Quantitative Trader Core Responsibilities

A Quantitative Trader plays a crucial role in financial markets by leveraging mathematical models and statistical analysis to make informed trading decisions. Key responsibilities include developing algorithms, analyzing market data, and collaborating with risk management and technology teams to optimize trading strategies. Essential skills encompass technical proficiency in programming languages, operational insight into market mechanics, and strong problem-solving abilities. These competencies are vital for achieving organizational goals, and a well-structured resume can effectively highlight these qualifications, making a strong case for the candidate's value.

Common Responsibilities Listed on Quantitative Trader Resume

- Develop and implement quantitative trading strategies.

- Analyze large datasets to identify market trends and opportunities.

- Collaborate with software engineers to optimize trading systems.

- Conduct risk assessments and manage portfolio exposure.

- Monitor trading performance and refine models as necessary.

- Utilize statistical methods to forecast market behavior.

- Generate reports on trading activities and results.

- Stay updated on market developments and emerging technologies.

- Participate in cross-functional teams to enhance trading operations.

- Ensure compliance with regulatory requirements and internal policies.

- Engage in continuous learning to improve trading algorithms.

High-Level Resume Tips for Quantitative Trader Professionals

In the competitive landscape of quantitative trading, a well-crafted resume is not just a document; it is your first and often only chance to make a lasting impression on potential employers. This critical tool must effectively showcase your unique blend of analytical skills, technical expertise, and notable achievements. A polished resume can open doors to interviews and opportunities that may seem out of reach. In this guide, we will provide practical and actionable resume tips specifically tailored for Quantitative Trader professionals, ensuring your application stands out in a crowded field.

Top Resume Tips for Quantitative Trader Professionals

- Tailor your resume to align with the specific job description, using relevant keywords and phrases to pass applicant tracking systems.

- Highlight your relevant experience in quantitative analysis, data modeling, and algorithm development in a dedicated section.

- Quantify your achievements by including metrics and statistics that demonstrate your impact, such as percentage increases in trading profits or risk mitigation.

- Showcase industry-specific skills like proficiency in programming languages (Python, R, C++) and familiarity with trading platforms and tools.

- Include certifications and educational qualifications that are relevant to quantitative trading, such as CFA, FRM, or advanced degrees in mathematics or finance.

- Utilize a clean and professional layout that makes your resume easy to read, with clear headings and bullet points for quick navigation.

- Incorporate projects or case studies that reflect your problem-solving abilities and innovative approaches to trading strategies.

- Emphasize soft skills such as teamwork, communication, and adaptability, which are essential for collaborating with diverse teams and stakeholders.

- Keep your resume concise, ideally fitting onto one page while ensuring that all critical information is included and easily digestible.

By implementing these tips, you can significantly enhance your chances of landing a job in the Quantitative Trader field. A well-structured and targeted resume not only highlights your qualifications but also conveys your commitment to excellence, setting you apart from other candidates in this challenging and dynamic industry.

Why Resume Headlines & Titles are Important for Quantitative Trader

In the highly competitive field of quantitative trading, a well-crafted resume headline or title serves as a critical first impression for candidates. A strong headline can immediately capture the attention of hiring managers by succinctly summarizing a candidate's key qualifications and areas of expertise. This impactful phrase should be concise and directly relevant to the job being applied for, enabling recruiters to quickly assess whether the candidate possesses the necessary skills and experience. In a profession where mathematical proficiency and analytical skills are paramount, a compelling headline can set the tone for the entire resume, making it essential for aspiring quantitative traders to prioritize this aspect of their application.

Best Practices for Crafting Resume Headlines for Quantitative Trader

- Keep it concise: Aim for one impactful sentence or phrase.

- Be specific: Use terminology relevant to quantitative trading and finance.

- Highlight key skills: Focus on your strongest skills that match the job description.

- Include measurable achievements: If possible, reference quantifiable results you have delivered.

- Tailor for each application: Customize your headline to align with the specific job requirements.

- Use action-oriented language: Start with strong action verbs to convey confidence and capability.

- Maintain professionalism: Ensure the language and tone are suitable for a finance-related role.

- Avoid jargon: While specificity is important, excessive jargon can detract from clarity.

Example Resume Headlines for Quantitative Trader

Strong Resume Headlines

"Quantitative Trader with 5+ Years of Experience in Algorithmic Trading and Risk Management"

“Proven Track Record of Developing High-Performance Trading Models Utilizing Machine Learning Techniques”

“Expert in Statistical Analysis and Financial Modeling for Hedge Fund Investments”

Weak Resume Headlines

“Trader Seeking New Opportunities”

“Experienced Professional in Finance”

Strong headlines are effective because they clearly communicate the candidate's expertise, experience, and achievements in a concise manner, directly relevant to the role of a quantitative trader. They utilize specific language that resonates with hiring managers and demonstrate the candidate's value proposition. In contrast, weak headlines fail to impress because they are vague and lack specificity, making it difficult for recruiters to gauge the candidate's qualifications or potential contributions to the team. By avoiding generic phrases, candidates can enhance their chances of standing out in a crowded job market.

Writing an Exceptional Quantitative Trader Resume Summary

A resume summary is a critical component for a Quantitative Trader, serving as the first impression that potential employers will have of a candidate. A well-crafted summary quickly captures the attention of hiring managers by effectively showcasing key skills, relevant experience, and notable accomplishments in the finance and trading domains. It should be concise yet impactful, tailored specifically to the job the candidate is applying for, and highlight the unique value they bring to the role. In a competitive job market, the ability to present oneself clearly and compellingly in a resume summary can make the difference between landing an interview or being overlooked.

Best Practices for Writing a Quantitative Trader Resume Summary

- Quantify achievements: Use numbers and percentages to demonstrate your success and impact in previous roles.

- Focus on relevant skills: Highlight technical skills, such as programming languages, statistical analysis, and financial modeling, that are pertinent to the job.

- Tailor the summary: Customize your summary for each job application to align with the specific requirements and keywords in the job description.

- Be concise: Keep the summary to 3-5 sentences, ensuring it is easy to read and quickly conveys your qualifications.

- Showcase industry knowledge: Mention your understanding of market trends, trading strategies, or risk management to demonstrate your expertise.

- Include soft skills: While technical skills are essential, also highlight soft skills like teamwork, communication, and problem-solving abilities.

- Use action verbs: Start sentences with strong action verbs to convey a sense of proactivity and results-oriented mindset.

- Revise and refine: Continuously update your summary to reflect new experiences, skills, and achievements as your career progresses.

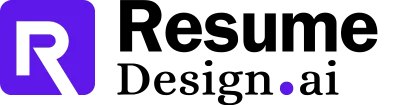

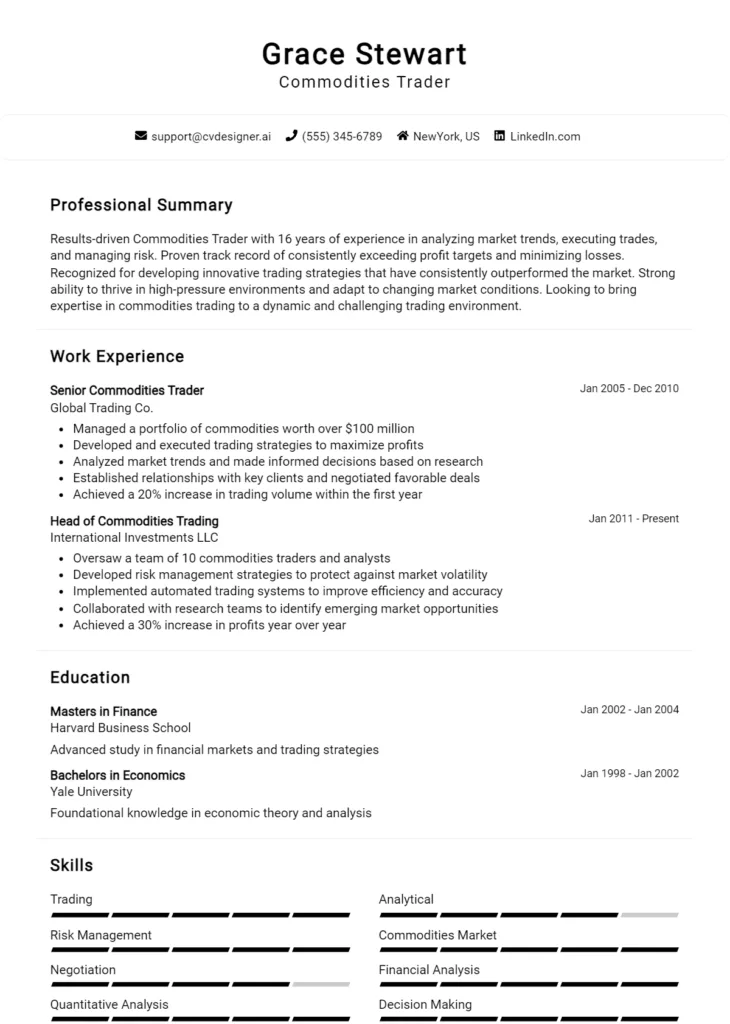

Example Quantitative Trader Resume Summaries

Strong Resume Summaries

Results-driven Quantitative Trader with over 5 years of experience in algorithmic trading and statistical arbitrage, achieving a 25% annual return on investment through data-driven strategies. Proficient in Python and R, with a proven track record of developing predictive models that enhance trading performance.

Dynamic Quantitative Analyst with expertise in high-frequency trading and risk management, successfully reducing portfolio volatility by 15% while maximizing returns. Skilled in machine learning and data analysis, with a Master’s degree in Financial Engineering.

Accomplished Quantitative Trader with a strong background in derivatives and options trading, having generated $3 million in profit through innovative trading strategies. Adept at leveraging advanced statistical techniques and tools to identify market inefficiencies.

Weak Resume Summaries

Experienced trader with skills in various financial markets looking for new opportunities.

Quantitative professional with a background in finance and some programming knowledge seeking to contribute to a trading team.

The examples of strong resume summaries stand out because they provide specific, quantifiable achievements and directly relate to the skills and experience relevant to a Quantitative Trader role. They articulate the candidate's value proposition clearly and concisely. In contrast, the weak summaries are vague, lack measurable outcomes, and do not convey a strong sense of expertise or relevance to the position, making them less compelling to hiring managers.

Work Experience Section for Quantitative Trader Resume

The work experience section of a Quantitative Trader resume is a crucial component that effectively showcases a candidate's technical skills and professional growth. This section serves as a platform to highlight the ability to manage teams, deliver high-quality financial products, and implement quantitative strategies that lead to significant results. By quantifying achievements and aligning experience with industry standards, candidates can demonstrate their value to prospective employers, making it essential to present this information clearly and compellingly.

Best Practices for Quantitative Trader Work Experience

- Focus on quantifiable results: Use numbers and metrics to demonstrate your impact on previous roles.

- Highlight relevant technical skills: Clearly outline programming languages, statistical methods, and tools you are proficient in.

- Showcase collaboration: Emphasize teamwork and cross-departmental projects to illustrate your ability to work effectively with others.

- Detail leadership experience: If applicable, describe any leadership roles or initiatives you’ve taken that improved processes or outcomes.

- Tailor your experience: Align your work history with the specific requirements of the job you’re applying for.

- Use action-oriented language: Start bullet points with strong action verbs to convey a sense of accomplishment.

- Keep it concise: Focus on the most relevant experiences and avoid unnecessary details to maintain clarity.

- Include continuous learning: Mention any certifications or trainings that enhance your quantitative skills.

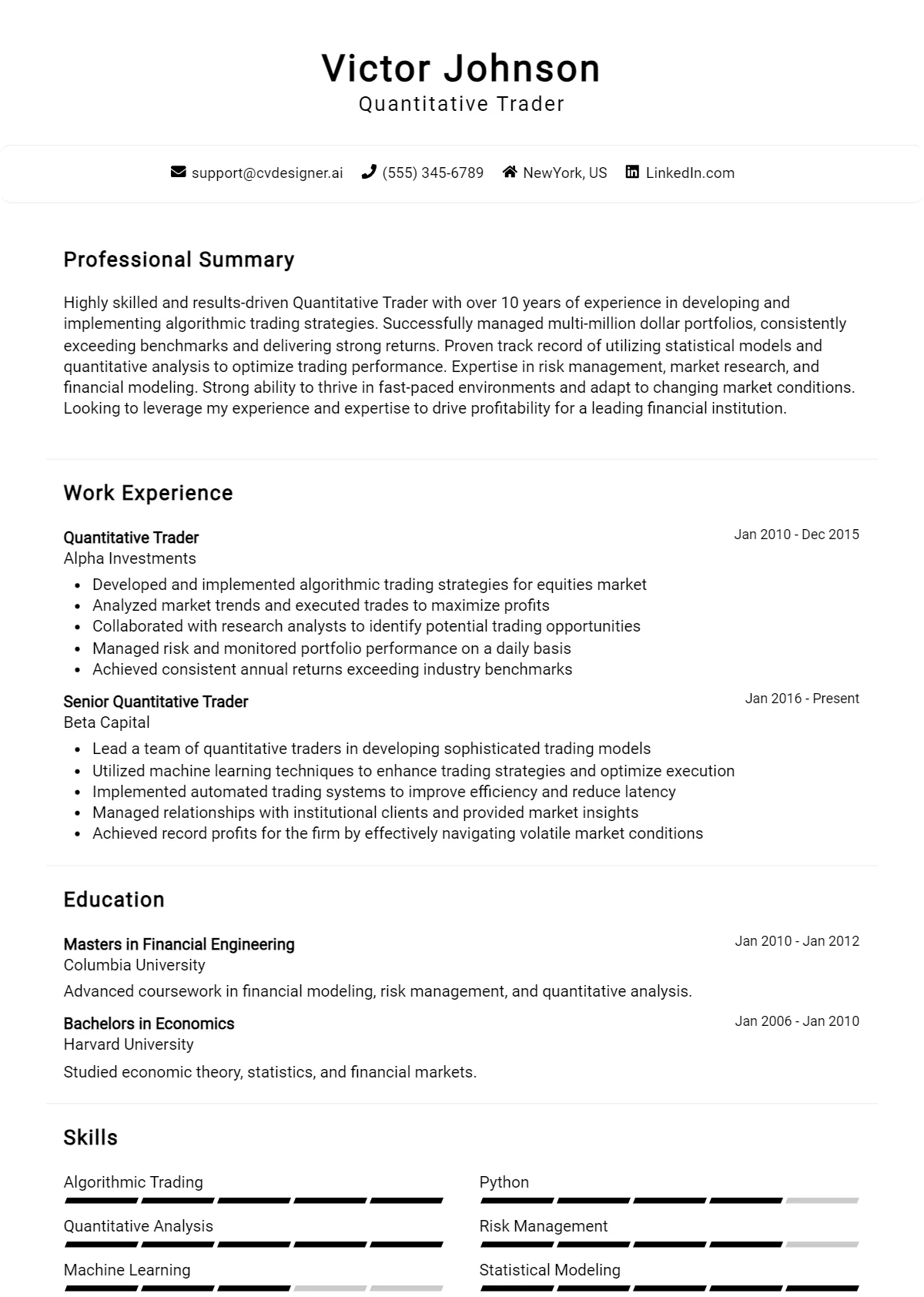

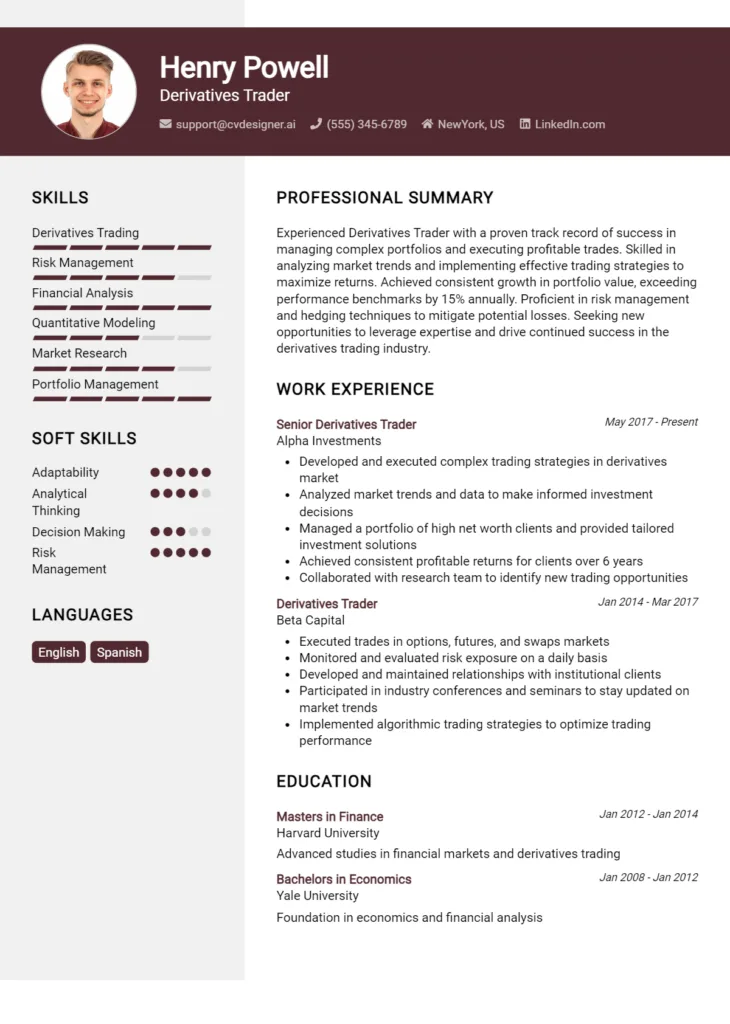

Example Work Experiences for Quantitative Trader

Strong Experiences

- Developed and implemented a trading algorithm that increased portfolio returns by 15% over six months, outperforming the benchmark index.

- Led a team of 5 quant analysts in a project that optimized risk management protocols, resulting in a 25% reduction in volatility.

- Collaborated with software engineers to create a high-frequency trading platform, reducing execution times by 30% and increasing trade volume.

- Conducted comprehensive market analysis using machine learning techniques, leading to the identification of profitable trading opportunities that generated $2M in additional revenue.

Weak Experiences

- Worked on various trading projects that involved analysis and data collection.

- Participated in team meetings to discuss trading strategies.

- Assisted in the development of trading models without specifying results or contributions.

- Engaged in general financial analysis tasks.

The examples labeled as strong experiences are considered effective because they provide specific, quantifiable outcomes, demonstrate technical leadership, and highlight collaboration that led to significant business results. In contrast, the weak experiences lack detail and measurable achievements, making it difficult for potential employers to assess the candidate's impact or expertise in the field.

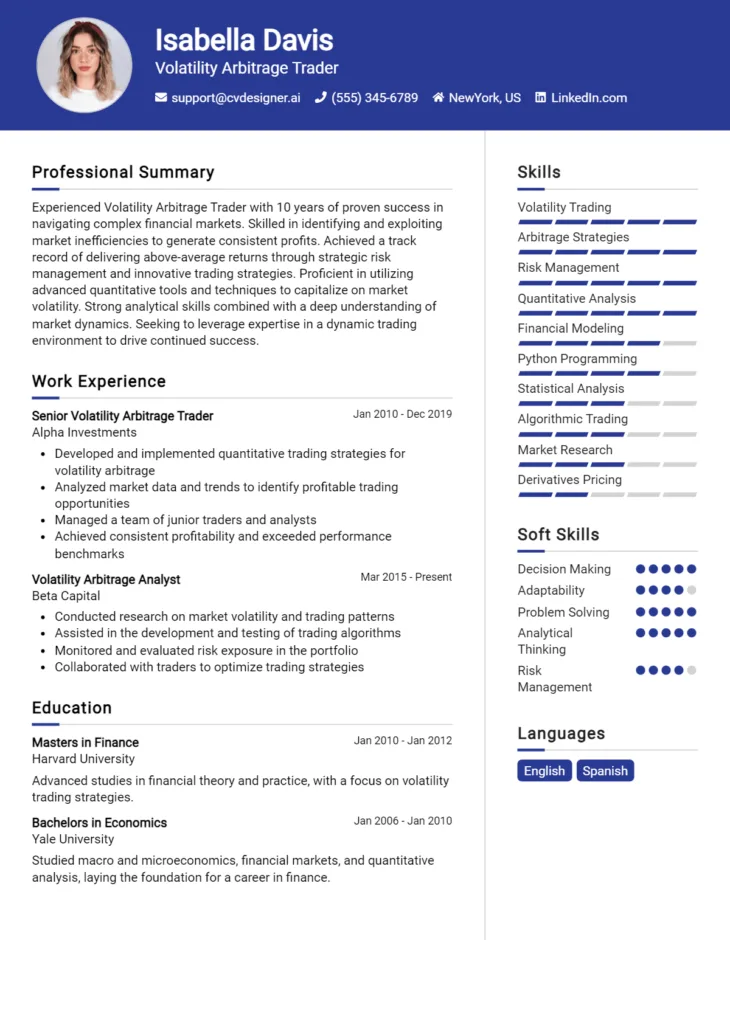

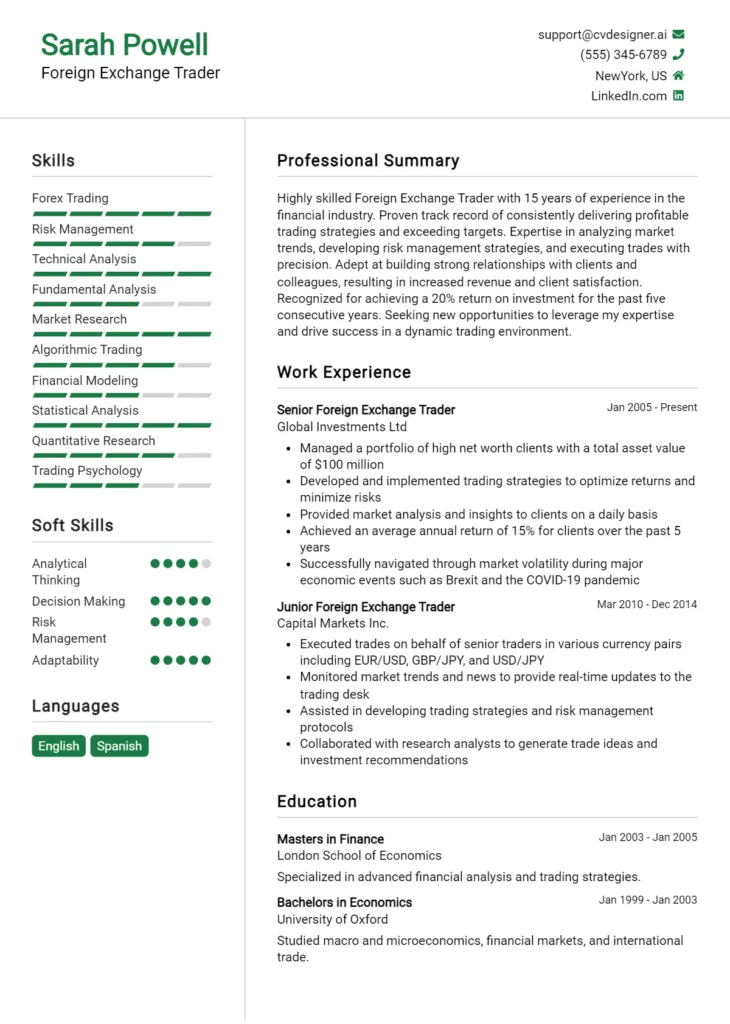

Education and Certifications Section for Quantitative Trader Resume

The education and certifications section of a Quantitative Trader resume is a critical component that showcases the candidate's academic background and specialized knowledge in the field. This section not only highlights relevant degrees but also emphasizes industry-recognized certifications and any continuous learning efforts that demonstrate the candidate's commitment to professional development. By providing detailed information on relevant coursework and specialized training, candidates can significantly enhance their credibility and better align themselves with the demands of the job role, ultimately making a compelling case for their suitability in the competitive world of quantitative trading.

Best Practices for Quantitative Trader Education and Certifications

- Prioritize relevant degrees, such as a Master's or PhD in Finance, Mathematics, Statistics, or Computer Science.

- Include industry-recognized certifications like CFA, FRM, or CQF to establish expertise.

- Detail relevant coursework that directly pertains to quantitative analysis, algorithmic trading, or financial modeling.

- Highlight any specialized training programs or workshops attended that are pertinent to quantitative trading.

- Use clear and concise language to describe educational achievements without excessive jargon.

- List honors or awards received during your educational journey that showcase exceptional performance.

- Consider including ongoing education or professional development courses to demonstrate a commitment to continuous learning.

- Ensure that all information is up-to-date and accurately reflects the candidate’s qualifications.

Example Education and Certifications for Quantitative Trader

Strong Examples

- Master of Science in Financial Engineering, Columbia University, 2020

- Chartered Financial Analyst (CFA), Level II Candidate

- Relevant Coursework: Statistical Analysis, Algorithmic Trading Strategies, Machine Learning for Finance

- Certificate in Quantitative Finance (CQF), 2021

Weak Examples

- Bachelor of Arts in History, University of California, 2015

- Certification in Basic Excel Skills, 2019

- Online Course in Personal Finance, Coursera, 2020

- High School Diploma, 2012

The strong examples are considered relevant because they showcase advanced degrees and certifications directly applicable to quantitative trading, underscoring the candidate’s qualifications and expertise in the field. In contrast, the weak examples highlight educational qualifications that lack relevance to quantitative trading, such as degrees in unrelated fields, basic certifications, and courses that do not contribute to the skill set required for a Quantitative Trader role. This distinction emphasizes the importance of aligning educational credentials with industry standards and job expectations.

Top Skills & Keywords for Quantitative Trader Resume

In the competitive field of quantitative trading, a well-crafted resume is essential for showcasing the blend of analytical prowess and strategic thinking required for success. Skills play a pivotal role in distinguishing candidates from one another, as they highlight the unique capabilities that a trader can bring to a firm. Both hard and soft skills are critical; hard skills demonstrate technical knowledge and proficiency in quantitative methods, while soft skills reflect the interpersonal and cognitive abilities that facilitate teamwork and effective decision-making. For those looking to excel in this dynamic industry, understanding which skills to emphasize can significantly enhance their chances of landing a lucrative position.

Top Hard & Soft Skills for Quantitative Trader

Soft Skills

- Analytical Thinking

- Problem Solving

- Communication Skills

- Team Collaboration

- Adaptability

- Attention to Detail

- Time Management

- Critical Thinking

- Decision Making

- Creativity

Hard Skills

- Statistical Analysis

- Programming Languages (Python, R, C++)

- Machine Learning Techniques

- Risk Management

- Financial Modeling

- Algorithm Development

- Data Mining

- Quantitative Research

- Trading Platforms Proficiency

- Market Analysis

Highlighting these skills on your resume, along with relevant work experience, can significantly improve your prospects in the quantitative trading industry.

Stand Out with a Winning Quantitative Trader Cover Letter

Dear Hiring Manager,

I am writing to express my interest in the Quantitative Trader position at [Company Name], as advertised on [Job Board/Company Website]. With a strong background in quantitative analysis, programming, and financial markets, I am excited about the opportunity to contribute to your team’s success. My academic foundation, combined with practical experience in developing trading algorithms and conducting statistical research, has equipped me with the skills necessary to excel in this role.

During my time at [Previous Company/University], I honed my ability to analyze large datasets and extract actionable insights. I developed a trading strategy that utilized machine learning techniques to predict market movements, resulting in a 15% increase in portfolio returns over six months. My proficiency in programming languages such as Python and R, along with my experience in risk management and optimization techniques, enables me to create robust trading models that are both effective and efficient. I am particularly drawn to [Company Name] due to its innovative approach to quantitative trading and its commitment to leveraging technology to stay ahead in the market.

Collaboration is key in the world of trading, and I pride myself on my ability to work effectively in team settings. I have successfully partnered with data scientists and financial analysts to refine trading strategies and create solutions that drive profitability. My strong communication skills allow me to convey complex quantitative concepts to stakeholders of varying backgrounds, ensuring that all team members are aligned and informed. I am eager to bring my technical expertise and collaborative spirit to [Company Name] and contribute to its continued growth and success.

Thank you for considering my application. I look forward to the opportunity to discuss how my skills and experiences align with the goals of [Company Name]. I am excited about the possibility of joining your team and contributing to innovative trading strategies that push boundaries and drive results.

Sincerely,

[Your Name]

[Your Contact Information]

Common Mistakes to Avoid in a Quantitative Trader Resume

When crafting a resume for a Quantitative Trader position, it's crucial to present a clear and compelling narrative of your skills and experiences. However, many candidates make common mistakes that can undermine their chances of standing out in a competitive field. Here are some pitfalls to avoid when creating a resume for a Quantitative Trader role:

Vague Job Descriptions: Failing to provide specific details about your past roles can leave hiring managers unclear about your actual contributions and skills. Be precise about your responsibilities and achievements.

Overly Technical Jargon: While it's important to demonstrate your technical expertise, using excessive jargon can alienate those who may not be as familiar with the terminology. Aim for clarity over complexity.

Neglecting Quantitative Skills: Not highlighting your quantitative skills, such as proficiency in statistical analysis or programming languages (e.g., Python, R, MATLAB), can make your resume less appealing. Be sure to emphasize relevant skills.

Ignoring Soft Skills: Quantitative trading isn't solely about numbers; communication and teamwork are also vital. Omitting soft skills like problem-solving and collaboration can give an incomplete picture of your capabilities.

Lack of Quantifiable Achievements: Failing to include metrics or outcomes from your previous work can weaken your resume. Use specific figures to demonstrate your impact, such as "increased portfolio returns by 15%."

Outdated Information: Including outdated skills or technologies can suggest you are not keeping up with industry trends. Regularly update your resume to reflect your current skills and knowledge.

Poor Formatting: A cluttered or unprofessional layout can detract from the content of your resume. Use clear headings, bullet points, and consistent formatting to enhance readability.

One-Size-Fits-All Approach: Submitting the same resume for every application can be detrimental. Tailor your resume to each position by aligning your experience with the specific requirements of the job description.

Conclusion

As a Quantitative Trader, your role encompasses a unique blend of finance, mathematics, and technology. Throughout this article, we've explored the essential skills and qualifications needed to excel in this competitive field. Key points include the importance of strong analytical abilities, proficiency in programming languages like Python and R, and a solid understanding of financial markets and instruments.

Additionally, we've highlighted the significance of developing robust trading strategies and the role of data analysis in making informed decisions. Continuous learning and adapting to market changes are also crucial attributes for a successful career as a Quantitative Trader.

In conclusion, it's essential to present these skills and experiences effectively in your resume. If you're looking to enhance your job prospects, take a moment to review your Quantitative Trader resume. Utilize tools such as resume templates, resume builder, resume examples, and cover letter templates to craft a compelling application that stands out to potential employers. Start your journey towards landing your dream job today!