Institutional Sales Trader Core Responsibilities

An Institutional Sales Trader plays a pivotal role in the financial services industry, acting as a bridge between clients and various internal departments. Key responsibilities include executing trades, managing client relationships, and providing market insights. Successful professionals must possess strong technical skills, operational expertise, and exceptional problem-solving abilities to navigate complex transactions. These competencies contribute significantly to the organization’s objectives, making it essential to highlight them on a well-structured resume for maximum impact.

Common Responsibilities Listed on Institutional Sales Trader Resume

- Execute institutional trades across various asset classes.

- Develop and maintain strong relationships with institutional clients.

- Provide market analysis and trading recommendations.

- Collaborate with research and operations teams to ensure trade accuracy.

- Monitor market trends and economic indicators.

- Prepare and present trading performance reports.

- Manage risk and ensure compliance with regulations.

- Assist clients with strategic investment decisions.

- Utilize trading platforms and software efficiently.

- Negotiate pricing and terms with counterparties.

- Coordinate with back-office teams for settlement and reconciliation.

- Stay updated on industry developments and best practices.

High-Level Resume Tips for Institutional Sales Trader Professionals

A well-crafted resume is a crucial asset for Institutional Sales Trader professionals, serving as the first impression a candidate makes on potential employers. In a highly competitive field where precision and expertise are paramount, your resume must effectively reflect not only your skills but also your achievements. It should tell a compelling story of your professional journey, showcasing your ability to navigate complex financial markets and build strong client relationships. This guide will provide practical and actionable resume tips specifically tailored for Institutional Sales Trader professionals, helping you create a document that stands out in the crowded job market.

Top Resume Tips for Institutional Sales Trader Professionals

- Tailor your resume to align with the job description, emphasizing relevant skills and experience that match the specific requirements of the position.

- Highlight your experience in trading and sales, detailing the types of securities you have dealt with and the markets you have worked in.

- Quantify your achievements by including metrics such as the percentage of sales growth you contributed to or the volume of trades executed.

- Showcase your proficiency with industry-specific tools and platforms, such as Bloomberg or Eikon, to demonstrate your technical expertise.

- Include relevant certifications, such as FINRA licenses or CFA, to establish credibility and commitment to your profession.

- Emphasize your ability to build and maintain relationships with institutional clients, highlighting any key accounts or partnerships you managed.

- Use action verbs to describe your contributions, such as "executed," "developed," or "analyzed," to convey a sense of proactivity and impact.

- Keep your resume concise and focused, ideally one page, to ensure that hiring managers can quickly assess your qualifications.

- Incorporate industry jargon and terminology to demonstrate your familiarity with the field, but ensure that it's accessible to all potential readers.

By implementing these tips, you can significantly increase your chances of landing a job in the Institutional Sales Trader field. A polished and targeted resume will not only showcase your qualifications effectively but also set you apart from other candidates, ultimately opening doors to new opportunities in this dynamic industry.

Why Resume Headlines & Titles are Important for Institutional Sales Trader

In the competitive field of institutional sales trading, a well-crafted resume headline or title can be the difference between landing an interview and being overlooked. A strong headline immediately captures the attention of hiring managers, summarizing a candidate's key qualifications in a single, impactful phrase. It serves as a hook that not only highlights the candidate's relevant skills and experiences but also sets the tone for the rest of the resume. Therefore, it is imperative that the headline is concise, relevant, and directly aligned with the job being applied for, ensuring that hiring managers quickly recognize the candidate's potential value to their organization.

Best Practices for Crafting Resume Headlines for Institutional Sales Trader

- Keep it concise: Aim for a headline that is brief yet informative, ideally no more than 10-12 words.

- Be role-specific: Tailor the headline to reflect the specific position of Institutional Sales Trader you are applying for.

- Highlight key strengths: Incorporate your top skills or accomplishments that are relevant to the role.

- Use industry keywords: Include terminology commonly used in the institutional trading sector to resonate with hiring managers.

- Avoid buzzwords: Steer clear of overused phrases that lack substance; instead, focus on concrete achievements.

- Emphasize results: If possible, quantify your achievements or contributions to showcase your impact in previous roles.

- Showcase unique attributes: Identify what differentiates you from other candidates and reflect that in your headline.

- Align with the job description: Review the job posting carefully and mirror the language and requirements in your headline.

Example Resume Headlines for Institutional Sales Trader

Strong Resume Headlines

"Dynamic Institutional Sales Trader with Proven Track Record of Exceeding Client Expectations"

“Results-Driven Sales Trader Specializing in Equity and Derivative Markets”

“Strategic Institutional Sales Trader with Over 10 Years of Experience in High-Volume Trading Environments”

Weak Resume Headlines

“Sales Trader Seeking Opportunities”

“Experienced Professional”

The strong resume headlines are effective because they are specific, convey relevant skills and experiences, and showcase measurable achievements, making them appealing to hiring managers. In contrast, the weak headlines fail to impress due to their vagueness and lack of detail, leaving hiring managers with little insight into the candidate’s capabilities. A compelling headline not only captures attention but also invites the reader to explore the resume further, increasing the chances of a successful job application.

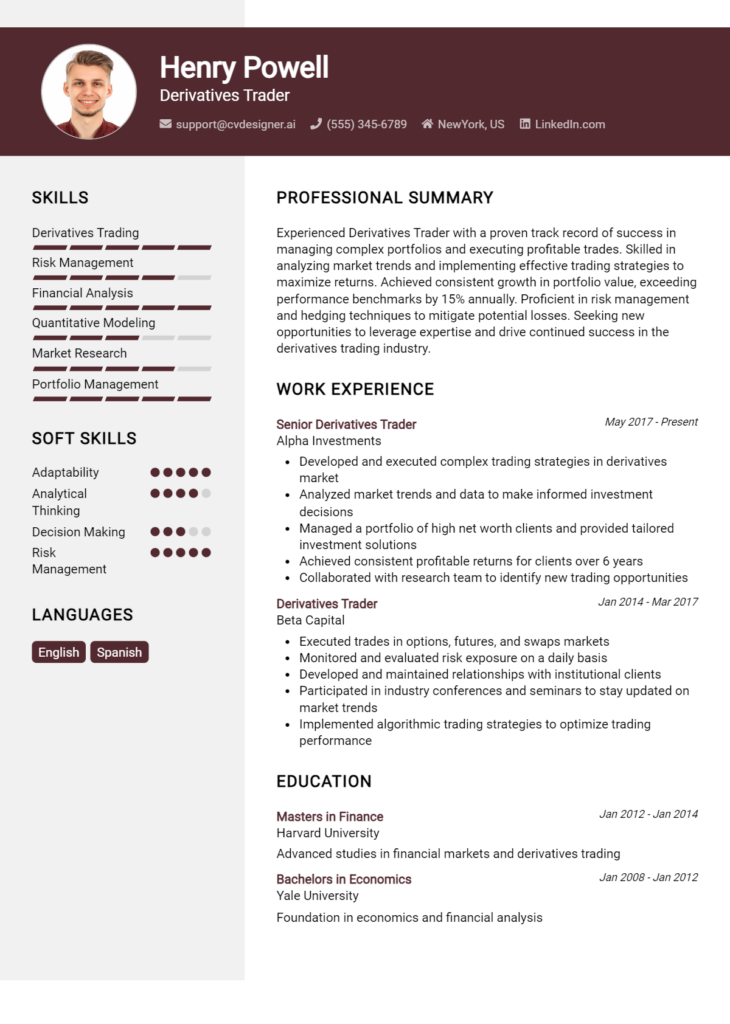

Writing an Exceptional Institutional Sales Trader Resume Summary

A well-crafted resume summary is crucial for an Institutional Sales Trader, as it serves as the first impression for hiring managers. This summary should effectively encapsulate key skills, relevant experience, and noteworthy accomplishments that align with the demands of the role. A strong summary not only captures attention quickly but also provides a snapshot of the candidate's suitability for the position. It should be concise, impactful, and tailored specifically to the job at hand, ensuring that the candidate stands out in a competitive field.

Best Practices for Writing a Institutional Sales Trader Resume Summary

- Quantify Achievements: Use numbers to highlight your successes, such as volume of trades or percentage of revenue growth.

- Focus on Relevant Skills: Highlight skills directly related to institutional trading, such as market analysis, risk management, and client relationship management.

- Tailor for the Job Description: Customize your summary to reflect the specific requirements and keywords found in the job listing.

- Be Concise: Keep your summary to 2-4 sentences, ensuring that each word adds value and relevance.

- Showcase Industry Knowledge: Mention familiarity with market trends, financial products, and trading platforms to demonstrate expertise.

- Highlight Client Engagement: Include your ability to build and maintain strong relationships with institutional clients.

- Use Action-Oriented Language: Start with strong action verbs to convey a sense of proactivity and achievement.

- Maintain Professional Tone: Ensure that the language used is professional and aligns with the expectations of the finance industry.

Example Institutional Sales Trader Resume Summaries

Strong Resume Summaries

Dynamic Institutional Sales Trader with over 8 years of experience, successfully managing a portfolio worth $500 million, resulting in a 15% increase in annual revenue. Expert in executing high-volume trades and providing strategic market insights to institutional clients.

Results-driven Sales Trader with a proven track record of generating $3 million in commission revenue within two years. Leverages strong analytical skills and market knowledge to advise institutional clients on investment opportunities and risk management strategies.

Highly skilled Institutional Sales Trader with 10+ years in the financial sector, specializing in equity and fixed income markets. Achieved a 20% growth in client assets through tailored trading strategies and exceptional service delivery.

Weak Resume Summaries

Sales trader with experience in the financial industry looking for a new opportunity to utilize my skills.

Institutional Sales Trader with a good understanding of trading, seeking a position to further my career in a reputable firm.

The strong summaries are considered effective because they include quantifiable results, specific skills, and direct relevance to the role of an Institutional Sales Trader. They demonstrate a clear impact on revenue and client asset growth, showcasing the candidate's contributions effectively. In contrast, the weak summaries lack specificity and measurable outcomes, making them generic and less appealing to hiring managers who seek concrete evidence of success and expertise.

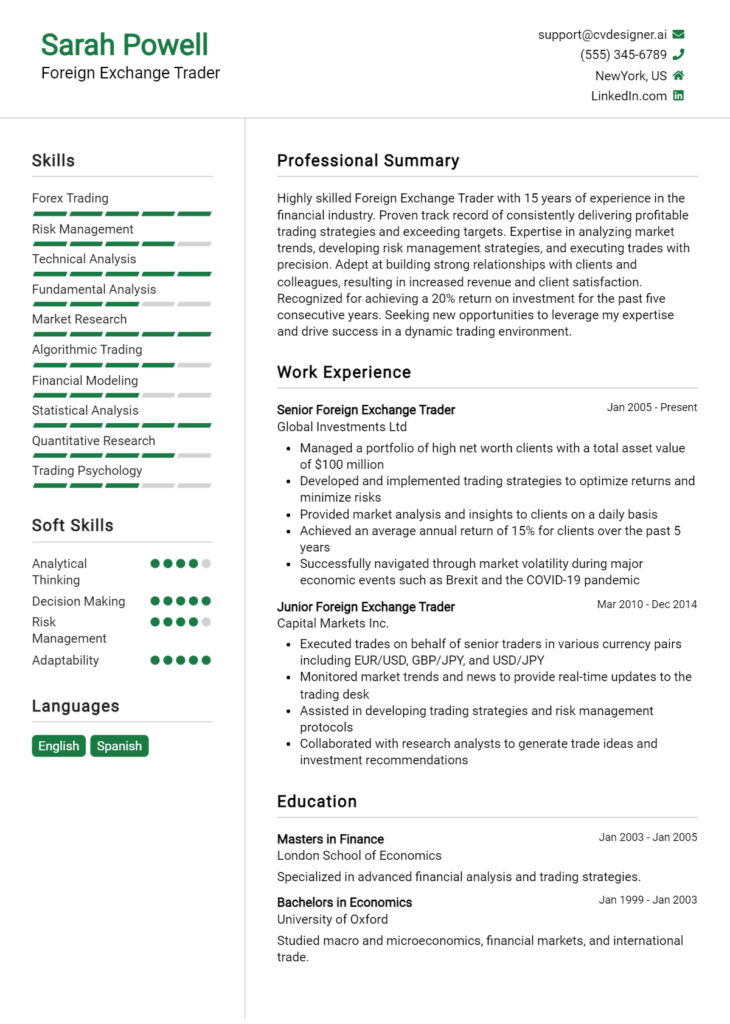

Work Experience Section for Institutional Sales Trader Resume

The work experience section is a critical component of an Institutional Sales Trader resume, as it serves as a platform to demonstrate the candidate's technical skills and industry knowledge. This section not only highlights past roles but also illustrates the candidate's ability to manage teams, execute trades, and deliver high-quality financial products. By quantifying achievements and aligning experiences with industry standards, candidates can effectively showcase their value to potential employers. It is essential to provide concrete examples of past successes to stand out in a competitive job market.

Best Practices for Institutional Sales Trader Work Experience

- Highlight specific technical skills relevant to trading platforms and instruments.

- Quantify achievements using metrics such as percentage of growth, volume of trades executed, or revenue generated.

- Emphasize collaboration with team members and stakeholders to demonstrate teamwork and leadership capabilities.

- Include relevant certifications or trainings that enhance credibility in the role.

- Tailor the work experience descriptions to align with the job requirements of the position being applied for.

- Use action verbs to begin bullet points, showcasing proactive involvement in projects and tasks.

- Provide context for achievements by describing challenges faced and strategies implemented to overcome them.

- Keep descriptions concise and focused on the most relevant experiences to maintain the reader's attention.

Example Work Experiences for Institutional Sales Trader

Strong Experiences

- Executed over 1,500 equity trades per month, achieving a 20% increase in portfolio performance through strategic buying and selling.

- Led a team of 5 sales traders in a high-pressure environment, resulting in a 30% reduction in trade execution time and improved client satisfaction scores.

- Implemented a new trading algorithm that optimized transaction costs, saving the firm approximately $1M annually.

- Collaborated with the risk management team to develop comprehensive risk assessment models, enhancing risk mitigation strategies across multiple portfolios.

Weak Experiences

- Performed trades and managed client accounts.

- Worked with the sales team to improve processes.

- Engaged in various trading activities as part of a team.

- Participated in meetings to discuss trading strategies.

The examples provided are considered strong because they offer specific, quantifiable outcomes and demonstrate the candidate's leadership and collaborative efforts. Each bullet point clearly articulates achievements and the impact of the candidate's contributions, making them compelling to potential employers. In contrast, the weak experiences lack detail and clarity, failing to convey the candidate's skills or accomplishments effectively. Vague descriptions do not provide enough context or measurable results, which can lead to a lack of interest from hiring managers.

Education and Certifications Section for Institutional Sales Trader Resume

The education and certifications section of an Institutional Sales Trader resume is crucial as it showcases the candidate's academic background and industry-specific credentials, thereby reflecting their qualifications and commitment to the field. This section serves as a platform to highlight relevant coursework, certifications, and specialized training that enhances the candidate's credibility and demonstrates their alignment with the requirements of the role. By providing specific details about their educational achievements and continued professional development, candidates can effectively communicate their preparedness for the challenges of an institutional sales trading environment.

Best Practices for Institutional Sales Trader Education and Certifications

- Focus on relevant degrees such as Finance, Economics, or Business Administration.

- Include industry-recognized certifications like the Chartered Financial Analyst (CFA) or Financial Risk Manager (FRM).

- Highlight any specialized training or courses related to trading platforms, financial instruments, or investment strategies.

- Be specific about advanced coursework in quantitative analysis, portfolio management, or financial modeling.

- List ongoing education efforts, such as workshops or webinars, to demonstrate a commitment to continuous learning.

- Use clear formatting to make it easy for hiring managers to quickly identify key qualifications.

- Prioritize certifications that are current and relevant to the institutional sales trading field.

- Avoid listing outdated qualifications that may detract from your current capabilities.

Example Education and Certifications for Institutional Sales Trader

Strong Examples

- Bachelor of Science in Finance, University of Chicago, 2018

- Chartered Financial Analyst (CFA) Level II Candidate

- Certificate in Investment Performance Measurement (CIPM)

- Completed coursework in Advanced Financial Derivatives and Risk Management

Weak Examples

- Bachelor of Arts in History, State University, 2015

- Certificate in Basic Accounting (Outdated)

- Completed a workshop on Personal Finance Management

- High School Diploma, 2010

The strong examples are considered effective because they directly relate to the responsibilities and skills required for an Institutional Sales Trader, showcasing relevant degrees and current certifications that enhance the candidate's profile. In contrast, the weak examples reflect educational qualifications that are either irrelevant to the role or outdated, which could hinder the candidate's appeal to potential employers looking for up-to-date expertise in financial markets and trading strategies.

Top Skills & Keywords for Institutional Sales Trader Resume

As an Institutional Sales Trader, possessing the right skills is crucial for success in this fast-paced and competitive field. A well-crafted resume showcases both hard and soft skills that align with the demands of the role. Hard skills demonstrate technical proficiency and knowledge of trading strategies, financial instruments, and market analysis, while soft skills highlight interpersonal abilities, communication, and teamwork. By effectively presenting these skills, candidates can distinguish themselves in the eyes of potential employers, ultimately increasing their chances of landing a coveted position in institutional sales trading.

Top Hard & Soft Skills for Institutional Sales Trader

Soft Skills

- Strong communication skills

- Relationship management

- Negotiation skills

- Problem-solving abilities

- Adaptability to changing markets

- Team collaboration

- Time management

- Attention to detail

- Emotional intelligence

- Analytical thinking

Hard Skills

- Proficiency in trading platforms (e.g., Bloomberg, Eikon)

- Market analysis and research

- Understanding of financial instruments (stocks, bonds, derivatives)

- Risk management techniques

- Knowledge of regulatory compliance

- Data analysis and interpretation

- Quantitative skills

- Familiarity with algorithmic trading

- Financial modeling

- Execution of trades and order management

By focusing on these skills and effectively articulating relevant work experience, candidates can create a compelling resume that highlights their qualifications for the Institutional Sales Trader position.

Stand Out with a Winning Institutional Sales Trader Cover Letter

I am writing to express my interest in the Institutional Sales Trader position at [Company Name]. With a robust background in financial markets and a proven track record in executing institutional sales strategies, I am excited about the opportunity to contribute to your team. My experience in building and maintaining client relationships, combined with my analytical skills and market knowledge, makes me a strong candidate for this role.

In my previous position at [Previous Company Name], I successfully managed a diverse portfolio of institutional clients, tailoring trading strategies to meet their unique needs. I developed a comprehensive understanding of various asset classes, including equities, fixed income, and derivatives, which allowed me to provide clients with insightful market analyses and execution strategies. My ability to leverage technology for trade execution and analysis has resulted in a 25% increase in trade efficiency, significantly benefiting my clients and enhancing overall profitability for the firm.

Additionally, I pride myself on my strong communication skills and my ability to work collaboratively within a team. I have consistently demonstrated my capacity to thrive in high-pressure environments while maintaining a client-first approach. By staying updated on market trends and economic indicators, I ensure that my clients receive timely information and strategic advice to navigate the ever-changing financial landscape. I am eager to bring this dedication and expertise to [Company Name] and contribute to your continued success in the institutional trading space.

Thank you for considering my application. I am looking forward to the opportunity to discuss how my experience and skills align with the needs of your team. I am excited about the possibility of working together to deliver exceptional service and results for your institutional clients.

Common Mistakes to Avoid in a Institutional Sales Trader Resume

When crafting a resume for the role of an Institutional Sales Trader, it is crucial to present yourself in the best light possible. Missteps in your resume can lead to missed opportunities, especially in a competitive field where precision and professionalism are paramount. Here are some common mistakes to avoid when creating your Institutional Sales Trader resume:

Inadequate Quantification of Achievements: Failing to provide specific metrics or data that demonstrate your success can make your experience seem less impactful. Use percentages, dollar amounts, or numbers to highlight your contributions.

Generic Job Descriptions: Listing responsibilities without tailoring them to the institutional sales trading role can weaken your resume. Be sure to focus on relevant skills and experiences that align closely with the job requirements.

Ignoring Industry Language: Not incorporating industry-specific terminology may signal a lack of familiarity with the field. Use common jargon and acronyms that are recognized within institutional trading to showcase your expertise.

Neglecting Soft Skills: Institutional sales trading requires strong interpersonal and communication skills. Omitting these attributes can result in an incomplete representation of your abilities. Highlight your ability to build relationships and negotiate effectively.

Cluttered Formatting: A resume that is difficult to read due to poor formatting can detract from your qualifications. Use clear headings, bullet points, and a clean layout to ensure easy navigation and readability.

Overlooking Customization: Sending a generic resume for multiple job applications can be detrimental. Tailor your resume to each position, emphasizing the skills and experiences that match the specific job description.

Excessive Length: An overly long resume can overwhelm hiring managers. Aim for a concise format, ideally one page, that highlights the most relevant experiences and accomplishments.

Typos and Grammatical Errors: Submitting a resume filled with spelling or grammatical mistakes can undermine your professionalism. Always proofread your resume or have someone else review it to ensure it is error-free.

Conclusion

As an Institutional Sales Trader, your expertise in navigating complex financial markets and building strong relationships with institutional clients is pivotal to your success. This role requires a deep understanding of market trends, exceptional communication skills, and the ability to execute trades efficiently. Key responsibilities include advising clients on investment strategies, managing portfolios, and optimizing trade execution to maximize returns. Additionally, staying informed about market developments and regulatory changes is crucial for providing valuable insights to clients.

To excel in this competitive field, it is essential to have a standout resume that highlights your skills, experiences, and achievements effectively. Ensure that your resume is tailored to the specific demands of the Institutional Sales Trader role, showcasing your ability to drive sales and enhance client satisfaction.

As you reflect on your career and prepare to advance, take the time to review and update your Institutional Sales Trader resume. Utilize resources like resume templates, resume builder, resume examples, and cover letter templates to create a compelling application that clearly demonstrates your qualifications. Don’t miss the opportunity to present yourself as a strong candidate in this dynamic industry!