Treasury Analyst Core Responsibilities

A Treasury Analyst plays a vital role in managing an organization's financial assets, ensuring liquidity, and optimizing cash flow. This position requires strong analytical skills, attention to detail, and proficiency in financial modeling and forecasting. Treasury Analysts bridge finance, accounting, and operational departments, utilizing technical and problem-solving abilities to identify financial risks and opportunities. A well-structured resume can effectively showcase these qualifications, demonstrating the candidate's potential contribution to achieving organizational goals.

Common Responsibilities Listed on Treasury Analyst Resume

- Monitor cash flow and liquidity levels to ensure financial stability.

- Prepare cash forecasts and manage short-term investments.

- Conduct financial analysis to support strategic decision-making.

- Coordinate with banks and financial institutions for funding requirements.

- Analyze and manage foreign exchange and interest rate risks.

- Develop and maintain treasury policies and procedures.

- Prepare reports on cash management and financial performance.

- Support audits and compliance with regulatory requirements.

- Collaborate with finance and accounting teams on budgeting processes.

- Utilize treasury management systems for transaction processing.

- Identify opportunities for process improvements and efficiencies.

- Assist in mergers, acquisitions, and other financial initiatives.

High-Level Resume Tips for Treasury Analyst Professionals

In the competitive landscape of finance, a well-crafted resume is crucial for Treasury Analyst professionals seeking to make a strong first impression on potential employers. Your resume serves as a personal marketing tool that reflects not only your skills and achievements but also your understanding of the financial sector's intricacies. It is essential that your resume succinctly communicates your expertise in treasury management, financial analysis, and risk assessment, as these are key areas of focus for employers. This guide will provide practical and actionable resume tips specifically tailored for Treasury Analyst professionals, helping you stand out in a crowded job market.

Top Resume Tips for Treasury Analyst Professionals

- Tailor your resume to the specific job description by incorporating relevant keywords and phrases that match the employer's requirements.

- Highlight your relevant experience in treasury operations, cash management, and financial forecasting to demonstrate your expertise.

- Quantify your achievements with specific metrics, such as cost savings, increases in cash flow, or successful implementation of financial strategies.

- Showcase your proficiency in treasury management software and financial modeling tools that are commonly used in the industry.

- Include certifications such as Certified Treasury Professional (CTP) to establish credibility and commitment to your profession.

- Emphasize your analytical skills by outlining your ability to interpret financial data and make informed decisions based on your analysis.

- Utilize a clean and professional layout that enhances readability and ensures your key points stand out to hiring managers.

- Incorporate any relevant experience with risk management and compliance to showcase your understanding of regulatory requirements.

- Demonstrate effective communication skills by detailing your experience working with cross-functional teams and presenting financial insights to stakeholders.

By implementing these tips, you can significantly increase your chances of landing a job in the Treasury Analyst field. A polished and strategically tailored resume will not only highlight your qualifications but also convey your dedication to excelling in the treasury profession, making you a compelling candidate in the eyes of potential employers.

Why Resume Headlines & Titles are Important for Treasury Analyst

In the competitive field of treasury analysis, a well-crafted resume headline or title is crucial for standing out among a sea of applicants. A strong headline can capture the attention of hiring managers instantly, summarizing a candidate’s key qualifications and setting the tone for the rest of the resume. It should be concise, relevant, and directly related to the specific treasury analyst position being applied for, making it easier for employers to quickly gauge a candidate's fit for the role. With the right headline, candidates can effectively communicate their expertise and professional identity, increasing their chances of landing an interview.

Best Practices for Crafting Resume Headlines for Treasury Analyst

- Keep it concise: Aim for a headline that is no more than one or two lines long.

- Be specific: Tailor your headline to reflect the specific treasury analyst role you are applying for.

- Highlight key skills: Incorporate relevant skills or certifications that align with the job description.

- Use impactful language: Choose strong action words and industry-specific terminology.

- Avoid jargon: Ensure that your headline is easily understood by hiring managers.

- Showcase achievements: If possible, include a quantifiable achievement that demonstrates your capabilities.

- Align with job listing: Mirror the language used in the job posting to resonate with employers.

- Reflect your professional identity: Your headline should encapsulate who you are as a treasury analyst.

Example Resume Headlines for Treasury Analyst

Strong Resume Headlines

Results-Driven Treasury Analyst with 5 Years of Experience in Cash Management and Risk Mitigation

Detail-Oriented Treasury Analyst Specializing in Financial Forecasting and Strategic Investment Analysis

Certified Treasury Professional with Proven Track Record in Debt Management and Liquidity Optimization

Dynamic Treasury Analyst with Expertise in Regulatory Compliance and Financial Modelling

Weak Resume Headlines

Treasury Analyst Looking for a Job

Finance Professional Seeking Opportunities

Experienced Analyst

Strong resume headlines are effective because they immediately communicate the candidate's value proposition, showcasing their unique skills and experiences that are relevant to the treasury analyst role. They convey a sense of professionalism and confidence that can intrigue hiring managers. In contrast, weak headlines fail to impress because they are vague, lack specificity, and do not highlight any particular strengths or qualifications. This can lead to candidates being overlooked in favor of those who present a clearer, more compelling narrative about their professional capabilities.

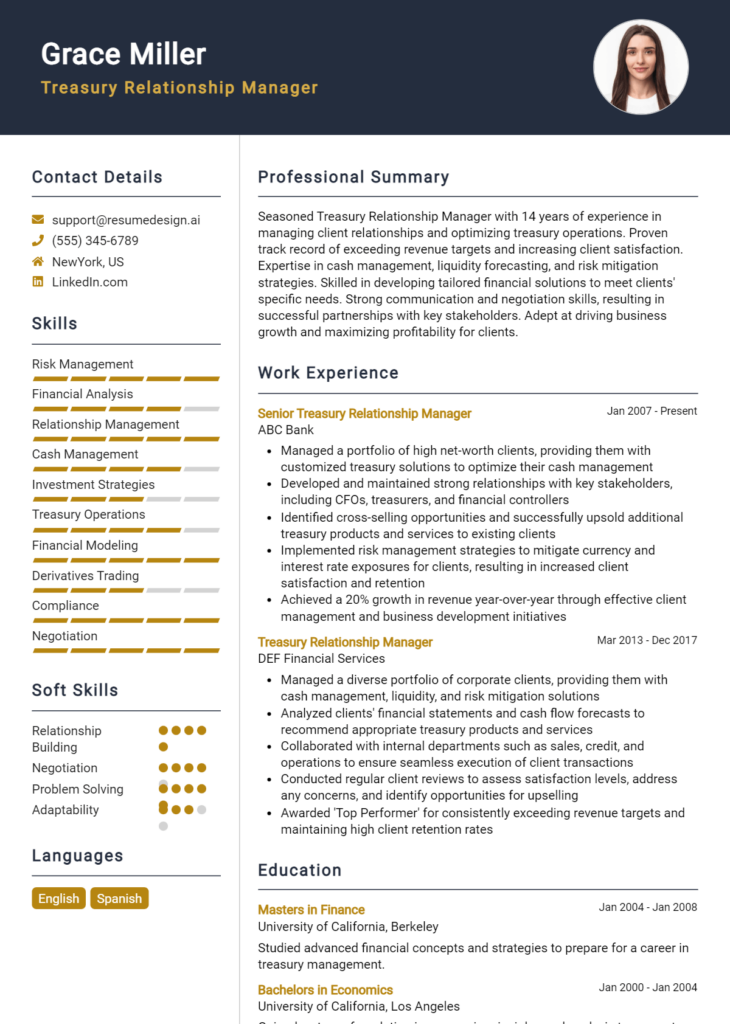

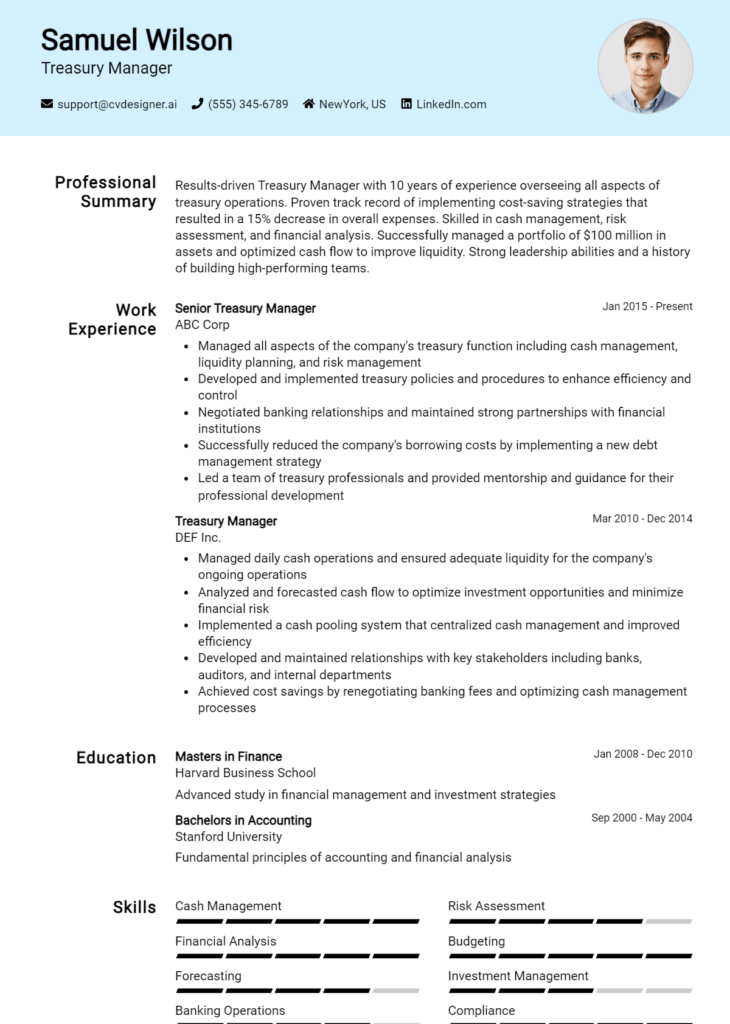

Writing an Exceptional Treasury Analyst Resume Summary

A resume summary serves as a critical introduction to a Treasury Analyst's qualifications, providing a snapshot of their skills, experience, and accomplishments. It is often the first element hiring managers read, making it essential for quickly capturing their attention. A well-crafted summary highlights key competencies relevant to the job role, allowing candidates to stand out in a competitive job market. It should be concise, impactful, and tailored specifically to the position being applied for, ensuring that the most pertinent information is communicated effectively.

Best Practices for Writing a Treasury Analyst Resume Summary

- Quantify Achievements: Use numbers and percentages to showcase the impact of your work, such as cost savings or revenue increases.

- Focus on Relevant Skills: Highlight specific skills required for the Treasury Analyst role, such as financial analysis, cash management, or risk assessment.

- Tailor for the Job Description: Customize your summary to align with the keywords and requirements listed in the job posting.

- Keep it Concise: Aim for 3-5 sentences that effectively summarize your qualifications without being overly verbose.

- Showcase Industry Knowledge: Include relevant industry experience or knowledge that makes you a strong candidate.

- Use Action Words: Start sentences with strong action verbs to convey your accomplishments and contributions effectively.

- Be Professional: Maintain a formal tone that reflects the seriousness and professionalism of the finance industry.

- Avoid Jargon: While it’s essential to use industry terms, ensure that your summary is easily understandable to a broad audience.

Example Treasury Analyst Resume Summaries

Strong Resume Summaries

Results-driven Treasury Analyst with over 5 years of experience in cash flow forecasting and liquidity management, successfully optimizing cash reserves by 20%, resulting in annual savings of over $250,000.

Detail-oriented financial professional skilled in risk assessment and mitigation strategies, having implemented a new risk management framework that reduced exposure by 30% in the past fiscal year.

Proficient Treasury Analyst with expertise in financial modeling and investment analysis, leading a team that increased portfolio returns by 15% through strategic asset allocation.

Weak Resume Summaries

A motivated individual with an interest in finance and treasury management, seeking a position to utilize my skills.

Experienced in finance with some skills in analysis and reporting, looking for a new opportunity to grow.

The examples provided illustrate the difference between strong and weak resume summaries. Strong summaries are specific, quantifying achievements and showcasing relevant skills that directly relate to the Treasury Analyst role. They demonstrate a clear understanding of the job's requirements and present impactful results. In contrast, weak summaries lack detail and specificity, making them too generic to capture the attention of hiring managers. By focusing on measurable outcomes and relevant expertise, candidates can significantly improve their chances of making a strong impression.

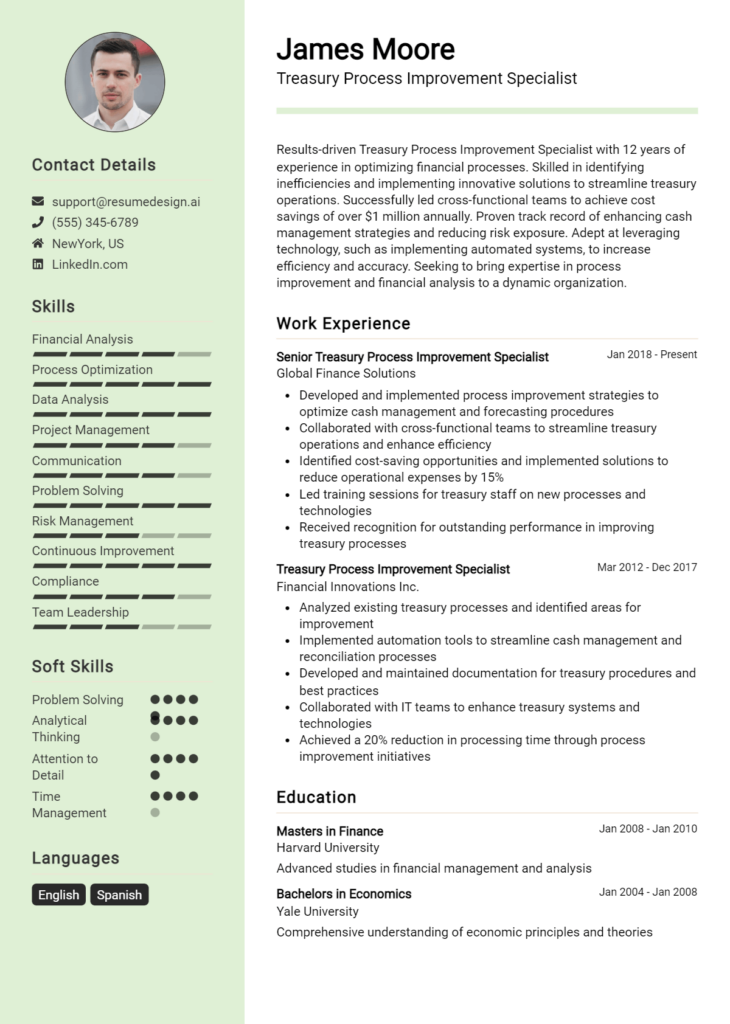

Work Experience Section for Treasury Analyst Resume

The work experience section of a Treasury Analyst resume is crucial as it provides a detailed account of the candidate's technical skills and professional achievements. This section is not just a list of job titles and responsibilities; it showcases the candidate's ability to manage teams, oversee financial operations, and deliver high-quality results that align with industry standards. By quantifying achievements and demonstrating relevant experience, candidates can effectively highlight their contributions to previous employers and their readiness for the challenges of the Treasury Analyst role.

Best Practices for Treasury Analyst Work Experience

- Focus on quantifiable achievements, showcasing metrics that demonstrate your impact.

- Highlight specific technical skills relevant to treasury management, such as cash flow forecasting and financial modeling.

- Emphasize collaboration by detailing your role in team projects and cross-departmental initiatives.

- Utilize action verbs to convey your contributions effectively and enhance the dynamism of your statements.

- Align your experiences with industry standards and best practices to show familiarity with current trends.

- Include relevant software tools or systems you have worked with, such as ERP systems or treasury management software.

- Provide context for your achievements by briefly describing the challenges faced and the solutions implemented.

- Tailor your work experience to the job description, ensuring relevance to the prospective employer's needs.

Example Work Experiences for Treasury Analyst

Strong Experiences

- Led a cross-functional team in a project that improved cash flow forecasting accuracy by 25%, resulting in better liquidity management.

- Implemented a new treasury management system that reduced transaction processing time by 30%, saving the company $50,000 annually.

- Managed a team of 5 analysts to streamline the monthly cash reconciliation process, decreasing the time spent by 40% while enhancing data accuracy.

- Developed and presented quarterly financial reports to senior management, resulting in strategic investment decisions that increased ROI by 15%.

Weak Experiences

- Responsible for financial reporting and analysis.

- Assisted in managing cash flows.

- Helped the team with various treasury-related tasks.

- Worked on reporting duties as needed.

The examples of strong experiences are characterized by specific, quantifiable achievements that demonstrate the candidate's technical expertise and leadership capabilities. These statements provide clear evidence of impact and success in previous roles. In contrast, the weak experiences lack detail and fail to highlight significant contributions or measurable outcomes, making them less compelling to potential employers. Strong experiences illustrate a proactive approach and a clear understanding of the responsibilities inherent in a Treasury Analyst position.

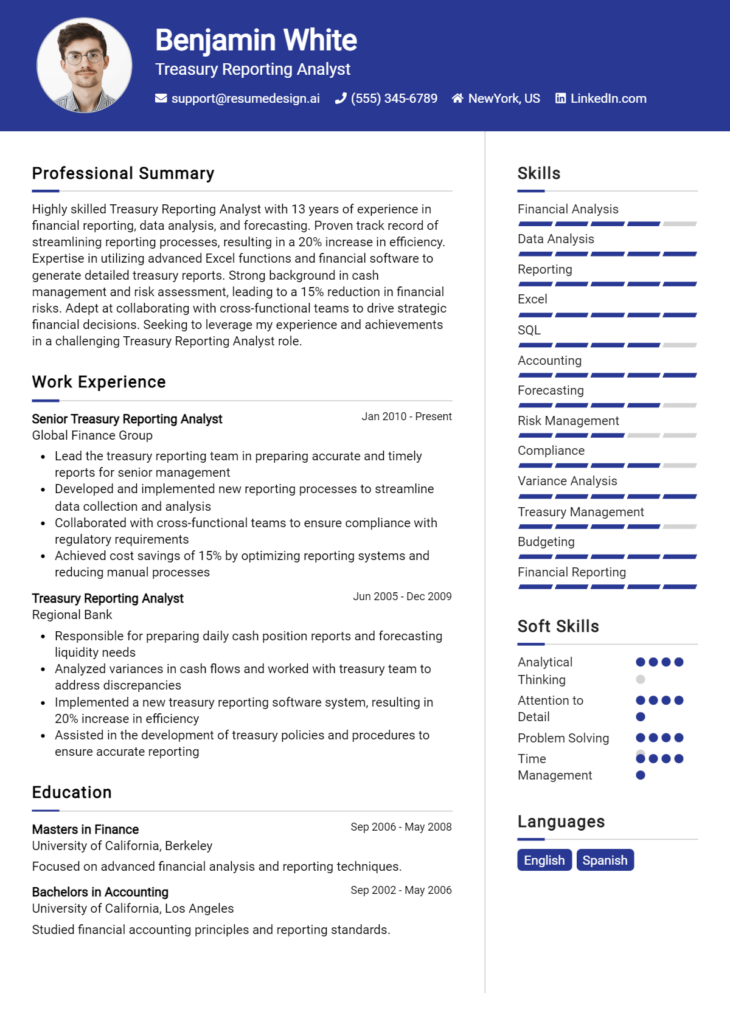

Education and Certifications Section for Treasury Analyst Resume

The education and certifications section of a Treasury Analyst resume plays a crucial role in establishing a candidate's qualifications and expertise in the field of finance. This section not only highlights the candidate's academic background but also showcases industry-relevant certifications and a commitment to continuous learning. By providing relevant coursework, specialized training, and recognized certifications, candidates can enhance their credibility and demonstrate their alignment with the specific requirements of the Treasury Analyst role, making them more appealing to potential employers.

Best Practices for Treasury Analyst Education and Certifications

- Focus on relevant degrees such as Finance, Economics, or Accounting.

- Include industry-recognized certifications like the Certified Treasury Professional (CTP) or Chartered Financial Analyst (CFA).

- Highlight any specialized training related to treasury management, risk management, or financial analysis.

- List relevant coursework that demonstrates knowledge in financial modeling, cash management, and investment strategies.

- Keep descriptions concise but informative, emphasizing skills gained or knowledge acquired.

- Prioritize recent certifications or education to reflect current knowledge and skill sets.

- Consider including online courses from reputable platforms that enhance your qualifications.

- Ensure clarity and consistency in formatting for easy readability.

Example Education and Certifications for Treasury Analyst

Strong Examples

- Bachelor of Science in Finance, University of XYZ, Graduated May 2021

- Certified Treasury Professional (CTP), Association for Financial Professionals, 2022

- Advanced Financial Analysis Course, Online Learning Platform, Completed July 2023

- Master of Business Administration (MBA) with a concentration in Finance, University of ABC, Expected Graduation December 2024

Weak Examples

- Bachelor of Arts in History, University of DEF, Graduated May 2015

- Certification in Basic Accounting, Local Community College, 2010

- Online Course in Personal Finance, Completed January 2019

- High School Diploma, ABC High School, Graduated 2010

The examples provided illustrate the distinction between strong and weak qualifications in the education and certifications section. Strong examples demonstrate a direct relevance to the Treasury Analyst role through specialized degrees, recognized certifications, and recent training that align with industry demands. In contrast, weak examples lack relevance or are outdated, showcasing qualifications that do not effectively support the candidate's suitability for the Treasury Analyst position. This clarity helps hiring managers quickly identify candidates who possess the necessary academic and professional background for the role.

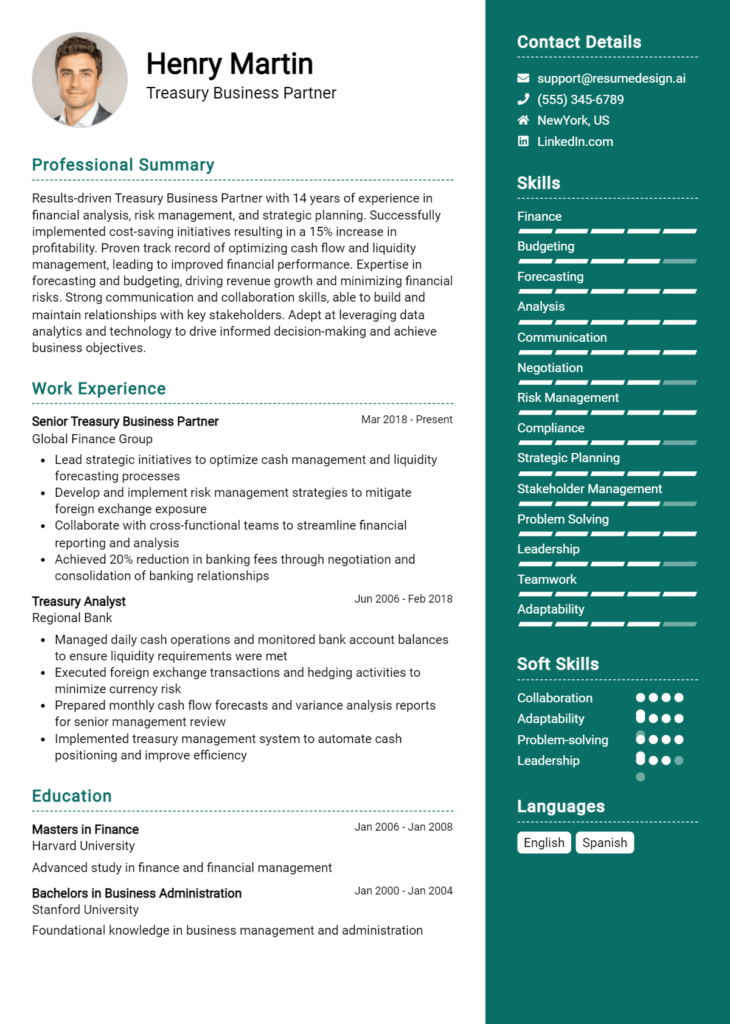

Top Skills & Keywords for Treasury Analyst Resume

A well-crafted Treasury Analyst resume is essential in showcasing not only your professional journey but also the specific skills that make you an asset to any organization. Employers are increasingly looking for candidates who possess a combination of hard and soft skills that align with the demands of the role. Highlighting these skills effectively can set you apart from other applicants and demonstrate your capacity to manage an organization’s financial assets, evaluate risk, and optimize cash flow. Therefore, understanding the key skills required for a Treasury Analyst position is vital for creating a compelling resume that resonates with hiring managers.

Top Hard & Soft Skills for Treasury Analyst

Soft Skills

- Analytical Thinking

- Attention to Detail

- Problem-Solving

- Communication Skills

- Team Collaboration

- Time Management

- Adaptability

- Critical Thinking

- Negotiation Skills

- Interpersonal Skills

- Ethical Judgment

- Decision-Making

- Conflict Resolution

- Customer Service Orientation

- Initiative

Hard Skills

- Financial Modeling

- Cash Management

- Risk Assessment

- Treasury Management Systems (TMS)

- Regulatory Compliance

- Excel Proficiency

- Data Analysis

- Investment Strategies

- Forecasting Techniques

- Accounting Principles

- Financial Reporting

- Banking Relationships

- Cash Flow Management

- Quantitative Analysis

- ERP Software Knowledge

By integrating these skills into your Treasury Analyst resume, you can effectively showcase your qualifications and enhance your chances of landing that coveted position. Don't forget to also emphasize your relevant work experience to provide a comprehensive view of your capabilities in the field.

Stand Out with a Winning Treasury Analyst Cover Letter

I am excited to apply for the Treasury Analyst position at [Company Name], as advertised on [Job Board/Company Website]. With a robust background in financial analysis and treasury management, coupled with my keen attention to detail and strong analytical skills, I am confident in my ability to contribute effectively to your team. My experience in managing cash flow, optimizing liquidity, and executing investment strategies aligns perfectly with the responsibilities outlined in the job description.

In my previous role at [Previous Company Name], I successfully conducted cash flow forecasting and analysis, enabling the management team to make informed decisions regarding working capital and investment opportunities. I implemented a new reporting process that improved the accuracy and timeliness of our financial data, which ultimately reduced costs by 15%. My proficiency in software tools such as Excel, SAP, and treasury management systems has equipped me with the technical skills necessary to analyze complex financial data and provide actionable insights.

I am particularly drawn to the innovative approach [Company Name] takes in its treasury operations. Your commitment to leveraging technology to enhance financial processes resonates with my passion for continuous improvement and efficiency. I am eager to bring my expertise in risk management and compliance to ensure that [Company Name] maintains its strong financial standing while navigating the ever-changing economic landscape.

Thank you for considering my application. I look forward to the opportunity to discuss how my skills and experiences can contribute to the success of your treasury team. I am enthusiastic about the possibility of being part of [Company Name] and helping to drive financial excellence within your organization.

Common Mistakes to Avoid in a Treasury Analyst Resume

When crafting a resume for a Treasury Analyst position, it's essential to present your qualifications and experience effectively. However, many candidates fall into common pitfalls that can detract from their overall presentation. Avoiding these mistakes will enhance your chances of making a strong impression on hiring managers and securing an interview. Here are some common errors to steer clear of:

Vague Job Descriptions: Failing to provide specific details about previous roles can leave hiring managers uncertain about your skills and contributions. Always quantify your achievements and describe your responsibilities clearly.

Ignoring Keywords: Many companies use applicant tracking systems (ATS) to filter resumes. Not including relevant keywords from the job description can result in your resume being overlooked.

Overly Complex Language: Using jargon or overly technical language can confuse the reader. Aim for clarity and conciseness to ensure your qualifications are easily understood.

Neglecting Soft Skills: While technical abilities are critical, soft skills such as communication, teamwork, and problem-solving are equally important in a Treasury Analyst role. Make sure to highlight these skills in your resume.

Inconsistent Formatting: A cluttered or inconsistent layout can make your resume difficult to read. Use a clean, professional format with consistent font sizes and styles to enhance readability.

Lack of Relevant Experience: Tailoring your resume to focus on experience that directly relates to treasury functions is crucial. Avoid including unrelated jobs that do not provide context for your analytical skills.

Too Much Personal Information: Including excessive personal details, such as social security numbers or outdated contact information, can be a red flag. Stick to professional information that pertains to the job.

Ignoring Proofreading: Spelling and grammatical errors can undermine your professionalism. Always proofread your resume multiple times or ask someone else to review it before submission.

Conclusion

As a Treasury Analyst, you play a critical role in managing an organization's financial assets, ensuring liquidity, and mitigating financial risks. Your responsibilities often include cash management, forecasting, investment analysis, and compliance with financial regulations. Given the importance of your role, it's essential to present your skills and experience effectively in your resume.

In summary, highlight your analytical skills, familiarity with financial software, and understanding of market trends. Additionally, emphasize your ability to communicate complex financial data clearly, as this is crucial when collaborating with other departments and stakeholders.

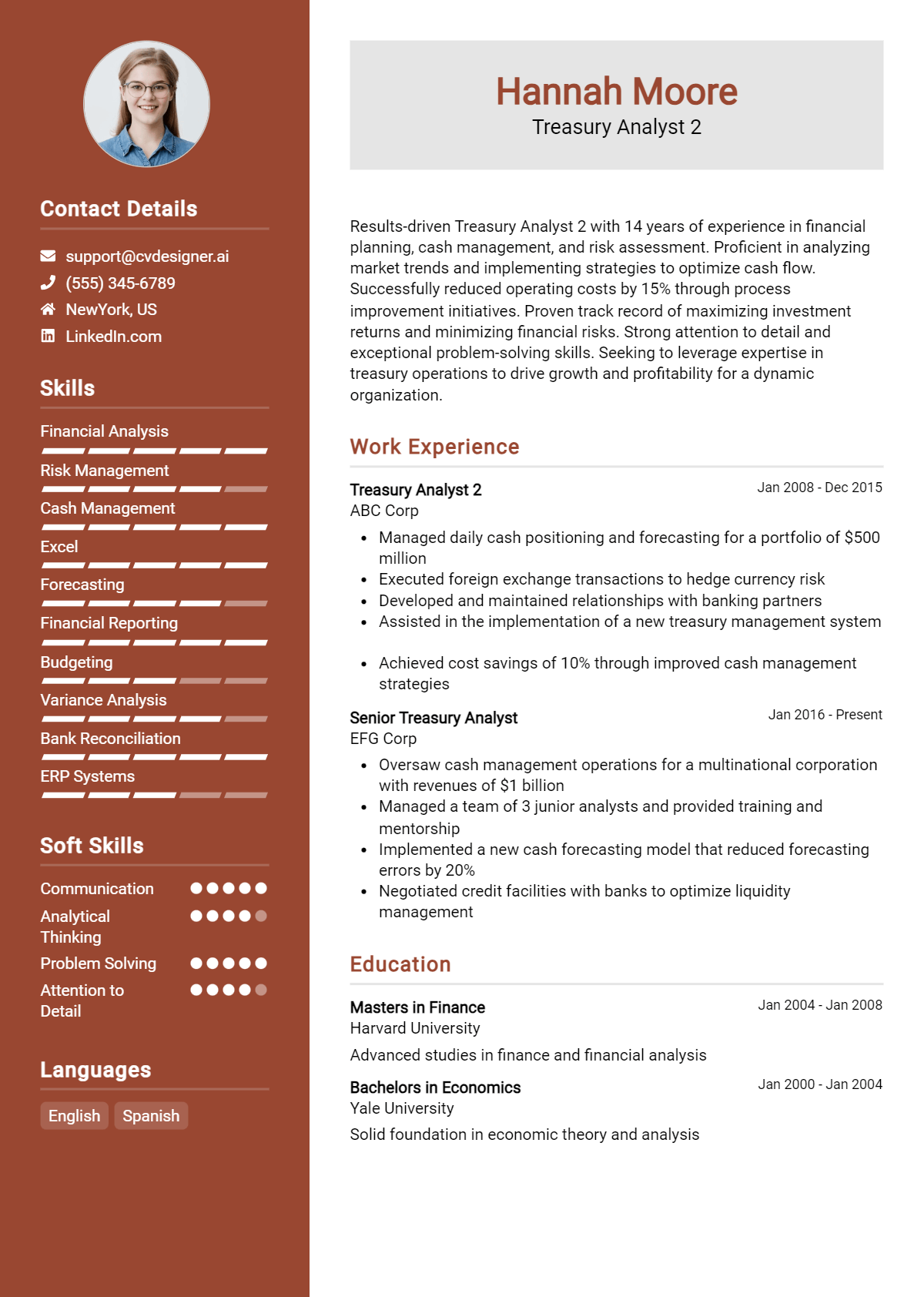

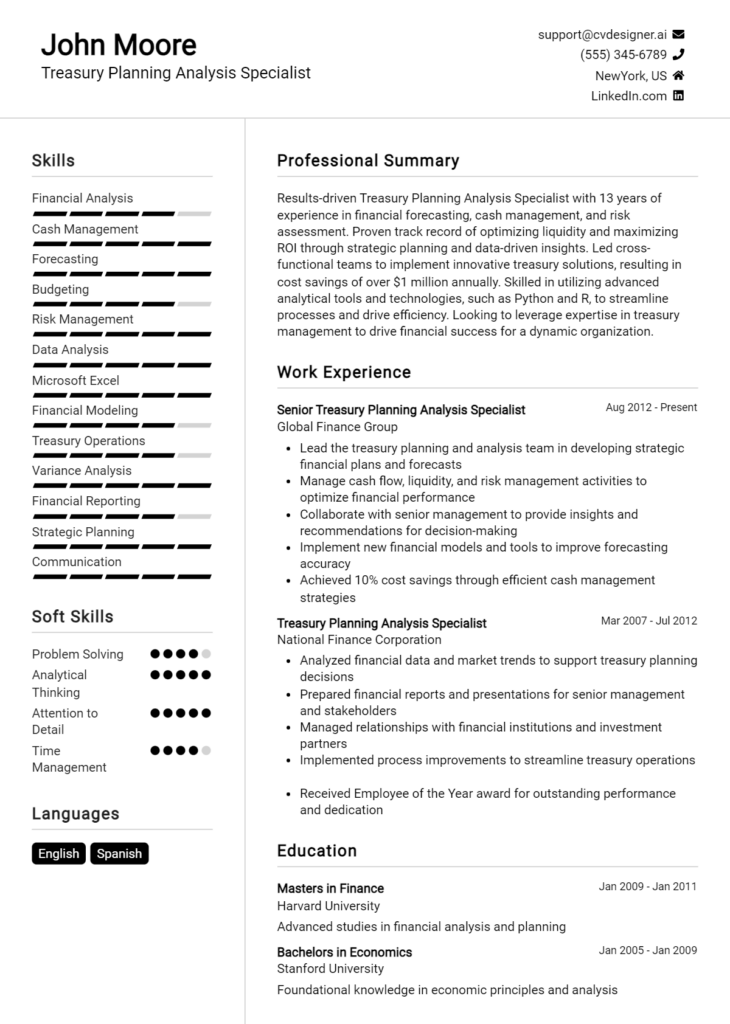

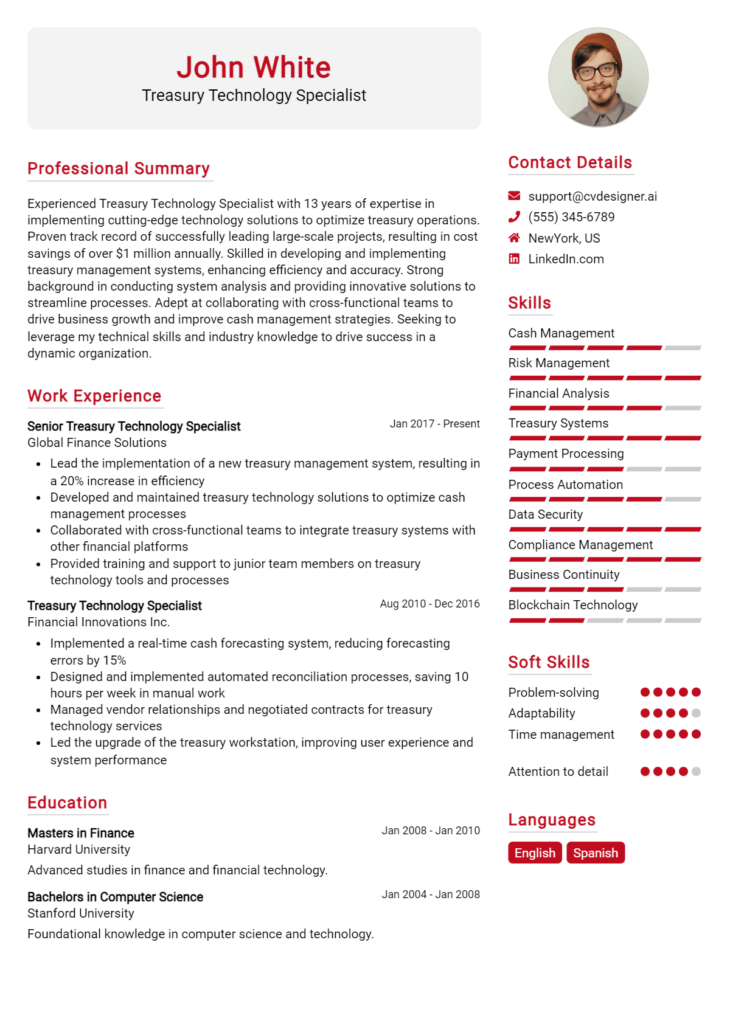

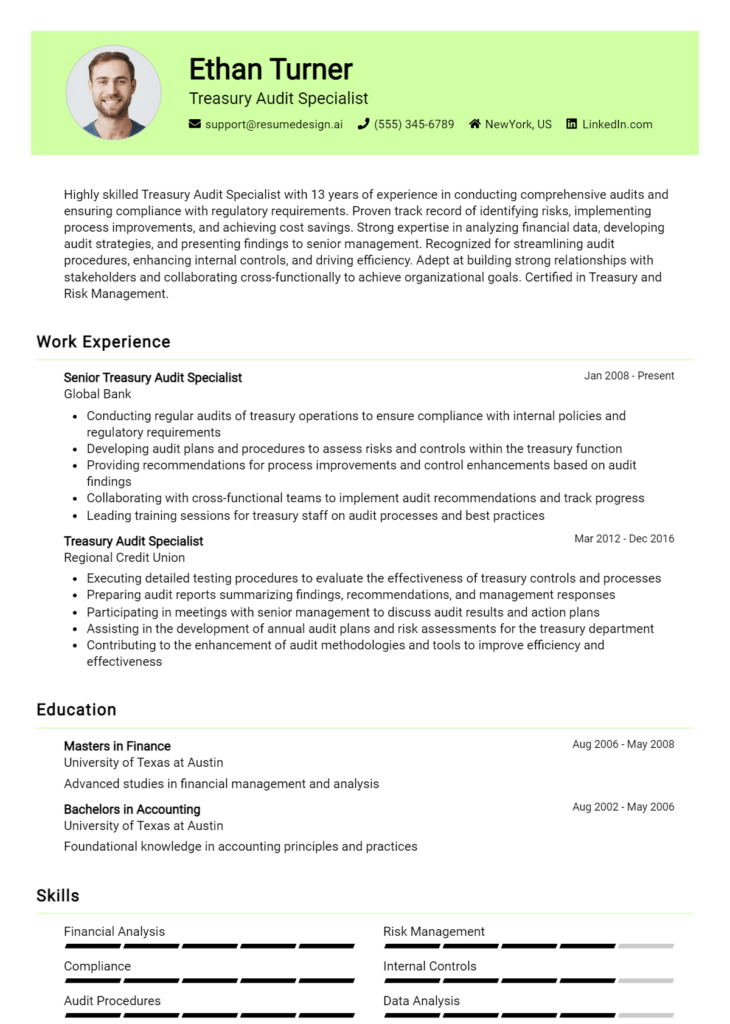

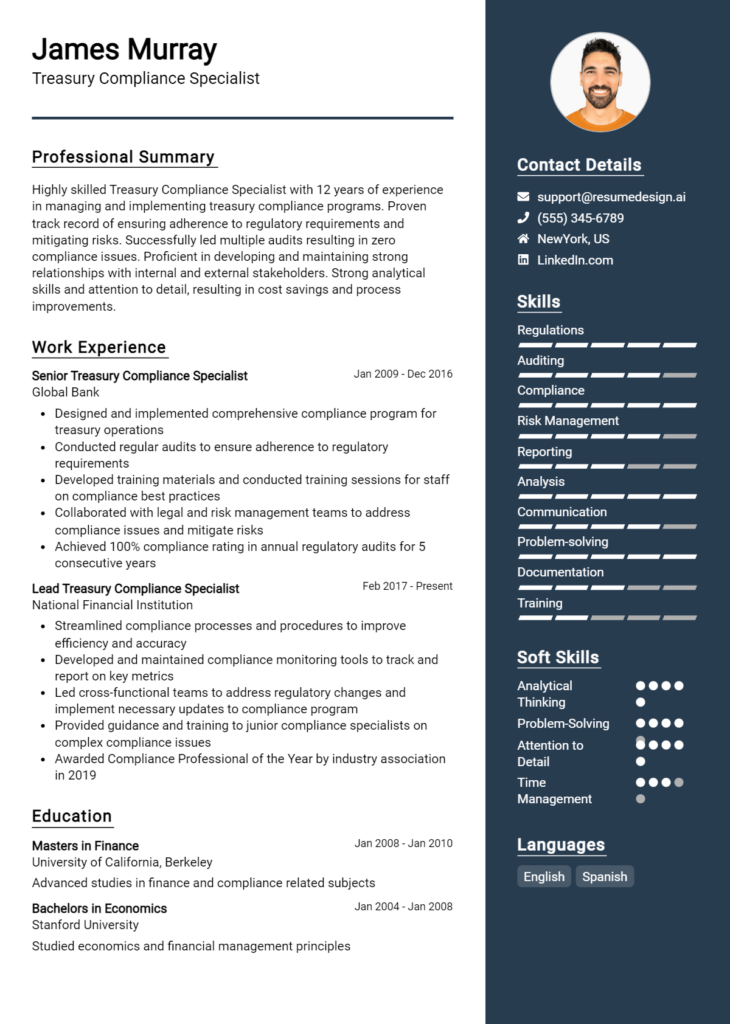

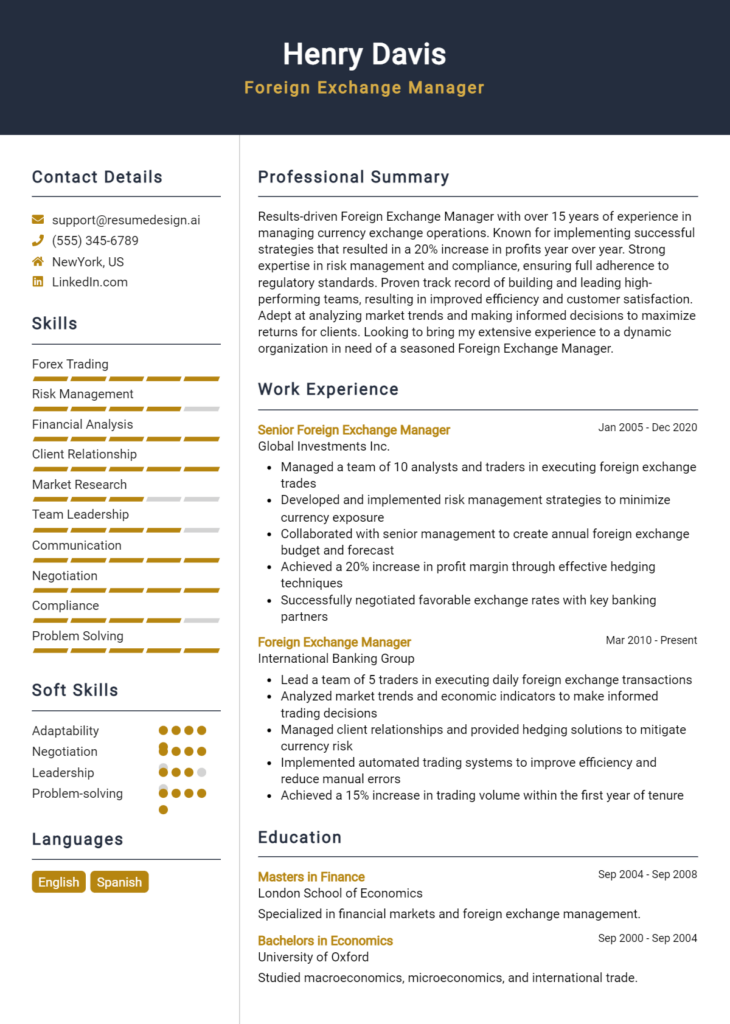

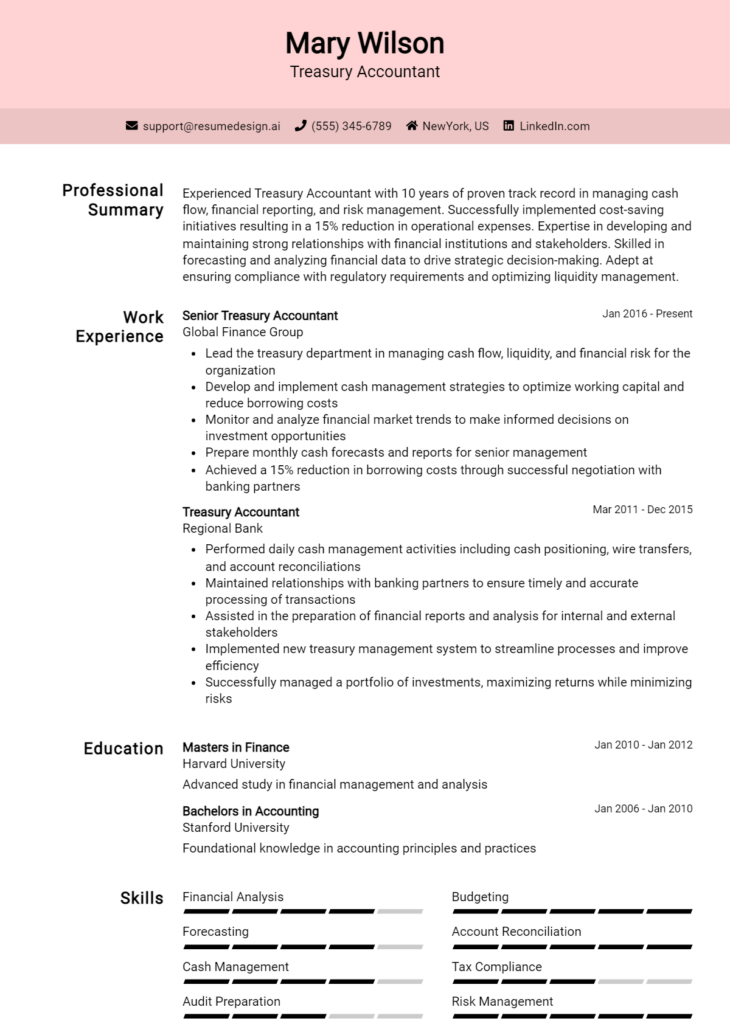

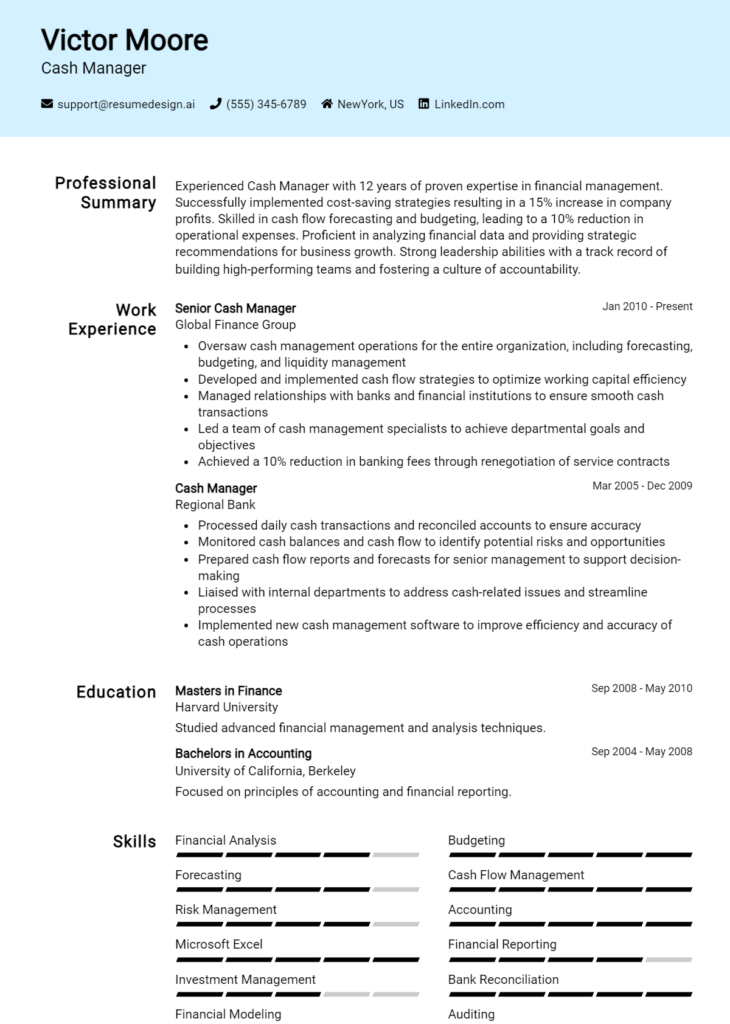

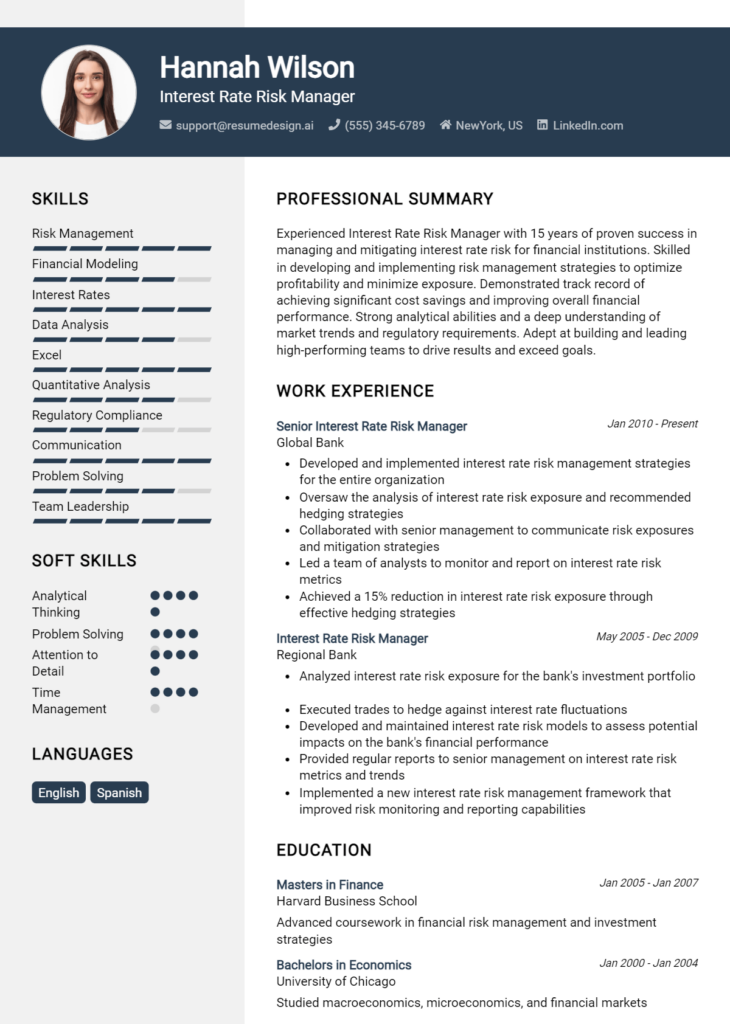

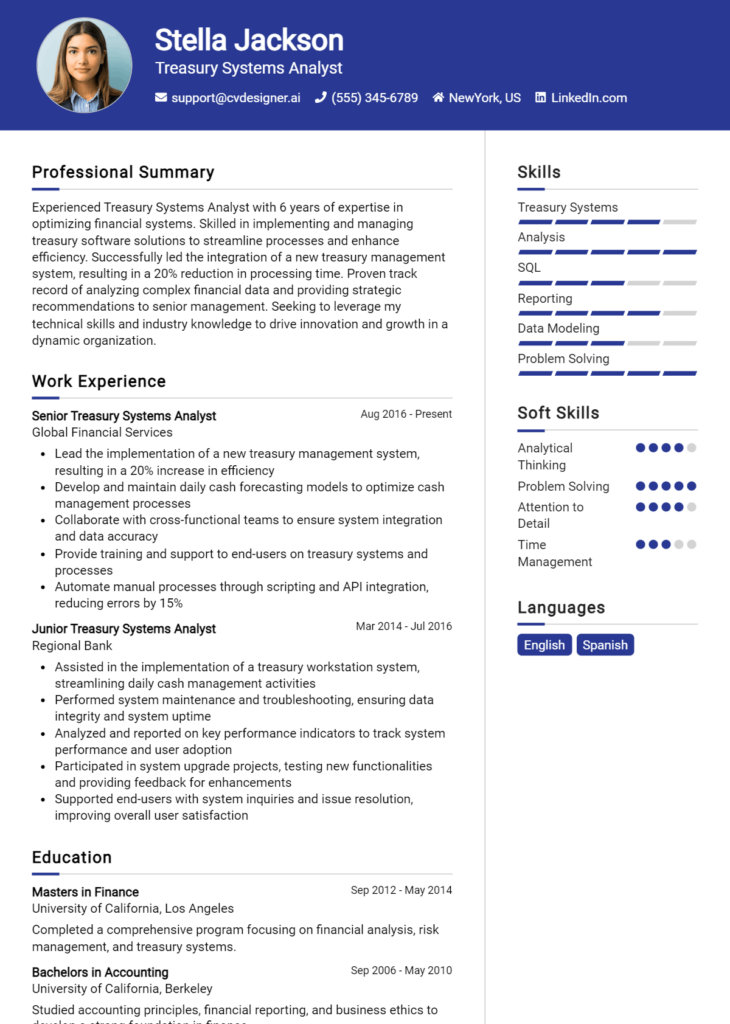

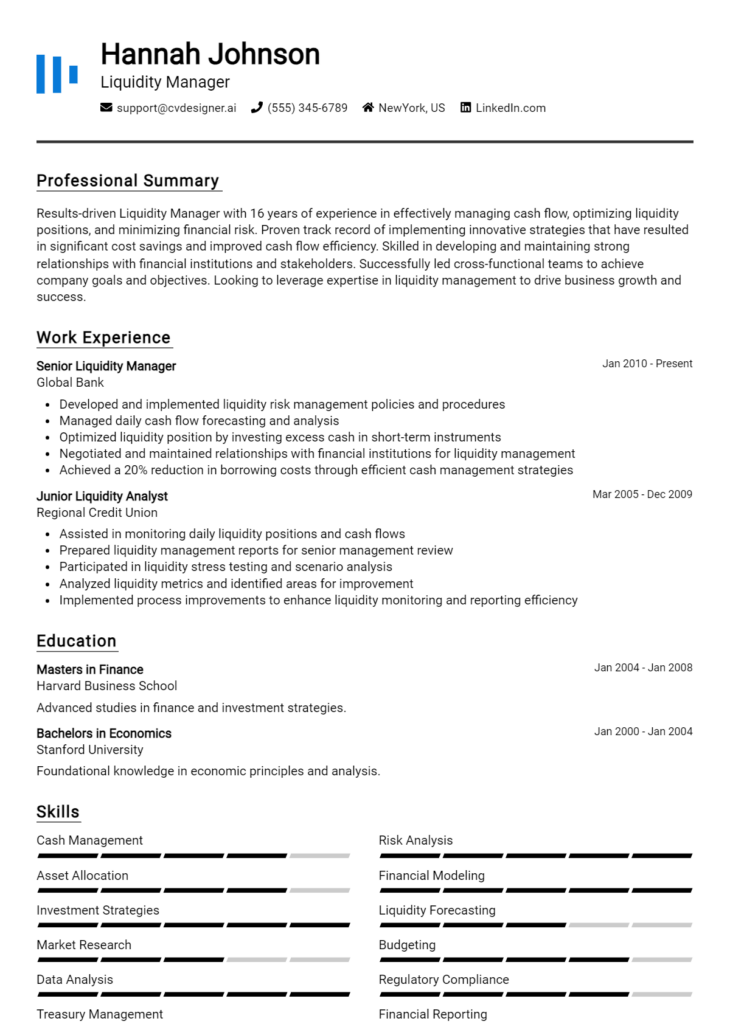

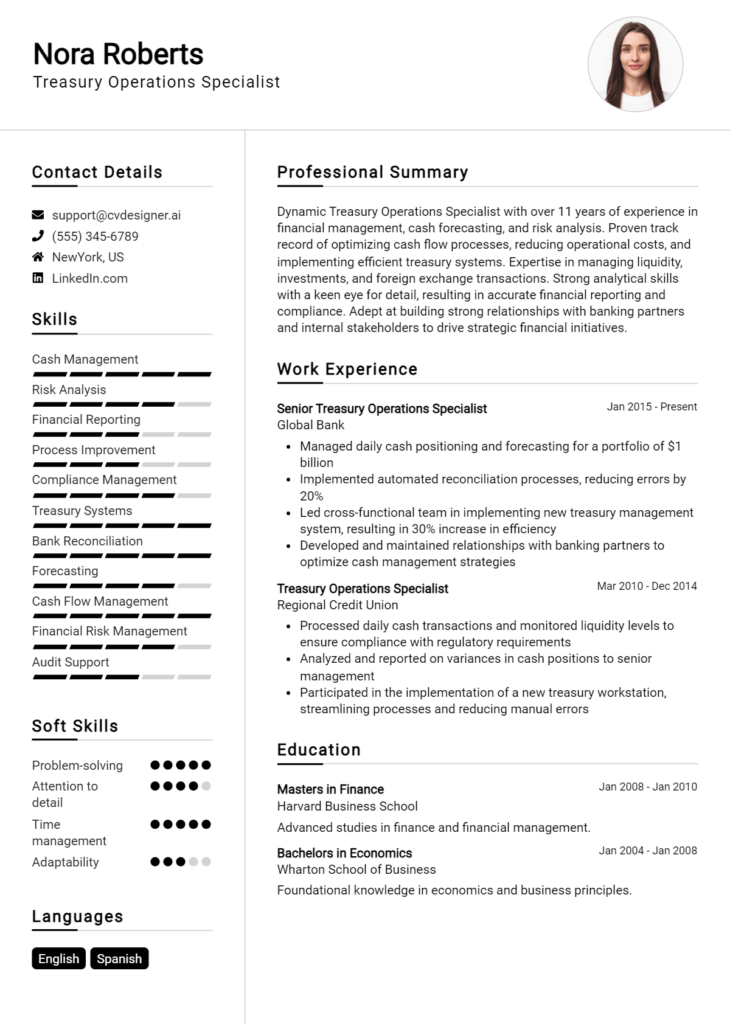

To ensure your resume stands out, take the time to review and refine it. Consider utilizing tools such as resume templates, which can provide a professional layout, or a resume builder to create a polished document easily. You can also explore resume examples tailored for Treasury Analysts to inspire your own content. Don't forget to enhance your application with a compelling cover letter using cover letter templates.

Now is the perfect time to revisit your Treasury Analyst resume and ensure it reflects your qualifications and achievements accurately. Take action today to increase your chances of landing your next opportunity!