Mortgage Processor Core Responsibilities

A Mortgage Processor plays a critical role in the loan approval process, acting as a liaison between loan officers, underwriters, and clients. Key responsibilities include analyzing financial documents, verifying applicant information, and ensuring compliance with regulations. Essential skills encompass technical proficiency in mortgage software, operational efficiency, and strong problem-solving abilities. These competencies are vital for facilitating seamless transactions, contributing to organizational success. A well-structured resume can effectively showcase these qualifications, enhancing career prospects in the industry.

Common Responsibilities Listed on Mortgage Processor Resume

- Review and verify loan application information for accuracy.

- Gather and analyze financial documents, including credit reports and tax returns.

- Communicate with clients to obtain necessary documentation and clarify loan terms.

- Ensure compliance with state and federal lending regulations.

- Collaborate with underwriters to resolve issues and expedite loan processing.

- Maintain detailed records of all transactions and communications.

- Prepare loan files for approval and submission to underwriting.

- Track and manage multiple loan applications simultaneously.

- Assist in training new staff on mortgage processing procedures.

- Monitor loan status and provide updates to clients and stakeholders.

- Implement process improvements to enhance operational efficiency.

- Utilize mortgage software and tools for accurate data management.

High-Level Resume Tips for Mortgage Processor Professionals

In today's competitive job market, a well-crafted resume is crucial for Mortgage Processor professionals seeking to make a lasting impression on potential employers. Your resume often serves as the first gateway to your next opportunity, and it needs to effectively showcase your skills, achievements, and relevant experience in the mortgage industry. A compelling resume not only highlights your qualifications but also reflects your understanding of the role's demands and your ability to meet them. This guide will provide practical and actionable resume tips specifically tailored for Mortgage Processor professionals to help you stand out in the application process.

Top Resume Tips for Mortgage Processor Professionals

- Tailor your resume to the specific job description by incorporating relevant keywords and phrases that match the role.

- Highlight your relevant experience in the mortgage industry, emphasizing roles that involved processing, underwriting, or customer service.

- Quantify your achievements where possible, such as the number of loans processed, percentage of on-time closings, or customer satisfaction ratings.

- Showcase your knowledge of mortgage software systems and tools, such as Encompass or Calyx, which are commonly used in the industry.

- Include certifications or training relevant to mortgage processing, such as NMLS licensing or specialized mortgage courses.

- Demonstrate your ability to work under pressure by mentioning instances where you successfully met tight deadlines or managed high volumes of applications.

- Emphasize your attention to detail by providing examples of how your thoroughness has contributed to reducing errors or improving processes.

- Highlight your communication skills, both written and verbal, as these are essential for collaborating with clients, lenders, and underwriters.

- Consider adding a section for professional affiliations or memberships in mortgage-related organizations to enhance your credibility.

By implementing these tips, Mortgage Processor professionals can significantly increase their chances of landing a job in the field. A resume that is tailored, quantifiable, and reflective of industry standards not only enhances your appeal to employers but also sets the stage for a successful interview and ultimately, a fulfilling career in mortgage processing.

Why Resume Headlines & Titles are Important for Mortgage Processor

In the competitive field of mortgage processing, a well-crafted resume headline or title is critical for capturing the attention of hiring managers. As the first element they encounter, a strong headline serves as a concise summary of a candidate's key qualifications, allowing them to make a quick yet informed decision about the applicant's potential fit for the role. By presenting an impactful phrase that clearly reflects the candidate's skills and experience relevant to the mortgage processing industry, a headline can distinguish one resume from the rest in a crowded applicant pool. Therefore, it is essential for candidates to ensure that their resume headlines are concise, relevant, and directly related to the job they are applying for.

Best Practices for Crafting Resume Headlines for Mortgage Processor

- Keep it concise—aim for one impactful phrase that summarizes your qualifications.

- Make it role-specific by including relevant keywords from the job description.

- Highlight key skills or experiences that set you apart from other candidates.

- Use action-oriented language to convey confidence and competence.

- Avoid jargon or overly technical terms that may not be universally understood.

- Tailor your headline for each application to ensure maximum relevance.

- Ensure it reflects your unique value proposition in the mortgage processing field.

- Consider incorporating quantifiable achievements to add credibility.

Example Resume Headlines for Mortgage Processor

Strong Resume Headlines

Experienced Mortgage Processor with 5+ Years of Specialization in FHA Loans

Detail-Oriented Mortgage Processor Skilled in Streamlining Loan Approvals

Certified Mortgage Processor with Proven Track Record of Reducing Turnaround Times

Weak Resume Headlines

Mortgage Processor

Experienced in Finance

Strong resume headlines are effective because they immediately convey specific qualifications and achievements, making it easy for hiring managers to see the candidate’s potential value to their organization. They utilize clear language and relevant terminology that resonates with the job role, while also providing insight into the candidate's unique skills. In contrast, weak headlines fail to impress because they lack specificity and do not highlight any unique qualifications or accomplishments. These generic titles do not differentiate the candidate in a competitive job market, making it difficult for hiring managers to recognize their potential contributions.

Writing an Exceptional Mortgage Processor Resume Summary

A well-crafted resume summary is crucial for a Mortgage Processor's job application, as it serves as the first impression on hiring managers. A strong summary effectively encapsulates the candidate's key skills, relevant experience, and notable accomplishments, quickly capturing the attention of potential employers. In a competitive job market, having a concise and impactful summary tailored specifically to the position can significantly enhance the candidate's chances of being noticed and invited for an interview.

Best Practices for Writing a Mortgage Processor Resume Summary

- Quantify achievements: Use numbers and statistics to demonstrate your impact, such as the number of loans processed or percentage of successful applications.

- Focus on relevant skills: Highlight key mortgage processing skills such as attention to detail, organizational abilities, and knowledge of loan regulations.

- Tailor the summary: Customize your summary for each job application by incorporating specific keywords and phrases from the job description.

- Keep it concise: Aim for 2-4 sentences that convey your strengths without overwhelming the reader.

- Showcase your experience: Include years of experience and specific roles that demonstrate your expertise in mortgage processing.

- Highlight certifications: Mention any relevant certifications or training that set you apart from other candidates.

- Use action verbs: Start with strong action verbs to convey your accomplishments and responsibilities effectively.

- Maintain a positive tone: Use confident language that showcases your enthusiasm for the role and the mortgage industry.

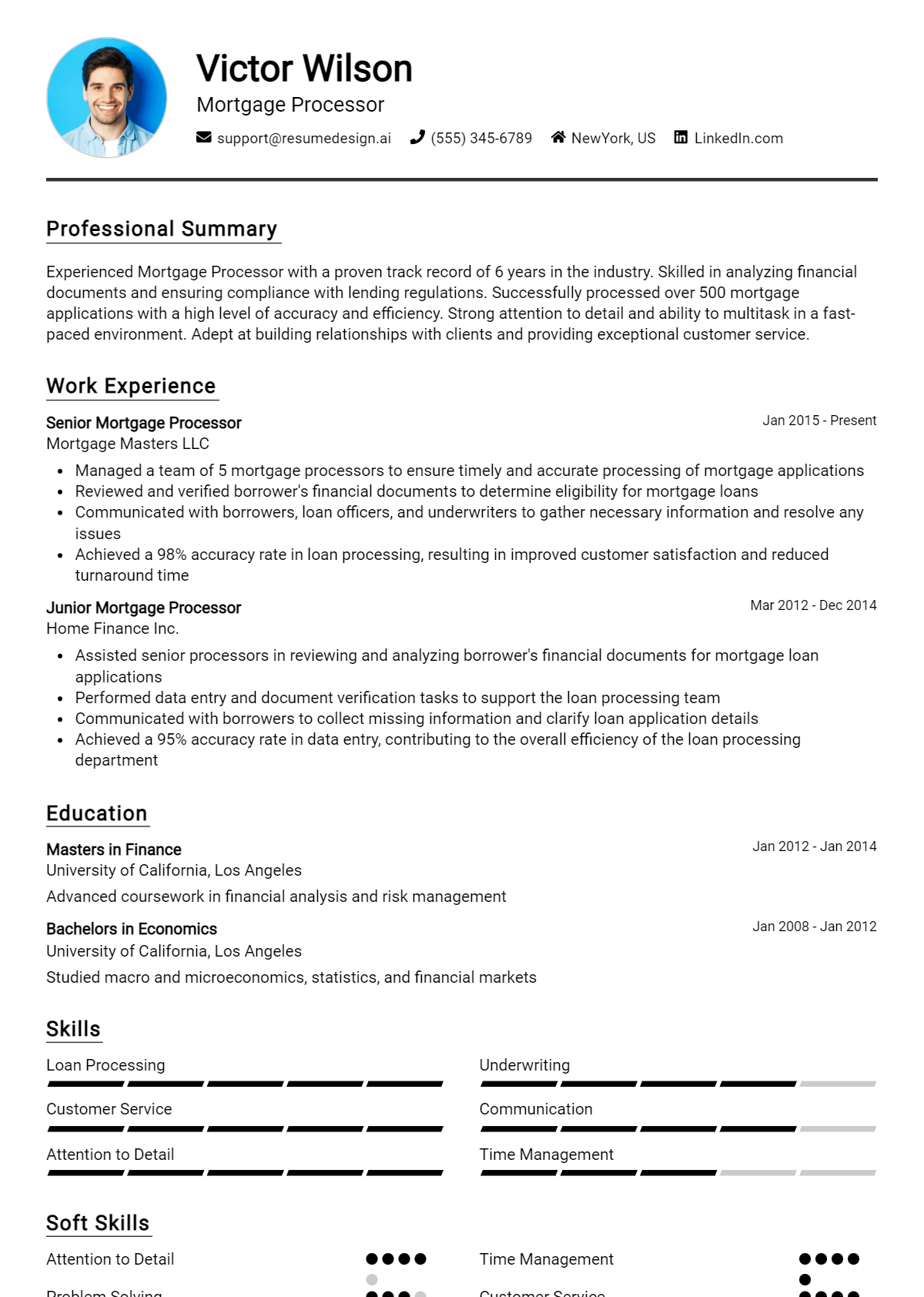

Example Mortgage Processor Resume Summaries

Strong Resume Summaries

Detail-oriented Mortgage Processor with over 5 years of experience managing a portfolio of 150+ loans per month, resulting in a 98% approval rate through thorough documentation and compliance checks.

Results-driven Mortgage Processor with a proven track record of reducing processing times by 25% while maintaining stringent quality control standards, ensuring customer satisfaction and loyalty.

Experienced Mortgage Processor skilled in utilizing advanced software tools to streamline the loan application process, leading to a 30% increase in efficiency and a significant reduction in processing errors.

Dedicated Mortgage Processor with a comprehensive understanding of FHA, VA, and conventional loans, successfully closing over 200 transactions annually and consistently exceeding performance goals.

Weak Resume Summaries

Skilled professional looking for a position as a Mortgage Processor with experience in the field.

Mortgage Processor with some experience seeking to contribute to a team in a lending environment.

The examples of strong resume summaries are considered effective because they include quantitative results, showcase relevant skills, and demonstrate direct experience pertinent to the Mortgage Processor role. In contrast, the weak resume summaries lack specificity, quantifiable outcomes, and do not convey a clear value proposition, making them less likely to engage the hiring manager's interest.

Work Experience Section for Mortgage Processor Resume

The work experience section of a Mortgage Processor resume is pivotal in demonstrating a candidate's qualifications and suitability for the role. This section not only highlights the applicant's technical skills in managing loan applications and processing documents but also illustrates their ability to collaborate with various teams to deliver high-quality results. By quantifying achievements—such as the number of loans processed or the reduction of processing time—and aligning experiences with industry standards, candidates can effectively showcase their value to potential employers.

Best Practices for Mortgage Processor Work Experience

- Utilize action verbs to begin each bullet point, demonstrating proactivity and impact.

- Quantify achievements by including specific numbers, percentages, or dollar amounts where possible.

- Highlight relevant technical skills, such as familiarity with mortgage software and regulatory compliance.

- Describe collaborative efforts with teams, underlining your role in achieving shared goals.

- Tailor experiences to match the job description and industry standards, focusing on relevant tasks.

- Showcase a clear progression in responsibilities or roles within the mortgage processing field.

- Include certifications and training that enhance your qualifications for the position.

- Keep descriptions concise while ensuring they convey your contributions effectively.

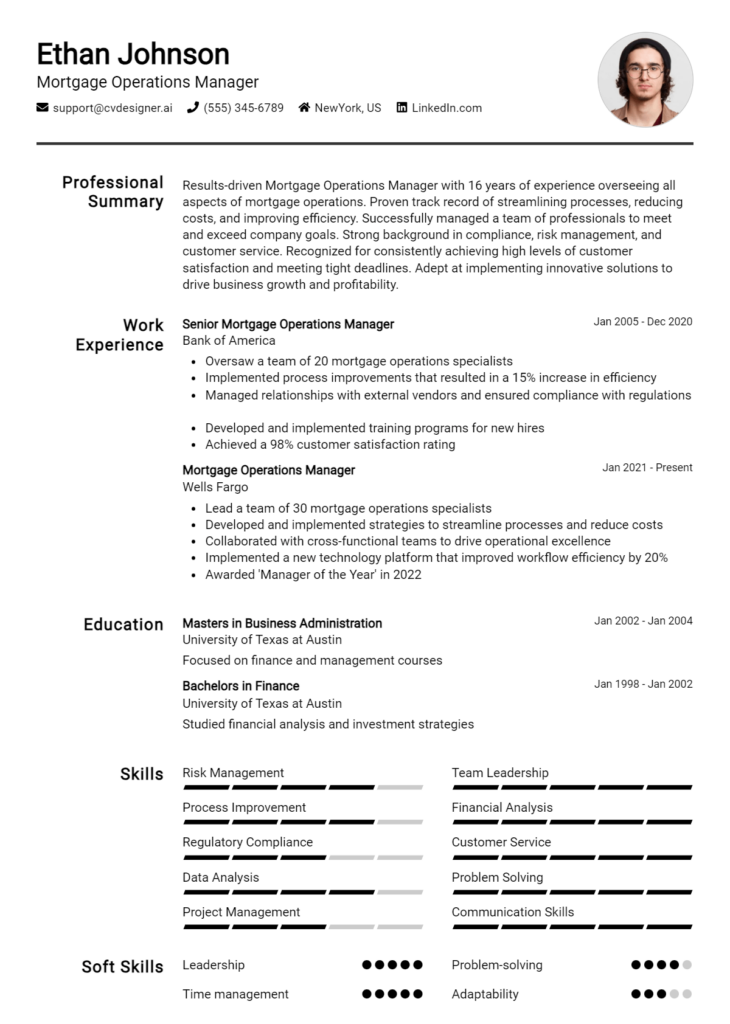

Example Work Experiences for Mortgage Processor

Strong Experiences

- Processed an average of 50 loan applications per month, achieving a 98% approval rate through meticulous document verification.

- Led a team of 5 in streamlining the mortgage processing workflow, reducing turnaround time by 30% and enhancing customer satisfaction scores.

- Implemented a new software system that improved data accuracy by 25%, resulting in a significant decrease in compliance issues.

- Collaborated with underwriters and real estate agents to facilitate smooth transactions, contributing to a 20% increase in referral business.

Weak Experiences

- Assisted with loan applications and paperwork.

- Worked on various tasks related to mortgage processing.

- Helped the team with filing and organizing documents.

- Participated in meetings about mortgage processing issues.

The examples provided illustrate a clear distinction between strong and weak experiences. Strong experiences are characterized by specific, quantifiable achievements and demonstrate the candidate's leadership and collaborative skills, showcasing their impact on the organization. In contrast, weak experiences lack specificity and do not convey the candidate's contributions or technical expertise, making them less compelling to potential employers.

Education and Certifications Section for Mortgage Processor Resume

The education and certifications section of a Mortgage Processor resume is critical as it provides potential employers with insights into the candidate's academic background and professional qualifications. This section not only showcases relevant degrees and industry-recognized certifications but also reflects the candidate's commitment to continuous learning and professional development. By including pertinent coursework, certifications, and any specialized training, candidates can significantly enhance their credibility and demonstrate their alignment with the job role, making them more attractive to prospective employers.

Best Practices for Mortgage Processor Education and Certifications

- Prioritize relevant degrees, such as Finance, Business Administration, or Real Estate.

- Include certifications from recognized industry organizations like the Mortgage Bankers Association (MBA) or National Association of Mortgage Processors (NAMP).

- Provide details on specialized training programs or workshops focused on mortgage processing.

- Highlight any continuing education courses or seminars that keep you updated on industry trends.

- Be specific about coursework that pertains directly to mortgage processing, underwriting, or loan origination.

- List any honors or recognitions received during your academic journey that underscore your expertise.

- Maintain a clear and organized format that allows easy readability for hiring managers.

- Avoid including irrelevant degrees or certifications that do not pertain to the mortgage industry.

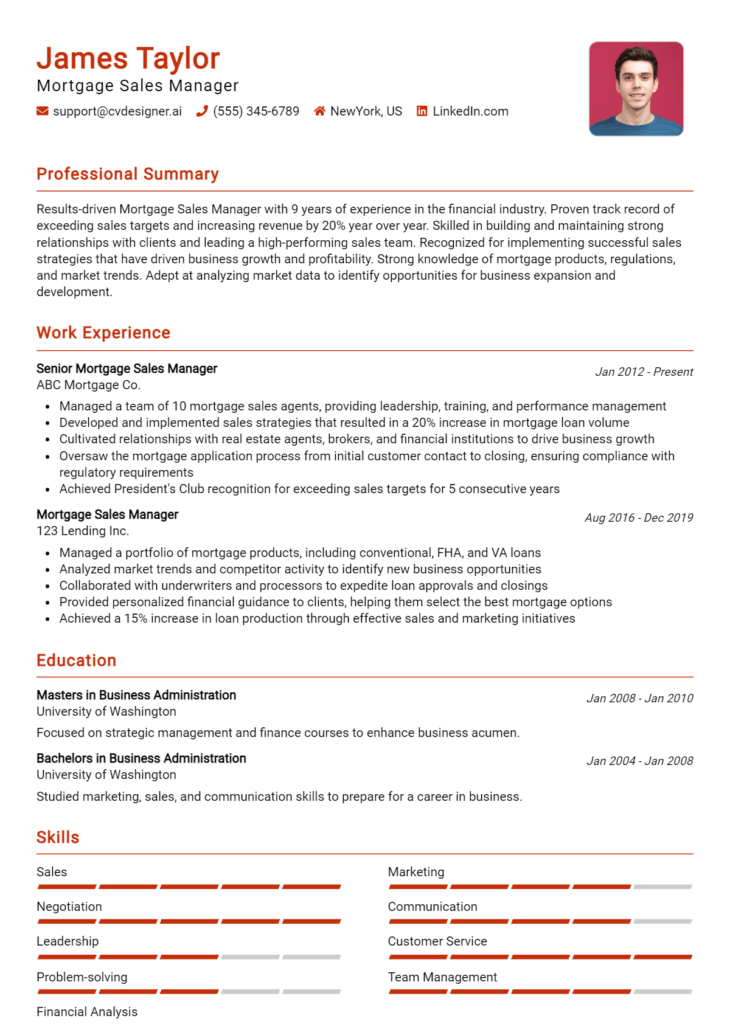

Example Education and Certifications for Mortgage Processor

Strong Examples

- Bachelor of Science in Finance, University of State

- Certified Mortgage Processor (CMP) – National Association of Mortgage Processors (NAMP)

- Completed coursework in Mortgage Lending and Risk Management

- Continuing Education Certificate in Regulatory Compliance for Mortgage Professionals

Weak Examples

- Bachelor of Arts in English Literature

- Certification in Basic Office Skills from a local community college

- Completed a workshop on Creative Writing

- High School Diploma with no further education or training

The strong examples are considered relevant because they directly relate to the skills and knowledge required in the mortgage processing field, showcasing both educational background and professional certifications that enhance the candidate’s qualifications. Conversely, the weak examples demonstrate a lack of relevance to the mortgage industry, with qualifications that do not support the specific requirements of a Mortgage Processor role, thereby diminishing the candidate's suitability for the position.

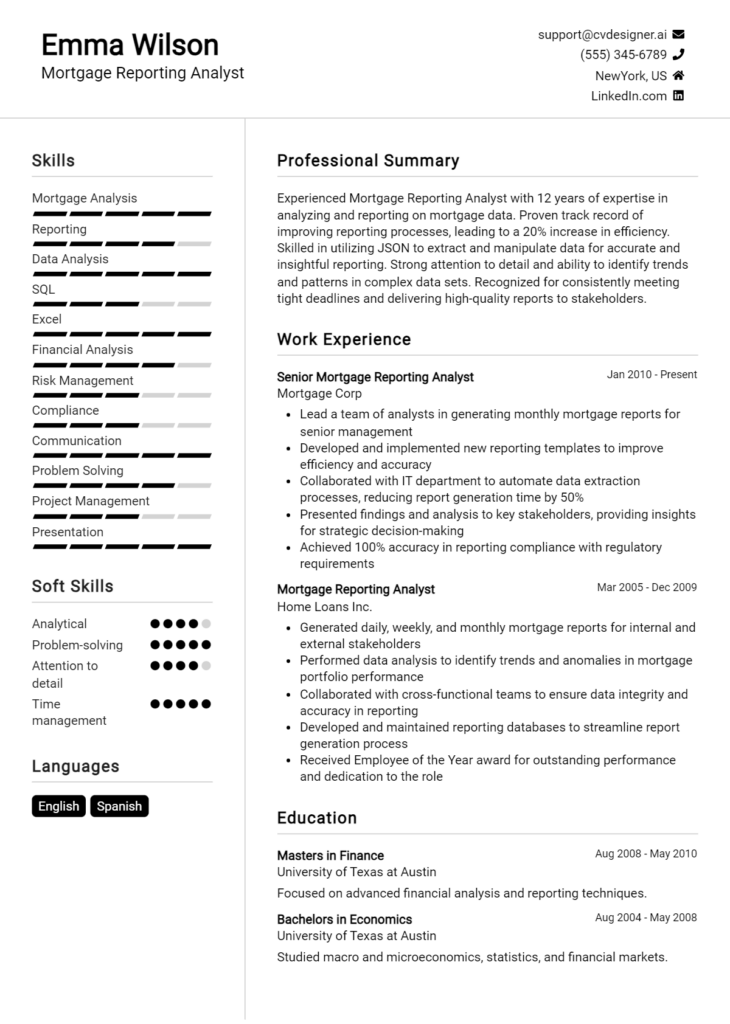

Top Skills & Keywords for Mortgage Processor Resume

When crafting a resume for a Mortgage Processor position, highlighting the right skills is crucial. These skills not only demonstrate your qualifications but also reflect your ability to handle the complexities of the mortgage processing industry. A well-structured resume that emphasizes both hard and soft skills can significantly enhance your chances of standing out to potential employers. As the mortgage landscape continues to evolve, possessing the right combination of technical abilities and interpersonal traits is essential for success in this role.

Top Hard & Soft Skills for Mortgage Processor

Soft Skills

- Attention to Detail

- Time Management

- Communication Skills

- Problem-Solving Ability

- Customer Service Orientation

- Adaptability

- Team Collaboration

- Stress Management

- Analytical Thinking

- Negotiation Skills

- Critical Thinking

- Emotional Intelligence

- Conflict Resolution

- Patience

- Active Listening

Hard Skills

- Proficiency in Mortgage Software (e.g., Encompass, Calyx)

- Knowledge of Mortgage Regulations and Compliance

- Loan Processing Techniques

- Financial Analysis

- Data Entry and Management

- Knowledge of Credit Reports

- Understanding of Underwriting Guidelines

- Proficient in Microsoft Office Suite

- Familiarity with Real Estate Transactions

- Document Verification and Processing

- Risk Assessment Skills

- Basic Accounting Principles

- Familiarity with Loan Origination Systems

- Record Keeping and Documentation

- Research Skills

- Ability to Prepare Loan Packages

- Customer Relationship Management (CRM) Software

- Understanding of Interest Rates and Loan Terms

To further enhance your resume, consider integrating your work experience alongside these skills to create a comprehensive profile that showcases your qualifications in the mortgage processing field. For a more detailed exploration of essential skills, you can refer to specialized resources that can help you refine your resume.

Stand Out with a Winning Mortgage Processor Cover Letter

Dear [Hiring Manager's Name],

I am writing to express my interest in the Mortgage Processor position at [Company Name] as advertised on [where you found the job listing]. With over [X years] of experience in the mortgage industry and a strong commitment to delivering exceptional service, I am confident in my ability to excel in this role and contribute to the success of your team. My background has equipped me with a thorough understanding of the mortgage processing cycle, from application to closing, and I am eager to bring my expertise to [Company Name].

In my previous role at [Previous Company Name], I successfully managed a high volume of mortgage applications, ensuring that all documentation was accurate, complete, and compliant with regulatory standards. My attention to detail and organizational skills allowed me to streamline processes, reducing turnaround times and enhancing client satisfaction. I pride myself on my ability to communicate effectively with clients, underwriters, and loan officers, fostering strong relationships and facilitating a smooth workflow. I am well-versed in using various mortgage processing software, which I believe will enable me to quickly adapt to your systems and contribute from day one.

What excites me most about the opportunity at [Company Name] is your commitment to providing tailored mortgage solutions to clients. I share your belief that every client deserves personalized service, and I am dedicated to ensuring that each application is handled with care and precision. I am eager to leverage my skills and experience to help your team achieve its goals and uphold its reputation for excellence in the mortgage industry.

Thank you for considering my application. I look forward to the opportunity to discuss how my experience and passion for mortgage processing align with the needs of [Company Name]. I am available for an interview at your earliest convenience and can be reached at [Your Phone Number] or [Your Email Address].

Sincerely,

[Your Name]

Common Mistakes to Avoid in a Mortgage Processor Resume

When crafting a resume for the role of a mortgage processor, it's crucial to present your qualifications and experience in a clear and compelling manner. However, many applicants make common mistakes that can detract from their chances of landing an interview. By avoiding these pitfalls, you can enhance your resume's effectiveness and showcase your suitability for the position. Here are some common mistakes to steer clear of:

Generic Objective Statements: Using a one-size-fits-all objective fails to convey your specific interest in the mortgage processing role. Tailor your objective to reflect your passion for the industry and the unique skills you bring.

Neglecting Industry Keywords: Failing to include relevant industry terminology can make your resume less appealing to hiring managers and applicant tracking systems. Incorporate keywords related to mortgage processing to improve visibility.

Overly Complicated Formatting: Using overly intricate designs or fonts can detract from the content of your resume. Stick to a clean, professional layout that is easy to read and highlights your qualifications effectively.

Listing Responsibilities Instead of Achievements: Merely outlining your job duties does not demonstrate your impact. Focus on quantifiable achievements and specific contributions you made in previous roles.

Ignoring Errors and Typos: Spelling and grammatical mistakes can undermine your professionalism. Always proofread your resume multiple times and consider having someone else review it for errors.

Omitting Relevant Certifications: Credentials such as NMLS licensing or specialized mortgage training are essential for a mortgage processor role. Ensure these qualifications are prominently displayed on your resume.

Using Passive Language: Passive language can make your resume sound weak and unassertive. Use active verbs to describe your experiences and contributions, showcasing your initiative and impact.

Failing to Customize for Each Application: Sending out the same resume for multiple jobs can be detrimental. Tailor your resume for each application to highlight the most relevant experience and skills for the specific position.

Conclusion

In conclusion, being a successful Mortgage Processor requires a blend of technical skills, attention to detail, and effective communication. It's essential to understand the mortgage application process, maintain a thorough knowledge of loan products, and ensure compliance with regulations. Additionally, strong organizational abilities and customer service skills play a critical role in managing multiple files and providing support to clients throughout the process.

As you reflect on your career as a Mortgage Processor, consider reviewing your resume to ensure it highlights your relevant skills and experiences effectively. A well-crafted resume can greatly enhance your chances of landing your desired position.

To assist you in this endeavor, explore the variety of resources available to help you create a standout resume. Check out resume templates for professional layouts, use the resume builder for a guided creation process, and review resume examples for inspiration. Additionally, don’t forget to create a compelling cover letter with our cover letter templates to further strengthen your application. Take action today and elevate your career prospects!