Payroll Accountant Core Responsibilities

A Payroll Accountant plays a crucial role in managing payroll processes, ensuring accurate employee compensation, tax calculations, and compliance with labor laws. This position requires strong technical skills in accounting software and HR systems, alongside operational abilities to collaborate with HR and finance departments. Problem-solving skills are essential for addressing discrepancies and streamlining payroll operations. These competencies contribute to the organization’s financial integrity, making a well-structured resume vital for showcasing relevant qualifications and experiences.

Common Responsibilities Listed on Payroll Accountant Resume

- Process payroll for all employees accurately and on time.

- Ensure compliance with federal, state, and local payroll regulations.

- Maintain payroll records and ensure data integrity.

- Resolve payroll discrepancies and respond to employee inquiries.

- Calculate and process employee deductions, bonuses, and commissions.

- Prepare and submit payroll reports and tax filings.

- Collaborate with HR to ensure accurate employee data management.

- Conduct regular audits of payroll processes and systems.

- Implement and maintain payroll policies and procedures.

- Assist in the development of payroll-related training materials.

- Support financial audits and provide necessary documentation.

- Stay updated on changes in payroll legislation and best practices.

High-Level Resume Tips for Payroll Accountant Professionals

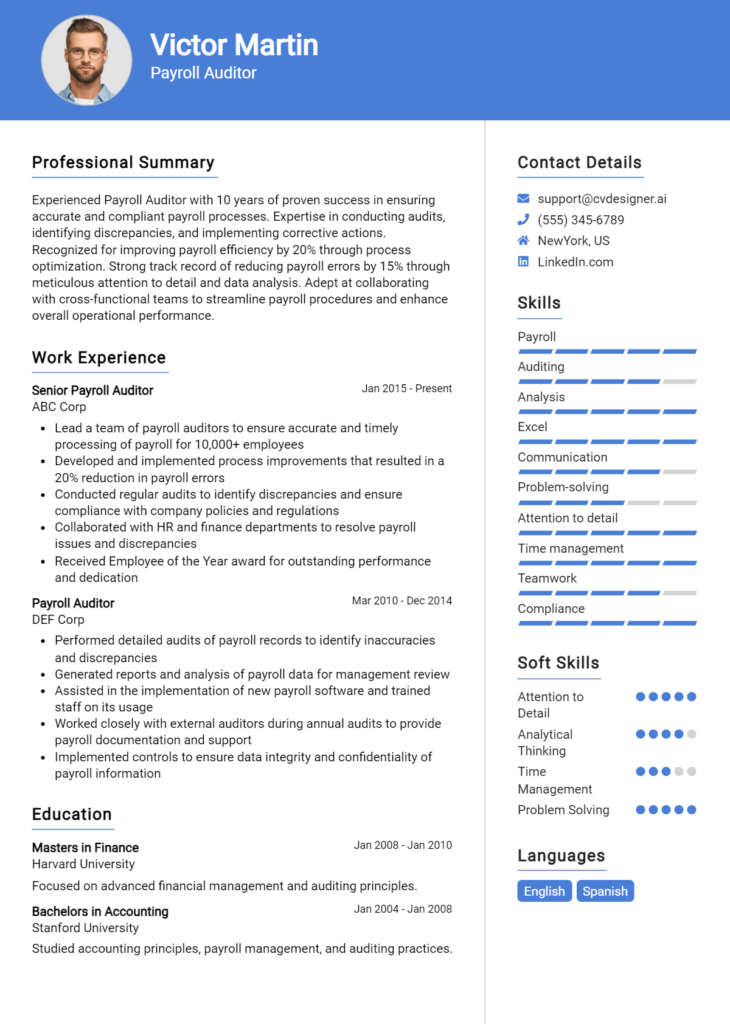

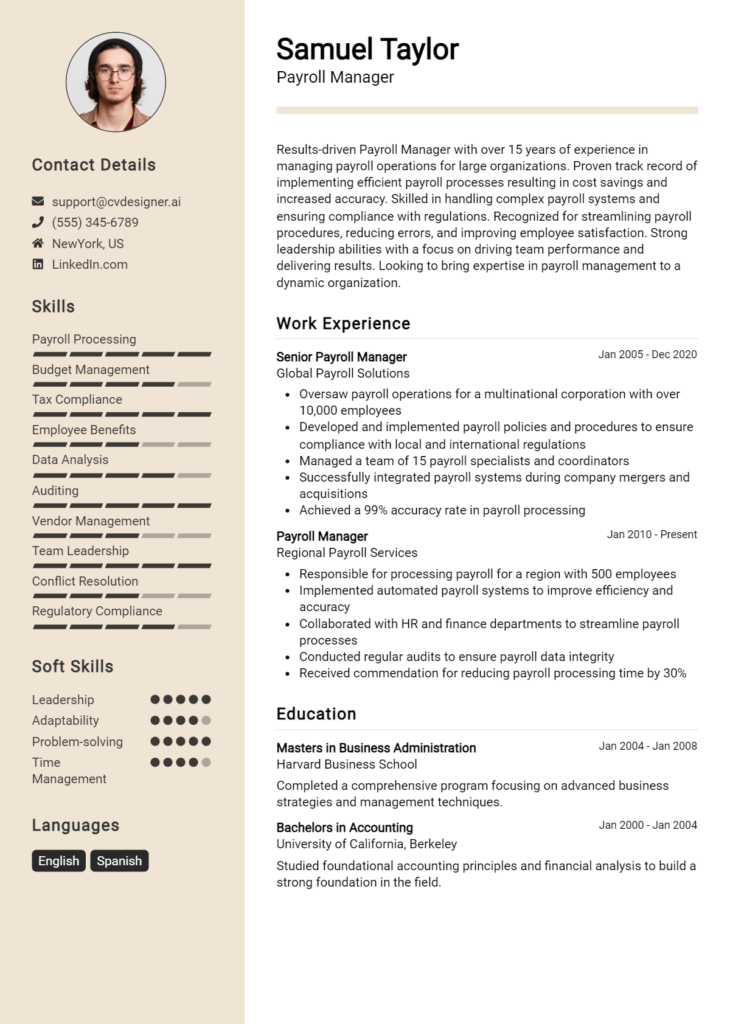

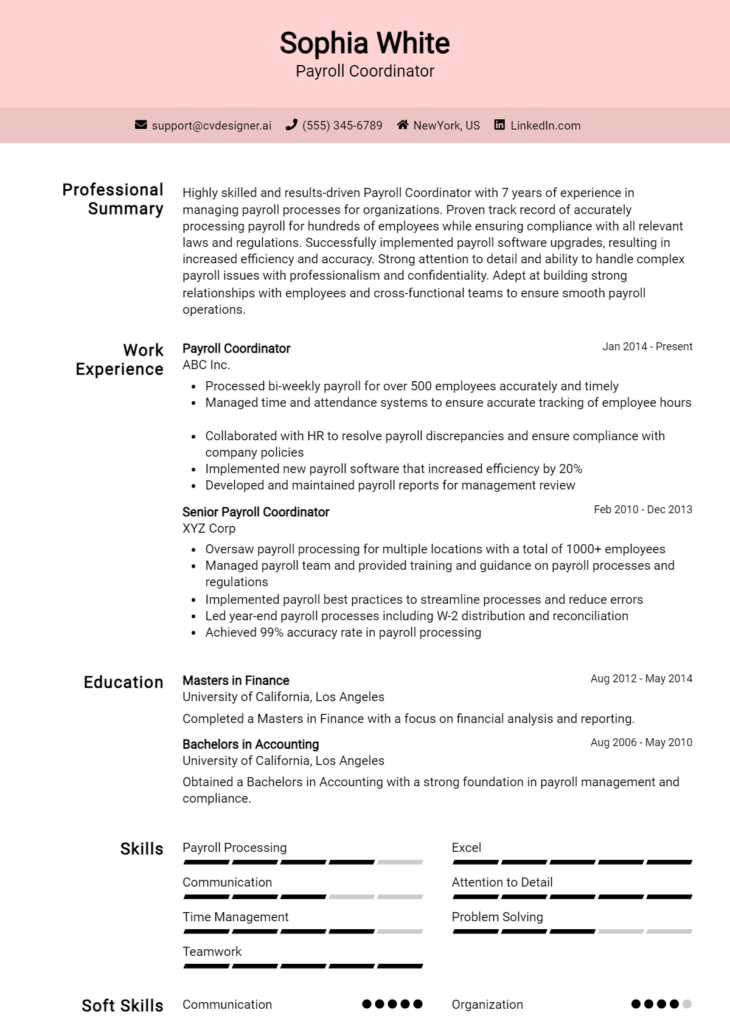

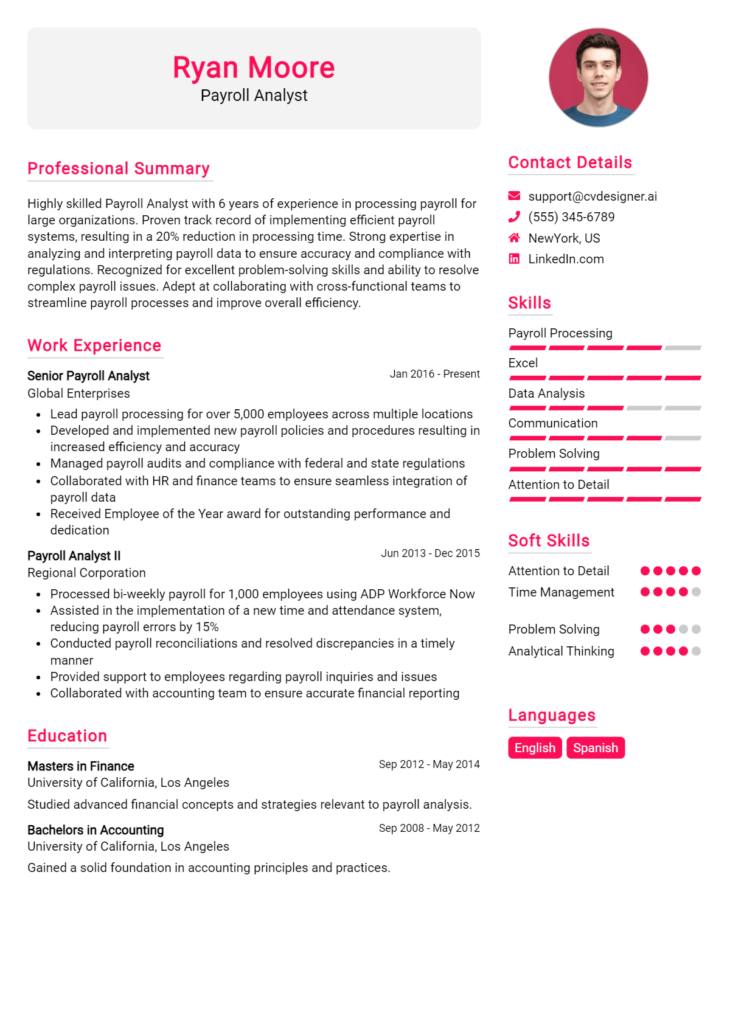

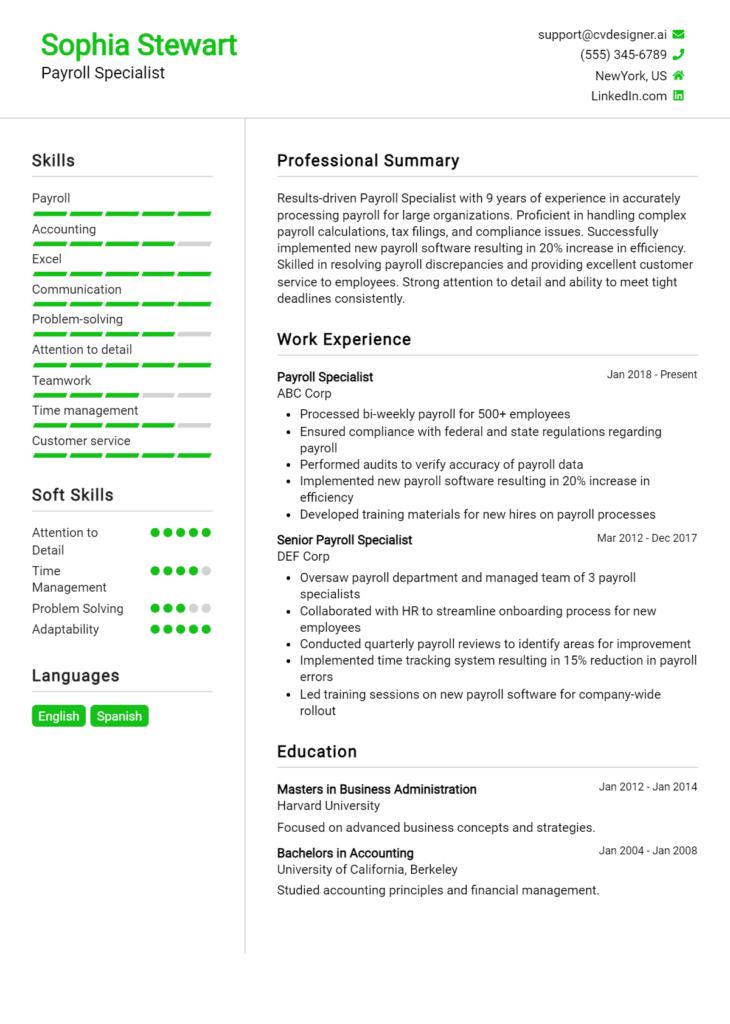

In today's competitive job market, a well-crafted resume is crucial for Payroll Accountant professionals aiming to make a lasting impression on potential employers. Your resume often serves as the first point of contact, and it is essential that it effectively showcases not just your skills, but also your achievements in the field. A compelling resume can set you apart in a sea of applicants, highlighting your expertise in payroll processes, compliance, and financial reporting. This guide will provide practical and actionable resume tips specifically tailored for Payroll Accountant professionals, ensuring that your resume reflects the unique qualifications that employers seek.

Top Resume Tips for Payroll Accountant Professionals

- Tailor your resume to match the specific job description, using keywords that align with the employer's requirements.

- Highlight relevant experience in payroll management, emphasizing your understanding of payroll systems and software.

- Quantify your achievements where possible, such as by detailing the number of employees managed or the accuracy percentage of payroll processed.

- Include industry-specific certifications, such as Certified Payroll Professional (CPP), to demonstrate your commitment to the field.

- Showcase your proficiency in relevant software, such as ADP, QuickBooks, or other payroll processing systems.

- Emphasize your knowledge of payroll regulations and compliance issues, illustrating your ability to minimize risks for the employer.

- Use a clean, professional format that enhances readability and ensures that key information stands out.

- Incorporate action verbs to convey your contributions effectively, such as "managed," "implemented," or "streamlined."

- Include a summary statement at the top of your resume that encapsulates your professional experience and career goals.

- Keep your resume concise, ideally one page, focusing on the most relevant experiences and skills to the position applied for.

By implementing these tips, you can significantly increase your chances of landing a job in the Payroll Accountant field. A meticulously tailored resume that highlights your skills, achievements, and industry knowledge not only captures the attention of hiring managers but also showcases your professional value, making you a standout candidate in the competitive landscape of payroll accounting.

Why Resume Headlines & Titles are Important for Payroll Accountant

In the competitive field of payroll accounting, a well-crafted resume headline or title serves as a crucial first impression for potential employers. It provides a snapshot of the candidate’s qualifications and expertise, allowing hiring managers to quickly assess their relevance for the role. A strong headline can effectively capture attention, summarizing key skills and experiences in a concise and impactful manner. By making this section directly related to the job being applied for, candidates can distinguish themselves from other applicants and set the tone for the rest of their resume.

Best Practices for Crafting Resume Headlines for Payroll Accountant

- Keep it concise: Aim for one impactful phrase that summarizes your qualifications.

- Be role-specific: Tailor your headline to reflect the specific position you are applying for.

- Highlight key strengths: Include relevant skills, experiences, or accomplishments that set you apart.

- Use industry-specific terminology: Incorporate jargon or keywords commonly used in payroll accounting.

- Avoid generic titles: Steer clear of vague descriptions that do not convey your unique qualifications.

- Consider your audience: Write with the hiring manager in mind to ensure relevance and appeal.

- Showcase results: If possible, mention quantifiable achievements to demonstrate your impact.

- Update regularly: Revise your headline to match the evolving job market and your career goals.

Example Resume Headlines for Payroll Accountant

Strong Resume Headlines

"Detail-Oriented Payroll Accountant with 5+ Years of Experience in Streamlining Payroll Processes"

“Certified Payroll Professional Specializing in Compliance and Accuracy in Payroll Management”

“Results-Driven Payroll Accountant with Proven Track Record of Reducing Payroll Errors by 30%”

Weak Resume Headlines

“Payroll Accountant Looking for a Job”

“Experienced Professional in Accounting”

Strong resume headlines are effective because they convey specific skills and achievements that directly relate to the payroll accountant role, making them engaging and relevant to hiring managers. Conversely, weak headlines fail to impress as they lack detail and specificity, leaving the hiring manager with little information about the candidate’s unique qualifications and capabilities. By focusing on impactful and targeted language, candidates can create a lasting impression from the very first line of their resume.

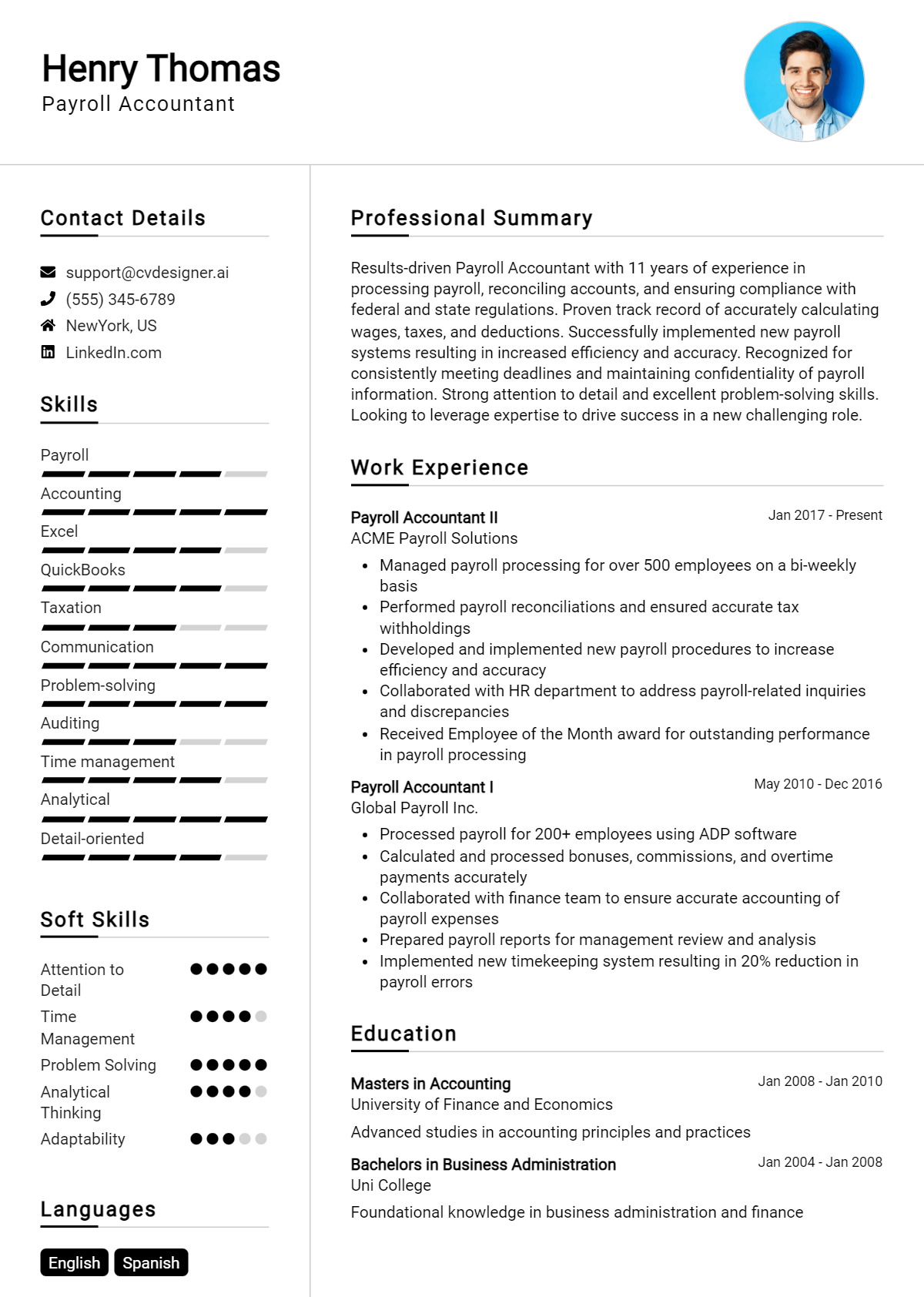

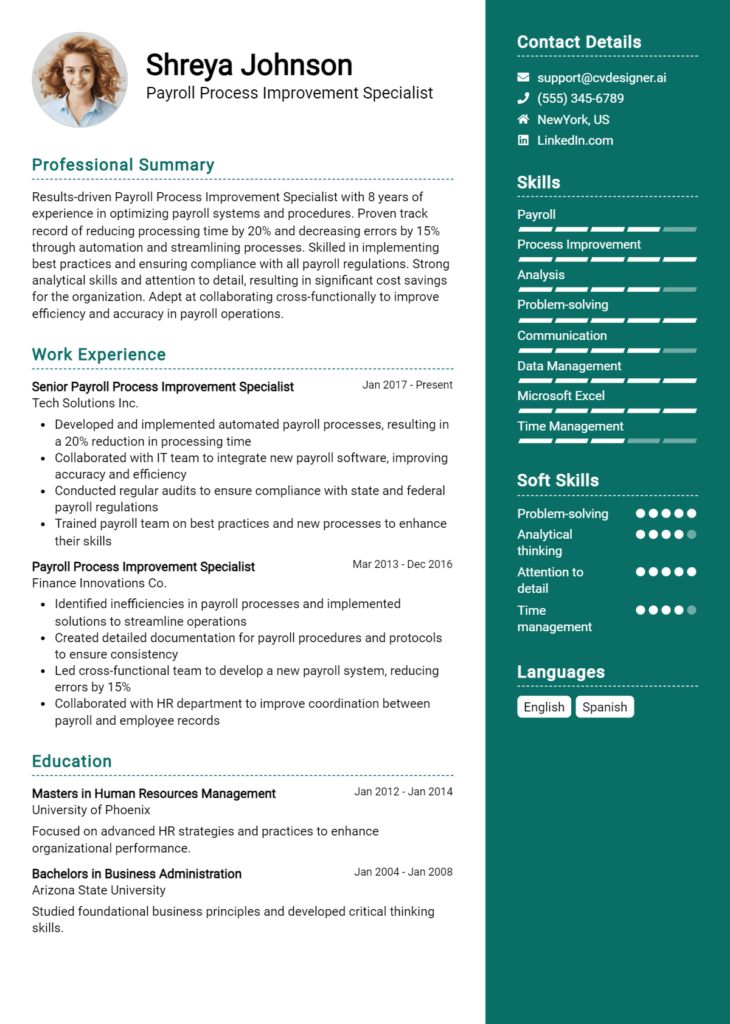

Writing an Exceptional Payroll Accountant Resume Summary

A well-crafted resume summary is crucial for a Payroll Accountant, as it serves as the first impression for hiring managers. This brief section quickly captures attention by showcasing key skills, relevant experience, and significant accomplishments related to the role. A strong summary should be concise and impactful, tailored to reflect the specific job requirements of the position being applied for. By effectively summarizing qualifications, candidates can set themselves apart in a competitive job market and encourage further review of their resume.

Best Practices for Writing a Payroll Accountant Resume Summary

- Quantify achievements: Use numbers to demonstrate the impact of your work, such as the size of payroll processed or error reduction percentages.

- Focus on skills: Highlight specific skills relevant to payroll accounting, such as proficiency in payroll software, compliance knowledge, and attention to detail.

- Tailor the summary: Customize the summary for each job application by incorporating keywords from the job description.

- Be concise: Aim for 2-4 sentences that deliver maximum information with minimal words.

- Showcase relevant experience: Mention years of experience and specific payroll-related roles held in the past.

- Highlight accomplishments: Briefly mention major achievements, such as successful audits or implementation of new payroll systems.

- Use action verbs: Start sentences with strong action verbs to convey confidence and proactivity.

- Maintain professionalism: Keep the tone formal and focused on professional achievements and skills.

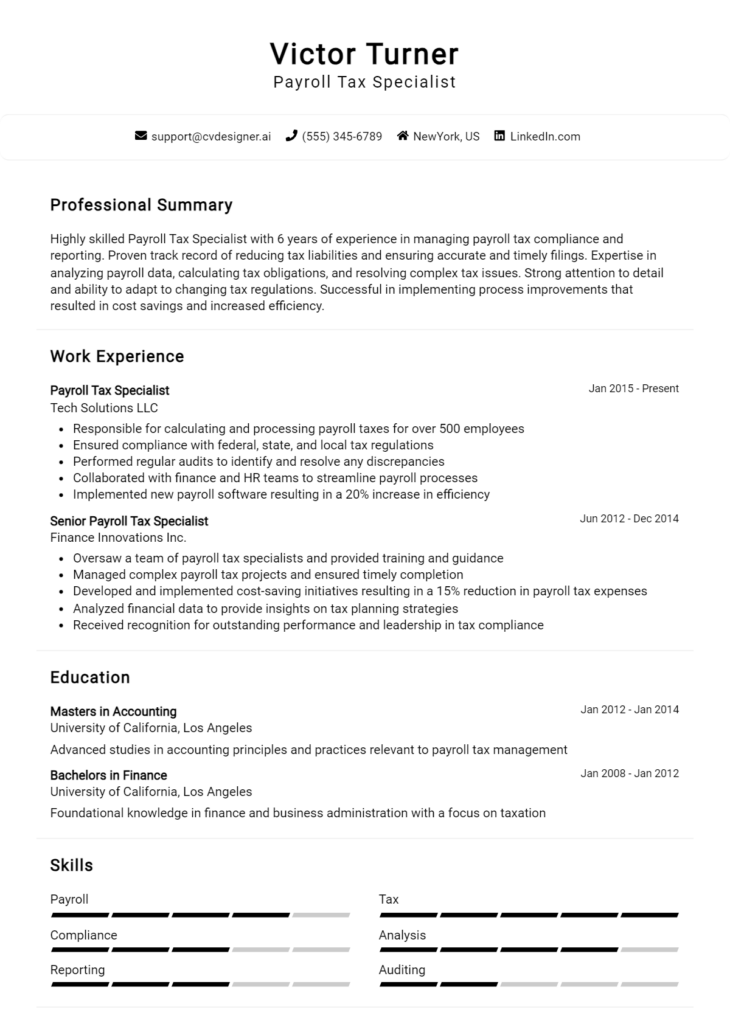

Example Payroll Accountant Resume Summaries

Strong Resume Summaries

Detail-oriented Payroll Accountant with over 7 years of experience managing payroll for organizations with over 500 employees. Successfully reduced payroll discrepancies by 30% through the implementation of a new software system, enhancing overall efficiency and accuracy.

Dedicated Payroll Accountant with extensive knowledge in federal and state payroll regulations, adept at processing multi-state payrolls for a large corporation. Achieved a 95% satisfaction rate in employee feedback regarding payroll accuracy and timeliness.

Results-driven Payroll Accountant with a proven track record of processing payroll for over $10 million in annual salary disbursements. Spearheaded a project that automated payroll processes, resulting in a 40% reduction in processing time.

Weak Resume Summaries

Experienced payroll professional looking for a new opportunity in accounting.

Payroll Accountant with some experience in processing payroll and handling employee inquiries.

The examples of strong resume summaries are effective because they contain specific details, quantifiable achievements, and relevant skills that align closely with the Payroll Accountant role. In contrast, the weak summaries lack specificity and measurable outcomes, making them appear vague and less compelling, which may fail to engage hiring managers' interest.

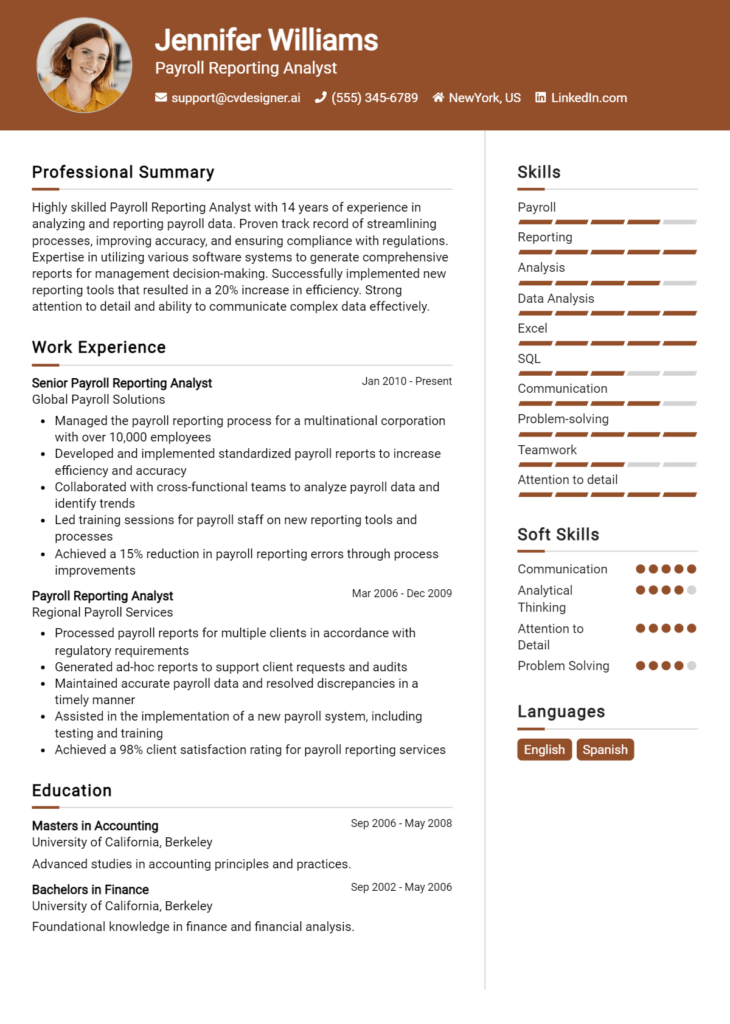

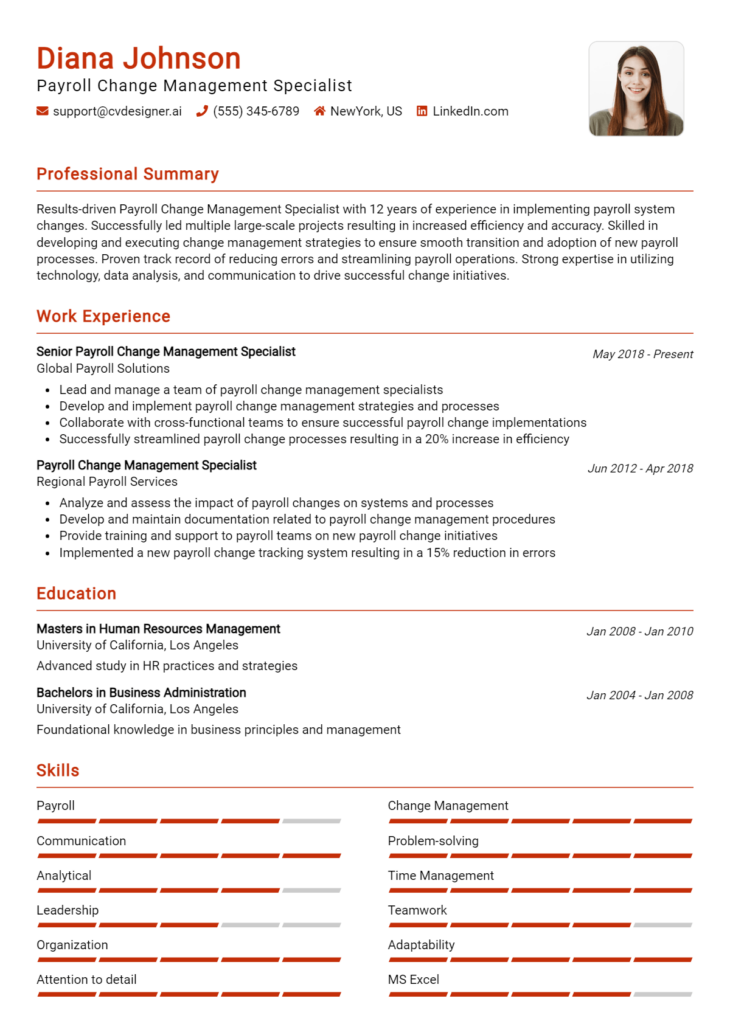

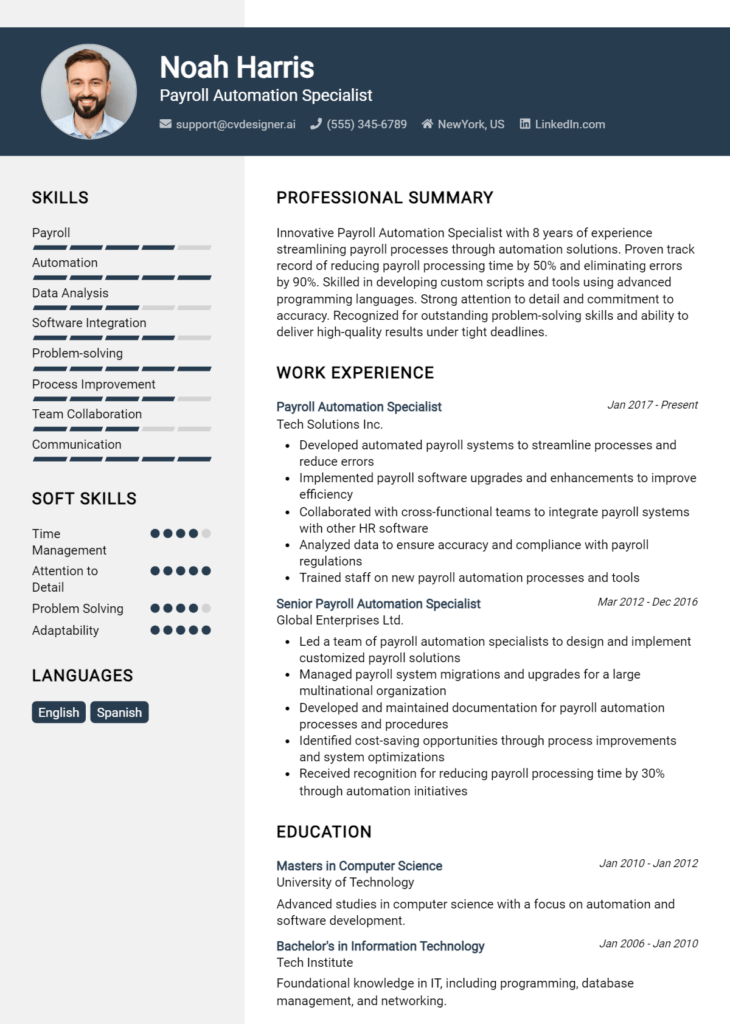

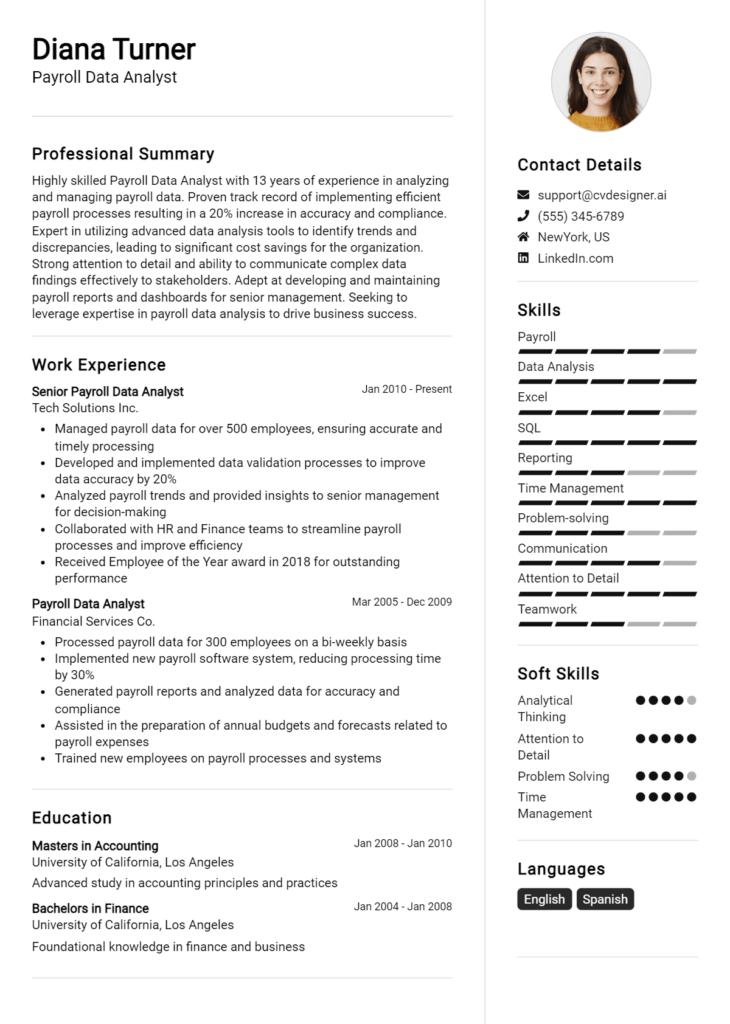

Work Experience Section for Payroll Accountant Resume

The work experience section in a Payroll Accountant resume is crucial as it serves as a platform to showcase the candidate's technical skills and their capacity to manage teams effectively while delivering high-quality results. This section not only reflects the candidate's practical knowledge in payroll management and compliance but also demonstrates their ability to achieve measurable outcomes in their previous roles. By quantifying achievements and aligning their experience with industry standards, candidates can significantly enhance their appeal to potential employers, illustrating their readiness to contribute effectively to the organization's payroll processes.

Best Practices for Payroll Accountant Work Experience

- Highlight technical expertise in payroll software and compliance regulations.

- Quantify results with specific metrics, such as error reduction percentages or cost savings.

- Demonstrate collaboration by mentioning cross-departmental projects or team leadership.

- Use action verbs to convey a strong sense of initiative and responsibility.

- Tailor experiences to reflect the job description and industry requirements.

- Include relevant certifications or training that bolster your qualifications.

- Focus on both individual contributions and team achievements.

- Keep descriptions concise while ensuring clarity and impact.

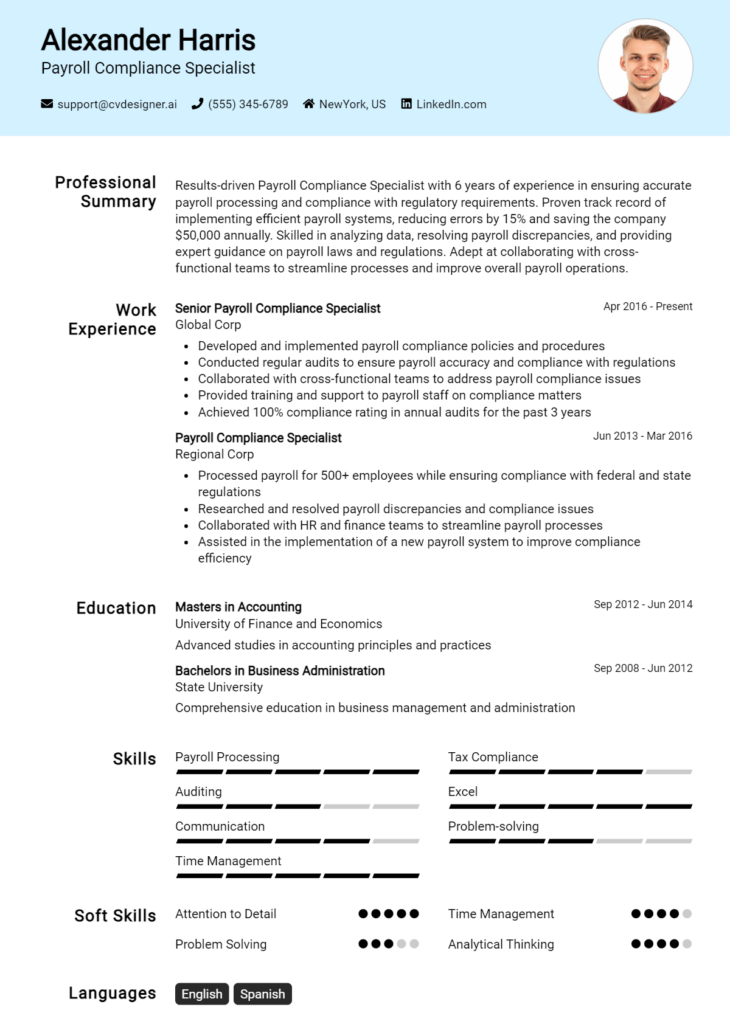

Example Work Experiences for Payroll Accountant

Strong Experiences

- Implemented a new payroll system that reduced processing time by 30%, enhancing overall departmental efficiency.

- Led a team of three accountants in reconciling payroll discrepancies, resulting in a 95% accuracy rate over six months.

- Streamlined payroll reporting procedures, which decreased the month-end close time by 20 hours, allowing for timely financial analyses.

- Coordinated with HR to develop a training program for new hires, which improved onboarding efficiency by 40%.

Weak Experiences

- Responsible for payroll tasks.

- Helped with team projects on occasion.

- Managed some payroll-related issues.

- Participated in meetings about payroll.

The examples provided are considered strong because they incorporate specific, quantifiable achievements and demonstrate proactive leadership and teamwork in the payroll function. In contrast, the weak experiences lack detail, specificity, and measurable outcomes, making them less impactful and failing to convey the candidate's value or contributions to previous employers.

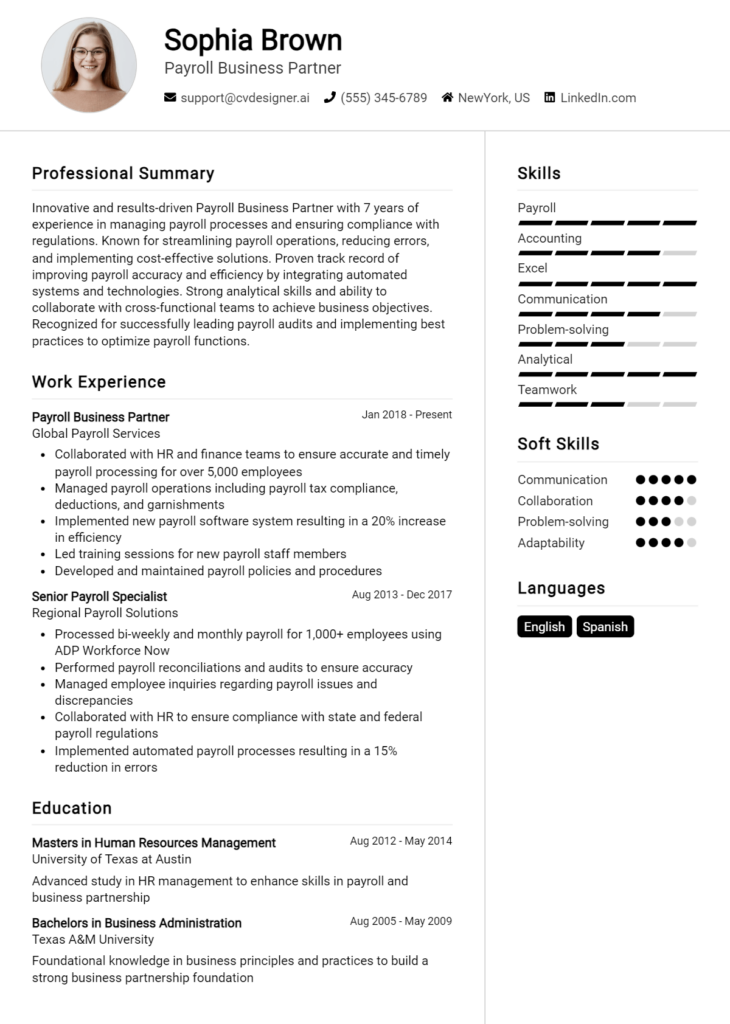

Education and Certifications Section for Payroll Accountant Resume

The education and certifications section of a Payroll Accountant resume is crucial as it showcases the candidate's academic achievements and professional qualifications. This section not only reflects the foundational knowledge gained through formal education but also highlights the relevance of industry certifications and ongoing learning efforts. By including pertinent coursework, recognized certifications, and specialized training, candidates can significantly enhance their credibility and demonstrate their alignment with the job role. A well-crafted education and certifications section signals to employers that the candidate possesses the necessary skills and dedication required in the payroll accounting field.

Best Practices for Payroll Accountant Education and Certifications

- Include relevant degrees such as Accounting, Finance, or Business Administration.

- Highlight industry-recognized certifications like Certified Payroll Professional (CPP) or Certified Public Accountant (CPA).

- Provide details of relevant coursework, especially in payroll processing, tax law, and financial reporting.

- List any continuing education courses or seminars attended that relate specifically to payroll and accounting practices.

- Indicate the date of certification or graduation to show recent educational achievements.

- Use precise language to describe your qualifications to ensure clarity and impact.

- Prioritize certifications and courses that are current and recognized within the industry.

- Consider including online courses from reputable platforms that enhance your payroll skills.

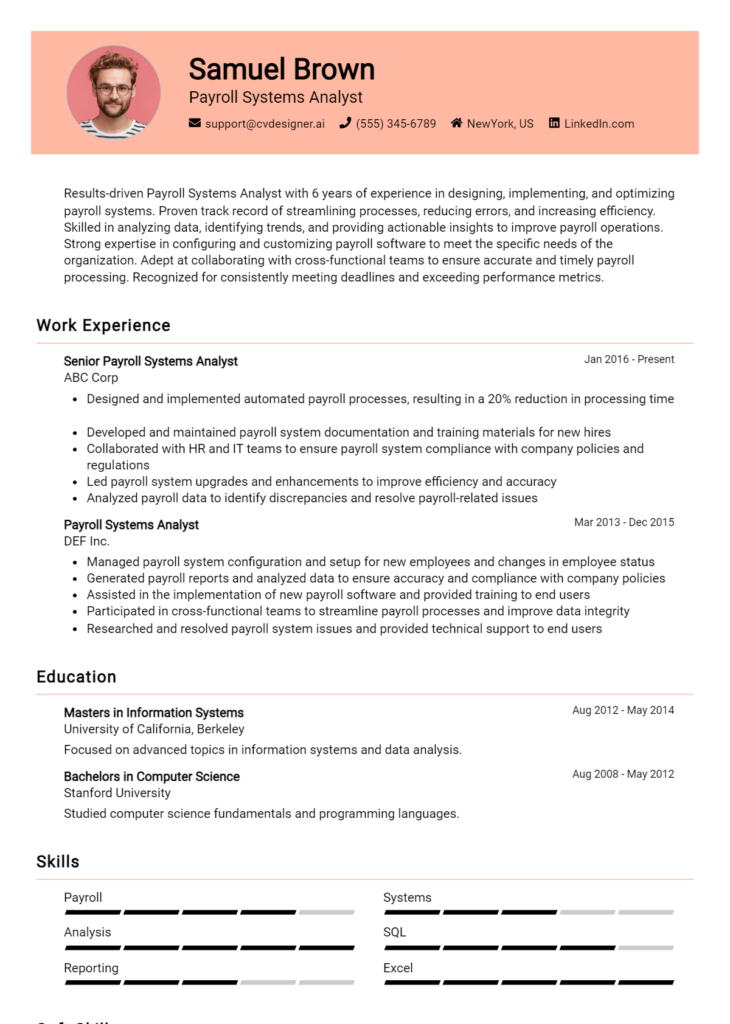

Example Education and Certifications for Payroll Accountant

Strong Examples

- Bachelor of Science in Accounting, University of XYZ, Graduated May 2021

- Certified Payroll Professional (CPP), American Payroll Association, Certified July 2022

- Relevant Coursework: Advanced Payroll Management, Tax Compliance, Financial Accounting

- Continuing Education: Payroll Tax Fundamentals Seminar, Completed March 2023

Weak Examples

- Bachelor of Arts in English Literature, University of ABC, Graduated June 2010

- Certification in Basic Computer Skills, Online Learning Institute, Issued August 2019

- Coursework: Introduction to Sociology and Art History

- High School Diploma, XYZ High School, Graduated June 2008

The strong examples provided illustrate relevant educational qualifications and certifications that align directly with the Payroll Accountant role, showcasing the candidate's preparedness and expertise in the field. In contrast, the weak examples reflect outdated or irrelevant qualifications that do not contribute to the candidate's suitability for the position, potentially diminishing their appeal to employers looking for specialized skills and knowledge in payroll accounting.

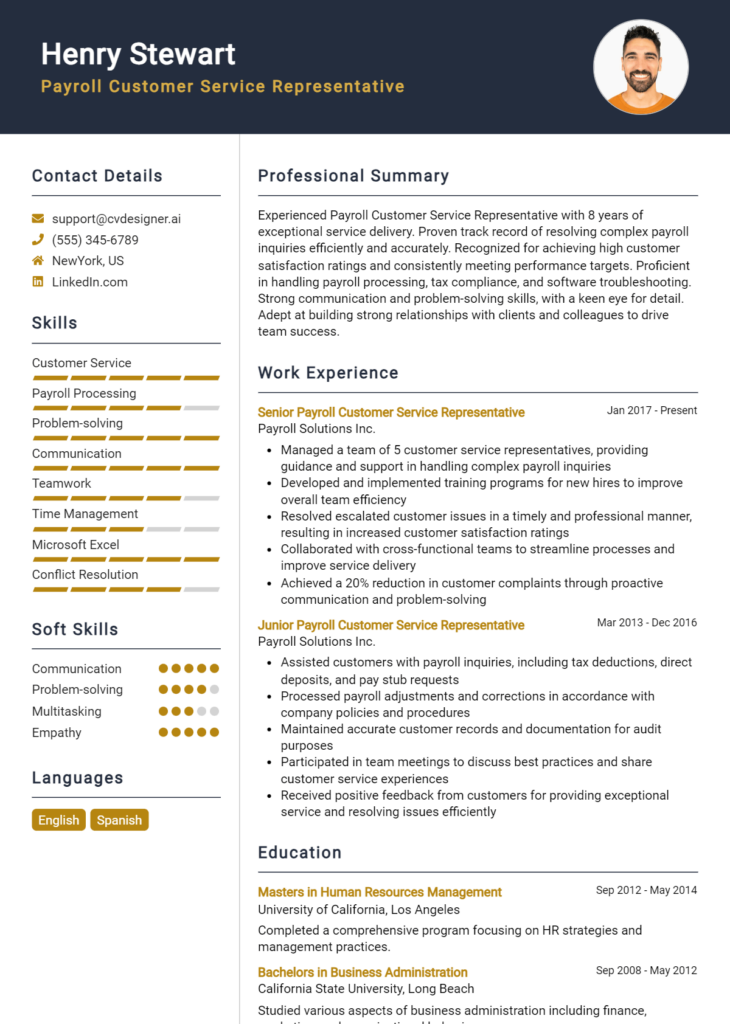

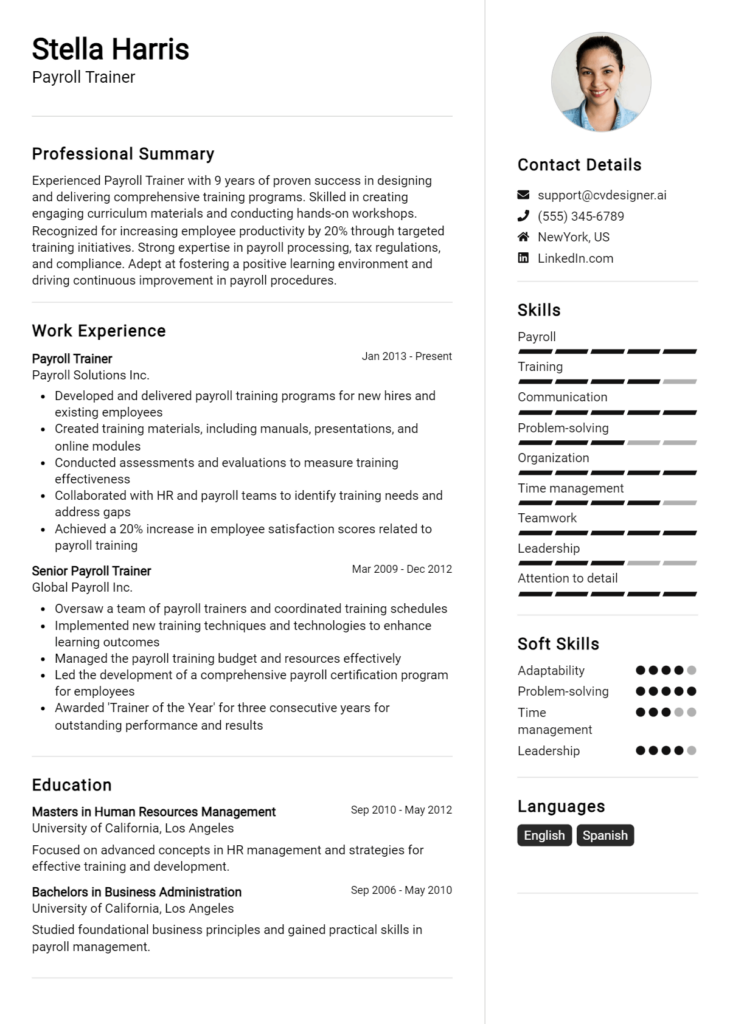

Top Skills & Keywords for Payroll Accountant Resume

The role of a Payroll Accountant is critical in ensuring that employees are compensated accurately and on time. A well-crafted resume that highlights the right skills is essential for making a strong impression on potential employers. Skills not only reflect your qualifications but also demonstrate your ability to handle the complexities of payroll processing, compliance with regulations, and financial reporting. A strong combination of both hard and soft skills can set you apart, showcasing your technical expertise while also highlighting your interpersonal abilities and problem-solving capabilities.

Top Hard & Soft Skills for Payroll Accountant

Soft Skills

- Attention to Detail

- Time Management

- Problem-Solving Skills

- Communication Skills

- Team Collaboration

- Adaptability

- Ethics and Integrity

- Critical Thinking

- Customer Service Orientation

- Organizational Skills

- Conflict Resolution

- Analytical Thinking

- Multitasking

- Flexibility

- Interpersonal Skills

Hard Skills

- Payroll Software Proficiency (e.g., ADP, QuickBooks)

- Tax Regulations Knowledge

- Accounting Principles

- Financial Reporting

- Data Entry Accuracy

- Microsoft Excel (Advanced Functions)

- Compliance Management

- Budgeting and Forecasting

- General Ledger Management

- Reconciliation Procedures

- Auditing Skills

- HR Policies Understanding

- Benefits Administration

- Statistical Analysis

- Database Management

To further enhance your resume, consider detailing your work experience in relation to these skills. Highlighting specific achievements and responsibilities can provide context to your qualifications and strengthen your application. Additionally, ensuring that you include relevant skills tailored to the job description can make a significant difference in catching the attention of hiring managers.

Stand Out with a Winning Payroll Accountant Cover Letter

I am excited to apply for the Payroll Accountant position at [Company Name], as advertised on [where you found the job listing]. With a solid background in payroll processing and a keen eye for detail, I am confident in my ability to contribute effectively to your team. My experience managing payroll for diverse organizations has equipped me with the skills necessary to ensure accurate and timely payroll completion while adhering to all compliance regulations.

In my previous role at [Previous Company Name], I successfully managed the payroll for over [number] employees, implementing automated payroll systems that reduced processing time by 25%. My proficiency in payroll software such as [specific software] and my understanding of federal and state tax regulations allowed me to streamline payroll functions and minimize errors. I am particularly proud of my ability to handle complex payroll scenarios, including multi-state taxation and employee benefits deductions, ensuring that every employee is paid accurately and on time.

Additionally, I possess strong analytical skills that allow me to identify trends and discrepancies in payroll data, enabling proactive resolution of issues before they escalate. I am a collaborative team player who thrives in a fast-paced environment and enjoys working closely with HR and finance departments to align payroll processes with overall organizational goals. My commitment to continuous improvement drives me to stay updated on industry best practices and technological advancements in payroll processing.

I am enthusiastic about the opportunity to bring my expertise in payroll accounting to [Company Name]. I believe my attention to detail, technical skills, and dedication to accuracy make me an excellent fit for your team. I look forward to discussing how my background and passion for payroll can contribute to the continued success of your organization. Thank you for considering my application.

Common Mistakes to Avoid in a Payroll Accountant Resume

When crafting a resume for a Payroll Accountant position, it's essential to highlight your qualifications and experience effectively. However, many candidates make common mistakes that can undermine their chances of landing an interview. Understanding these pitfalls can help you create a more compelling resume that showcases your skills and expertise in payroll management. Here are some common mistakes to avoid:

Lack of Specificity: Using vague terms or generic job descriptions can make your resume blend in with others. Instead, provide specific examples of your responsibilities and achievements related to payroll.

Ignoring Keywords: Many employers use applicant tracking systems (ATS) to filter resumes. Failing to include relevant keywords from the job description can result in your resume being overlooked.

Overloading with Jargon: While industry terminology can demonstrate expertise, overusing jargon can alienate hiring managers. Balance technical terms with clear explanations to ensure your resume is accessible.

Neglecting Quantifiable Achievements: Highlighting accomplishments without including quantifiable results can weaken your impact. Use numbers to illustrate your contributions, such as the number of employees processed or percentage improvements in payroll accuracy.

Inconsistent Formatting: A cluttered or inconsistent format can distract from your qualifications. Use a clean, professional layout with consistent fonts, bullet points, and spacing to enhance readability.

Focusing on Duties Instead of Impact: Many candidates list job duties rather than emphasizing the impact of their work. Shift the focus to how your contributions improved payroll efficiency or compliance.

Omitting Relevant Skills: Failing to include relevant skills, such as proficiency in payroll software or knowledge of labor laws, can leave out essential qualifications. Make sure to tailor your skills section to the specific job requirements.

Ignoring Proofreading: Typos and grammatical errors can create a negative impression and suggest a lack of attention to detail. Always proofread your resume multiple times or ask someone else to review it before submission.

Conclusion

As a Payroll Accountant, your role is crucial in ensuring that employees are compensated accurately and on time. You manage payroll processes, maintain records, and ensure compliance with tax regulations and reporting requirements. Your attention to detail and analytical skills are essential for identifying discrepancies and resolving payroll issues.

Additionally, staying updated with the latest payroll software and tax laws can enhance your efficiency and effectiveness in this position. Collaboration with HR and finance teams is key, as well as strong communication skills to address employee inquiries regarding payroll matters.

In conclusion, to present yourself as a strong candidate for a Payroll Accountant position, it's essential to have a well-crafted resume that highlights your relevant skills and experience. Take the time to review your resume and ensure it showcases your qualifications effectively.

To assist you in this process, consider utilizing various tools available online. You can explore resume templates for professional layouts, use the resume builder for easy customization, review resume examples to get inspiration, and create impactful cover letters with cover letter templates. Start refining your resume today to stand out in the competitive job market!