Mortgage Compliance Specialist Core Responsibilities

A Mortgage Compliance Specialist plays a pivotal role in ensuring that lending practices adhere to federal and state regulations, thereby safeguarding the organization from legal risks. This position requires a strong understanding of mortgage laws, technical proficiency in compliance software, and exceptional problem-solving skills. By collaborating with various departments, such as legal, operations, and risk management, the specialist ensures seamless communication and compliance across the organization. A well-structured resume that highlights these skills can effectively demonstrate the candidate's ability to contribute to the company's overall compliance goals.

Common Responsibilities Listed on Mortgage Compliance Specialist Resume

- Conduct thorough reviews of mortgage loan files for compliance with regulations.

- Monitor changes in federal and state lending laws and implement necessary policy updates.

- Provide training and support to staff on compliance issues and best practices.

- Prepare and submit compliance reports to management and regulatory agencies.

- Collaborate with legal and risk management teams to address compliance concerns.

- Analyze compliance data to identify potential risks and recommend solutions.

- Assist in audits and examinations by regulatory bodies.

- Maintain accurate records of compliance activities and findings.

- Develop and implement compliance monitoring programs.

- Respond to inquiries related to compliance issues from internal and external stakeholders.

- Facilitate communication between departments to ensure cohesive compliance efforts.

High-Level Resume Tips for Mortgage Compliance Specialist Professionals

A well-crafted resume is crucial for Mortgage Compliance Specialist professionals, as it serves as the first impression a candidate makes on potential employers. In a competitive job market, your resume must not only highlight your skills and qualifications but also effectively showcase your achievements and industry knowledge. A strong resume can set you apart from other candidates and demonstrate your suitability for the role. This guide will provide practical and actionable resume tips specifically tailored for Mortgage Compliance Specialist professionals to help you create a compelling narrative that resonates with hiring managers.

Top Resume Tips for Mortgage Compliance Specialist Professionals

- Tailor your resume to the job description by incorporating relevant keywords and phrases to align with the specific requirements of the position.

- Showcase your experience in mortgage compliance and regulations, emphasizing your understanding of federal and state laws, such as RESPA, TILA, and Dodd-Frank.

- Quantify your achievements by including specific metrics, such as the number of compliance audits conducted or the percentage of reduced discrepancies in loan documentation.

- Highlight industry-specific skills, such as risk assessment, regulatory reporting, and knowledge of compliance management systems.

- Include certifications related to mortgage compliance, such as Certified Regulatory Compliance Manager (CRCM) or Mortgage Compliance Specialist (MCS), to add credibility to your qualifications.

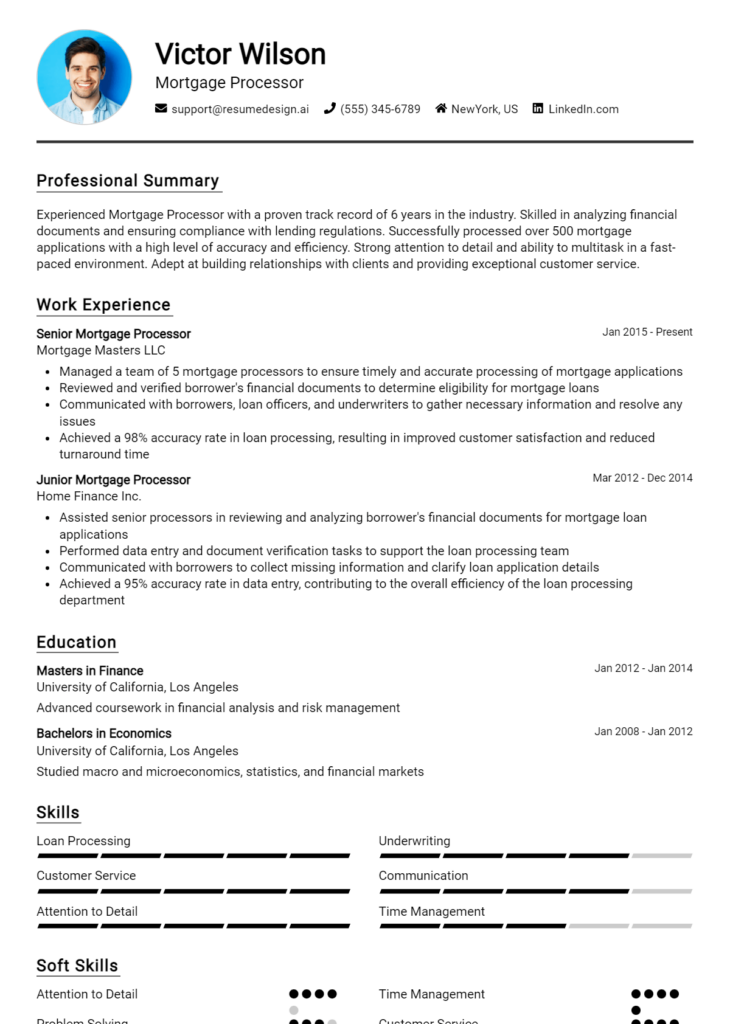

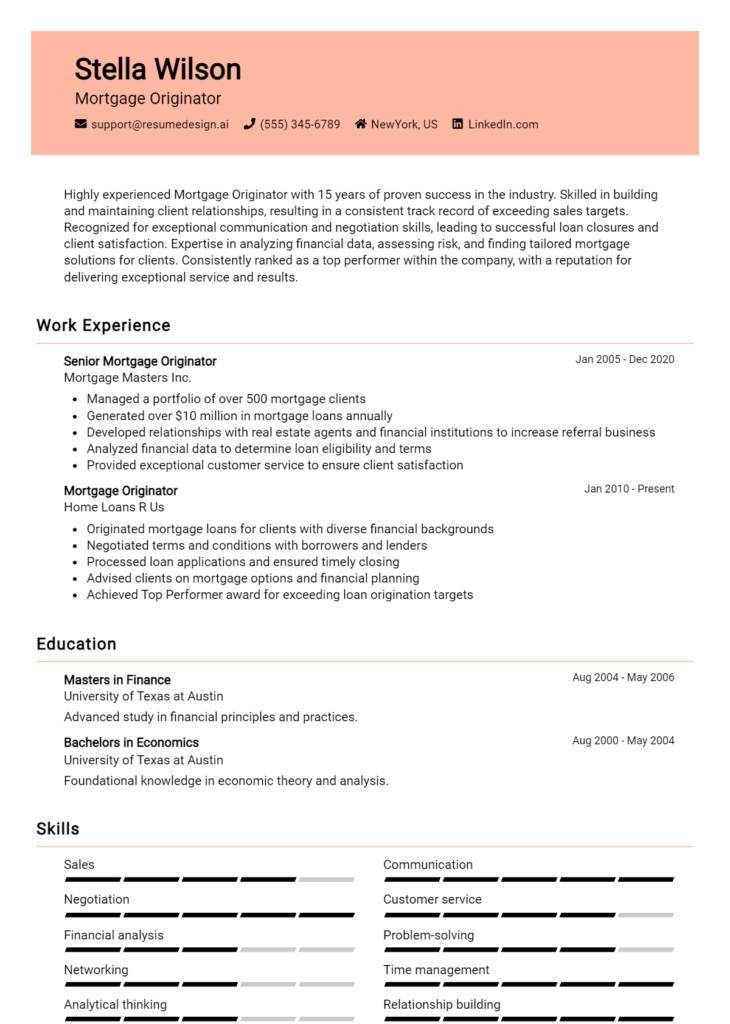

- Utilize a clean and professional format that enhances readability and draws attention to key sections of your resume.

- Incorporate a summary statement at the top of your resume that succinctly outlines your expertise, experience, and career goals.

- Demonstrate your problem-solving ability by providing examples of how you have successfully navigated compliance challenges in previous roles.

- Keep your resume concise, ideally one page, focusing on the most relevant experiences and skills that pertain to the Mortgage Compliance Specialist role.

By implementing these tips, you can significantly increase your chances of landing a job in the Mortgage Compliance Specialist field. A well-structured and targeted resume will not only highlight your qualifications but also convey your commitment to compliance excellence, making you a compelling candidate for potential employers.

Why Resume Headlines & Titles are Important for Mortgage Compliance Specialist

The role of a Mortgage Compliance Specialist is critical in ensuring that mortgage lenders adhere to various laws, regulations, and internal policies. A well-crafted resume headline or title serves as an essential element for candidates in this field, as it can instantly capture the attention of hiring managers and succinctly summarize the candidate's key qualifications. A strong headline should be concise, relevant, and directly related to the job being applied for, allowing applicants to stand out in a competitive job market by clearly communicating their expertise and value proposition from the very first glance.

Best Practices for Crafting Resume Headlines for Mortgage Compliance Specialist

- Keep it concise: Aim for 6-10 words that summarize your expertise.

- Be role-specific: Use terminology and keywords relevant to mortgage compliance.

- Highlight key qualifications: Focus on your most significant skills or experiences.

- Use action verbs: Start with strong action words that convey your capabilities.

- Avoid jargon: Ensure clarity by using accessible language over industry jargon.

- Tailor for each application: Customize your headline for the specific job you are applying for.

- Showcase your value: Emphasize how you can contribute to the organization's compliance efforts.

- Consider including certifications: Mention relevant certifications that enhance your credibility.

Example Resume Headlines for Mortgage Compliance Specialist

Strong Resume Headlines

"Experienced Mortgage Compliance Specialist with 5+ Years in Regulatory Oversight"

“Detail-Oriented Compliance Expert Specialized in FHA and RESPA Regulations”

“Certified Mortgage Compliance Professional Committed to Risk Mitigation”

“Proven Track Record in Enhancing Compliance Processes for Mortgage Lenders”

Weak Resume Headlines

“Mortgage Specialist”

“Experienced in Compliance”

The strong headlines are effective because they clearly convey the candidate's specific expertise and accomplishments, using relevant keywords that immediately resonate with hiring managers in the mortgage industry. They not only highlight qualifications but also establish a sense of authority and specialization. Conversely, the weak headlines fail to impress due to their vagueness and lack of specificity, leaving hiring managers with little understanding of the candidate's qualifications or the unique value they bring to the role.

Writing an Exceptional Mortgage Compliance Specialist Resume Summary

A well-crafted resume summary is crucial for a Mortgage Compliance Specialist, as it serves as the first impression for hiring managers. This brief yet impactful section quickly highlights the candidate's key skills, relevant experience, and significant accomplishments that align with the job role. By presenting a concise and tailored summary, candidates can effectively capture the attention of employers and set the tone for the rest of their resume, increasing their chances of landing an interview.

Best Practices for Writing a Mortgage Compliance Specialist Resume Summary

- Quantify achievements: Use numbers to demonstrate the impact of your work, such as percentage improvements or cost savings.

- Focus on relevant skills: Highlight specific compliance skills or knowledge of regulations that are pertinent to the mortgage industry.

- Tailor the summary: Customize your summary for each job application to reflect the requirements outlined in the job description.

- Keep it concise: Aim for 2-4 sentences that succinctly capture your qualifications without overwhelming the reader.

- Use action verbs: Start sentences with strong action verbs to convey a sense of proactivity and effectiveness.

- Highlight certifications: Mention any relevant certifications or licenses that bolster your qualifications as a compliance specialist.

- Showcase industry knowledge: Include knowledge of mortgage regulations and compliance standards that set you apart from other candidates.

- Emphasize problem-solving skills: Illustrate your ability to identify and resolve compliance issues effectively.

Example Mortgage Compliance Specialist Resume Summaries

Strong Resume Summaries

Detail-oriented Mortgage Compliance Specialist with over 5 years of experience ensuring adherence to federal and state regulations. Successfully identified compliance gaps, resulting in a 30% reduction in audit findings and enhanced operational efficiency.

Proficient in mortgage regulations and compliance audits, with a proven track record of implementing corrective action plans that decreased compliance violations by 40%. Holds a Certified Mortgage Compliance Professional (CMCP) designation.

Results-driven professional with 7 years in the mortgage industry, specializing in compliance management. Led a team that streamlined compliance processes, achieving a 25% reduction in processing time and improving overall client satisfaction.

Weak Resume Summaries

Experienced compliance specialist looking for a mortgage job. I have skills in regulation and compliance.

Hardworking individual with some knowledge of mortgage compliance. I want to help companies meet their compliance needs.

The strong resume summaries effectively highlight specific achievements, quantifiable results, and relevant skills, making them stand out to hiring managers. In contrast, the weak summaries lack detail and specificity, making them appear generic and unconvincing, which diminishes the chances of grabbing the attention of potential employers.

Work Experience Section for Mortgage Compliance Specialist Resume

The work experience section in a Mortgage Compliance Specialist resume is pivotal as it serves as a platform for candidates to demonstrate their technical acumen, leadership capabilities, and commitment to delivering high-quality compliance products. This section allows applicants to illustrate their proficiency in navigating complex regulatory environments, managing teams effectively, and achieving measurable results that align with industry standards. By quantifying achievements and clearly articulating relevant experiences, candidates can significantly enhance their appeal to potential employers and showcase their readiness for the role.

Best Practices for Mortgage Compliance Specialist Work Experience

- Clearly outline specific compliance regulations and standards you have worked with.

- Quantify your achievements with metrics (e.g., reduced compliance errors by X% or improved audit scores).

- Highlight your technical expertise in compliance software and tools used in the industry.

- Demonstrate collaboration by mentioning cross-functional teams you’ve led or worked with.

- Use action verbs to convey your contributions and responsibilities effectively.

- Tailor your experiences to reflect the job description and industry standards relevant to the position.

- Include training or certifications that enhance your technical skill set.

- Focus on results-driven narratives that illustrate the impact of your work on organizational goals.

Example Work Experiences for Mortgage Compliance Specialist

Strong Experiences

- Led a team of 5 compliance analysts to successfully implement a new policy framework, resulting in a 30% reduction in regulatory violations over one year.

- Managed the compliance audit process, achieving a 95% pass rate and reducing the time taken for audits by 20% through streamlined procedures.

- Developed and delivered training programs on mortgage regulations, enhancing team knowledge and reducing compliance errors by 40%.

- Collaborated with IT to integrate compliance software, improving reporting accuracy by 50% and facilitating real-time monitoring of compliance metrics.

Weak Experiences

- Worked on compliance tasks as needed without specifying any outcomes or improvements.

- Assisted in compliance-related activities and occasionally attended meetings.

- Participated in audits, but did not mention any specific contributions or results.

- Handled general paperwork related to compliance without detailing the impact of my work.

The examples provided illustrate a clear distinction between strong and weak experiences. Strong experiences are characterized by quantifiable outcomes, specific achievements, and a demonstration of leadership and collaboration, showcasing the candidate’s effectiveness in their role. Conversely, weak experiences tend to be vague, lacking in detail, and fail to convey the impact of the candidate's contributions, thus diminishing their overall appeal to potential employers.

Education and Certifications Section for Mortgage Compliance Specialist Resume

The education and certifications section of a Mortgage Compliance Specialist resume is crucial as it serves as a testament to the candidate's academic achievements and professional qualifications. This section not only showcases the candidate's foundational knowledge but also highlights relevant industry certifications and ongoing education efforts that are essential in the rapidly evolving landscape of mortgage compliance. By including pertinent coursework, recognized certifications, and specialized training, candidates can significantly enhance their credibility and demonstrate their alignment with the specific requirements of the job role, reinforcing their commitment to maintaining compliance standards in the mortgage industry.

Best Practices for Mortgage Compliance Specialist Education and Certifications

- Focus on relevant degrees such as Finance, Business Administration, or Law.

- List industry-specific certifications like Certified Mortgage Compliance Professional (CMCP) or Certified Compliance and Regulatory Professional (CCRP).

- Include coursework that directly relates to mortgage compliance, such as risk management and regulatory compliance.

- Highlight any specialized training or workshops that enhance your understanding of current laws and regulations.

- Keep the section concise but detailed enough to provide context for each credential.

- Prioritize recent certifications and education to show commitment to continuous learning.

- Use clear formatting to ensure easy readability and emphasis on key qualifications.

- Consider including software or technical training relevant to compliance tracking and reporting.

Example Education and Certifications for Mortgage Compliance Specialist

Strong Examples

- Bachelor of Science in Finance from XYZ University

- Certified Mortgage Compliance Professional (CMCP)

- Completed coursework in Regulatory Compliance and Risk Management

- Advanced Certification in Consumer Financial Protection Bureau (CFPB) Regulations

Weak Examples

- Bachelor of Arts in History

- Certification in Project Management (not related to mortgage compliance)

- Old certification from 2010 in General Business Practices

- High School Diploma

The examples provided highlight the importance of relevance and timeliness in educational qualifications and certifications. Strong examples showcase degrees and certifications that are directly aligned with the Mortgage Compliance Specialist role, demonstrating the candidate's readiness and expertise in the field. In contrast, weak examples feature unrelated degrees or outdated certifications that do not contribute to the candidate's qualifications for the position, potentially diminishing their appeal to employers seeking specialized knowledge and skills in mortgage compliance.

Top Skills & Keywords for Mortgage Compliance Specialist Resume

As a Mortgage Compliance Specialist, possessing the right skills is crucial for navigating the complexities of mortgage regulations and ensuring adherence to legal standards. A well-crafted resume that highlights both soft and hard skills can significantly enhance your chances of securing a position in this competitive field. Soft skills such as attention to detail and effective communication are essential for understanding intricate compliance requirements and collaborating with various stakeholders. Meanwhile, hard skills like knowledge of relevant laws and proficiency in compliance software demonstrate your technical expertise and ability to manage the demands of the role. Crafting a resume that effectively showcases these skills will provide potential employers with insight into your qualifications and readiness to contribute to their organization.

Top Hard & Soft Skills for Mortgage Compliance Specialist

Soft Skills

- Attention to Detail

- Strong Communication Skills

- Analytical Thinking

- Problem-Solving Abilities

- Time Management

- Organizational Skills

- Team Collaboration

- Adaptability

- Client Relationship Management

- Ethical Judgement

Hard Skills

- Knowledge of Mortgage Regulations (e.g., RESPA, TILA)

- Proficiency in Compliance Software

- Risk Assessment Techniques

- Data Analysis and Reporting

- Understanding of Underwriting Processes

- Familiarity with Loan Processing Systems

- Auditing Skills

- Policy Development

- Legal Research Skills

- Financial Analysis

By emphasizing these skills in your resume, along with relevant work experience, you can create a compelling application that aligns with the requirements of a Mortgage Compliance Specialist position.

Stand Out with a Winning Mortgage Compliance Specialist Cover Letter

Dear Hiring Manager,

I am writing to express my interest in the Mortgage Compliance Specialist position at [Company Name], as advertised on [Where You Found the Job Posting]. With a robust background in mortgage regulations and compliance, alongside my commitment to ensuring the highest standards of ethical practice, I am excited about the opportunity to contribute to your team. My experience has equipped me with a thorough understanding of federal and state lending regulations, risk management, and the complexities of the mortgage industry, which I believe align perfectly with the requirements of this role.

In my previous position at [Previous Company Name], I successfully conducted compliance audits and assessments that resulted in a 30% reduction in compliance-related issues over a one-year period. My proactive approach to identifying potential risks and implementing effective solutions not only safeguarded the company against regulatory penalties but also enhanced the overall customer experience. Additionally, my strong analytical skills enable me to interpret complex regulations and communicate them clearly to both internal teams and clients, ensuring that everyone is aligned with compliance mandates.

I am particularly drawn to [Company Name] because of its reputation for integrity and innovation in the mortgage industry. I am eager to bring my expertise in compliance management and my passion for upholding ethical standards to your organization. I thrive in dynamic environments and am adept at developing training programs that educate staff on compliance requirements, fostering a culture of accountability and transparency.

Thank you for considering my application. I look forward to the opportunity to discuss how my skills and experiences can contribute to the continued success of [Company Name]. I am excited about the possibility of joining your team and helping to maintain the high standards of compliance that your organization is known for.

Sincerely,

[Your Name]

[Your Phone Number]

[Your Email Address]

Common Mistakes to Avoid in a Mortgage Compliance Specialist Resume

When crafting a resume for a Mortgage Compliance Specialist position, it's essential to present a clear and professional representation of your qualifications and experiences. However, many candidates make common mistakes that can hinder their chances of landing an interview. Avoiding these pitfalls will help ensure that your resume stands out in a competitive job market.

Lack of Relevant Keywords: Failing to include industry-specific keywords can cause your resume to be overlooked by applicant tracking systems (ATS) that many employers use to filter candidates.

Vague Job Descriptions: Using generic descriptions that don’t specify your achievements or contributions can leave hiring managers with a limited understanding of your capabilities.

Ignoring Compliance Regulations: Not highlighting your knowledge of key regulations, such as RESPA or TILA, can undermine your credibility as a compliance specialist.

Inconsistent Formatting: A resume with inconsistent fonts, sizes, or spacing can appear unprofessional and may distract from your qualifications.

Neglecting Soft Skills: Focusing solely on technical skills and neglecting to mention interpersonal skills, such as communication and problem-solving, can give a one-dimensional view of your capabilities.

Omitting Certifications: Failing to list relevant certifications, such as a Certified Mortgage Compliance Professional (CMCP), can result in missed opportunities to showcase your expertise.

Including Irrelevant Experience: Adding unrelated job experiences can dilute the focus of your resume and make it harder for hiring managers to see your relevant qualifications.

Spelling and Grammar Errors: Typos and grammatical mistakes can create an impression of carelessness and lack of attention to detail, which are critical traits for a compliance role.

Conclusion

As a Mortgage Compliance Specialist, it is essential to stay updated with the ever-evolving regulations and standards governing the mortgage industry. Key responsibilities include ensuring compliance with federal and state laws, conducting audits, and assisting in the development of policies and procedures that mitigate risks. Additionally, strong analytical skills, attention to detail, and the ability to interpret complex legal documents are crucial for success in this role.

To summarize, a Mortgage Compliance Specialist plays a vital role in safeguarding the integrity of mortgage operations while ensuring that lenders adhere to established regulatory frameworks. Given the competitive nature of the job market, it is important to present a polished and professional resume that highlights your skills and experiences effectively.

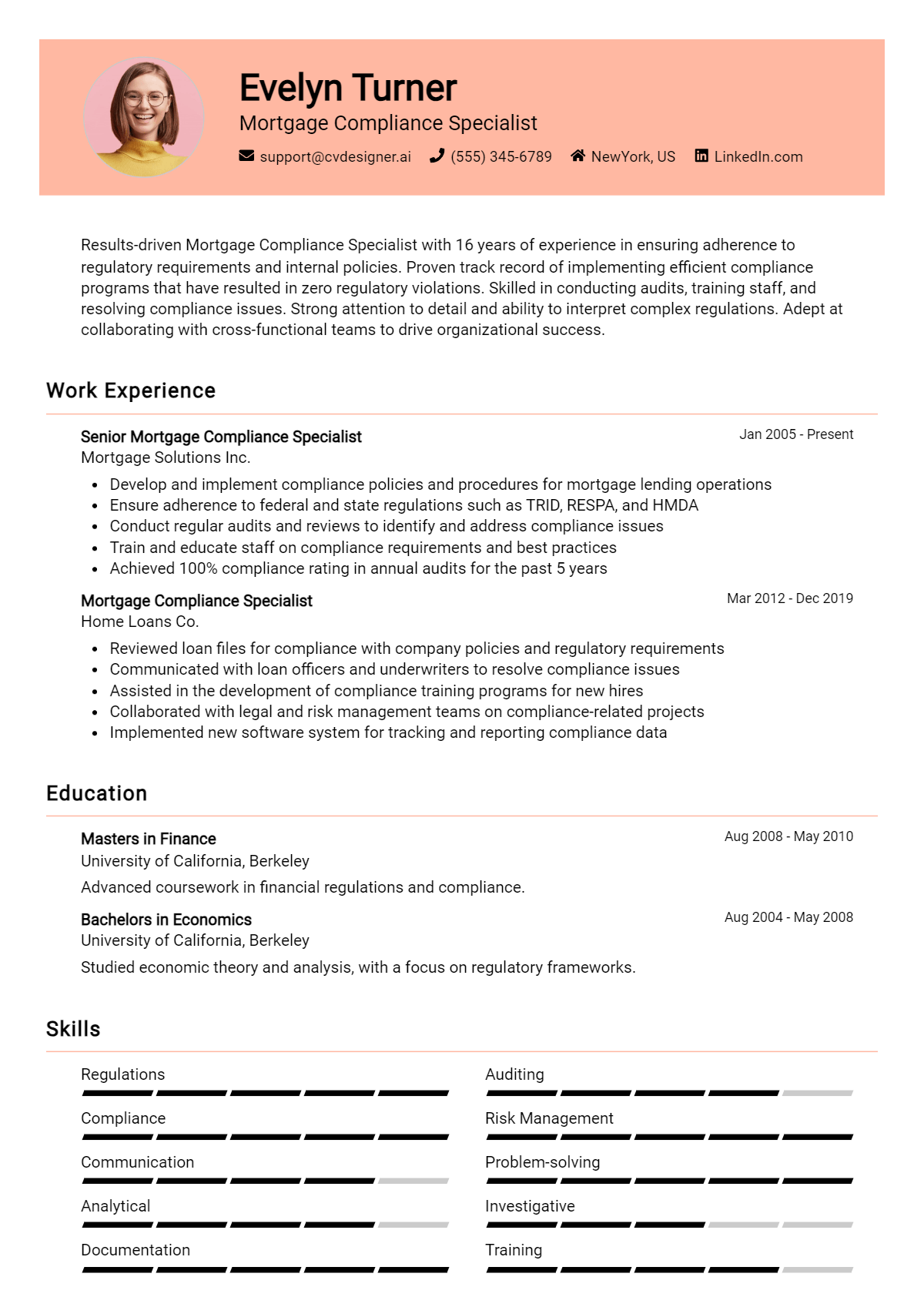

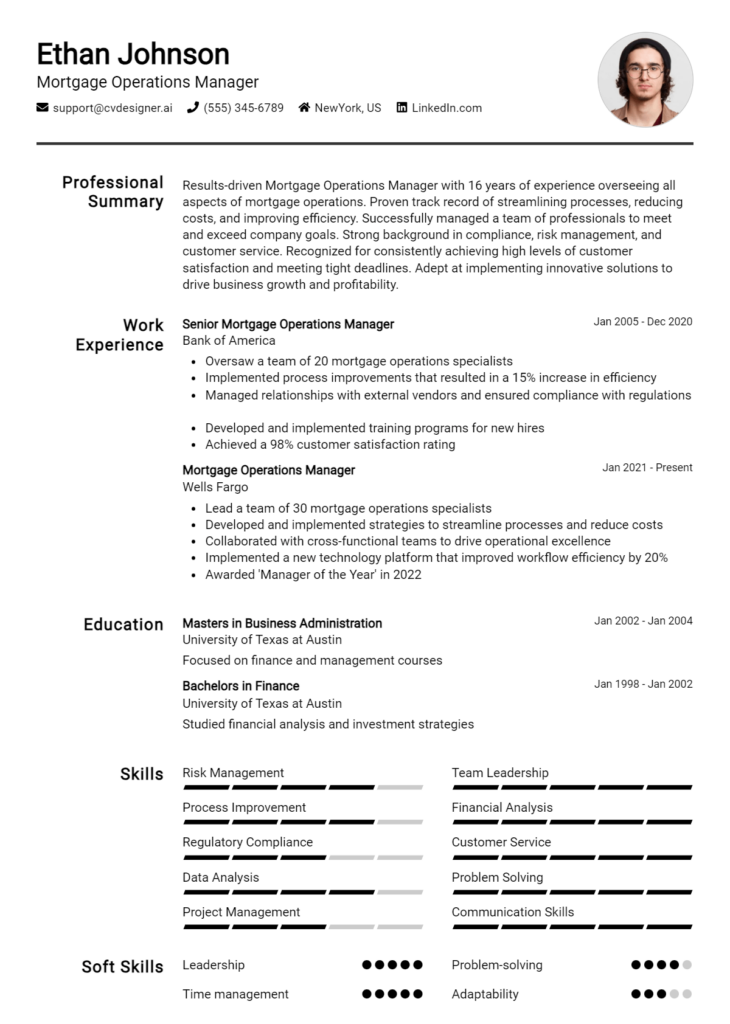

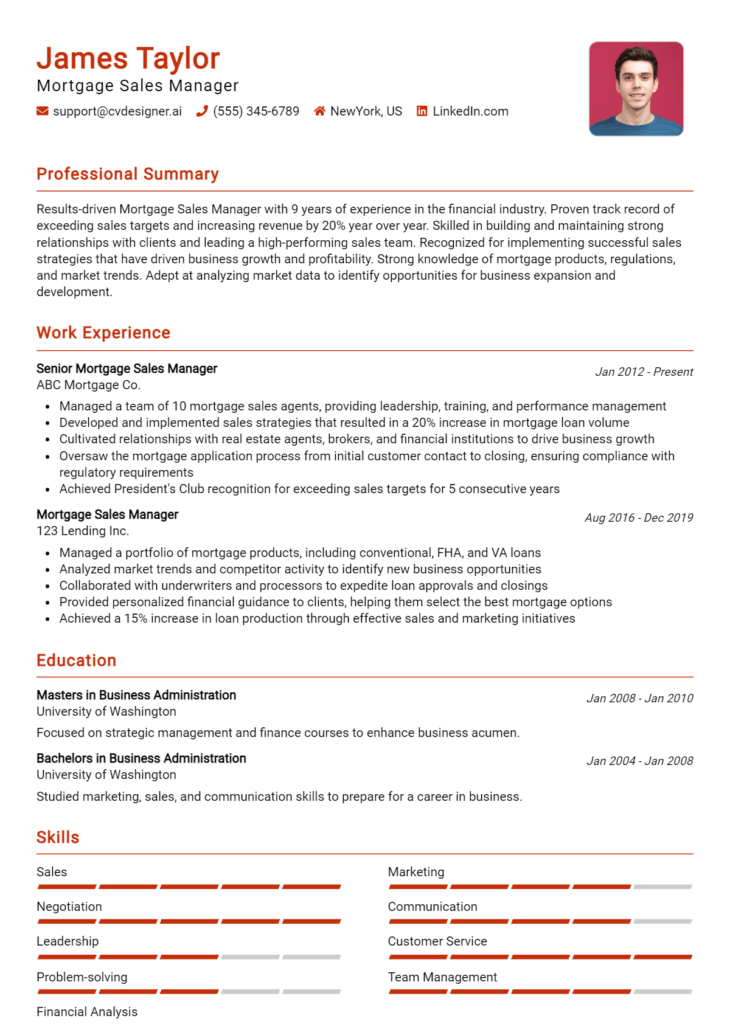

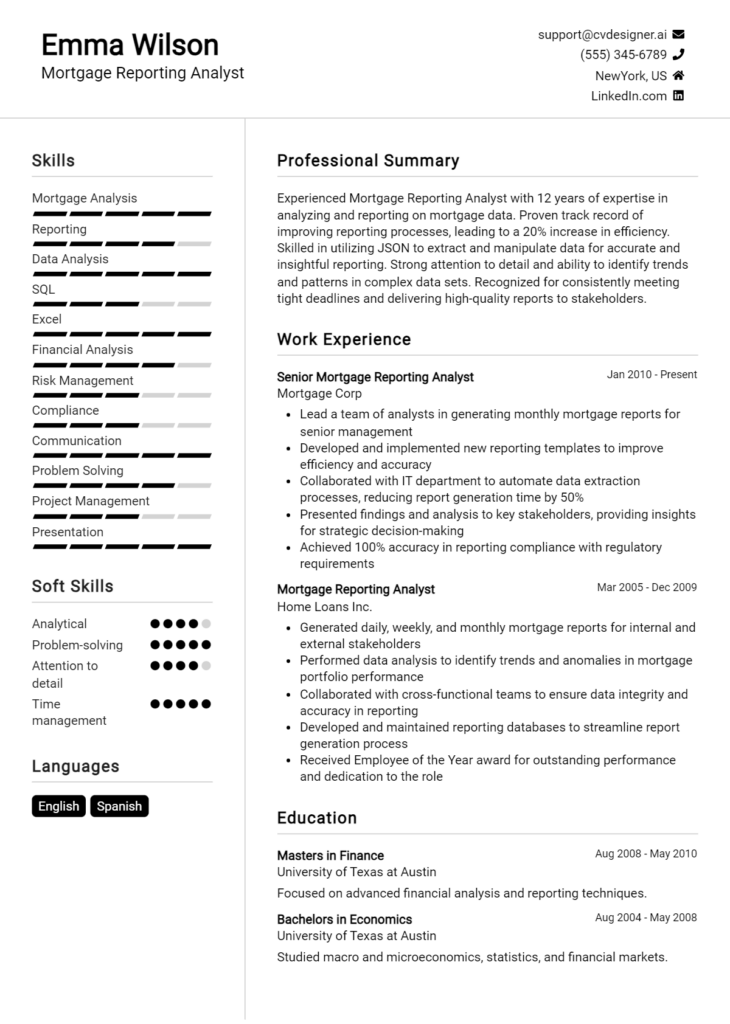

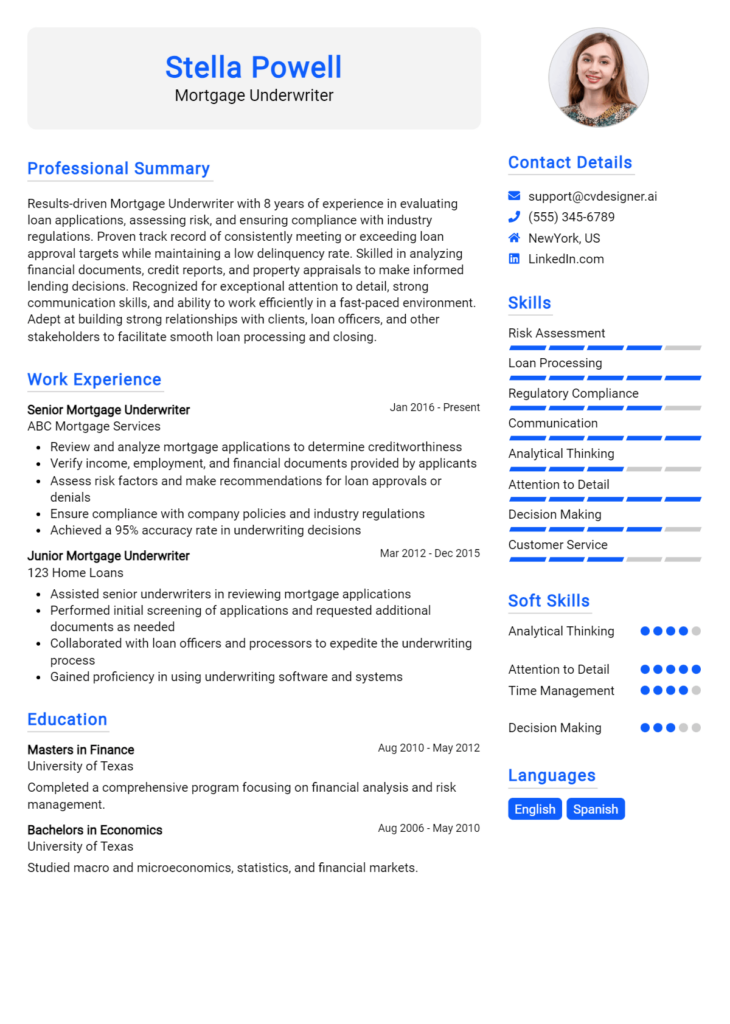

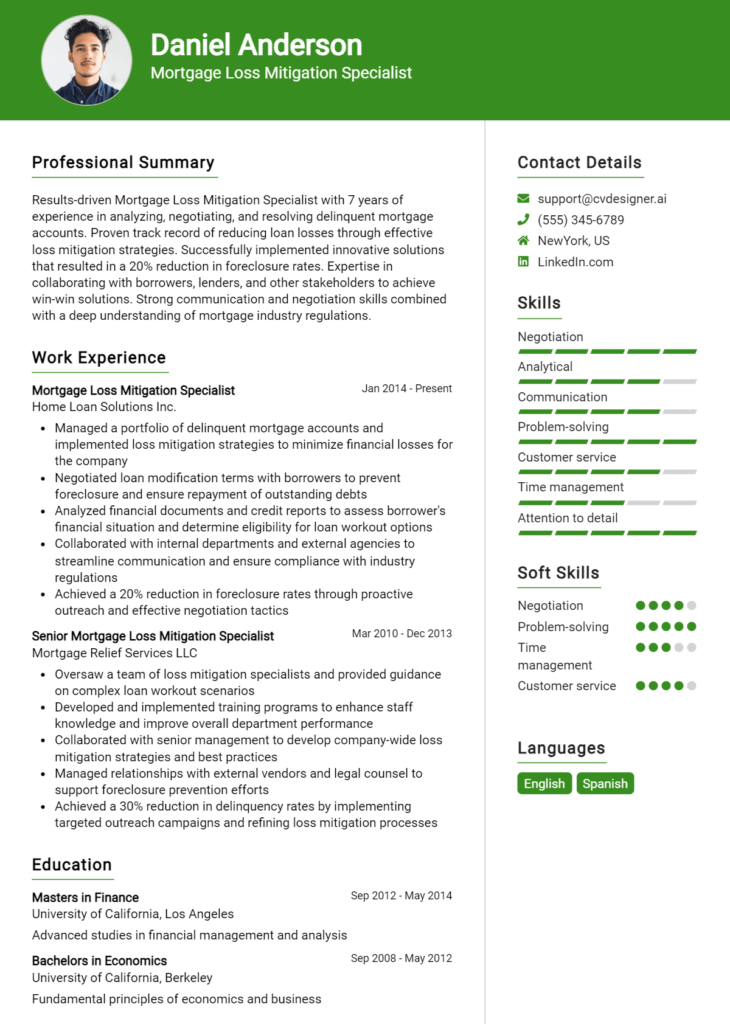

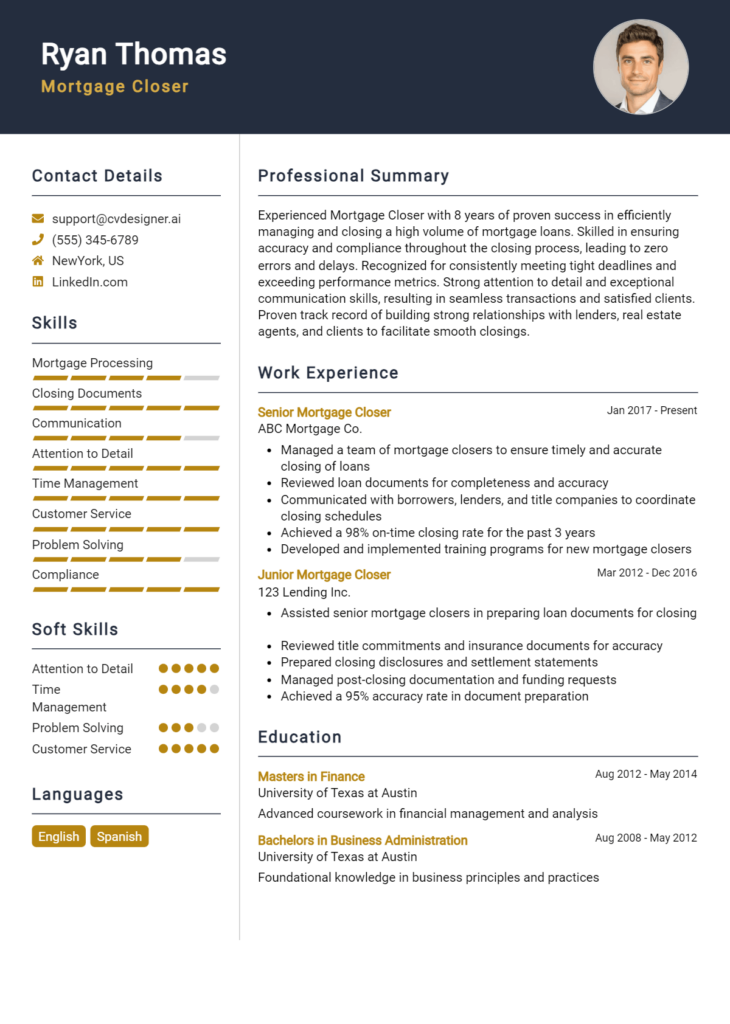

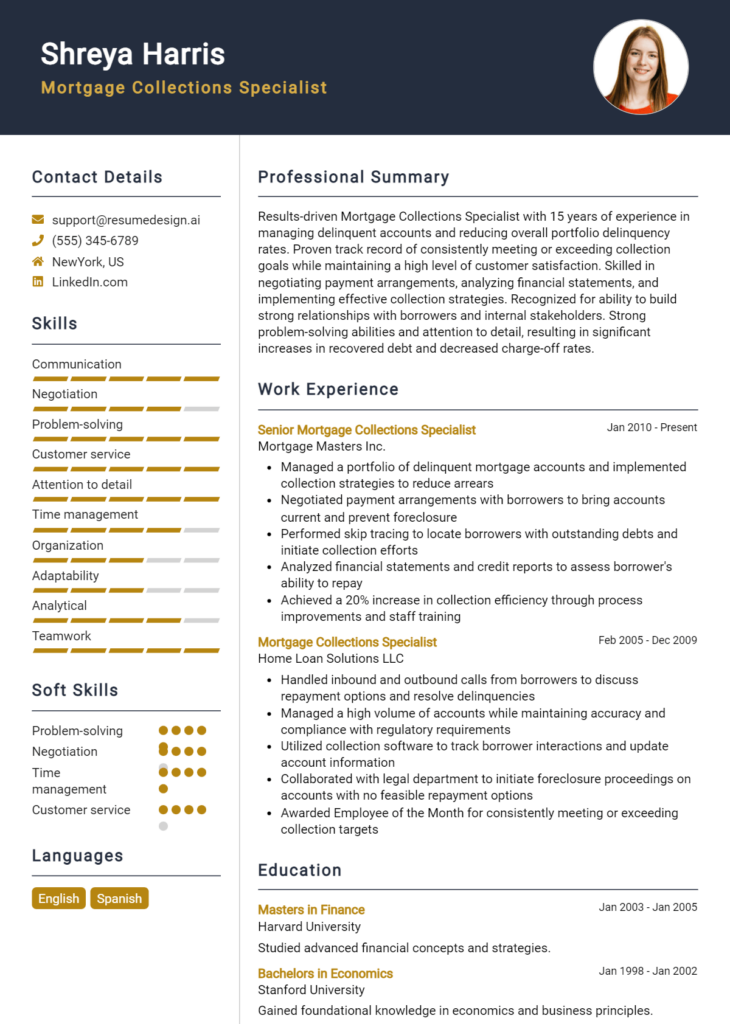

Now is the perfect time to review your Mortgage Compliance Specialist resume. Take advantage of the various resources available to enhance your application. Explore our resume templates to find a design that fits your style, utilize our resume builder for a user-friendly experience, and check out resume examples to get inspired by successful candidates. Don’t forget to create a compelling first impression with our cover letter templates. Start refining your resume today to stand out in the competitive mortgage compliance field!