Treasury Reporting Analyst Core Responsibilities

A Treasury Reporting Analyst plays a crucial role by bridging finance, accounting, and operational departments. This professional is responsible for preparing and analyzing treasury reports, monitoring cash flow, and ensuring compliance with financial regulations. Essential skills include technical proficiency in financial software, strong analytical abilities, and effective problem-solving capabilities. These skills are vital for contributing to the organization’s financial health, and a well-structured resume can effectively highlight these qualifications to prospective employers.

Common Responsibilities Listed on Treasury Reporting Analyst Resume

- Prepare and analyze daily cash position reports.

- Monitor and manage liquidity levels across departments.

- Conduct variance analysis on treasury-related data.

- Assist in the preparation of financial forecasts and budgets.

- Ensure compliance with internal controls and regulations.

- Collaborate with accounting and finance teams for accurate reporting.

- Evaluate investment opportunities and risk assessments.

- Implement and maintain treasury management systems.

- Prepare reports for senior management and stakeholders.

- Support audits and regulatory examinations as needed.

- Identify and resolve discrepancies in financial data.

- Provide insights to improve treasury processes and efficiencies.

High-Level Resume Tips for Treasury Reporting Analyst Professionals

In today's competitive job market, a well-crafted resume is crucial for Treasury Reporting Analyst professionals looking to make their mark. As the first impression a candidate makes on a potential employer, the resume must effectively illustrate both skills and achievements that align with the demands of the role. This guide will provide practical and actionable tips specifically tailored for Treasury Reporting Analyst professionals, ensuring your resume stands out in a crowded field and accurately represents your qualifications.

Top Resume Tips for Treasury Reporting Analyst Professionals

- Tailor your resume to the job description by incorporating relevant keywords and phrases that match the specific requirements of the position.

- Highlight your experience in financial reporting, cash flow analysis, and treasury operations to demonstrate your direct relevance to the role.

- Quantify your achievements by including metrics and key performance indicators (KPIs) that showcase your impact on previous employers, such as improvements in reporting accuracy or reductions in processing times.

- Include industry-specific skills, such as proficiency in treasury management systems, financial modeling, and risk assessment, to highlight your technical expertise.

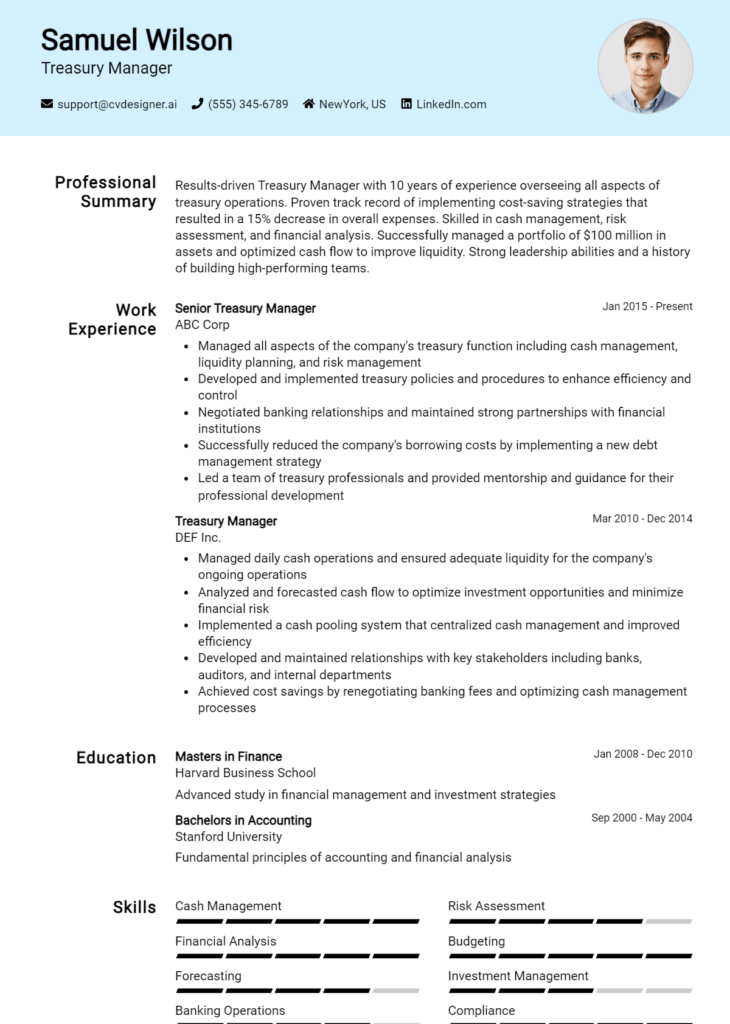

- Utilize a clean and professional format that enhances readability, making it easy for hiring managers to quickly assess your qualifications.

- Incorporate action verbs to describe your responsibilities and accomplishments, which can create a stronger and more dynamic impression.

- Showcase relevant certifications, such as Certified Treasury Professional (CTP) or Chartered Financial Analyst (CFA), to signify your commitment to the profession.

- Keep your resume to one or two pages, ensuring that every piece of information is relevant and impactful.

- Consider including a summary statement at the top that encapsulates your career highlights and what you bring to the role.

By implementing these tips, Treasury Reporting Analyst professionals can significantly enhance their resumes, increasing their chances of landing interviews and ultimately securing positions in a competitive job market. A strategic approach to resume crafting not only highlights your qualifications but also demonstrates your professionalism and attention to detail, qualities that are essential in the finance industry.

Why Resume Headlines & Titles are Important for Treasury Reporting Analyst

A Treasury Reporting Analyst plays a critical role in the financial health of an organization, focusing on the analysis, reporting, and management of the company’s treasury functions. In this competitive field, a well-crafted resume headline or title serves as a powerful tool to capture the attention of hiring managers. A strong headline succinctly summarizes a candidate's key qualifications and professional strengths in one impactful phrase, offering a quick insight into their suitability for the role. This concise summary should be relevant and directly related to the job being applied for, effectively setting the tone for the rest of the resume and encouraging hiring managers to read further.

Best Practices for Crafting Resume Headlines for Treasury Reporting Analyst

- Keep it concise—aim for one impactful sentence or phrase.

- Make it role-specific to highlight your expertise in treasury reporting.

- Use strong action words and industry-specific terminology.

- Incorporate quantifiable achievements or skills when possible.

- Avoid jargon or vague language; clarity is key.

- Tailor the headline to match the specific job description.

- Consider including relevant certifications or notable credentials.

- Ensure it reflects your unique value proposition as a candidate.

Example Resume Headlines for Treasury Reporting Analyst

Strong Resume Headlines

"Results-Driven Treasury Reporting Analyst with 5+ Years of Experience in Risk Management and Cash Flow Optimization"

“Certified Treasury Professional Specializing in Financial Reporting and Regulatory Compliance”

“Detail-Oriented Analyst with Proven Track Record in Enhancing Treasury Processes and Reporting Accuracy”

“Strategic Financial Analyst Leveraging Advanced Analytics to Drive Treasury Reporting Efficiency”

Weak Resume Headlines

“Treasury Analyst”

“Experienced Professional Seeking Opportunities”

The strong headlines are effective because they provide specific information about the candidate's skills and experiences that are directly relevant to the Treasury Reporting Analyst role, making them stand out. They also incorporate industry terminology and highlight unique qualifications, which can resonate well with hiring managers. In contrast, the weak headlines lack specificity and fail to convey any meaningful information about the candidate's qualifications or achievements, making them less memorable and impactful in a competitive job market.

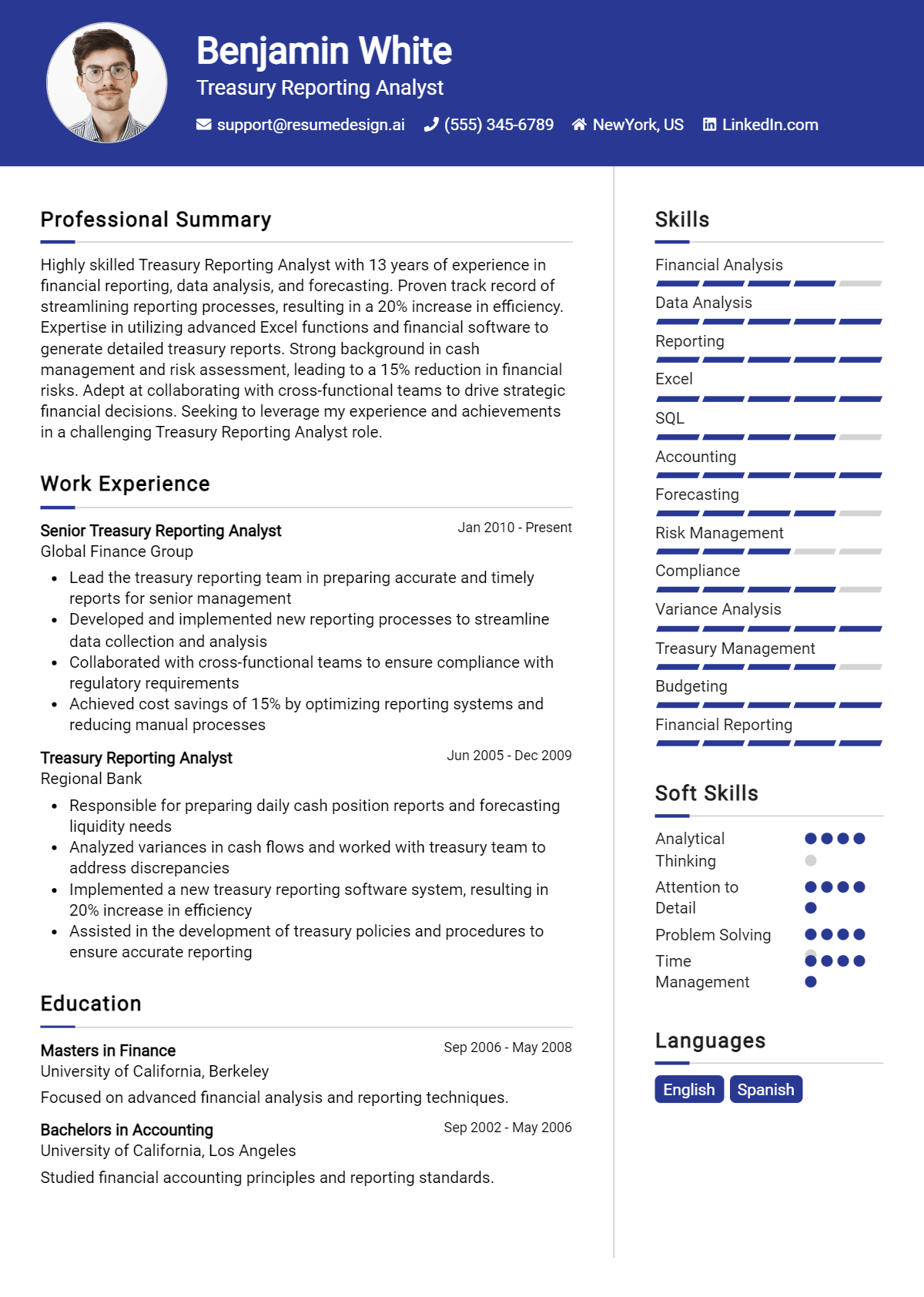

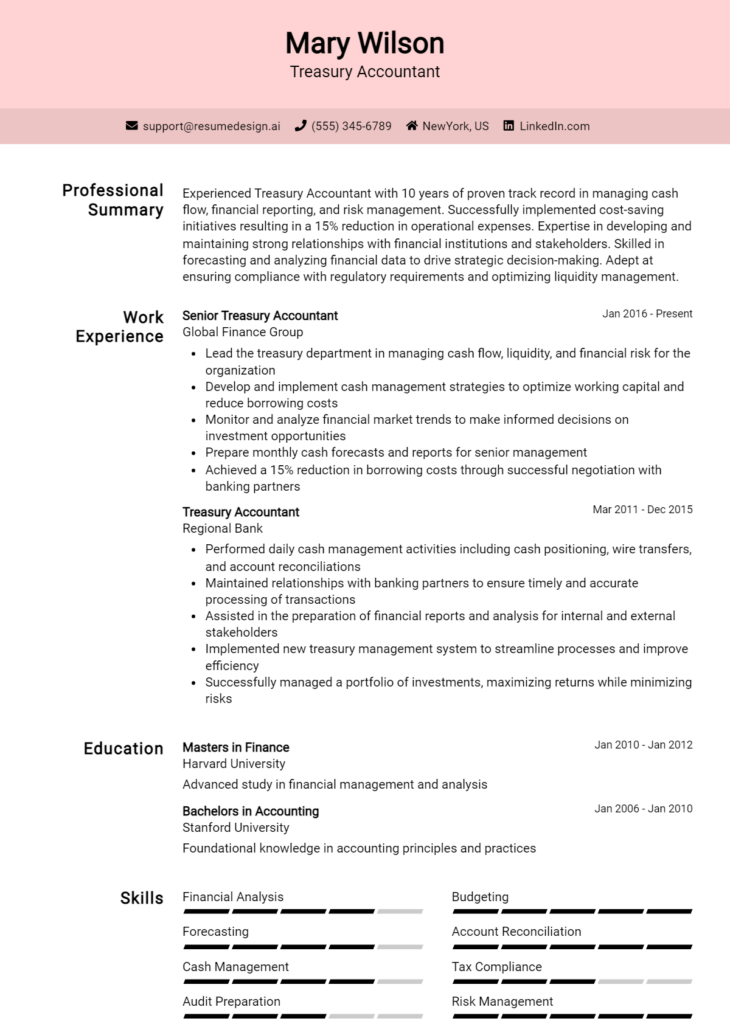

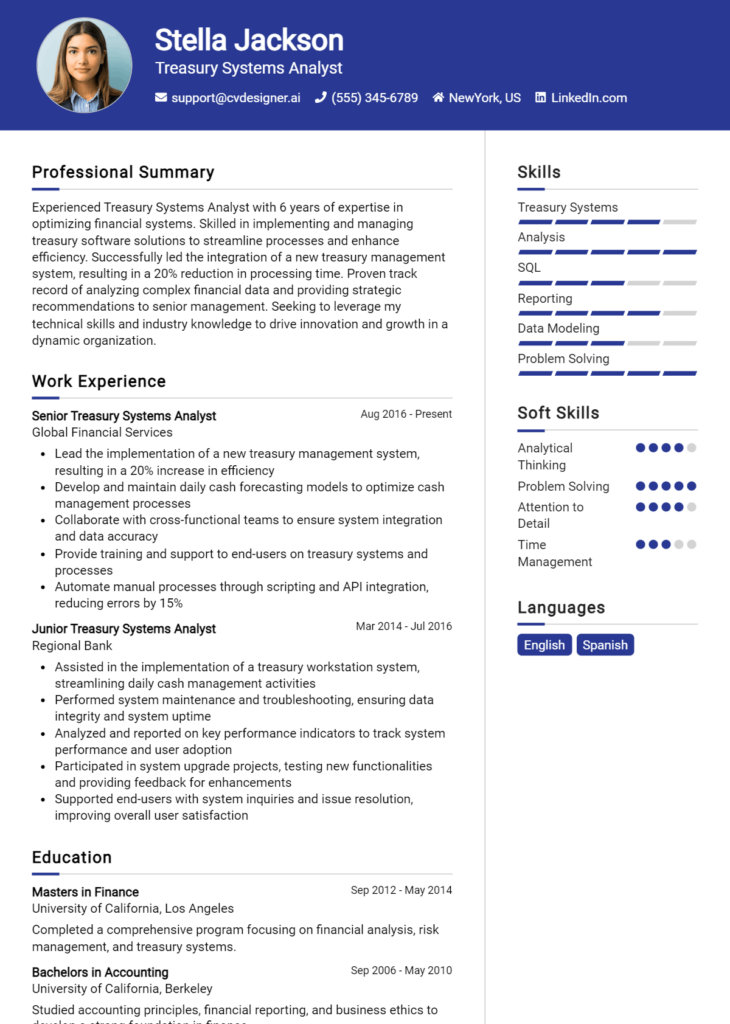

Writing an Exceptional Treasury Reporting Analyst Resume Summary

A well-crafted resume summary is crucial for a Treasury Reporting Analyst as it serves as the first impression to hiring managers. In a competitive job market, a strong summary quickly captures attention by succinctly showcasing key skills, relevant experience, and notable accomplishments that directly align with the job role. It should be concise and impactful, providing a snapshot of the candidate’s qualifications while being tailored to the specific job description. This strategic approach not only highlights the candidate's fit for the position but also sets the tone for the rest of the resume.

Best Practices for Writing a Treasury Reporting Analyst Resume Summary

- Quantify achievements: Use numbers and percentages to highlight your impact and contributions.

- Focus on relevant skills: Emphasize skills that are directly related to treasury reporting and financial analysis.

- Tailor the summary: Customize the summary for each job application, reflecting the specific requirements and language used in the job description.

- Highlight key accomplishments: Mention significant projects or achievements that demonstrate your expertise.

- Keep it concise: Aim for 2-4 sentences that pack a punch without excessive detail.

- Use action verbs: Start sentences with strong action verbs to convey confidence and initiative.

- Showcase industry knowledge: Include insights about treasury functions or financial regulations relevant to the role.

- Maintain professionalism: Keep the tone formal and avoid overly casual language or clichés.

Example Treasury Reporting Analyst Resume Summaries

Strong Resume Summaries

Results-driven Treasury Reporting Analyst with over 5 years of experience in managing cash flow forecasting and liquidity analysis. Successfully improved reporting accuracy by 30% through the implementation of automated reporting tools, resulting in enhanced decision-making capabilities for senior management.

Detail-oriented professional with a proven track record in treasury operations and financial reporting. Led a cross-functional team to streamline the monthly reporting process, reducing turnaround time by 25% while maintaining compliance with all regulatory standards.

Accomplished Treasury Reporting Analyst skilled in financial modeling and variance analysis. Developed comprehensive reporting frameworks that increased operational efficiency by 40%, directly contributing to a significant reduction in financial discrepancies.

Weak Resume Summaries

Experienced analyst with a background in finance and treasury reporting. Looking for a position to utilize my skills.

Detail-oriented professional seeking a role in treasury reporting. I have experience in financial analysis.

The examples of strong summaries are considered effective because they quantify achievements, provide specific skills, and directly relate to the responsibilities of a Treasury Reporting Analyst. They demonstrate clear value and expertise, increasing the likelihood of engaging hiring managers. In contrast, the weak summaries lack specificity and measurable outcomes, making them generic and less compelling, which may fail to capture the attention of potential employers.

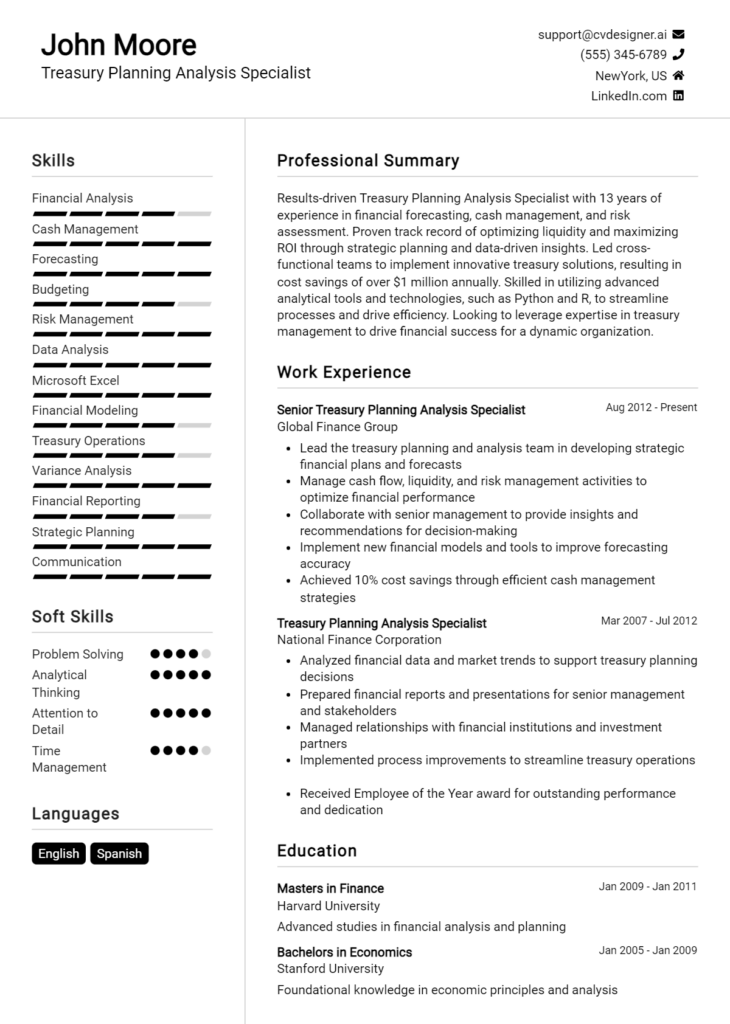

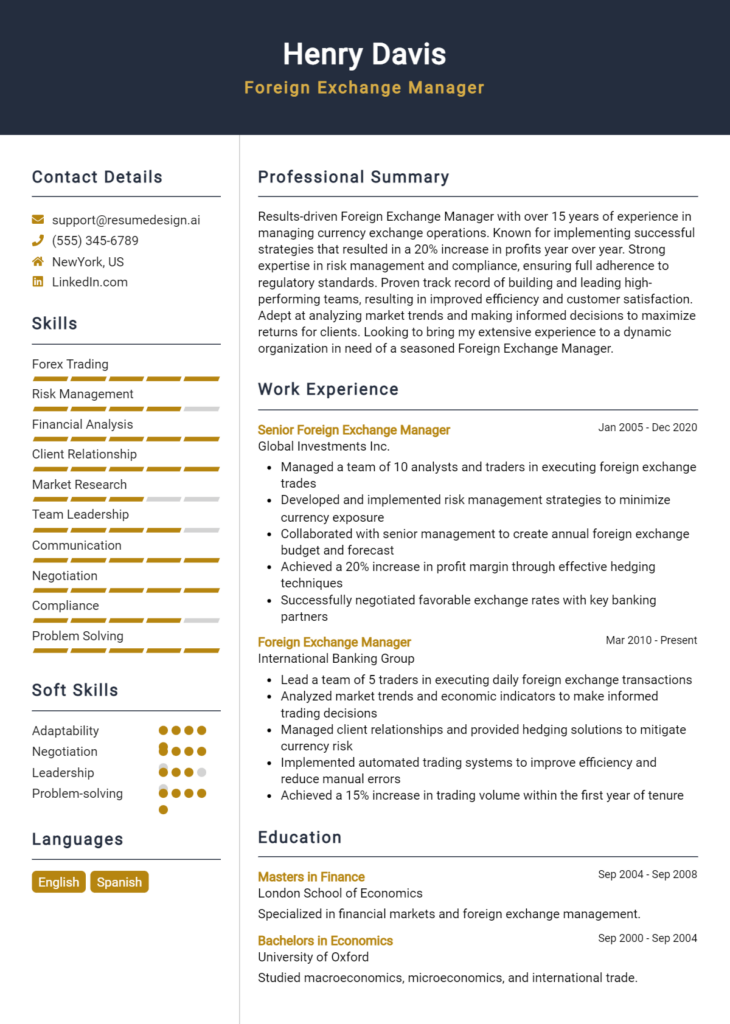

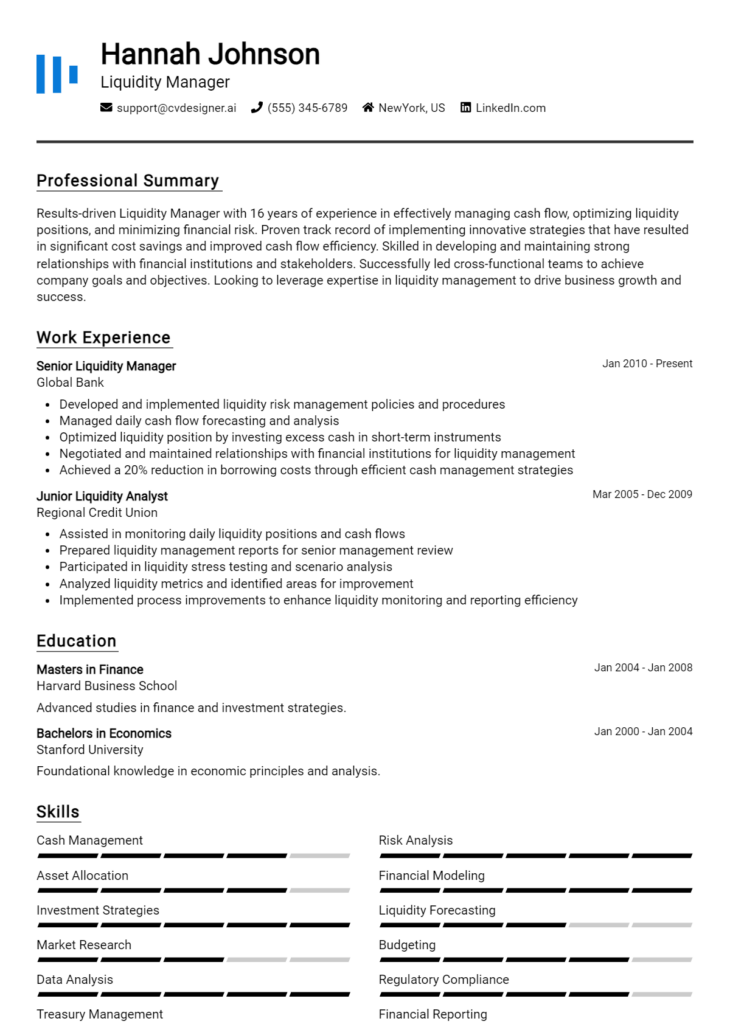

Work Experience Section for Treasury Reporting Analyst Resume

The work experience section is a critical component of a Treasury Reporting Analyst resume, as it serves as a showcase for the candidate's technical skills, ability to manage teams, and deliver high-quality financial products. This section highlights the applicant's hands-on experience with financial reporting, treasury management systems, and compliance with industry regulations. By quantifying achievements and aligning their experience with industry standards, candidates can demonstrate their value to potential employers and set themselves apart in a competitive job market.

Best Practices for Treasury Reporting Analyst Work Experience

- Highlight relevant technical skills such as proficiency in financial modeling, forecasting, and treasury management software.

- Quantify achievements with metrics, such as cost savings, efficiency improvements, or revenue generation.

- Showcase leadership experience by detailing team management responsibilities and project oversight.

- Emphasize collaboration with cross-functional teams, including finance, accounting, and compliance departments.

- Align experience with industry standards and best practices to demonstrate understanding of the field.

- Use action verbs to convey impact and ownership of projects and tasks.

- Detail specific methodologies or frameworks used in reporting processes.

- Include relevant certifications or training that enhance your qualifications as a Treasury Reporting Analyst.

Example Work Experiences for Treasury Reporting Analyst

Strong Experiences

- Led a team of 5 analysts to automate the monthly treasury reporting process, reducing reporting time by 30% and increasing accuracy by implementing a new software tool.

- Developed and maintained comprehensive cash flow forecasts that improved liquidity management, resulting in a 15% reduction in borrowing costs year-over-year.

- Collaborated with cross-functional teams to ensure compliance with regulatory requirements, successfully passing all audits over three consecutive years.

- Implemented a new financial modeling framework that contributed to a 20% increase in investment returns through improved risk assessment.

Weak Experiences

- Worked on treasury reports and did some analysis.

- Assisted in team meetings and contributed to discussions.

- Helped with various financial tasks as needed.

- Participated in compliance training sessions occasionally.

The examples listed above are considered strong because they are specific, quantifiable, and demonstrate direct impact on the organization’s financial health and operational efficiency. They clearly outline the candidate's achievements and technical expertise, showcasing leadership and collaboration. In contrast, the weak experiences are vague and lack measurable outcomes, making it difficult for potential employers to assess the candidate's capabilities and contributions effectively. Strong experiences convey clear value, while weak experiences fail to establish the candidate's qualifications in a meaningful way.

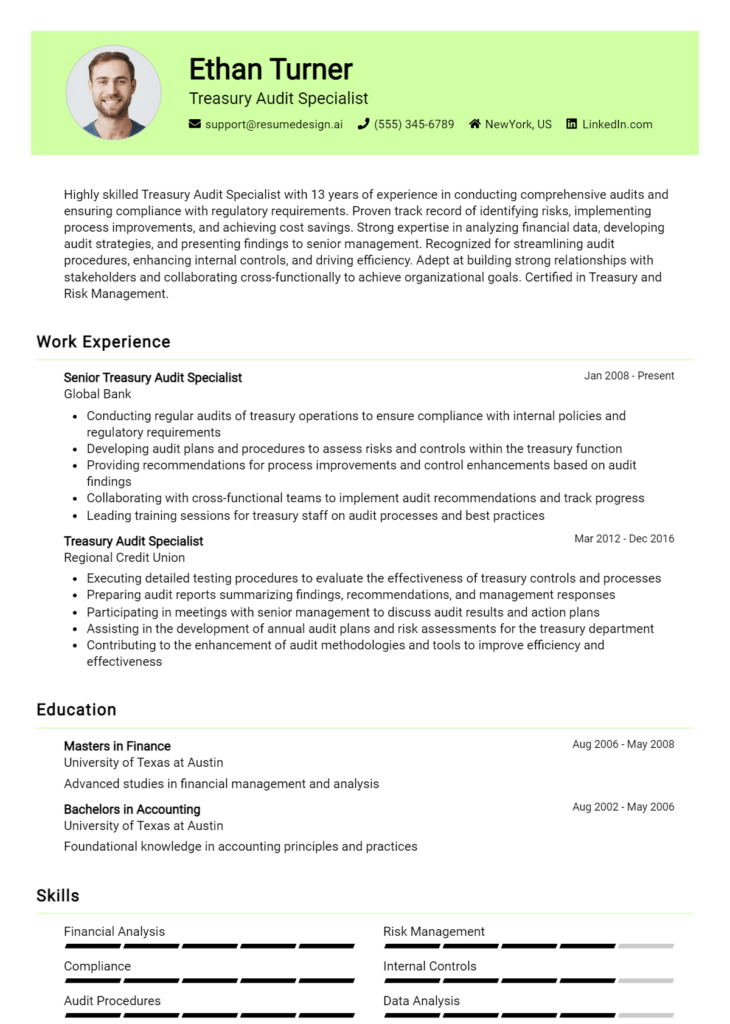

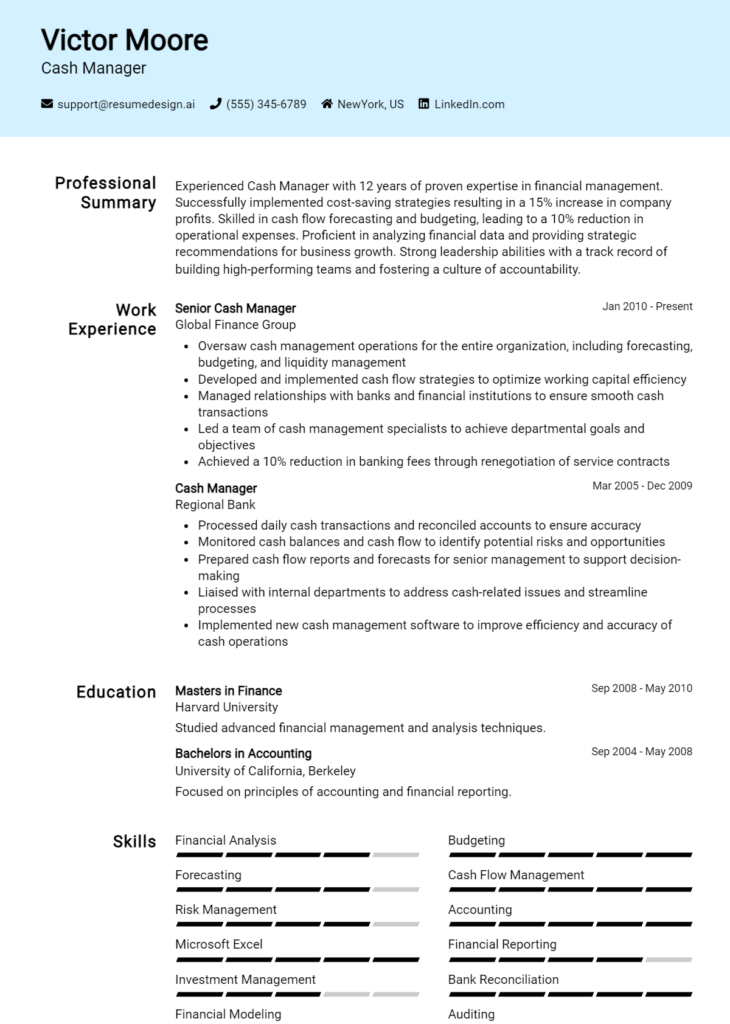

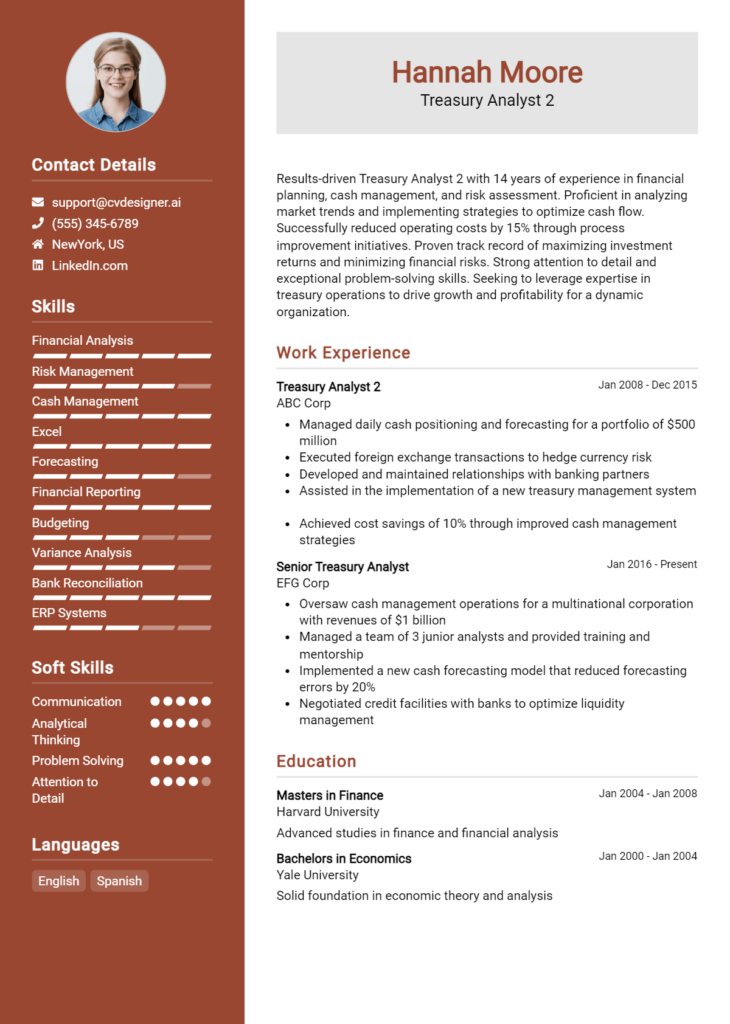

Education and Certifications Section for Treasury Reporting Analyst Resume

The education and certifications section of a Treasury Reporting Analyst resume is crucial as it showcases the candidate's academic foundation, relevant industry certifications, and commitment to continuous professional development. This section not only reflects the candidate's qualifications but also emphasizes their dedication to acquiring the necessary skills and knowledge essential for success in the financial sector. By detailing relevant coursework, certifications, and specialized training, candidates can significantly enhance their credibility and demonstrate their alignment with the specific demands of the Treasury Reporting Analyst role.

Best Practices for Treasury Reporting Analyst Education and Certifications

- List degrees and certifications in reverse chronological order, starting with the most recent.

- Include relevant coursework that directly pertains to treasury management or financial analysis.

- Highlight industry-recognized certifications such as Certified Treasury Professional (CTP) or Chartered Financial Analyst (CFA).

- Clearly indicate the institution, degree, and graduation date for each educational entry.

- Use bullet points to make the information easy to read and digest for hiring managers.

- Showcase any specialized training or workshops that enhance your expertise in treasury reporting.

- Consider including GPA or honors if they are exemplary and relevant to the role.

- Keep the section focused and concise, emphasizing only the most pertinent qualifications.

Example Education and Certifications for Treasury Reporting Analyst

Strong Examples

- M.S. in Finance, University of XYZ, 2022

- Certified Treasury Professional (CTP), Association for Financial Professionals, 2023

- Advanced Financial Management Coursework, University of XYZ

- B.A. in Accounting, University of ABC, 2020

Weak Examples

- Diploma in General Studies, Community College, 2015

- Outdated certification in QuickBooks, 2017

- B.S. in Sociology, University of DEF, 2019

- Basic Excel Training, 2018

The strong examples demonstrate relevant educational achievements and certifications that directly align with the responsibilities of a Treasury Reporting Analyst, such as a Master's degree in Finance and a Certified Treasury Professional designation. These qualifications highlight the candidate's expertise and commitment to the field. In contrast, the weak examples showcase educational qualifications and certifications that lack relevance to the role, such as a diploma in General Studies or an outdated QuickBooks certification, which do not adequately reflect the candidate's preparedness for a position in treasury reporting.

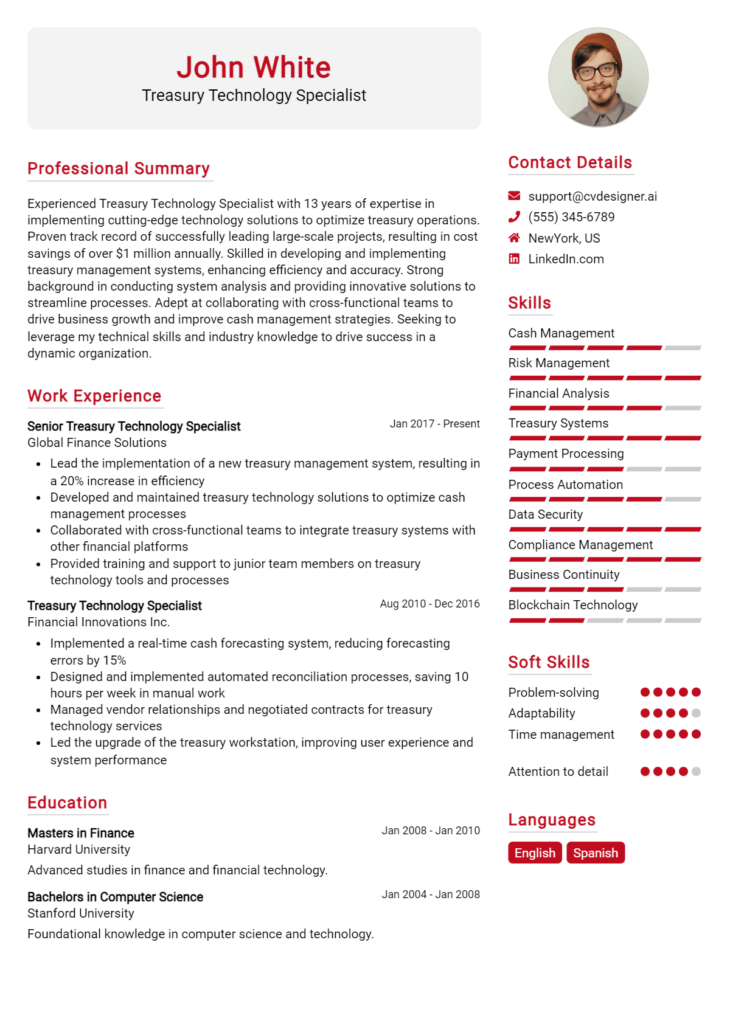

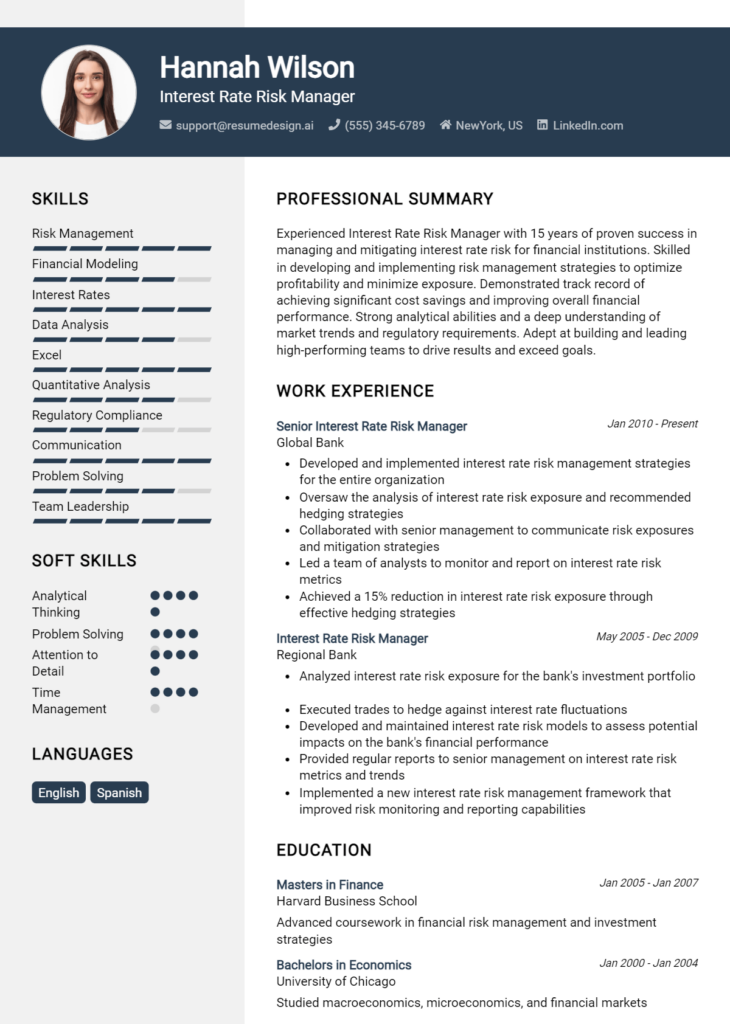

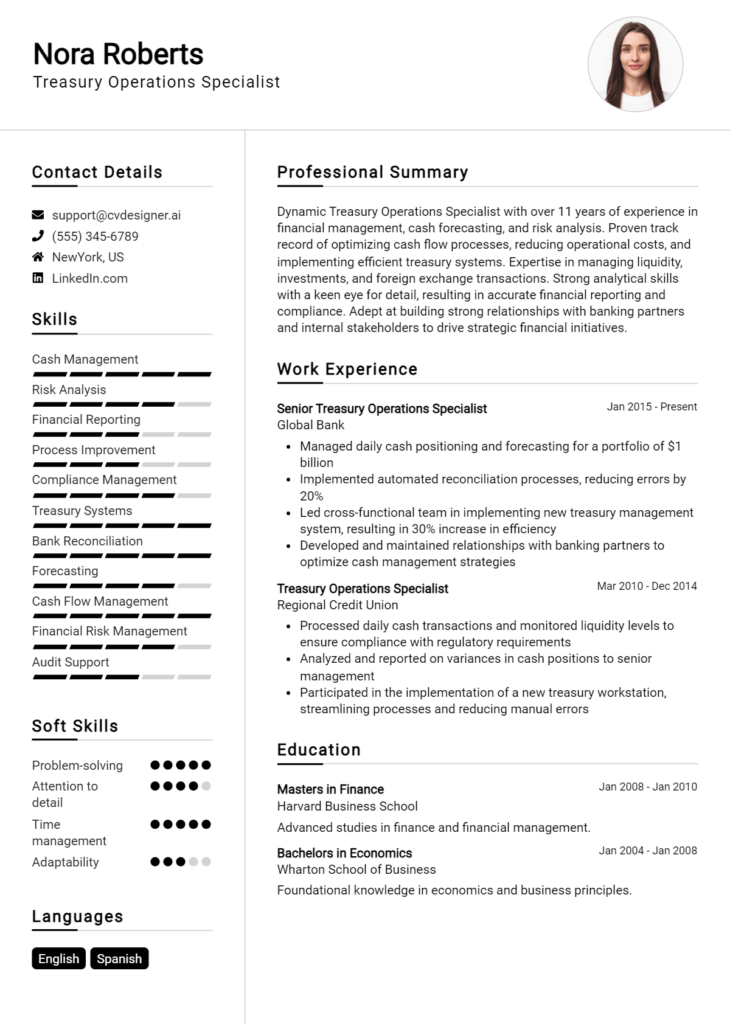

Top Skills & Keywords for Treasury Reporting Analyst Resume

As a Treasury Reporting Analyst, possessing the right skills is crucial for success in the role. The financial landscape is constantly evolving, making it essential for professionals in this field to demonstrate both technical and interpersonal capabilities. A well-crafted resume that highlights relevant skills not only showcases your qualifications but also aligns with the expectations of prospective employers. This balance of hard and soft skills can set you apart in a competitive job market, ensuring that you meet the analytical demands of treasury operations while effectively communicating insights to stakeholders. For those looking to enhance their resumes, understanding the key skills required for a Treasury Reporting Analyst is vital.

Top Hard & Soft Skills for Treasury Reporting Analyst

Soft Skills

- Analytical Thinking

- Attention to Detail

- Problem-Solving

- Communication Skills

- Time Management

- Team Collaboration

- Adaptability

- Critical Thinking

- Interpersonal Skills

- Ethical Judgment

Hard Skills

- Financial Reporting

- Treasury Management Systems

- Data Analysis and Interpretation

- Excel Proficiency (Advanced)

- Knowledge of GAAP and IFRS

- Cash Flow Forecasting

- Risk Management

- Financial Modeling

- Regulatory Compliance

- Variance Analysis

For more insights on essential skills and effective work experience that can enhance your resume, be sure to explore additional resources.

Stand Out with a Winning Treasury Reporting Analyst Cover Letter

As a dedicated finance professional with a strong background in treasury management and financial reporting, I am excited to apply for the Treasury Reporting Analyst position at [Company Name]. With over [X years] of experience in financial analysis and reporting, I have developed a keen ability to translate complex financial data into actionable insights that drive strategic decision-making. My expertise in treasury operations, combined with my proficiency in financial software and reporting tools, positions me to contribute effectively to your team.

In my previous role at [Previous Company], I was responsible for preparing comprehensive cash flow forecasts and variance analyses that supported executive decision-making. I successfully collaborated with cross-functional teams to enhance reporting processes, resulting in a [percentage]% improvement in accuracy and timeliness of financial reports. My analytical skills, coupled with a meticulous attention to detail, allowed me to identify trends and recommend strategies that optimized cash management and liquidity for the organization.

I am particularly drawn to this opportunity at [Company Name] because of your commitment to innovation in financial practices and the emphasis on leveraging data to inform treasury strategies. I am eager to bring my strong analytical capabilities and my passion for finance to your team. Moreover, I am adept at utilizing advanced Excel functions and financial modeling techniques, which I believe will further enhance your treasury reporting processes and contribute to achieving the company's financial objectives.

I am excited about the prospect of joining [Company Name] and further discussing how my background and skills align with the needs of your team. Thank you for considering my application. I look forward to the opportunity to contribute to your organization and help drive the success of your treasury operations.

Common Mistakes to Avoid in a Treasury Reporting Analyst Resume

When crafting a resume for the position of a Treasury Reporting Analyst, it's crucial to present your skills and experiences in the best possible light. However, many candidates make common mistakes that can hinder their chances of landing an interview. Avoiding these pitfalls will help ensure that your resume stands out in a competitive job market. Below are some of the most frequent missteps to steer clear of:

Generic Objective Statements: Using a vague or generic objective can make your resume blend in rather than stand out. Tailor your objective to reflect your specific goals and how they align with the company's mission.

Lack of Quantifiable Achievements: Failing to include specific metrics or achievements can weaken your accomplishments. Always quantify your successes, such as "Improved cash flow forecasting accuracy by 20%."

Overcomplicating Technical Jargon: Using excessive financial jargon can alienate hiring managers who may not have a deep technical background. Aim for clarity and simplicity while still demonstrating your knowledge.

Ignoring Relevant Skills: Not highlighting the specific skills required for a Treasury Reporting Analyst position—such as proficiency in financial software or familiarity with regulatory compliance—can lead to missed opportunities.

Inconsistent Formatting: A resume that lacks uniformity in font size, style, and bullet points can appear unprofessional. Consistency in formatting enhances readability and creates a polished look.

Too Long or Too Short: A resume that is overly lengthy can deter hiring managers from reading it in full, while an overly concise resume may omit critical information. Aim for a balanced length, ideally one page for early-career professionals and up to two pages for those with more extensive experience.

Neglecting to Tailor for Each Application: Sending the same resume for multiple job applications can hinder your chances. Customize your resume for each position by incorporating keywords from the job description.

Not Proofreading: Spelling and grammatical errors can project a lack of attention to detail, which is crucial in treasury roles. Always proofread your resume carefully or have someone review it for you before submission.

Conclusion

In conclusion, the role of a Treasury Reporting Analyst is crucial for organizations looking to maintain financial health and compliance. Key responsibilities include analyzing cash flow, preparing reports, ensuring regulatory compliance, and providing insights that drive strategic financial decisions. To excel in this position, candidates should demonstrate strong analytical skills, proficiency in financial software, and an understanding of treasury operations.

As you reflect on your qualifications and experiences, consider reviewing your resume to ensure it effectively highlights your skills and accomplishments in this area. A well-crafted resume can set you apart from other candidates and increase your chances of landing an interview.

To assist you in this process, take advantage of the various resources available. Explore resume templates to find a design that suits your style. Use the resume builder to create a professional-looking resume effortlessly. Review resume examples to gather ideas and inspiration for your own document. Additionally, consider using cover letter templates to complement your application and make a strong impression.

Don’t miss the opportunity to polish your application materials and enhance your prospects in the competitive job market for Treasury Reporting Analysts. Start reviewing and refining your resume today!