Equity Trader Core Responsibilities

Equity Traders play a crucial role in financial markets, focusing on buying and selling stocks to maximize returns for their clients or firms. They leverage technical analysis, operational acumen, and strong problem-solving skills to make informed decisions swiftly. This role acts as a bridge between research, marketing, and compliance departments, ensuring that trading strategies align with organizational goals. A well-structured resume highlighting these competencies is essential for showcasing the candidate's ability to contribute effectively to the team's success.

Common Responsibilities Listed on Equity Trader Resume

- Analyze market trends and stock performance to inform trading decisions.

- Execute buy and sell orders in a timely manner.

- Monitor and manage investment portfolios for risk and return optimization.

- Collaborate with research analysts to evaluate investment opportunities.

- Develop and implement trading strategies based on market conditions.

- Maintain compliance with regulatory requirements and internal policies.

- Utilize trading platforms and software for data analysis and order execution.

- Communicate effectively with clients and stakeholders regarding trading activities.

- Conduct post-trade analysis to assess performance and improve strategies.

- Stay informed about economic news and financial developments.

High-Level Resume Tips for Equity Trader Professionals

In the competitive world of finance, a well-crafted resume is crucial for Equity Trader professionals seeking to make their mark. It serves as the first impression that potential employers will have of a candidate, and as such, it must effectively reflect not only the individual’s skills and qualifications but also their notable achievements in the field. A strong resume will set the tone for further discussions and can be the key to unlocking new career opportunities. This guide will provide practical and actionable resume tips specifically tailored for Equity Trader professionals, ensuring that your application stands out in a crowded job market.

Top Resume Tips for Equity Trader Professionals

- Tailor your resume to each job description, emphasizing the skills and experiences that align with the specific requirements of the position.

- Highlight relevant experience by including internships, roles, or projects that demonstrate your understanding of equity markets and trading strategies.

- Quantify your achievements with specific metrics, such as percentage of profit generated, volume of trades executed, or performance relative to benchmarks.

- Showcase industry-specific skills such as technical analysis, risk management, and familiarity with trading platforms and software.

- Incorporate keywords from the job posting to help your resume pass through applicant tracking systems (ATS) and attract the attention of hiring managers.

- Include certifications or licenses relevant to trading, such as the Chartered Financial Analyst (CFA) designation or Series 7 and Series 63 licenses.

- Demonstrate your understanding of market trends and economic indicators by briefly mentioning significant market events you navigated successfully.

- Keep your resume concise, ideally one page, and ensure it is formatted clearly for easy reading by recruiters.

- Highlight soft skills such as decision-making, analytical thinking, and communication, which are critical for success in trading roles.

By implementing these tips, Equity Trader professionals can significantly enhance their resumes, increasing their chances of landing interviews and ultimately securing a position in this dynamic field. A strong resume not only showcases qualifications but also tells a story of achievements and skills that resonate with potential employers.

Why Resume Headlines & Titles are Important for Equity Trader

In the competitive landscape of finance, where every detail matters, the role of an Equity Trader is pivotal in executing buy and sell orders for stocks, analyzing market trends, and making split-second decisions that can yield significant profits or losses. A resume headline or title serves as a critical first impression, summarizing a candidate's qualifications and expertise in a concise phrase. A strong headline captures the attention of hiring managers immediately, highlighting key skills and experiences relevant to the position. It should be direct, impactful, and tailored to the specific job being applied for, ensuring that the candidate stands out in a crowded applicant pool.

Best Practices for Crafting Resume Headlines for Equity Trader

- Keep it concise: Aim for one impactful phrase that summarizes your expertise.

- Be specific: Tailor the headline to reflect the specific role of an Equity Trader.

- Highlight key skills: Focus on your strongest skills and experiences relevant to trading.

- Use industry terminology: Incorporate relevant terms to demonstrate familiarity with the field.

- Showcase achievements: If applicable, mention any significant accomplishments or metrics that illustrate your success.

- Avoid jargon: Ensure clarity by avoiding overly complex language or industry jargon that may confuse hiring managers.

- Reflect your unique value: Communicate what sets you apart from other candidates in the trading field.

- Maintain professionalism: Ensure the tone is formal and appropriate for the finance industry.

Example Resume Headlines for Equity Trader

Strong Resume Headlines

"Results-Driven Equity Trader with 5+ Years of Experience in High-Volume Markets"

“Expert in Technical Analysis and Risk Management for Equity Trading Strategies”

“Proven Track Record of Generating Profitable Trades in Volatile Markets”

Weak Resume Headlines

“Equity Trader Looking for Opportunities”

“Finance Professional with Experience”

The strong headlines are effective because they clearly communicate specific skills, experience, and accomplishments that are relevant to the role of an Equity Trader. They not only convey expertise but also suggest a track record of success, making them compelling to hiring managers. In contrast, the weak headlines lack specificity and fail to convey any unique strengths or achievements, making them forgettable and less likely to capture the attention of potential employers.

Writing an Exceptional Equity Trader Resume Summary

A well-crafted resume summary is essential for an Equity Trader, as it serves as the first impression to hiring managers. This brief yet impactful section quickly captures attention by highlighting key skills, relevant experience, and noteworthy accomplishments that align with the demands of the role. In a competitive job market, a strong summary not only succinctly presents the candidate's qualifications but also demonstrates how they can add value to the organization. It should be concise, compelling, and specifically tailored to the job description to maximize its effectiveness.

Best Practices for Writing a Equity Trader Resume Summary

- Quantify achievements: Use specific numbers or percentages to demonstrate the impact of your work.

- Focus on skills: Highlight both technical and soft skills relevant to equity trading.

- Tailor the summary: Customize your summary for each job application to reflect the requirements of the specific role.

- Use action verbs: Start sentences with strong action verbs to convey confidence and decisiveness.

- Keep it concise: Aim for 2-4 sentences to maintain the reader's attention while delivering key information.

- Showcase relevant experience: Include experiences that directly relate to trading activities, market analysis, or portfolio management.

- Highlight certifications: Mention any relevant certifications, such as CFA or Series 7, to enhance credibility.

- Emphasize results: Focus on the outcomes of your trading strategies to demonstrate your effectiveness.

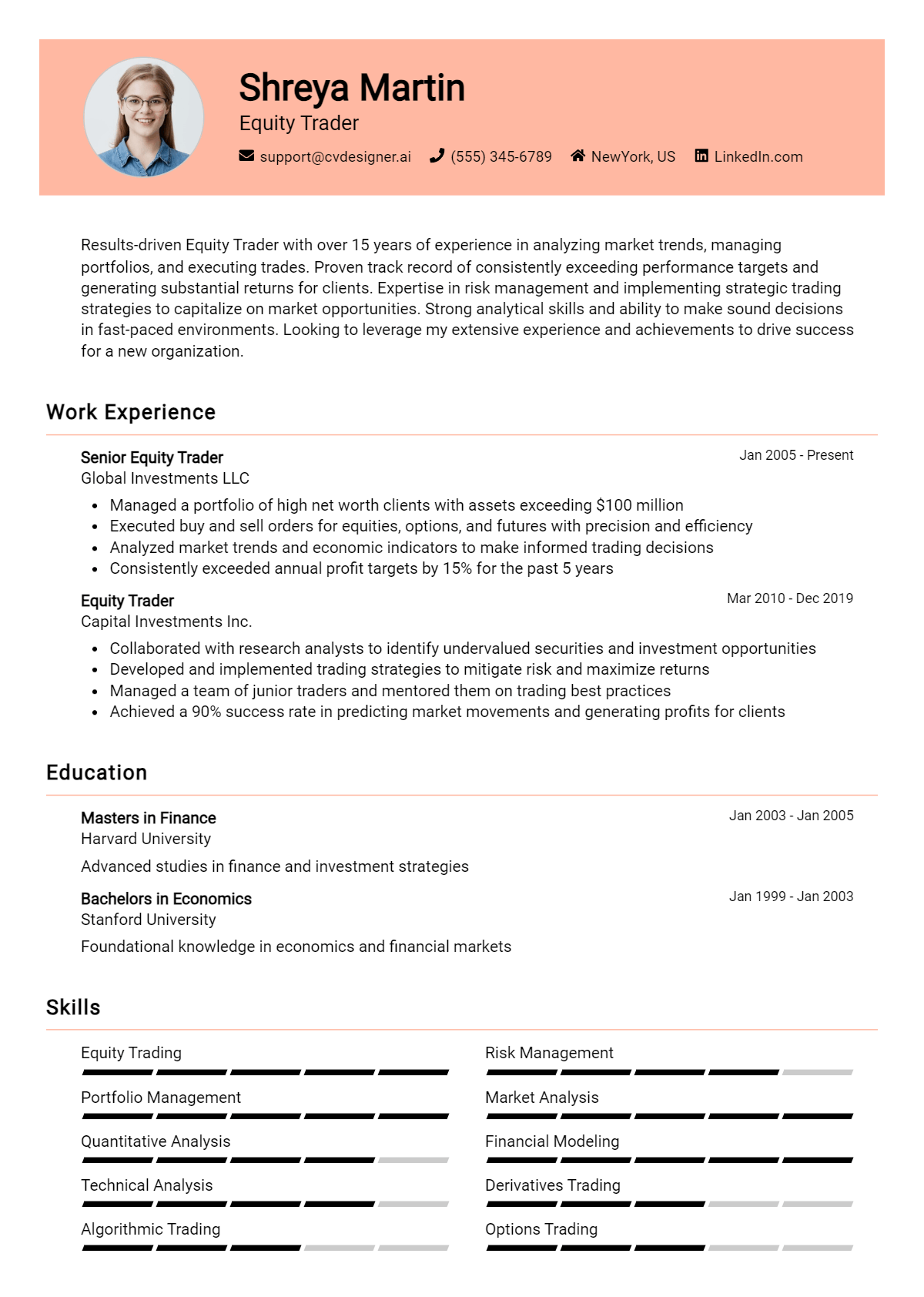

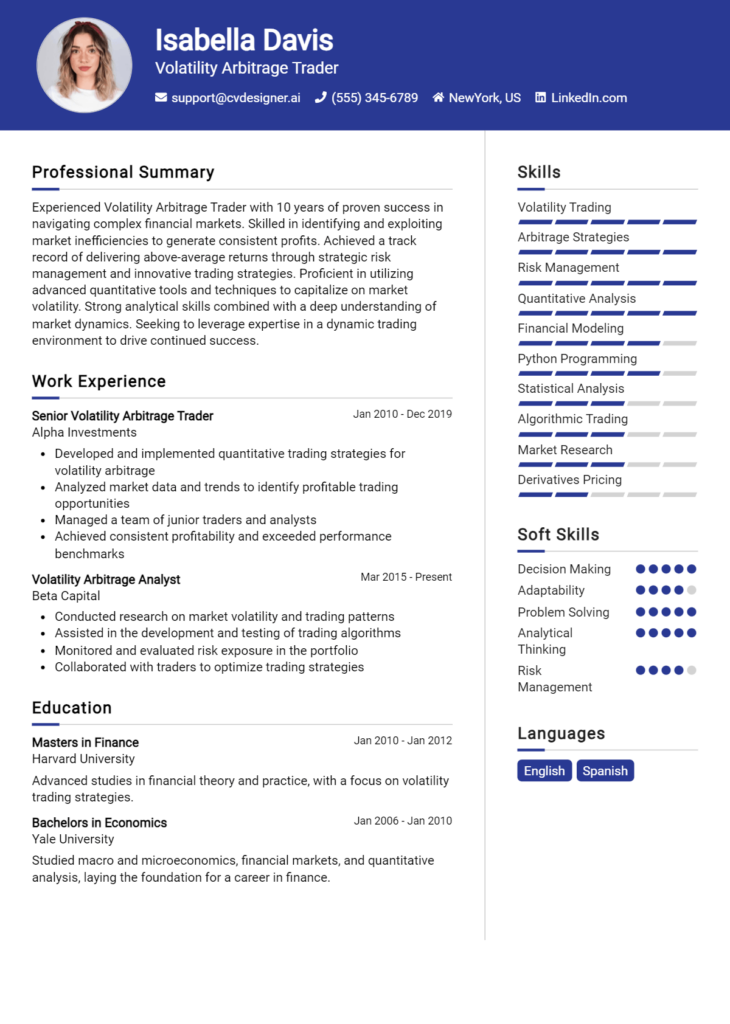

Example Equity Trader Resume Summaries

Strong Resume Summaries

Dynamic Equity Trader with over 5 years of experience managing multi-million dollar portfolios, achieving an average annual return of 15% through strategic investment decisions and rigorous market analysis.

Results-oriented Equity Trader skilled in leveraging quantitative analysis to drive profitable trades, with a track record of increasing portfolio value by 30% in under 12 months while maintaining risk exposure below 5%.

Proficient Equity Trader with expertise in high-frequency trading and algorithmic strategies, successfully executing over 2,000 trades monthly and enhancing liquidity for institutional clients.

Weak Resume Summaries

Experienced trader looking for a new opportunity in equity trading.

Skilled in trading and investment management, with a good understanding of the market.

The strong resume summaries are considered effective because they provide specific examples of achievements and skills, quantifying results that demonstrate the candidate's value to potential employers. In contrast, the weak summaries lack detail and specificity, making it difficult for hiring managers to gauge the candidate's qualifications or impact in previous roles.

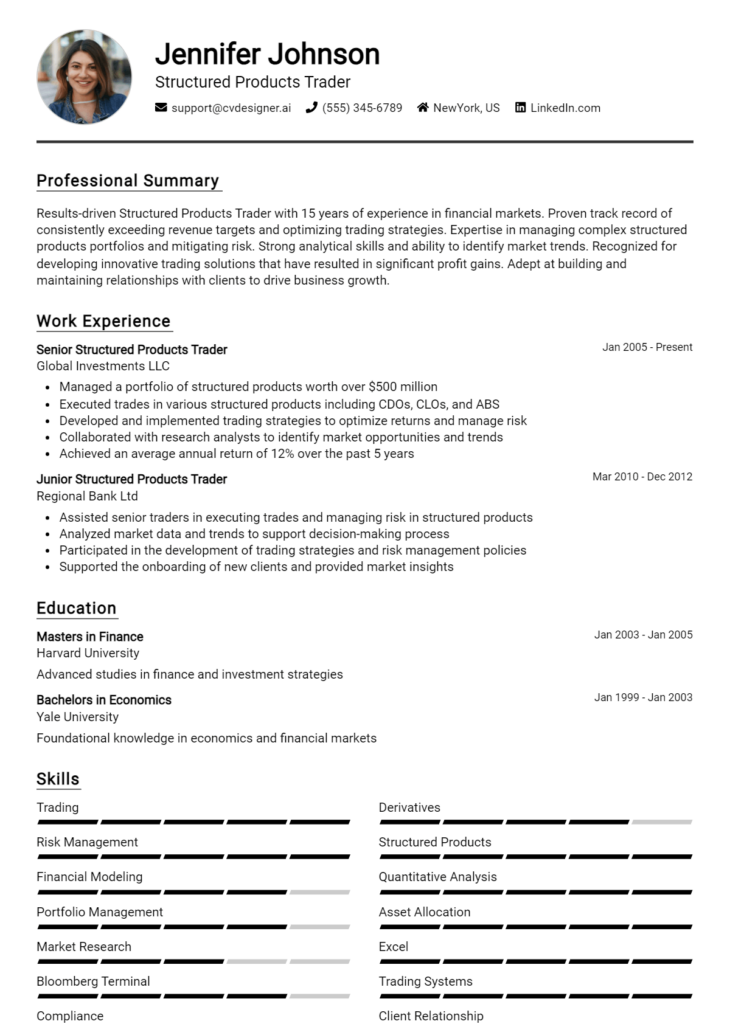

Work Experience Section for Equity Trader Resume

The work experience section of an Equity Trader resume is crucial as it provides potential employers with insights into the candidate's practical experience and technical abilities. This section not only highlights the candidate's proficiency in trading strategies and market analysis but also demonstrates their capacity to manage teams and deliver high-quality trading products. By quantifying achievements and aligning their experience with industry standards, candidates can effectively showcase their value to prospective employers, making a compelling case for their expertise in the fast-paced world of equity trading.

Best Practices for Equity Trader Work Experience

- Clearly outline your trading strategies and methodologies used in previous roles.

- Quantify your achievements with specific metrics, such as percentage gains, revenue generated, or risk management success.

- Highlight experiences that demonstrate technical skills, such as proficiency in trading software or data analysis tools.

- Showcase your ability to collaborate with teams, including how you contributed to group decision-making and strategy development.

- Include any leadership roles or responsibilities that illustrate your capacity to mentor and guide team members.

- Align your experiences with industry standards and terminology to resonate with hiring managers.

- Use action verbs to convey your contributions and impact effectively.

- Tailor your work experience to reflect the specific requirements of the job you are applying for.

Example Work Experiences for Equity Trader

Strong Experiences

- Achieved a 25% annual return on investment by implementing a new algorithmic trading strategy, outperforming the market benchmark.

- Led a team of 5 traders to develop and execute a risk management framework that reduced trading losses by 30% over one year.

- Collaborated with the IT department to enhance trading software, resulting in a 15% improvement in order execution speed.

- Executed over 1,000 trades per week, maintaining a win rate of 70% through meticulous market analysis and research.

Weak Experiences

- Worked as a trader in a fast-paced environment, handling various trades.

- Participated in team meetings to discuss trading strategies.

- Responsible for monitoring market trends and updating records.

- Assisted with trade execution and other related tasks.

The examples of strong experiences are considered effective because they provide specific, quantifiable outcomes that demonstrate the candidate's impact and technical expertise in equity trading. In contrast, the weak experiences lack detail and measurable results, making them less compelling to hiring managers. By focusing on concrete achievements and collaborative efforts, candidates can create a more persuasive narrative of their capabilities in the competitive trading landscape.

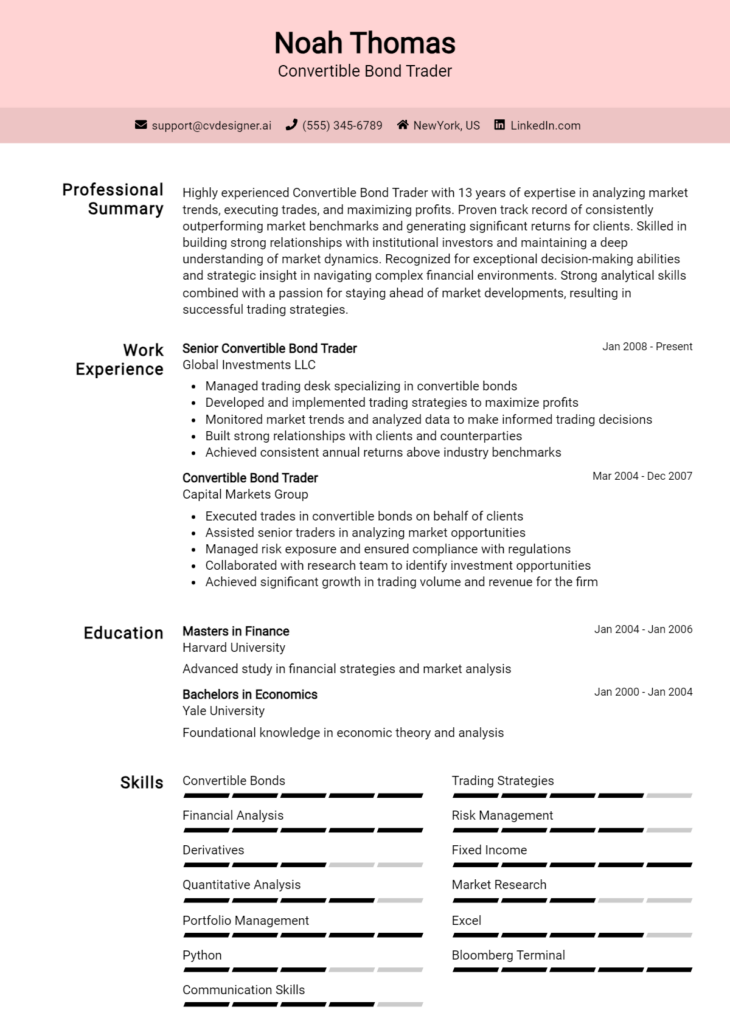

Education and Certifications Section for Equity Trader Resume

The education and certifications section of an Equity Trader resume is crucial as it underscores the candidate's academic background and highlights their commitment to continuous learning in a competitive field. This section not only reflects the candidate's foundational knowledge but also showcases any industry-relevant certifications and specialized training that can significantly enhance their credibility. By providing pertinent coursework, recognized certifications, and a commitment to staying updated with industry practices, candidates can demonstrate their alignment with the job requirements and their dedication to professional growth.

Best Practices for Equity Trader Education and Certifications

- Prioritize relevant degrees such as Finance, Economics, or Business Administration.

- Include industry-recognized certifications like CFA (Chartered Financial Analyst) or CMT (Chartered Market Technician).

- Highlight any specialized training in trading platforms, risk management, or financial analysis.

- Provide details on relevant coursework that pertains to financial markets, derivatives, and portfolio management.

- Keep the information concise and focused on recent qualifications and achievements.

- Showcase continuous learning efforts through workshops, seminars, or online courses related to trading strategies.

- Use a clear format that distinguishes between degrees, certifications, and training for easy readability.

- Tailor the section to the specific requirements of the job, emphasizing qualifications that match the role’s expectations.

Example Education and Certifications for Equity Trader

Strong Examples

- Bachelor of Science in Finance, University of Chicago, 2020

- CFA Level II Candidate, Chartered Financial Analyst Institute, 2023

- Certificate in Advanced Trading Strategies, New York Institute of Finance, 2022

- Relevant Coursework: Financial Markets, Derivatives, and Investment Analysis

Weak Examples

- Bachelor of Arts in History, State University, 2018

- Certification in Basic Microsoft Office, Online Learning Platform, 2021

- High School Diploma, Local High School, 2016

- Outdated Certification in Stock Market Basics, 2015

The strong examples are considered effective because they directly relate to the skills and knowledge required for an Equity Trader role, showcasing relevant degrees and certifications that enhance the candidate's marketability. In contrast, the weak examples lack relevance to the trading field, featuring outdated or unrelated qualifications that do not support the candidate's suitability for the position. This clear distinction helps potential employers quickly assess the candidate's qualifications.

Top Skills & Keywords for Equity Trader Resume

An effective resume for an Equity Trader must highlight both hard and soft skills that are essential for success in this fast-paced and competitive field. The ability to analyze market trends, make quick decisions, and navigate high-stakes environments is crucial. Furthermore, showcasing interpersonal skills such as communication and teamwork can set a candidate apart from others. A well-crafted resume that emphasizes these skills not only demonstrates a candidate's qualifications but also aligns their experiences with the demands of the role. For a deeper insight into how to present these skills effectively, check out the resources on skills and work experience.

Top Hard & Soft Skills for Equity Trader

Soft Skills

- Strong Analytical Thinking

- Effective Communication

- Quick Decision-Making

- Team Collaboration

- Emotional Resilience

- Adaptability to Market Changes

- Problem-Solving Skills

- Intuition and Judgment

- Stress Management

- Negotiation Skills

Hard Skills

- Technical Analysis

- Fundamental Analysis

- Risk Management Techniques

- Trading Software Proficiency (e.g., Bloomberg, Eikon)

- Financial Modeling

- Market Research

- Quantitative Analysis

- Portfolio Management

- Regulatory Compliance Knowledge

- Statistical Analysis Tools (e.g., Excel, R, Python)

Stand Out with a Winning Equity Trader Cover Letter

Dear [Hiring Manager's Name],

I am writing to express my interest in the Equity Trader position at [Company Name] as advertised on [where you found the job listing]. With a strong foundation in financial markets and a passion for equity trading, I believe I am well-equipped to contribute to your team and help drive investment success. My experience in analyzing market trends, executing trades, and managing portfolios has honed my skills in making informed decisions in high-pressure environments.

During my previous role at [Previous Company Name], I successfully executed trades across various equity markets, consistently achieving an average annual return that exceeded benchmarks. My ability to leverage advanced trading strategies and utilize quantitative analysis tools allowed me to identify lucrative opportunities while mitigating risk. I am particularly proud of developing a trading algorithm that improved trade execution speed by 30%, significantly enhancing our team’s overall performance. My strong analytical skills, combined with a keen understanding of market dynamics, enable me to react swiftly and effectively to market changes.

Additionally, I am committed to continuous learning and staying abreast of market developments. I regularly participate in trading seminars and workshops to refine my strategies and expand my knowledge. I am excited about the prospect of contributing to a forward-thinking firm like [Company Name] that values innovation and excellence in trading practices. My enthusiasm for the financial markets, paired with my proven track record, makes me a strong candidate for this role.

Thank you for considering my application. I look forward to the opportunity to discuss how my skills and experiences align with the goals of [Company Name]. I am eager to bring my expertise in equity trading to your esteemed organization and contribute to its ongoing success.

Sincerely,

[Your Name]

[Your Phone Number]

[Your Email Address]

Common Mistakes to Avoid in a Equity Trader Resume

Creating an effective resume as an equity trader is crucial in standing out in a competitive job market. However, many candidates make common mistakes that can hinder their chances of securing an interview. By avoiding these pitfalls, you can present a polished and professional resume that highlights your skills and experiences effectively. Here are some common mistakes to watch out for:

Lack of Quantifiable Achievements: Failing to include specific numbers or results can make your accomplishments seem vague. Use metrics to showcase your performance, such as percentage increases in portfolio value or successful trade volumes.

Overly Technical Jargon: While it’s important to demonstrate your knowledge, using excessive jargon can alienate hiring managers who may not be familiar with every term. Aim for clarity and balance technical language with explanations.

Ignoring Tailoring for the Position: Sending out a generic resume without tailoring it to the specific job can leave a negative impression. Customize your skills and experiences to align with the job description and company values.

Including Irrelevant Experience: Listing jobs that have no connection to equity trading can clutter your resume. Focus on experiences that showcase relevant skills, such as analytical abilities, market knowledge, or risk management.

Neglecting Soft Skills: Equity trading isn’t just about numbers; soft skills like communication, teamwork, and decision-making are crucial. Highlight these qualities to demonstrate your well-roundedness as a candidate.

Poor Formatting and Structure: A cluttered or unprofessional layout can detract from the content of your resume. Use a clean, organized format with clear headings and bullet points to enhance readability.

Spelling and Grammar Errors: Simple mistakes can signal carelessness. Always proofread your resume to eliminate typos and grammatical errors, as these can undermine your professionalism.

Omitting Relevant Certifications or Education: Many trading positions require specific qualifications. Ensure you list relevant degrees, licenses, or certifications that demonstrate your competency in the field.

Conclusion

As an equity trader, your resume plays a crucial role in showcasing your skills and experiences to potential employers. Throughout this article, we've discussed the key attributes of successful equity traders, including strong analytical skills, risk management capabilities, and a deep understanding of market trends. We also highlighted the importance of demonstrating your proficiency with trading software and your ability to work under pressure while making quick decisions.

In conclusion, crafting a compelling Equity Trader resume is essential for standing out in a competitive job market. Take the time to review and refine your resume, ensuring that it effectively highlights your relevant experiences and skills.

To assist you in this process, consider utilizing various resources available to enhance your resume. You can explore resume templates for structured layouts, use a resume builder for easy customization, and check out resume examples for inspiration. Additionally, don't forget to create a strong first impression with a well-crafted cover letter.

Take action today and elevate your Equity Trader resume to secure the job you desire!