Financial Process Improvement Specialist Core Responsibilities

A Financial Process Improvement Specialist plays a crucial role in enhancing efficiency across financial operations by analyzing existing processes and recommending improvements. This professional collaborates with various departments to align financial strategies with organizational goals, requiring strong technical, operational, and problem-solving skills. Emphasizing data analysis and process mapping, these specialists drive continuous improvement initiatives. A well-structured resume effectively highlights these qualifications, showcasing the candidate’s ability to contribute significantly to the organization’s success.

Common Responsibilities Listed on Financial Process Improvement Specialist Resume

- Analyze and map current financial processes to identify inefficiencies.

- Develop and implement process improvement strategies.

- Collaborate with cross-functional teams to enhance financial operations.

- Utilize data analytics to drive decision-making and reporting improvements.

- Conduct training sessions to promote best practices in financial processes.

- Monitor and evaluate the effectiveness of implemented changes.

- Prepare detailed reports and presentations for senior management.

- Assist in the development of financial policies and procedures.

- Identify and mitigate risks associated with financial processes.

- Stay updated on industry trends and regulatory changes affecting financial operations.

- Support technology integration to optimize financial workflows.

High-Level Resume Tips for Financial Process Improvement Specialist Professionals

In today’s competitive job market, a well-crafted resume is crucial for Financial Process Improvement Specialist professionals. This document often serves as the first impression a candidate makes on a potential employer, making it essential to effectively showcase both skills and achievements. A strong resume not only highlights a candidate's qualifications but also demonstrates their ability to drive efficiency and optimize financial processes. In this guide, we will provide practical and actionable resume tips specifically tailored for Financial Process Improvement Specialist professionals to help you stand out in the application process.

Top Resume Tips for Financial Process Improvement Specialist Professionals

- Tailor your resume to match the specific job description, using keywords and phrases found in the posting.

- Highlight relevant experience in financial process improvement, such as previous roles or projects that showcase your expertise.

- Quantify your achievements by including metrics, percentages, or dollar amounts to demonstrate the impact of your work.

- Emphasize industry-specific skills, such as data analysis, process mapping, and financial modeling.

- Include certifications and relevant training, such as Six Sigma or Lean Management, to enhance your qualifications.

- Utilize clear and concise language, avoiding jargon that may not be familiar to all hiring managers.

- Incorporate a professional summary at the top of your resume that encapsulates your key skills and career goals.

- Ensure your resume format is clean and easy to read, with consistent fonts and headings to enhance overall presentation.

- Showcase any cross-functional collaboration experience, highlighting your ability to work with different departments to improve processes.

- Proofread your resume multiple times to eliminate any spelling or grammatical errors that could detract from your professionalism.

By implementing these resume tips, Financial Process Improvement Specialist professionals can significantly increase their chances of landing a job in their field. A tailored and impactful resume not only conveys your qualifications but also demonstrates your commitment to excellence and process optimization, making you a compelling candidate for potential employers.

Why Resume Headlines & Titles are Important for Financial Process Improvement Specialist

In the competitive field of finance, the role of a Financial Process Improvement Specialist is pivotal in enhancing efficiency and driving organizational success. A well-crafted resume headline or title serves as the first impression a candidate makes on hiring managers, succinctly summarizing their key qualifications and expertise in just a few words. A strong headline can immediately grab attention, highlighting relevant skills and experiences that align with the job requirements. It should be concise, relevant, and directly related to the position being applied for, setting the tone for the rest of the resume and making a compelling case for the candidate’s fit for the role.

Best Practices for Crafting Resume Headlines for Financial Process Improvement Specialist

- Keep it concise: Use fewer than 10 words to convey your expertise.

- Be specific: Tailor the headline to reflect the job description and required skills.

- Highlight key qualifications: Include your most relevant certifications or experiences.

- Use action-oriented language: Start with strong action verbs or impactful phrases.

- Incorporate keywords: Use industry-specific terminology to improve visibility.

- Showcase value: Emphasize how your skills can benefit the organization.

- Avoid jargon: Use clear language that is easily understood by hiring managers.

- Reflect your unique selling proposition: Identify what sets you apart from other candidates.

Example Resume Headlines for Financial Process Improvement Specialist

Strong Resume Headlines

Proven Financial Process Improvement Specialist with 10+ Years Experience in Cost Reduction

Results-Driven Financial Analyst Focused on Streamlining Operations and Enhancing Profitability

Certified Lean Six Sigma Professional Specializing in Financial Process Optimization

Expert in Data-Driven Financial Strategies to Improve Operational Efficiency

Weak Resume Headlines

Financial Expert

Experienced Professional in Finance

Looking for a Job in Finance

The strong headlines are effective because they clearly convey the candidate’s specific skills and accomplishments in the field of financial process improvement, making an immediate impact on hiring managers. They utilize action-oriented language and relevant keywords, creating a sense of urgency and relevance. In contrast, the weak headlines fail to impress due to their vagueness and lack of specificity, failing to communicate the candidate's true value or proficiency in the role, which can lead to missed opportunities in a competitive job market.

Writing an Exceptional Financial Process Improvement Specialist Resume Summary

A well-crafted resume summary is crucial for a Financial Process Improvement Specialist, as it serves as a compelling introduction to a candidate's qualifications. This brief yet powerful section allows job seekers to quickly capture the attention of hiring managers by highlighting their key skills, relevant experience, and significant accomplishments within the financial sector. A strong resume summary should be concise and impactful, tailored specifically to the job description to ensure that it resonates with the prospective employer and sets the tone for the rest of the application.

Best Practices for Writing a Financial Process Improvement Specialist Resume Summary

- Quantify Achievements: Use specific numbers to showcase your impact, such as percentage improvements or cost savings.

- Focus on Relevant Skills: Highlight skills that are directly related to financial process improvement, such as data analysis, project management, and financial modeling.

- Tailor the Summary: Customize your summary for each job application to align with the specific requirements outlined in the job description.

- Keep it Concise: Aim for 2-4 sentences that effectively summarize your qualifications without overwhelming the reader.

- Showcase Industry Knowledge: Mention familiarity with financial regulations, compliance, and best practices in the industry.

- Use Action Verbs: Start sentences with strong action verbs to convey your proactive approach to process improvement.

- Highlight Soft Skills: Include essential soft skills such as communication, teamwork, and problem-solving that complement your technical abilities.

- Include Relevant Certifications: If applicable, mention any certifications that enhance your credibility in financial process improvement.

Example Financial Process Improvement Specialist Resume Summaries

Strong Resume Summaries

Results-driven Financial Process Improvement Specialist with over 5 years of experience optimizing financial workflows, achieving a 30% reduction in processing time and saving the company $200,000 annually. Proficient in Lean Six Sigma methodologies and data analytics, with a proven ability to lead cross-functional teams in implementing process enhancements.

Detail-oriented finance professional with a track record of improving budgeting processes, which led to a 25% increase in forecasting accuracy. Skilled in utilizing advanced Excel functions and financial modeling techniques, contributing to data-driven decision-making and strategic financial planning.

Dynamic Financial Process Improvement Specialist with a passion for streamlining operations and enhancing efficiency. Successfully spearheaded a project that automated manual reporting processes, resulting in a 40% decrease in report generation time and improved stakeholder satisfaction.

Weak Resume Summaries

Experienced financial professional looking to improve processes in a company.

Hardworking individual with skills in finance and process improvement seeking new opportunities.

The strong resume summaries stand out due to their clear quantification of achievements and specific skills relevant to the Financial Process Improvement Specialist role. They provide concrete examples of how the candidate has made a measurable impact in previous positions, giving hiring managers a compelling reason to consider them. In contrast, the weak summaries are vague and lack specific outcomes or relevant details, making it difficult for employers to assess the candidates' qualifications and fit for the role.

Work Experience Section for Financial Process Improvement Specialist Resume

The work experience section of a Financial Process Improvement Specialist resume is crucial as it serves as a testament to the candidate's professional journey, showcasing their technical skills, leadership capabilities, and ability to deliver high-quality results that align with industry standards. This section not only highlights past roles and responsibilities but also emphasizes quantifiable achievements that demonstrate the candidate's effectiveness in enhancing financial processes. By effectively aligning their experience with industry benchmarks, candidates can better illustrate their value to potential employers and their readiness to tackle complex challenges in the financial sector.

Best Practices for Financial Process Improvement Specialist Work Experience

- Clearly articulate roles and responsibilities, focusing on specific financial processes improved.

- Quantify achievements using metrics such as percentage improvements, cost savings, and time reductions.

- Highlight technical skills relevant to financial process improvement, such as software proficiency and data analysis.

- Demonstrate leadership abilities by detailing experiences in managing teams and driving collaborative projects.

- Use industry-specific terminology to align experience with the expectations of financial organizations.

- Include continuous improvement initiatives that resulted in enhanced operational efficiency.

- Showcase cross-functional collaboration and effective communication with stakeholders.

- Tailor experiences to reflect the requirements of the specific job being applied for.

Example Work Experiences for Financial Process Improvement Specialist

Strong Experiences

- Led a team that redesigned the monthly financial reporting process, reducing report generation time by 40% and increasing accuracy by 25%.

- Implemented a new budgeting software that resulted in annual savings of $150,000 through improved resource allocation and expense tracking.

- Collaborated with cross-functional teams to identify and eliminate bottlenecks in the invoicing process, enhancing overall cash flow by 30%.

- Developed and executed a training program for staff on financial compliance, resulting in a 50% reduction in audit findings over two years.

Weak Experiences

- Worked on financial process improvements.

- Helped the team with reporting tasks.

- Participated in various projects related to finance.

- Assisted in improving some financial processes.

The examples listed as strong experiences are deemed effective because they highlight specific achievements, quantifiable results, and demonstrate leadership and collaboration within teams. In contrast, the weak experiences lack detail and fail to convey any significant impact or measurable outcomes, making them less impressive to potential employers. Strong experiences focus on concrete contributions and results, while weak experiences are vague and do not illustrate the candidate’s value proposition effectively.

Certifications and Education for a Financial Process Improvement Specialist Resume

When crafting your resume as a Financial Process Improvement Specialist, it’s essential to highlight relevant certifications and educational backgrounds that showcase your expertise in financial processes, analysis, and improvement methodologies.

Certifications to Prioritize:

Certified Six Sigma Green Belt (CSSGB): This certification demonstrates your ability to utilize Six Sigma methodologies for process improvement, which is highly applicable in financial environments.

Certified Lean Practitioner: Lean principles focus on waste reduction and efficiency, making this certification valuable for enhancing financial processes.

Certified Business Analysis Professional (CBAP): This certification emphasizes your skills in business analysis, which is crucial for understanding and improving financial processes.

Project Management Professional (PMP): Since process improvement often involves project management skills, a PMP certification can differentiate you as a candidate capable of managing improvement initiatives effectively.

Educational Background Examples:

Bachelor’s Degree in Finance: A foundational understanding of financial principles, markets, and instruments provides a solid base for any financial process improvement role.

Bachelor’s Degree in Accounting: This degree ensures proficiency in financial reporting and compliance, essential for analyzing and improving financial processes.

Master’s Degree in Business Administration (MBA): An MBA with a focus on operations management or finance offers advanced knowledge in strategic thinking and process optimization.

Master’s Degree in Financial Engineering: This advanced degree equips you with quantitative skills and the ability to apply complex financial models, crucial for improving financial processes.

Including these certifications and educational backgrounds will bolster your resume and demonstrate your commitment to professional development in financial process improvement.

Top Skills & Keywords for Financial Process Improvement Specialist Resume

As a Financial Process Improvement Specialist, possessing the right skills is crucial for effectively analyzing and enhancing financial processes within an organization. A well-crafted resume that highlights both soft and hard skills can significantly increase your chances of standing out to potential employers. Skills not only demonstrate your technical proficiency but also showcase your ability to collaborate, communicate, and lead initiatives that drive efficiency and accuracy in financial operations. By emphasizing the right combination of competencies, you can illustrate your value and readiness to contribute to the financial success of an organization.

Top Hard & Soft Skills for Financial Process Improvement Specialist

Soft Skills

- Analytical Thinking

- Problem-Solving

- Communication Skills

- Team Collaboration

- Adaptability

- Attention to Detail

- Time Management

- Leadership

- Conflict Resolution

- Critical Thinking

Hard Skills

- Financial Analysis

- Process Mapping

- Data Visualization

- Project Management

- Risk Assessment

- Budgeting and Forecasting

- Compliance Knowledge

- ERP Software Proficiency

- Six Sigma/Lean Methodologies

- Statistical Analysis

To further enhance your resume, consider exploring additional skills and detailing relevant work experience that aligns with the responsibilities of a Financial Process Improvement Specialist.

Stand Out with a Winning Financial Process Improvement Specialist Cover Letter

I am writing to express my interest in the Financial Process Improvement Specialist position at [Company Name], as advertised on [where you found the job listing]. With a proven track record of enhancing financial operations through strategic process improvements and a strong analytical skill set, I am excited about the opportunity to contribute to your team. My experience in identifying inefficiencies and implementing effective solutions has consistently led to increased operational efficiency and reduced costs in previous roles.

In my previous position at [Previous Company Name], I successfully led a project aimed at streamlining the accounts payable process, which resulted in a 30% reduction in processing time and a 15% decrease in related costs. By utilizing data analysis and process mapping techniques, I was able to pinpoint bottlenecks and develop targeted strategies that not only improved workflow but also enhanced overall accuracy. My collaborative approach allowed me to work closely with cross-functional teams to ensure that changes were effectively communicated and adopted, fostering a culture of continuous improvement.

I am particularly drawn to [Company Name] because of your commitment to innovation and excellence in financial practices. I admire your recent initiatives in [specific initiatives or values of the company], and I am eager to bring my expertise in financial process optimization to further enhance your operations. I am confident that my proactive mindset and results-driven approach will align well with your organizational goals, ultimately contributing to sustained growth and efficiency.

I look forward to the opportunity to discuss how my background, skills, and enthusiasms align with the needs of your team. Thank you for considering my application. I am excited about the possibility of contributing to [Company Name] as a Financial Process Improvement Specialist and am eager to bring my passion for optimizing financial processes to your esteemed organization.

Common Mistakes to Avoid in a Financial Process Improvement Specialist Resume

Crafting a resume as a Financial Process Improvement Specialist requires attention to detail and a clear presentation of skills and experiences. However, many candidates make common mistakes that can hinder their chances of landing an interview. Avoiding these pitfalls can help ensure that your resume effectively showcases your qualifications and aligns with the expectations of hiring managers in the finance sector.

Vague Job Descriptions: Using generic phrases instead of specific achievements can make your contributions seem less impactful. Tailor descriptions to highlight measurable outcomes and improvements you brought to previous roles.

Ignoring Keywords: Failing to incorporate industry-specific keywords can reduce the chances of your resume passing through Applicant Tracking Systems (ATS). Research job postings to identify relevant terms and include them in your resume.

Lack of Quantifiable Results: Not including metrics or data to demonstrate the success of your process improvements can weaken your claims. Use numbers, percentages, or timeframes to illustrate the effectiveness of your initiatives.

Overloading with Jargon: While industry terms can showcase your expertise, excessive jargon can alienate readers unfamiliar with specific terminology. Aim for clarity and balance to ensure your resume is accessible to all potential employers.

Neglecting Soft Skills: Focusing solely on technical skills may overlook essential soft skills such as communication, teamwork, and problem-solving. Highlight these abilities to show your holistic approach to financial process improvement.

Using an Unprofessional Format: An unorganized or visually cluttered resume can distract from your qualifications. Use a clean, professional layout that enhances readability and emphasizes key information.

Not Tailoring the Resume: Submitting a one-size-fits-all resume without tailoring it to specific job descriptions can signal a lack of genuine interest. Customize your resume for each application to reflect how your skills align with the employer's needs.

Including Irrelevant Information: Listing experiences or skills that do not pertain to the role of a Financial Process Improvement Specialist can dilute your message. Focus on relevant experiences that highlight your suitability for the job.

Conclusion

As a Financial Process Improvement Specialist, your role is pivotal in enhancing the efficiency and effectiveness of financial operations. Key points to consider include the importance of analyzing current processes, identifying areas for improvement, and implementing best practices and technologies that drive financial performance. Your analytical skills, attention to detail, and ability to collaborate with cross-functional teams are essential in achieving these objectives.

Moreover, showcasing your experience with financial modeling, data analysis, and process automation is crucial on your resume. Highlighting any successful projects that resulted in significant cost savings or process enhancements will set you apart from other candidates.

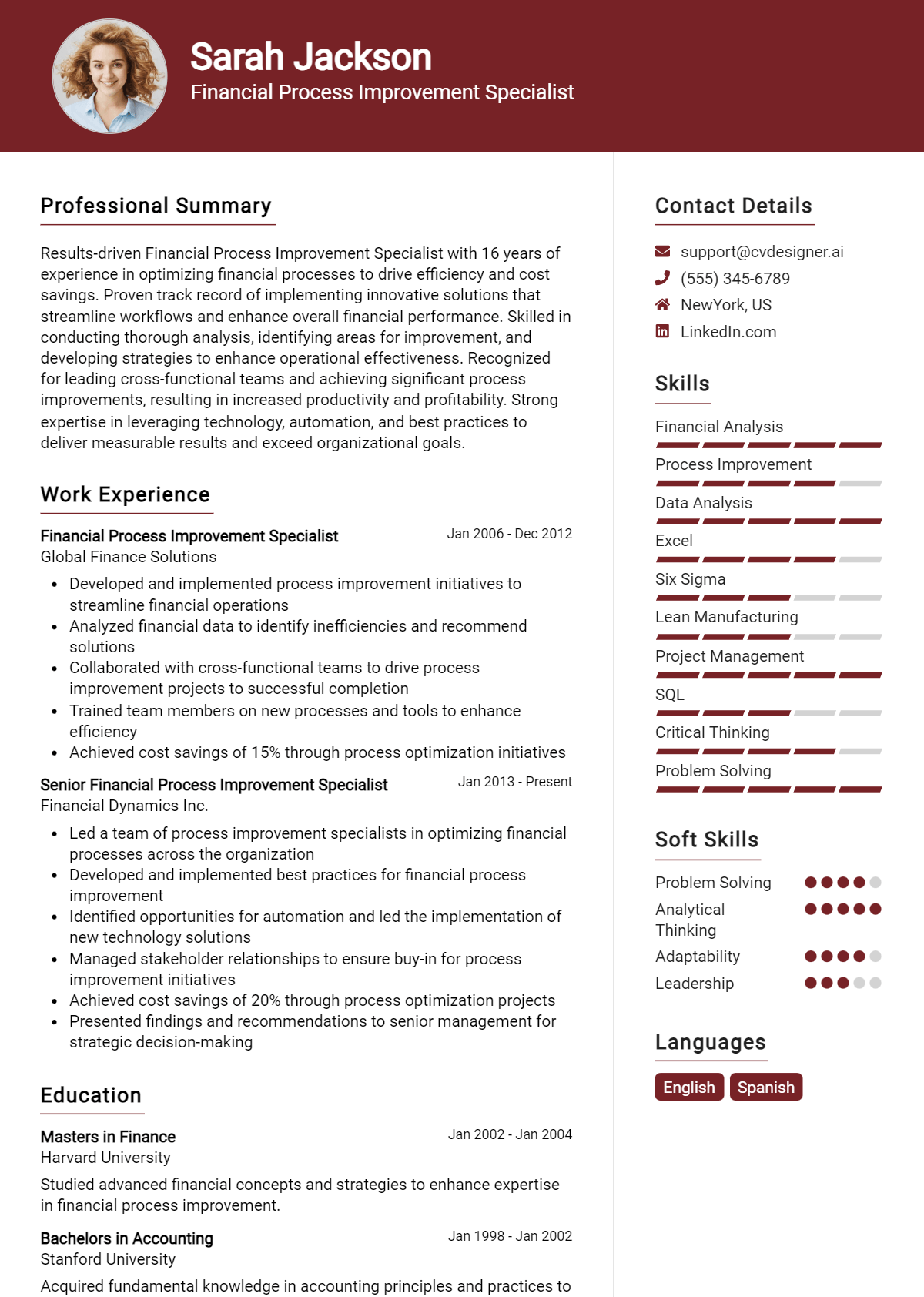

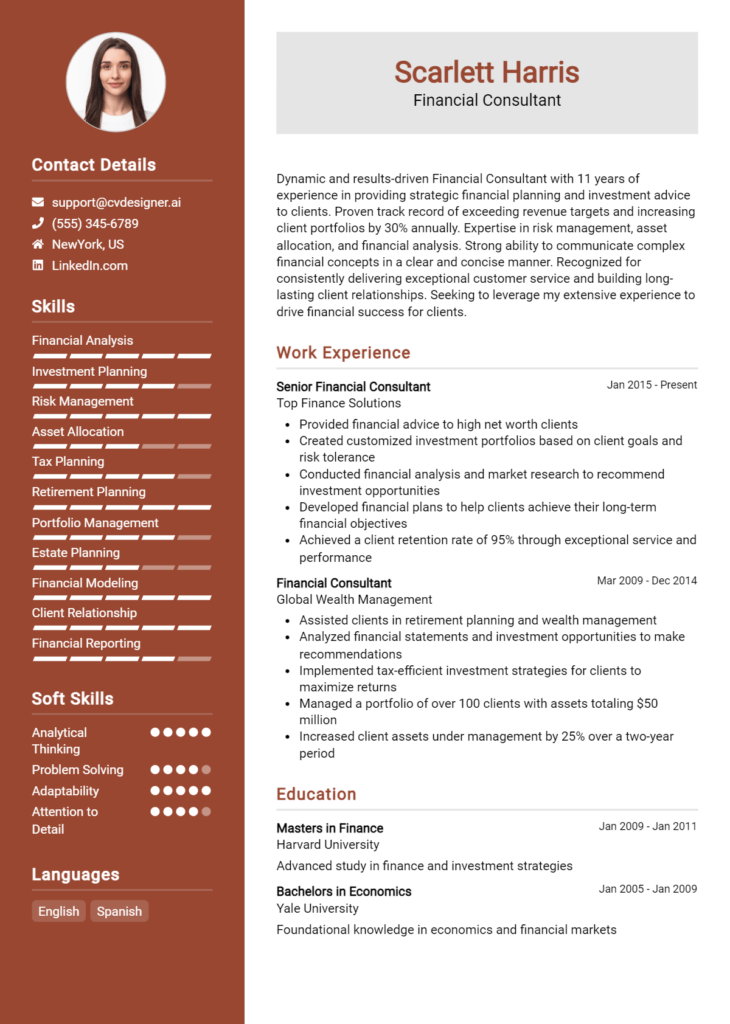

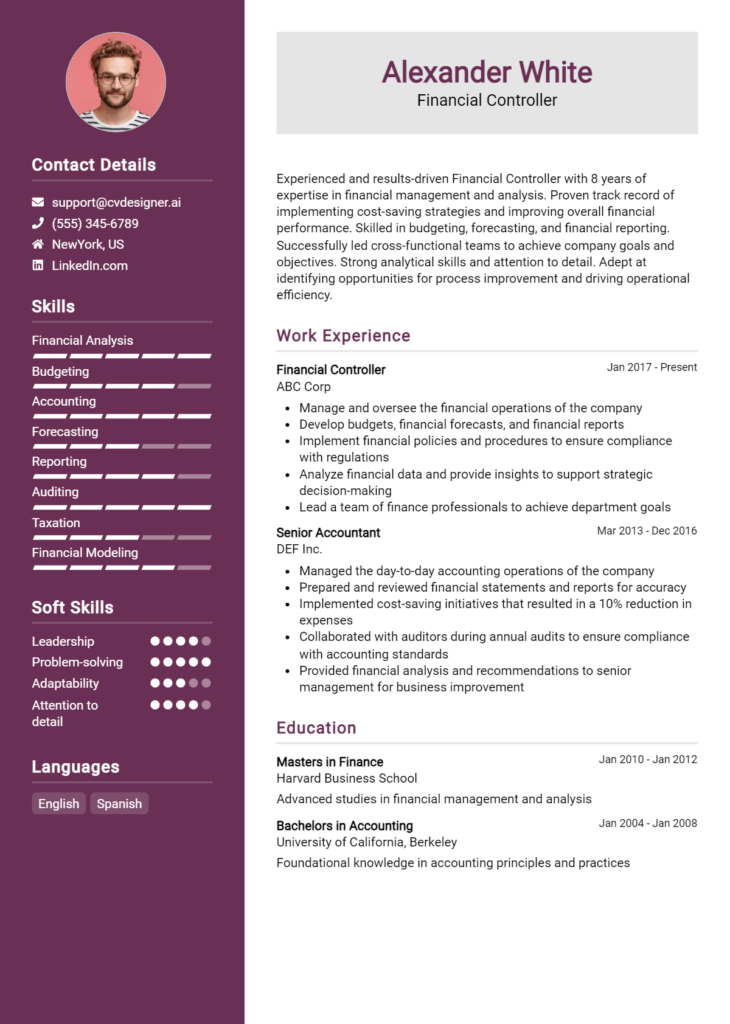

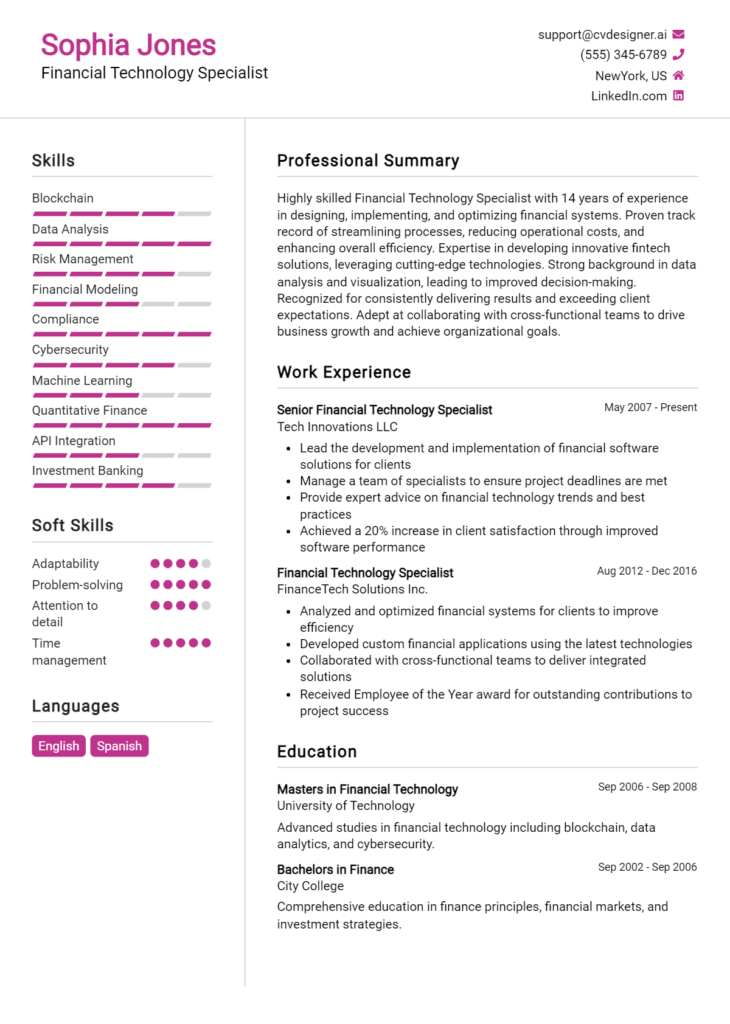

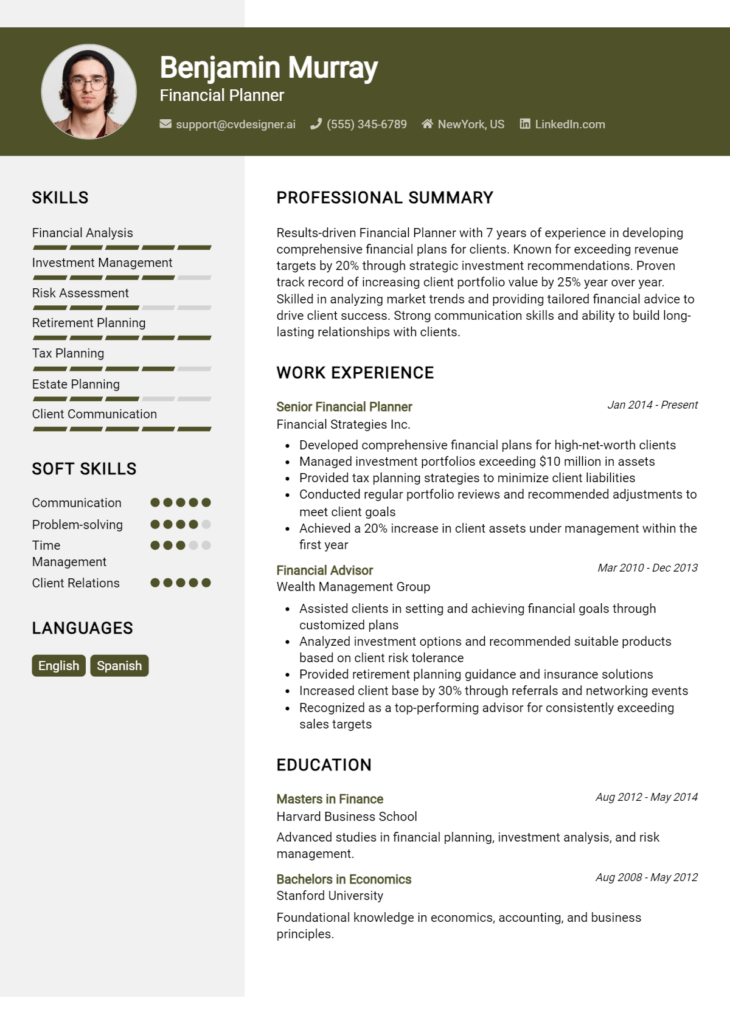

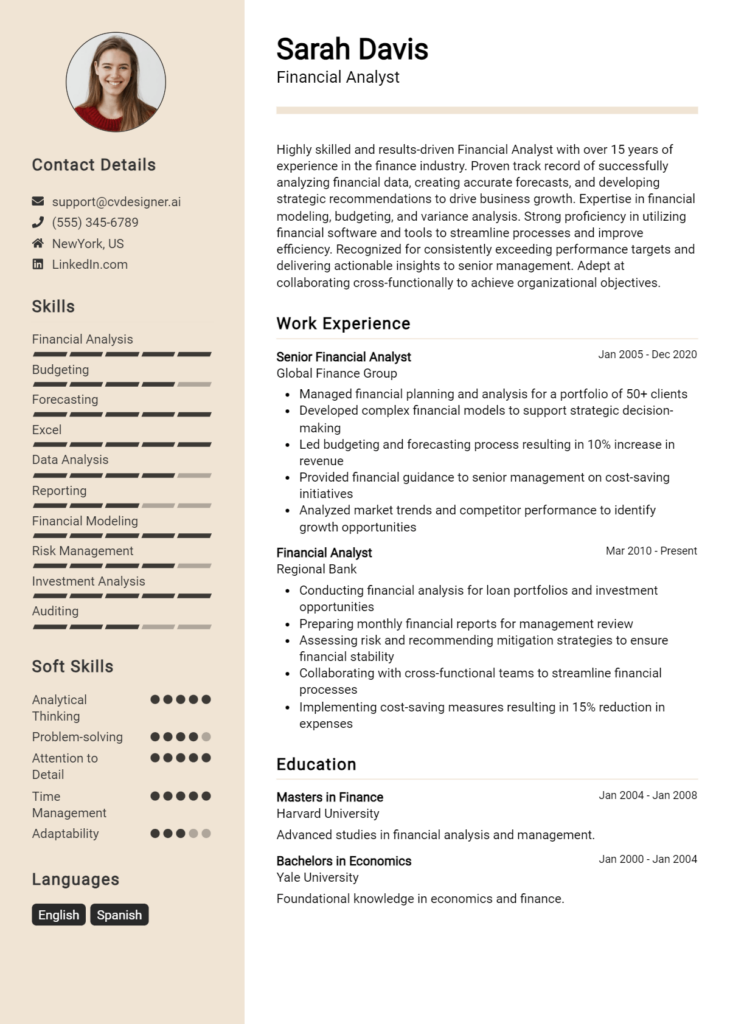

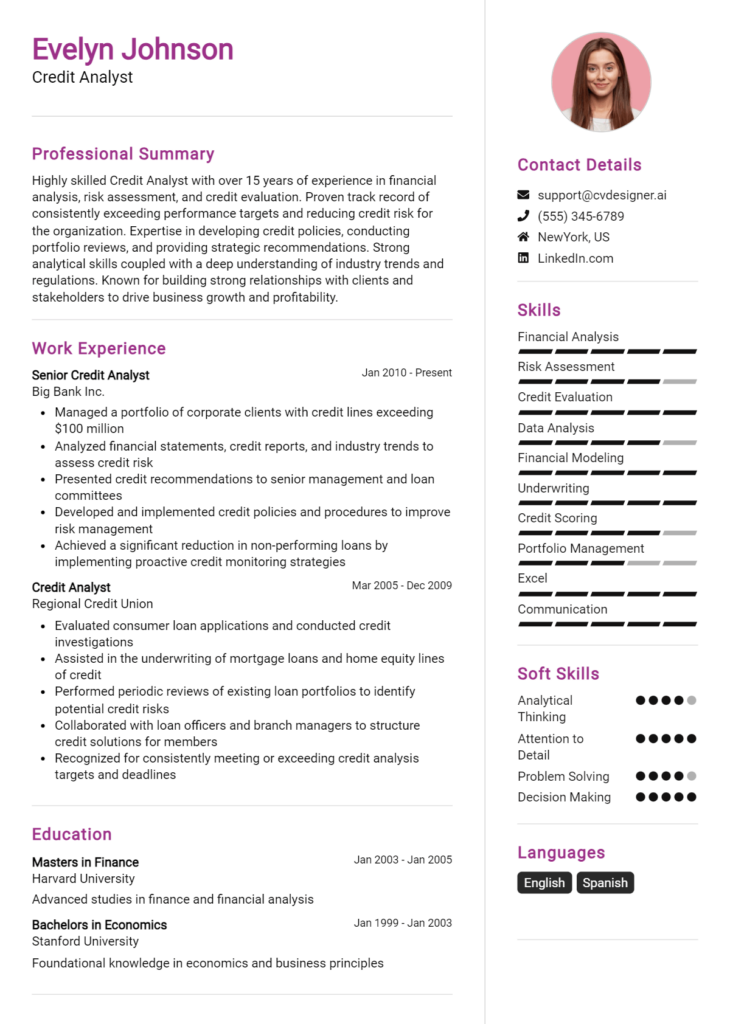

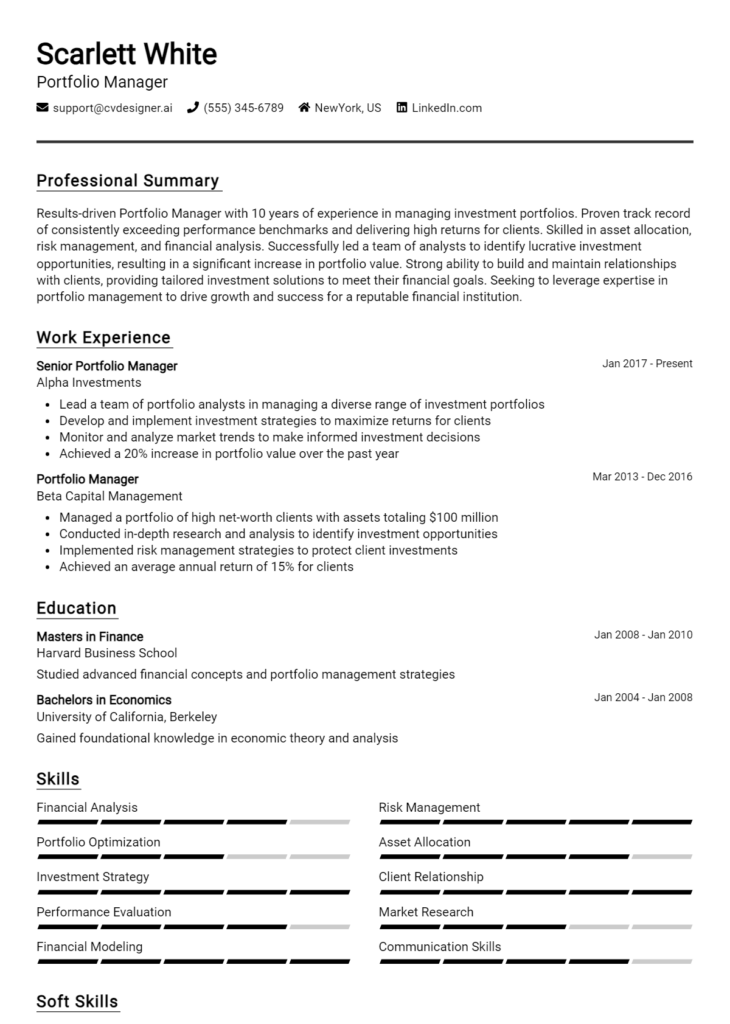

To ensure your resume stands out in a competitive job market, it’s essential to tailor it to the specific requirements of the Financial Process Improvement Specialist role. Utilize available resources to enhance your application materials. Check out resume templates to find a format that best represents your skills and experience. Consider using the resume builder for an easy and effective way to create a professional resume. Additionally, don’t forget to craft a compelling cover letter using the cover letter templates available, which can help articulate your value proposition to potential employers.

Take action now! Review your resume and leverage these tools to ensure it effectively communicates your qualifications as a Financial Process Improvement Specialist.