Mortgage Originator Core Responsibilities

A Mortgage Originator plays a critical role in facilitating the loan process by assessing client needs, evaluating financial information, and recommending suitable mortgage solutions. This position requires strong technical skills to navigate financial software, operational knowledge to streamline processes, and problem-solving abilities to address client concerns effectively. By bridging the gap between clients, lenders, and underwriting teams, a Mortgage Originator contributes significantly to organizational goals. A well-structured resume highlighting these competencies can attract potential employers, showcasing the candidate's value in driving successful lending outcomes.

Common Responsibilities Listed on Mortgage Originator Resume

- Evaluate clients' financial situations and credit histories.

- Provide tailored mortgage product recommendations.

- Prepare and review loan applications and documentation.

- Communicate with clients throughout the loan process.

- Collaborate with underwriters to ensure loan approval.

- Maintain up-to-date knowledge of mortgage products and regulations.

- Conduct market research to identify lending opportunities.

- Develop and maintain strong relationships with real estate agents.

- Track loan progress and address any issues promptly.

- Assist clients in understanding mortgage terms and conditions.

- Prepare reports on loan performance and client feedback.

- Participate in community outreach to promote services.

High-Level Resume Tips for Mortgage Originator Professionals

In the competitive world of mortgage origination, a well-crafted resume serves as your first opportunity to make a lasting impression on potential employers. As a Mortgage Originator, it is crucial that your resume not only highlights your skills and experiences but also showcases your achievements in a way that aligns with the expectations of hiring managers. A thoughtfully designed resume can distinguish you from other candidates and effectively communicate your value in a crowded job market. This guide will provide practical and actionable resume tips specifically tailored for Mortgage Originator professionals, ensuring that your qualifications stand out.

Top Resume Tips for Mortgage Originator Professionals

- Tailor your resume to the job description by incorporating keywords and phrases that match the specific role you are applying for.

- Showcase relevant experience in the mortgage industry, including any positions held, responsibilities, and the types of loans you have worked with.

- Quantify your achievements by including metrics such as loan volume, closing rates, and customer satisfaction scores.

- Highlight industry-specific skills such as knowledge of mortgage regulations, loan processing, and client relationship management.

- Include certifications and licenses relevant to mortgage origination, such as NMLS licensing, to demonstrate your qualifications.

- Utilize a clean and professional format that enhances readability and allows your key information to stand out.

- Incorporate testimonials or recommendations from previous employers or clients to add credibility to your accomplishments.

- Keep your resume concise, ideally one page, focusing on the most relevant information that directly pertains to the Mortgage Originator role.

- Highlight your ability to work collaboratively with other professionals, such as real estate agents and underwriters, to close deals effectively.

By implementing these tips, you can significantly increase your chances of landing a job in the Mortgage Originator field. A polished and targeted resume will not only reflect your qualifications but also demonstrate your commitment to excellence, making you a standout candidate in a competitive job market.

Why Resume Headlines & Titles are Important for Mortgage Originator

In the competitive field of mortgage origination, a well-crafted resume is essential for standing out among numerous applicants. One of the most critical components of a resume is the headline or title, which serves as a first impression for hiring managers. A strong headline can immediately capture attention and summarize a candidate's key qualifications in a single impactful phrase. It should be concise, relevant, and directly related to the specific job being applied for, allowing hiring managers to quickly gauge a candidate's suitability for the role.

Best Practices for Crafting Resume Headlines for Mortgage Originator

- Keep it concise: Aim for no more than 10-12 words.

- Be role-specific: Tailor the headline to the mortgage origination field.

- Highlight key skills: Include critical skills that are relevant to the position.

- Use action words: Start with strong verbs that convey confidence and proactivity.

- Include quantifiable achievements: If possible, reference specific accomplishments.

- Showcase relevant experience: Mention years of experience or notable companies worked for.

- Avoid jargon: Use clear language that is easily understood by all readers.

- Stay professional: Maintain a formal tone appropriate for the banking and finance industry.

Example Resume Headlines for Mortgage Originator

Strong Resume Headlines

"Results-Driven Mortgage Originator with 10+ Years of Experience in Client Relations"

“Top-Performing Loan Officer Specializing in FHA and VA Loans with Proven Closing Ratios”

“Dedicated Mortgage Professional with a Track Record of Exceeding Sales Targets”

Weak Resume Headlines

“Mortgage Specialist”

“Experienced in Finance”

The strong headlines are effective because they are specific, highlight relevant experience, and emphasize key accomplishments that directly relate to the mortgage origination role. They provide a clear picture of the candidate’s strengths and make a compelling case for their candidacy. In contrast, the weak headlines fail to impress due to their vagueness and lack of relevant detail, making it difficult for hiring managers to discern the candidate's unique qualifications or value proposition in a crowded applicant pool.

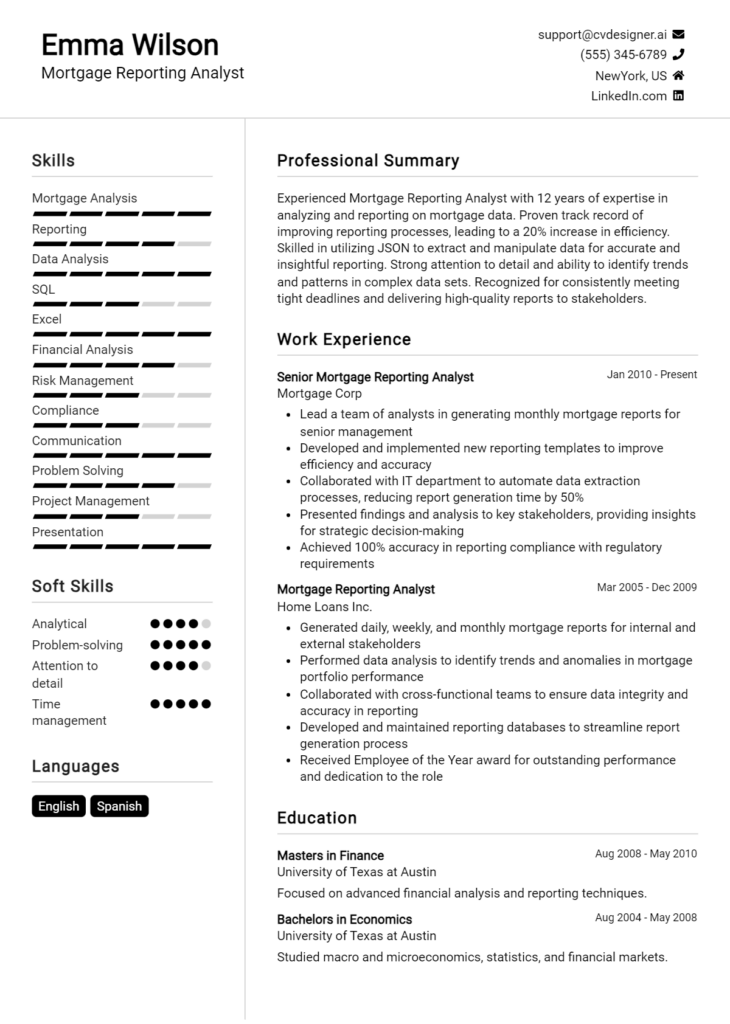

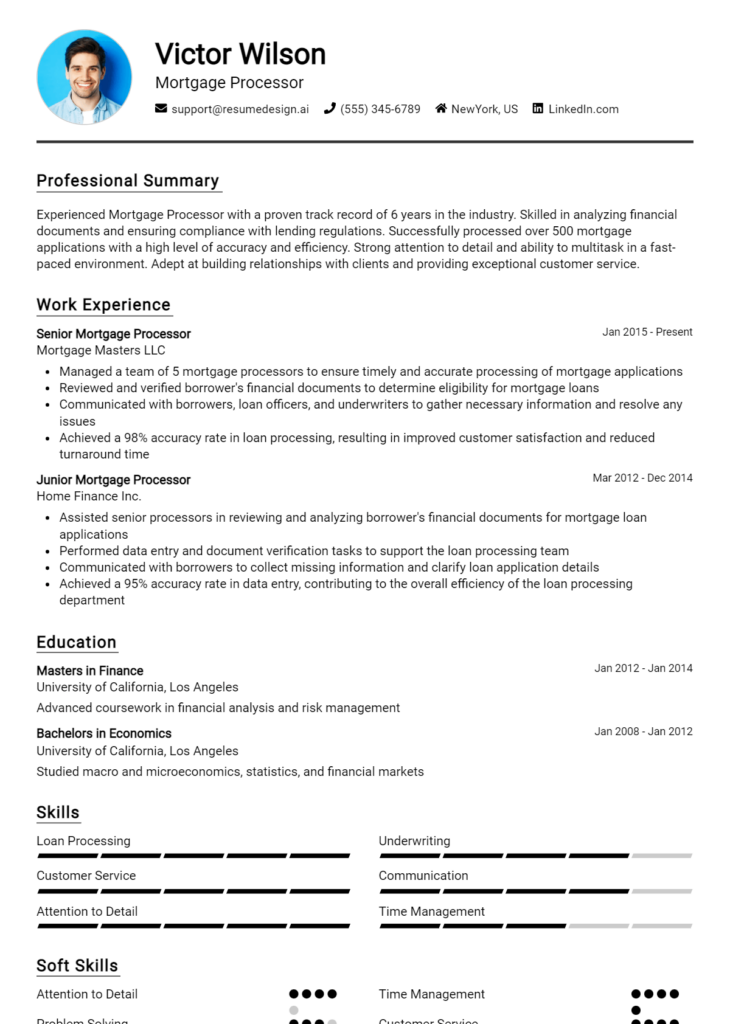

Writing an Exceptional Mortgage Originator Resume Summary

Crafting an exceptional resume summary is essential for Mortgage Originators seeking to make a lasting impression on hiring managers. A well-crafted summary serves as a powerful introduction, succinctly highlighting key skills, relevant experience, and notable accomplishments that align with the mortgage industry. It captures attention quickly, providing a snapshot of the candidate's qualifications and setting the tone for the rest of the resume. A strong summary should be concise, impactful, and tailored specifically to the job being applied for, ensuring it resonates with prospective employers.

Best Practices for Writing a Mortgage Originator Resume Summary

- Quantify Achievements: Use specific numbers and percentages to illustrate your success and impact in previous roles.

- Focus on Relevant Skills: Highlight the most pertinent skills related to mortgage origination, such as customer service, negotiation, and financial analysis.

- Tailor to the Job Description: Customize your summary to reflect the requirements and responsibilities listed in the job posting.

- Keep it Concise: Aim for 2-4 sentences that capture the essence of your professional background without unnecessary fluff.

- Use Strong Action Verbs: Start sentences with powerful verbs to convey confidence and proactivity.

- Showcase Industry Knowledge: Reference specific mortgage-related expertise or certifications to demonstrate your qualifications.

- Highlight Customer-Focused Achievements: Emphasize how you have positively impacted clients or increased customer satisfaction.

- Stay Professional: Maintain a formal tone and avoid casual language to reflect your professionalism in the industry.

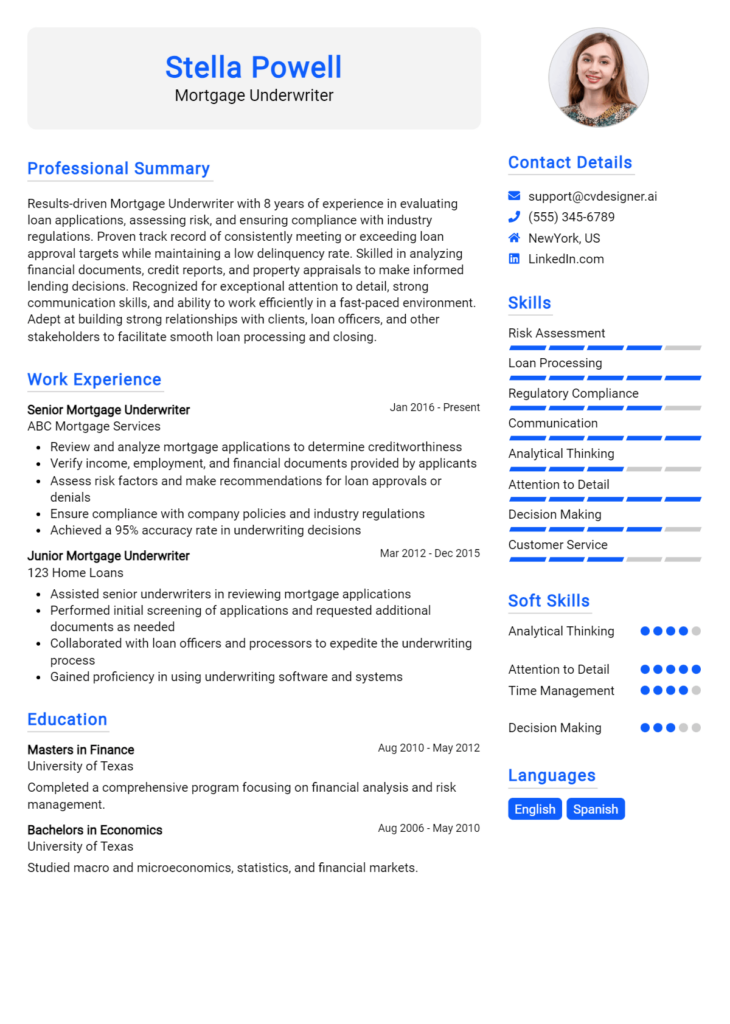

Example Mortgage Originator Resume Summaries

Strong Resume Summaries

Detail-oriented Mortgage Originator with over 5 years of experience in the industry, successfully closing 150+ loans annually and consistently exceeding sales targets by 20%. Proven track record in building strong client relationships and providing tailored mortgage solutions that meet individual needs.

Dynamic Mortgage Specialist with a history of increasing loan origination volume by 30% year-over-year. Skilled in assessing client financial profiles, developing customized lending strategies, and maintaining compliance with regulatory standards. Recognized for outstanding customer service and achieving a 95% client satisfaction rate.

Results-driven Mortgage Originator with expertise in FHA, VA, and conventional loans, achieving over $50 million in funded loans in the past fiscal year. Proficient in utilizing advanced mortgage software and CRM systems to streamline processes and enhance client communication.

Weak Resume Summaries

Mortgage Originator with some experience in the field. I am looking for a new opportunity to grow and learn in a challenging environment.

Dedicated professional with a background in finance. I have worked with clients in various capacities and am interested in mortgage origination.

The strong resume summaries are considered effective because they provide specific, quantifiable achievements and relevant skills that directly relate to the mortgage origination role. They convey a clear sense of the candidate's abilities and accomplishments, making them stand out. In contrast, the weak summaries lack detail and specificity, making them generic and unremarkable. They do not provide compelling reasons for a hiring manager to consider the candidate further, missing the opportunity to showcase their qualifications in a competitive job market.

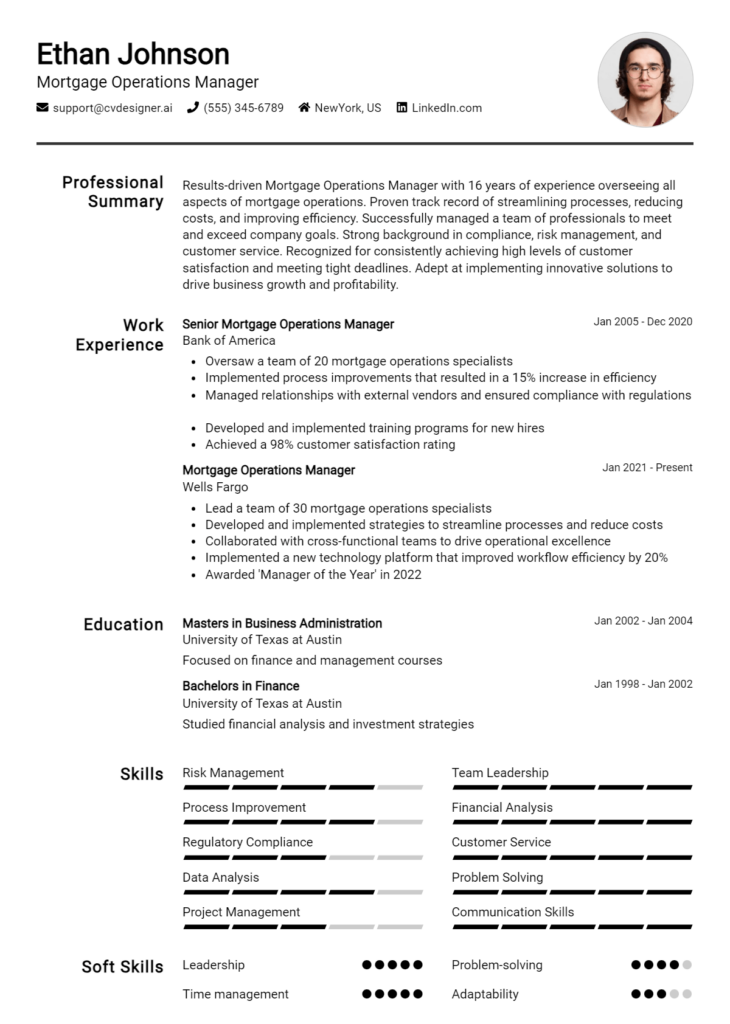

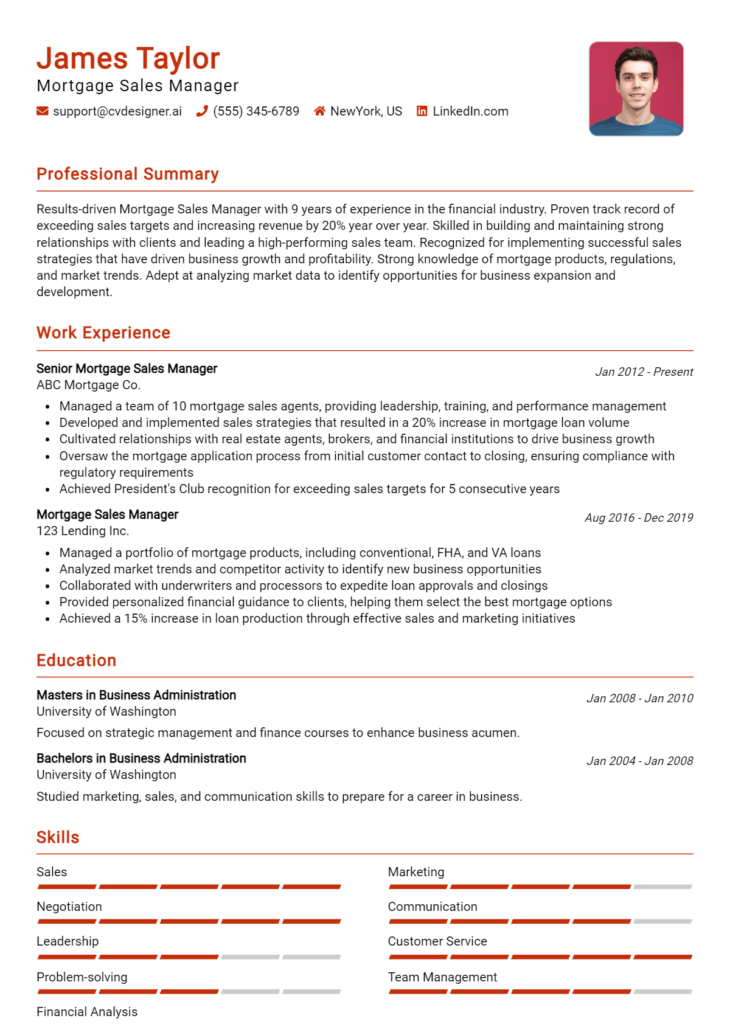

Work Experience Section for Mortgage Originator Resume

The work experience section of a Mortgage Originator resume is crucial as it provides a comprehensive overview of the candidate's practical skills and accomplishments in the mortgage industry. This section highlights the technical abilities required to navigate complex loan products, regulations, and market conditions while also showcasing the candidate's leadership qualities and their capacity to manage teams effectively. By detailing quantifiable achievements and aligning past experiences with industry standards, candidates can demonstrate their value to potential employers and their readiness to deliver high-quality mortgage solutions.

Best Practices for Mortgage Originator Work Experience

- Clearly outline technical skills related to mortgage origination, such as underwriting, processing, and compliance.

- Quantify achievements with specific metrics, such as the number of loans processed or the percentage of on-time closings.

- Highlight leadership roles and team management experiences that demonstrate collaboration and mentorship.

- Use industry-specific terminology to align your experience with job descriptions and expectations.

- Focus on results-driven statements that showcase your contribution to the organization's success.

- Tailor your work experience to reflect the specific requirements and trends within the mortgage industry.

- Include relevant certifications or training that enhance your technical expertise.

- Keep the language concise and impactful, avoiding jargon that may dilute the message.

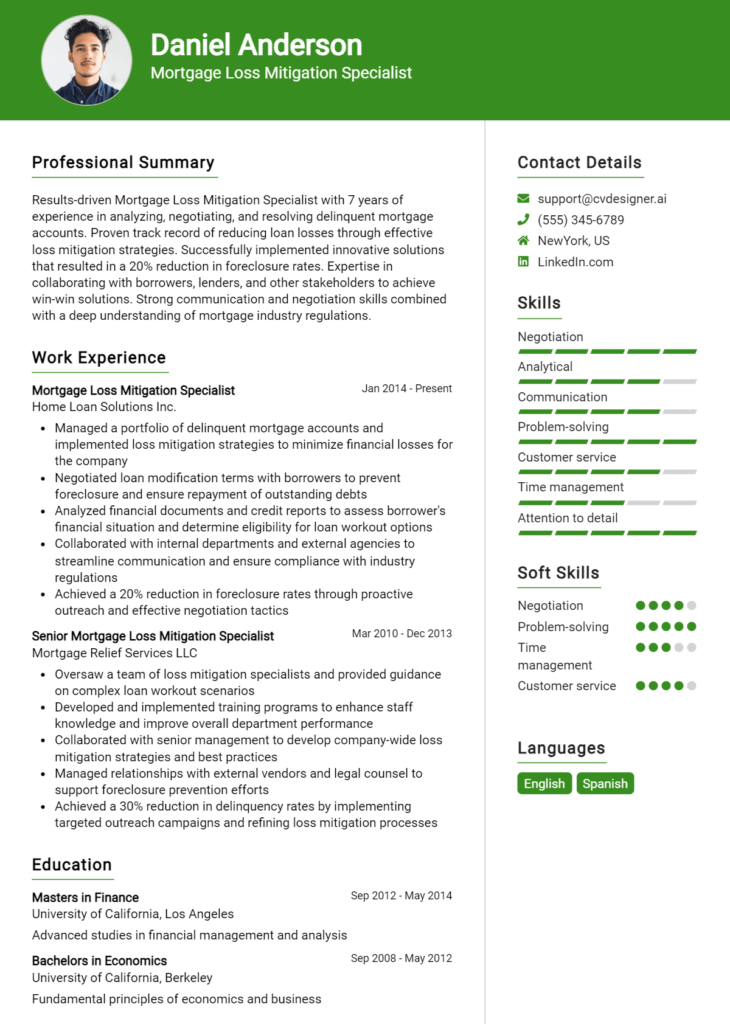

Example Work Experiences for Mortgage Originator

Strong Experiences

- Originated over $15 million in residential loans annually, increasing branch revenue by 25% through strategic client relationships.

- Led a team of 5 loan officers, implementing streamlined processes that improved loan processing time by 30%.

- Designed and executed a training program for new hires, resulting in a 40% decrease in onboarding time and increased team productivity.

- Achieved a 95% customer satisfaction rating by consistently exceeding client expectations and providing tailored mortgage solutions.

Weak Experiences

- Worked on various loan applications and helped clients.

- Assisted in the mortgage process and completed paperwork.

- Participated in team meetings and contributed ideas.

- Handled customer inquiries about loans and interest rates.

The examples identified as strong experiences are characterized by quantifiable outcomes and specific contributions that demonstrate the candidate's technical expertise, leadership capabilities, and ability to collaborate effectively. In contrast, the weak experiences lack specificity and measurable achievements, making them less impactful and not effectively showcasing the candidate’s qualifications or value to potential employers.

Education and Certifications Section for Mortgage Originator Resume

The education and certifications section of a Mortgage Originator resume is crucial as it showcases the candidate's academic achievements, relevant certifications, and commitment to continuous professional development. This section serves as a testament to the candidate's qualifications, demonstrating a solid foundation in finance, real estate, and regulatory compliance. By detailing coursework, industry-recognized certifications, and specialized training, candidates can significantly enhance their credibility and align themselves more closely with the requirements of the job role, making them more attractive to potential employers.

Best Practices for Mortgage Originator Education and Certifications

- Prioritize relevant degrees such as finance, business, or real estate.

- Include industry-recognized certifications like NMLS licensing or Certified Mortgage Consultant (CMC).

- List relevant coursework that directly pertains to mortgage origination, underwriting, or real estate finance.

- Highlight any ongoing education or training courses to demonstrate continuous learning.

- Use clear and concise formatting for easy readability.

- Consider including honors or awards received related to your education or certifications.

- Ensure all information is up-to-date and reflects the latest industry standards.

- Align your educational background with the specific requirements outlined in the job description.

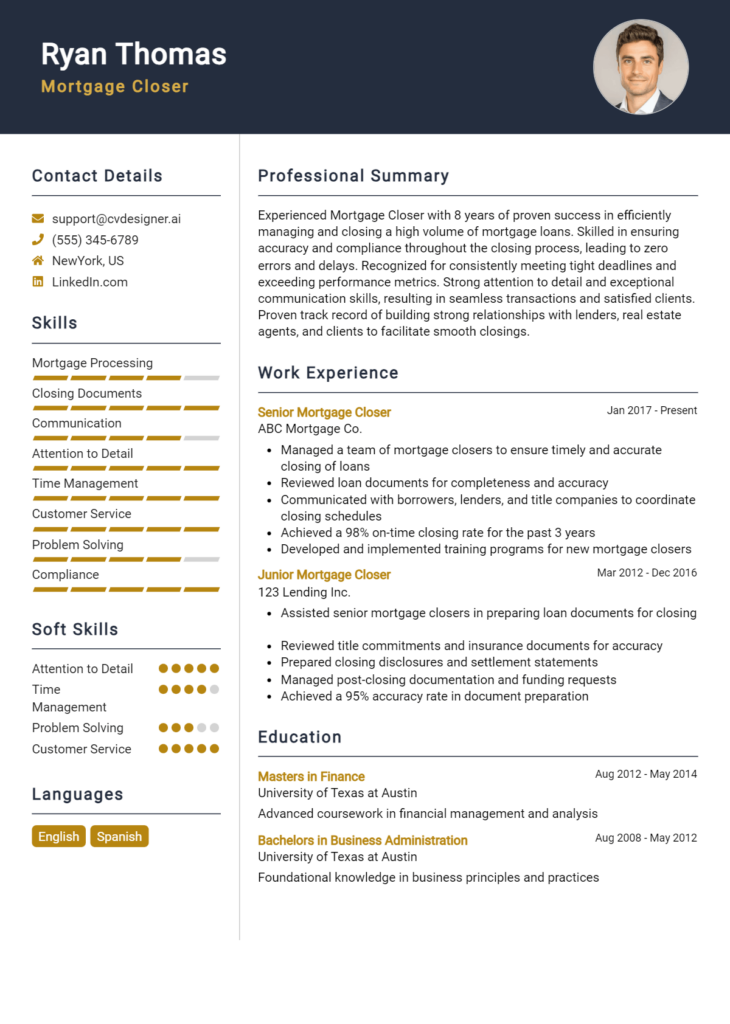

Example Education and Certifications for Mortgage Originator

Strong Examples

- Bachelor of Science in Finance, University of XYZ, 2018

- NMLS Licensed Mortgage Originator, 2021

- Certified Mortgage Consultant (CMC), Mortgage Bankers Association, 2022

- Coursework in Real Estate Finance, Advanced Underwriting, and Risk Management

Weak Examples

- Associate Degree in Liberal Arts, Community College of ABC, 2010

- Certification in Basic Computer Skills, 2019

- High School Diploma, 2005

- Outdated Mortgage Originator Certification, 2010

The examples provided demonstrate a clear distinction between strong and weak qualifications. Strong examples are relevant, recent, and align closely with the Mortgage Originator role, indicating a well-prepared candidate. In contrast, weak examples reflect outdated or irrelevant qualifications that do not contribute to the candidate's suitability for the position, potentially undermining their application.

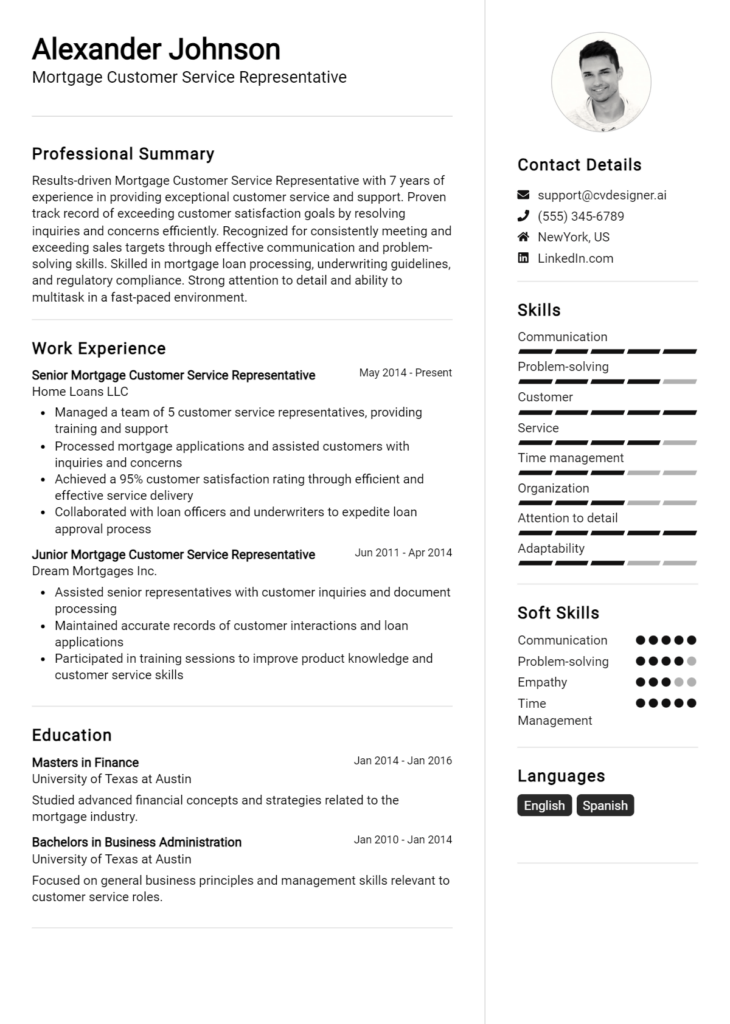

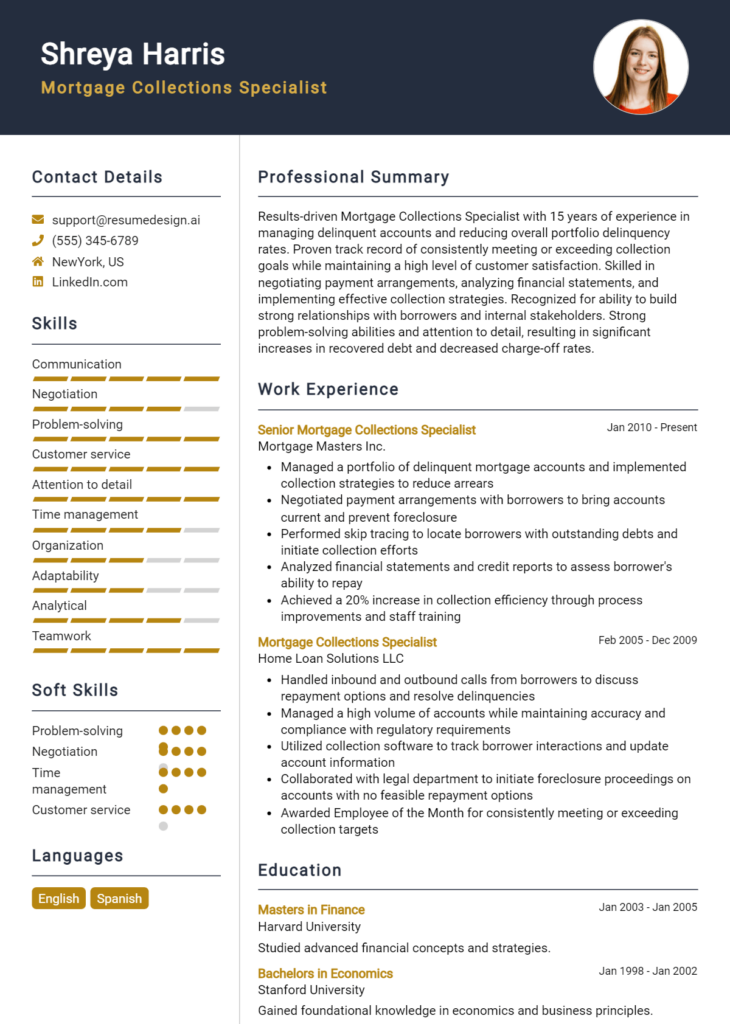

Top Skills & Keywords for Mortgage Originator Resume

A well-crafted resume is essential for a Mortgage Originator, as it serves as the first impression for potential employers. Highlighting the right mix of skills can set a candidate apart in a competitive job market. Skills not only demonstrate the applicant's qualifications but also showcase their ability to navigate the complexities of the mortgage industry, from understanding client needs to staying updated on regulations. A strong resume reflects both hard and soft skills that are critical in fostering relationships with clients, lenders, and industry partners. By aligning these skills with the specific demands of the role, a Mortgage Originator can effectively communicate their value to prospective employers.

Top Hard & Soft Skills for Mortgage Originator

Soft Skills

- Excellent communication

- Strong interpersonal skills

- Customer service orientation

- Negotiation skills

- Problem-solving abilities

- Time management

- Attention to detail

- Adaptability

- Empathy

- Team collaboration

Hard Skills

- Knowledge of mortgage products

- Proficiency in mortgage software (e.g., Encompass, Calyx)

- Understanding of federal and state regulations

- Financial analysis

- Credit analysis

- Risk assessment

- Loan origination processes

- Data entry accuracy

- Microsoft Office Suite proficiency

- Market analysis

For further insights on how to enhance your resume, consider exploring additional skills and the importance of work experience in showcasing your qualifications.

Stand Out with a Winning Mortgage Originator Cover Letter

Dear [Hiring Manager's Name],

I am excited to apply for the Mortgage Originator position at [Company Name], as advertised on [where you found the job listing]. With over [X years] of experience in the mortgage industry, I have honed my skills in customer service, financial analysis, and loan processing. My passion for helping clients achieve their homeownership dreams, combined with my expertise in navigating the complexities of mortgage products, positions me as a strong candidate for this role.

In my previous role at [Previous Company Name], I successfully guided numerous clients through the mortgage application process, ensuring a seamless experience from pre-approval to closing. My ability to build strong relationships with clients and real estate professionals alike has resulted in a robust referral network and consistently high client satisfaction ratings. I am adept at assessing individual financial situations and effectively communicating suitable mortgage options, enabling my clients to make informed decisions that align with their goals.

I am particularly drawn to [Company Name] because of your commitment to providing exceptional service and innovative mortgage solutions. I am eager to contribute to your team by leveraging my expertise in market trends and underwriting guidelines to help clients secure the best possible financing for their homes. I am confident that my proactive approach to problem-solving and my dedication to ongoing professional development will make a positive impact at your firm.

Thank you for considering my application. I look forward to the opportunity to discuss how my skills and experiences align with the needs of your team. I am excited about the possibility of contributing to [Company Name] and helping clients achieve their homeownership aspirations.

Sincerely,

[Your Name]

[Your Phone Number]

[Your Email Address]

Common Mistakes to Avoid in a Mortgage Originator Resume

When crafting a resume as a Mortgage Originator, it's crucial to present your qualifications and experience in a clear and compelling manner. However, many applicants make common mistakes that can hinder their chances of landing an interview. By avoiding these pitfalls, you can create a resume that effectively showcases your skills and expertise in the mortgage industry. Here are some common mistakes to look out for:

Generic Objective Statement: Using a one-size-fits-all objective can make your resume seem unoriginal. Tailor your statement to reflect your specific goals and how they align with the prospective employer's needs.

Lack of Quantifiable Achievements: Failing to include metrics that highlight your achievements can leave your resume lacking impact. Use specific numbers to demonstrate your success in closing loans or increasing customer satisfaction.

Ignoring Industry Keywords: Not incorporating relevant keywords from the mortgage industry can result in your resume being overlooked by Applicant Tracking Systems (ATS). Research the job description and include terms that hiring managers will be searching for.

Overloading with Jargon: While industry-specific language can demonstrate expertise, overusing jargon can alienate readers. Strike a balance by ensuring your resume is accessible to both industry professionals and HR personnel.

Inconsistent Formatting: A resume with inconsistent formatting can be distracting and unprofessional. Ensure your font, bullet points, and spacing are uniform throughout the document for a polished look.

Neglecting Soft Skills: Focusing solely on technical skills and neglecting soft skills like communication and customer service can be a mistake. Highlighting your interpersonal skills is essential in a client-facing role like a Mortgage Originator.

Excessive Length: Submitting a lengthy resume that exceeds one page can overwhelm hiring managers. Aim for brevity while ensuring all critical information is included, ideally keeping it to one page unless you have extensive experience.

Not Tailoring for Each Job: Using the same resume for every application can be detrimental. Customize your resume for each position by emphasizing relevant experience and skills that match the job description.

By being mindful of these common mistakes, you can enhance your resume and improve your chances of making a positive impression on potential employers in the mortgage industry.