your professional style.

- Use the resume builder to create a polished and tailored resume that showcases your qualifications effectively.

- Check out resume examples for inspiration on how to present your experience and skills.

- Don’t forget to craft a compelling cover letter with the help of cover letter templates that complements your resume.

Take action today to ensure your resume reflects your capabilities as a Mortgage Data Analyst, setting you on a path to secure your desired position in this dynamic field.