Mortgage Underwriter Core Responsibilities

A Mortgage Underwriter plays a vital role in the loan approval process, bridging finance, risk assessment, and customer service departments. Key responsibilities include analyzing credit reports, assessing borrower income, and evaluating property appraisals to determine loan eligibility. Successful underwriters possess strong technical skills, operational efficiency, and problem-solving abilities, ensuring compliance with regulations and organizational goals. A well-structured resume effectively highlights these qualifications, showcasing the candidate's value to potential employers.

Common Responsibilities Listed on Mortgage Underwriter Resume

- Evaluate and analyze loan applications for accuracy and completeness.

- Review credit reports and financial documents to assess borrower risk.

- Determine loan eligibility based on established guidelines and policies.

- Collaborate with loan officers and clients to clarify application details.

- Conduct thorough property appraisals and market analysis.

- Ensure compliance with federal and state lending regulations.

- Make informed decisions regarding loan approvals or denials.

- Maintain detailed records of underwriting decisions and processes.

- Communicate underwriting findings to relevant stakeholders.

- Assist in developing and implementing underwriting policies.

- Provide training and support to junior underwriters as needed.

High-Level Resume Tips for Mortgage Underwriter Professionals

In the competitive field of mortgage underwriting, a well-crafted resume is essential for standing out to potential employers. As the first impression you make, your resume must effectively showcase not only your skills and qualifications but also your unique achievements in the industry. A strong resume can be the difference between landing an interview and getting lost in the shuffle. This guide will provide practical and actionable resume tips specifically tailored for Mortgage Underwriter professionals, ensuring that your application reflects your expertise and sets you apart from the competition.

Top Resume Tips for Mortgage Underwriter Professionals

- Tailor your resume to each job description by incorporating relevant keywords and phrases that match the requirements outlined by the employer.

- Highlight your relevant experience prominently, focusing on roles that showcase your underwriting skills and knowledge of mortgage regulations.

- Quantify your achievements by using specific metrics, such as the number of loans processed or approval rates, to demonstrate your effectiveness in previous roles.

- Include industry-specific skills such as risk assessment, financial analysis, and familiarity with underwriting software to make your resume stand out.

- Use a clear and professional format that enhances readability, ensuring that your most important information is easily accessible.

- Incorporate a summary statement at the top of your resume that encapsulates your experience and career goals as a mortgage underwriter.

- Showcase continuous professional development by listing relevant certifications, training, or industry courses that enhance your qualifications.

- List any awards or recognitions you have received in the field to further establish your credibility and expertise.

- Keep your resume concise, ideally one page, focusing on the most relevant information to maintain the attention of hiring managers.

By implementing these tips, you can significantly increase your chances of landing a job in the Mortgage Underwriter field. A resume that effectively showcases your skills, achievements, and industry knowledge will resonate with employers and help you stand out in a crowded job market.

Why Resume Headlines & Titles are Important for Mortgage Underwriter

In the competitive field of mortgage underwriting, the importance of an effective resume headline or title cannot be overstated. This brief yet powerful phrase serves as the first impression a hiring manager has of a candidate, capturing their attention and summarizing their key qualifications in an instant. A strong headline succinctly communicates the candidate's role, expertise, and unique value proposition, making it easier for employers to assess their fit for the position. It should be concise, relevant, and directly related to the job being applied for, ensuring that it stands out amidst a sea of applications.

Best Practices for Crafting Resume Headlines for Mortgage Underwriter

- Keep it concise and to the point, ideally 5-7 words.

- Use industry-specific terminology to demonstrate your expertise.

- Highlight key qualifications or certifications relevant to underwriting.

- Incorporate strong action verbs to convey a sense of accomplishment.

- Tailor the headline to match the specific job description and requirements.

- Avoid using vague language; be specific about your skills and experience.

- Consider including quantifiable metrics to highlight achievements.

- Stay professional and avoid overly casual language or jargon.

Example Resume Headlines for Mortgage Underwriter

Strong Resume Headlines

Detail-Oriented Mortgage Underwriter with 7+ Years of Experience

Certified Residential Underwriter Specializing in Risk Assessment

Proven Track Record in Streamlining Loan Approval Processes

Experienced Underwriter with Expertise in FHA and VA Loans

Weak Resume Headlines

Mortgage Underwriter

Experienced Professional Seeking Opportunities

The strong headlines are effective because they clearly articulate the candidate’s specific skills and experiences, immediately conveying their value to potential employers. By using precise language and relevant qualifications, these headlines not only attract attention but also differentiate the candidate from others. In contrast, the weak headlines fail to impress due to their vagueness and lack of specificity, making it challenging for hiring managers to gauge the candidate's suitability for the role at a glance.

Writing an Exceptional Mortgage Underwriter Resume Summary

A well-crafted resume summary is crucial for a Mortgage Underwriter, as it serves as the first point of engagement with hiring managers. A strong summary quickly captures attention by succinctly showcasing key skills, relevant experience, and notable accomplishments that align with the job role. It should act as a powerful elevator pitch, highlighting the candidate's qualifications in a concise and impactful manner. Tailoring the summary to the specific job being applied for further enhances its effectiveness, making it easier for hiring managers to see the potential value the candidate brings to their organization.

Best Practices for Writing a Mortgage Underwriter Resume Summary

- Quantify achievements to demonstrate the impact of your work, such as the number of loans processed or the percentage of risk reduction.

- Focus on relevant skills, such as analytical abilities, attention to detail, and knowledge of underwriting guidelines.

- Tailor the summary to the job description, using keywords and phrases from the posting.

- Keep it concise, ideally between 3-5 sentences, ensuring every word adds value.

- Highlight any certifications or specialized training pertinent to mortgage underwriting.

- Use strong action verbs to convey your accomplishments and contributions effectively.

- Showcase your ability to work under pressure and meet tight deadlines, as these are essential traits for underwriters.

- Include any relevant software proficiency, especially with underwriting tools or loan management systems.

Example Mortgage Underwriter Resume Summaries

Strong Resume Summaries

Detail-oriented Mortgage Underwriter with over 5 years of experience in evaluating and approving mortgage applications. Successfully processed over 1,000 loans with a 98% approval rate, minimizing risk and ensuring compliance with federal regulations.

Results-driven Mortgage Underwriter skilled in analyzing financial documents and assessing borrower creditworthiness. Achieved a 30% reduction in loan default rates by implementing stringent underwriting criteria and enhancing risk assessment protocols.

Experienced Mortgage Underwriter with a proven track record of managing high-volume loan portfolios. Leveraged advanced underwriting software to streamline processes, resulting in a 20% increase in efficiency and expedited loan approval times.

Weak Resume Summaries

Mortgage Underwriter with some experience looking for a new position. Good at reviewing loan applications.

I am a Mortgage Underwriter who is detail-oriented and works well with numbers. I am interested in finding a job in this field.

The strong resume summaries effectively highlight specific skills, achievements, and quantifiable results relevant to the Mortgage Underwriter role. They convey a clear picture of the candidate's capabilities and accomplishments, making them stand out to hiring managers. In contrast, the weak summaries lack detail and specificity, failing to provide concrete examples of the candidate's qualifications or impact, which may leave hiring managers unimpressed and less inclined to pursue the application further.

Work Experience Section for Mortgage Underwriter Resume

The work experience section of a Mortgage Underwriter resume is critical in demonstrating a candidate's technical skills, leadership abilities, and commitment to producing high-quality outcomes. This section not only highlights specific responsibilities and roles undertaken throughout a candidate's career but also emphasizes quantifiable achievements that align with industry standards. By effectively showcasing experience and results, candidates can illustrate their capacity to manage teams, streamline processes, and contribute to successful mortgage underwriting operations.

Best Practices for Mortgage Underwriter Work Experience

- Use clear and specific job titles to accurately reflect your role.

- Quantify achievements with metrics, such as reduction in processing time or increase in loan approval rates.

- Highlight technical skills relevant to underwriting software and compliance standards.

- Emphasize teamwork and collaboration by detailing cross-functional projects.

- Tailor your experience to align with the specific requirements of the job you are applying for.

- Use action verbs to describe responsibilities and accomplishments to create a dynamic presentation.

- Include relevant certifications and training that enhance your underwriting expertise.

- Showcase problem-solving skills by including examples of complex cases you successfully managed.

Example Work Experiences for Mortgage Underwriter

Strong Experiences

- Successfully evaluated and underwrote over 300 mortgage applications annually, resulting in a 20% increase in loan approval rates.

- Led a team of five underwriters, implementing new workflows that reduced processing time by 30% while maintaining compliance with industry regulations.

- Collaborated with loan officers and real estate agents to resolve complex underwriting issues, enhancing customer satisfaction scores by 15%.

- Developed and executed training programs for junior underwriters, improving team productivity and accuracy by 25% within six months.

Weak Experiences

- Responsible for reviewing mortgage applications.

- Worked with a team on various underwriting tasks.

- Helped with training new employees.

- Participated in meetings regarding underwriting processes.

The examples categorized as strong experiences effectively demonstrate measurable outcomes, showcasing the candidate's significant contributions and leadership within the underwriting process. In contrast, the weak experiences lack specific details and quantifiable achievements, making them less impactful and failing to convey the candidate's true capabilities in the mortgage underwriting field.

Education and Certifications Section for Mortgage Underwriter Resume

The education and certifications section in a Mortgage Underwriter resume plays a critical role in establishing the candidate's qualifications and expertise in the field. This section underscores the candidate's academic background, showcasing relevant degrees and coursework that provide a foundation for effective underwriting practices. Additionally, industry-recognized certifications and ongoing professional development efforts demonstrate a commitment to maintaining up-to-date knowledge in an ever-evolving mortgage landscape. By presenting pertinent educational qualifications and specialized training, candidates can significantly enhance their credibility and align themselves closely with the expectations of potential employers.

Best Practices for Mortgage Underwriter Education and Certifications

- Prioritize relevant degrees such as Finance, Business Administration, or Economics to showcase a solid academic foundation.

- Include industry-recognized certifications, such as the Certified Mortgage Underwriter (CMU) or the Mortgage Bankers Association (MBA) designation.

- Detail specific coursework related to underwriting, risk assessment, and mortgage regulations to demonstrate specialized knowledge.

- Highlight any additional training programs or workshops that focus on current industry trends and best practices.

- Emphasize continuous learning efforts, such as online courses, webinars, or seminars attended in the mortgage and finance sectors.

- List any relevant internships or hands-on experience within the mortgage industry that complements formal education.

- Ensure that all certifications are current and provide proof of ongoing professional development efforts.

- Tailor the education and certifications section to the job description to align with the specific requirements of the position.

Example Education and Certifications for Mortgage Underwriter

Strong Examples

- Bachelor’s Degree in Finance, University of ABC, 2020

- Certified Mortgage Underwriter (CMU), Mortgage Bankers Association, 2021

- Coursework in Risk Management and Mortgage Regulations, University of ABC

- Advanced Training in Automated Underwriting Systems, 2022

Weak Examples

- Bachelor’s Degree in History, University of XYZ, 2015

- Certification in Basic Office Administration, 2018

- Coursework in English Literature, University of XYZ

- Outdated Mortgage Underwriting Certification, 2010

The examples provided are considered strong because they directly relate to the key competencies and knowledge areas required for a Mortgage Underwriter. They highlight relevant degrees, recognized certifications, and specialized coursework that demonstrate a thorough understanding of the mortgage industry. In contrast, the weak examples are ineffective as they either lack relevance to the underwriting field or represent qualifications that do not align with the current requirements of the role, ultimately diminishing the candidate's appeal to potential employers.

Top Skills & Keywords for Mortgage Underwriter Resume

In the competitive field of mortgage underwriting, showcasing the right skills on your resume is crucial for standing out to potential employers. A well-crafted resume that highlights both hard and soft skills can effectively demonstrate your qualifications and suitability for the role. Employers seek candidates who not only possess the technical knowledge necessary for assessing financial risk but also those who excel in communication and interpersonal interactions. By focusing on the essential skills relevant to mortgage underwriting, you can enhance your resume and increase your chances of securing an interview.

Top Hard & Soft Skills for Mortgage Underwriter

Soft Skills

- Attention to detail

- Strong analytical skills

- Effective communication

- Problem-solving abilities

- Time management

- Customer service orientation

- Team collaboration

- Adaptability

- Negotiation skills

- Critical thinking

- Conflict resolution

- Empathy

- Decision-making

- Relationship building

Hard Skills

- Knowledge of mortgage underwriting guidelines

- Proficiency in financial analysis

- Familiarity with credit scoring systems

- Expertise in risk assessment

- Understanding of loan processing software

- Mastery of regulatory compliance

- Ability to interpret financial documents

- Proficient in data analysis tools

- Knowledge of property valuation methods

- Familiarity with mortgage products and services

- Competence in preparing underwriting reports

- Experience with automated underwriting systems

- Ability to conduct thorough background checks

- Proficient in Microsoft Excel and other relevant software

By emphasizing these key skills and showcasing relevant work experience, you can create a compelling resume that captures the attention of hiring managers in the mortgage industry.

Stand Out with a Winning Mortgage Underwriter Cover Letter

Dear [Hiring Manager's Name],

I am writing to express my strong interest in the Mortgage Underwriter position at [Company Name], as advertised on [Job Board/Company Website]. With over [X years] of experience in the mortgage industry and a keen eye for detail, I am confident in my ability to contribute effectively to your team and ensure the highest standards of underwriting quality and risk assessment. My background in evaluating loan applications, coupled with my commitment to providing exceptional service, aligns perfectly with the goals of [Company Name].

In my previous role at [Previous Company Name], I successfully assessed and underwrote a diverse range of mortgage loans, consistently meeting and exceeding performance benchmarks. I have developed a robust understanding of loan policies, guidelines, and regulatory requirements, allowing me to make informed decisions that mitigate risk while facilitating timely closings. My ability to analyze borrower creditworthiness and financial history has not only improved processing times but also enhanced customer satisfaction by ensuring transparent communication throughout the underwriting process.

I am particularly drawn to the innovative approach [Company Name] employs in the mortgage sector. I admire your commitment to leveraging technology to streamline operations and improve the customer experience. I am eager to bring my expertise in data analysis and risk management to your team, contributing to the development of more efficient underwriting practices. Furthermore, I believe that my collaborative spirit and strong communication skills will help foster effective relationships with loan officers and other stakeholders, ultimately driving success for [Company Name].

Thank you for considering my application. I am excited about the opportunity to discuss how my experience and skills align with the needs of your underwriting team. I look forward to the possibility of contributing to [Company Name] and helping clients achieve their homeownership dreams.

Sincerely,

[Your Name]

[Your Phone Number]

[Your Email Address]

Common Mistakes to Avoid in a Mortgage Underwriter Resume

Crafting a resume as a Mortgage Underwriter requires attention to detail and a clear demonstration of relevant skills and experience. However, many applicants make common mistakes that can hinder their chances of landing an interview. Understanding these pitfalls is crucial for creating a compelling resume that highlights your qualifications effectively. Below are some frequent errors to avoid when putting together your Mortgage Underwriter resume:

Generic Objective Statement: Using a vague objective that doesn’t specify your goals or how you can benefit the employer can make your resume blend in with others. Tailor your objective to reflect your aspirations and the value you bring.

Neglecting Relevant Skills: Failing to include specific underwriting skills, such as risk assessment, financial analysis, and knowledge of lending regulations, can leave out key qualifications that employers look for. Always highlight relevant competencies.

Overloading with Jargon: While industry-specific terms are important, excessive jargon may confuse the reader. Strive for a balance that showcases your expertise without alienating those unfamiliar with certain terms.

Inconsistent Formatting: A cluttered or inconsistent format can detract from the professionalism of your resume. Ensure uniformity in font, size, and spacing to create a clean, easy-to-read layout.

Ignoring Quantifiable Achievements: Omitting metrics that demonstrate your success, such as the number of loans processed or a percentage reduction in default rates, can weaken your impact. Use specific numbers to illustrate your accomplishments.

Lack of Customization: Submitting a one-size-fits-all resume for different jobs can be detrimental. Tailor your resume for each position by aligning your experience with the specific requirements and culture of the company.

Failing to Proofread: Typos and grammatical errors can create an impression of carelessness and lack of attention to detail, which are critical traits for an underwriter. Always proofread your resume or have someone else review it.

Listing Duties Instead of Accomplishments: Simply listing job duties can make your resume feel flat. Focus on what you achieved in those roles, emphasizing how your contributions positively impacted previous employers.

Conclusion

As we conclude our exploration of the Mortgage Underwriter role, it's essential to highlight the key competencies and responsibilities that define this critical position in the lending industry. Mortgage Underwriters play a vital role in assessing loan applications, ensuring that borrowers meet the necessary criteria, and mitigating risks for lending institutions. Their expertise in analyzing financial documents, credit histories, and market conditions is paramount to making informed lending decisions.

Furthermore, attention to detail, strong analytical skills, and a thorough understanding of underwriting guidelines are crucial for success in this role. The ever-evolving landscape of mortgage regulations also necessitates continuous learning and adaptability.

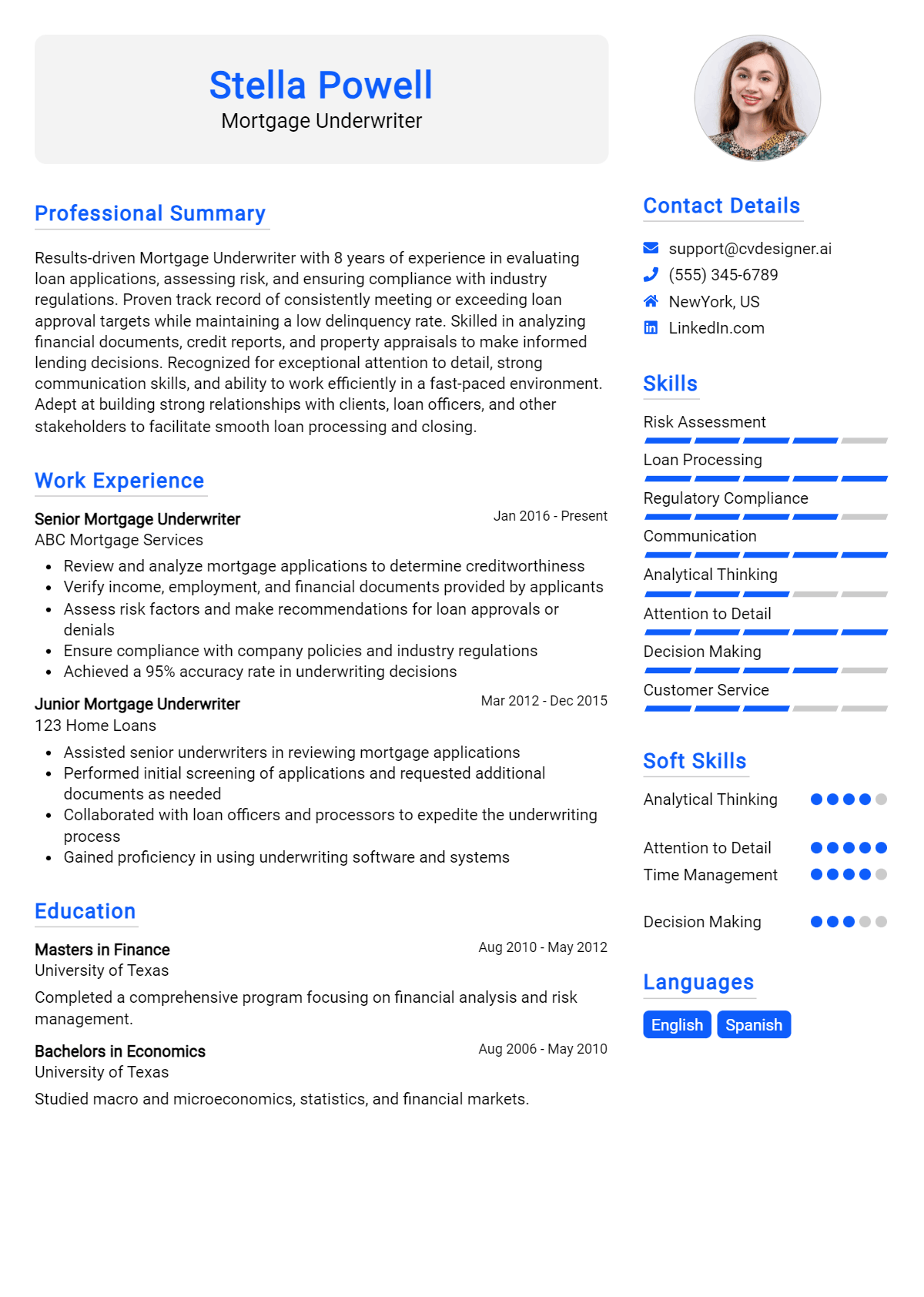

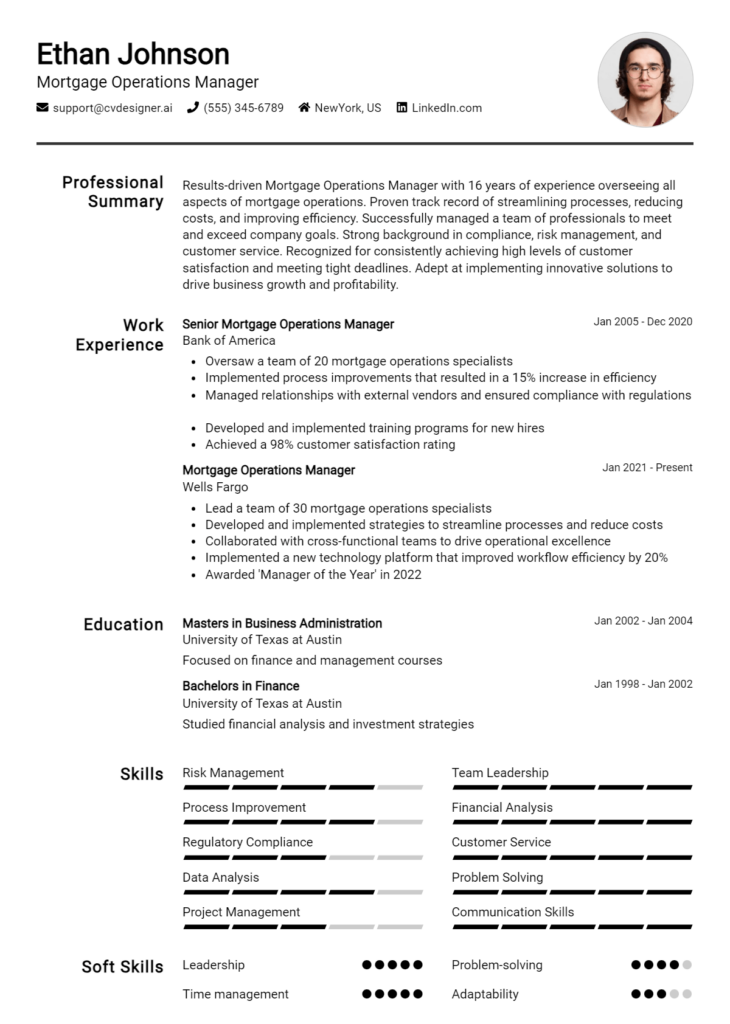

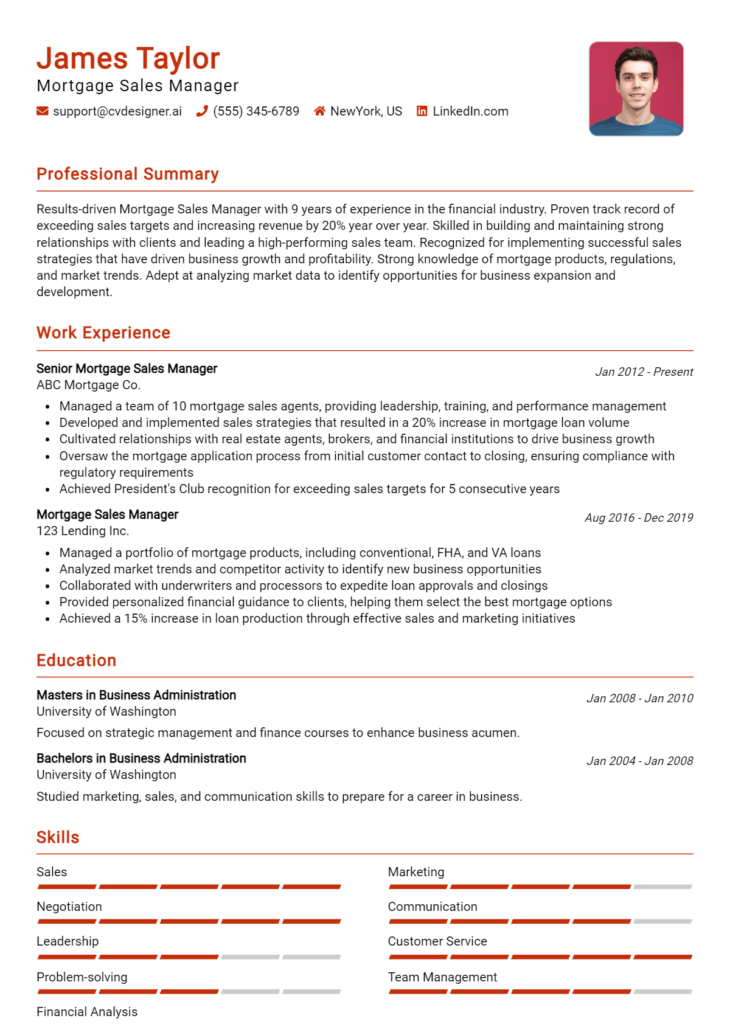

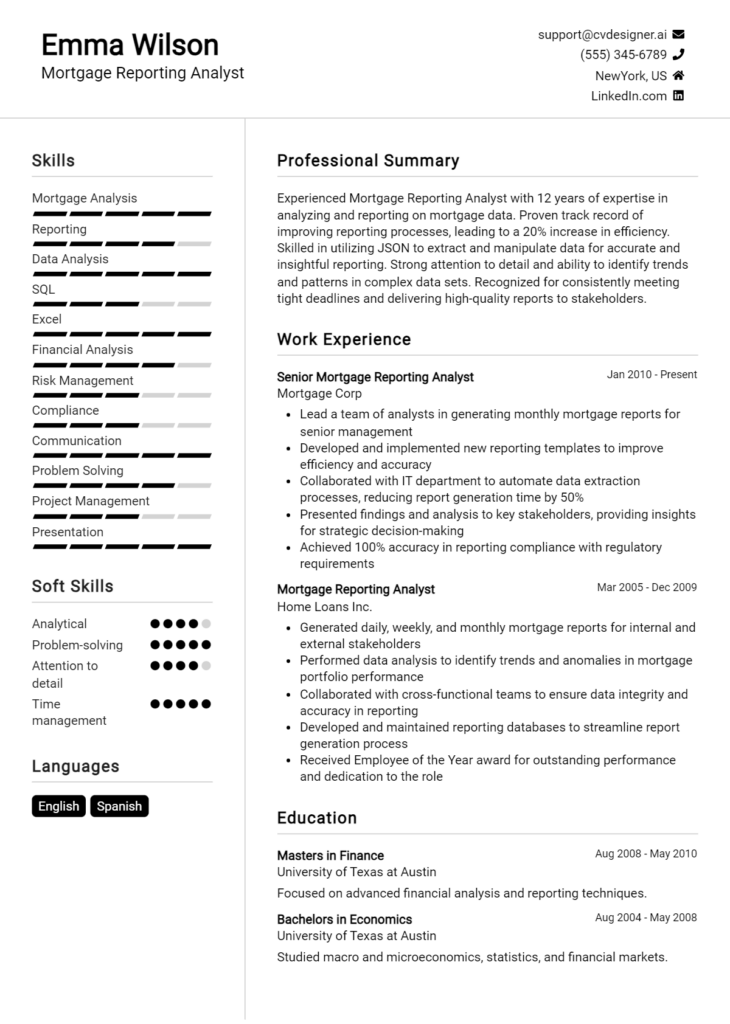

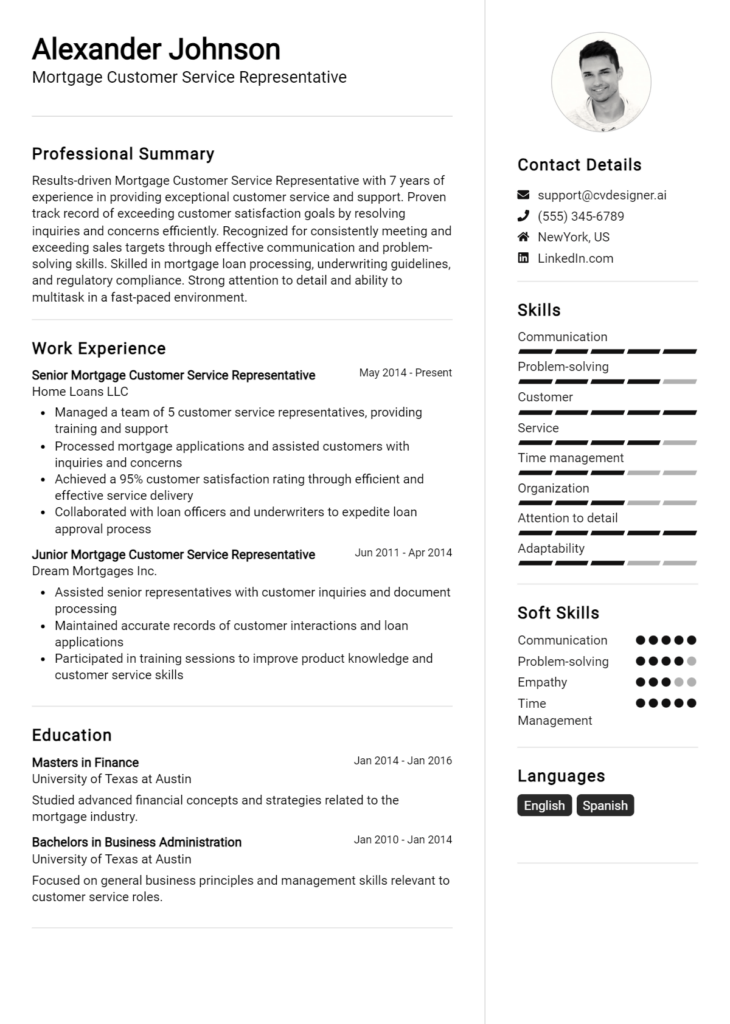

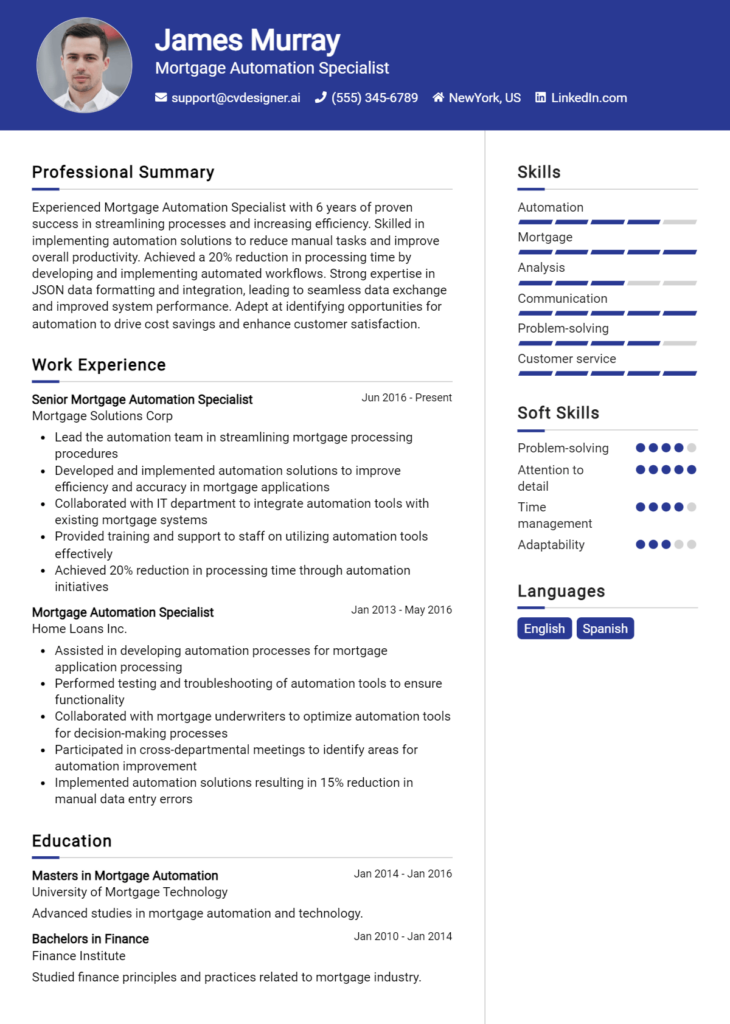

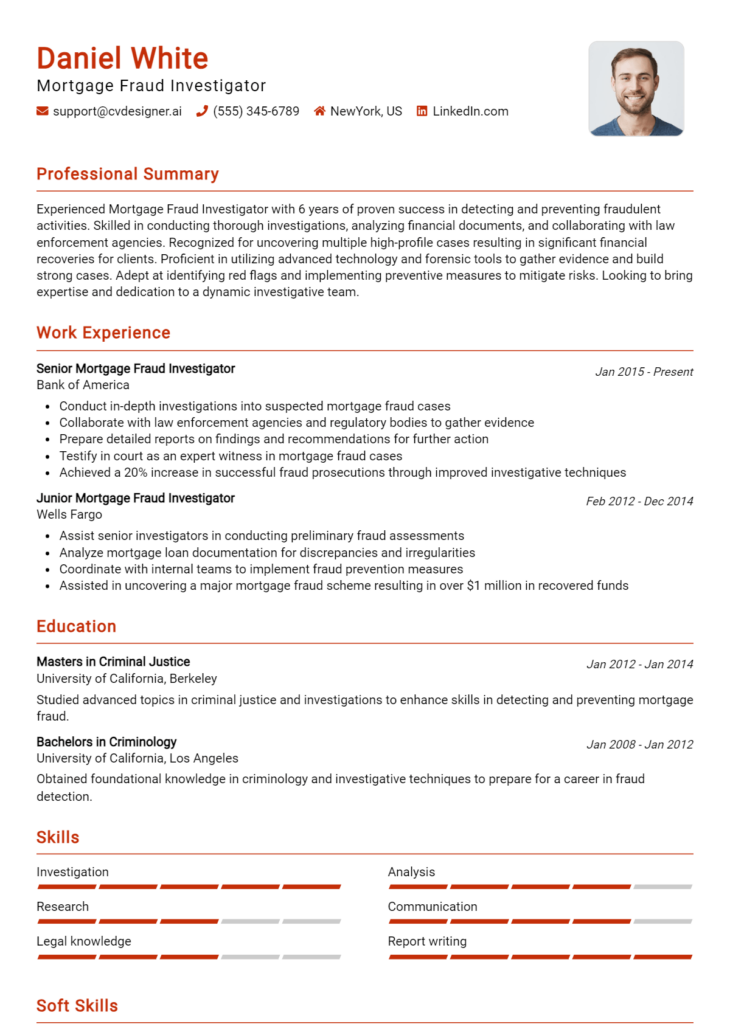

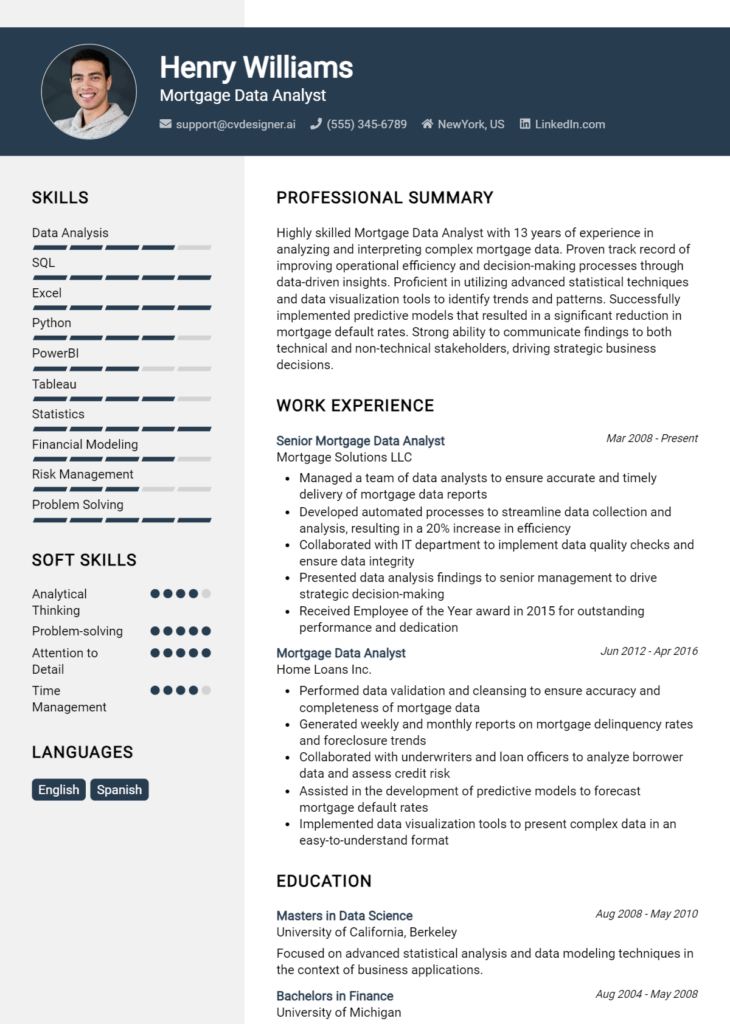

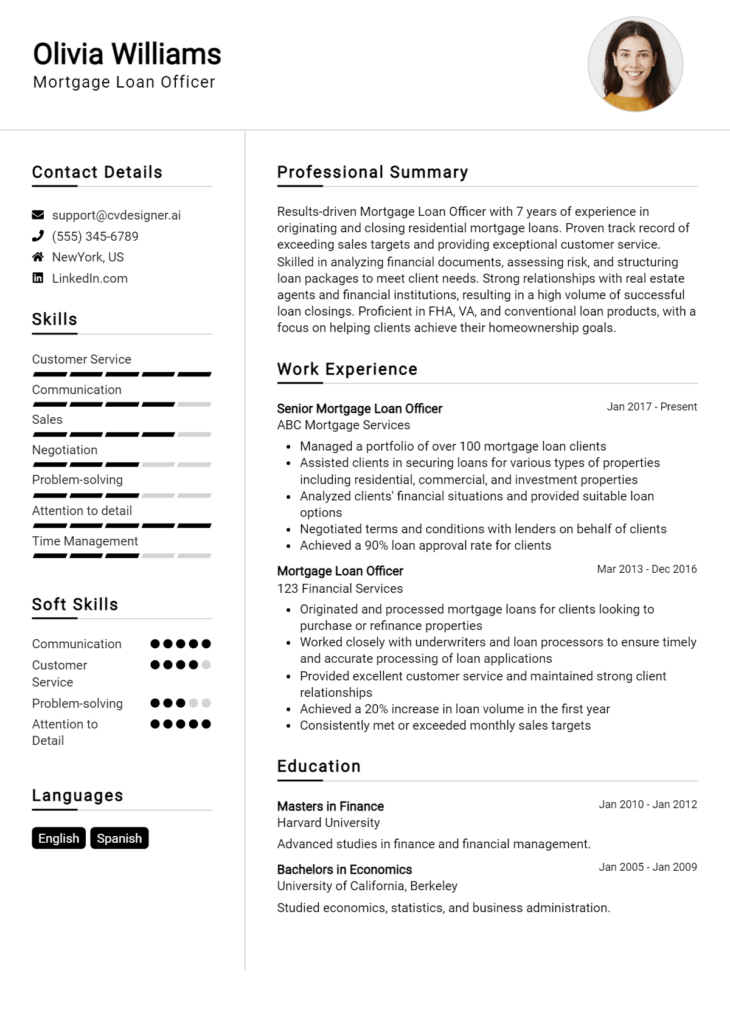

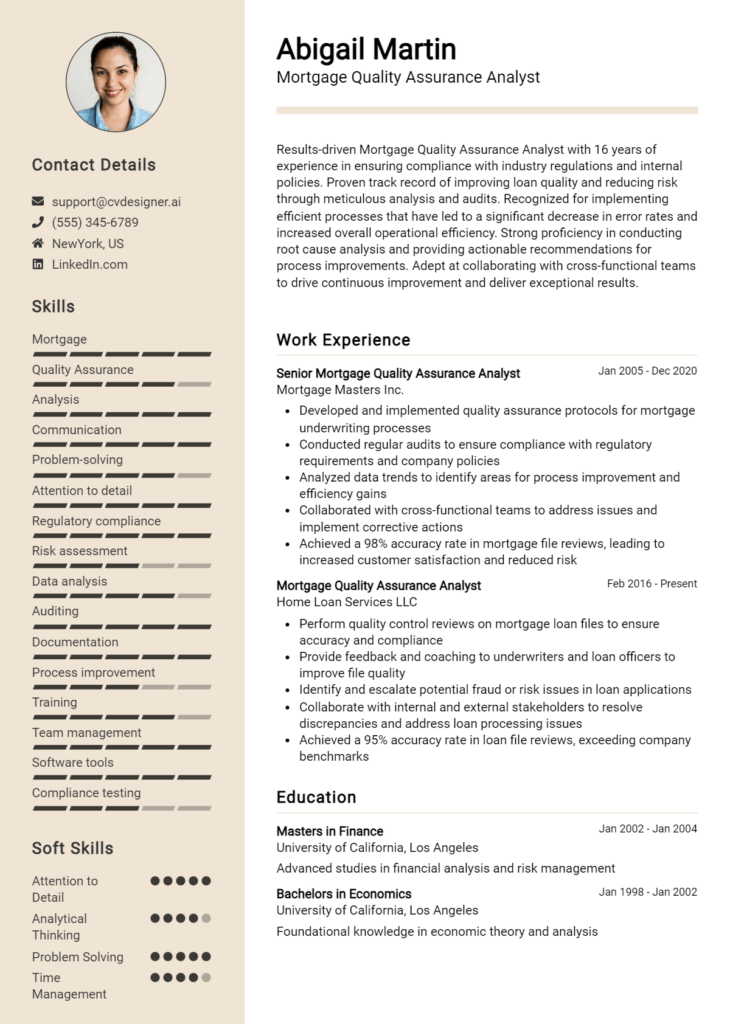

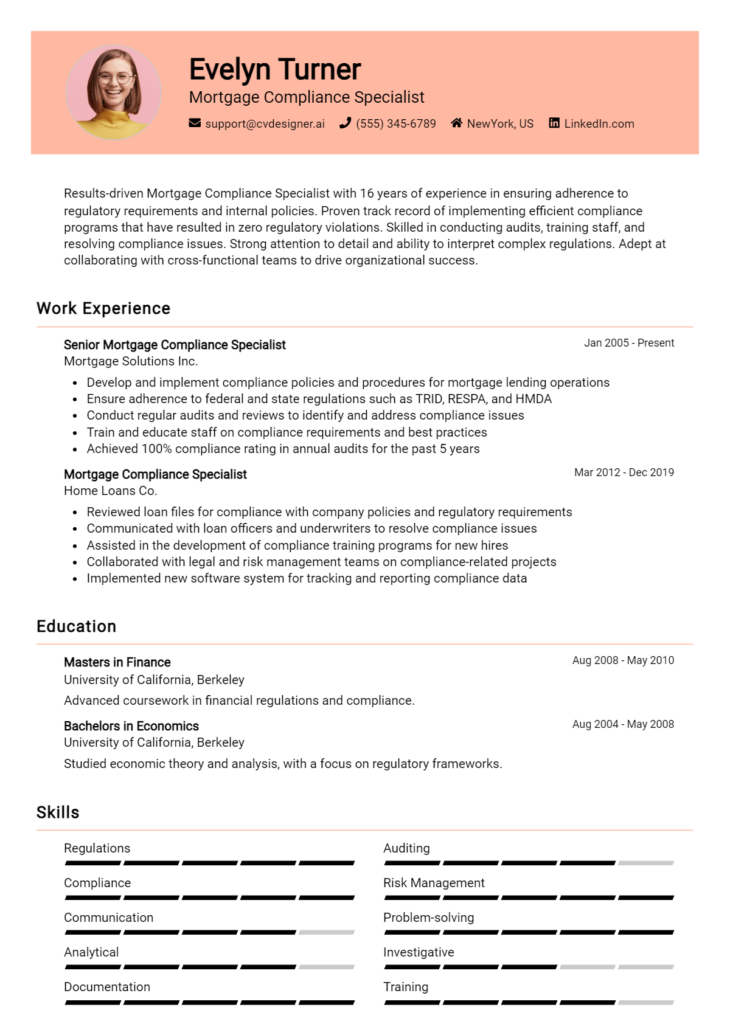

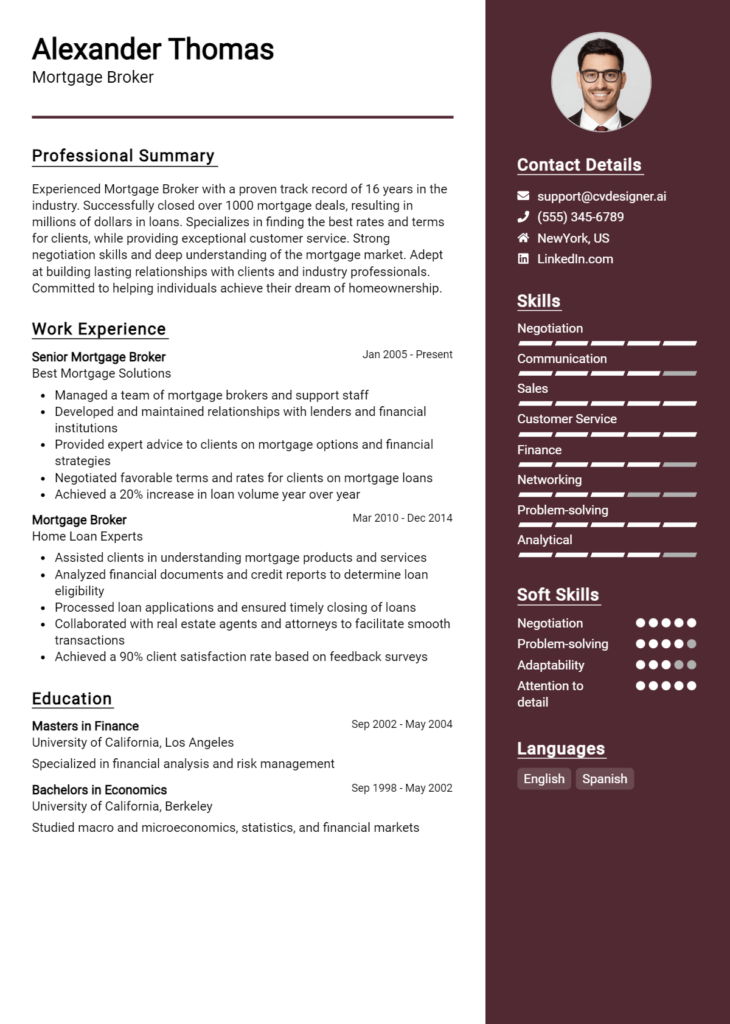

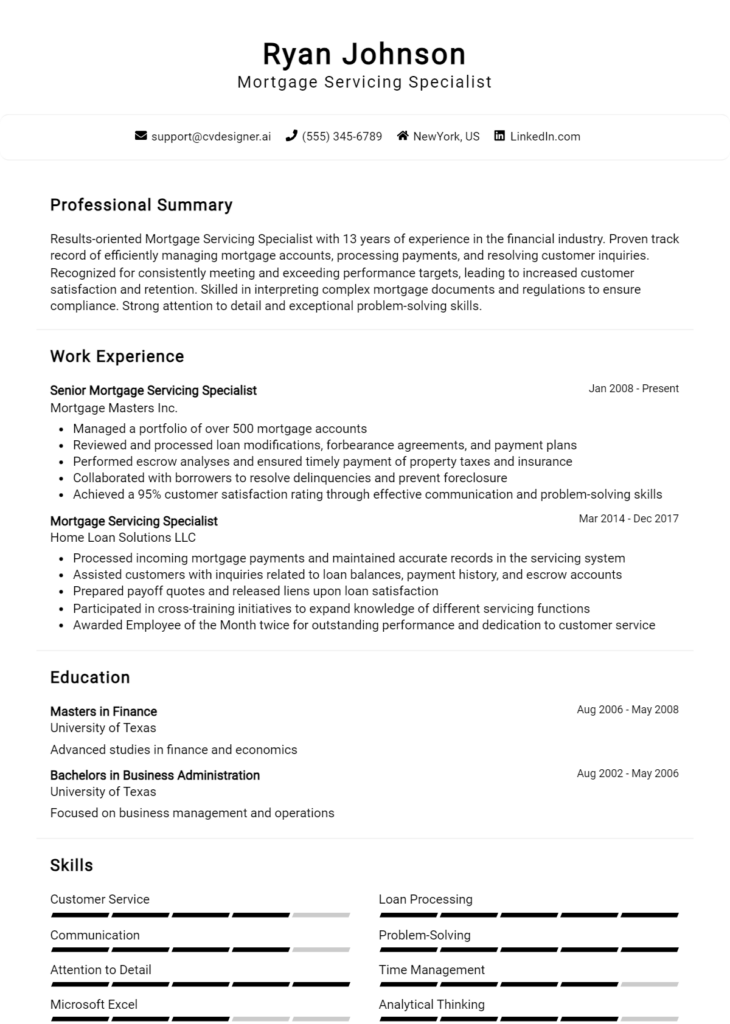

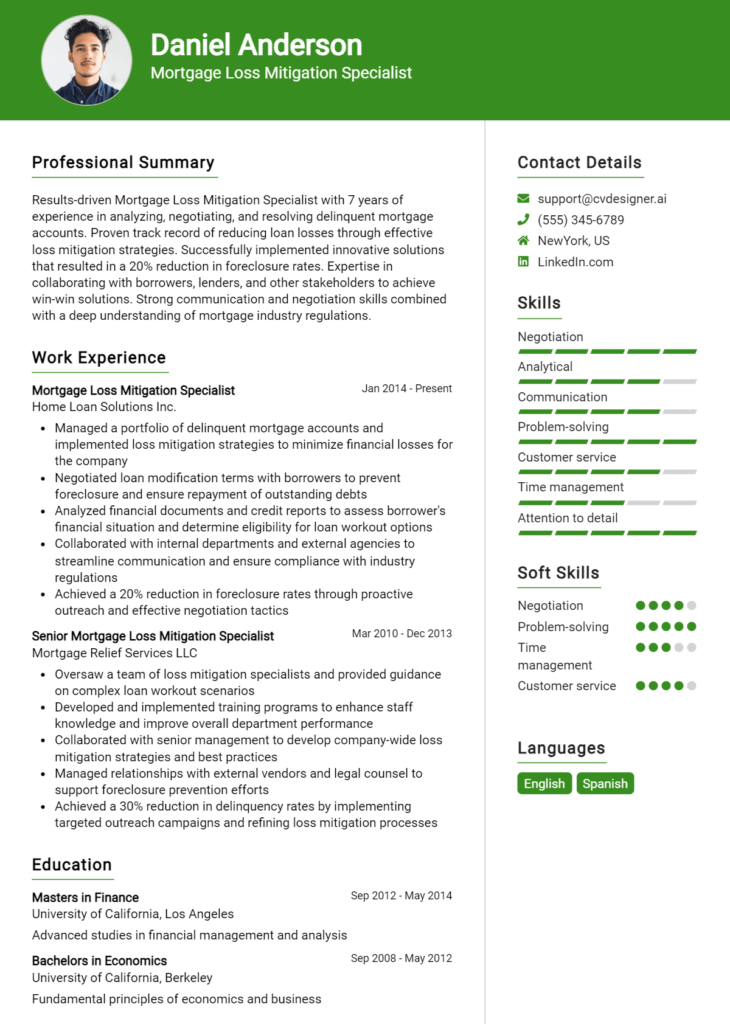

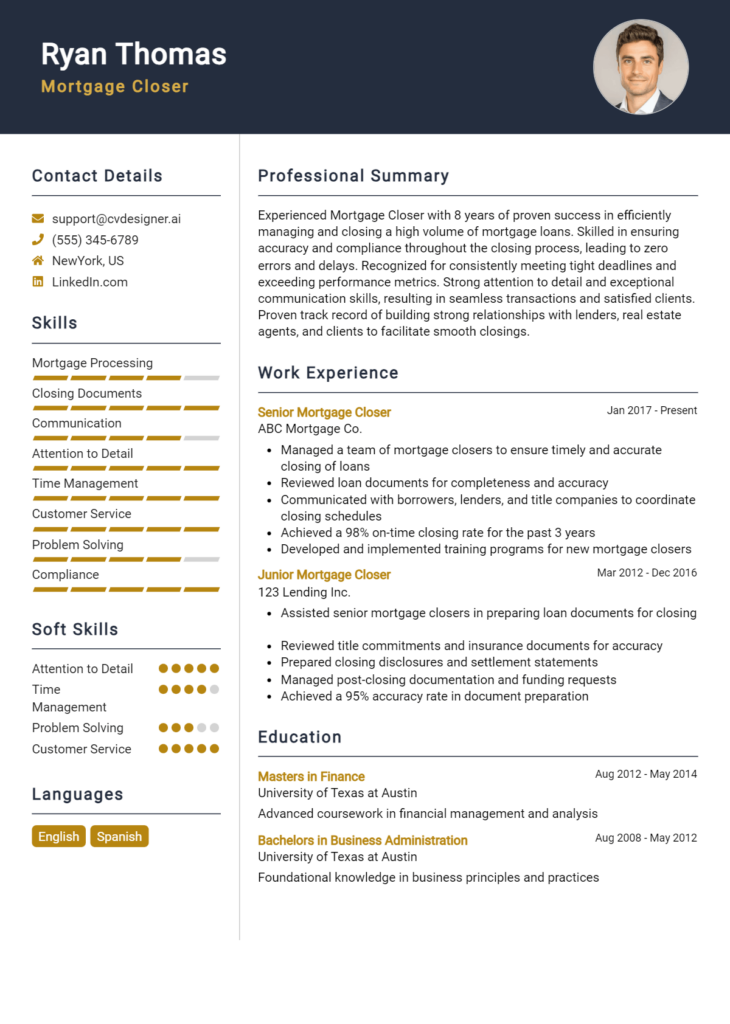

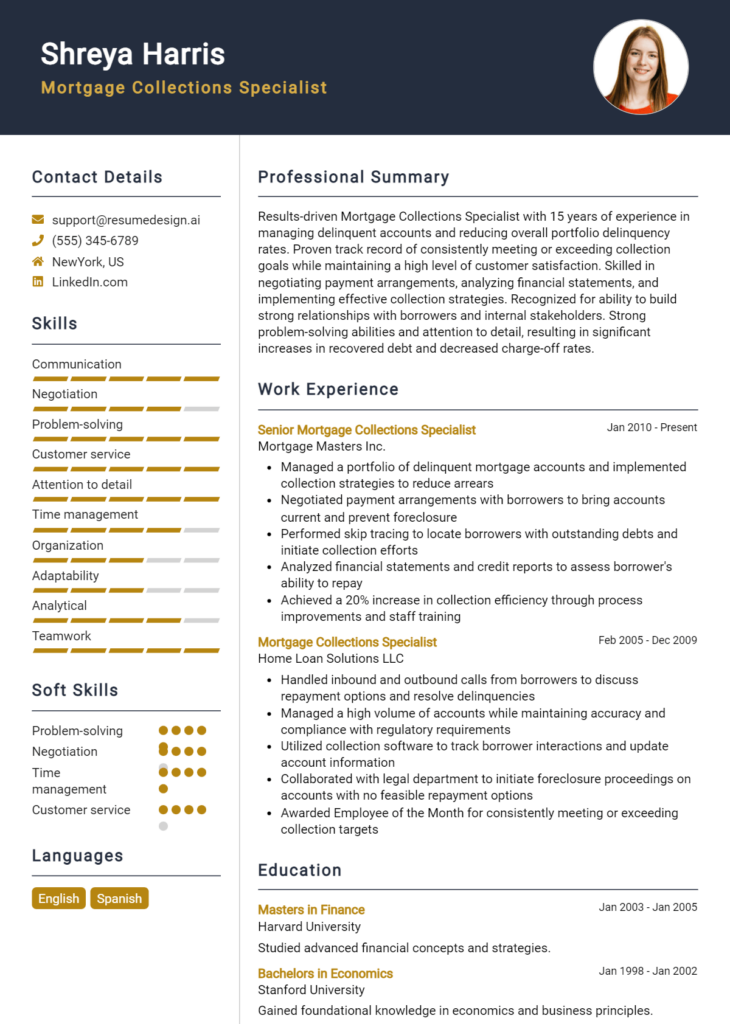

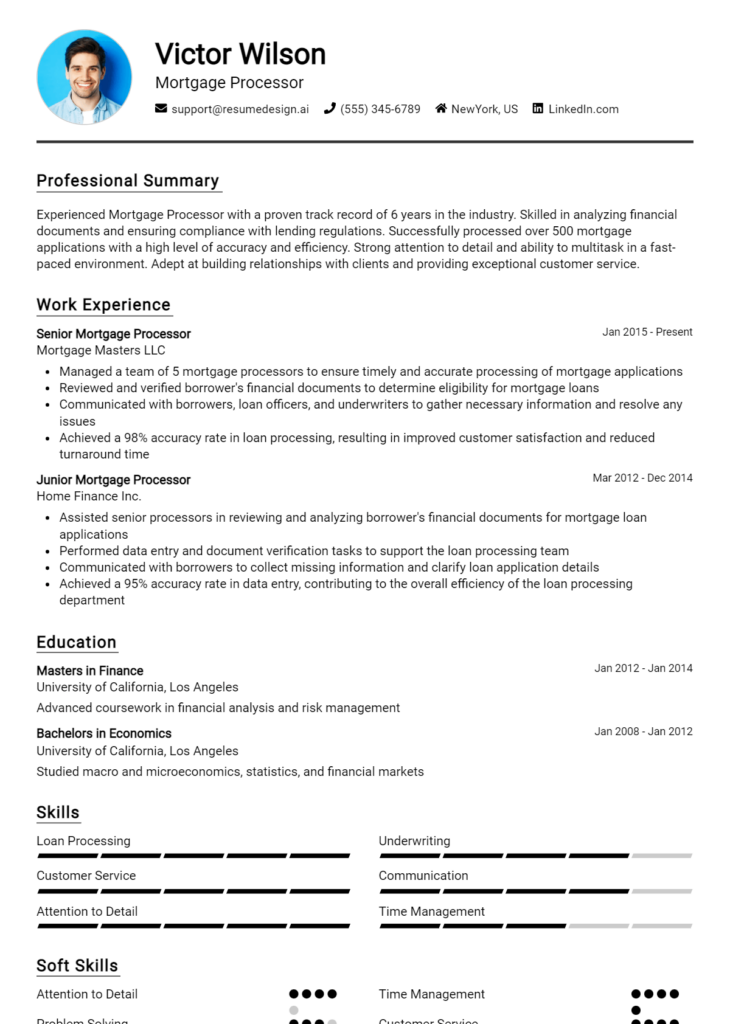

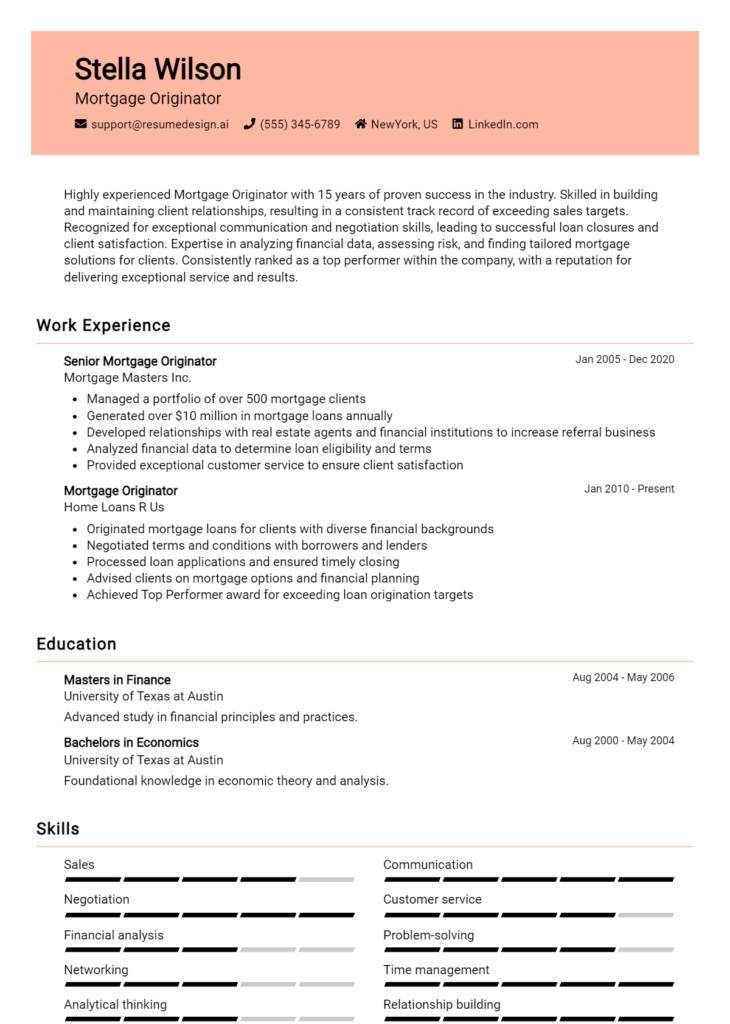

To ensure you stand out in this competitive field, it's time to take a closer look at your Mortgage Underwriter resume. A well-crafted resume can significantly enhance your chances of landing your desired position. Consider utilizing tools such as resume templates, which can provide a professional layout tailored to the industry. Additionally, a resume builder can simplify the process of creating a polished document that highlights your skills and experiences effectively.

Don’t forget to explore resume examples for inspiration, and enhance your application with a compelling cover letter template that speaks to your qualifications and enthusiasm for the role. Take action today and refine your resume to better position yourself for success in your career as a Mortgage Underwriter!