Volatility Trader Core Responsibilities

A Volatility Trader plays a critical role in financial markets, focusing on the pricing and trading of options and derivatives to manage risk and capitalize on market fluctuations. Key responsibilities include analyzing market trends, executing trades, and collaborating with risk management and research teams. Proficiency in quantitative analysis, strong problem-solving skills, and technical expertise in trading platforms are essential. These competencies not only enhance individual performance but also align with the organization’s strategic objectives, making a well-structured resume pivotal in showcasing these qualifications.

Common Responsibilities Listed on Volatility Trader Resume

- Conducting market analysis to identify trading opportunities.

- Executing trades in options and derivatives to optimize portfolio performance.

- Developing and implementing trading strategies based on volatility forecasts.

- Collaborating with risk management teams to assess and mitigate financial risks.

- Monitoring market conditions and adjusting positions accordingly.

- Utilizing quantitative models to evaluate pricing and risk factors.

- Maintaining compliance with regulatory requirements and internal policies.

- Creating detailed reports on trading performance and market trends.

- Engaging in continuous learning and adaptation to new market instruments.

- Communicating effectively with cross-functional teams to align on strategies.

- Utilizing advanced trading platforms and software for real-time analysis.

High-Level Resume Tips for Volatility Trader Professionals

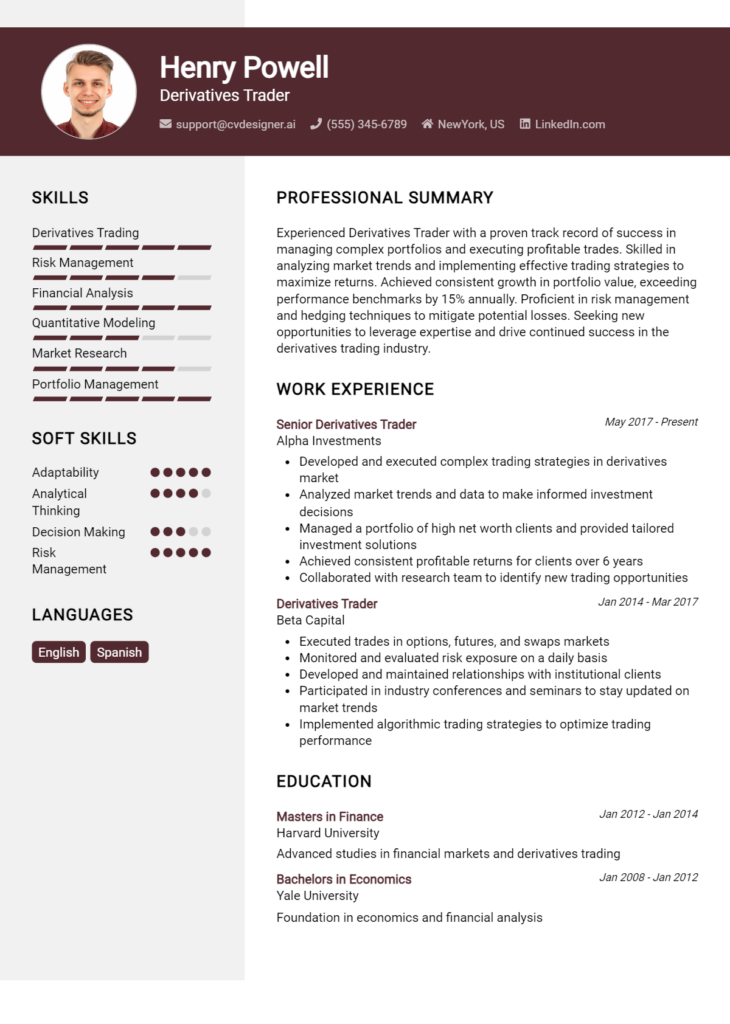

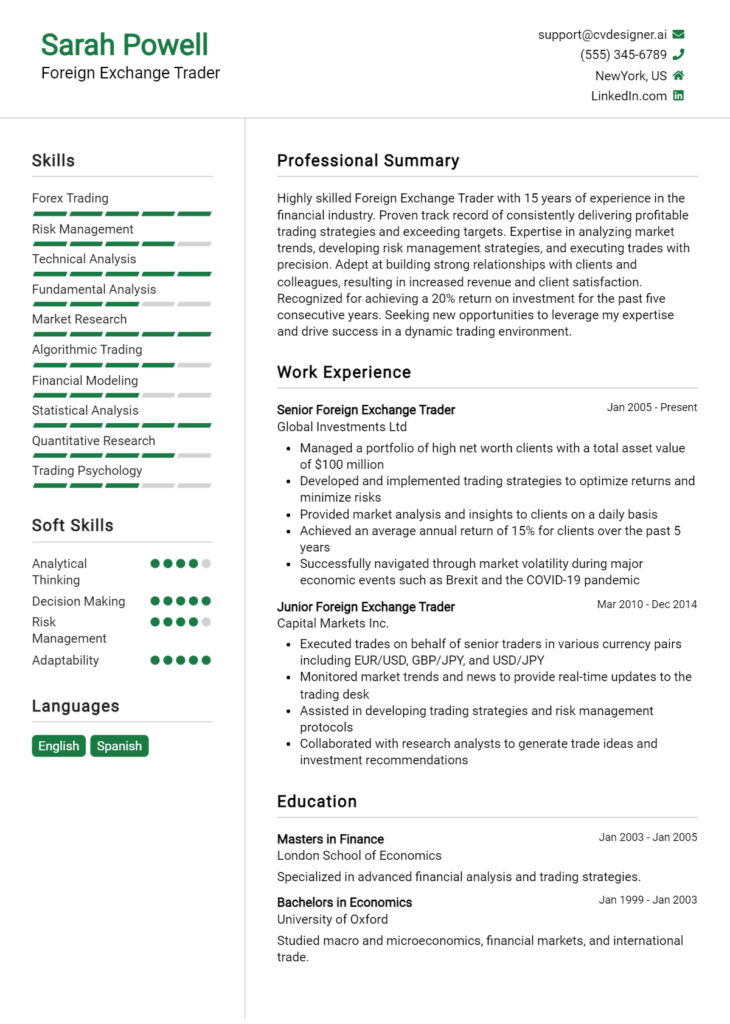

In the competitive world of finance, a well-crafted resume is crucial for Volatility Trader professionals looking to make an impact. Your resume often serves as the first impression you make on potential employers, and it needs to effectively reflect both your skills and achievements in the field. A strong resume can set you apart from the competition, showcasing your analytical abilities, risk management experience, and understanding of market dynamics. This guide will provide practical and actionable resume tips specifically tailored for Volatility Trader professionals, helping you present your qualifications in the best possible light.

Top Resume Tips for Volatility Trader Professionals

- Tailor your resume to match the specific job description, highlighting relevant skills and experiences that align with the employer's needs.

- Showcase your relevant experience in trading and risk management, detailing the types of products you have traded and the markets you have worked in.

- Quantify your achievements with specific metrics, such as percentage returns, risk-adjusted performance, or successful trade volumes.

- Highlight industry-specific skills, including proficiency in trading software, quantitative analysis, and market forecasting techniques.

- Include relevant certifications or educational qualifications, such as CFA, FRM, or specialized courses in derivatives and volatility trading.

- Utilize action verbs to describe your accomplishments and responsibilities, reinforcing your proactive role in trading activities.

- Incorporate keywords from the job description to optimize your resume for applicant tracking systems (ATS) and increase visibility.

- Keep the format clean and professional, using bullet points for clarity and ensuring easy readability for hiring managers.

- Consider adding a summary statement at the top that encapsulates your experience and highlights your strengths as a Volatility Trader.

By implementing these tips, you can significantly increase your chances of landing a job in the Volatility Trader field. A focused and well-structured resume not only showcases your qualifications effectively but also demonstrates your understanding of the industry, making you a more attractive candidate to potential employers.

Why Resume Headlines & Titles are Important for Volatility Trader

In the competitive field of finance, particularly for roles like a Volatility Trader, a well-crafted resume headline or title serves as a critical first impression. These concise phrases encapsulate a candidate’s core qualifications and strengths, allowing hiring managers to quickly gauge their fit for the position. A strong headline can grab attention immediately and set the tone for the rest of the resume, highlighting relevant skills and experiences that align with the job description. Therefore, it is essential for candidates to choose a headline that is not only relevant but also impactful, ensuring it resonates with the specifics of the role being applied for.

Best Practices for Crafting Resume Headlines for Volatility Trader

- Keep it concise: Aim for a headline that is brief yet informative, ideally no longer than a single sentence.

- Be role-specific: Tailor the headline to reflect the specific position of Volatility Trader, incorporating relevant industry terminology.

- Highlight key strengths: Focus on the most compelling aspects of your experience, such as expertise in risk analysis or trading strategies.

- Use action-oriented language: Start with strong action verbs to convey confidence and proactivity.

- Incorporate metrics when possible: Quantifying achievements can make your headline more impressive (e.g., "Achieved 25% ROI through strategic volatility trading").

- Ensure relevance: Align your headline with the job description to make it clear you are a fit for the role.

- Avoid jargon: While industry-specific terms are important, overly complex language may alienate hiring managers.

- Stay professional: Maintain a formal tone to reflect the seriousness of the finance industry.

Example Resume Headlines for Volatility Trader

Strong Resume Headlines

Dynamic Volatility Trader with 5+ Years of Experience in High-Stakes Markets

Expert in Derivatives Trading, Delivering Consistent Alpha Through Market Analysis

Results-Driven Trader Specializing in Risk Management and Predictive Analytics

Accomplished Volatility Trader with Proven Track Record of 30% Annual Returns

Weak Resume Headlines

Trader Looking for Opportunities

Experienced Professional in Finance

The strong headlines listed above effectively communicate specific strengths and accomplishments, making them attractive to hiring managers who seek candidates with proven results in volatility trading. They highlight relevant experience, use powerful adjectives, and provide measurable achievements, all of which create a compelling narrative. Conversely, the weak headlines fail to impress because they lack specificity and do not convey the candidate’s unique value or qualifications for the Volatility Trader role, rendering them forgettable amid a sea of applicants.

Writing an Exceptional Volatility Trader Resume Summary

A well-crafted resume summary is crucial for a Volatility Trader, as it serves as the first impression to hiring managers. This brief section should succinctly highlight key skills, relevant experience, and notable accomplishments that align with the specific requirements of the position. A strong summary not only captures attention quickly but also sets the tone for the rest of the resume, making it imperative that candidates present an impactful and tailored overview of their qualifications.

Best Practices for Writing a Volatility Trader Resume Summary

- Quantify your achievements: Use specific numbers and metrics to illustrate your success in previous roles.

- Highlight relevant skills: Focus on key skills pertinent to volatility trading, such as risk management, quantitative analysis, and market forecasting.

- Tailor the summary: Modify your summary to reflect the specific requirements and language found in the job description you are applying for.

- Be concise: Keep your summary to 2-4 sentences, ensuring it is impactful and to the point.

- Showcase key accomplishments: Mention any awards, recognitions, or standout projects that demonstrate your capabilities.

- Use action verbs: Start sentences with strong action verbs to convey energy and proactivity.

- Reflect your personality: Let your passion for trading shine through to give a personal touch to your profile.

- Avoid jargon: While industry-specific terms are important, ensure your summary remains understandable and engaging to a wider audience.

Example Volatility Trader Resume Summaries

Strong Resume Summaries

Dynamic Volatility Trader with over 5 years of experience in options trading, achieving an average annual return of 18% through strategic risk management and market analysis. Proven ability to leverage quantitative models to predict market movements and optimize trading strategies.

Results-driven trader specializing in volatility instruments, successfully managing a $50 million portfolio with a focus on maximizing returns while minimizing risk exposure. Developed proprietary algorithms that enhanced trade execution speed by 30%.

Experienced in high-frequency trading and volatility arbitrage, delivering a 25% increase in profitability over the last fiscal year. Strong analytical skills combined with a deep understanding of market dynamics and macroeconomic factors.

Weak Resume Summaries

I am a trader with experience in various financial markets. I am good at analyzing data and making trades.

Focused on trading strategies and market volatility. I have worked in finance for a few years and am looking for new opportunities.

The strong resume summaries are considered effective because they quantify achievements, highlight relevant skills, and demonstrate a clear connection to the role of a Volatility Trader. They provide specific examples of success and articulate the candidate's expertise in a compelling way. In contrast, the weak summaries lack detail, fail to showcase accomplishments or relevant experience, and come across as generic, making it difficult for hiring managers to gauge the candidate's suitability for the position.

Work Experience Section for Volatility Trader Resume

The work experience section of a Volatility Trader resume is crucial in demonstrating the candidate's technical skills and their ability to deliver high-quality financial products. This section not only showcases relevant trading experience but also highlights the candidate's proficiency in quantitative analysis, risk management, and team leadership. By quantifying achievements—such as increased profitability, reduced risk exposure, or enhanced trading strategies—and aligning experiences with industry standards, candidates can effectively convey their value to potential employers, making a compelling case for their qualifications in the competitive trading landscape.

Best Practices for Volatility Trader Work Experience

- Use specific metrics to quantify achievements, such as percentage increases in portfolio performance or reductions in volatility risk.

- Highlight technical skills relevant to volatility trading, including expertise in quantitative modeling, statistical analysis, and software proficiency.

- Emphasize collaboration by detailing experiences leading teams or working cross-functionally to achieve trading objectives.

- Focus on results-driven statements, ensuring each bullet point conveys a clear outcome or impact.

- Align terminology and accomplishments with industry standards to demonstrate familiarity with current market practices.

- Include relevant certifications or training that bolster technical competencies in volatility trading.

- Tailor the work experience section to the specific job description, emphasizing the most pertinent experiences.

- Maintain clarity and conciseness, avoiding jargon that may not be universally understood in the finance sector.

Example Work Experiences for Volatility Trader

Strong Experiences

- Developed and implemented a volatility trading strategy that led to a 30% increase in annual returns, outperforming the benchmark index.

- Managed a team of five traders, fostering collaboration that resulted in a 15% reduction in risk exposure across the portfolio.

- Utilized advanced quantitative models to predict market trends, improving forecast accuracy by 25% over previous methodologies.

- Coordinated cross-departmental initiatives that resulted in the successful launch of a new derivatives product, generating $2 million in revenue within the first year.

Weak Experiences

- Worked on trading strategies that sometimes improved performance.

- Participated in team meetings to discuss market trends.

- Assisted in the analysis of volatility without specifying outcomes or impacts.

- Helped out with various trading tasks as needed.

The examples labeled as strong are considered impactful because they provide specific metrics and outcomes that clearly demonstrate the candidate's contributions to trading performance and team dynamics. They highlight leadership, technical proficiency, and collaboration, all of which are essential for a successful Volatility Trader. Conversely, the weak examples lack specificity and quantifiable results, making it difficult for potential employers to gauge the candidate's true impact and effectiveness in their roles.

Education and Certifications Section for Volatility Trader Resume

The education and certifications section of a Volatility Trader resume is crucial for demonstrating the candidate's academic background and professional qualifications. This section highlights not only the foundational knowledge acquired through formal education but also industry-relevant certifications that validate the candidate's expertise in trading and financial analysis. Continuous learning efforts, such as specialized training and relevant coursework, reflect a commitment to staying updated with market trends and trading strategies. By providing detailed and pertinent information in this section, candidates can significantly enhance their credibility and better align themselves with the specific demands of the Volatility Trader role.

Best Practices for Volatility Trader Education and Certifications

- Focus on relevant degrees, such as Finance, Economics, Mathematics, or Quantitative Analysis.

- Include industry-recognized certifications, such as CFA (Chartered Financial Analyst) or CMT (Chartered Market Technician).

- List coursework that directly pertains to volatility trading, derivatives, or risk management.

- Highlight any advanced degrees, such as a Master's in Finance or an MBA with a focus on trading.

- Showcase participation in specialized training programs or workshops related to trading strategies or financial modeling.

- Emphasize continuous education efforts, such as online courses or seminars, to demonstrate a commitment to professional development.

- Use clear and concise formatting to ensure easy readability and quick reference for hiring managers.

- Tailor the education and certifications section to align closely with the specific job description and requirements of the position sought.

Example Education and Certifications for Volatility Trader

Strong Examples

- Bachelor of Science in Finance, University of XYZ, Graduated Cum Laude, 2020

- Chartered Financial Analyst (CFA), Level II Candidate

- Certificate in Quantitative Finance, ABC Institute, 2021

- Relevant Coursework: Advanced Derivatives, Risk Management Strategies, Statistical Analysis for Finance

Weak Examples

- Bachelor of Arts in History, University of ABC, 2018

- Certification in Basic Accounting, XYZ Community College, 2019

- Completed a workshop on Creative Writing, 2020

- High School Diploma, Graduated with Honors, 2016

The strong examples are considered effective because they showcase degrees and certifications that are directly relevant to the field of volatility trading, demonstrating both academic rigor and professional certification that enhances credibility. In contrast, the weak examples illustrate qualifications that lack relevance to the role of a Volatility Trader, with degrees and certifications that do not contribute to the necessary skill set or knowledge base needed for success in this position, thereby diminishing the candidate's appeal to potential employers.

Top Skills & Keywords for Volatility Trader Resume

As a Volatility Trader, having the right skills is crucial for navigating the complexities of financial markets. A well-crafted resume that highlights both hard and soft skills can significantly enhance your chances of landing a position in this competitive field. Employers look for candidates who not only possess technical expertise but also demonstrate strong analytical abilities and interpersonal skills. By showcasing your relevant skills, you can effectively illustrate your capacity to manage risk, analyze market trends, and make informed trading decisions. This balance of competencies can set you apart and reflect your readiness for the challenges of volatility trading.

Top Hard & Soft Skills for Volatility Trader

Soft Skills

- Strong Analytical Thinking

- Effective Communication

- Adaptability

- Problem-Solving

- Attention to Detail

- Emotional Resilience

- Team Collaboration

- Decision-Making

- Time Management

- Stress Management

Hard Skills

- Knowledge of Options and Derivatives

- Risk Management Techniques

- Financial Modeling

- Statistical Analysis

- Market Research

- Trading Platforms Proficiency

- Quantitative Analysis

- Familiarity with Algorithmic Trading

- Programming Skills (e.g., Python, R)

- Technical Analysis

For a deeper dive into essential skills and the importance of showcasing your work experience, consider how these elements can enhance your resume and attract potential employers.

Stand Out with a Winning Volatility Trader Cover Letter

I am writing to express my interest in the Volatility Trader position at [Company Name]. With a strong background in quantitative finance and extensive experience in trading derivatives, I am excited about the opportunity to leverage my analytical skills and market insights to drive profitability in your trading desk. My passion for understanding market dynamics, combined with my proficiency in statistical modeling and risk assessment, have equipped me with the tools necessary to navigate the complexities of volatility trading.

In my previous role at [Previous Company Name], I successfully developed and implemented trading strategies that capitalized on volatility fluctuations across various asset classes. By utilizing advanced algorithms and real-time data analysis, I was able to identify profitable trading opportunities while effectively managing risk exposure. My ability to remain calm under pressure and make data-driven decisions has consistently resulted in exceeding performance benchmarks, contributing to a robust trading portfolio.

I am particularly drawn to [Company Name] because of its innovative approach to trading and commitment to utilizing cutting-edge technology. I am eager to contribute my expertise in quantitative analysis and my hands-on experience with trading platforms to enhance your team’s performance. Additionally, I thrive in collaborative environments and believe that my strong communication skills will allow me to work effectively with both traders and analysts to construct tailored trading strategies that align with your firm's objectives.

Thank you for considering my application. I look forward to the opportunity to discuss how my background and skills can contribute to the continued success of [Company Name]. I am excited about the possibility of joining your team and helping to drive strategic trading initiatives in the dynamic world of volatility.

Common Mistakes to Avoid in a Volatility Trader Resume

When crafting a resume for a Volatility Trader position, it’s crucial to present your skills and experience in a way that resonates with hiring managers. However, many candidates fall into common traps that can diminish their chances of landing an interview. Here are some mistakes to avoid when creating your Volatility Trader resume:

Lack of Specificity: Vague descriptions of past roles can leave employers confused. Instead of saying “managed trading strategies,” specify the strategies and their results.

Neglecting Quantifiable Achievements: Not including metrics or performance data can weaken your claims. Highlight specific achievements, such as “increased portfolio performance by 15% over six months.”

Overloading with Jargon: While industry-specific terminology is important, excessive jargon can alienate readers. Strike a balance by using clear language that conveys your expertise without overwhelming the reader.

Ignoring Relevant Skills: Failing to emphasize skills that are crucial for volatility trading, such as risk management, quantitative analysis, or familiarity with trading software, can lead to missed opportunities.

Poor Formatting: A cluttered or unprofessional layout can detract from your content. Use a clean, organized format with clear headings to make your resume easy to navigate.

Excessive Length: A resume that is too long can lose the reader's attention. Aim for one to two pages, focusing on the most relevant experiences that align with the job description.

Not Tailoring the Resume: Sending the same resume to multiple employers can be ineffective. Tailor your resume to each job by incorporating keywords from the job description and highlighting your most relevant experiences.

Neglecting Soft Skills: While technical skills are essential, overlooking soft skills like communication, teamwork, and adaptability can paint an incomplete picture of your candidacy. Include examples that demonstrate these traits in action.

Conclusion

As a Volatility Trader, your role is crucial in navigating the complexities of financial markets. You must possess a deep understanding of market dynamics and the ability to analyze and manage risk effectively. Key skills include quantitative analysis, familiarity with derivatives, and the ability to leverage statistical models to forecast market behavior. Additionally, strong communication skills are essential for articulating strategies and insights to stakeholders.

In this competitive field, having a standout resume is paramount. Your resume should highlight your analytical skills, relevant experience, and accomplishments that showcase your expertise in volatility trading. Emphasize any certifications or special training that can set you apart from other candidates.

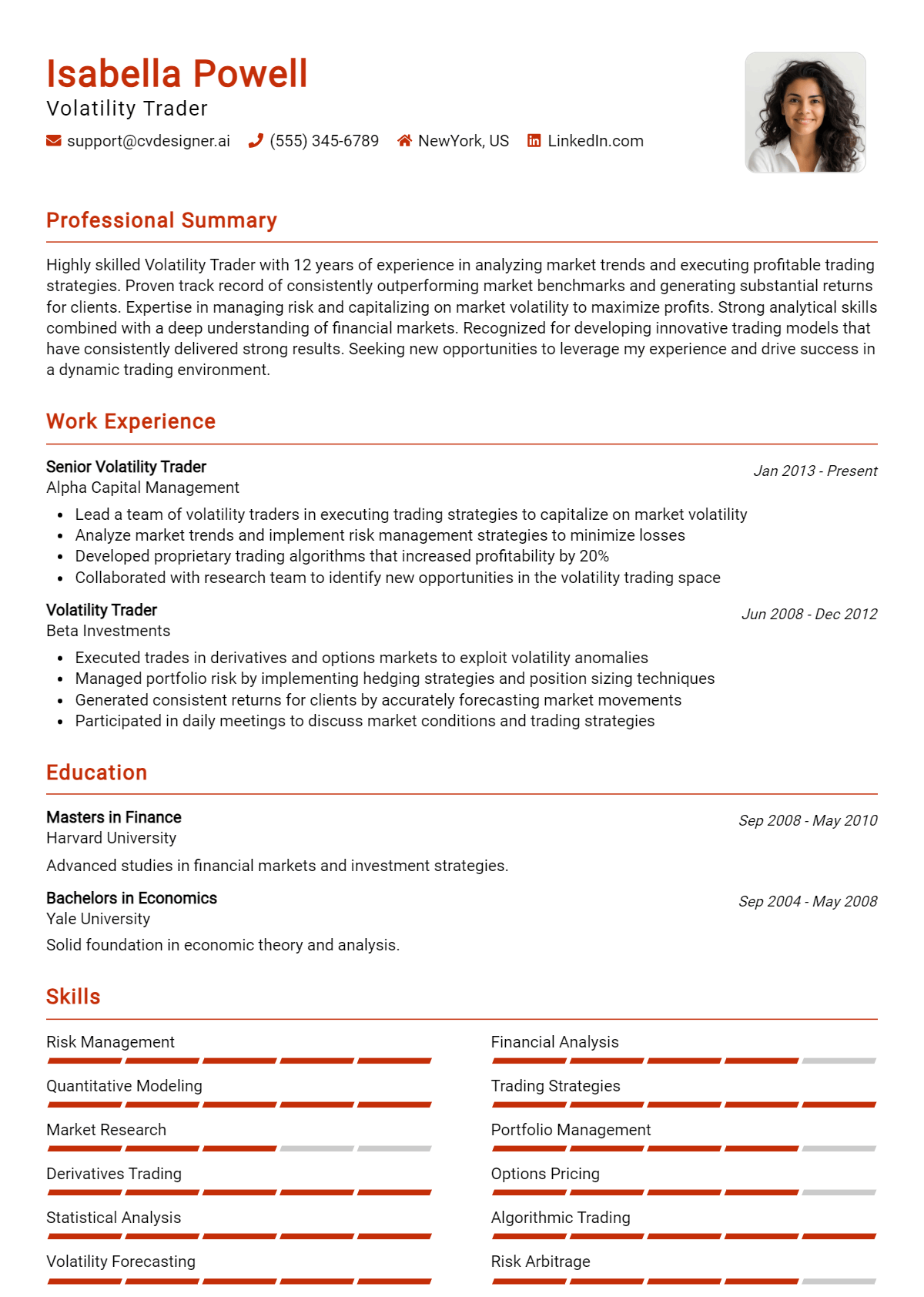

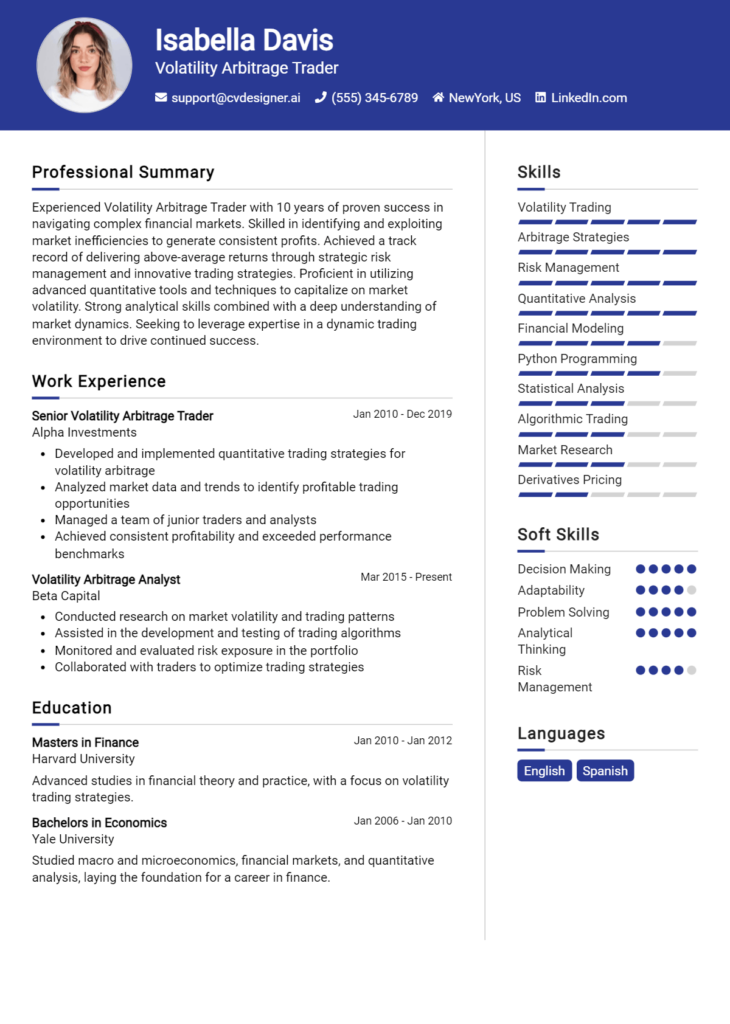

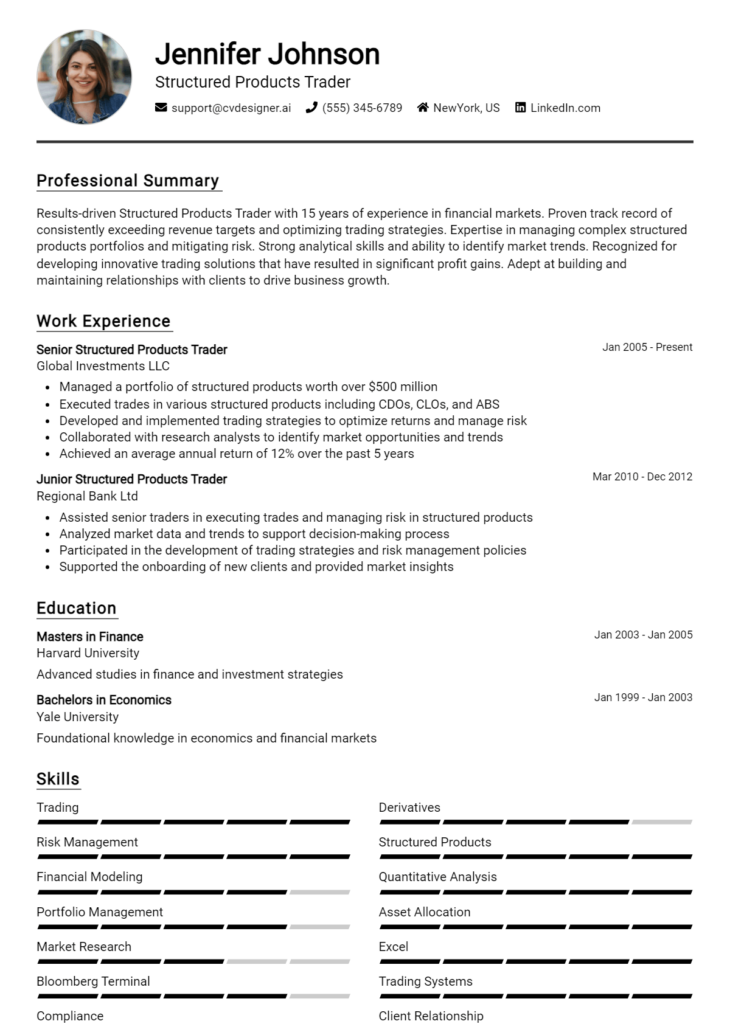

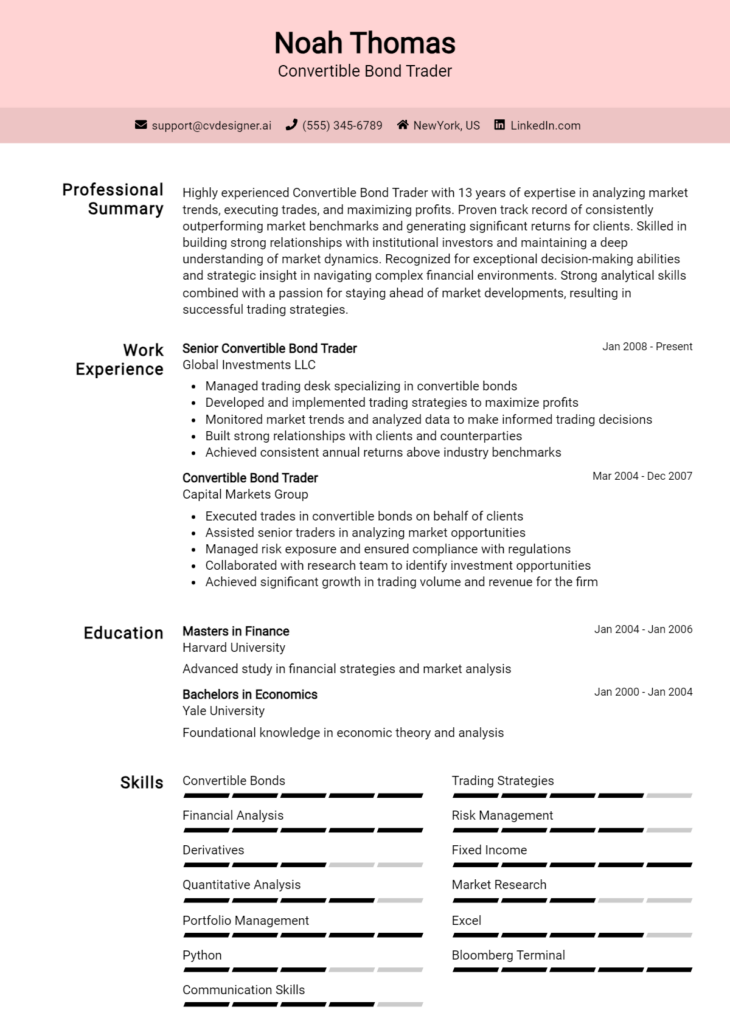

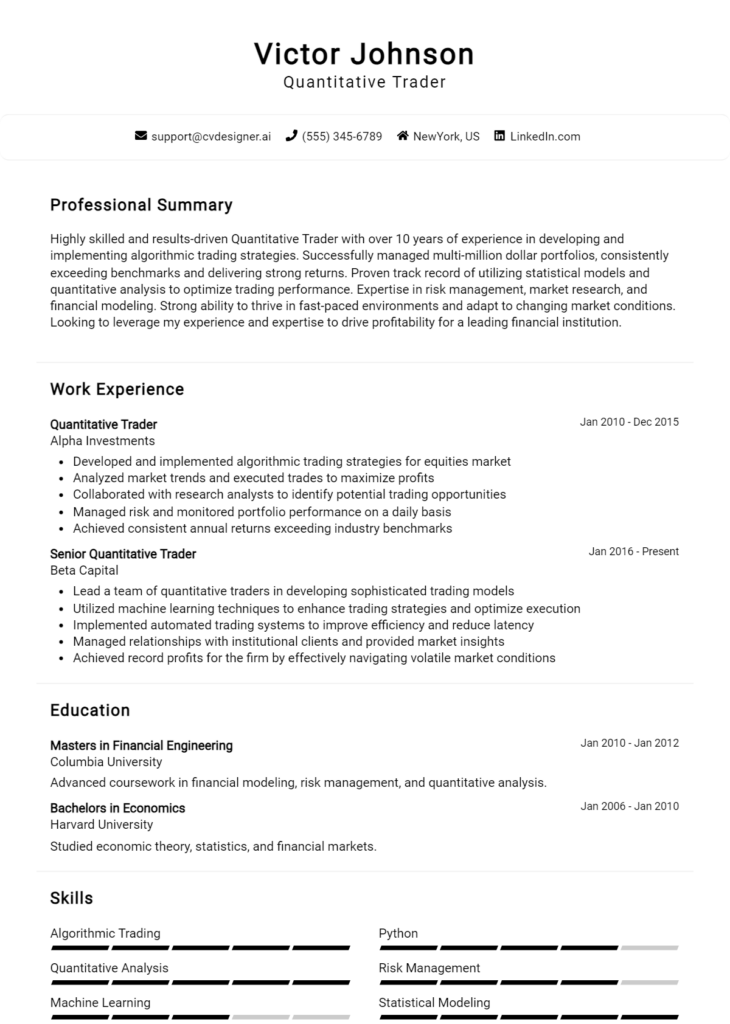

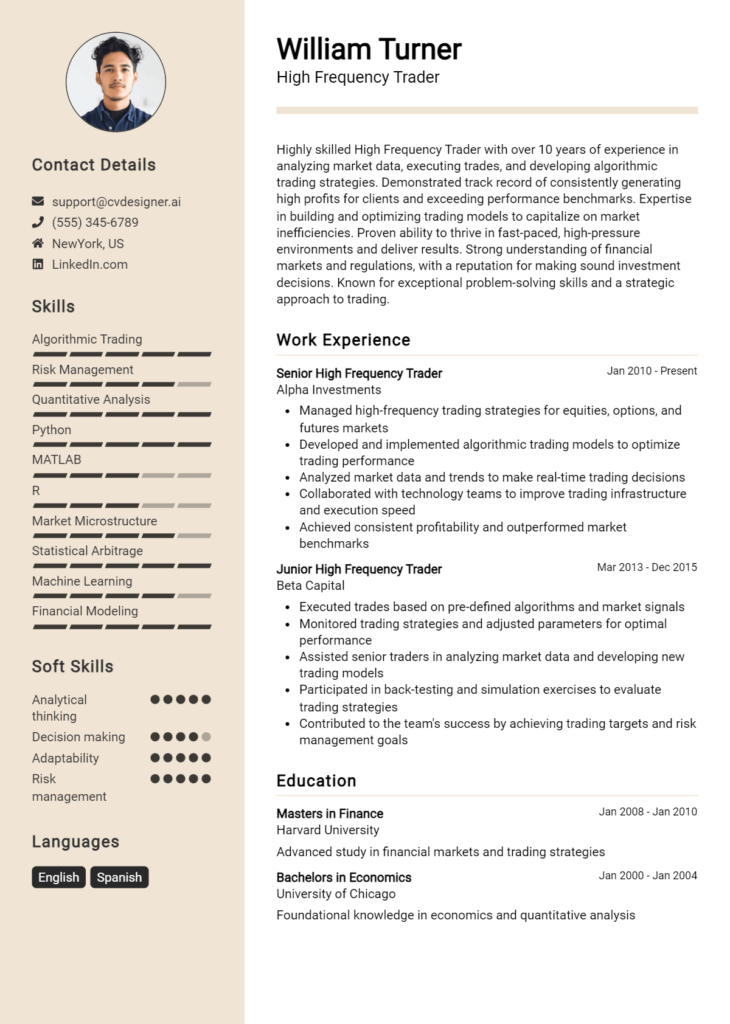

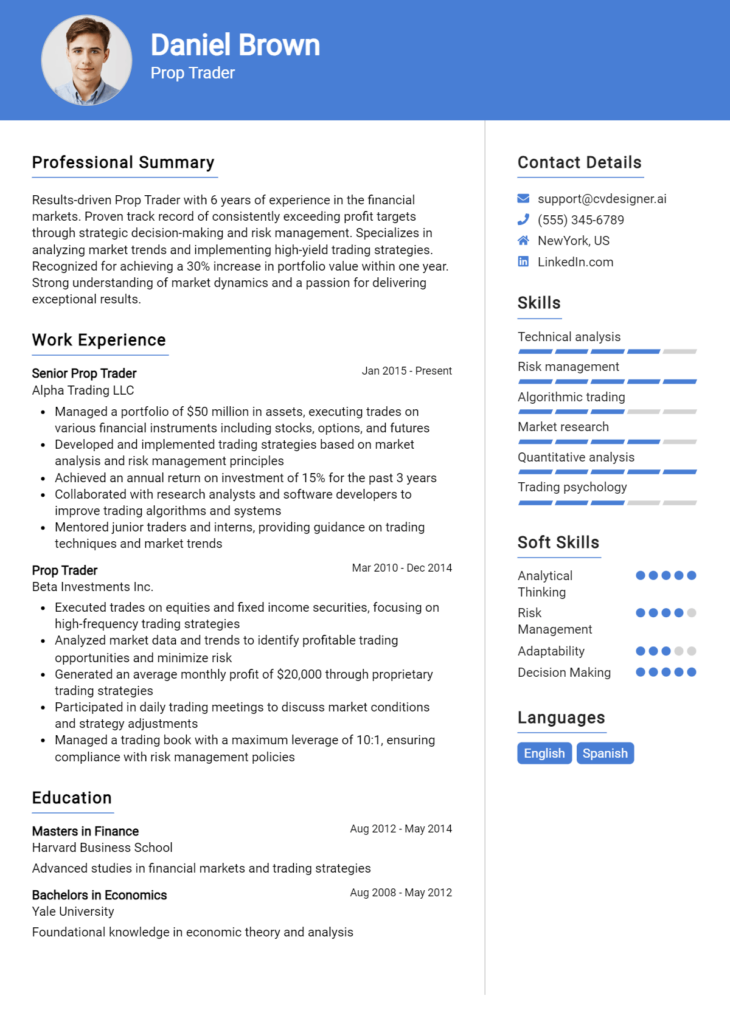

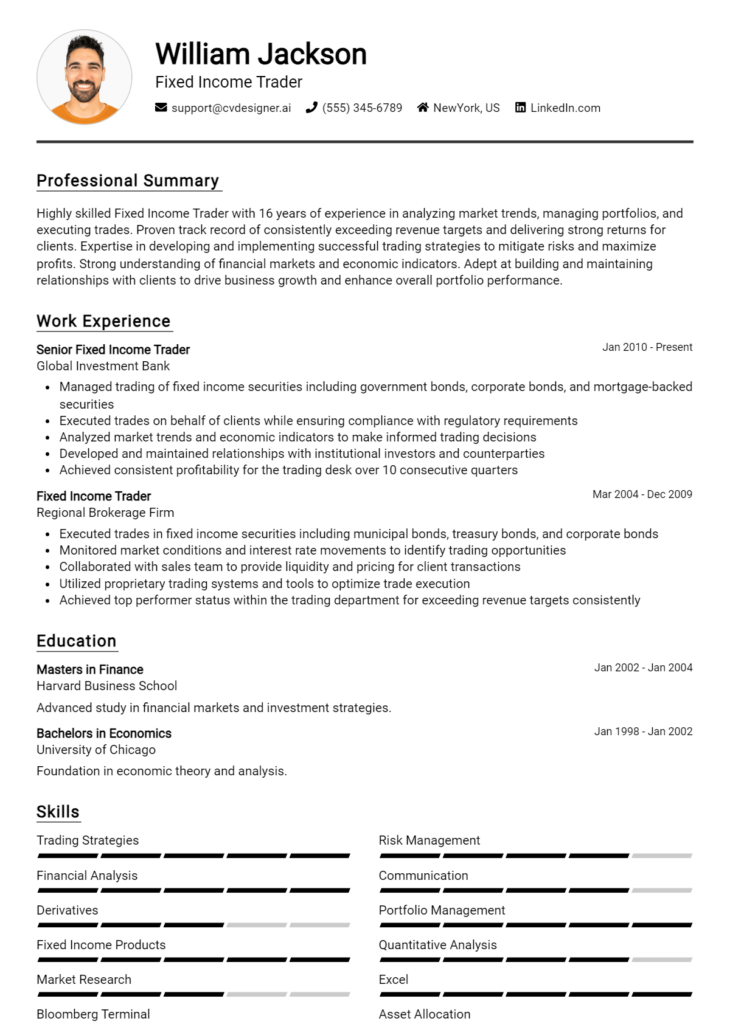

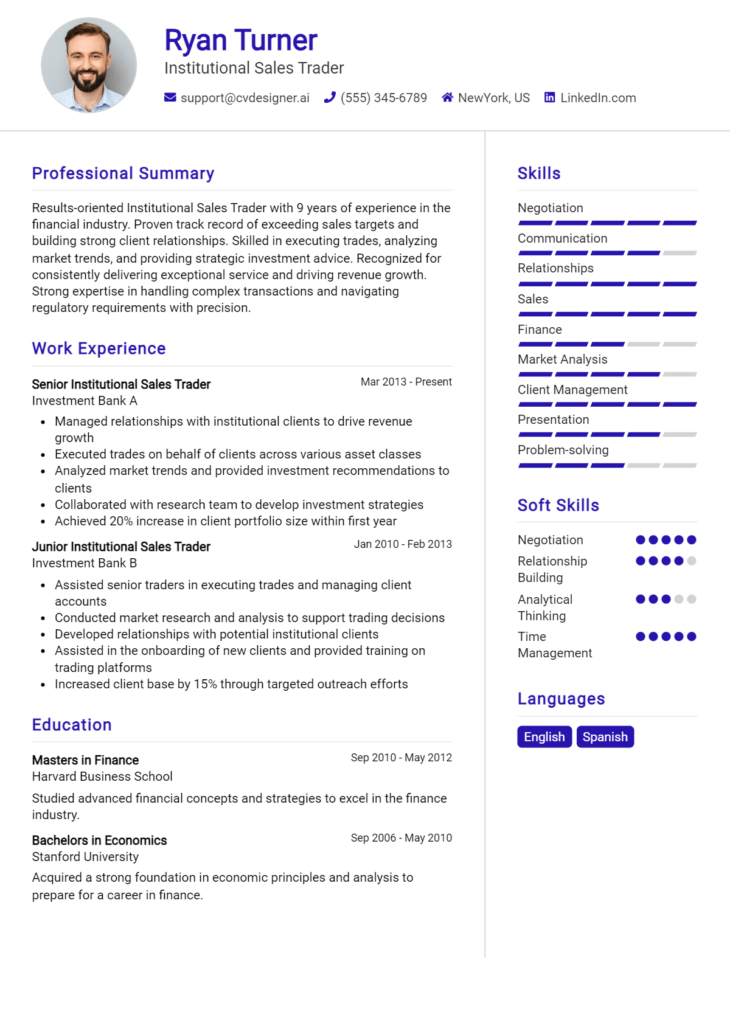

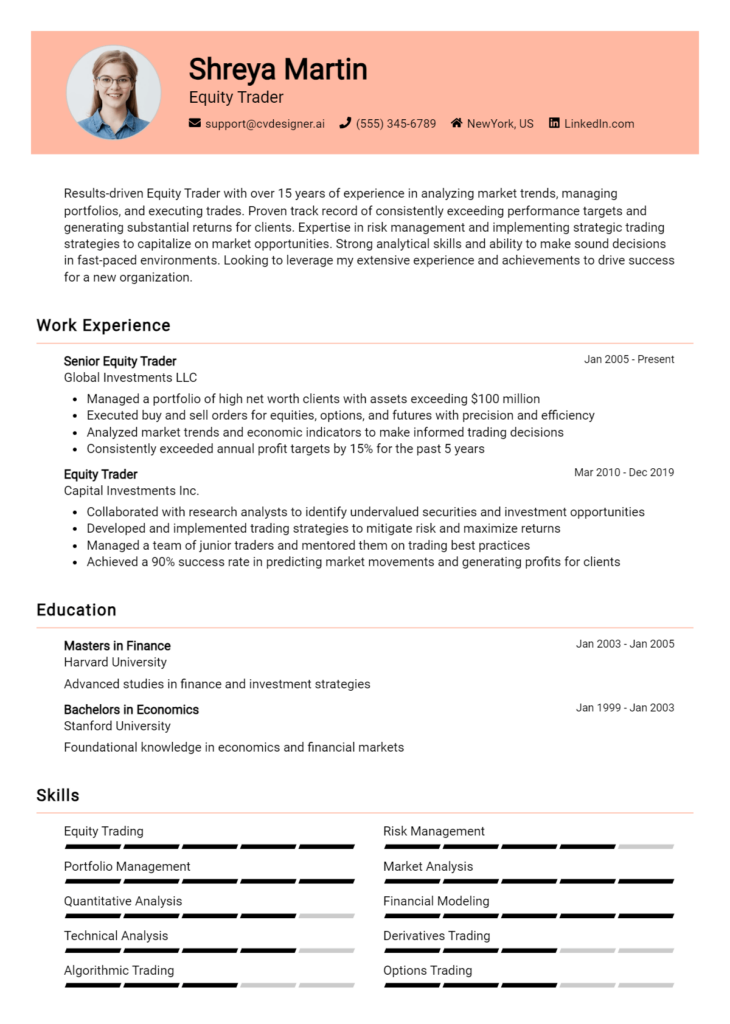

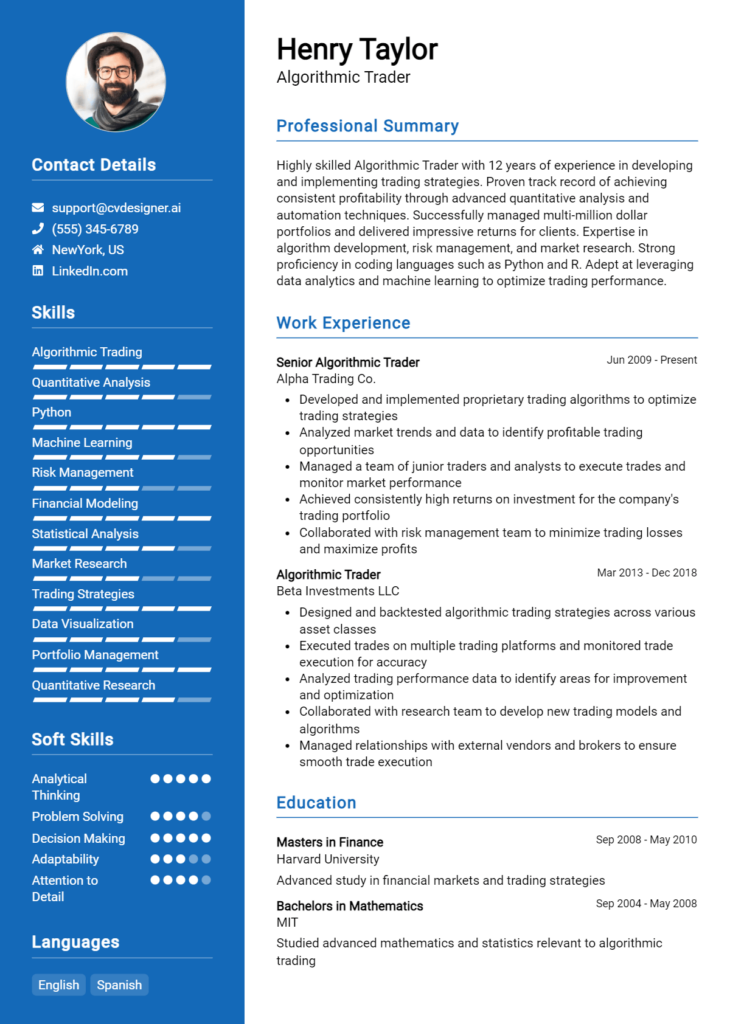

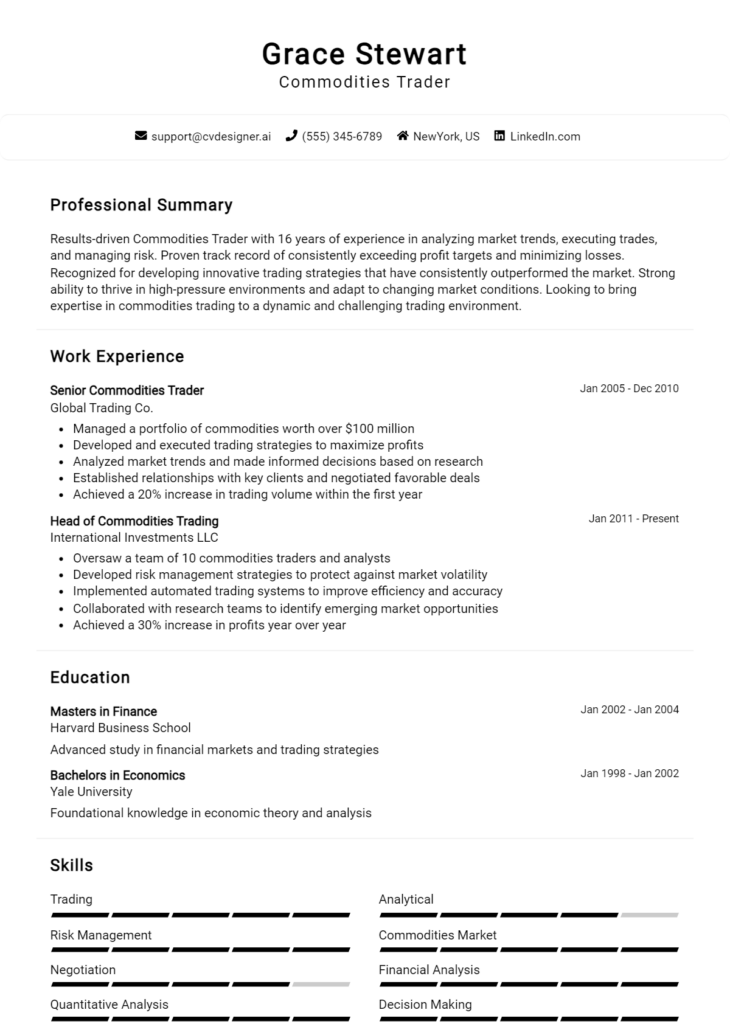

To ensure your resume reflects your qualifications effectively, take advantage of various resources available. Explore our resume templates to find a design that fits your style. Use the resume builder for a user-friendly way to create a polished document that highlights your skills and experiences. Look through our resume examples for inspiration and ideas on how to present your information compellingly. Additionally, don’t forget to craft a professional introduction with our cover letter templates that complement your resume.

Take action today—review your Volatility Trader resume and ensure it stands out in a competitive job market. Utilize the tools available to you and present yourself as the ideal candidate ready to tackle the challenges of volatility trading.