Foreign Exchange Manager Core Responsibilities

A Foreign Exchange Manager plays a crucial role in managing currency risk and optimizing foreign exchange transactions. This position requires a blend of technical expertise in financial markets, operational acumen, and strong problem-solving skills to effectively bridge finance, trading, and compliance departments. Success in this role not only contributes to the organization’s overall financial health but also enhances strategic decision-making. A well-structured resume can effectively highlight these qualifications, demonstrating the candidate's ability to drive organizational goals.

Common Responsibilities Listed on Foreign Exchange Manager Resume

- Monitor and analyze foreign exchange market trends and data.

- Develop and implement foreign exchange risk management strategies.

- Execute currency transactions and manage trading operations.

- Collaborate with finance and treasury departments for budget forecasting.

- Ensure compliance with regulatory requirements across jurisdictions.

- Prepare detailed reports on currency performance and risk exposure.

- Advise stakeholders on foreign exchange strategies and policies.

- Conduct training sessions on forex instruments and market dynamics.

- Negotiate favorable terms with banking partners and financial institutions.

- Utilize financial modeling to assess potential forex impacts.

- Monitor and manage liquidity positions related to forex transactions.

High-Level Resume Tips for Foreign Exchange Manager Professionals

In today's competitive job market, a well-crafted resume serves as a vital tool for Foreign Exchange Manager professionals aiming to make a strong first impression on potential employers. Your resume is not just a summary of your work history; it is a reflection of your skills, achievements, and unique value proposition. Given the complexities of the foreign exchange industry, your resume must effectively showcase your expertise and accomplishments to stand out among other candidates. This guide will provide practical and actionable resume tips specifically tailored for Foreign Exchange Manager professionals, ensuring that you present yourself in the best possible light.

Top Resume Tips for Foreign Exchange Manager Professionals

- Tailor your resume to the specific job description by incorporating relevant keywords and phrases.

- Highlight your experience in foreign exchange markets, including specific currencies and trading strategies.

- Quantify your achievements, such as percentage increases in portfolio performance or successful risk management outcomes.

- Showcase relevant certifications, such as CFA or CMT, to demonstrate your commitment to professional development.

- Emphasize your analytical skills by detailing your experience with market analysis and forecasting.

- Include any experience with trading platforms and software that are widely used in the industry.

- Demonstrate your understanding of regulatory compliance and risk assessment in foreign exchange transactions.

- Utilize a clean and professional layout to enhance readability and ensure key information stands out.

- Incorporate soft skills such as communication and negotiation that are essential for managing client relationships.

- Keep your resume concise, ideally no longer than two pages, while ensuring all relevant information is included.

By implementing these tips, you can significantly enhance your chances of landing a job in the Foreign Exchange Manager field. A targeted and well-structured resume not only highlights your qualifications but also conveys your professionalism and readiness to contribute to a prospective employer's success in the dynamic world of foreign exchange.

Why Resume Headlines & Titles are Important for Foreign Exchange Manager

In the competitive field of foreign exchange management, having a strong resume headline or title is crucial for attracting the attention of hiring managers. A well-crafted headline serves as a powerful first impression, summarizing a candidate's key qualifications in a concise and impactful phrase. It encapsulates the essence of the candidate's expertise, ensuring that essential skills and experiences are immediately recognizable. A strong headline should be direct, relevant to the position being applied for, and capable of compelling the reader to delve deeper into the resume.

Best Practices for Crafting Resume Headlines for Foreign Exchange Manager

- Keep it concise: Aim for one impactful phrase that summarizes your qualifications.

- Be role-specific: Tailor your headline to reflect the specific position of Foreign Exchange Manager.

- Highlight key strengths: Use keywords that emphasize your most relevant skills and experiences.

- Use action words: Incorporate dynamic verbs to convey a sense of proactivity and achievement.

- Avoid jargon: Ensure your language is clear and accessible to a broad audience.

- Focus on results: If possible, include metrics or outcomes that demonstrate your impact in previous roles.

- Stay professional: Maintain a formal tone appropriate for the finance industry.

- Update regularly: Revise your headline to reflect new skills or experiences as your career progresses.

Example Resume Headlines for Foreign Exchange Manager

Strong Resume Headlines

"Dynamic Foreign Exchange Manager with 10+ Years of Proven Success in Currency Risk Management"

“Results-Oriented FX Expert Specializing in Strategic Hedging and Market Analysis”

“Innovative Foreign Exchange Manager Driving Revenue Growth through Effective Currency Strategies”

Weak Resume Headlines

“Looking for a Job in Finance”

“Experienced Professional”

Strong resume headlines are effective because they are specific, highlight relevant skills, and convey a clear message about the candidate's value proposition. They engage hiring managers by offering a snapshot of the candidate's expertise and accomplishments. In contrast, weak headlines fail to impress due to their vagueness and lack of specificity, making it difficult for hiring managers to gauge the candidate's suitability for the role. By avoiding generic phrases and focusing on impactful language, candidates can significantly enhance their chances of standing out in the recruitment process.

Writing an Exceptional Foreign Exchange Manager Resume Summary

A resume summary is a critical component for a Foreign Exchange Manager, as it serves as the first impression for hiring managers. A well-crafted summary quickly captures attention by succinctly highlighting key skills, relevant experience, and notable accomplishments that align with the job requirements. This brief overview should be concise and impactful, effectively setting the tone for the rest of the resume while demonstrating the candidate's fit for the specific foreign exchange role they are applying for.

Best Practices for Writing a Foreign Exchange Manager Resume Summary

- Quantify Achievements: Use specific numbers and metrics to showcase your success in previous roles.

- Focus on Skills: Highlight essential skills relevant to foreign exchange management, such as risk assessment, market analysis, and trading strategies.

- Tailor the Summary: Customize your summary for each job application to reflect the specific requirements and language of the job description.

- Showcase Relevant Experience: Emphasize past roles that directly relate to foreign exchange management.

- Use Strong Action Verbs: Start sentences with powerful verbs that convey your impact and contributions.

- Keep it Concise: Aim for 2-4 sentences that effectively communicate your qualifications without unnecessary detail.

- Highlight Soft Skills: Include interpersonal skills like communication and teamwork that are vital for working in finance.

- Avoid Jargon: Use clear language to ensure that your summary is easily understood by a diverse audience.

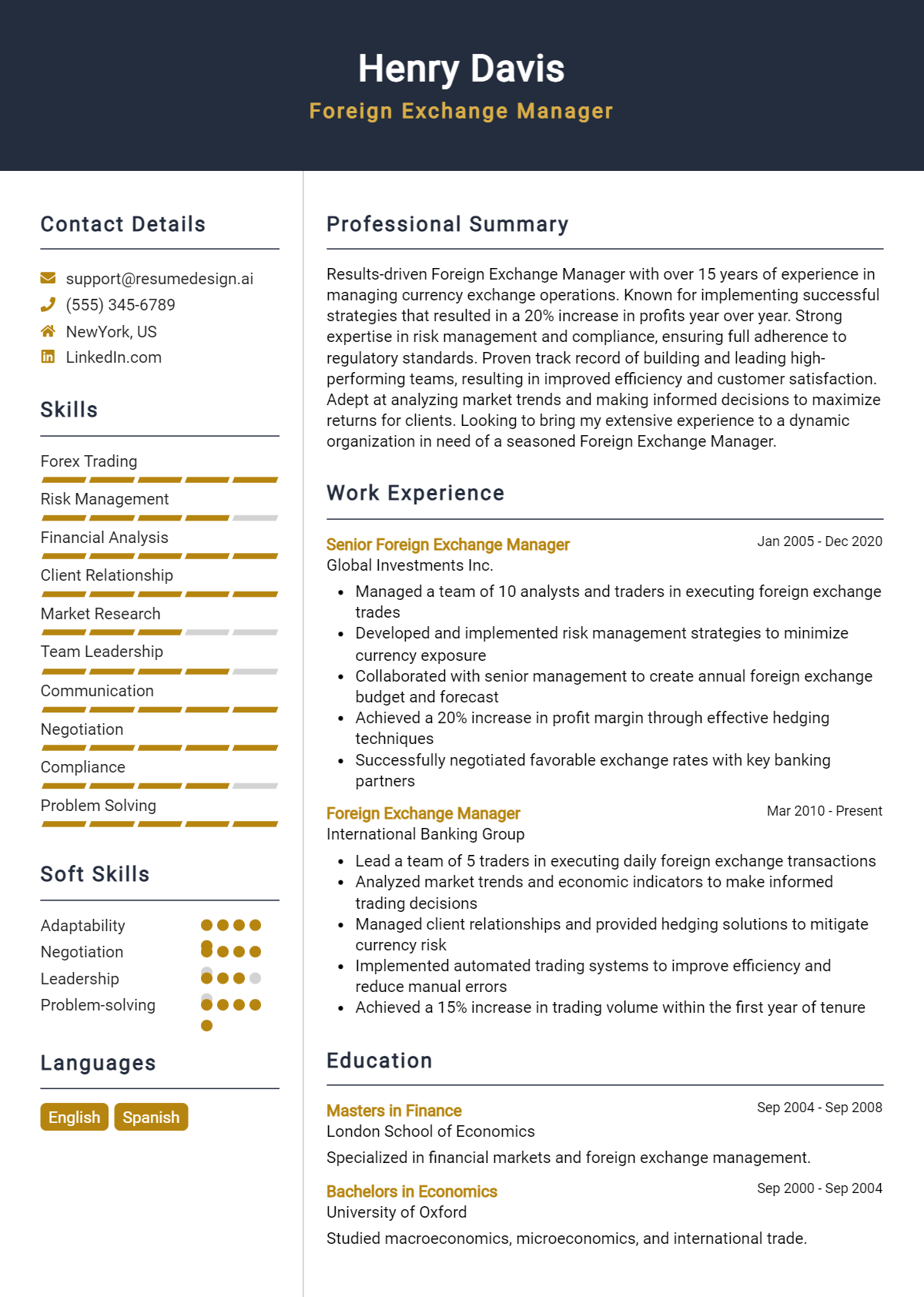

Example Foreign Exchange Manager Resume Summaries

Strong Resume Summaries

Dynamic Foreign Exchange Manager with over 8 years of experience in optimizing trading strategies, resulting in a 30% increase in annual revenue. Proficient in risk management and currency analysis, with a strong track record of improving market position through strategic partnerships.

Results-driven Foreign Exchange Manager with expertise in managing portfolios exceeding $500 million. Successfully implemented advanced trading algorithms that reduced transaction costs by 20%, enhancing overall profitability and client satisfaction.

Experienced Foreign Exchange Manager specializing in currency trading and market forecasting, achieving an average return on investment of 15% over the past three years. Adept at leveraging data analytics to inform trading decisions and mitigate risks.

Weak Resume Summaries

Foreign Exchange Manager with experience in finance looking for a new opportunity in a dynamic company.

Detail-oriented professional skilled in various financial roles, seeking to leverage experience in foreign exchange management.

The strong resume summaries demonstrate the candidates' specific achievements and skills, providing quantifiable outcomes that illustrate their effectiveness in previous roles. They are tailored to the foreign exchange manager position, making them relevant and compelling. In contrast, the weak summaries are vague, lack concrete accomplishments, and do not effectively convey the candidates' qualifications, making them less impactful to hiring managers.

Work Experience Section for Foreign Exchange Manager Resume

The work experience section is a critical component of a Foreign Exchange Manager resume, serving as a platform to demonstrate the candidate's technical skills and expertise in managing foreign exchange operations. This section not only highlights the ability to lead teams effectively but also showcases a history of delivering high-quality financial products and services. By quantifying achievements and aligning past experiences with industry standards, candidates can significantly enhance their appeal to potential employers, illustrating their capability to drive performance and contribute to the organization’s success.

Best Practices for Foreign Exchange Manager Work Experience

- Use specific metrics to quantify achievements, such as percentage increases in revenue or reductions in operating costs.

- Highlight relevant technical skills, such as proficiency in forex trading platforms or financial analysis tools.

- Emphasize leadership roles and team management experience to showcase your ability to lead and motivate teams.

- Include industry-related keywords to align with job descriptions and ensure compatibility with applicant tracking systems.

- Demonstrate collaboration by detailing cross-functional projects with other departments, such as risk management or compliance.

- Showcase continuous learning and certifications in foreign exchange or finance to highlight your commitment to professional development.

- Provide context for each role by mentioning the size and scope of previous employers or projects worked on.

- Focus on results-driven statements that illustrate the impact of your contributions on the organization’s bottom line.

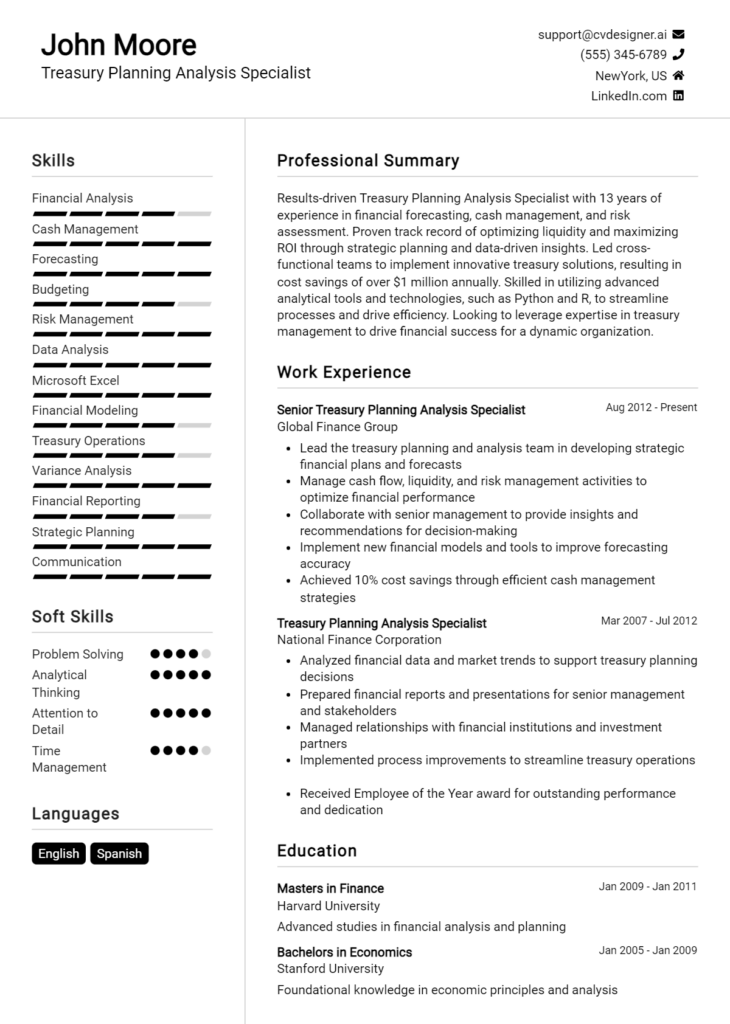

Example Work Experiences for Foreign Exchange Manager

Strong Experiences

- Led a team of 10 analysts in the implementation of a new forex trading strategy, resulting in a 25% increase in quarterly trading profits.

- Managed a $500 million foreign exchange portfolio, achieving a 15% return on investment through strategic risk management and market analysis.

- Collaborated with the compliance department to establish new trading protocols that reduced regulatory discrepancies by 40%.

- Implemented a training program for junior traders that improved team performance metrics by 30% within six months.

Weak Experiences

- Worked in a finance department and was involved in some forex-related tasks.

- Assisted in various projects that had to do with currency exchanges.

- Helped the team achieve some financial goals.

- Participated in meetings about foreign exchange trends and strategies.

The examples listed as strong experiences are considered impactful because they clearly quantify achievements, demonstrate leadership and collaboration, and provide specific context regarding the candidate's contributions. In contrast, the weak experiences lack detail and measurable outcomes, making them less persuasive and failing to effectively showcase the candidate's capabilities and impact in the foreign exchange domain.

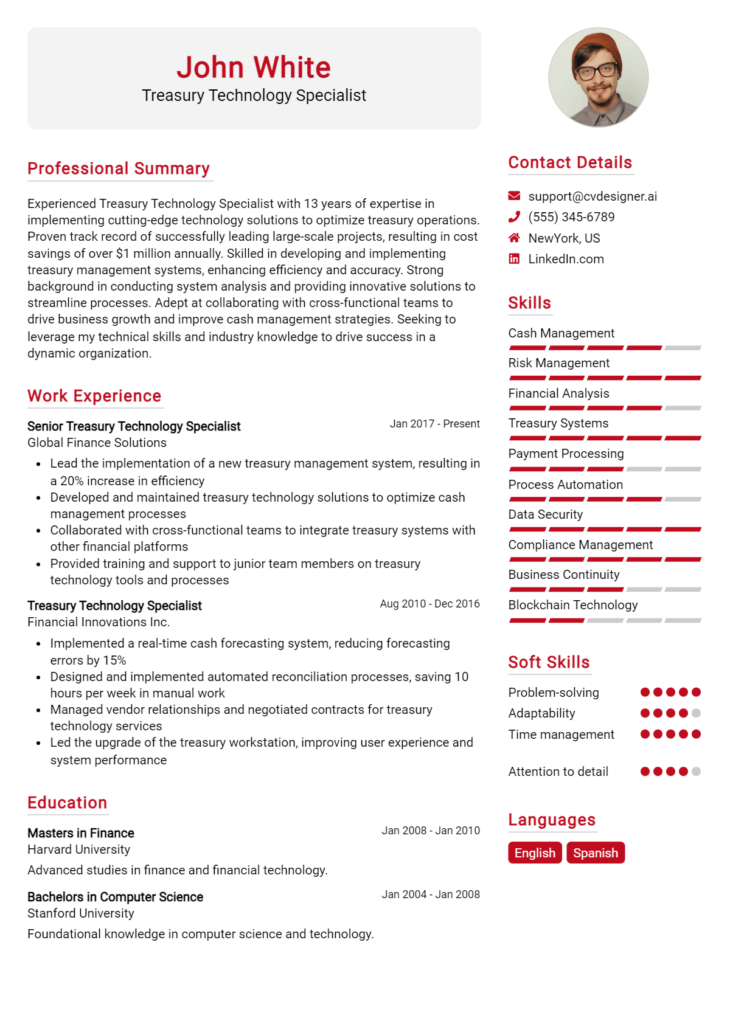

Education and Certifications Section for Foreign Exchange Manager Resume

The education and certifications section of a Foreign Exchange Manager resume is crucial as it showcases the candidate's academic qualifications, industry-relevant certifications, and commitment to continuous professional development. This section serves to validate the applicant's expertise in foreign exchange markets, financial analysis, risk management, and trading strategies. By providing details on relevant coursework, certifications, and any specialized training, candidates can significantly enhance their credibility and demonstrate their alignment with the job requirements, making them more appealing to potential employers.

Best Practices for Foreign Exchange Manager Education and Certifications

- Include degrees related to finance, economics, or business administration to showcase relevant academic background.

- Highlight industry-recognized certifications, such as Chartered Financial Analyst (CFA) or Financial Risk Manager (FRM), to enhance credibility.

- Detail relevant coursework that pertains to foreign exchange, such as international finance, currency trading, and financial derivatives.

- List any specialized training programs or workshops attended that focus on forex trading strategies or market analysis.

- Ensure that certifications and courses are current and relevant to the evolving foreign exchange landscape.

- Consider including continuing education credits or professional development courses to demonstrate a commitment to lifelong learning.

- Use clear and concise descriptions to provide context for the education and certifications listed.

- Prioritize the most relevant qualifications at the top of the section to capture the hiring manager's attention quickly.

Example Education and Certifications for Foreign Exchange Manager

Strong Examples

- MBA in Finance, University of Chicago Booth School of Business

- Chartered Financial Analyst (CFA) Level II Candidate

- Certificate in Foreign Exchange Management from the International Institute of Finance

- Relevant Coursework: International Financial Markets, Currency Risk Management

Weak Examples

- Bachelor's Degree in Philosophy, University of California

- Certification in Basic Accounting Principles (outdated)

- Coursework in General Studies with no relevance to finance or foreign exchange

- High School Diploma with no further qualifications or certifications

The examples provided illustrate the distinction between strong and weak educational qualifications and certifications. Strong examples are directly relevant to the role of a Foreign Exchange Manager, showcasing a solid foundation in finance and specialized knowledge applicable to the foreign exchange market. In contrast, weak examples highlight qualifications that lack relevance or are outdated, which may detract from the candidate's suitability for the role and could raise concerns about their commitment to professional development in the field.

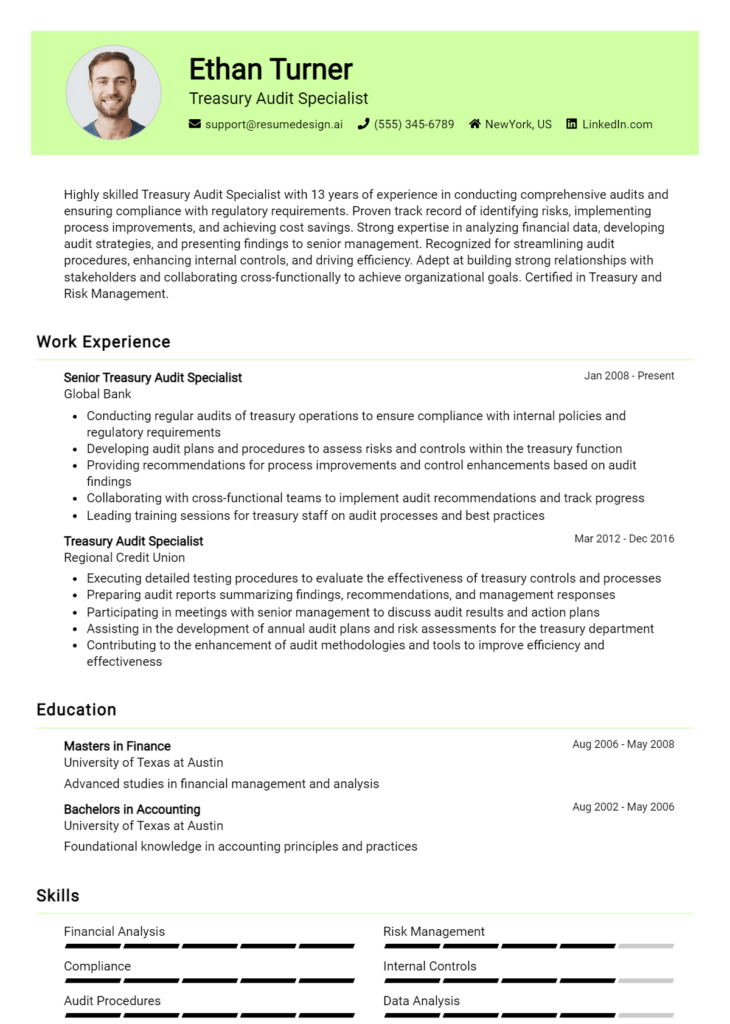

Top Skills & Keywords for Foreign Exchange Manager Resume

In the competitive field of foreign exchange management, possessing a robust set of skills is essential for standing out in the job market. A well-crafted resume that highlights both hard and soft skills can significantly enhance a candidate's chances of securing an interview. Employers seek individuals who not only have the technical expertise to navigate the complexities of currency markets but also the interpersonal skills necessary for effective communication and decision-making. By emphasizing these key skills, candidates can demonstrate their readiness to manage foreign exchange operations and contribute to the financial success of their organization.

Top Hard & Soft Skills for Foreign Exchange Manager

Soft Skills

- Strong analytical thinking

- Effective communication

- Problem-solving abilities

- Adaptability and flexibility

- Attention to detail

- Team collaboration

- Leadership capabilities

- Time management

- Negotiation skills

- Client relationship management

- Cultural awareness

- Critical thinking

- Stress management

- Decision-making skills

- Conflict resolution

Hard Skills

- Proficient in foreign exchange trading platforms

- Knowledge of economic indicators

- Understanding of risk management strategies

- Currency pair analysis

- Technical analysis skills

- Familiarity with financial regulations

- Expertise in market research

- Quantitative analysis

- Financial modeling

- Excel and data analysis software proficiency

- Experience with hedging techniques

- Knowledge of international finance

- Trading strategy development

- Portfolio management

- Statistical analysis

- Experience in compliance and reporting

- Familiarity with automated trading systems

By incorporating these essential skills into your resume and demonstrating relevant work experience, you can position yourself as a capable candidate for the role of Foreign Exchange Manager.

Stand Out with a Winning Foreign Exchange Manager Cover Letter

Dear [Hiring Manager's Name],

I am excited to apply for the Foreign Exchange Manager position at [Company Name], as advertised on [Where You Found the Job Posting]. With over [X years] of experience in the financial services industry, specializing in currency trading and risk management, I am confident in my ability to contribute effectively to your team and help [Company Name] navigate the complexities of the global foreign exchange markets.

In my previous role at [Your Previous Company], I successfully managed a diverse portfolio of currency trades, optimizing trading strategies to enhance profitability while minimizing risks. My deep understanding of global economic indicators and geopolitical events has enabled me to make informed trading decisions, resulting in an average annual return of [X%]. I am particularly proud of my ability to analyze market trends and implement innovative hedging strategies that have significantly reduced exposure to currency fluctuations for my clients.

I am drawn to the opportunity at [Company Name] due to its reputation for excellence in [specific aspect of the company, e.g., innovation, client service, etc.]. I am eager to leverage my analytical skills and extensive knowledge of foreign exchange markets to drive strategic initiatives and enhance trading performance. My collaborative nature and strong communication skills equip me to work effectively with cross-functional teams, ensuring that we align our trading strategies with the overall financial goals of the organization.

Thank you for considering my application. I look forward to the opportunity to discuss how my background, skills, and enthusiasm for the foreign exchange market can align with the objectives of [Company Name]. I am excited about the possibility of contributing to your esteemed firm and am confident that my proactive approach will make a positive impact on your trading operations.

Sincerely,

[Your Name]

[Your Phone Number]

[Your Email Address]

Common Mistakes to Avoid in a Foreign Exchange Manager Resume

Crafting an effective resume as a Foreign Exchange Manager is crucial in standing out in a competitive financial job market. However, many candidates make common mistakes that can undermine their qualifications or fail to grab the attention of hiring managers. Avoiding these pitfalls can significantly enhance your chances of landing an interview. Here are some common mistakes to watch out for:

Generic Objective Statements: Using a vague or generic objective statement can make your resume blend in with others. Instead, tailor your objective to highlight your specific skills and goals relevant to the foreign exchange sector.

Overloading with Jargon: While it's important to demonstrate your expertise, overloading your resume with technical jargon can confuse readers. Use clear language that communicates your skills effectively without alienating those who may not be familiar with every term.

Neglecting Quantifiable Achievements: Failing to include quantifiable achievements can weaken your resume. Highlighting specific results, such as percentage increases in trading profits or reduced risk exposure, can illustrate your impact more convincingly.

Poor Formatting: A cluttered or poorly formatted resume can make it difficult for hiring managers to navigate. Ensure your resume is clean, organized, and easy to read, using consistent fonts, headings, and bullet points.

Ignoring Soft Skills: While technical skills are vital, neglecting to mention soft skills like communication, negotiation, and problem-solving can lead to an incomplete picture of your capabilities. Include these skills to show your well-roundedness.

Listing Responsibilities Instead of Achievements: Simply listing job responsibilities can make your resume sound dull. Focus on your achievements and how you added value to your previous roles instead of reiterating job descriptions.

Failing to Customize for Each Application: Sending out a one-size-fits-all resume can be detrimental. Tailor your resume for each application, incorporating keywords from the job description to align with what the employer is seeking.

Omitting Relevant Certifications or Training: Not highlighting relevant certifications, such as CFA or CMT, can be a missed opportunity. These credentials can set you apart from other candidates and demonstrate your commitment to the field.

Conclusion

In summary, the role of a Foreign Exchange Manager is pivotal in navigating the complexities of the global currency markets. Key responsibilities include managing foreign exchange transactions, analyzing market trends, and developing strategies to mitigate risks associated with currency fluctuations. This position not only requires a deep understanding of financial markets but also strong analytical and communication skills to effectively collaborate with other departments and stakeholders.

As the demand for skilled professionals in this field continues to grow, it’s essential to ensure your resume stands out. Take a moment to review and refine your Foreign Exchange Manager resume to highlight your relevant experience and skills. Consider utilizing the various resources available to you, such as resume templates, a resume builder, resume examples, and cover letter templates. These tools can help you craft a compelling application that effectively showcases your qualifications and sets you apart in the competitive job market. Don’t miss out on the opportunity to present your best self to potential employers!