Credit Analyst Core Responsibilities

A Credit Analyst plays a crucial role in evaluating creditworthiness and financial risks for organizations. Key responsibilities include analyzing financial statements, assessing credit data, and preparing reports to inform lending decisions. This role requires strong technical skills in financial modeling, operational expertise in risk assessment, and problem-solving abilities to navigate complex financial scenarios. By bridging finance, risk management, and operations, Credit Analysts contribute significantly to organizational goals. A well-structured resume can effectively highlight these qualifications, showcasing a candidate's ability to drive informed decision-making.

Common Responsibilities Listed on Credit Analyst Resume

- Conduct thorough analysis of financial statements and credit reports.

- Assess the creditworthiness of individuals and businesses.

- Prepare detailed credit proposals and risk assessment reports.

- Monitor and evaluate existing credit accounts for ongoing risk.

- Collaborate with underwriters and loan officers to guide lending decisions.

- Utilize financial modeling techniques to project cash flows.

- Maintain up-to-date knowledge of industry regulations and market trends.

- Communicate findings and recommendations to stakeholders across departments.

- Develop and implement credit risk policies and procedures.

- Perform stress testing and scenario analysis for credit portfolios.

- Participate in the training and development of junior analysts.

- Assist in the preparation of presentations for senior management.

High-Level Resume Tips for Credit Analyst Professionals

In today's competitive job market, a well-crafted resume is essential for Credit Analyst professionals looking to make a strong impression on potential employers. Your resume is often the first point of contact between you and your prospective employer, serving as a powerful marketing tool that showcases your skills, experience, and accomplishments. It needs to not only reflect your capabilities but also demonstrate your understanding of the financial industry and analytical prowess. In this guide, we will provide practical and actionable resume tips specifically tailored for Credit Analyst professionals, ensuring you stand out in the applicant pool.

Top Resume Tips for Credit Analyst Professionals

- Tailor your resume to the job description: Highlight the skills and experiences that align closely with the specific requirements of the job you are applying for.

- Showcase relevant experience: Include internships, entry-level jobs, or projects that demonstrate your analytical skills and understanding of credit markets.

- Quantify your achievements: Use numbers to illustrate your accomplishments, such as the percentage of loan applications you successfully analyzed or the amount of money saved through your recommendations.

- Highlight industry-specific skills: Emphasize technical skills such as financial modeling, risk assessment, and proficiency in relevant software (e.g., Excel, SAS, or specific credit analysis tools).

- Use clear and concise language: Avoid jargon and ensure your resume is easy to read, making your qualifications apparent at a glance.

- Include relevant certifications: Mention any certifications such as CFA, FRM, or any other finance-related designations that enhance your credibility.

- Demonstrate your knowledge of regulatory frameworks: Familiarity with laws and regulations governing credit and lending can set you apart from other candidates.

- Incorporate a strong summary statement: Begin your resume with a compelling summary that encapsulates your expertise and career goals in the credit analysis field.

- Be mindful of formatting: Use a clean, professional layout that enhances readability, and ensure consistency in font, bullet points, and headings.

By implementing these tips, you can significantly increase your chances of landing a job in the Credit Analyst field. A well-structured and thoughtfully crafted resume not only showcases your qualifications but also demonstrates your commitment to the profession, ultimately helping you to stand out in a competitive job market.

Why Resume Headlines & Titles are Important for Credit Analyst

In the competitive field of credit analysis, a well-crafted resume is essential for standing out. Among the critical components of a resume, headlines and titles play a pivotal role. A strong resume headline can instantly capture the attention of hiring managers and serve as a succinct summary of a candidate's key qualifications. It should be concise yet powerful, providing a glimpse into the candidate’s expertise and relevance to the position being applied for. This first impression can set the tone for the entire application, making it imperative for candidates to carefully select a headline that resonates with the specific job requirements.

Best Practices for Crafting Resume Headlines for Credit Analyst

- Keep it concise—aim for one impactful phrase.

- Make it role-specific—align with the job description.

- Highlight key qualifications or accomplishments.

- Use action-oriented language to convey confidence.

- Avoid jargon unless it's widely recognized in the industry.

- Incorporate relevant keywords that match the job posting.

- Focus on your unique selling points to differentiate yourself.

- Revise and tailor your headline for each application.

Example Resume Headlines for Credit Analyst

Strong Resume Headlines

Results-Driven Credit Analyst with 5+ Years of Experience in Risk Assessment

Detail-Oriented Financial Analyst Specializing in Credit Risk and Portfolio Management

Proven Track Record in Enhancing Credit Policies and Improving Approval Rates

Weak Resume Headlines

Credit Analyst Looking for a Job

Finance Professional with Experience

The strong headlines are effective because they succinctly convey the candidate’s relevant experience and unique strengths, making an immediate impact on hiring managers. They are tailored to the role and provide a clear indication of what the applicant brings to the table. In contrast, the weak headlines fall short as they lack specificity and fail to highlight key qualifications, making them forgettable and less likely to grab attention in a competitive job market.

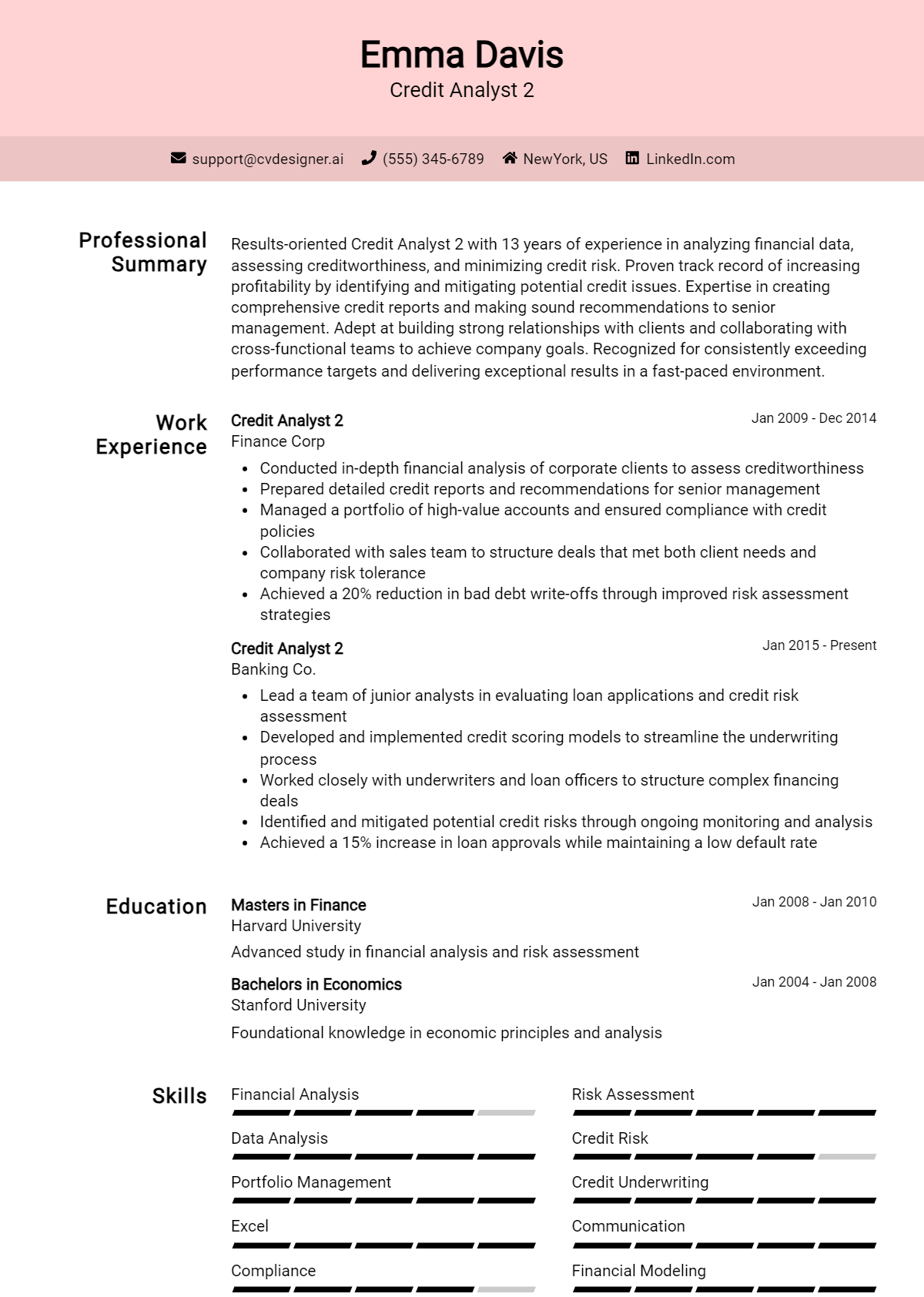

Writing an Exceptional Credit Analyst Resume Summary

A well-crafted resume summary is a critical component of a Credit Analyst's resume, as it serves as the first impression a hiring manager will have of a candidate. A strong summary quickly captures attention by highlighting key skills, relevant experience, and notable accomplishments that align with the job role. It should be concise and impactful, tailored to the specific job description, showcasing the applicant's unique qualifications and setting the stage for the rest of the resume.

Best Practices for Writing a Credit Analyst Resume Summary

- Quantify achievements: Use numbers to demonstrate your impact, such as the amount of credit analyzed or percentage of risk reduced.

- Focus on skills: Highlight key skills relevant to the role, such as financial analysis, risk assessment, and data interpretation.

- Tailor to the job description: Customize the summary to reflect the specific requirements and language used in the job posting.

- Be concise: Aim for 2-4 sentences that deliver essential information without unnecessary detail.

- Showcase industry knowledge: Mention any relevant industry experience or certifications that enhance your credibility.

- Use action verbs: Start sentences with strong action verbs to convey confidence and proactivity.

- Highlight soft skills: Include relevant soft skills such as communication, teamwork, and problem-solving abilities that are crucial for a Credit Analyst.

Example Credit Analyst Resume Summaries

Strong Resume Summaries

Detail-oriented Credit Analyst with over 5 years of experience in evaluating credit risk for a portfolio of over $100 million. Proven track record of reducing default rates by 15% through comprehensive risk assessments and strategic credit recommendations.

Analytical Credit Analyst skilled in financial modeling and data analysis, with a history of increasing loan approval efficiency by 20%. Expert in utilizing advanced credit scoring systems and providing actionable insights to improve lending strategies.

Results-driven Credit Analyst with expertise in credit risk management and a commitment to enhancing profitability. Successfully implemented a new credit analysis framework that decreased turnaround time by 30%, leading to improved customer satisfaction.

Weak Resume Summaries

Credit Analyst with experience in the finance industry looking for a new opportunity.

Motivated individual seeking a credit analyst position to utilize my skills in financial analysis and risk assessment.

The examples labeled as strong are effective because they include specific achievements, quantify results, and highlight relevant skills that directly relate to the Credit Analyst role. They demonstrate a clear understanding of the responsibilities and impact of the position. In contrast, the weak examples are vague and generic, failing to provide concrete evidence of the candidate’s qualifications or specific skills, making it difficult for hiring managers to gauge their suitability for the role.

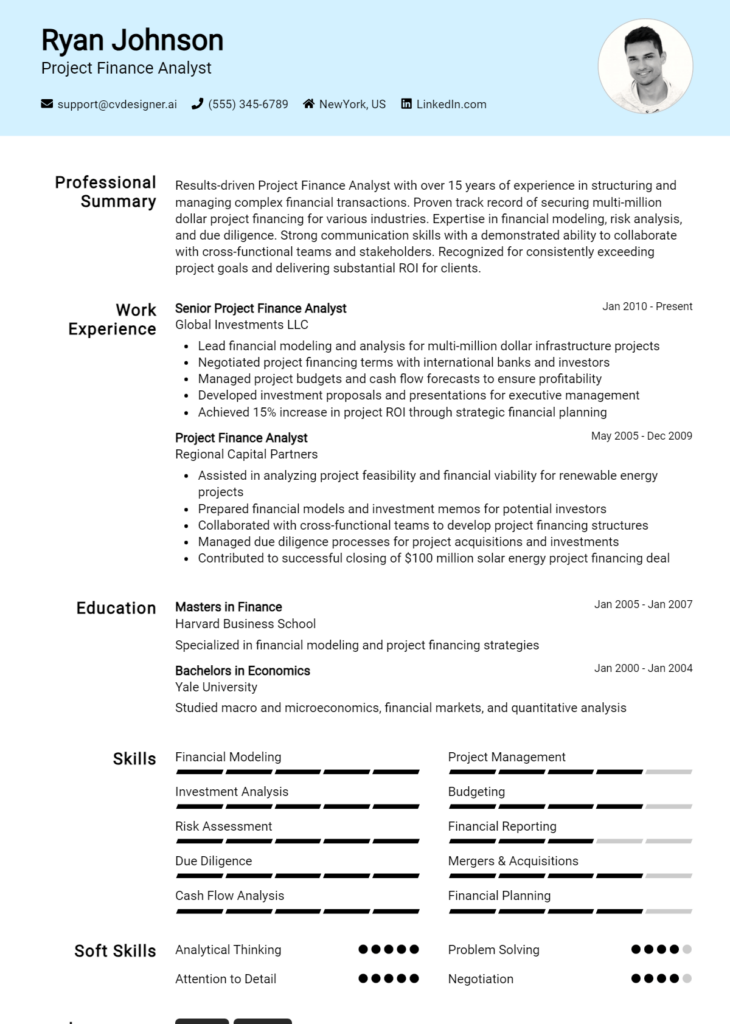

Work Experience Section for Credit Analyst Resume

The work experience section of a Credit Analyst resume is crucial as it provides a platform for candidates to demonstrate their technical skills, team management capabilities, and commitment to delivering high-quality financial products. This section allows potential employers to assess how well a candidate's past experiences align with industry standards and expectations. By quantifying achievements and highlighting relevant experiences, candidates can effectively showcase their impact in previous roles, making a strong case for their suitability for the position.

Best Practices for Credit Analyst Work Experience

- Highlight technical skills relevant to credit analysis, such as financial modeling, risk assessment, and data analytics.

- Quantify achievements wherever possible, using metrics to illustrate the scope and impact of your work.

- Use industry-specific terminology to demonstrate familiarity with the credit analysis field.

- Emphasize collaboration by detailing experiences working with cross-functional teams, such as finance, marketing, and operations.

- Include examples of leadership or initiatives taken that led to improved processes or outcomes.

- Tailor your work experience to align with the job description, highlighting relevant tasks and achievements.

- Maintain clarity and conciseness in descriptions to ensure easy readability.

- Focus on continuous professional development, mentioning any relevant certifications or training completed.

Example Work Experiences for Credit Analyst

Strong Experiences

- Led a team of analysts to revamp the credit assessment process, reducing approval times by 30% while maintaining a default rate below 1%.

- Developed a predictive model that increased loan portfolio profitability by 15%, using advanced data analytics tools.

- Collaborated with the risk management team to create a comprehensive risk assessment framework that improved compliance with regulatory standards by 25%.

- Managed a project that analyzed customer credit scores leading to a 20% increase in credit limit approvals, resulting in a 10% increase in revenue.

Weak Experiences

- Assisted team members with various tasks related to credit analysis.

- Worked on projects that involved analyzing data without specifying outcomes or results.

- Participated in meetings discussing credit policies and procedures.

- Completed routine credit assessments with no mention of efficiency or effectiveness improvements.

The examples provided illustrate the difference between strong and weak experiences in a Credit Analyst resume. Strong experiences are characterized by quantifiable achievements, technical leadership, and collaborative efforts that clearly demonstrate a candidate's capabilities and contributions. In contrast, weak experiences lack specific outcomes, metrics, and depth, making them less impactful and memorable to potential employers. By focusing on strong examples, candidates can significantly enhance their chances of standing out in a competitive job market.

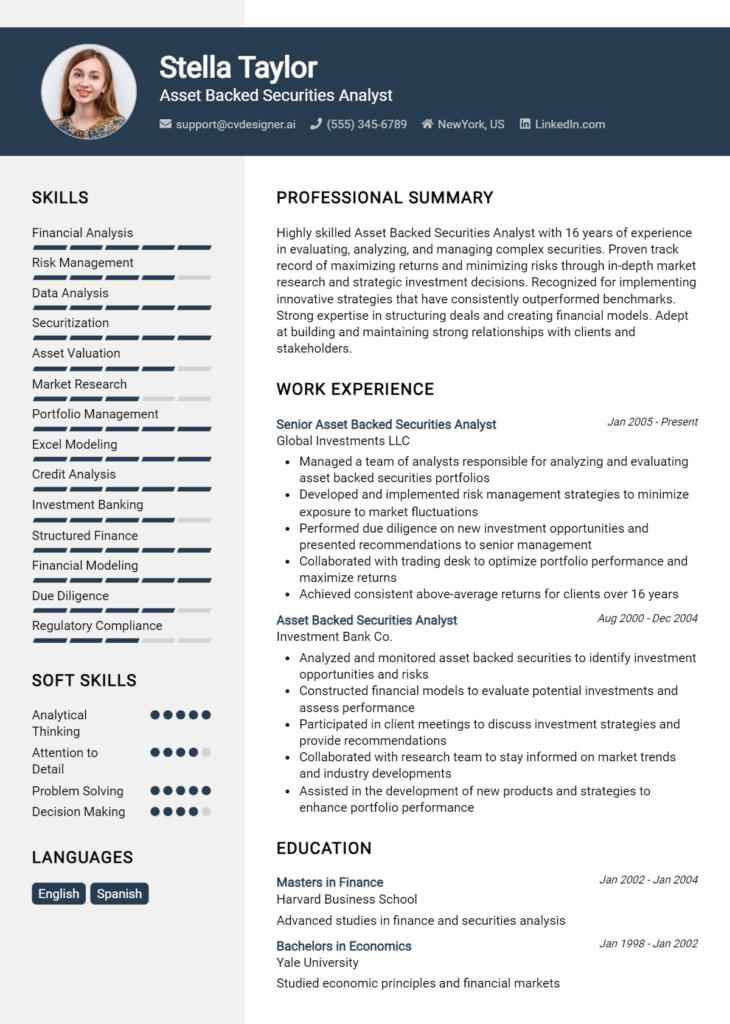

Education and Certifications Section for Credit Analyst Resume

The education and certifications section of a Credit Analyst resume plays a crucial role in showcasing a candidate's academic qualifications and commitment to the finance sector. This section not only highlights the foundational knowledge acquired through formal education but also emphasizes industry-relevant certifications that signal expertise and credibility. By providing details about relevant coursework, specialized training, and ongoing education efforts, candidates can effectively demonstrate their alignment with the job requirements and their dedication to professional growth. This strategic presentation of educational background and credentials can significantly enhance a candidate's appeal to potential employers.

Best Practices for Credit Analyst Education and Certifications

- Prioritize relevant degrees such as Finance, Accounting, or Economics.

- Include industry-recognized certifications like CFA, CPA, or CCRA.

- List relevant coursework that directly relates to credit analysis, risk assessment, or financial modeling.

- Highlight any specialized training or workshops that demonstrate advanced skills.

- Be specific about the levels of education completed, including honors or distinctions.

- Keep the section organized and easy to read, using bullet points for clarity.

- Update the section regularly to reflect any new qualifications or ongoing education.

- Consider including professional development courses relevant to credit analysis or financial regulations.

Example Education and Certifications for Credit Analyst

Strong Examples

- Bachelor of Science in Finance, University of XYZ, Graduated Cum Laude

- Chartered Financial Analyst (CFA) Level II Candidate

- Certificate in Credit Analysis, ABC Institute of Finance

- Relevant Coursework: Risk Management, Financial Statement Analysis, and Investment Analysis

Weak Examples

- Bachelor of Arts in History, University of ABC

- Certificate in Basic Accounting (Completed 2015)

- Online Course in Personal Finance (No Certification)

- High School Diploma, Graduated 2010

The examples provided are considered strong because they reflect a clear focus on relevant education and industry-recognized certifications that enhance a candidate's qualifications for a Credit Analyst role. The inclusion of specific degrees and coursework directly related to finance showcases the candidate's preparedness for the position. On the other hand, the weak examples lack relevance to the financial sector, featuring outdated or unrelated qualifications that do not align with the expectations of hiring managers seeking skilled credit analysts.

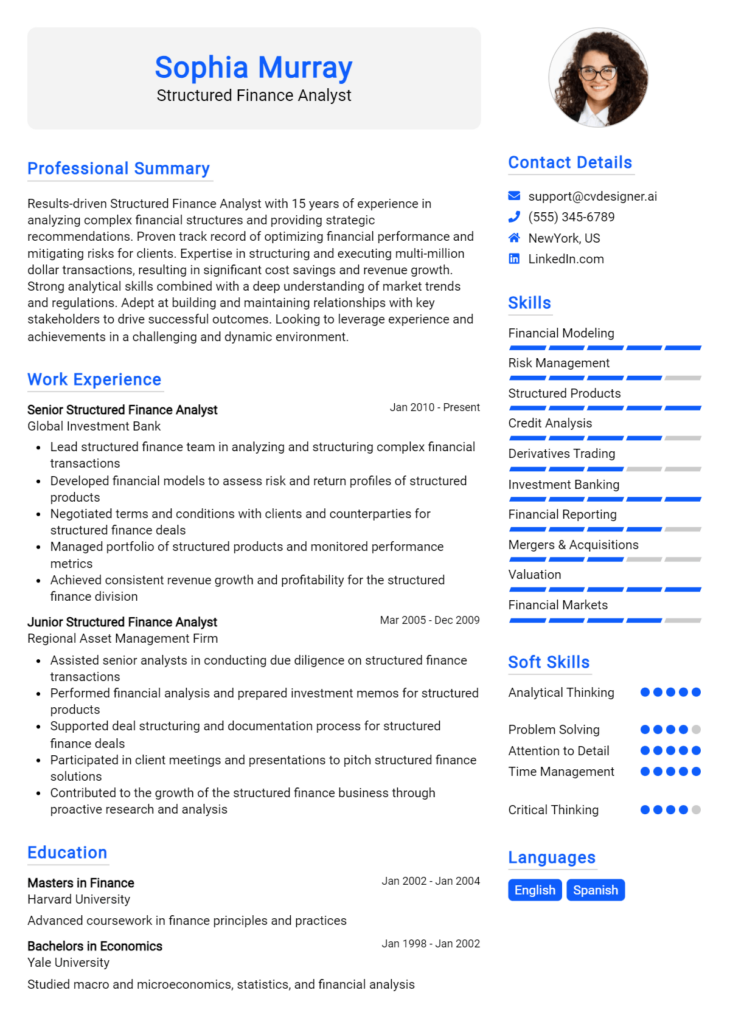

Top Skills & Keywords for Credit Analyst Resume

As a Credit Analyst, possessing the right skills is crucial for effectively assessing creditworthiness and making informed lending decisions. A well-crafted resume that highlights both hard and soft skills can significantly enhance your chances of landing a job in this competitive field. Employers look for candidates who not only have analytical capabilities but also strong interpersonal skills to communicate findings and collaborate with various stakeholders. By emphasizing these skills, you can demonstrate your ability to navigate the complexities of credit analysis and contribute positively to a financial institution's objectives.

Top Hard & Soft Skills for Credit Analyst

Soft Skills

- Strong Analytical Thinking

- Attention to Detail

- Effective Communication

- Problem-Solving Abilities

- Time Management

- Team Collaboration

- Adaptability

- Critical Thinking

- Conflict Resolution

- Customer Service Orientation

Hard Skills

- Financial Analysis

- Credit Risk Assessment

- Data Analysis

- Proficiency in Financial Modeling

- Knowledge of Credit Scoring Systems

- Familiarity with Regulatory Requirements

- Advanced Excel Skills

- Statistical Analysis Software (e.g., SAS, R)

- Knowledge of Financial Statements

- Understanding of Economic Indicators

By integrating these skills into your resume, you can create a compelling narrative that showcases your qualifications for the Credit Analyst role. For more insights on how to enhance your resume, check out our sections on skills and work experience.

Stand Out with a Winning Credit Analyst Cover Letter

I am writing to express my interest in the Credit Analyst position at [Company Name] as advertised on [where you found the job listing]. With a robust background in financial analysis and a strong understanding of credit evaluation processes, I am excited about the opportunity to contribute to your team. My academic qualifications, combined with [X years] of hands-on experience in the finance sector, have equipped me with the skills necessary to assess creditworthiness and facilitate informed lending decisions.

In my previous role at [Previous Company Name], I successfully analyzed credit data and financial statements to determine the risk involved in lending money to individuals and businesses. I developed detailed credit reports that provided insights into applicants' financial health and repayment capabilities. My proficiency in using financial modeling tools and credit assessment software enabled me to streamline the evaluation process, resulting in a 20% reduction in turnaround time for credit applications. This experience has not only honed my analytical skills but also reinforced my ability to communicate complex financial concepts clearly and effectively to stakeholders.

Additionally, I am skilled in conducting market research and monitoring economic trends, which allows me to anticipate potential risks and opportunities in lending. My attention to detail and commitment to accuracy ensure that all analyses are thorough and reliable, contributing to sound decision-making. I am particularly drawn to [Company Name] because of its commitment to [specific value or goal of the company], and I am eager to be a part of a team that prioritizes responsible lending practices.

I am excited about the possibility of bringing my unique expertise to [Company Name] and contributing to your mission of [specific mission or goal of the company]. I look forward to the opportunity to discuss how my background, skills, and enthusiasms align with the needs of your team. Thank you for considering my application; I hope to speak with you soon.

Common Mistakes to Avoid in a Credit Analyst Resume

When crafting a resume for a Credit Analyst position, it's crucial to present your skills and experiences in a clear and compelling manner. However, many candidates make common mistakes that can undermine their chances of landing an interview. Avoiding these pitfalls can significantly enhance the effectiveness of your resume and showcase your qualifications more effectively to potential employers.

Generic Objective Statements: Using a vague objective that does not specify your goals or relate to the role can make your resume forgettable. Tailor your objective to reflect your aspirations as a Credit Analyst.

Neglecting Relevant Skills: Failing to highlight specific skills relevant to credit analysis, such as financial modeling, risk assessment, and data analysis, can leave hiring managers questioning your qualifications. Be sure to list technical skills and tools you are proficient in.

Overlooking Quantifiable Achievements: Instead of merely listing job duties, focus on quantifiable achievements that demonstrate your impact in previous roles. Use metrics to show how you improved processes or outcomes.

Typos and Grammatical Errors: Attention to detail is critical in finance roles. Typos and grammatical errors can create a negative impression, suggesting a lack of professionalism. Always proofread your resume or have someone else review it.

Inconsistent Formatting: A resume with inconsistent formatting can be distracting and difficult to read. Use a uniform font, size, and style throughout to maintain a professional appearance.

Excessive Length: A resume that is too long can deter hiring managers from reading it in full. Aim for one page if you have less experience, or two pages at most for more seasoned professionals, focusing on relevant information only.

Including Irrelevant Work Experience: Listing jobs that do not relate to the credit analyst role can dilute your resume. Focus on experiences that highlight your analytical skills, financial knowledge, or any relevant industry exposure.

Failure to Tailor for Each Application: Sending out a generic resume for multiple applications can be detrimental. Tailor each resume to the specific job description, emphasizing the skills and experiences that align best with the requirements of the position.

Conclusion

As a Credit Analyst, your role is crucial in assessing the creditworthiness of individuals and businesses, analyzing financial data, and making informed recommendations regarding lending decisions. Throughout this article, we explored the essential skills required for success in this position, including strong analytical abilities, attention to detail, and proficiency in financial modeling. We also discussed the importance of effective communication since you will often present your findings to stakeholders and support decision-making processes.

Additionally, we highlighted the need for continuous learning to stay updated on industry trends and regulatory changes, which can significantly impact your analysis and recommendations. Networking with other professionals in the field can provide valuable insights and opportunities for career advancement.

To ensure you stand out in a competitive job market, it's essential to have a polished and professional resume that showcases your skills and experiences effectively. We encourage you to take action now—review your Credit Analyst resume and make necessary updates to reflect your qualifications.

Utilize the available resources to enhance your job application materials: explore our resume templates, try out our resume builder, check out resume examples, and craft an impressive introduction with our cover letter templates. These tools can help you create a compelling resume that highlights your strengths as a Credit Analyst and positions you for success in your job search. Don’t wait—start refining your resume today!