Mortgage Loan Officer Core Responsibilities

A Mortgage Loan Officer plays a crucial role in facilitating the loan process, acting as a bridge between clients, financial institutions, and underwriting departments. Key responsibilities include assessing client needs, analyzing financial data, and recommending suitable loan products. Successful candidates must possess strong technical skills, operational knowledge, and problem-solving abilities to navigate complex financial scenarios. These skills not only contribute to achieving organizational goals but also enhance customer satisfaction. A well-structured resume that highlights these qualifications can significantly improve job prospects.

Common Responsibilities Listed on Mortgage Loan Officer Resume

- Evaluate loan applications and financial data for accuracy.

- Guide clients through the loan process and provide expert advice.

- Develop and maintain relationships with real estate agents and other referral sources.

- Analyze credit reports and assess borrower eligibility.

- Prepare and present loan proposals to clients.

- Ensure compliance with federal and state regulations.

- Assist clients in gathering necessary documentation.

- Monitor loan progress and communicate updates to clients.

- Resolve issues and challenges that arise during the loan process.

- Stay updated on industry trends and lending products.

- Maintain accurate records of client interactions and transactions.

- Provide exceptional customer service throughout the loan process.

High-Level Resume Tips for Mortgage Loan Officer Professionals

In the competitive world of mortgage lending, a well-crafted resume is essential for Mortgage Loan Officer professionals who want to stand out to potential employers. Your resume is often the first impression you make, and it needs to effectively reflect your skills, experience, and achievements in the industry. A strong resume not only demonstrates your qualifications but also showcases your ability to drive results and meet client needs. In this guide, we will provide practical and actionable resume tips specifically tailored for Mortgage Loan Officer professionals, helping you craft a document that truly represents your capabilities and aspirations.

Top Resume Tips for Mortgage Loan Officer Professionals

- Tailor your resume to match the job description, highlighting the skills and experiences that align with the specific role.

- Showcase relevant experience in mortgage lending, including positions held, responsibilities, and the types of loans you have worked with.

- Quantify your achievements by including specific metrics, such as the number of loans processed, average loan amounts, or percentage of sales goals met.

- Highlight industry-specific skills, such as knowledge of mortgage products, underwriting processes, and regulatory compliance.

- Include certifications and licenses relevant to the mortgage industry, such as NMLS licensing or specialized training programs.

- Demonstrate your customer service skills by providing examples of how you've built relationships and assisted clients throughout the lending process.

- Utilize strong action verbs to describe your contributions and accomplishments, making your resume more dynamic and impactful.

- Keep your layout clean and professional, using bullet points for easy readability and ensuring that your most important information stands out.

- Incorporate keywords from the job listing to improve your chances of passing Applicant Tracking Systems (ATS) commonly used by employers.

By implementing these tips, you can significantly enhance your resume and increase your chances of landing a job as a Mortgage Loan Officer. A focused and well-structured resume will not only highlight your qualifications but also convey your commitment to excellence in the field, ultimately setting you apart from the competition.

Why Resume Headlines & Titles are Important for Mortgage Loan Officer

In the competitive field of mortgage lending, a Mortgage Loan Officer plays a crucial role in helping clients secure financing for their homes. A well-crafted resume is essential for candidates seeking to stand out, and the importance of resume headlines and titles cannot be overstated. A strong headline or title serves as a powerful first impression, immediately grabbing the attention of hiring managers and succinctly summarizing a candidate's key qualifications in just a few words. It should be concise, relevant, and directly related to the Mortgage Loan Officer position, effectively conveying the candidate's expertise and unique selling points.

Best Practices for Crafting Resume Headlines for Mortgage Loan Officer

- Keep it concise: Aim for one to two impactful phrases.

- Be role-specific: Use terminology that reflects the mortgage industry.

- Highlight key qualifications: Focus on skills or achievements that are relevant.

- Use action-oriented language: Begin with strong verbs to convey confidence.

- Incorporate numbers or metrics: Quantify achievements to enhance credibility.

- Tailor to the job description: Align your headline with the specific role you’re applying for.

- Avoid jargon: Use clear language that can be easily understood by hiring managers.

- Make it memorable: Create a unique phrasing to stand out from other candidates.

Example Resume Headlines for Mortgage Loan Officer

Strong Resume Headlines

"Experienced Mortgage Loan Officer with 10+ Years of Proven Success in Closing High-Value Loans"

“Top-Performing Loan Officer Specializing in First-Time Homebuyer Financing and Customer Satisfaction”

“Licensed Mortgage Professional with a Track Record of Exceeding Sales Targets by 30%”

Weak Resume Headlines

“Mortgage Loan Officer”

“Seeking a Job in Finance”

The strong headlines are effective because they immediately communicate the candidate's experience, specialization, and measurable success, thereby generating interest among hiring managers. They provide a clear snapshot of what the applicant brings to the table. In contrast, the weak headlines fail to make an impact; they are overly generic and lack the specifics that would help a candidate stand out, making it difficult for hiring managers to discern the applicant's qualifications or unique value proposition.

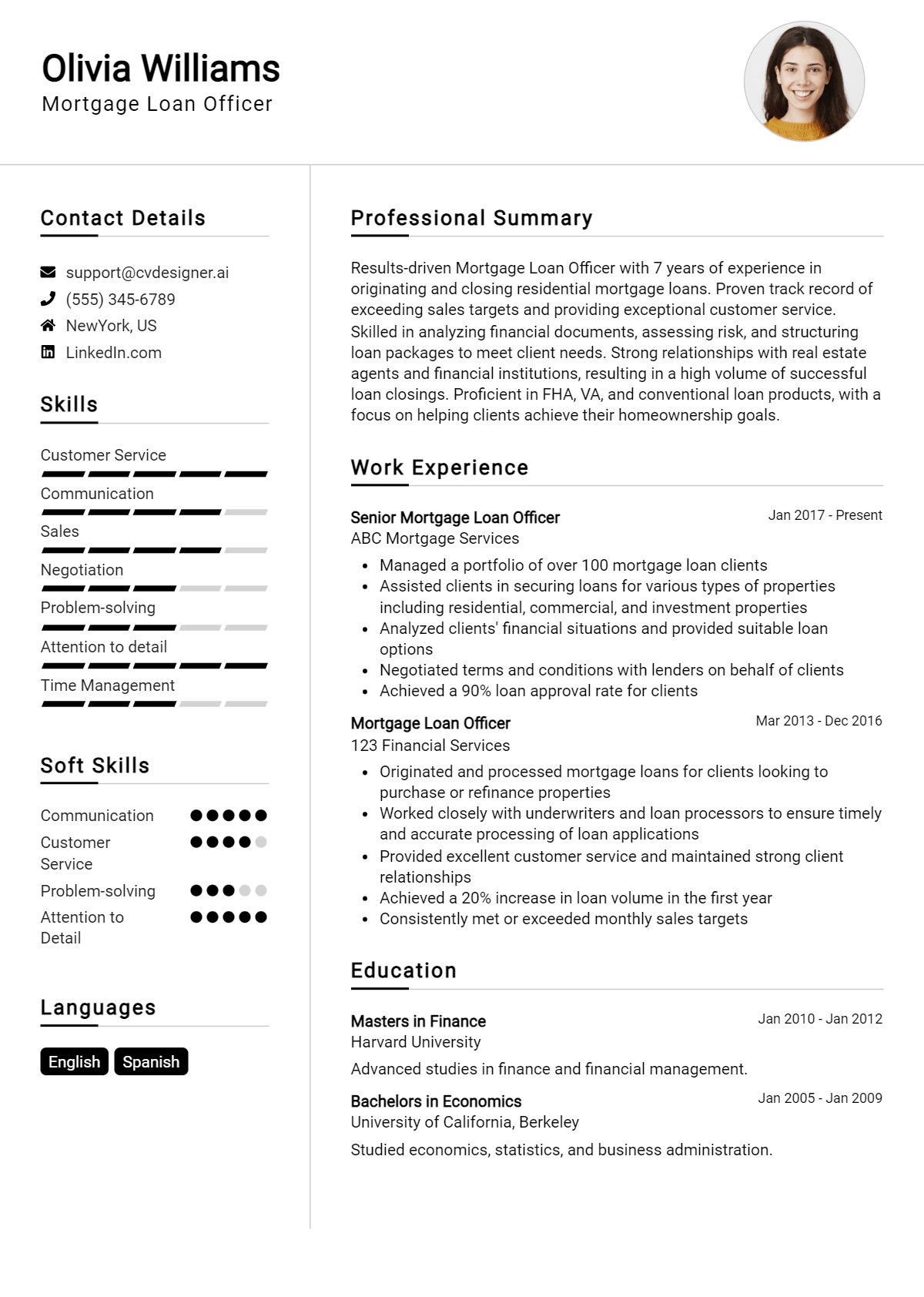

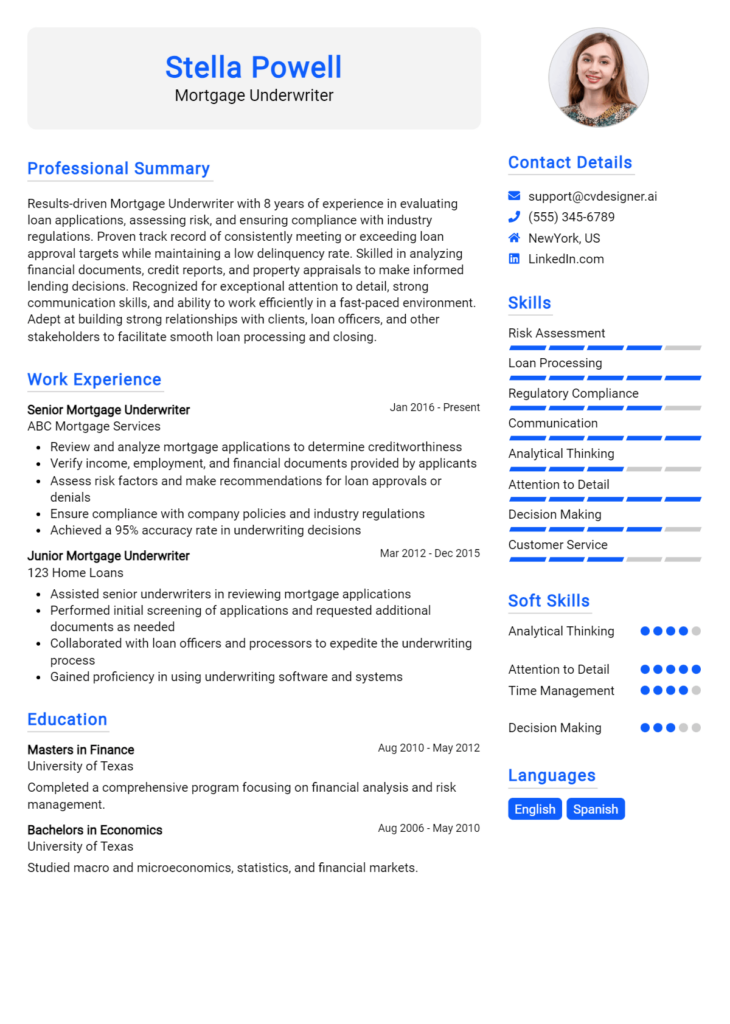

Writing an Exceptional Mortgage Loan Officer Resume Summary

A well-crafted resume summary is crucial for a Mortgage Loan Officer as it serves as the first impression for hiring managers, quickly capturing their attention. In a competitive job market, a strong summary highlights key skills, relevant experience, and notable accomplishments, succinctly presenting the candidate's qualifications. This brief yet impactful introduction needs to be tailored to the specific job application, ensuring that it effectively communicates how the candidate aligns with the needs of potential employers.

Best Practices for Writing a Mortgage Loan Officer Resume Summary

- Quantify achievements: Use numbers and percentages to highlight accomplishments.

- Focus on relevant skills: Emphasize skills that are directly applicable to mortgage lending.

- Tailor the summary: Customize the summary for each job application based on the job description.

- Keep it concise: Limit the summary to 2-4 sentences for clarity and impact.

- Highlight industry knowledge: Mention familiarity with current mortgage products and regulations.

- Showcase customer service skills: Emphasize the ability to build and maintain client relationships.

- Include certifications or licenses: Mention relevant qualifications like NMLS registration.

- Demonstrate results-driven performance: Share examples of how you have achieved or exceeded targets.

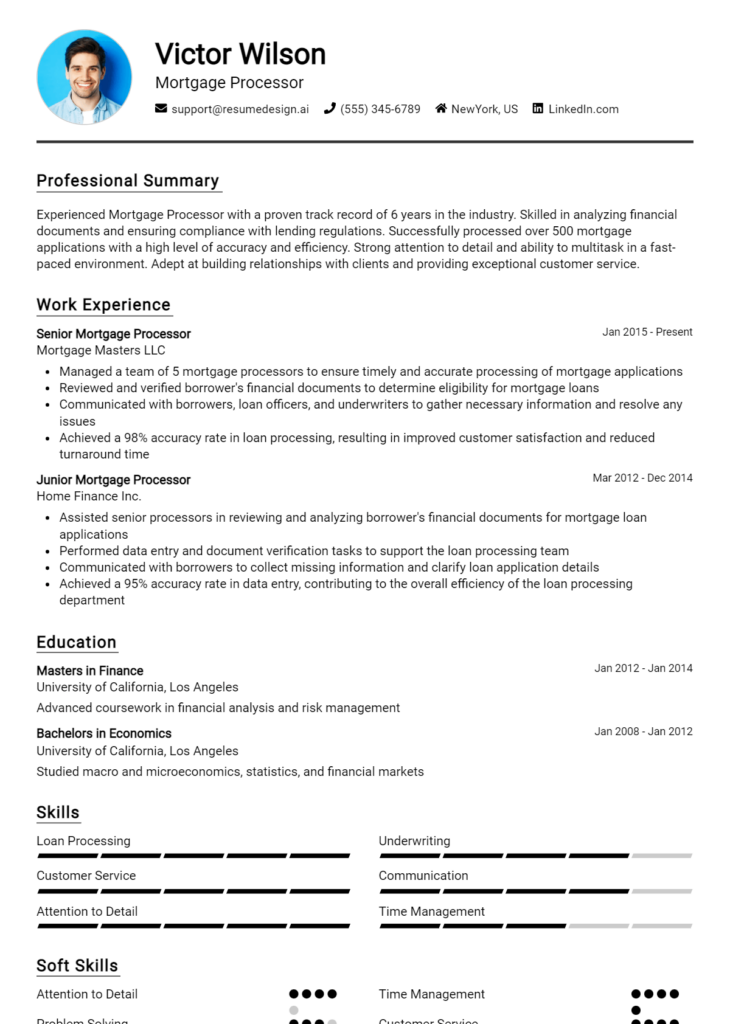

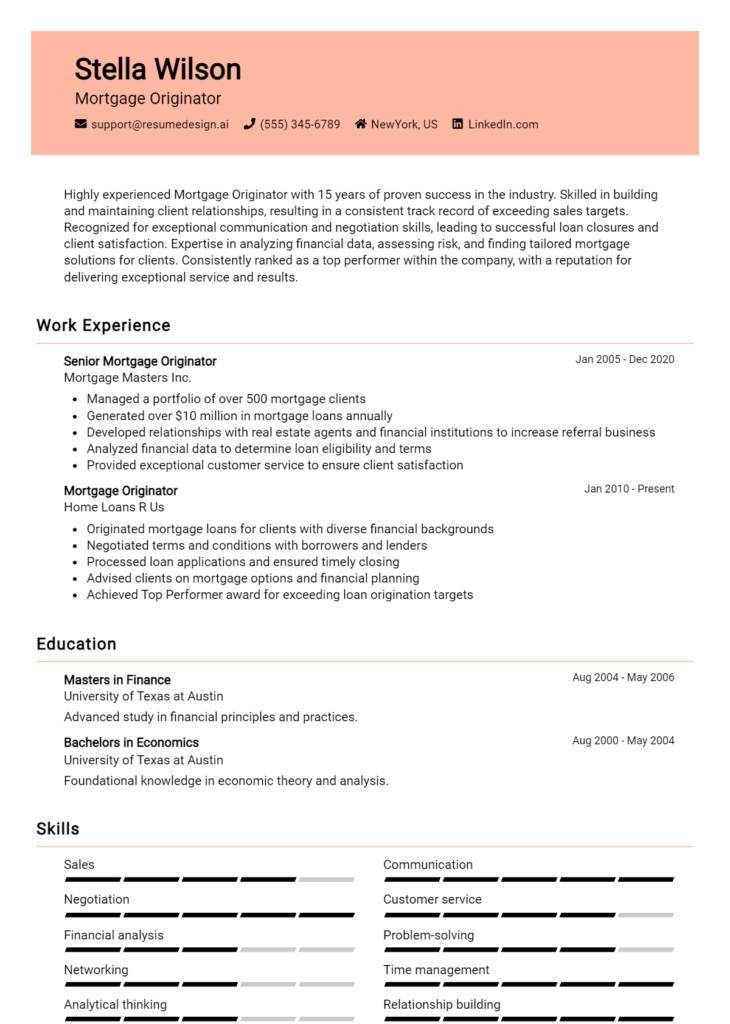

Example Mortgage Loan Officer Resume Summaries

Strong Resume Summaries

Result-oriented Mortgage Loan Officer with over 7 years of experience in the industry, successfully closing over $50 million in loans annually. Skilled in building strong client relationships and navigating complex financial situations, with a proven track record of increasing loan approval rates by 20% through effective communication and service excellence.

Dedicated Mortgage Loan Officer with a strong background in residential lending, achieving 95% customer satisfaction ratings through personalized service. Proven ability to manage a portfolio of over 200 clients, leading to a 30% increase in referral business over the past year.

Experienced Mortgage Loan Officer proficient in analyzing financial data and presenting customized loan options. Successfully facilitated loan closings that exceeded $30 million within the last fiscal year, while ensuring compliance with all regulatory requirements.

Weak Resume Summaries

Mortgage Loan Officer with experience in the field. I have worked with various clients and helped them with their loan needs.

Skilled professional seeking a position in mortgage lending. I have knowledge of loans and customer service.

The strong resume summaries stand out due to their specific achievements, quantifiable outcomes, and a clear demonstration of relevant skills tailored to the Mortgage Loan Officer role. In contrast, the weak summaries are vague, lacking concrete details and measurable results, making it difficult for hiring managers to gauge the candidate's qualifications and potential impact in the position.

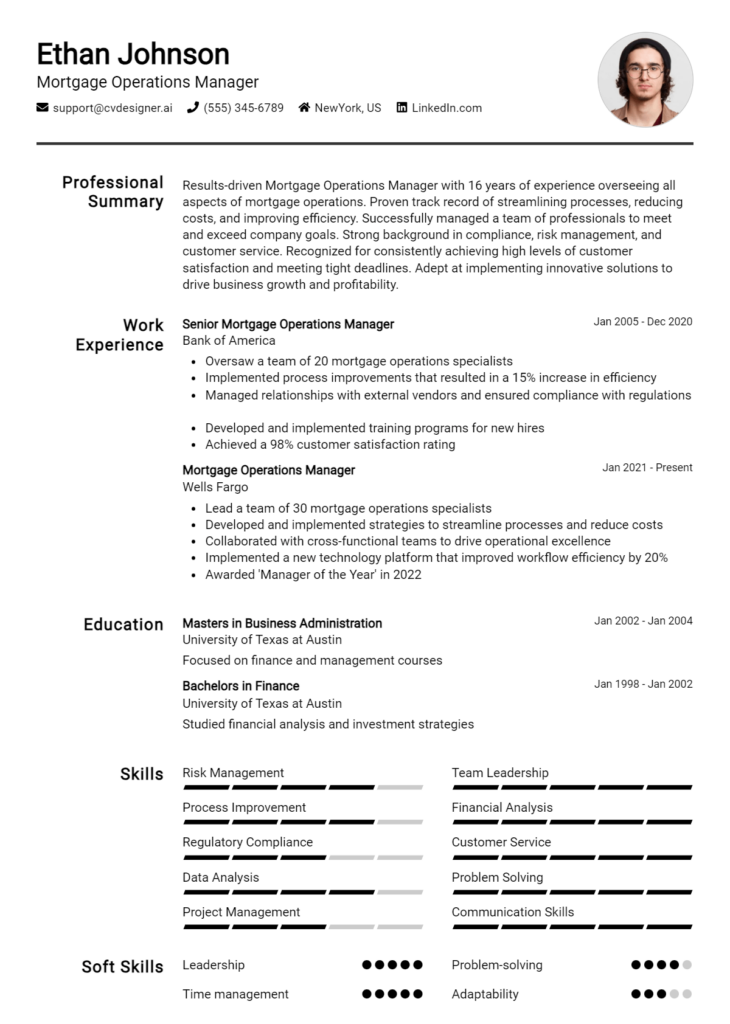

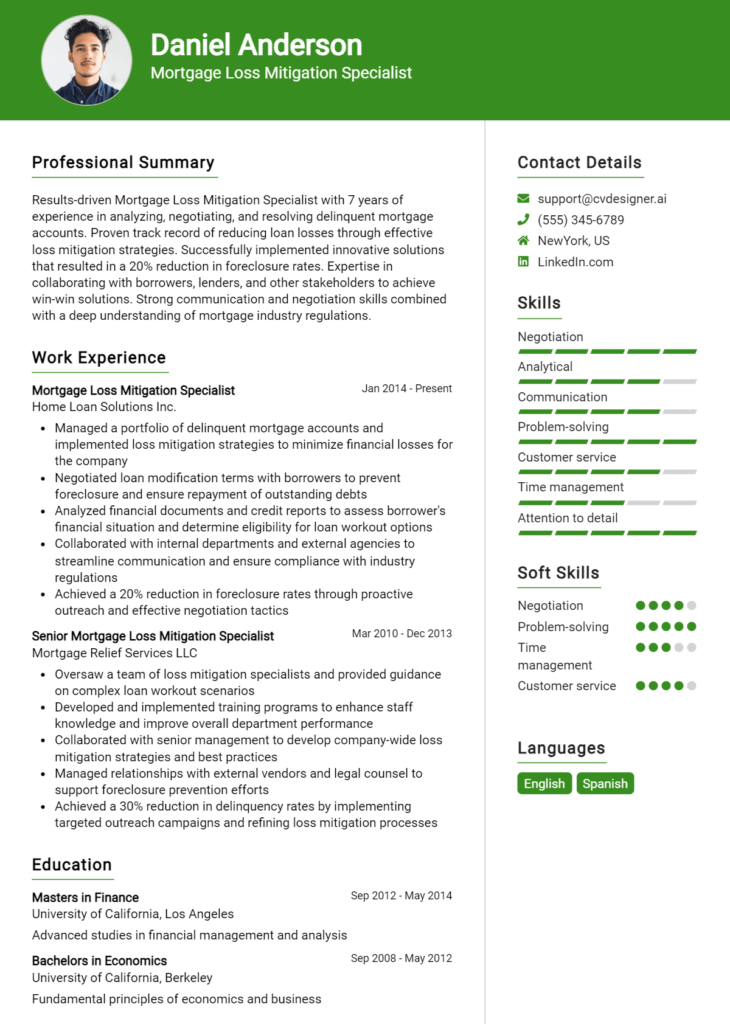

Work Experience Section for Mortgage Loan Officer Resume

The work experience section of a Mortgage Loan Officer resume is crucial as it serves as a platform to showcase the candidate's technical skills, leadership capabilities, and commitment to delivering high-quality products. This section not only highlights relevant experiences but also quantifies achievements, demonstrating how the candidate has contributed to their previous employers' success. Aligning these experiences with industry standards is vital, as it helps to position the candidate as a knowledgeable and capable professional in the competitive mortgage landscape.

Best Practices for Mortgage Loan Officer Work Experience

- Highlight relevant technical skills such as underwriting, loan processing, and compliance knowledge.

- Quantify achievements with specific numbers, such as loan volume processed, closing ratios, or customer satisfaction rates.

- Emphasize teamwork and collaboration by detailing experiences in leading teams or participating in cross-functional projects.

- Use action verbs to convey proactivity and results-driven mindset.

- Align work experience statements with industry standards and terminology to demonstrate familiarity with the field.

- Include any certifications or training that enhance your credibility as a mortgage professional.

- Focus on outcomes and the impact of your work on the organization’s bottom line.

- Tailor your experiences to the job description to resonate with hiring managers and applicant tracking systems.

Example Work Experiences for Mortgage Loan Officer

Strong Experiences

- Successfully closed over $50 million in residential loans in 2022, achieving a 95% customer satisfaction rate through exceptional service and timely communication.

- Led a team of five loan processors, streamlining the application process and reducing turnaround time by 30% while maintaining compliance with regulations.

- Implemented a new CRM system that increased lead conversion rates by 20%, resulting in an additional $10 million in loan volume.

- Conducted monthly training sessions for new hires, enhancing team knowledge and improving overall efficiency by 15%.

Weak Experiences

- Worked on various loan applications and assisted clients with general inquiries.

- Participated in team meetings and contributed to discussions about loan processing.

- Helped with customer service tasks and occasionally closed loans.

- Gained experience in the mortgage industry over several years.

The examples of strong experiences are considered effective because they include quantifiable outcomes and specific achievements that clearly demonstrate the candidate’s impact on their previous employers. In contrast, the weak experiences lack detail and specificity, making them vague and unimpressive. They do not provide a clear picture of the candidate's contributions or technical skills, which could lead to a lack of interest from potential employers.

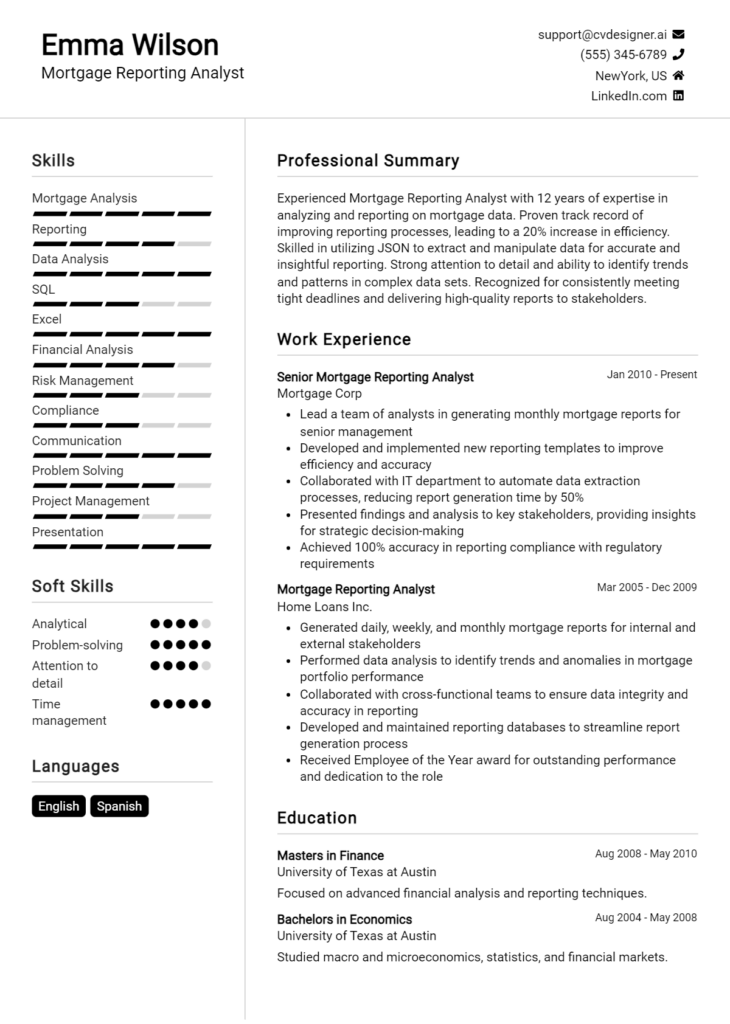

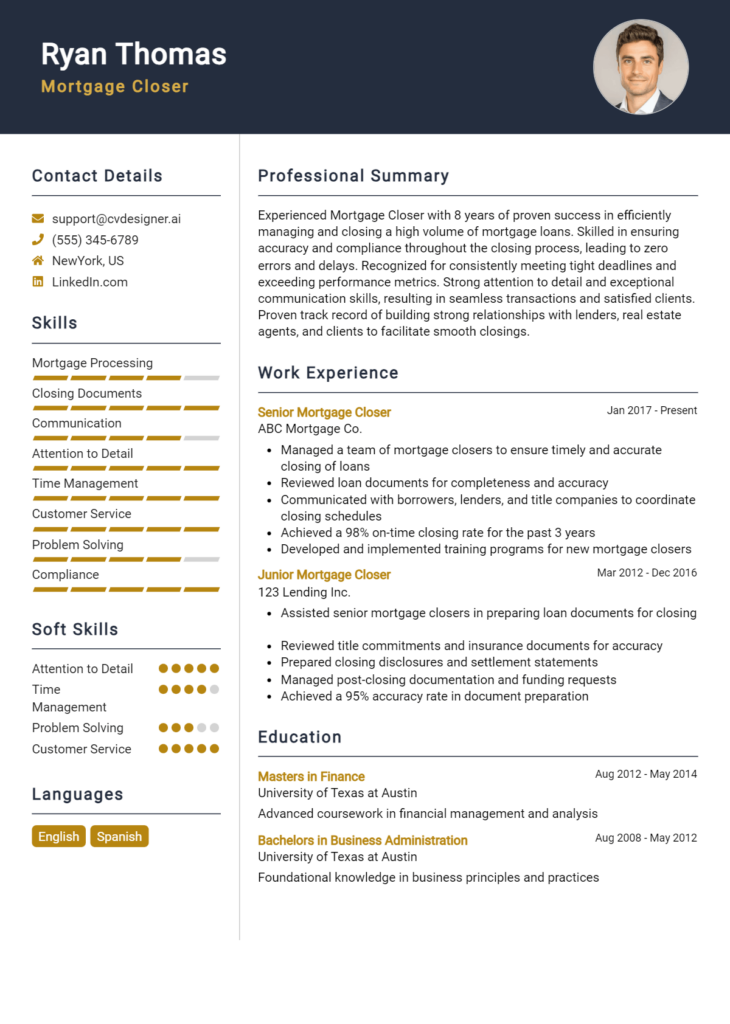

Education and Certifications Section for Mortgage Loan Officer Resume

The education and certifications section of a Mortgage Loan Officer resume plays a crucial role in establishing the candidate's qualifications and commitment to the industry. This section not only showcases the candidate's academic background but also highlights relevant certifications and continuous learning efforts that align with the demands of the mortgage industry. By providing details about relevant coursework, industry-recognized certifications, and any specialized training, candidates can enhance their credibility and demonstrate their preparedness for the responsibilities associated with the role of a Mortgage Loan Officer.

Best Practices for Mortgage Loan Officer Education and Certifications

- Include only relevant degrees and certifications that directly relate to mortgage lending or finance.

- List your most recent educational achievements first, following a reverse chronological order.

- Highlight certifications from recognized institutions or industry organizations, such as the Mortgage Bankers Association.

- Detail specific coursework that pertains to mortgage lending, finance, or real estate.

- Consider including ongoing education or training programs to showcase commitment to professional development.

- Use clear, concise formatting to ensure easy readability and accessibility of the information.

- Avoid listing outdated or irrelevant qualifications that do not enhance your suitability for the role.

- Tailor the education and certifications section to align with the job description and requirements of the position.

Example Education and Certifications for Mortgage Loan Officer

Strong Examples

- Bachelor of Science in Finance, ABC University, 2020

- Certified Mortgage Advisor (CMA), Mortgage Bankers Association, 2021

- Advanced Mortgage Underwriting Course, XYZ Training Institute, 2022

- Real Estate Principles and Practices Certification, DEF Real Estate School, 2019

Weak Examples

- Bachelor of Arts in History, ABC University, 2010

- Real Estate License obtained in 2005 (expired)

- Certification in Microsoft Office Applications, 2018

- High School Diploma, XYZ High School, 2005

The examples provided illustrate the difference between strong and weak qualifications in the context of a Mortgage Loan Officer's resume. Strong examples showcase relevant degrees and certifications that are directly applicable to the mortgage industry, demonstrating the candidate's preparedness and expertise. In contrast, weak examples highlight qualifications that are outdated, irrelevant, or do not enhance the candidate's alignment with the role, ultimately detracting from their overall credibility and suitability for the position.

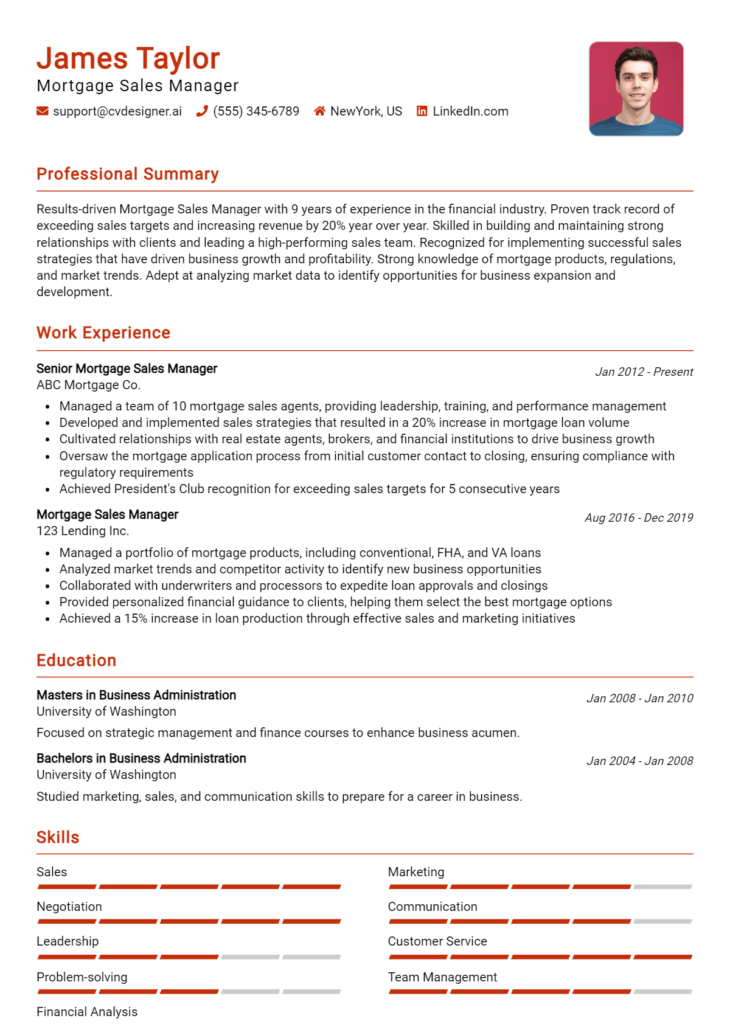

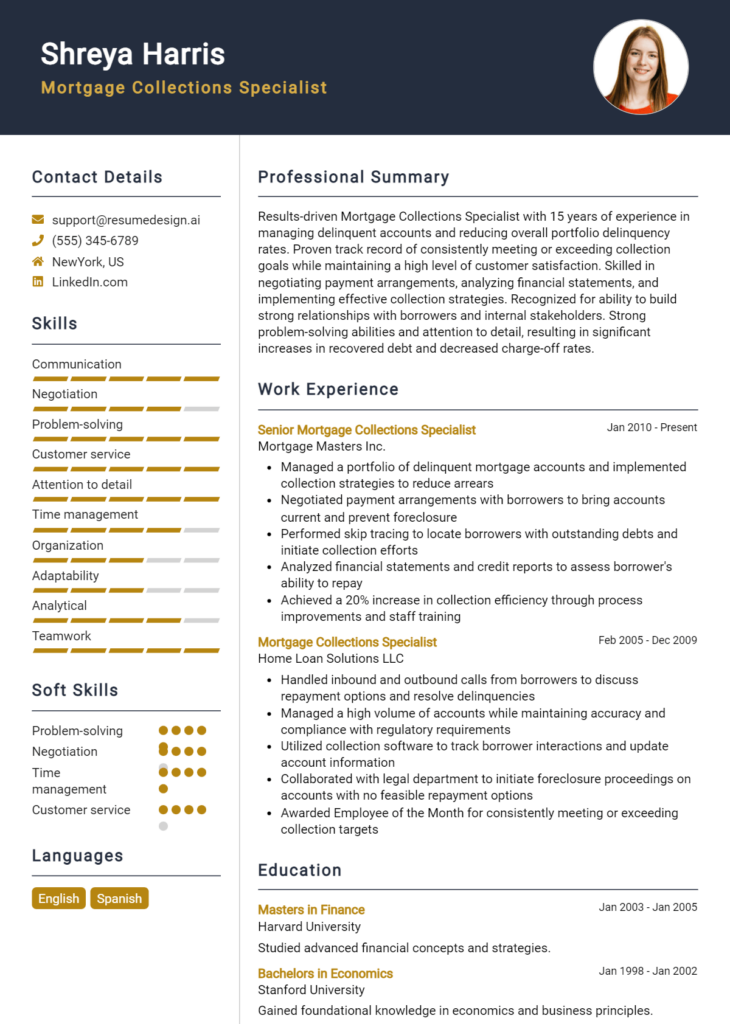

Top Skills & Keywords for Mortgage Loan Officer Resume

As a Mortgage Loan Officer, possessing the right skills is essential for success in this competitive industry. A well-crafted resume that highlights both hard and soft skills can make a significant difference in attracting potential employers and securing interviews. Skills not only demonstrate your qualifications but also showcase your ability to build relationships with clients, navigate complex financial processes, and effectively communicate solutions. By emphasizing these skills on your resume, you can illustrate your value as a candidate and your readiness to contribute to a lending institution.

Top Hard & Soft Skills for Mortgage Loan Officer

Soft Skills

- Excellent communication skills

- Strong interpersonal abilities

- Customer service orientation

- Problem-solving aptitude

- Attention to detail

- Time management

- Negotiation skills

- Adaptability

- Active listening

- Team player

Hard Skills

- Knowledge of mortgage products

- Proficiency in underwriting guidelines

- Familiarity with loan processing software

- Financial analysis skills

- Understanding of credit reports

- Regulatory compliance knowledge

- Risk assessment capabilities

- Sales techniques

- Data entry accuracy

- Market research abilities

By integrating these skills into your resume, along with a strong focus on relevant work experience, you can enhance your chances of standing out in the job market as a Mortgage Loan Officer.

Stand Out with a Winning Mortgage Loan Officer Cover Letter

Dear Hiring Manager,

I am writing to express my interest in the Mortgage Loan Officer position at [Company Name] as advertised on [Job Board/Company Website]. With over [X years] of experience in the mortgage lending industry, coupled with a strong background in customer service and financial analysis, I am excited about the opportunity to help clients navigate the mortgage process while providing them with tailored solutions that meet their unique needs. My proven track record of exceeding sales goals and building lasting relationships with clients has prepared me to contribute to the continued success of your team.

Throughout my career, I have developed a deep understanding of the mortgage lending process, from pre-qualification to closing. I pride myself on my ability to communicate complex financial information in an easily digestible manner, ensuring that clients feel informed and confident in their decisions. At my previous position with [Previous Company Name], I successfully managed a portfolio of [X number] clients, guiding them through various loan options and providing expert advice. My attention to detail and commitment to compliance have consistently resulted in a high level of customer satisfaction and a significant referral base.

I am particularly drawn to [Company Name] because of its commitment to excellent service and innovative lending solutions. I admire your approach to empowering clients and providing personalized support throughout the mortgage journey. I am confident that my skills in relationship building, analytical thinking, and problem-solving will make me a valuable asset to your team. I look forward to the possibility of discussing how my experience and vision align with the goals of [Company Name].

Thank you for considering my application. I hope to discuss my candidacy further and explore how I can contribute to the success of your team as a Mortgage Loan Officer. I am available for an interview at your convenience and can be reached at [Your Phone Number] or [Your Email Address].

Sincerely,

[Your Name]

Common Mistakes to Avoid in a Mortgage Loan Officer Resume

When crafting a resume as a Mortgage Loan Officer, it's crucial to present your qualifications and experience effectively. However, many candidates fall into common pitfalls that can jeopardize their chances of landing an interview. By avoiding these mistakes, you can enhance the clarity and impact of your resume, showcasing your expertise in the mortgage industry. Here are some prevalent errors to watch out for:

Lack of Specificity: Failing to include specific metrics or accomplishments can make your resume less compelling. Instead of stating you "increased sales," quantify it by saying you "increased sales by 25% within six months."

Overly Complex Language: Using jargon or overly complicated terms can confuse hiring managers. Aim for clear, straightforward language that conveys your expertise without overwhelming the reader.

Ignoring Job Descriptions: Tailoring your resume to align with the requirements of the job description is crucial. Generic resumes may fail to highlight the skills and experiences that employers are specifically seeking.

Omitting Relevant Certifications: Mortgage Loan Officers often require specific certifications. Neglecting to list relevant licenses or certifications can make your application incomplete and less competitive.

Poor Formatting: A cluttered or unprofessional resume layout can detract from your qualifications. Ensure your resume is well-organized, with consistent fonts, clear headings, and ample white space for readability.

Inconsistent Employment Dates: Gaps or inconsistencies in employment dates can raise red flags. Make sure your employment history is accurate and includes all relevant positions in chronological order.

Neglecting Soft Skills: While technical skills are vital, soft skills like communication, negotiation, and customer service are equally important. Failing to demonstrate these competencies can weaken your application.

Not Proofreading: Spelling and grammatical errors can create a negative impression. Always proofread your resume or have someone else review it to ensure professionalism and attention to detail.

Conclusion

As a Mortgage Loan Officer, your role is crucial in guiding clients through the loan application process and helping them secure financing for their homes. Key responsibilities include assessing clients' financial situations, providing loan product recommendations, and ensuring compliance with relevant regulations. Your ability to communicate effectively, build strong client relationships, and navigate the complexities of mortgage lending can set you apart in this competitive field.

To excel in this role, it’s essential to highlight your skills, experience, and achievements clearly in your resume. Take a moment to reflect on your qualifications and consider how they align with the expectations of potential employers. A well-crafted resume can significantly increase your chances of landing your desired position.

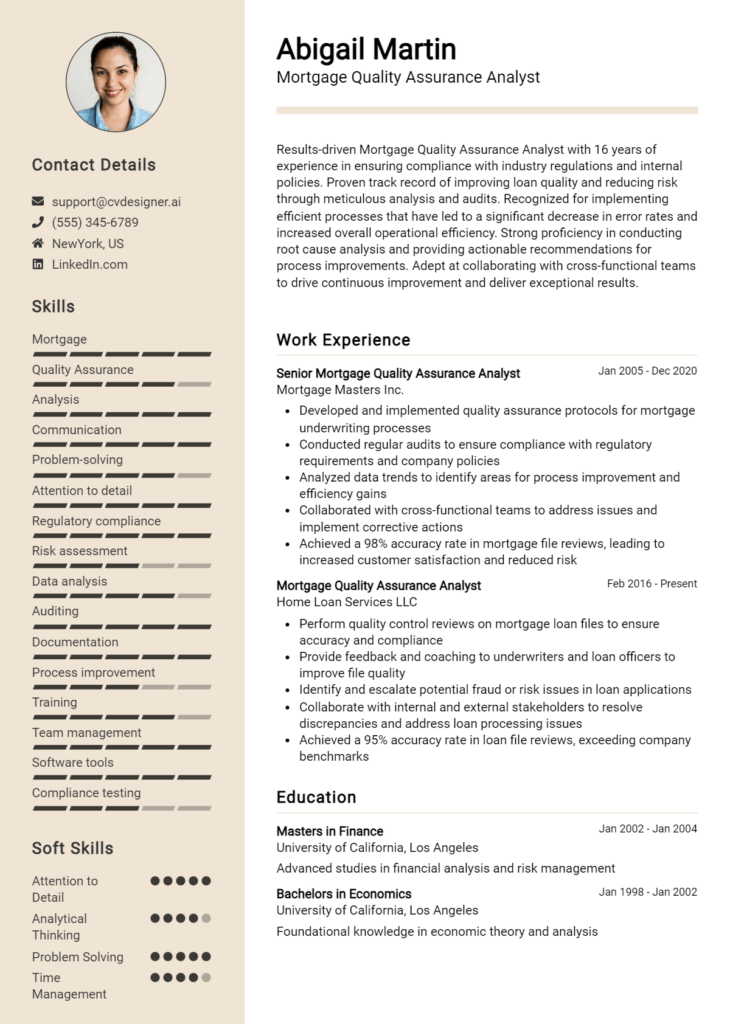

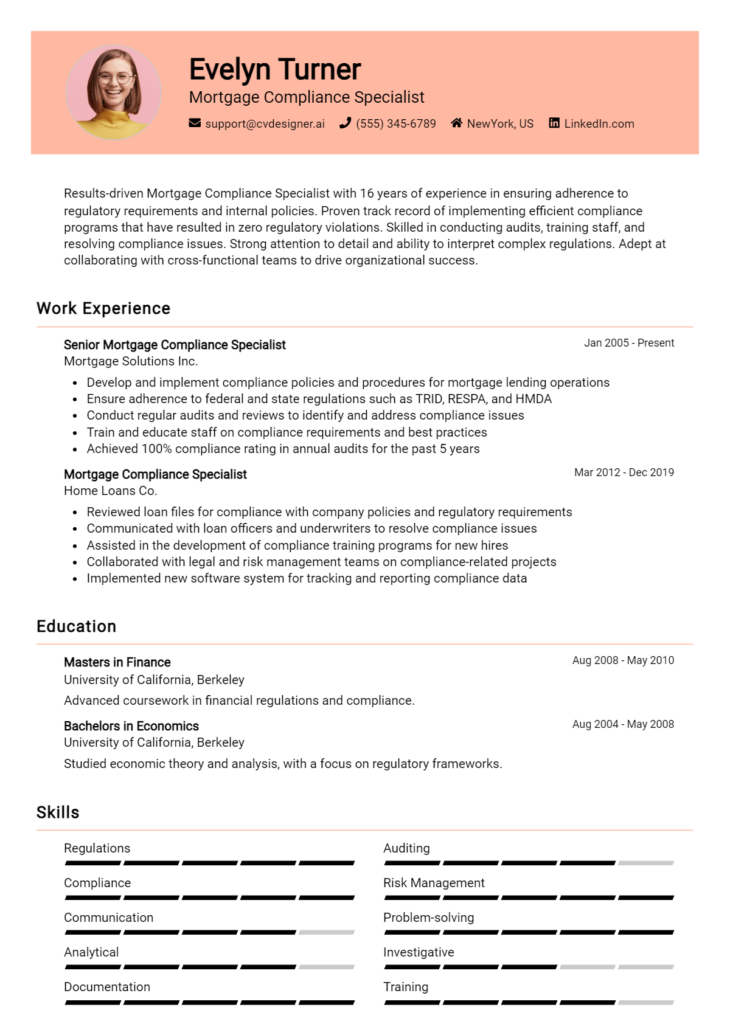

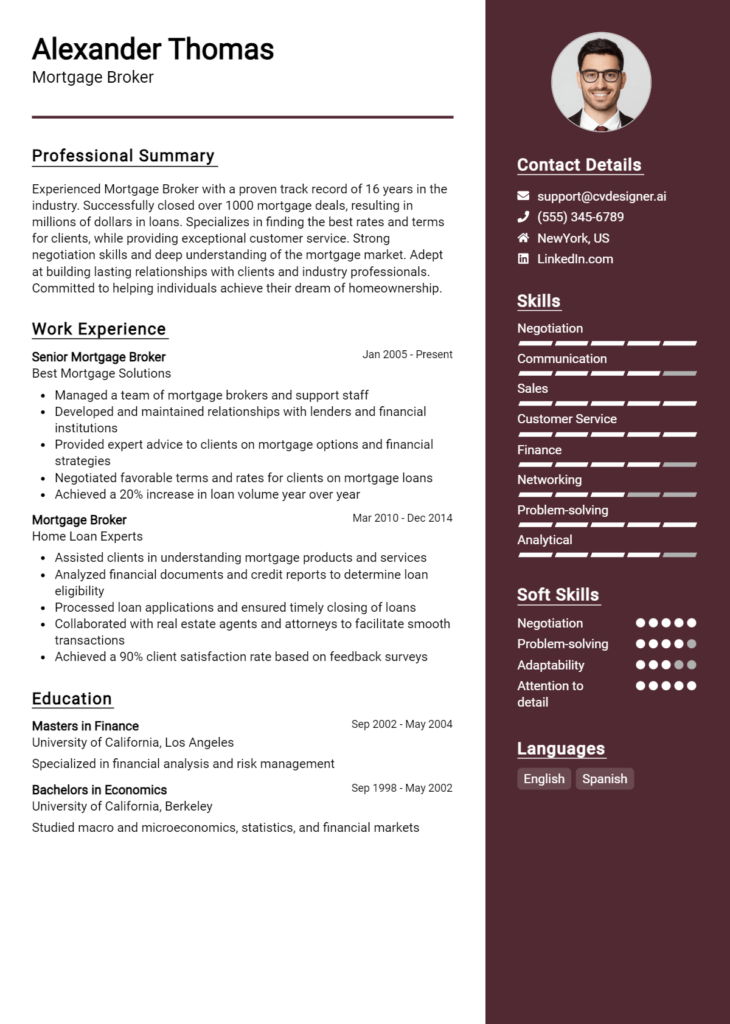

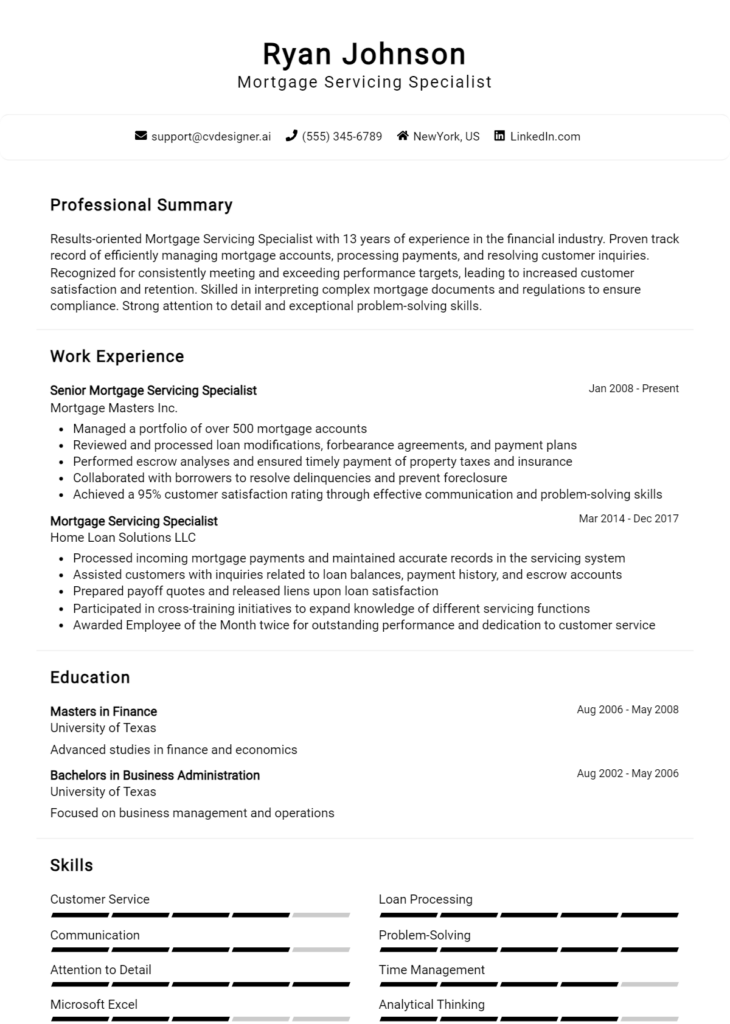

If you’re looking to enhance your resume or create a new one from scratch, there are several valuable resources available. Explore a variety of resume templates to find a design that suits your professional style. You can also utilize the resume builder for an easy and efficient way to compile your information. Additionally, check out resume examples for inspiration and best practices. Don’t forget to pair your resume with a standout cover letter using our cover letter templates.

Now is the perfect time to review your Mortgage Loan Officer resume and make any necessary updates to ensure it reflects your skills and accomplishments. Take advantage of these tools to enhance your job application materials and position yourself for success in your career.