Asset-Backed Securities Analyst Core Responsibilities

An Asset-Backed Securities Analyst plays a pivotal role in evaluating and managing asset-backed securities, requiring a blend of technical, operational, and problem-solving skills. This professional collaborates across departments, including finance, risk management, and compliance, to assess investments and ensure regulatory adherence. Strong analytical abilities and proficiency in financial modeling are essential for success, contributing to the organization’s strategic goals. A well-structured resume can effectively highlight these qualifications, showcasing the candidate's capacity to drive results.

Common Responsibilities Listed on Asset-Backed Securities Analyst Resume

- Conduct detailed credit analysis of asset-backed securities.

- Prepare financial models to evaluate potential investments.

- Monitor and report on the performance of asset-backed portfolios.

- Collaborate with risk management to assess investment risks.

- Ensure compliance with regulatory requirements and internal policies.

- Perform due diligence on underlying assets in securities.

- Prepare presentations and reports for stakeholders.

- Analyze market trends to inform investment strategies.

- Assist in structuring new asset-backed securities transactions.

- Engage in ongoing communication with investors and issuers.

- Utilize financial software and analytical tools for data analysis.

High-Level Resume Tips for Asset-Backed Securities Analyst Professionals

In the competitive field of asset-backed securities, a well-crafted resume serves as your first and often only chance to make a lasting impression on potential employers. As an Asset-Backed Securities Analyst, your resume must effectively showcase not just your technical skills, but also your achievements and the unique value you can bring to a firm. A polished resume is essential for reflecting your expertise in financial analysis, market trends, and risk assessment. This guide will provide practical and actionable resume tips specifically tailored for Asset-Backed Securities Analyst professionals, ensuring that you stand out in a crowded job market.

Top Resume Tips for Asset-Backed Securities Analyst Professionals

- Tailor your resume for each job application by incorporating keywords from the job description to highlight your relevant experience.

- Start with a strong summary statement that encapsulates your expertise and aligns with the requirements of the role.

- Use bullet points to clearly outline your responsibilities and achievements in previous positions, making it easy for hiring managers to scan your resume.

- Quantify your achievements whenever possible, such as specifying the percentage of risk reduction or revenue growth you contributed to in past roles.

- Highlight industry-specific skills such as knowledge of structured finance, credit analysis, and proficiency in relevant software tools (e.g., Excel, Bloomberg).

- Include certifications or relevant coursework that add credibility to your qualifications, such as CFA or specialized training in asset-backed securities.

- Showcase your understanding of regulatory frameworks and compliance issues related to asset-backed securities, as this is crucial for many employers.

- Keep your resume concise and focused—ideally one page—while ensuring it is well-organized and easy to read.

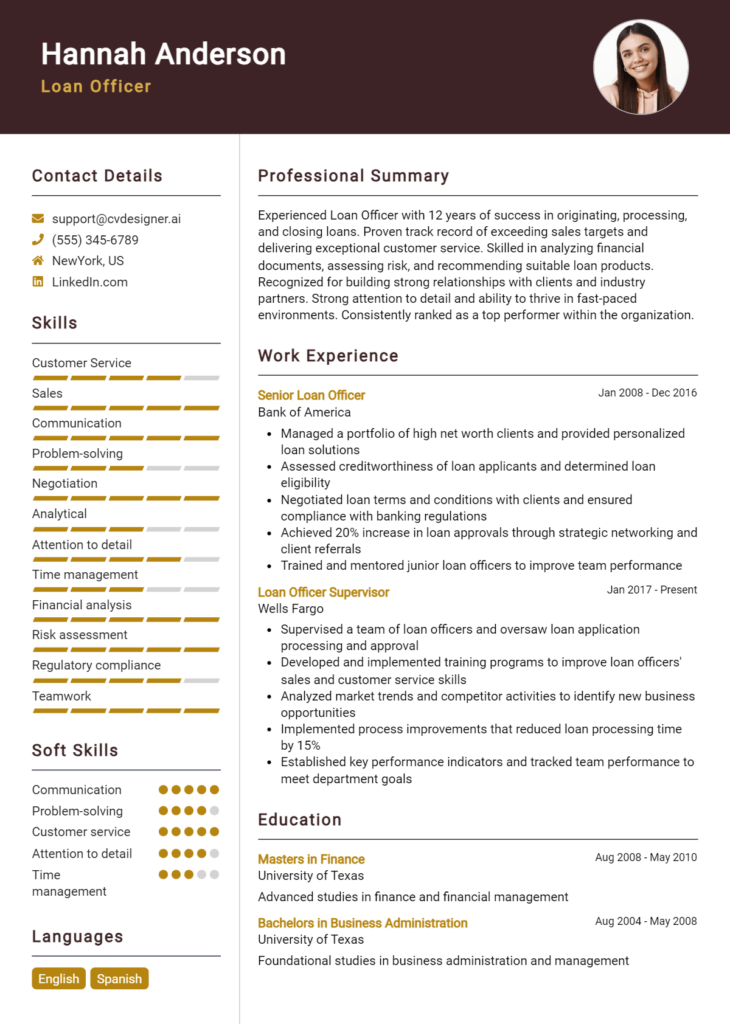

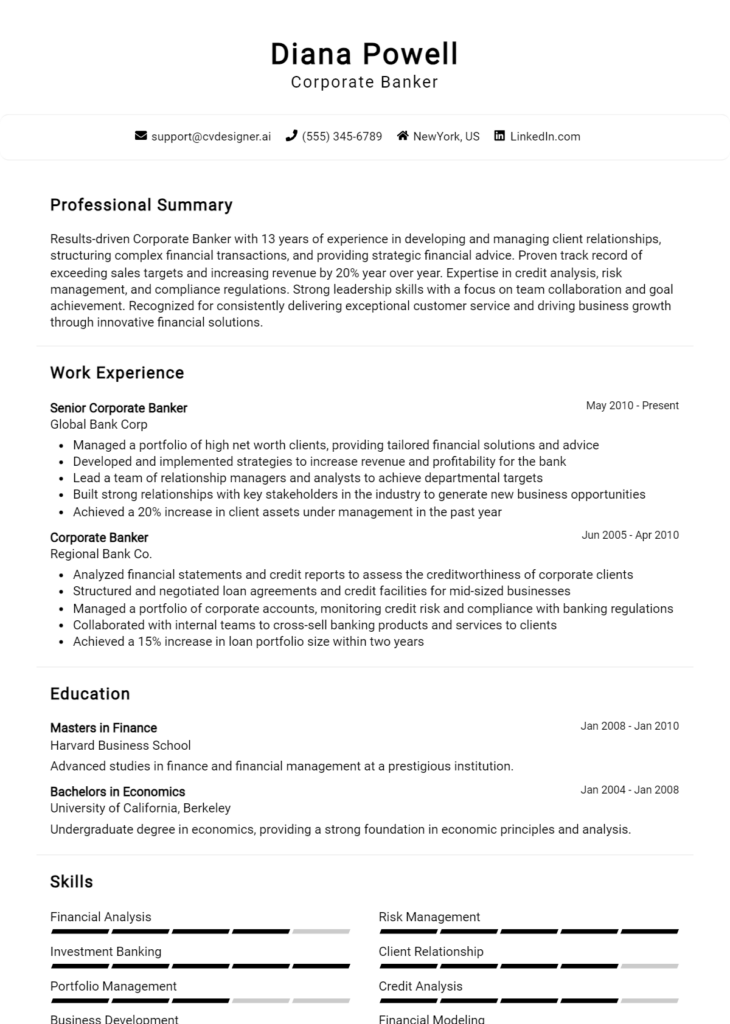

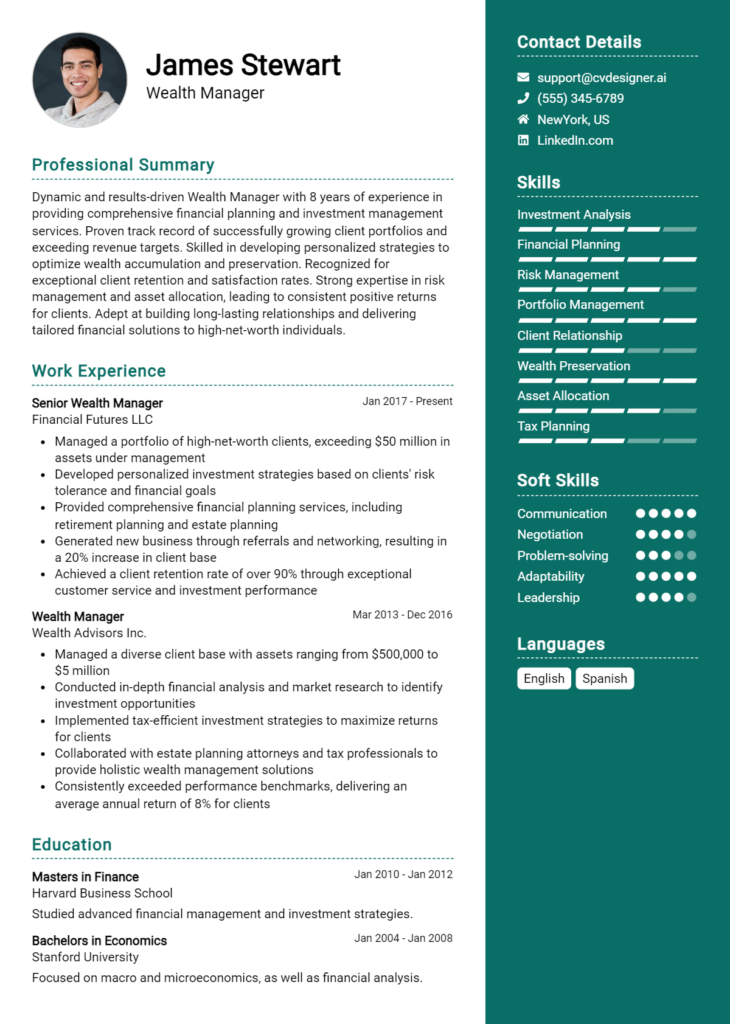

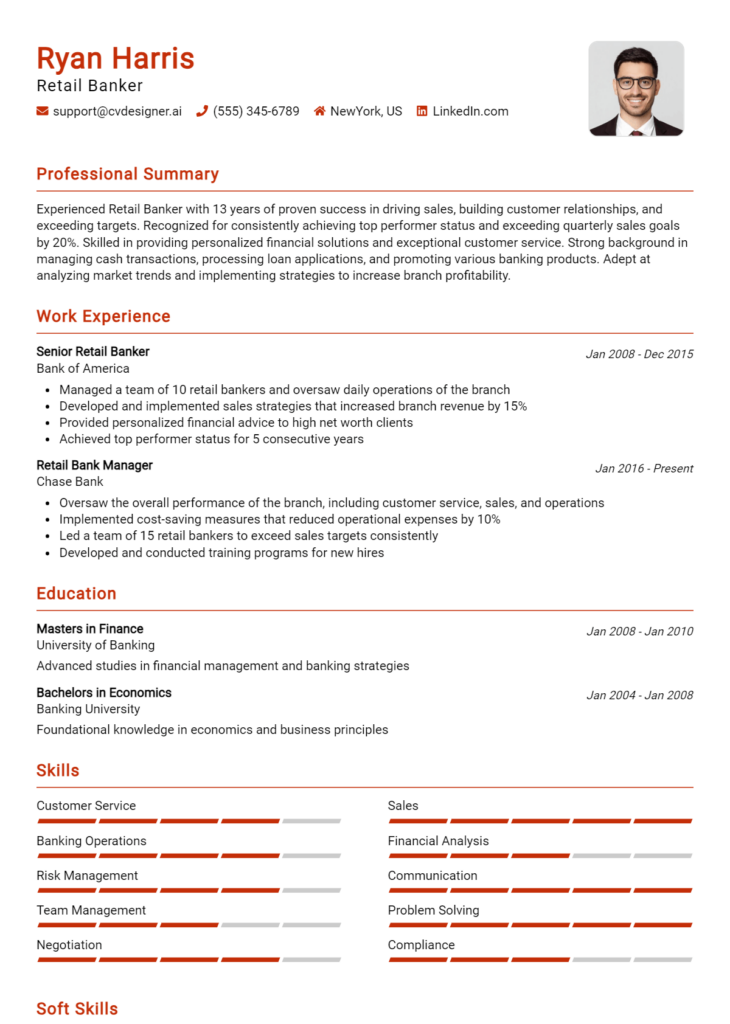

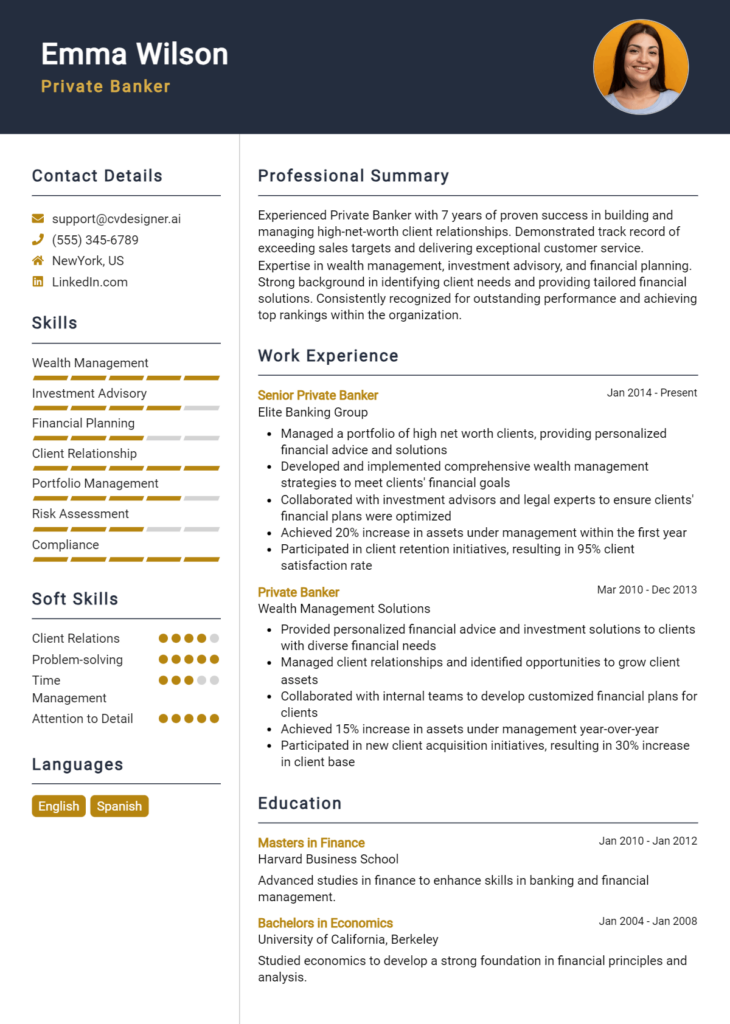

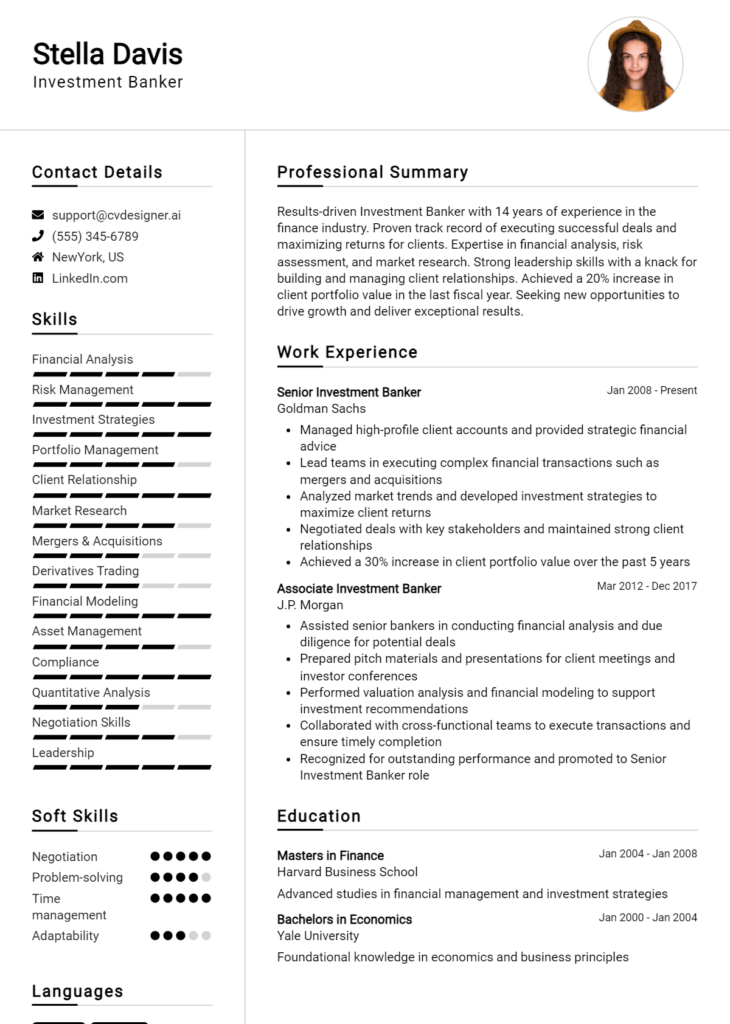

- Utilize a professional format and design that reflects the seriousness of the finance industry without being overly flashy.

By implementing these tips, you can significantly increase your chances of landing a job in the Asset-Backed Securities Analyst field. A targeted and well-structured resume not only highlights your skills and accomplishments but also demonstrates your understanding of the industry, making you a strong candidate in the eyes of potential employers.

Why Resume Headlines & Titles are Important for Asset-Backed Securities Analyst

In the competitive landscape of finance, specifically in the realm of asset-backed securities, the role of an Asset-Backed Securities Analyst is crucial. A well-crafted resume headline or title serves as a powerful first impression, capable of grabbing the attention of hiring managers and succinctly summarizing a candidate's key qualifications. It acts as a beacon, guiding employers to the most relevant information about a candidate's skills and experiences. A strong headline should be concise, relevant, and directly aligned with the position being applied for, ensuring that it captures the essence of what makes the candidate an outstanding fit for the role.

Best Practices for Crafting Resume Headlines for Asset-Backed Securities Analyst

- Keep it concise: Aim for one impactful phrase that summarizes your qualifications.

- Be role-specific: Tailor your headline to reflect the specific position you are applying for.

- Highlight key strengths: Focus on your most valuable skills or accomplishments relevant to asset-backed securities.

- Use industry terminology: Incorporate terminology commonly used in the asset-backed securities field to demonstrate familiarity.

- Showcase experience: If applicable, mention years of experience or key roles held in the industry.

- Avoid jargon: While using industry terms is important, ensure your headline is easily understandable.

- Make it impactful: Use strong action words to convey confidence and competence.

- Revise and refine: Review your headline multiple times to ensure clarity and effectiveness.

Example Resume Headlines for Asset-Backed Securities Analyst

Strong Resume Headlines

"Results-Driven Asset-Backed Securities Analyst with 5+ Years of Experience in Risk Assessment and Portfolio Management"

“Detail-Oriented Analyst Specializing in Structured Finance and Asset-Backed Securities Valuation”

“Dynamic Financial Analyst with Proven Expertise in Asset-Backed Securities and Credit Risk Analysis”

Weak Resume Headlines

“Analyst Looking for a Job”

“Finance Professional”

Strong headlines are effective because they provide specific information about a candidate's expertise and experience, immediately showcasing their value to potential employers. They utilize action-oriented language and relevant industry terms, making them engaging and informative. In contrast, weak headlines fail to impress because they lack specificity and do not convey the candidate's unique qualifications, leaving hiring managers with little incentive to explore further. By focusing on clarity and relevance, effective headlines can significantly enhance a resume’s impact.

Writing an Exceptional Asset-Backed Securities Analyst Resume Summary

A well-crafted resume summary is crucial for an Asset-Backed Securities Analyst as it serves as the first impression for hiring managers. This brief yet impactful section quickly captures attention by highlighting key skills, relevant experience, and notable accomplishments that align with the specific job role. A strong summary not only showcases the candidate's qualifications but also establishes their suitability for the position, making it easier for employers to see why they are a compelling choice. To maximize effectiveness, the summary should be concise, targeted, and tailored to the specific job description, ensuring that it resonates with the expectations of potential employers.

Best Practices for Writing a Asset-Backed Securities Analyst Resume Summary

- Quantify Achievements: Use numbers and statistics to illustrate your successes and impact in previous roles.

- Focus on Relevant Skills: Highlight specific skills that are directly applicable to asset-backed securities analysis, such as financial modeling and risk assessment.

- Tailor for the Job Description: Customize your summary to reflect the requirements and keywords mentioned in the job listing.

- Keep it Concise: Aim for 2-4 sentences that succinctly convey your qualifications and value.

- Use Action-Oriented Language: Start sentences with strong action verbs to demonstrate initiative and impact.

- Emphasize Industry Knowledge: Showcase your understanding of the asset-backed securities market and relevant regulations.

- Highlight Technical Proficiency: Mention any relevant software or tools you are proficient in, such as Excel or financial analysis software.

- Include Certifications: If applicable, refer to relevant certifications that enhance your credibility in the field.

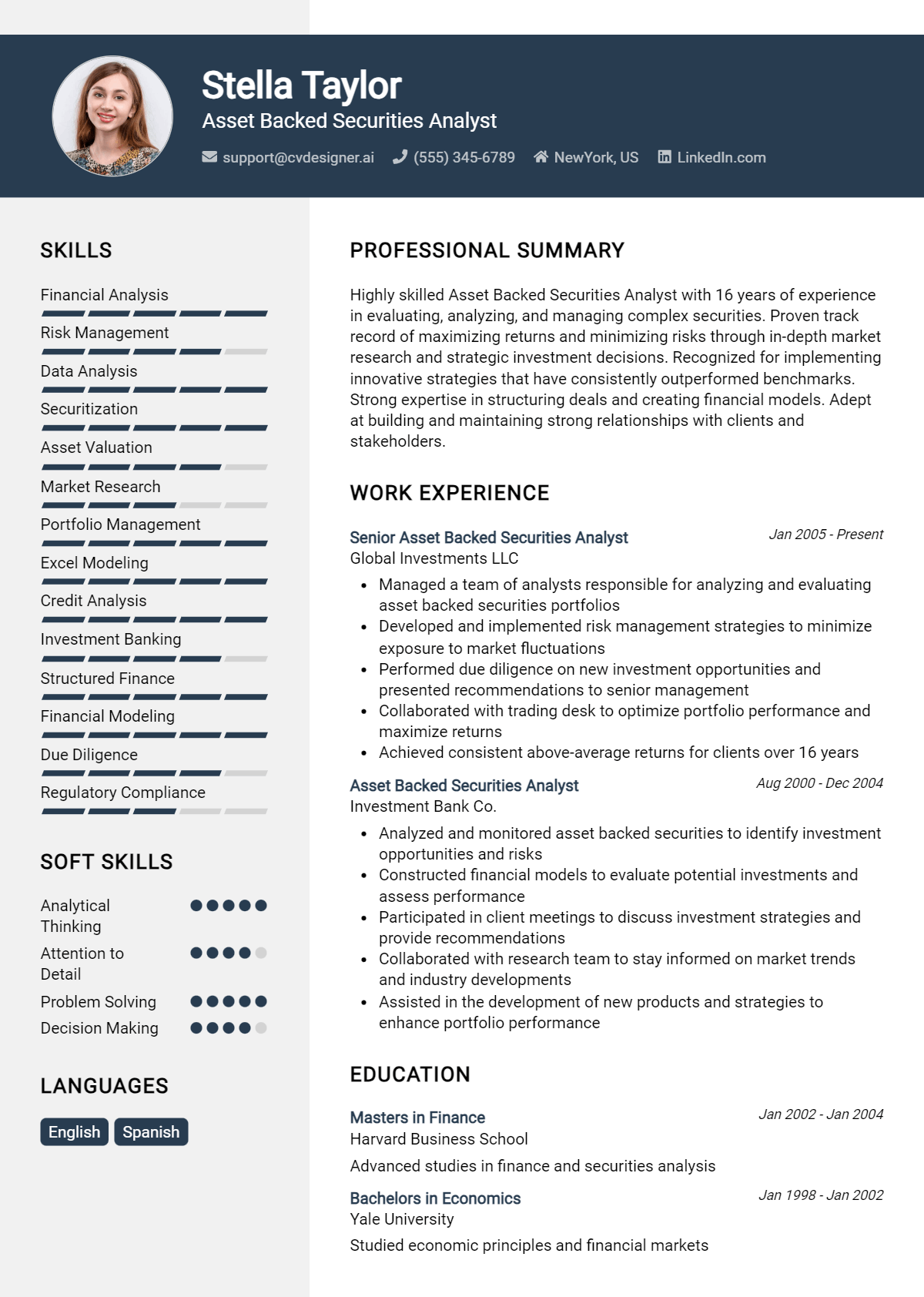

Example Asset-Backed Securities Analyst Resume Summaries

Strong Resume Summaries

Detail-oriented Asset-Backed Securities Analyst with over 5 years of experience in evaluating and managing structured finance products. Achieved a 30% increase in portfolio performance through rigorous risk assessment and strategic investment recommendations.

Results-driven financial analyst specializing in asset-backed securities, with a proven track record of conducting in-depth credit analysis and modeling that led to a 25% reduction in default rates across a $500 million portfolio.

Experienced Asset-Backed Securities Analyst with expertise in market analysis and asset valuation, recognized for enhancing reporting efficiency by 40% through the implementation of advanced analytical tools and techniques.

Weak Resume Summaries

Analyst with some experience in finance and asset-backed securities, looking for a new opportunity to grow my career.

Dedicated professional with a basic understanding of asset-backed securities and finance. Seeking to apply my skills in a challenging role.

The strong resume summaries are effective because they provide specific metrics and outcomes that demonstrate the candidate's impact and expertise in the field of asset-backed securities. They highlight relevant skills and achievements that make the candidates stand out. In contrast, the weak summaries lack detail and specificity, failing to convey the candidates' qualifications or the value they can bring to the role, making them less compelling to hiring managers.

Work Experience Section for Asset-Backed Securities Analyst Resume

The work experience section of an Asset-Backed Securities Analyst resume is pivotal in demonstrating the candidate's technical acumen, leadership capabilities, and commitment to delivering high-quality products. It serves as a narrative of the candidate's professional journey, showcasing their skills in analyzing securities, managing projects, and collaborating effectively with teams. By quantifying achievements and aligning experience with industry standards, candidates can provide compelling evidence of their contributions and impact within the asset-backed securities domain.

Best Practices for Asset-Backed Securities Analyst Work Experience

- Highlight specific technical skills relevant to asset-backed securities, such as cash flow modeling and risk assessment.

- Quantify achievements by including metrics, such as percentage increases in efficiency or reductions in risk exposure.

- Detail collaborative projects that demonstrate your ability to work effectively within a team environment.

- Use action verbs to convey a sense of impact and leadership in your previous roles.

- Align descriptions of past experiences with industry standards and common terminology used in the asset-backed securities field.

- Focus on outcomes and how your contributions led to successful project completions or enhanced performance.

- Include relevant certifications or training that bolster your qualifications in asset-backed securities analysis.

- Avoid jargon that may not be familiar to all readers; strive for clarity and precision in your descriptions.

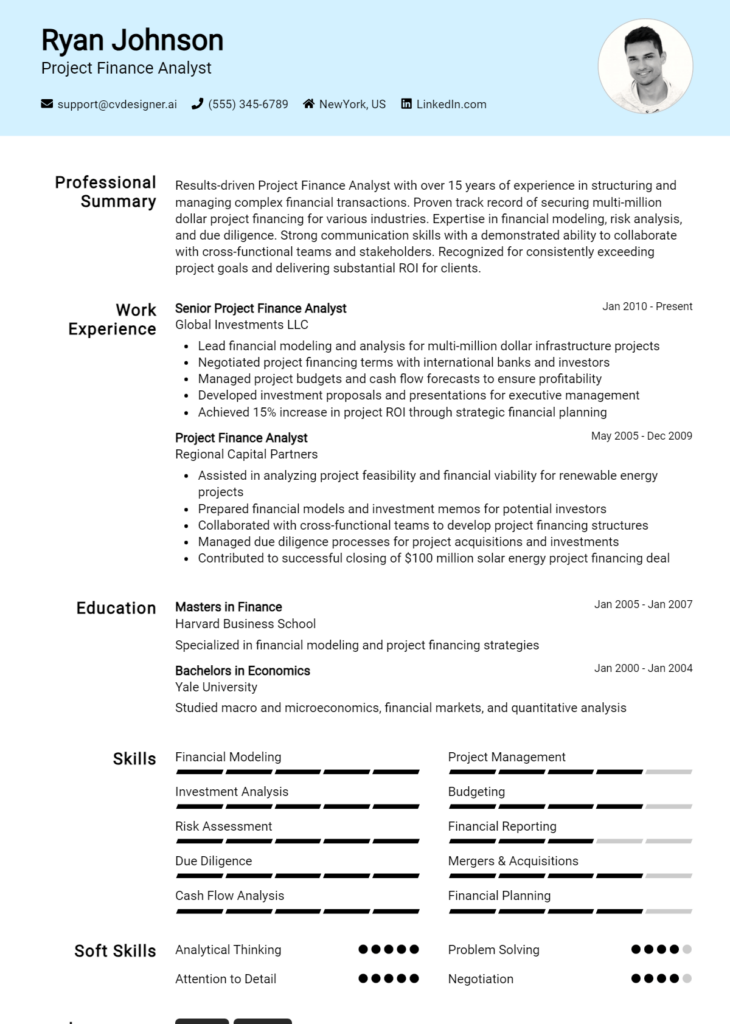

Example Work Experiences for Asset-Backed Securities Analyst

Strong Experiences

- Led a cross-functional team in the analysis of a $500 million asset-backed securities portfolio, resulting in a 15% increase in investment returns through strategic risk management.

- Developed and implemented a cash flow modeling system that improved forecasting accuracy by 30%, enhancing decision-making for stakeholders.

- Collaborated with legal and compliance departments to streamline documentation processes, reducing turnaround time by 25% while ensuring regulatory adherence.

- Presented analytical findings to senior management, facilitating a pivotal decision that resulted in the acquisition of high-yield asset-backed securities worth $200 million.

Weak Experiences

- Worked on various projects related to asset-backed securities.

- Assisted in analyzing financial data for the team.

- Participated in meetings about securities.

- Contributed to reports on asset-backed investments.

The examples listed as strong experiences are considered effective because they provide specific accomplishments, quantifiable results, and demonstrate leadership and collaboration. In contrast, the weak experiences lack detail, specificity, and measurable outcomes, making them less impactful and failing to convey the candidate's true capabilities and contributions in the asset-backed securities field.

Education and Certifications Section for Asset-Backed Securities Analyst Resume

The education and certifications section of an Asset-Backed Securities Analyst resume is pivotal in demonstrating a candidate's academic background, relevant industry certifications, and commitment to continuous learning. This section serves as a window into the candidate's foundational knowledge and specialized training that directly correlate with the job role. By providing relevant coursework, recognized certifications, and any specialized training, candidates can significantly enhance their credibility and showcase their alignment with the responsibilities and expectations of the position.

Best Practices for Asset-Backed Securities Analyst Education and Certifications

- Include degrees relevant to finance, economics, or accounting to establish a solid educational foundation.

- List industry-recognized certifications such as Chartered Financial Analyst (CFA) or Certified Treasury Professional (CTP) to highlight expertise.

- Provide details of relevant coursework that aligns with asset-backed securities, such as financial modeling or risk management.

- Keep the information concise, focusing on the most relevant qualifications that directly pertain to the role.

- Emphasize any specialized training or workshops that add depth to your knowledge in asset-backed securities.

- Use bullet points for clarity and ease of reading, allowing recruiters to quickly scan for key qualifications.

- Update the section regularly to reflect any new qualifications or ongoing education efforts.

- Tailor the content to align with specific job descriptions, emphasizing qualifications that match the employer's needs.

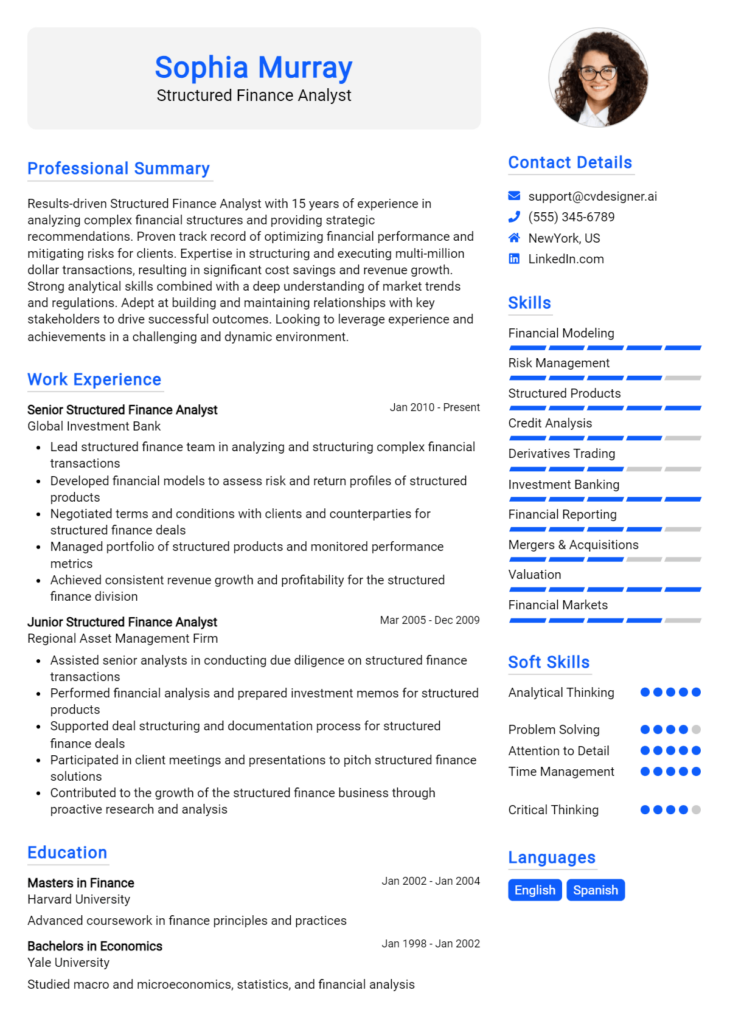

Example Education and Certifications for Asset-Backed Securities Analyst

Strong Examples

- MBA in Finance, University of Chicago Booth School of Business, 2022

- Chartered Financial Analyst (CFA) Level II Candidate

- Completed coursework in Asset-Backed Securities and Financial Derivatives at New York University

- Certified Risk Management Professional (CRMP), 2021

Weak Examples

- Bachelor's in Art History, University of California, 2010

- Certification in Basic Excel Skills, 2019

- High School Diploma, 2005

- Outdated certification in Securities Licensing from 2010

The examples provided reflect a clear distinction between strong and weak qualifications. Strong examples showcase degrees and certifications that are directly relevant to the asset-backed securities field, indicating advanced knowledge and dedication to the industry. In contrast, weak examples highlight irrelevant or outdated qualifications that do not contribute to the candidate's suitability for the role, thereby diminishing their overall credibility in a competitive job market.

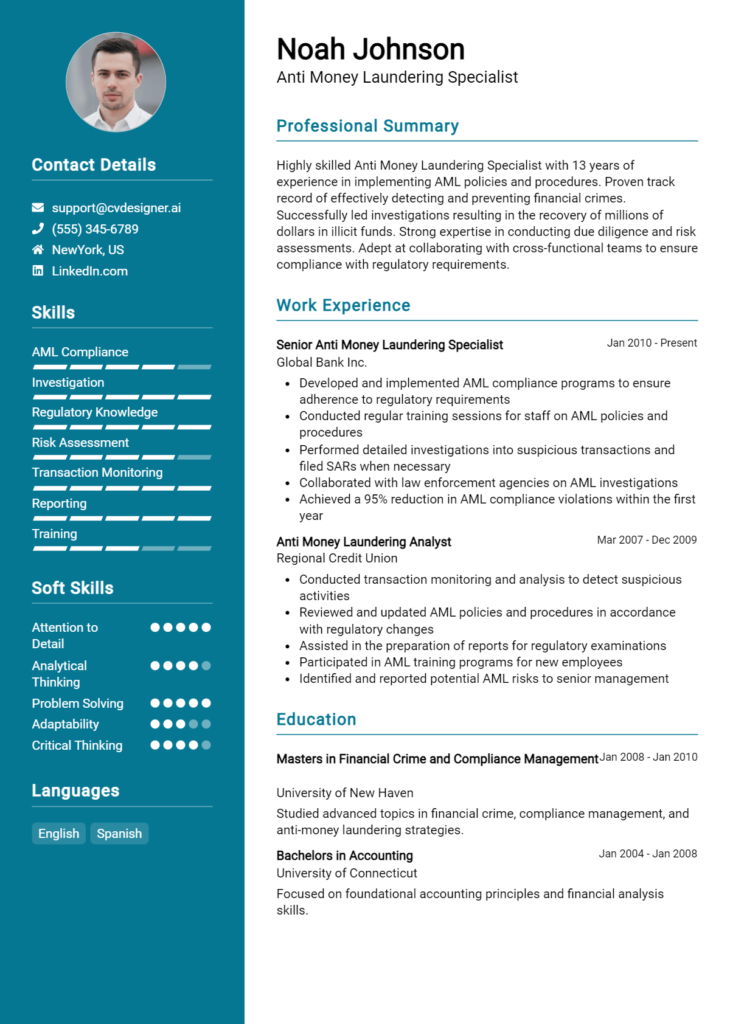

Top Skills & Keywords for Asset-Backed Securities Analyst Resume

As an Asset-Backed Securities Analyst, showcasing the right skills on your resume is crucial for standing out in a competitive job market. The ability to effectively analyze and interpret complex financial data, coupled with strong interpersonal and communication skills, can significantly enhance your candidacy. Employers look for a blend of technical expertise and soft skills that demonstrate not only your proficiency in asset-backed securities but also your ability to collaborate and contribute to team objectives. By highlighting both hard and soft skills relevant to this role, you can create a compelling resume that showcases your qualifications and readiness to excel in the finance industry.

Top Hard & Soft Skills for Asset-Backed Securities Analyst

Hard Skills

- Financial modeling

- Data analysis

- Risk assessment

- Valuation techniques

- Knowledge of securitization processes

- Asset valuation

- Credit analysis

- Regulatory compliance

- Portfolio management

- Statistical analysis

- Excel and advanced spreadsheet proficiency

- SQL and database management

- Financial reporting

- Familiarity with Bloomberg and other financial software

- Understanding of fixed income securities

- Market research

- Quantitative analysis

Soft Skills

- Strong analytical thinking

- Attention to detail

- Effective communication skills

- Problem-solving abilities

- Team collaboration

- Time management

- Adaptability to change

- Critical thinking

- Negotiation skills

- Client relationship management

- Initiative and self-motivation

- Emotional intelligence

- Conflict resolution

- Leadership potential

- Strategic thinking

- Networking abilities

- Ability to work under pressure

By integrating both skills and relevant work experience into your resume, you can create a comprehensive representation of your capabilities as an Asset-Backed Securities Analyst.

Stand Out with a Winning Asset-Backed Securities Analyst Cover Letter

I am writing to express my interest in the Asset-Backed Securities Analyst position at [Company Name], as advertised on [Job Board/Company Website]. With a strong foundation in finance and a deep understanding of asset-backed securities (ABS), I am excited about the opportunity to contribute to your team. My experience in analyzing and structuring ABS transactions, coupled with my analytical skills, make me a strong candidate for this role.

In my previous position at [Previous Company Name], I was responsible for conducting comprehensive credit analysis of various asset classes, including auto loans, credit card receivables, and mortgage-backed securities. By leveraging sophisticated financial models and analytical tools, I successfully identified key risk factors and developed strategies to mitigate potential losses. My ability to interpret complex data and present actionable insights to stakeholders has been instrumental in driving investment decisions and optimizing portfolio performance.

I am particularly drawn to [Company Name] because of its reputation for innovation in the financial services sector and its commitment to delivering value to clients. I am eager to bring my expertise in ABS and passion for financial markets to your team. I am confident that my proactive approach, strong attention to detail, and commitment to excellence will allow me to make a meaningful contribution to [Company Name]'s success.

Thank you for considering my application. I look forward to the opportunity to discuss how my background and skills align with the needs of your team. I am excited about the possibility of contributing to the success of [Company Name] and helping to navigate the complexities of the asset-backed securities market.

Common Mistakes to Avoid in a Asset-Backed Securities Analyst Resume

When crafting a resume for an Asset-Backed Securities Analyst position, it's crucial to present your qualifications and experience effectively. However, many candidates make common mistakes that can detract from their overall appeal to potential employers. Avoiding these pitfalls can significantly enhance your chances of landing an interview. Here are some common mistakes to watch for when creating your resume:

Generic Objective Statements: Using a one-size-fits-all objective statement can make your resume feel impersonal. Tailor your objective to reflect your specific interest in asset-backed securities and your career goals within the industry.

Overloading with Technical Jargon: While technical terms are important in finance, excessive jargon can alienate readers. Use clear language to describe your skills and experiences, ensuring they are understandable to both technical and non-technical audiences.

Neglecting Quantifiable Achievements: Failing to include specific accomplishments can make your resume less impactful. Highlight your contributions with quantifiable results, such as improvements in portfolio performance or successful deal closures.

Ignoring Relevant Experience: Some candidates overlook their relevant experience by focusing solely on their most recent job. Include all pertinent roles, internships, and projects that demonstrate your skills in asset-backed securities and related fields.

Poor Formatting: A cluttered or inconsistent format can make your resume difficult to read. Use clear headings, bullet points, and a consistent font throughout to ensure your information is easily digestible.

Lack of Customization for Each Application: Sending out the same resume for every job application can reduce your chances of standing out. Customize your resume for each position by aligning your skills and experiences with the specific job requirements.

Failure to Highlight Soft Skills: Technical expertise is vital, but soft skills like communication, teamwork, and problem-solving are equally important. Make sure to showcase these attributes, as they are crucial in collaborative environments.

Skipping the Cover Letter: A resume alone may not provide enough context for your qualifications. Neglecting to include a cover letter can mean missing an opportunity to explain your interest in the position and how your background makes you a suitable candidate.

Conclusion

As an Asset-Backed Securities Analyst, your role is pivotal in evaluating the performance and risks associated with securities backed by various assets. This article explored the essential skills required for the position, including financial modeling, risk assessment, and a deep understanding of market trends. Furthermore, we highlighted the importance of effective communication skills, as you will often collaborate with stakeholders and present your findings clearly.

In addition to technical skills, staying updated on regulatory changes and economic factors influencing asset-backed securities is crucial. We also discussed the significance of experience in financial analysis and familiarity with investment strategies that can impact asset-backed securities portfolios.

In conclusion, if you're aiming to advance your career as an Asset-Backed Securities Analyst, it's vital to ensure that your resume reflects your expertise and achievements effectively. We encourage you to take a moment to review your resume and consider utilizing available resources. Check out resume templates, build a standout document with our resume builder, explore resume examples, and craft a compelling introduction with our cover letter templates. Investing time in refining your resume could significantly enhance your job prospects in the competitive field of asset-backed securities.