Financial Technology Specialist Core Responsibilities

A Financial Technology Specialist plays a crucial role in bridging the gap between finance and technology departments, ensuring seamless integration of innovative solutions. Key responsibilities include analyzing financial systems, implementing new technologies, and optimizing operational processes. Essential skills encompass technical proficiency, operational insight, and robust problem-solving abilities, all vital for driving organizational goals. A well-structured resume that highlights these qualifications can significantly enhance a candidate's prospects in this dynamic field.

Common Responsibilities Listed on Financial Technology Specialist Resume

- Evaluating and implementing financial software solutions.

- Collaborating with IT and finance teams to enhance system performance.

- Conducting data analysis to identify trends and opportunities.

- Ensuring compliance with financial regulations and standards.

- Providing technical support and training to end-users.

- Monitoring industry trends to recommend innovative solutions.

- Developing and maintaining financial models and forecasts.

- Managing project timelines and deliverables effectively.

- Conducting risk assessments for new technologies.

- Documenting processes and creating user manuals.

- Facilitating communication between technical and non-technical stakeholders.

- Supporting the integration of emerging technologies within financial systems.

High-Level Resume Tips for Financial Technology Specialist Professionals

In the competitive field of financial technology, a well-crafted resume serves as a critical tool for professionals looking to make a lasting first impression on potential employers. Given that hiring managers often sift through countless applications, your resume must stand out by clearly reflecting not only your skills but also your achievements in the industry. It is essential that your document encapsulates your unique value proposition in a concise and compelling manner. This guide will provide practical and actionable resume tips specifically tailored for Financial Technology Specialist professionals, ensuring you present yourself as the ideal candidate for the role.

Top Resume Tips for Financial Technology Specialist Professionals

- Tailor your resume to the job description by incorporating relevant keywords and phrases that align with the requirements of the position.

- Highlight your experience with financial software and technologies, specifying any platforms or tools you are proficient in.

- Quantify your achievements with metrics, such as percentage increases in efficiency or cost savings, to provide concrete evidence of your impact.

- Showcase any certifications or specialized training relevant to financial technology, such as fintech certifications or data analysis courses.

- Include specific examples of projects you’ve worked on, detailing your role and the outcomes achieved to illustrate your experience.

- Emphasize your understanding of regulatory compliance and risk management, as these are crucial in the financial technology sector.

- Demonstrate your analytical skills by mentioning any relevant data analysis or financial modeling experience you possess.

- Incorporate soft skills such as problem-solving and communication, which are vital for collaboration in cross-functional teams.

- Keep your design clean and professional, using clear headings and bullet points for easy readability, while ensuring it is ATS-friendly.

By implementing these tips, you can significantly increase your chances of landing a job in the Financial Technology Specialist field. A resume that effectively showcases your tailored experiences, achievements, and industry-specific skills will not only capture the attention of hiring managers but also position you as a top contender in the competitive fintech job market.

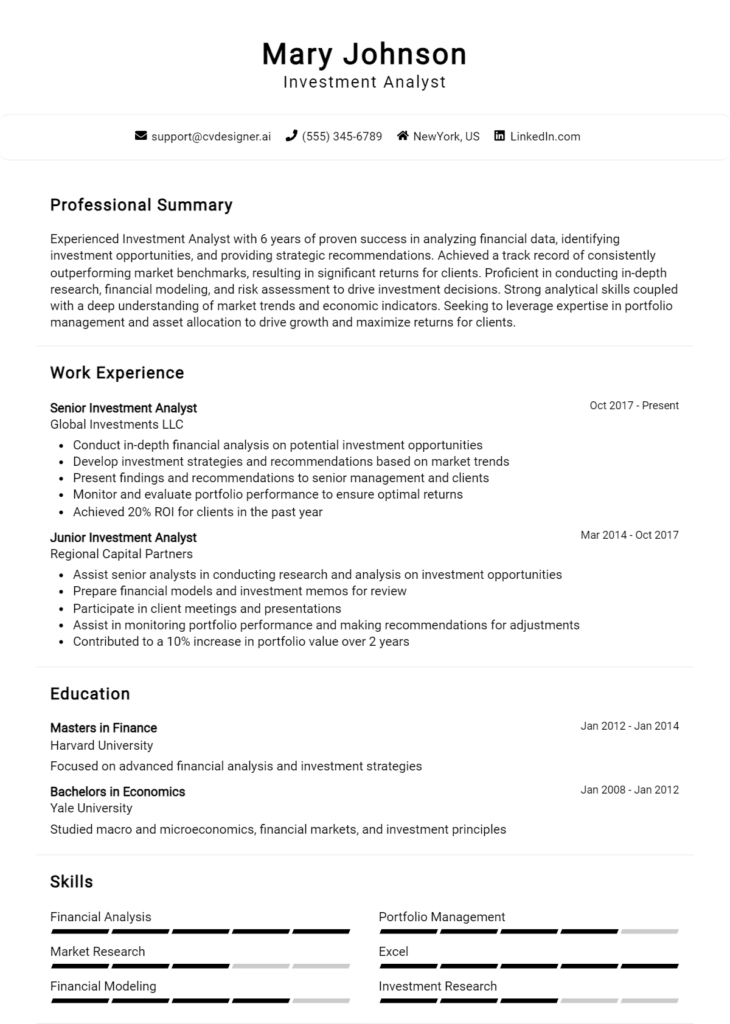

Why Resume Headlines & Titles are Important for Financial Technology Specialist

In the competitive field of financial technology, a Financial Technology Specialist plays a crucial role in bridging the gap between finance and technology, often tasked with developing innovative solutions that enhance financial services. Given the fast-paced nature of this industry, hiring managers sift through numerous applications, making it essential for candidates to stand out right from the start. A well-crafted resume headline or title can immediately capture attention, encapsulating a candidate's key qualifications and expertise in a succinct and impactful manner. These headlines should be concise, relevant, and directly aligned with the job being applied for, serving as a snapshot of what the candidate brings to the table in a highly specialized field.

Best Practices for Crafting Resume Headlines for Financial Technology Specialist

- Keep it concise—aim for one impactful phrase.

- Use specific keywords related to the financial technology sector.

- Highlight your unique skills or experiences relevant to the job.

- Align the headline with the specific role you are applying for.

- Avoid jargon or overly complex language.

- Showcase measurable achievements when possible.

- Tailor your headline for each application to maximize relevance.

- Consider including certifications or technical proficiencies.

Example Resume Headlines for Financial Technology Specialist

Strong Resume Headlines

"Innovative Financial Technology Specialist with 5+ Years in Blockchain Solutions"

“Data-Driven Analyst Specializing in AI-Powered Financial Tools and Strategies”

“Expert in Regulatory Compliance and Risk Management in FinTech”

“Transformational Leader in Financial Services Technology with Proven ROI Success”

Weak Resume Headlines

“Finance Professional Looking for Opportunities”

“Experienced Worker in Technology”

Strong resume headlines are effective because they convey specific expertise and accomplishments that directly relate to the financial technology role, making them appealing to hiring managers. They use concrete language and relevant keywords, which not only highlight the candidate's strengths but also match the job description. In contrast, weak headlines fail to impress due to their vagueness and lack of specificity, making it difficult for employers to gauge the candidate's qualifications or determine their fit for the position. By avoiding generic phrases, candidates can ensure their resumes stand out in a crowded job market.

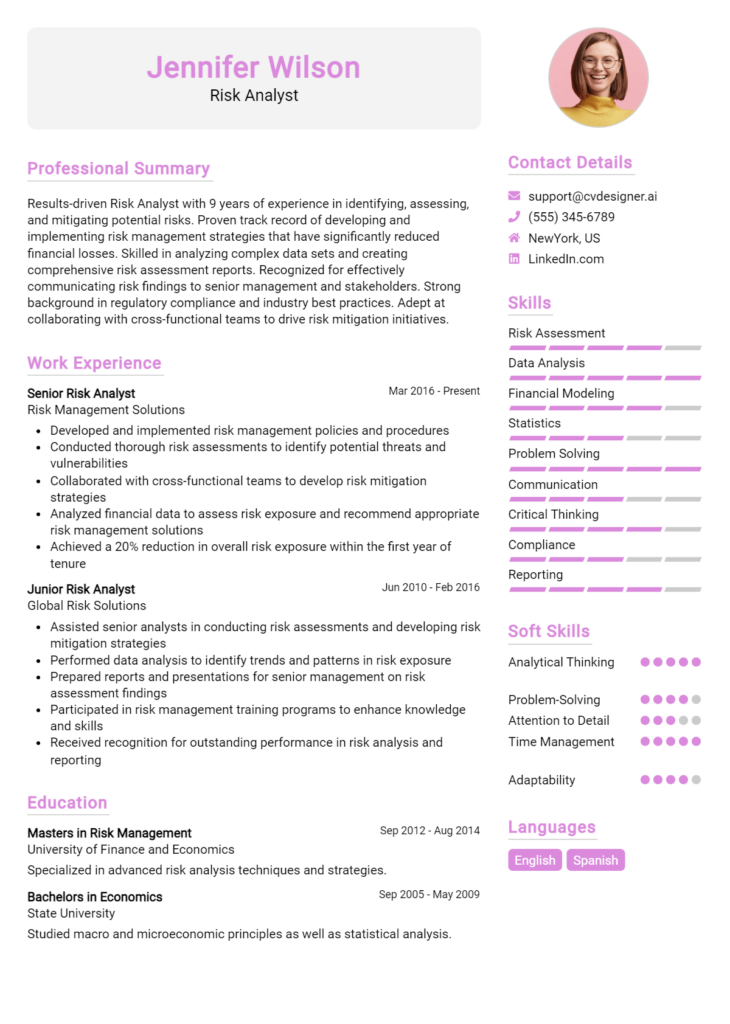

Writing an Exceptional Financial Technology Specialist Resume Summary

A well-crafted resume summary is crucial for a Financial Technology Specialist as it serves as the first impression a candidate makes on hiring managers. A strong summary succinctly highlights key skills, relevant experience, and notable accomplishments that align with the specific requirements of the job. In a competitive field where technical expertise and financial acumen are paramount, a concise and impactful summary captures the attention of recruiters, encouraging them to explore the rest of the resume. Tailoring this summary to reflect the candidate’s unique qualifications not only enhances its effectiveness but also demonstrates a genuine interest in the position.

Best Practices for Writing a Financial Technology Specialist Resume Summary

- Quantify Achievements: Use numbers and metrics to showcase your contributions and successes.

- Focus on Skills: Highlight the key technical and soft skills that are relevant to the job description.

- Tailor the Summary: Customize your summary for each position by incorporating keywords from the job posting.

- Be Concise: Keep the summary brief, ideally within 2-4 sentences, to maintain the reader's interest.

- Use Action Verbs: Start sentences with strong action verbs to convey confidence and proactivity.

- Showcase Industry Knowledge: Mention relevant trends, tools, or technologies that demonstrate your expertise in financial technology.

- Highlight Certifications: If applicable, include any relevant certifications that enhance your credibility.

- Emphasize Problem-Solving: Illustrate your ability to address challenges and drive innovation in financial technology.

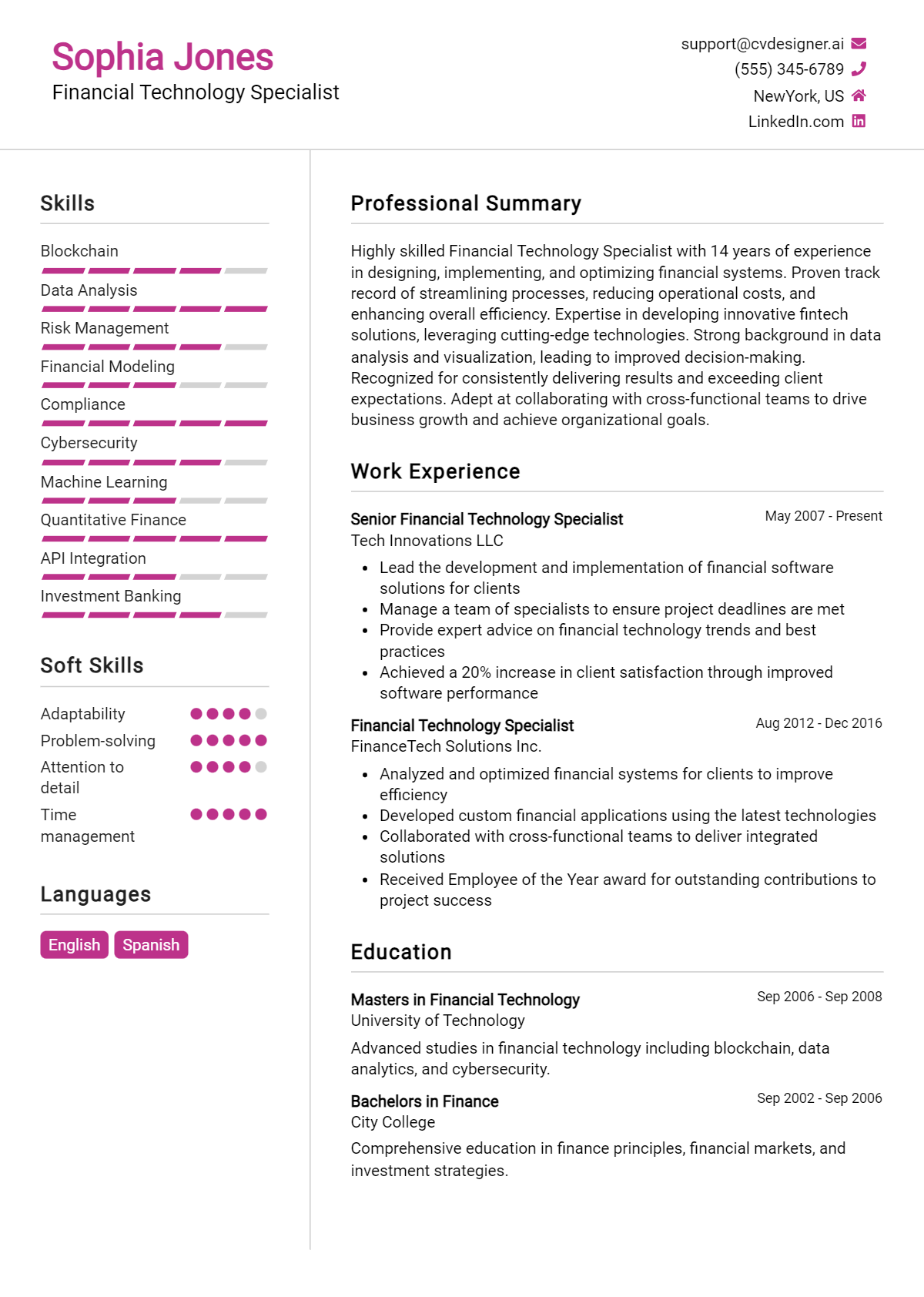

Example Financial Technology Specialist Resume Summaries

Strong Resume Summaries

Results-driven Financial Technology Specialist with over 7 years of experience in developing innovative payment solutions, achieving a 30% reduction in processing time and increasing customer satisfaction by 25% through enhanced user interface design.

Detail-oriented professional with expertise in blockchain technology and risk management, successfully led a project that reduced fraud incidents by 15% while improving transaction security for over 100,000 users.

Accomplished Financial Technology Specialist with a track record of implementing data analytics strategies that improved operational efficiency by 40% and contributed to a revenue growth of $2 million in the last fiscal year.

Weak Resume Summaries

Experienced financial technology professional looking for a new opportunity to utilize skills in a challenging environment.

Financial Technology Specialist with some experience in various technologies and a desire to help companies improve their processes.

The examples labeled as strong are considered effective because they include quantifiable achievements, specific skills relevant to the Financial Technology Specialist role, and a clear demonstration of how the candidate has positively impacted their previous employers. In contrast, the weak summaries are vague, lack measurable outcomes, and do not provide enough detail to differentiate the candidate from others, making them less compelling to hiring managers.

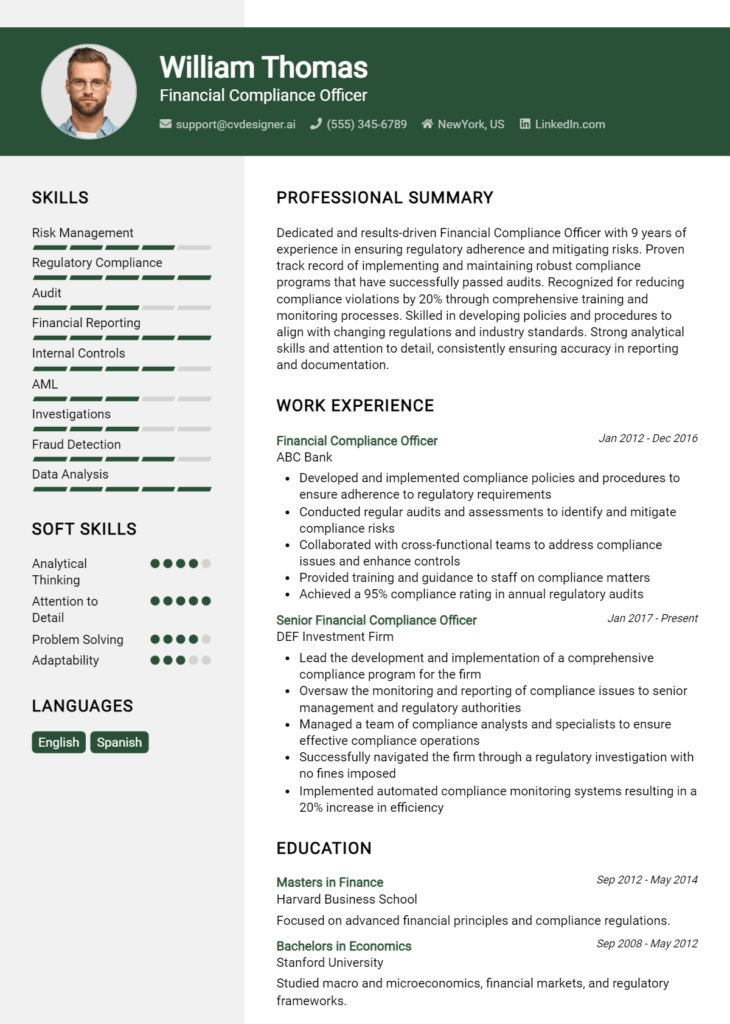

Work Experience Section for Financial Technology Specialist Resume

The work experience section of a Financial Technology Specialist resume is critical as it highlights the candidate's technical skills, leadership abilities, and capacity to deliver high-quality products within the fintech landscape. This section not only illustrates the applicant's hands-on experience with financial technologies but also emphasizes their proficiency in managing teams and projects that drive success. By quantifying achievements and aligning past roles with industry standards, candidates can effectively demonstrate their value to potential employers and stand out in a competitive job market.

Best Practices for Financial Technology Specialist Work Experience

- Highlight relevant technical skills related to fintech tools and platforms.

- Quantify achievements with metrics such as percentage improvements, cost savings, or revenue growth.

- Detail specific projects, emphasizing collaboration and teamwork.

- Use action verbs to convey leadership and initiative.

- Align your experience with industry standards and trends to showcase relevance.

- Include certifications or training that enhance your qualifications.

- Tailor your descriptions to match the job description of the position you are applying for.

- Focus on outcomes and impact rather than just duties and responsibilities.

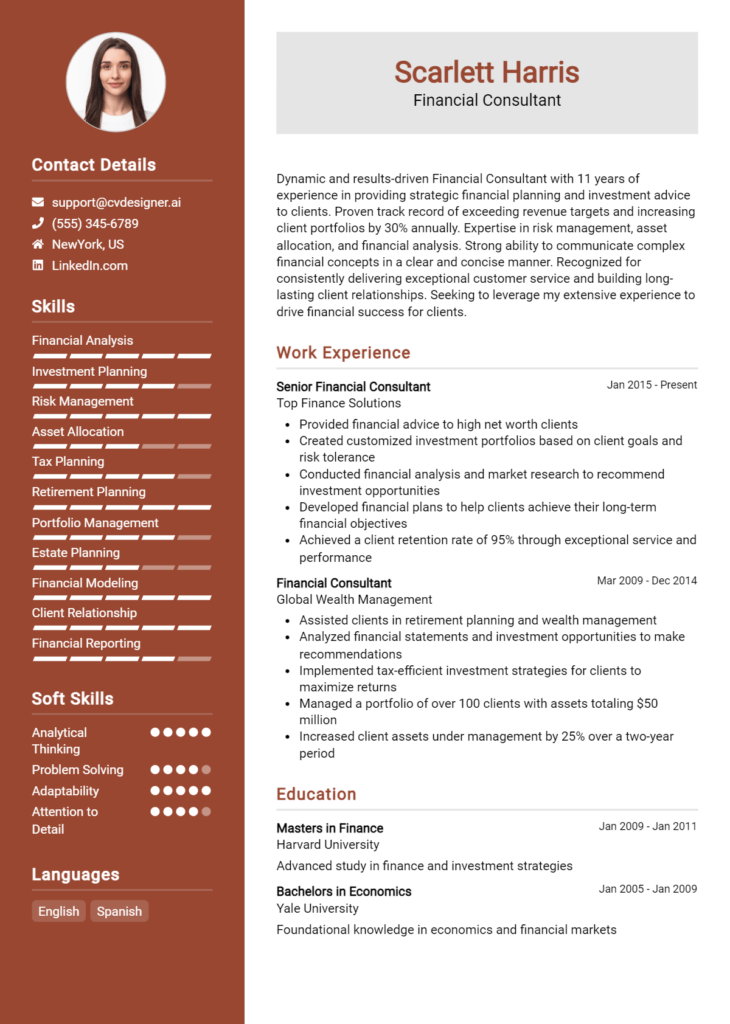

Example Work Experiences for Financial Technology Specialist

Strong Experiences

- Led a cross-functional team to implement a new payment processing system, resulting in a 25% increase in transaction speed and a 15% reduction in operational costs.

- Developed and launched a mobile banking application that achieved over 100,000 downloads within the first three months, enhancing customer engagement by 30%.

- Managed a project to upgrade cybersecurity measures, reducing vulnerabilities by 40% and ensuring compliance with regulatory standards.

- Collaborated with data analysts to create predictive models that improved loan approval rates by 20% while maintaining risk thresholds.

Weak Experiences

- Worked on various software projects.

- Responsible for general administration of financial systems.

- Participated in team meetings and discussions.

- Helped improve processes in the organization.

The strong experiences are considered impactful because they provide specific, quantifiable outcomes that showcase leadership, technical expertise, and collaboration. In contrast, the weak experiences lack detail and measurable achievements, making them less compelling and failing to illustrate the candidate's true capabilities in the financial technology sector.

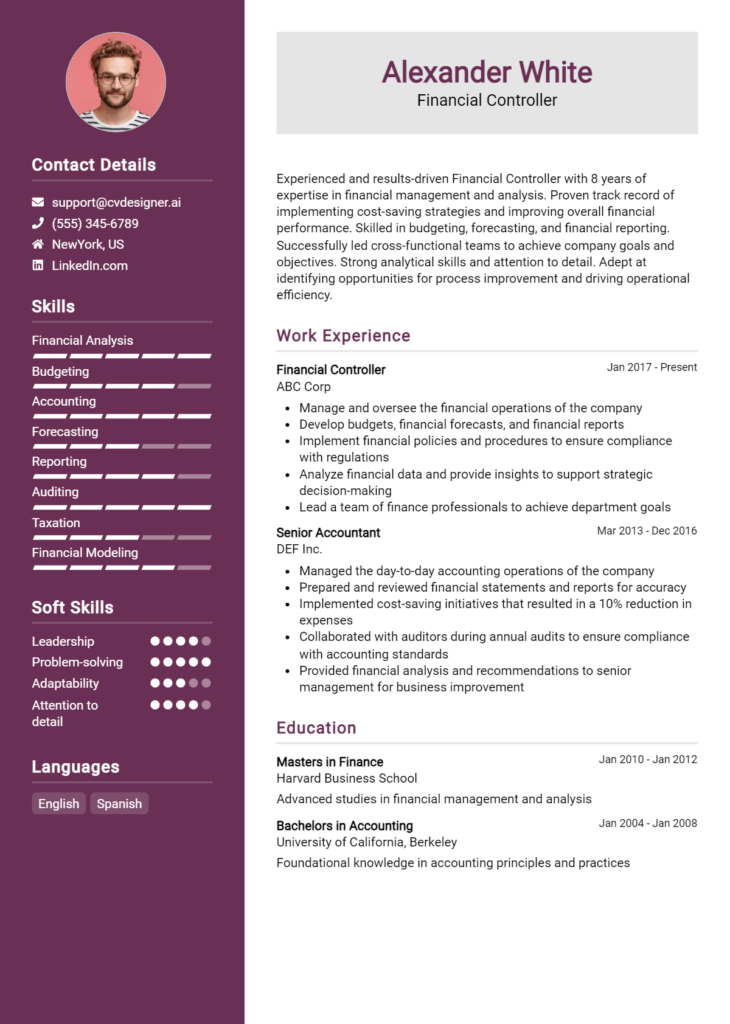

Certifications and Education for a Financial Technology Specialist Resume

When crafting a resume for a Financial Technology Specialist position, it is essential to highlight both your educational background and relevant certifications that demonstrate your expertise in finance and technology. Here are some guidelines on how to effectively list these qualifications:

Education:

Degree in Finance, Accounting, or Economics: A bachelor's or master's degree in Finance, Accounting, or Economics provides a strong foundation in financial principles and practices. Look for programs that offer courses in financial technology or fintech innovations.

Computer Science or Information Technology Degree: A degree in Computer Science, Information Technology, or a related field is crucial for understanding the technical aspects of financial technologies. Emphasis on programming, data analysis, or cybersecurity can be particularly beneficial.

Business Administration with a Focus on Finance or Technology: A degree in Business Administration that includes a concentration in Finance or Technology can demonstrate a well-rounded understanding of how financial systems operate within a business context.

Data Science or Analytics Degree: As financial technology increasingly relies on data analysis, a degree in Data Science or Analytics can be an asset. Programs that focus on machine learning and big data analytics are particularly relevant.

Certifications:

Certified Financial Technology Professional (CFTP): This certification demonstrates proficiency in the financial technology landscape, including knowledge of emerging fintech trends and standards.

Certified Information Systems Auditor (CISA): This certification is valuable for understanding the audit and control aspects of financial systems, ensuring that technology aligns with business goals.

Chartered Financial Analyst (CFA): While more traditional, the CFA credential is highly regarded in finance and can complement your tech skills by providing deep insights into investment analysis and portfolio management.

Certified Information Security Manager (CISM): Given the importance of cybersecurity in financial technology, this certification is beneficial for those looking to specialize in the security aspects of financial systems.

When listing your education and certifications, format them clearly and concisely, using bullet points for easy readability. Prioritize the most relevant qualifications for the specific role you are applying for, and ensure to stay updated on any new certifications that may emerge in the rapidly evolving fintech industry.

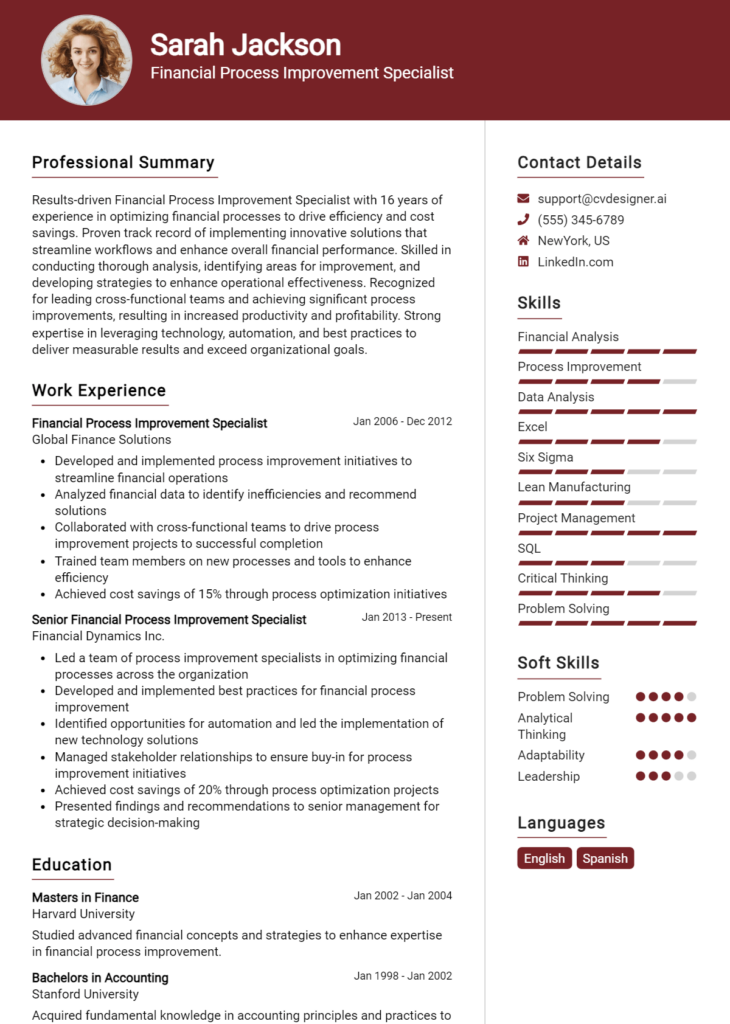

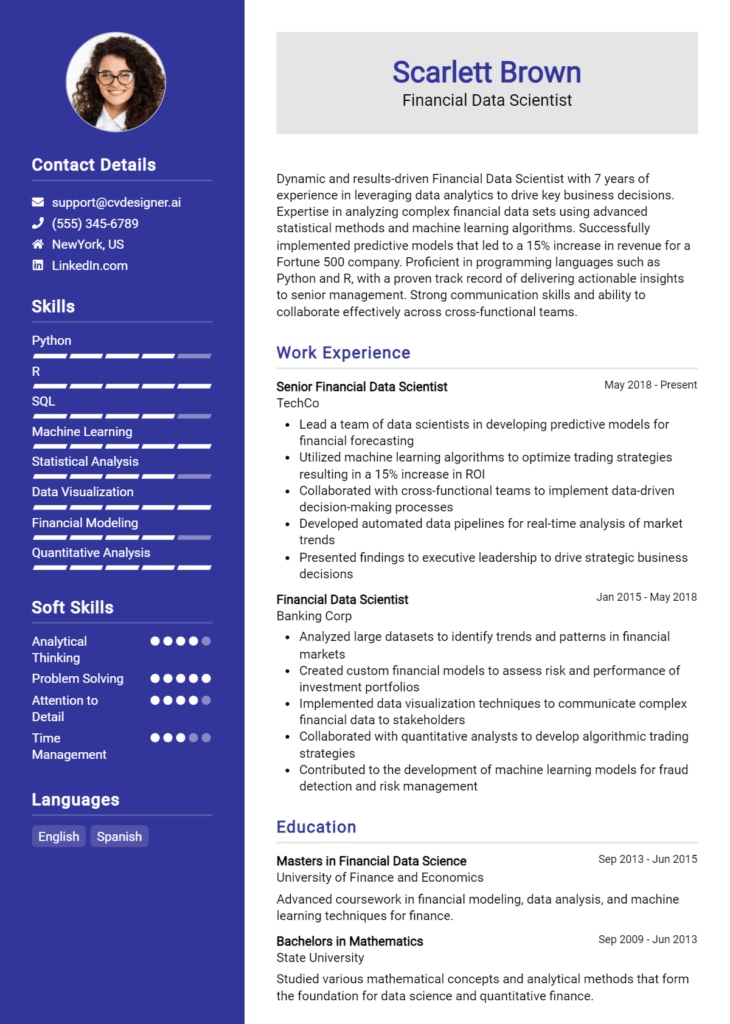

Top Skills & Keywords for Financial Technology Specialist Resume

In the rapidly evolving field of financial technology, a well-crafted resume is essential for standing out among candidates. A Financial Technology Specialist must possess a unique blend of skills that demonstrate their ability to bridge the gap between finance and technology. Highlighting both hard and soft skills on your resume is crucial, as these attributes showcase not only your technical expertise but also your interpersonal abilities and adaptability in a fast-paced environment. Employers seek candidates who can not only handle complex financial systems but also communicate effectively and work collaboratively with diverse teams. By optimizing your resume with relevant skills and emphasizing your work experience, you can significantly enhance your prospects in this competitive industry.

Top Hard & Soft Skills for Financial Technology Specialist

Soft Skills

- Strong communication skills

- Problem-solving abilities

- Analytical thinking

- Team collaboration

- Adaptability

- Attention to detail

- Customer service orientation

- Time management

- Critical thinking

- Leadership skills

Hard Skills

- Proficiency in financial modeling

- Familiarity with programming languages (e.g., Python, Java)

- Understanding of blockchain technology

- Experience with data analysis tools (e.g., SQL, R)

- Knowledge of regulatory compliance

- Expertise in risk management

- Familiarity with payment processing systems

- Understanding of cybersecurity principles

- Proficiency in software development lifecycle

- Experience with cloud computing platforms (e.g., AWS, Azure)

Stand Out with a Winning Financial Technology Specialist Cover Letter

I am writing to express my interest in the Financial Technology Specialist position at [Company Name] as advertised on [where you found the job listing]. With a strong foundation in finance, coupled with extensive experience in technology solutions, I am confident in my ability to contribute effectively to your team. My background in financial analysis, combined with my expertise in implementing innovative fintech solutions, positions me uniquely to help [Company Name] navigate the evolving landscape of financial technology.

In my previous role at [Previous Company Name], I successfully led a project to integrate a new payment processing system that enhanced transaction efficiency by 30%. This experience allowed me to hone my skills in data analysis and software implementation, as well as strengthen my ability to collaborate with cross-functional teams. My familiarity with regulatory frameworks and risk management practices ensures that I can not only drive technological advancements but also maintain compliance and security standards.

I am particularly drawn to [Company Name] because of your commitment to innovation and excellence in financial services. I admire your initiatives in leveraging blockchain technology and artificial intelligence to improve customer experiences. I am eager to bring my technical skills and analytical mindset to your organization, ensuring that we continue to push the boundaries of what is possible in fintech. I look forward to the opportunity to discuss how my experience and vision align with the goals of your team.

Thank you for considering my application. I hope to discuss my candidacy further and explore how I can contribute to the success of [Company Name] as a Financial Technology Specialist. I am excited about the potential to collaborate with talented professionals who share my passion for transforming the financial landscape through technology.

Common Mistakes to Avoid in a Financial Technology Specialist Resume

When crafting a resume for a Financial Technology Specialist position, it's crucial to present your skills and experiences in a way that grabs the attention of hiring managers. However, many candidates make common mistakes that can undermine their chances of landing an interview. By avoiding these pitfalls, you can create a more compelling resume that effectively highlights your qualifications and aligns with the unique demands of the fintech industry.

Vague Job Descriptions: Failing to provide specific details about your previous roles can make it difficult for employers to understand your expertise. Instead, use clear and concise language that directly relates to fintech.

Ignoring Relevant Skills: Omitting key fintech skills such as data analysis, programming languages, or knowledge of blockchain technology can weaken your application. Make sure to include the skills that are most relevant to the job.

Overloading with Jargon: While industry-specific terms can demonstrate your knowledge, overloading your resume with jargon can alienate non-technical hiring managers. Strike a balance by explaining complex terms clearly.

Lack of Quantifiable Achievements: Simply listing job duties does not demonstrate your impact. Use numbers and statistics to showcase your accomplishments, such as percentage increases in efficiency or revenue.

Poor Formatting: A cluttered or overly complex layout can detract from the content of your resume. Stick to a clean, professional format that makes it easy for hiring managers to find key information.

Not Tailoring the Resume: Sending out a generic resume without customizing it for each application can be detrimental. Tailor your resume to highlight the experiences and skills that match the specific job description.

Neglecting Soft Skills: While technical skills are crucial in fintech, soft skills such as communication and teamwork are equally important. Failing to include these can give a lopsided view of your capabilities.

Inaccurate or Outdated Information: Ensure that all the information on your resume, including dates of employment and qualifications, is accurate and up-to-date. Inaccuracies can create doubt about your attention to detail and professionalism.

Conclusion

In summary, the role of a Financial Technology Specialist is pivotal in today's rapidly evolving financial landscape. This position requires a blend of financial acumen and technical expertise, enabling professionals to bridge the gap between finance and technology. Key responsibilities include analyzing financial data, implementing innovative technology solutions, and ensuring compliance with regulations. As the demand for professionals who can navigate this intersection grows, so does the importance of a well-crafted resume that highlights relevant skills and experiences.

To stand out in the competitive job market, it's essential to present your qualifications effectively. Take the time to review and refine your Financial Technology Specialist resume to ensure it showcases your unique skills and experiences.

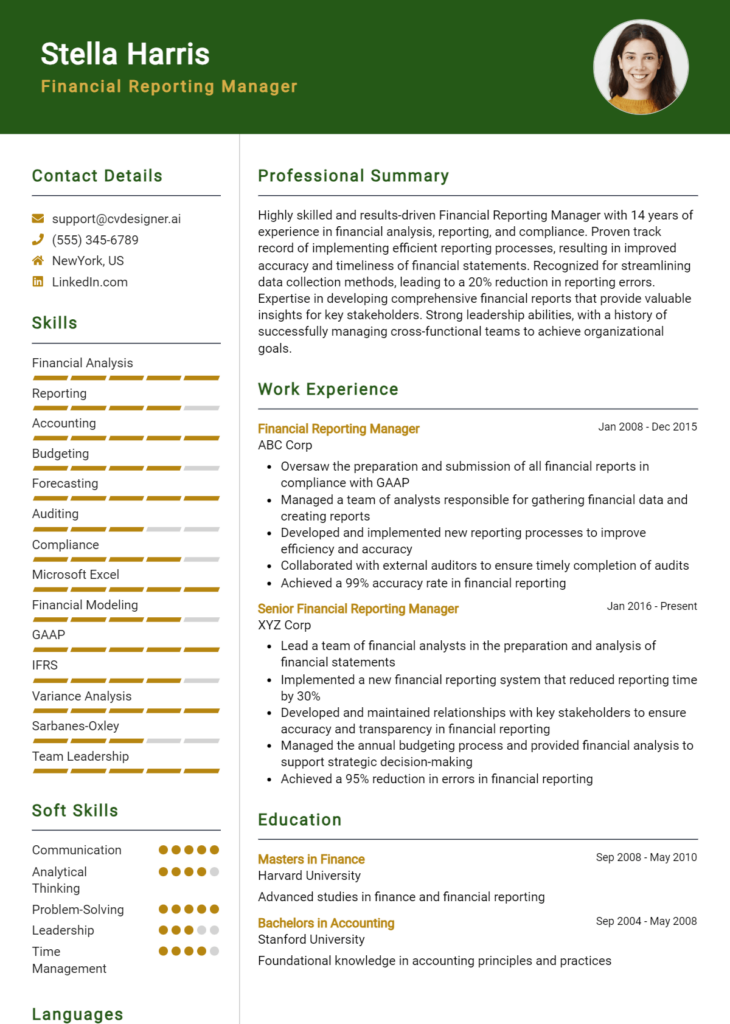

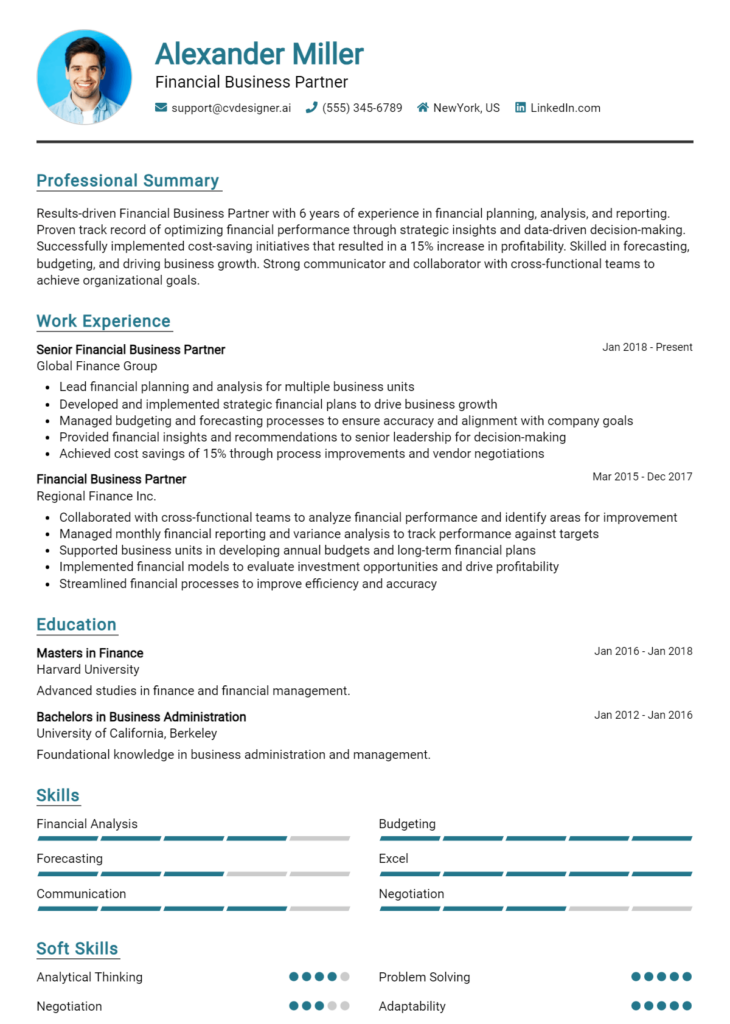

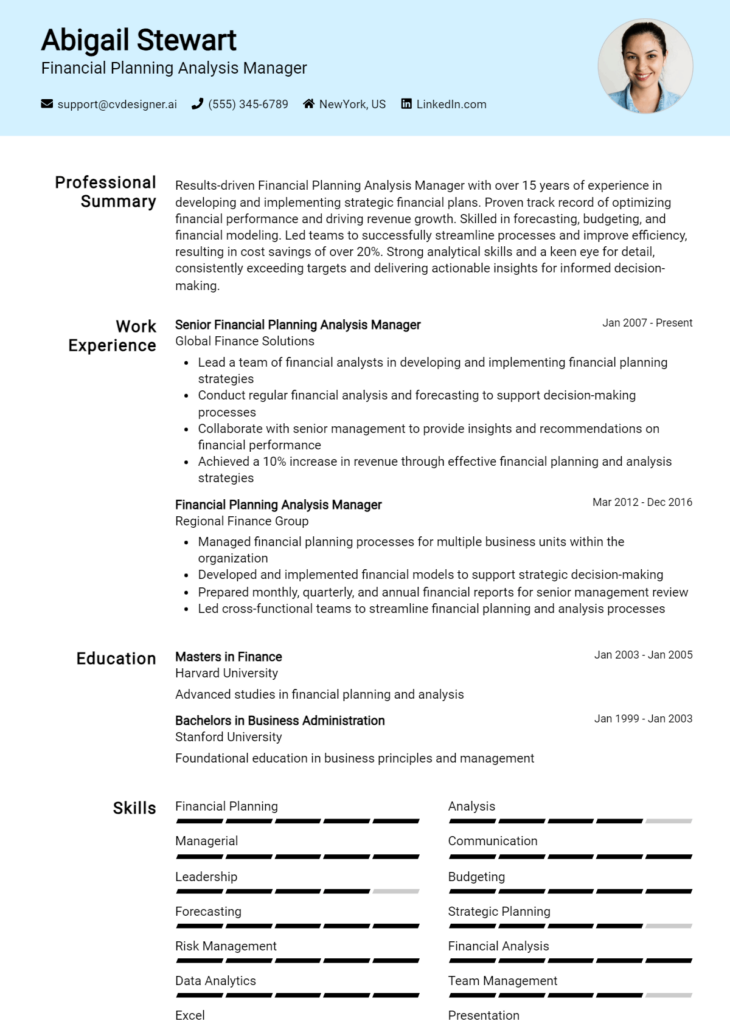

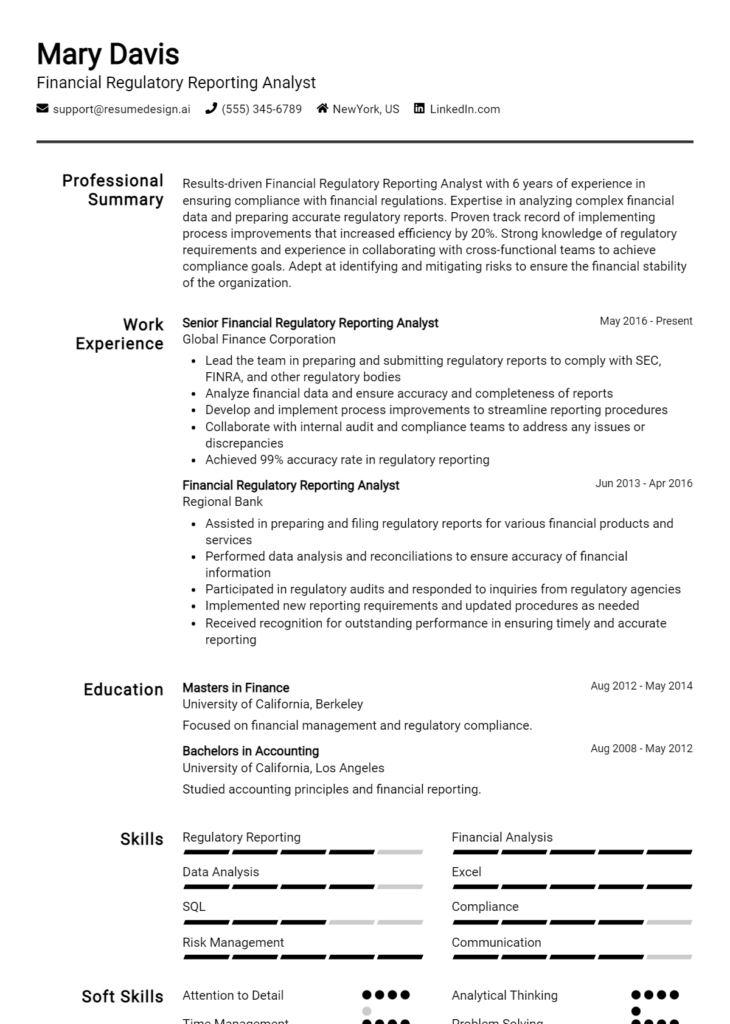

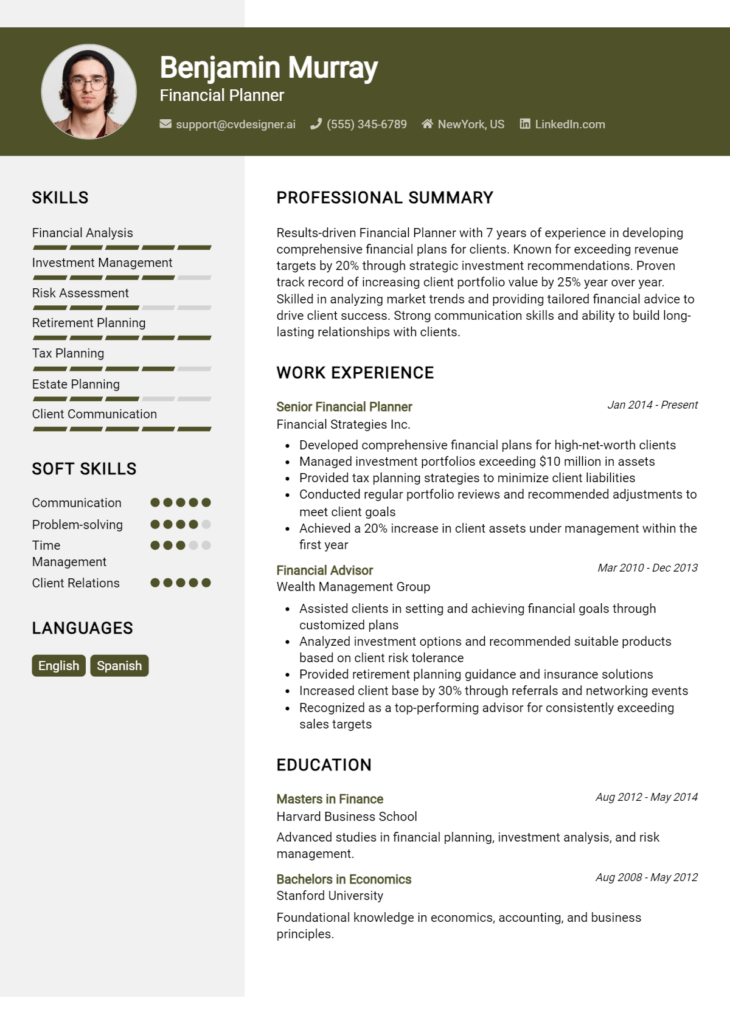

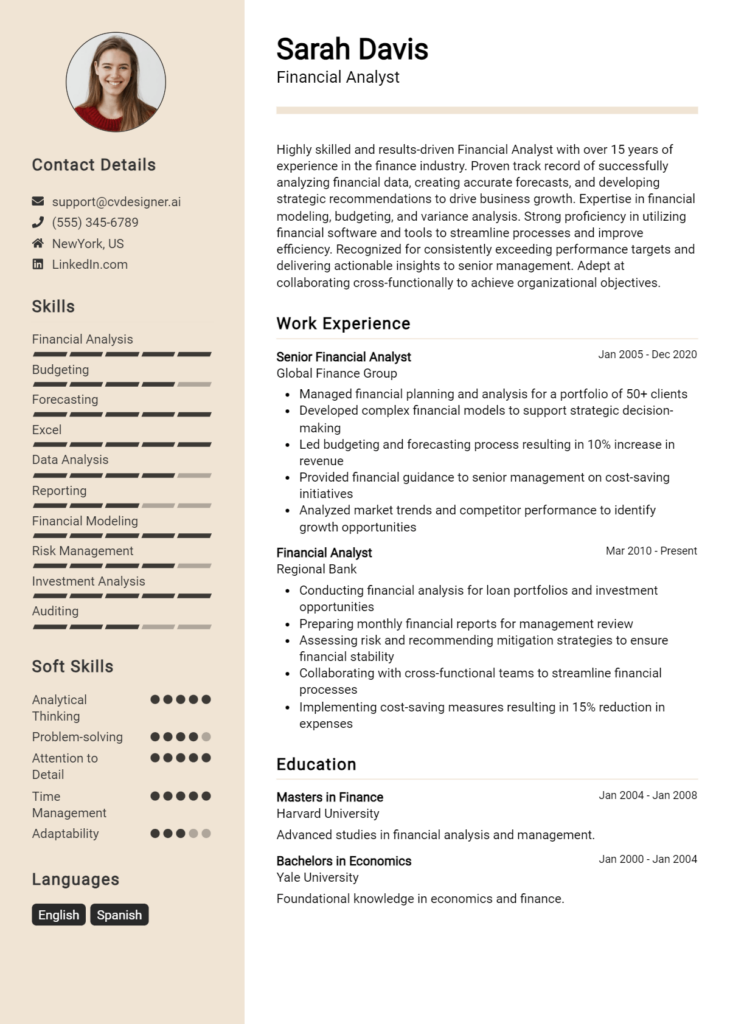

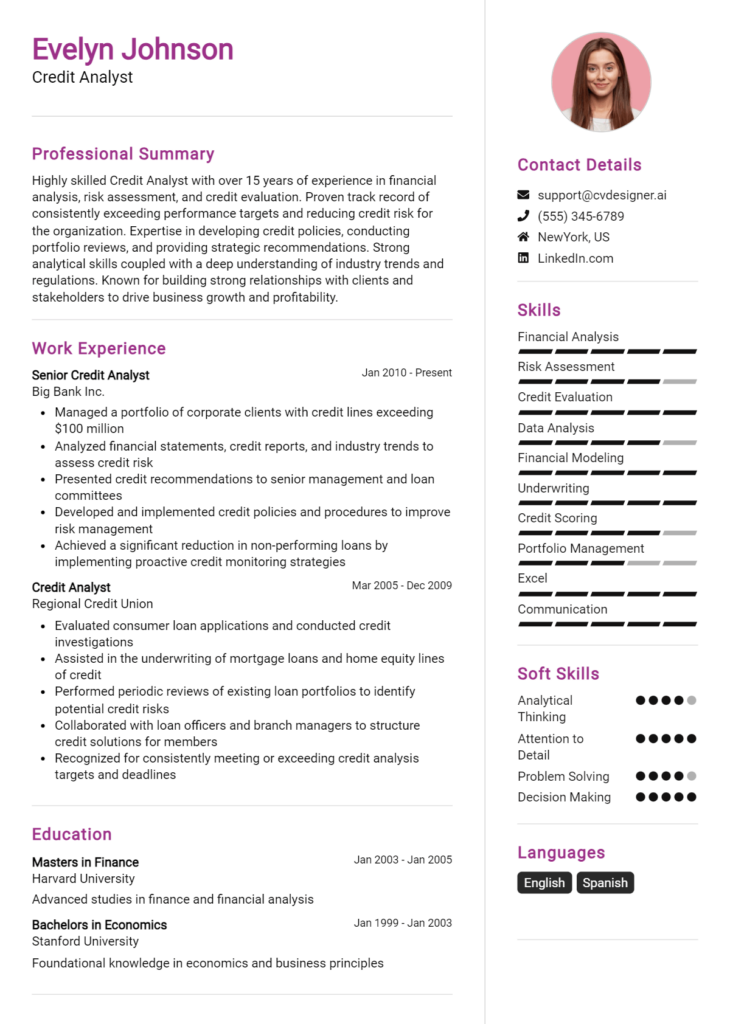

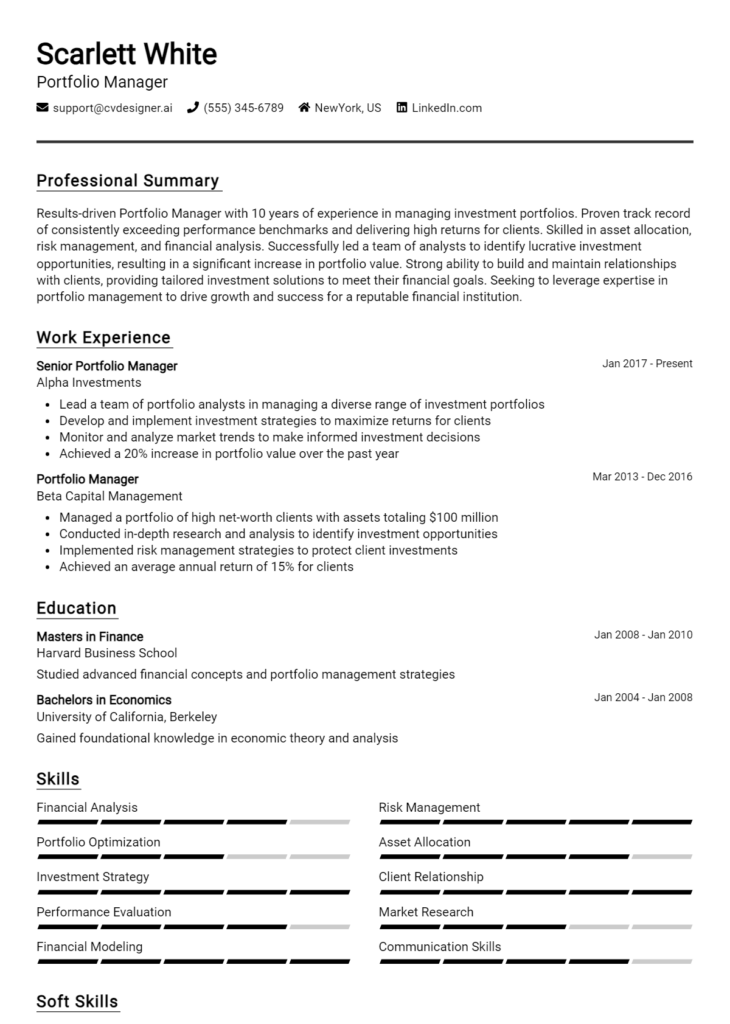

Don’t forget to utilize available tools to enhance your application. Explore our resume templates to find a design that resonates with your professional style. You can also leverage our resume builder for a streamlined approach to creating a polished resume. Additionally, consider using our cover letter templates to complement your application and make a strong impression on potential employers.

Take action now and elevate your job application materials to better reflect your qualifications and aspirations in the financial technology sector!