Volatility Arbitrage Trader Core Responsibilities

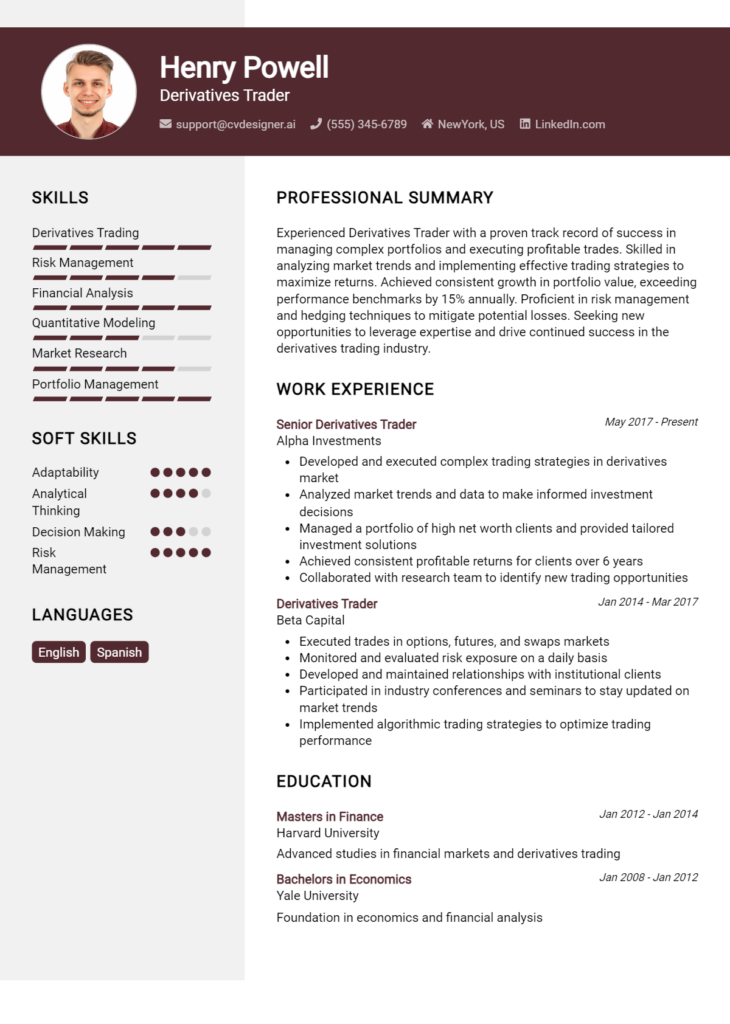

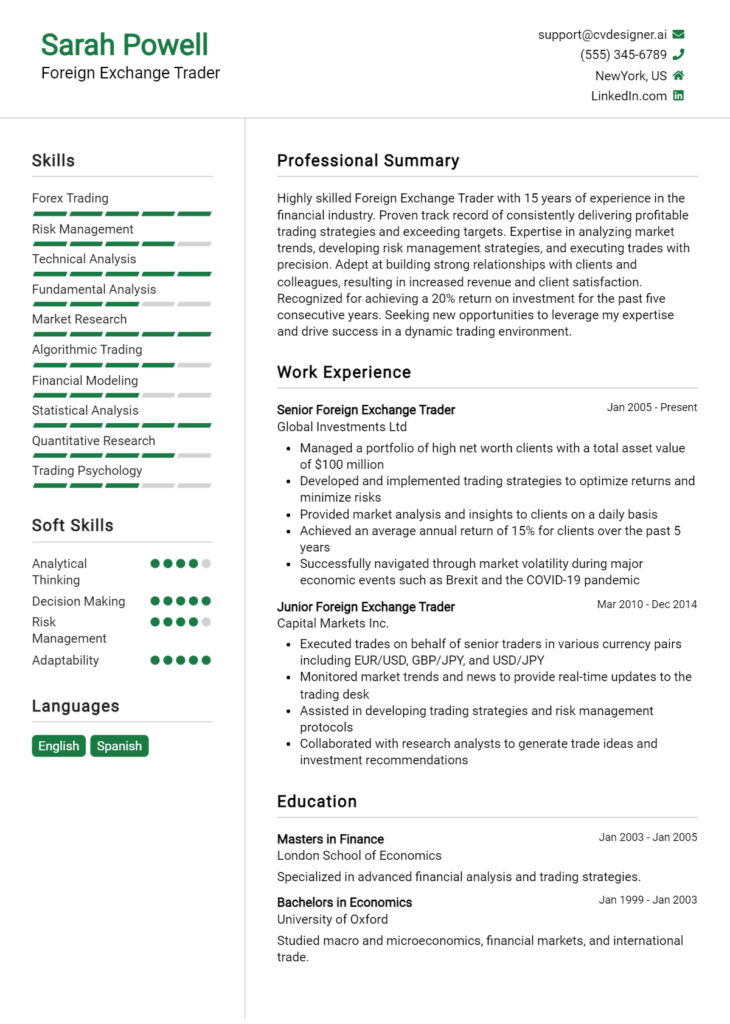

A Volatility Arbitrage Trader is primarily responsible for identifying and capitalizing on discrepancies in the pricing of volatility across various financial instruments. This role requires strong analytical skills, a deep understanding of market dynamics, and proficiency in quantitative analysis. By bridging the gap between trading, risk management, and research departments, these traders enhance operational efficiency and drive profitability. Technical expertise, operational acumen, and problem-solving abilities are essential for success, significantly contributing to the organization’s financial objectives. A well-structured resume that highlights these competencies can effectively showcase a trader's qualifications to potential employers.

Common Responsibilities Listed on Volatility Arbitrage Trader Resume

- Develop and execute volatility arbitrage trading strategies.

- Analyze market trends and volatility patterns to identify trading opportunities.

- Utilize quantitative models to assess risk and profitability.

- Monitor and manage a diversified portfolio of financial instruments.

- Collaborate with risk management to establish hedging strategies.

- Communicate complex trading concepts to stakeholders across departments.

- Utilize advanced statistical software for data analysis.

- Maintain compliance with regulatory requirements and internal policies.

- Conduct post-trade analysis to refine strategies and improve performance.

- Stay updated with market news and economic indicators affecting volatility.

- Work closely with IT teams to develop and enhance trading platforms.

High-Level Resume Tips for Volatility Arbitrage Trader Professionals

In the competitive field of finance, particularly for roles like Volatility Arbitrage Trader, a well-crafted resume is not just a document—it's your professional calling card. As the first impression you make on potential employers, your resume must effectively showcase your skills, achievements, and unique qualifications. A strong resume not only highlights your technical expertise but also demonstrates your understanding of the market dynamics that drive volatility trading. This guide will provide practical and actionable resume tips specifically tailored for Volatility Arbitrage Trader professionals, helping you stand out in a crowded job market.

Top Resume Tips for Volatility Arbitrage Trader Professionals

- Tailor your resume to each job description, emphasizing the skills and experiences that align closely with the specific role and company.

- Showcase relevant experience in volatility trading, derivatives, and quantitative analysis to demonstrate your expertise in the field.

- Quantify your achievements by including specific figures, such as percentage increases in returns or the volume of trades managed.

- Highlight industry-specific skills, such as knowledge of options pricing models, risk management strategies, and market analysis techniques.

- Incorporate keywords from the job posting to help your resume pass through Applicant Tracking Systems (ATS).

- Include any relevant certifications or training, such as CFA, FRM, or specialized courses in quantitative finance.

- Maintain a clean and professional format, using clear headings and bullet points for easy readability.

- Emphasize your ability to work under pressure and make quick decisions, as these traits are crucial in the fast-paced trading environment.

- Show your understanding of market trends and the economic factors affecting volatility, demonstrating your analytical capabilities.

By implementing these resume tips, you can significantly boost your chances of landing a job in the Volatility Arbitrage Trader field. A well-structured resume that effectively communicates your qualifications and achievements will not only capture the attention of hiring managers but also position you as a strong candidate in a highly specialized area of finance.

Why Resume Headlines & Titles are Important for Volatility Arbitrage Trader

In the competitive field of finance, particularly for a Volatility Arbitrage Trader, having an impactful resume headline or title is crucial. A well-crafted headline captures the attention of hiring managers, providing a succinct summary of a candidate's key qualifications and unique value proposition in just a few words. It serves as the first point of engagement, setting the tone for the entire resume. Therefore, it is essential that the headline is concise, relevant to the job being applied for, and communicates the candidate's strengths effectively, ensuring they stand out among a sea of applicants.

Best Practices for Crafting Resume Headlines for Volatility Arbitrage Trader

- Keep it concise: Aim for a headline that is no longer than 10-12 words.

- Be specific: Use industry-related terminology that reflects your expertise in volatility trading.

- Highlight key strengths: Focus on your most relevant skills or experiences that make you a strong candidate.

- Use active language: Choose powerful verbs that convey action and results.

- Include relevant qualifications: Mention certifications or degrees that pertain specifically to volatility arbitrage.

- Tailor to the job description: Align your headline with the specific requirements and language of the job posting.

- Showcase achievements: If possible, incorporate quantifiable metrics to demonstrate your impact in previous roles.

- Maintain professionalism: Ensure the tone is formal and aligns with the expectations of the finance industry.

Example Resume Headlines for Volatility Arbitrage Trader

Strong Resume Headlines

Dynamic Volatility Arbitrage Trader with 5+ Years of Proven Success in High-Frequency Trading

Results-Driven Trader Specializing in Derivative Instruments and Risk Management Strategies

Expert in Quantitative Analysis and Market Volatility, Delivering Consistent Alpha Generation

Skilled Volatility Arbitrage Specialist with a Track Record of Maximizing ROI through Strategic Positioning

Weak Resume Headlines

Trader Looking for Opportunities

Finance Professional with Some Experience

The strong headlines are effective because they convey specific strengths and achievements, showcasing the candidate's expertise in volatility arbitrage trading and their ability to deliver results. They utilize industry-specific language and highlight relevant experience, immediately appealing to hiring managers. In contrast, the weak headlines fail to impress due to their vagueness and lack of focus, offering no insight into the candidate's qualifications or the value they can bring to the role, which can lead to missed opportunities in a competitive job market.

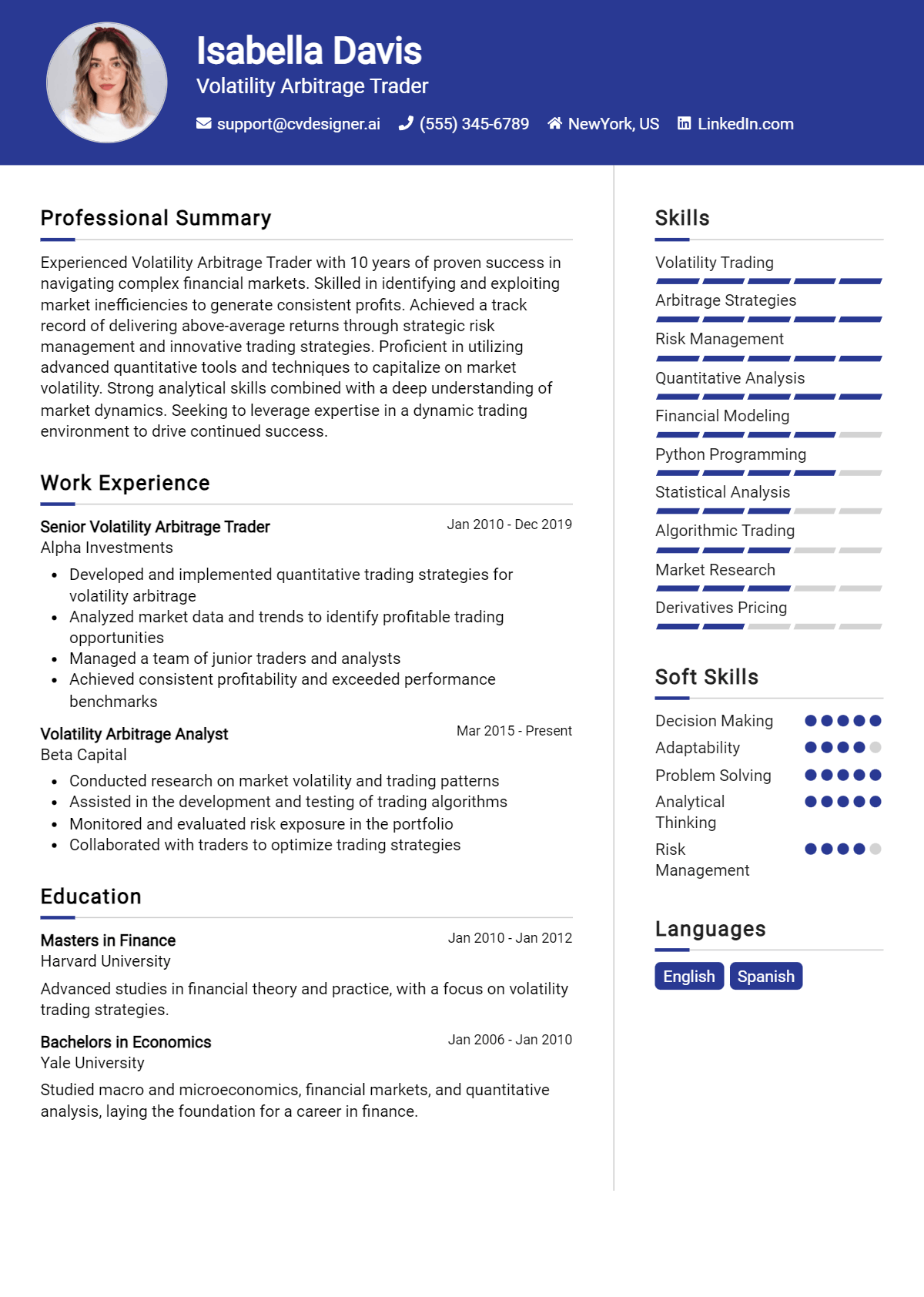

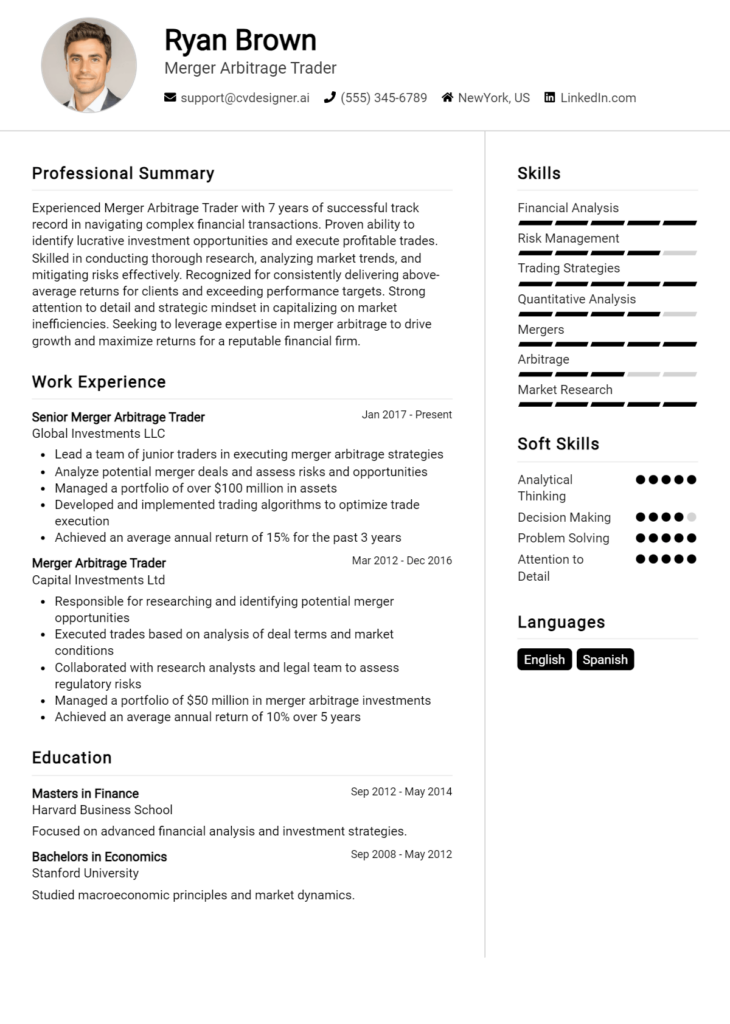

Writing an Exceptional Volatility Arbitrage Trader Resume Summary

A resume summary is a critical component for a Volatility Arbitrage Trader, as it serves as the first impression for hiring managers. A strong summary quickly captures attention by succinctly showcasing key skills, relevant experience, and notable accomplishments that align with the job role. It should be concise yet impactful, tailored to the specific job description, and designed to highlight the candidate's unique qualifications in the competitive field of trading. A well-crafted summary can effectively set the tone for the rest of the resume, making it essential for candidates to invest time in creating one that stands out.

Best Practices for Writing a Volatility Arbitrage Trader Resume Summary

- Quantify achievements to demonstrate impact (e.g., "Increased portfolio returns by 20% through strategic volatility trades").

- Focus on key skills relevant to volatility arbitrage, such as risk management and quantitative analysis.

- Tailor the summary to the specific job description, incorporating keywords from the job posting.

- Keep it concise, ideally between 2-4 sentences, to maintain the reader’s attention.

- Highlight relevant experience in the financial markets and specific trading strategies.

- Showcase any certifications or advanced degrees that enhance credibility in the field.

- Use action-oriented language to convey confidence and decisiveness.

- Avoid jargon that may confuse readers not familiar with specific trading terminologies.

Example Volatility Arbitrage Trader Resume Summaries

Strong Resume Summaries

Results-driven Volatility Arbitrage Trader with over 5 years of experience in executing complex trading strategies, achieving an average annual return of 25%. Proficient in quantitative analysis and risk management, with a proven track record of identifying market inefficiencies.

Detail-oriented trader skilled in volatility forecasting, successfully mitigating risk while generating profits in highly volatile markets. Managed a $50 million portfolio, consistently outperforming benchmarks by 15% during turbulent market conditions.

Accomplished Volatility Arbitrage Trader with an MBA in Finance and a strong analytical background. Leveraged advanced statistical models to enhance trading performance, resulting in an impressive 30% increase in quarterly returns.

Weak Resume Summaries

Experienced trader looking for new opportunities in the financial markets.

Skilled in various trading strategies and risk management techniques, seeking to apply my knowledge in a challenging role.

The strong resume summaries are considered effective because they provide specific, quantifiable results and directly relate to the skills and experiences required for the Volatility Arbitrage Trader role. They highlight achievements and showcase the candidate's ability to generate value in a competitive environment. In contrast, the weak summaries are vague and lack any measurable outcomes, making them less impactful and memorable to hiring managers.

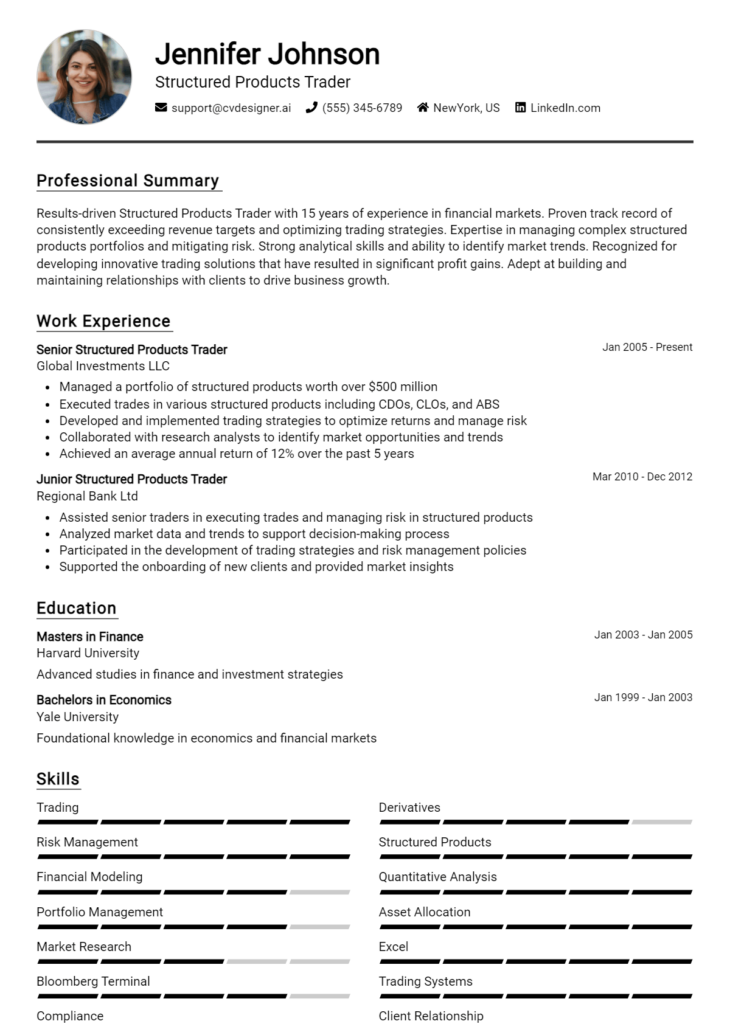

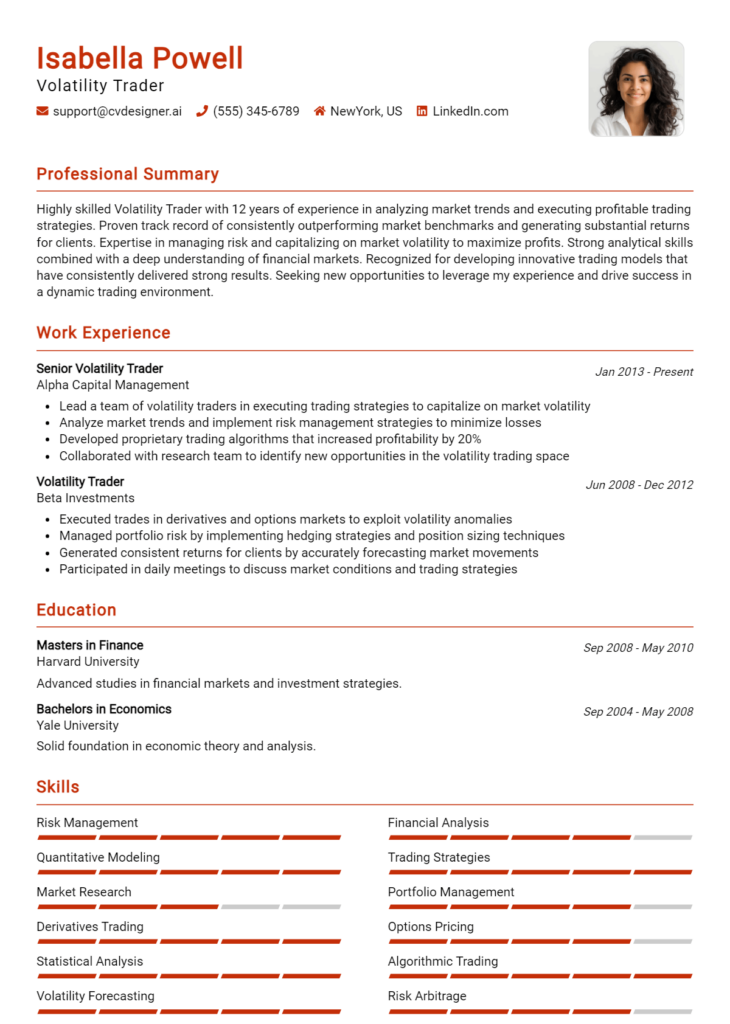

Work Experience Section for Volatility Arbitrage Trader Resume

The work experience section of a Volatility Arbitrage Trader resume is critical as it effectively showcases the candidate's technical skills and achievements in a highly specialized field. This section not only demonstrates the individual's ability to analyze market volatility and implement trading strategies but also highlights their capacity to manage teams and deliver high-quality results under pressure. By quantifying achievements and ensuring alignment with industry standards, candidates can present a compelling narrative that resonates with potential employers, setting themselves apart in a competitive job market.

Best Practices for Volatility Arbitrage Trader Work Experience

- Highlight technical skills, such as proficiency in statistical modeling, machine learning, and risk management.

- Quantify results where possible, using metrics like percentage returns, profit margins, or risk-adjusted returns.

- Emphasize collaboration with cross-functional teams to develop and refine trading strategies.

- Detail specific trading platforms and tools used, demonstrating familiarity with industry-standard technology.

- Include leadership roles that showcase the ability to mentor junior traders and lead trading initiatives.

- Showcase adaptability in trading strategies in response to market changes and volatility shifts.

- Utilize action-oriented language to convey impact and results effectively.

- Align experiences with market trends and regulatory considerations relevant to volatility arbitrage trading.

Example Work Experiences for Volatility Arbitrage Trader

Strong Experiences

- Developed and implemented a quantitative trading strategy that achieved a 25% annualized return, outperforming the benchmark index by 15%.

- Led a team of 5 traders to successfully execute a risk-mitigated portfolio that reduced overall volatility exposure by 30%, enhancing overall performance.

- Utilized machine learning algorithms to predict market fluctuations, resulting in a 40% increase in trade execution efficiency.

- Collaborated with the technology team to integrate advanced trading systems, improving data processing time by 50% and enhancing decision-making capabilities.

Weak Experiences

- Worked on various trading strategies that aimed to improve performance.

- Participated in team meetings to discuss trading ideas.

- Gained experience in trading without specifying outcomes or contributions.

- Involved in the development of trading systems but did not provide details on the impact.

The strong experiences are considered effective because they provide specific, quantifiable outcomes and highlight the candidate's technical skills and leadership abilities. Each bullet point demonstrates measurable success and collaboration, showcasing the candidate's impact in previous roles. In contrast, the weak experiences lack clarity and measurable results, making them vague and unimpressive. They fail to convey the candidate's contributions or expertise in the field, which can diminish their appeal to prospective employers.

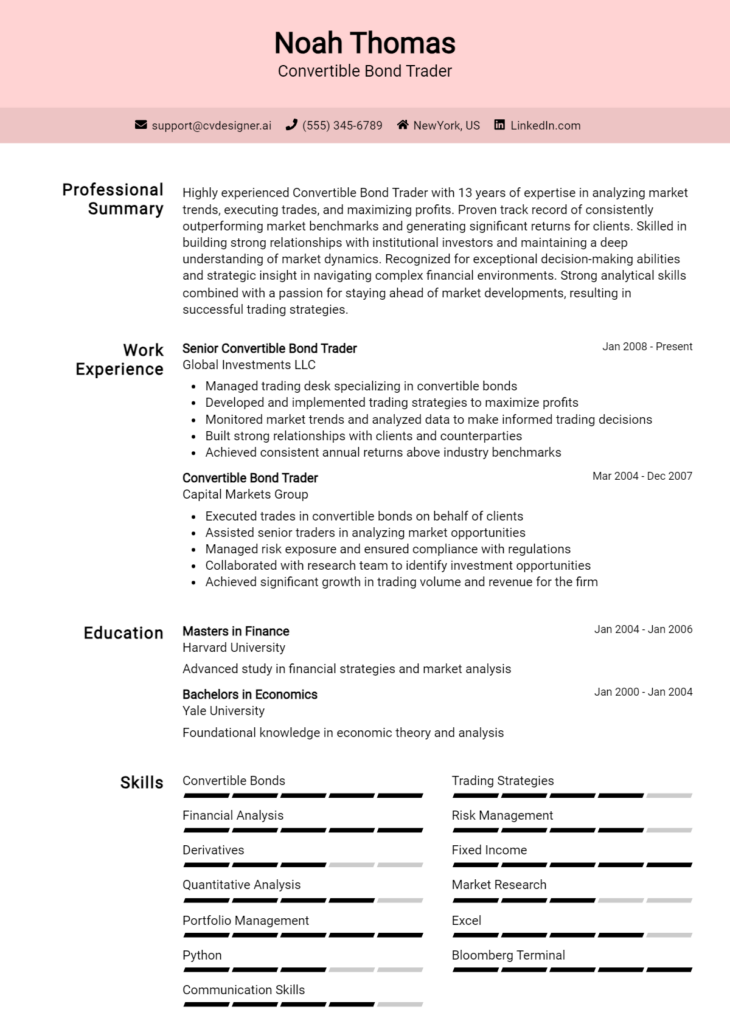

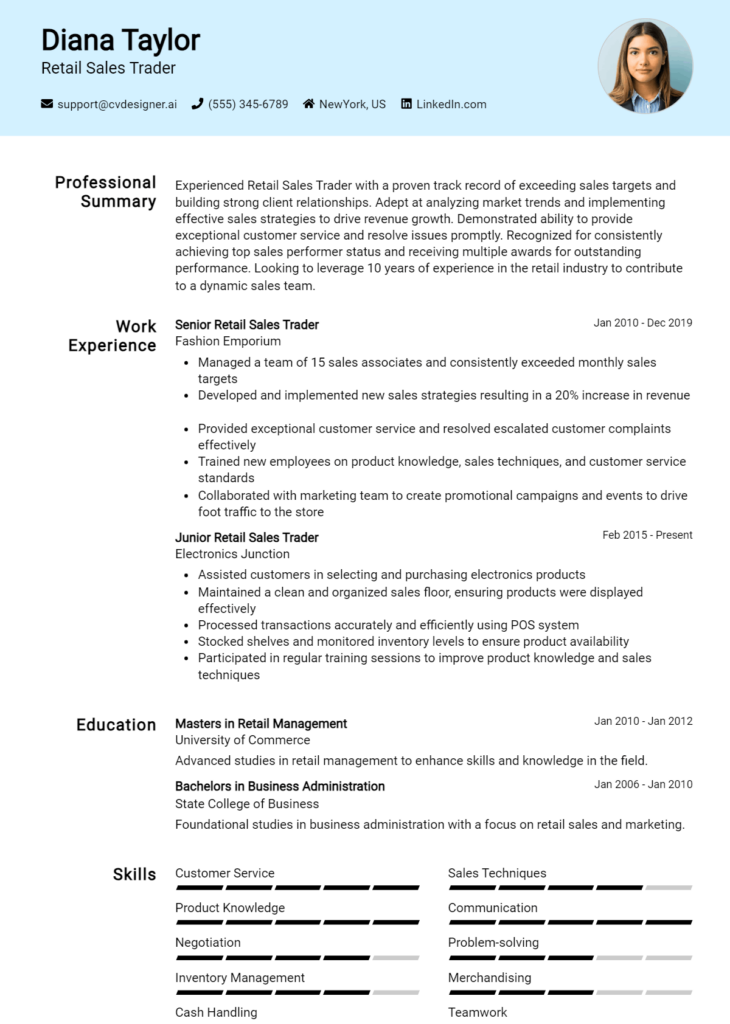

Education and Certifications Section for Volatility Arbitrage Trader Resume

The education and certifications section of a Volatility Arbitrage Trader resume is crucial, as it showcases the candidate's academic background and relevant credentials that align with the demands of the role. This section highlights the individual's commitment to continuous learning and professional development, demonstrating their preparedness to navigate the complexities of financial markets. Providing information on relevant coursework, industry-recognized certifications, and specialized training not only enhances the candidate's credibility but also positions them as a well-qualified contender for the job, reflecting their ability to apply theoretical knowledge to practical trading strategies.

Best Practices for Volatility Arbitrage Trader Education and Certifications

- Focus on relevant degrees such as Finance, Economics, or Mathematics.

- Include industry-recognized certifications like CFA, CMT, or FRM.

- List relevant coursework in quantitative analysis, financial modeling, and derivatives.

- Highlight any specialized training in trading platforms or algorithmic trading.

- Be specific about the level of education, including GPA if it is particularly strong.

- Update the section regularly to reflect any new qualifications or courses completed.

- Consider including online courses or workshops that are relevant to volatility trading.

- Use clear formatting to make the information easy to read and understand.

Example Education and Certifications for Volatility Arbitrage Trader

Strong Examples

- M.S. in Financial Engineering, Columbia University, 2021

- Chartered Financial Analyst (CFA) Level II Candidate

- Coursework in Options Pricing and Risk Management, University of Chicago

- Certificate in Algorithmic Trading, NY Institute of Finance, 2022

Weak Examples

- Bachelor's in History, State University, 2010

- Certificate in Basic Excel Skills, Online Course, 2019

- High School Diploma, Local High School, 2005

- Outdated Series 7 License, Expired 2018

The examples provided above illustrate the distinction between strong and weak qualifications for a Volatility Arbitrage Trader. Strong examples are directly relevant to the financial and trading fields, showcasing advanced education and industry-specific certifications that enhance the candidate's expertise. In contrast, weak examples reflect outdated or unrelated qualifications that do not contribute to the candidate's suitability for the role, thereby diminishing their competitive edge in the job market.

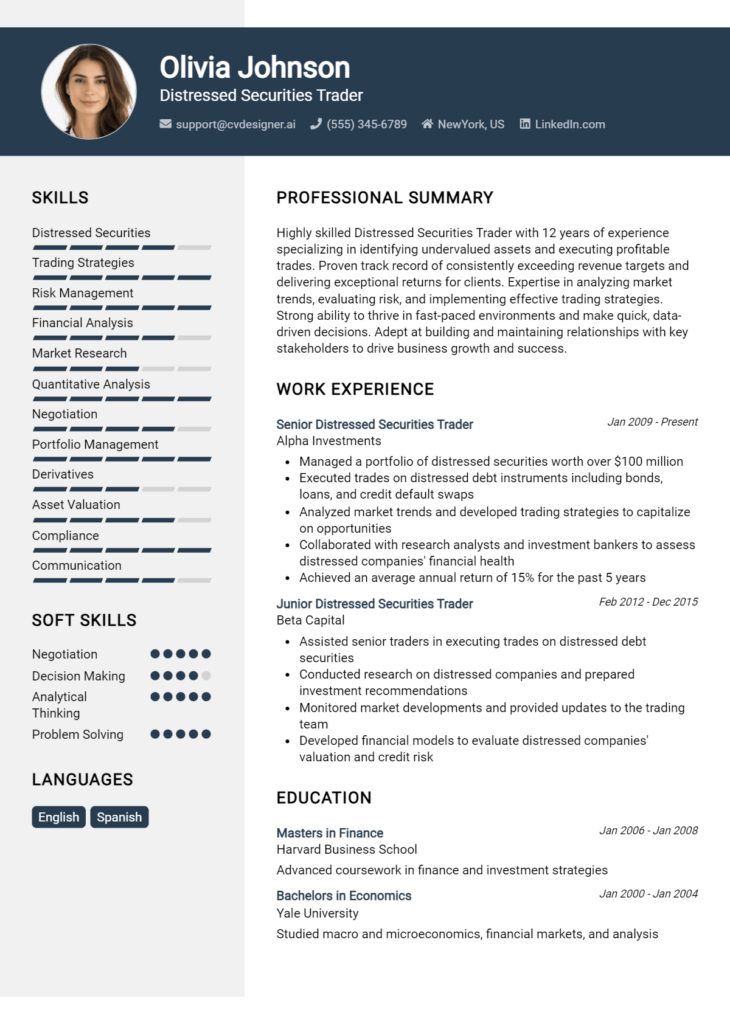

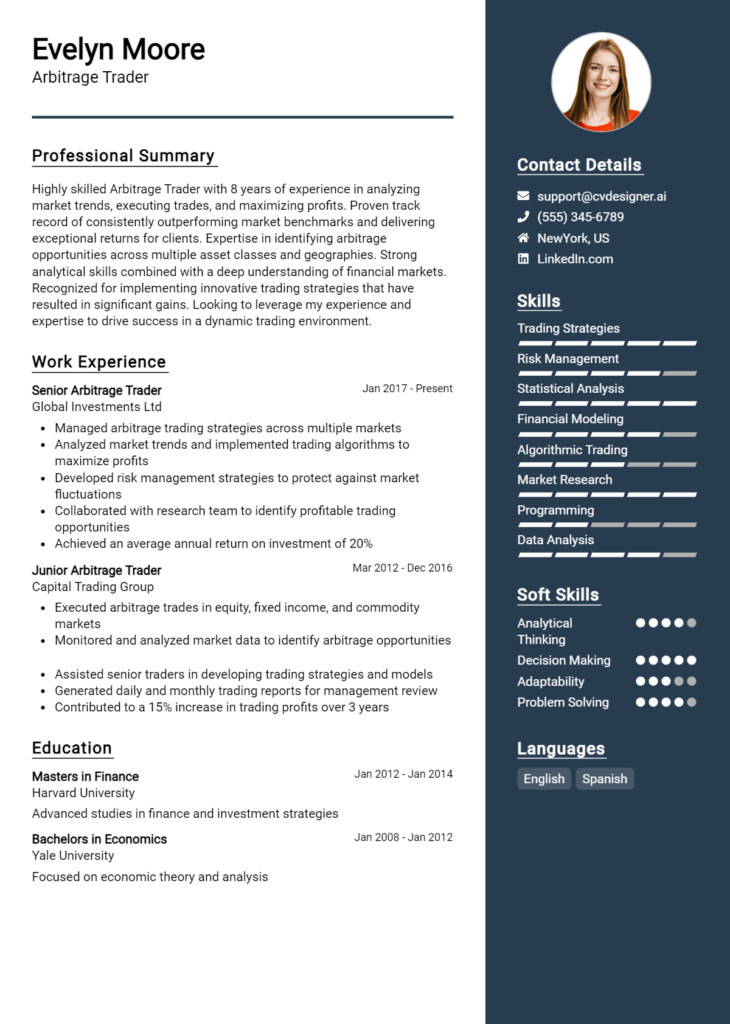

Top Skills & Keywords for Volatility Arbitrage Trader Resume

A well-crafted resume for a Volatility Arbitrage Trader is essential for showcasing the unique blend of skills required to excel in this high-pressure and analytical field. The right skills not only enhance a candidate's marketability but also demonstrate their ability to navigate complex financial instruments and market dynamics effectively. Highlighting both hard and soft skills in your resume can set you apart from other applicants by showcasing your technical expertise and interpersonal capabilities. As you prepare your resume, focus on including relevant skills that align with the demands of the role and reflect your work ethic, adaptability, and analytical thinking.

Top Hard & Soft Skills for Volatility Arbitrage Trader

Soft Skills

- Strong analytical thinking

- Effective communication

- Problem-solving abilities

- Attention to detail

- Team collaboration

- Adaptability to changing markets

- Time management

- Stress resilience

- Decision-making under pressure

- Ethical judgment and integrity

Hard Skills

- Proficiency in statistical analysis

- Knowledge of options pricing models (e.g., Black-Scholes)

- Familiarity with trading platforms (e.g., Bloomberg, MetaTrader)

- Experience with quantitative analysis tools (e.g., Python, R)

- Understanding of risk management strategies

- Expertise in financial derivatives and instruments

- Ability to interpret and analyze market data

- Familiarity with algorithmic trading strategies

- Knowledge of volatility indicators (e.g., VIX)

- Proficient in Excel and financial modeling techniques

Incorporating a blend of these hard and soft skills into your work experience section will further demonstrate your qualifications for the role of a Volatility Arbitrage Trader.

Stand Out with a Winning Volatility Arbitrage Trader Cover Letter

I am writing to express my interest in the Volatility Arbitrage Trader position at [Company Name], as advertised on [where you found the job listing]. With a strong background in quantitative analysis, financial modeling, and market research, coupled with my passion for identifying and capitalizing on volatility discrepancies, I am excited about the opportunity to contribute to your team. My academic foundation in finance and mathematics, combined with hands-on experience in high-frequency trading environments, has equipped me with the skills necessary to excel in this fast-paced role.

In my previous position at [Previous Company Name], I successfully developed and implemented algorithmic trading strategies that leveraged volatility arbitrage opportunities across various asset classes. By utilizing advanced statistical techniques and machine learning models, I was able to enhance the accuracy of my predictions and significantly improve the profitability of our trading desk. My ability to analyze market trends and interpret complex data sets has allowed me to make informed trading decisions while managing risk effectively. I thrive on the challenge of staying ahead in a competitive market, and I am confident that my analytical mindset and attention to detail will be a valuable asset to your trading team.

At [Company Name], I am particularly drawn to your commitment to innovation and technology in trading. I appreciate your focus on developing cutting-edge tools and methodologies to optimize trading strategies. I am eager to collaborate with your talented team to refine existing models and explore new avenues for capturing volatility arbitrage opportunities. My proactive approach and strong communication skills enable me to work seamlessly with cross-functional teams, ensuring that we collectively achieve our trading objectives while maintaining a disciplined risk management framework.

I am excited about the possibility of joining [Company Name] as a Volatility Arbitrage Trader and contributing to your continued success in the financial markets. Thank you for considering my application. I look forward to the opportunity to discuss how my background, skills, and enthusiasm align with your team’s goals.

Common Mistakes to Avoid in a Volatility Arbitrage Trader Resume

When crafting a resume for a Volatility Arbitrage Trader position, it's essential to present your skills and experience in a clear and compelling manner. However, many candidates make common mistakes that can undermine their chances of landing an interview. Being aware of these pitfalls can help you create a more effective resume that highlights your qualifications and suitability for this specialized role. Here are some common mistakes to avoid:

Vague Job Descriptions: Using generic terms like "trader" without specifying your role in volatility arbitrage can lead to confusion. Be precise about your responsibilities and achievements.

Ignoring Quantitative Skills: Failing to emphasize quantitative analysis skills can be detrimental. Highlight your proficiency in statistical methods, programming languages, and data analysis tools relevant to volatility trading.

Lack of Relevant Certifications: Omitting any certifications related to trading or finance can weaken your resume. Include certifications like CFA or CMT to demonstrate your commitment and expertise.

Overloading with Technical Jargon: While industry-specific terminology is important, overusing jargon can make your resume hard to read. Aim for clarity and ensure that your skills are comprehensible to hiring managers.

Neglecting Soft Skills: Focusing solely on technical abilities without mentioning soft skills such as communication, teamwork, or decision-making can be a mistake. Highlight how these skills have contributed to your success as a trader.

Generic Objective Statements: Using a one-size-fits-all objective statement can detract from your resume. Tailor your objective to reflect your specific interest in volatility arbitrage and the company you're applying to.

Inconsistent Formatting: A resume with inconsistent formatting can be distracting. Ensure that your layout, font, and bullet points are uniform throughout to present a professional image.

Failing to Quantify Achievements: Not providing metrics or specific outcomes related to your trading performance can diminish the impact of your accomplishments. Use numbers to demonstrate your success, such as percentage gains or risk-adjusted returns.

Conclusion

As a Volatility Arbitrage Trader, your role revolves around capitalizing on price discrepancies and fluctuations in the market to generate profitable trades. Key skills essential for this position include a strong understanding of financial markets, quantitative analysis, risk management, and proficiency in trading software. Additionally, a successful trader must stay updated on market trends, economic indicators, and geopolitical events that can impact volatility.

To excel as a Volatility Arbitrage Trader, it is crucial to have a well-structured resume that highlights your relevant experience, skills, and accomplishments. Potential employers look for candidates who demonstrate a solid track record of managing and mitigating risks while maximizing returns.

In conclusion, if you are looking to make strides in your career as a Volatility Arbitrage Trader, now is the time to refine your resume. Take advantage of tools available to help you create a standout application. Explore resume templates, use a resume builder for a polished layout, check out resume examples for inspiration, and don’t forget about cover letter templates to accompany your application. Start reviewing your resume today and position yourself for success in the competitive world of volatility trading!