Fixed Income Trader Core Responsibilities

A Fixed Income Trader plays a crucial role in the financial market, executing trades for bonds and other debt securities while analyzing market trends. This position requires strong technical skills, operational efficiency, and exceptional problem-solving abilities. Fixed Income Traders work closely with risk management, sales, and research teams to ensure informed decision-making. Their expertise contributes significantly to the organization’s financial health. A well-structured resume highlighting these skills can effectively demonstrate qualifications to prospective employers.

Common Responsibilities Listed on Fixed Income Trader Resume

- Execute trades in government and corporate bonds

- Analyze market trends and economic indicators

- Develop and manage trading strategies

- Monitor and report on portfolio performance

- Collaborate with research analysts and sales teams

- Assess risk and implement risk management practices

- Maintain compliance with regulatory standards

- Utilize trading software and analytical tools

- Communicate effectively with clients and stakeholders

- Prepare market analysis reports

- Negotiate pricing and terms with counterparties

- Provide insights for investment decisions

High-Level Resume Tips for Fixed Income Trader Professionals

In the competitive world of finance, a well-crafted resume is crucial for Fixed Income Trader professionals vying for top positions in the industry. Given that your resume is often the first impression you make on a potential employer, it must effectively showcase your skills, experience, and achievements in a way that captures attention. A strong resume not only reflects your qualifications but also communicates your understanding of the fixed income market and your ability to navigate its complexities. This guide aims to provide practical and actionable resume tips specifically tailored for Fixed Income Trader professionals, enabling you to stand out in a crowded job market.

Top Resume Tips for Fixed Income Trader Professionals

- Tailor your resume to match the job description, emphasizing keywords and phrases that align with the specific role you are applying for.

- Highlight relevant trading experience, including the types of fixed income securities you have worked with, such as bonds, treasuries, or municipal securities.

- Quantify your achievements by including metrics like profit margins, trade volumes, and successful strategies that led to increased revenue or risk mitigation.

- Showcase your proficiency in industry-specific tools and software, such as Bloomberg, Reuters, or risk management platforms, to demonstrate your technical capabilities.

- Include certifications or licenses relevant to fixed income trading, such as the Chartered Financial Analyst (CFA) designation or FINRA licenses.

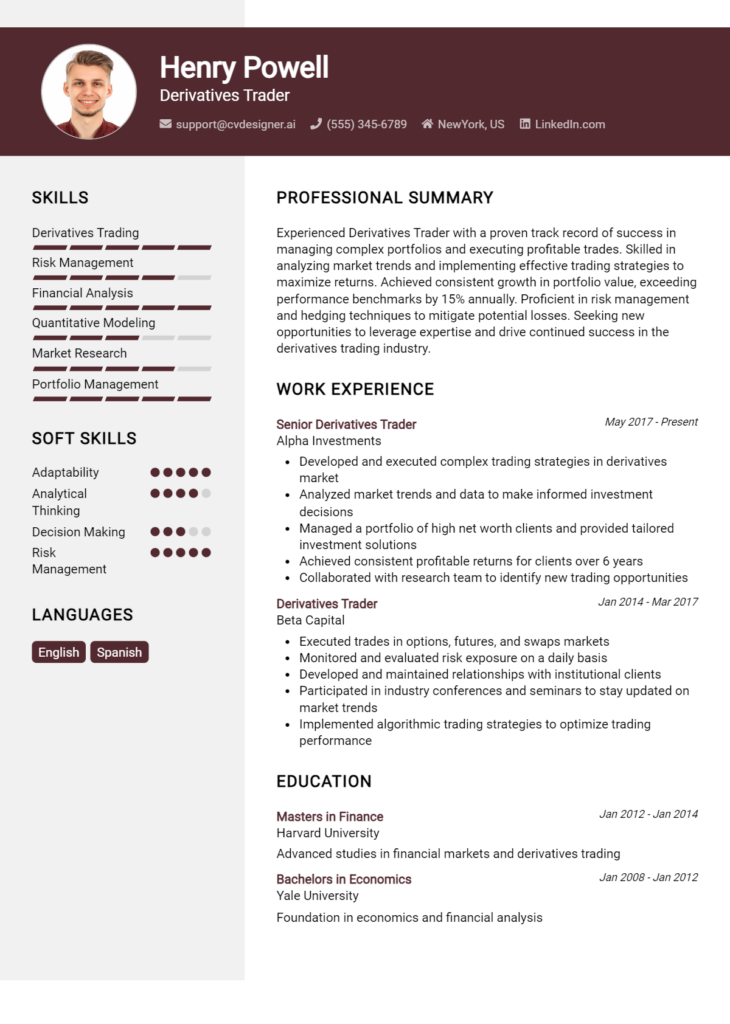

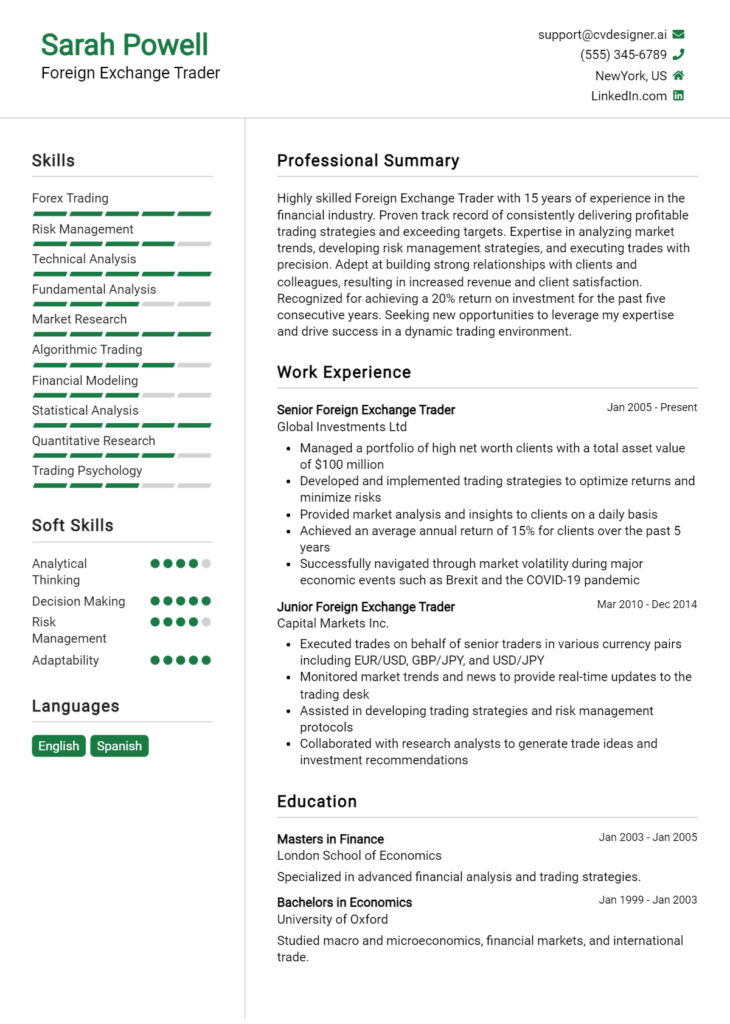

- Utilize a clear and professional format that enhances readability, ensuring that key information stands out easily for hiring managers.

- Incorporate a brief summary statement at the top of your resume that encapsulates your experience and career goals in fixed income trading.

- Demonstrate your understanding of market trends and economic indicators by mentioning any relevant analysis or research you have conducted.

- Highlight your ability to work collaboratively in teams, as well as your communication skills, which are critical for liaising with clients and stakeholders.

By implementing these tips, you can significantly increase your chances of landing a job in the Fixed Income Trader field. A targeted and well-structured resume not only showcases your qualifications but also positions you as a strong candidate who understands the industry's demands. With a compelling presentation of your skills and achievements, you'll be better equipped to attract the attention of potential employers and secure interviews in this competitive market.

Why Resume Headlines & Titles are Important for Fixed Income Trader

In the competitive field of fixed income trading, the importance of resume headlines and titles cannot be overstated. A compelling resume headline serves as the first impression for hiring managers, providing a succinct summary of a candidate's key qualifications and expertise. In a matter of seconds, a strong headline can capture attention and convey the essence of what the candidate brings to the table. It is crucial that this phrase is concise, relevant, and directly aligned with the position being applied for, as it sets the tone for the rest of the resume and can significantly influence the employer's decision to read further.

Best Practices for Crafting Resume Headlines for Fixed Income Trader

- Keep it concise: Aim for one impactful phrase that summarizes your qualifications.

- Be role-specific: Tailor the headline to reflect the specific position of Fixed Income Trader.

- Highlight key skills: Include essential skills relevant to fixed income trading, such as analytics or risk management.

- Use action-oriented language: Start with strong verbs to convey dynamism and proactivity.

- Incorporate relevant metrics: If possible, quantify achievements to provide concrete evidence of success.

- Align with job description: Use keywords from the job listing to enhance relevance and visibility.

- Avoid jargon: Use clear and straightforward language that can be understood by all hiring managers.

- Reflect professionalism: Ensure that the headline maintains a tone that is fitting for the financial industry.

Example Resume Headlines for Fixed Income Trader

Strong Resume Headlines

"Results-Driven Fixed Income Trader with 10+ Years of Experience in Portfolio Management and Risk Assessment"

“Dynamic Fixed Income Specialist: Proven Track Record of Exceeding Performance Targets by 20%”

“Analytical Fixed Income Trader Skilled in Data-Driven Decision Making and Market Analysis”

Weak Resume Headlines

“Trader Looking for Opportunities”

“Experienced Professional”

The strong headlines are effective because they are specific, action-oriented, and highlight measurable achievements or skills that directly relate to the role of a Fixed Income Trader. They immediately communicate the candidate's value and expertise, making a strong case for their suitability for the position. In contrast, the weak headlines fail to impress due to their vagueness and lack of relevant detail. They do not convey any unique strengths or qualifications, making it difficult for hiring managers to gauge the candidate's potential contributions to their team.

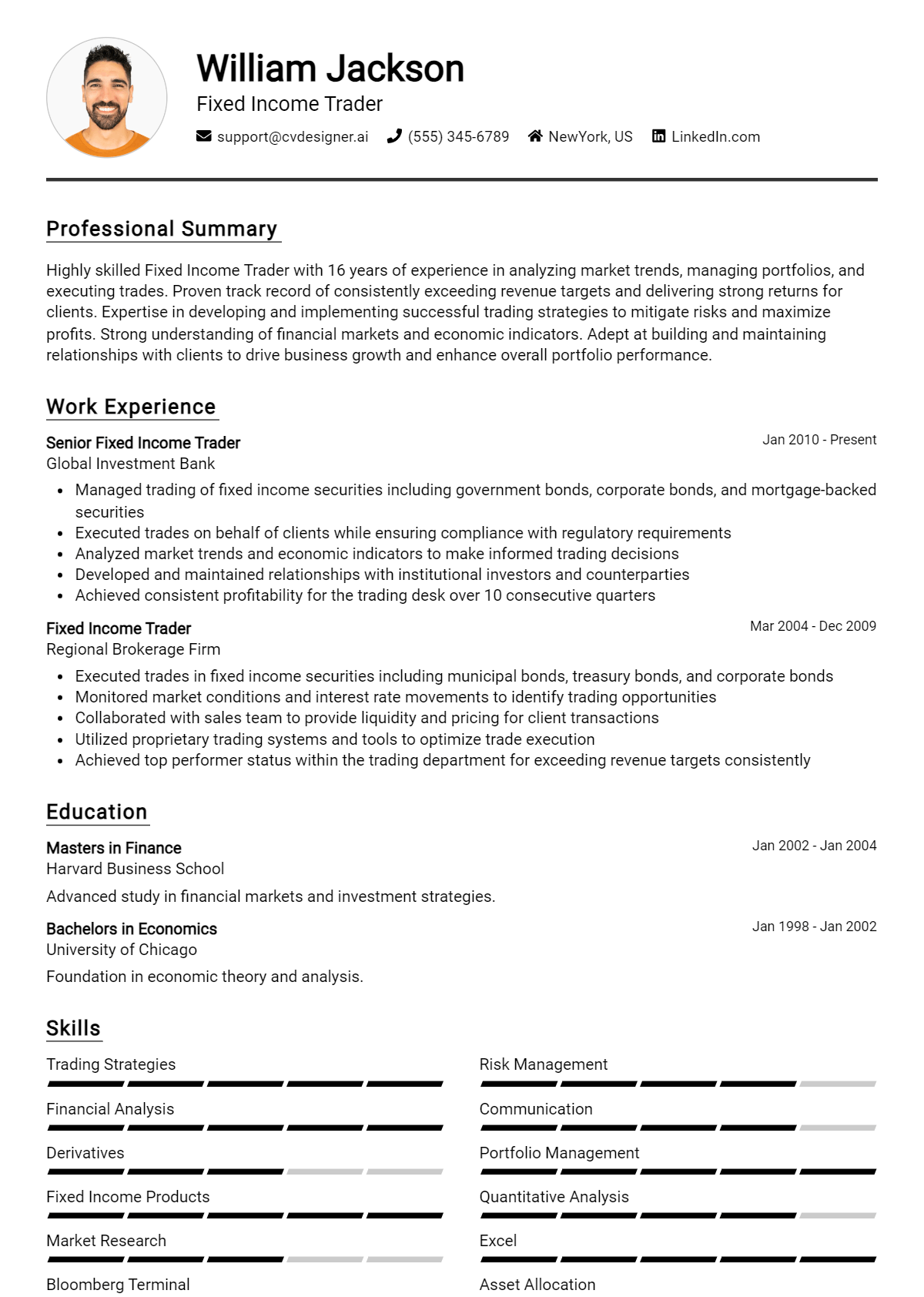

Writing an Exceptional Fixed Income Trader Resume Summary

A well-crafted resume summary is essential for a Fixed Income Trader, as it serves as the first impression a hiring manager will have of a candidate. This brief introduction captures attention by highlighting key skills, relevant experience, and notable accomplishments that directly relate to the trading role. A strong summary should be concise yet impactful, tailored to the specific position being applied for, and designed to quickly convey the candidate's suitability for the role in a competitive job market.

Best Practices for Writing a Fixed Income Trader Resume Summary

- Quantify Achievements: Use specific numbers to demonstrate your impact, such as percentage increases in portfolio performance or successful trade volumes.

- Focus on Key Skills: Highlight essential skills relevant to fixed income trading, such as risk assessment, market analysis, and proficiency in trading software.

- Tailor for the Job Description: Customize your summary to align with the specific requirements and responsibilities outlined in the job posting.

- Use Action Verbs: Start sentences with dynamic verbs to convey a sense of proactivity and accomplishment.

- Keep It Concise: Aim for 3-5 sentences that succinctly summarize your experience and qualifications.

- Showcase Relevant Experience: Emphasize previous trading roles, particularly in fixed income markets, to demonstrate your expertise.

- Include Certifications: Mention any relevant certifications, such as CFA or series licenses, to enhance credibility.

- Highlight Team Collaboration: If applicable, include examples of working with teams to achieve trading goals or improve processes.

Example Fixed Income Trader Resume Summaries

Strong Resume Summaries

Dynamic Fixed Income Trader with over 7 years of experience managing portfolios exceeding $500 million. Achieved a 12% annual return through strategic risk management and market analysis, while consistently outperforming benchmarks by 3%.

Results-driven Fixed Income Trader with expertise in municipal bonds and corporate debt, generating $20 million in revenue last year alone. Proven track record of utilizing quantitative analysis to identify lucrative trading opportunities.

Accomplished Fixed Income Trader with a strong background in derivatives and structured products. Successfully executed trades that improved liquidity and reduced risk exposure for a $1 billion portfolio, leading to a 15% increase in client satisfaction ratings.

Weak Resume Summaries

Experienced trader looking for new opportunities in fixed income. A team player with a background in finance.

Dedicated professional with skills in trading. Interested in fixed income roles and eager to contribute to a new team.

The examples demonstrate the differences between strong and weak resume summaries clearly. Strong summaries effectively quantify achievements, specify relevant skills, and directly relate to the Fixed Income Trader role, showcasing the candidate's value to potential employers. In contrast, weak summaries lack detail, are overly generic, and fail to communicate the candidate's qualifications or unique contributions, making them less compelling to hiring managers.

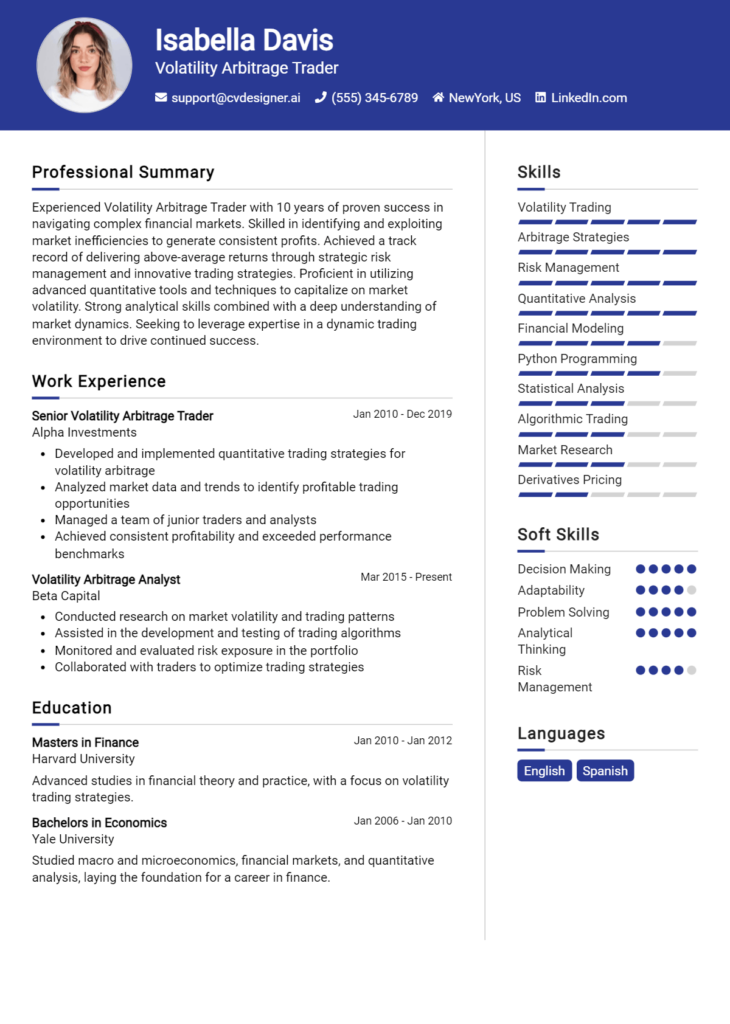

Work Experience Section for Fixed Income Trader Resume

The work experience section of a Fixed Income Trader resume is critical as it serves as a testament to the candidate's expertise in the field. This section not only highlights technical skills, such as knowledge of bond markets and trading strategies, but also showcases the ability to manage teams effectively and deliver high-quality trading products. Quantifying achievements—like percentage returns or volume traded—and aligning experiences with industry standards can significantly enhance the appeal of a resume, making it easier for hiring managers to recognize the candidate's value proposition.

Best Practices for Fixed Income Trader Work Experience

- Clearly outline technical skills related to fixed income trading, such as risk analysis and portfolio management.

- Quantify achievements with specific metrics, such as returns generated or trading volume handled.

- Use action verbs to convey a sense of leadership and initiative in trading operations.

- Highlight collaboration with teams, such as working with research analysts or risk management departments.

- Tailor your experience to reflect industry standards and terminology relevant to fixed income markets.

- Showcase proficiency in trading platforms and analytical tools used in the fixed income sector.

- Detail any compliance or regulatory experience that aligns with trading practices.

- Include examples of successful strategies implemented that led to improved trading outcomes.

Example Work Experiences for Fixed Income Trader

Strong Experiences

- Achieved a 15% annualized return on a $500 million bond portfolio through strategic asset allocation and risk management.

- Led a team of three traders in executing high-frequency trades, resulting in a 20% increase in trading volume over six months.

- Implemented a new risk assessment tool that decreased portfolio volatility by 10%, improving overall performance metrics.

- Collaborated with the research team to identify undervalued securities, contributing to a successful launch of a new fixed income fund that raised $200 million in capital.

Weak Experiences

- Responsible for trading activities and managing a bond portfolio.

- Worked with a team to achieve trading goals.

- Involved in the analysis of fixed income securities.

- Participated in meetings about trading strategies and market trends.

The examples of strong experiences are effective because they provide specific, quantifiable outcomes and demonstrate leadership and collaboration, showcasing the candidate's ability to deliver tangible results in fixed income trading. In contrast, the weak experiences lack clarity and measurable achievements, making them less compelling to potential employers. By focusing on detailed contributions and the impact of their work, candidates can make a significant impression in a competitive job market.

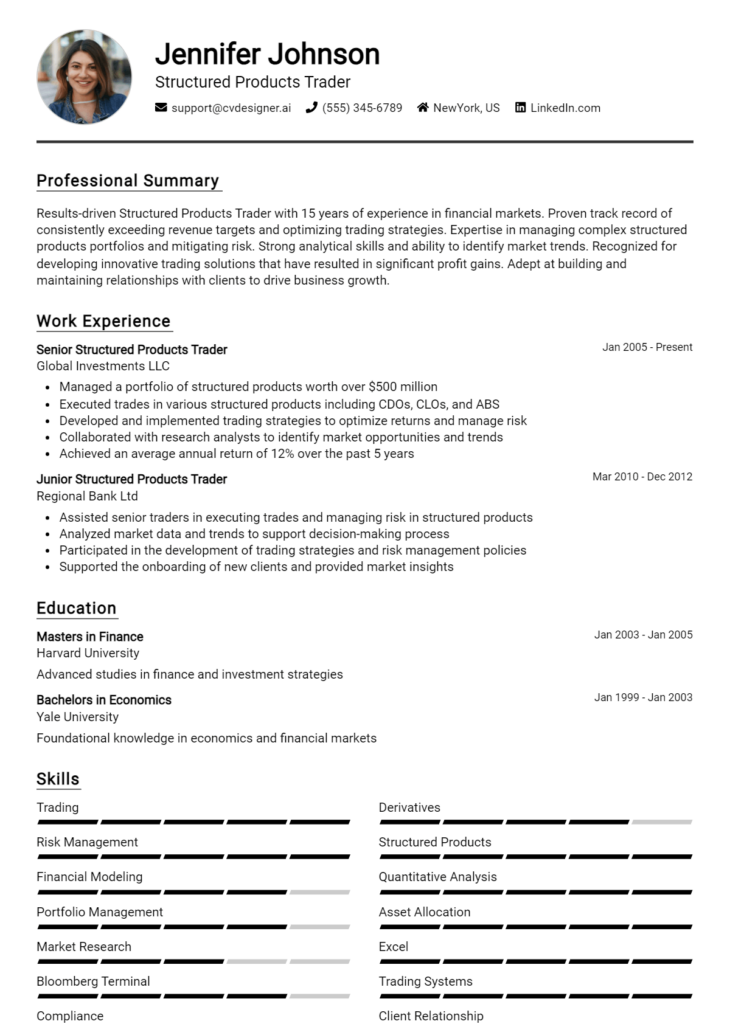

Education and Certifications Section for Fixed Income Trader Resume

The education and certifications section of a Fixed Income Trader resume is crucial as it serves as a testament to the candidate's academic foundation and specialized knowledge in the field. This section not only showcases degrees and relevant coursework, but also highlights industry-recognized certifications that reflect a commitment to continuous learning and professional development. By providing such details, candidates can significantly enhance their credibility and demonstrate their alignment with the demanding requirements of the trading environment, ultimately making a strong case for their capabilities to potential employers.

Best Practices for Fixed Income Trader Education and Certifications

- Focus on relevant degrees such as Finance, Economics, or Mathematics to demonstrate foundational knowledge.

- Include industry-recognized certifications such as CFA, FRM, or CMT to validate expertise and professionalism.

- Highlight specific coursework related to fixed income securities, risk management, and financial markets.

- Use clear and concise formatting to make the section easy to read and visually appealing.

- List any specialized training or workshops that pertain to fixed income trading strategies or tools.

- Prioritize the most recent and relevant qualifications to ensure alignment with current industry standards.

- Include GPA or honors if they bolster the strength of your academic credentials.

- Consider mentioning involvement in finance-related clubs or organizations to showcase engagement beyond the classroom.

Example Education and Certifications for Fixed Income Trader

Strong Examples

- M.S. in Finance, University of Chicago, 2022

- CFA Level II Candidate

- Completed coursework in Fixed Income Securities and Portfolio Management

- Certification in Risk Management from the Global Association of Risk Professionals (GARP)

Weak Examples

- B.A. in History, State University, 2010

- Certification in Business Analysis (outdated)

- Completed an online course in General Accounting

- High School Diploma, 2005

The strong examples are considered robust due to their direct relevance to the Fixed Income Trader position, showcasing advanced degrees and recognized certifications that reinforce the candidate's expertise in finance. In contrast, the weak examples reflect outdated or irrelevant qualifications that do not align with the skills and knowledge required in the trading environment, thereby diminishing the candidate's appeal to potential employers.

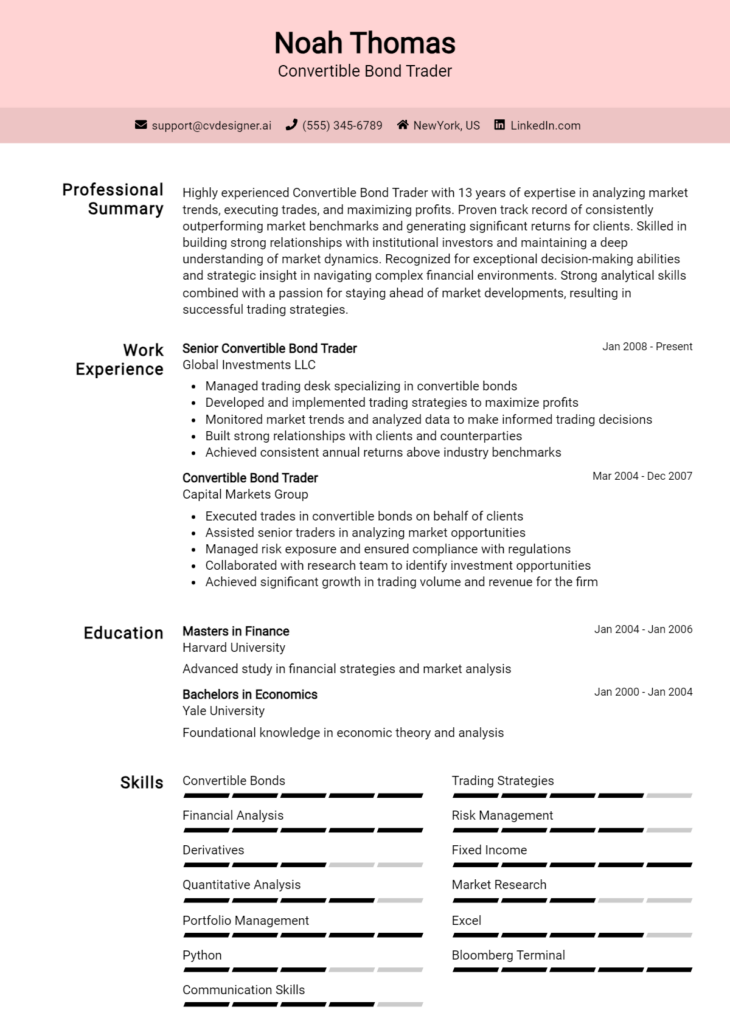

Top Skills & Keywords for Fixed Income Trader Resume

In the competitive field of fixed income trading, having a well-crafted resume that highlights key skills is essential for standing out to potential employers. A comprehensive understanding of both hard and soft skills can significantly enhance a trader's ability to navigate the complexities of the financial markets. Employers look for candidates who not only possess technical expertise but also demonstrate the interpersonal capabilities necessary for effective communication and teamwork. By showcasing the right mix of skills on a resume, traders can effectively communicate their value and readiness to contribute to the firm's success.

Top Hard & Soft Skills for Fixed Income Trader

Soft Skills

- Analytical Thinking

- Communication Skills

- Decision-Making

- Attention to Detail

- Team Collaboration

- Time Management

- Adaptability

- Problem-Solving

- Emotional Intelligence

- Negotiation Skills

- Stress Management

- Leadership

- Relationship Building

- Client Management

- Ethical Judgment

Hard Skills

- Knowledge of Fixed Income Securities

- Risk Assessment and Management

- Financial Modeling

- Quantitative Analysis

- Trading Platforms (e.g., Bloomberg, Reuters)

- Market Research Techniques

- Regulatory Compliance

- Portfolio Management

- Data Analysis Tools (e.g., Excel, Python)

- Bond Valuation Techniques

- Economic Indicator Analysis

- Interest Rate Forecasting

- Performance Measurement

- Derivatives Knowledge

- Financial Statement Analysis

For more insights into how to effectively present your work experience and skills, consider tailoring your resume to reflect the specific competencies that align with the demands of fixed income trading.

Stand Out with a Winning Fixed Income Trader Cover Letter

Dear [Hiring Manager's Name],

I am writing to express my interest in the Fixed Income Trader position at [Company Name], as advertised on [where you found the job listing]. With over [number] years of experience in fixed income markets and a proven track record of successfully managing trading strategies, I am excited about the opportunity to contribute to your team. My strong analytical skills, attention to detail, and ability to work in high-pressure environments have equipped me to thrive in dynamic trading situations.

In my previous role at [Previous Company Name], I was responsible for executing trades in government and corporate bonds, utilizing a combination of quantitative analysis and market research. I consistently identified and capitalized on arbitrage opportunities, resulting in a [percentage]% increase in portfolio returns over [specific time period]. My expertise in utilizing various trading platforms and financial modeling tools has allowed me to effectively assess market trends and make informed trading decisions. Additionally, my ability to collaborate with research teams and communicate insights has fostered a culture of informed risk-taking and strategic planning.

I am particularly drawn to [Company Name] because of its commitment to innovation in the fixed income space and its reputation for excellence in client service. I am eager to bring my skills in market analysis and risk management to your esteemed organization, where I can help drive profitability and enhance trading performance. I am confident that my proactive approach and dedication to continuous improvement will be a perfect fit for your team.

Thank you for considering my application. I look forward to the opportunity to discuss how my background and skills align with the goals of [Company Name]. I am excited about the possibility of contributing to your success as a Fixed Income Trader and am available for an interview at your earliest convenience.

Sincerely,

[Your Name]

[Your Phone Number]

[Your Email Address]

Common Mistakes to Avoid in a Fixed Income Trader Resume

When crafting a resume for a Fixed Income Trader position, it's essential to present your skills and experiences clearly and effectively. Many candidates make common mistakes that can hinder their chances of landing an interview. By understanding these pitfalls, you can ensure your resume stands out positively. Here are some frequent errors to avoid:

Lack of Quantifiable Achievements: Failing to include specific metrics or accomplishments can make your contributions seem vague. Use numbers to illustrate your success, such as percentage improvements in portfolio performance.

Generic Job Descriptions: Using one-size-fits-all descriptions for past roles can dilute your resume. Tailor each description to highlight relevant skills and experiences specific to fixed income trading.

Ignoring Industry Jargon: Not incorporating industry-specific terminology may signal a lack of familiarity with the field. Use terms commonly associated with fixed income trading to demonstrate your expertise.

Omitting Technical Skills: Fixed income trading often requires proficiency in financial modeling and trading software. Ensure you list these technical skills prominently on your resume.

Inconsistent Formatting: A cluttered or inconsistent layout can distract from the content of your resume. Use a clean, professional format with uniform fonts and spacing to enhance readability.

Neglecting Soft Skills: While technical skills are crucial, soft skills such as analytical thinking and communication are also important for traders. Be sure to highlight these competencies where relevant.

Overloading with Irrelevant Information: Including unrelated work experience or excessive details can dilute your core message. Focus on experiences that directly relate to fixed income trading.

Failing to Update the Resume: An outdated resume can misrepresent your current skills and experiences. Regularly update your resume to reflect your most recent achievements and any new skills acquired.

Conclusion

As a Fixed Income Trader, you play a critical role in managing and executing trades in the bond market, focusing on maximizing returns while mitigating risks. The key skills and qualifications necessary for this role include a strong understanding of financial markets, analytical capabilities, quantitative skills, and experience with trading platforms. Additionally, effective communication and decision-making skills are essential, as you need to collaborate with various stakeholders and make quick judgments based on market movements.

To stand out in this competitive field, it's crucial to ensure that your resume reflects your expertise and accomplishments accurately. Highlight specific achievements, relevant certifications, and any advanced financial modeling or analysis skills you've developed. Tailoring your resume to showcase your strengths and alignment with the job description will increase your chances of landing an interview.

Now is the time to take action! Review your Fixed Income Trader resume to ensure it effectively showcases your qualifications and experience. To assist you in this process, explore the available resources such as resume templates, resume builder, resume examples, and cover letter templates. These tools can help you create a polished and professional presentation of your skills that will impress potential employers. Don't wait—update your resume today!