Financial Planning & Analysis Manager Core Responsibilities

A Financial Planning & Analysis Manager plays a crucial role in an organization by bridging gaps between finance, operations, and strategic planning. Key responsibilities include developing financial forecasts, analyzing variances, and guiding budgetary decisions. Essential skills encompass technical proficiency in financial modeling, operational insight, and strong problem-solving capabilities, all vital for driving informed decision-making. A well-structured resume can effectively highlight these qualifications, showcasing how they contribute to the organization's overall goals and financial health.

Common Responsibilities Listed on Financial Planning & Analysis Manager Resume

- Develop and manage annual budgeting and forecasting processes.

- Analyze financial data to identify trends and variances.

- Collaborate with department heads to align financial goals.

- Prepare detailed financial reports for executive leadership.

- Conduct scenario modeling to support strategic planning.

- Monitor key performance indicators (KPIs) and metrics.

- Implement financial policies and best practices across the organization.

- Lead cross-functional teams in finance-related projects.

- Provide insights and recommendations to enhance profitability.

- Support investment and capital expenditure decisions.

- Facilitate financial training for non-financial managers.

- Ensure compliance with financial regulations and reporting standards.

High-Level Resume Tips for Financial Planning & Analysis Manager Professionals

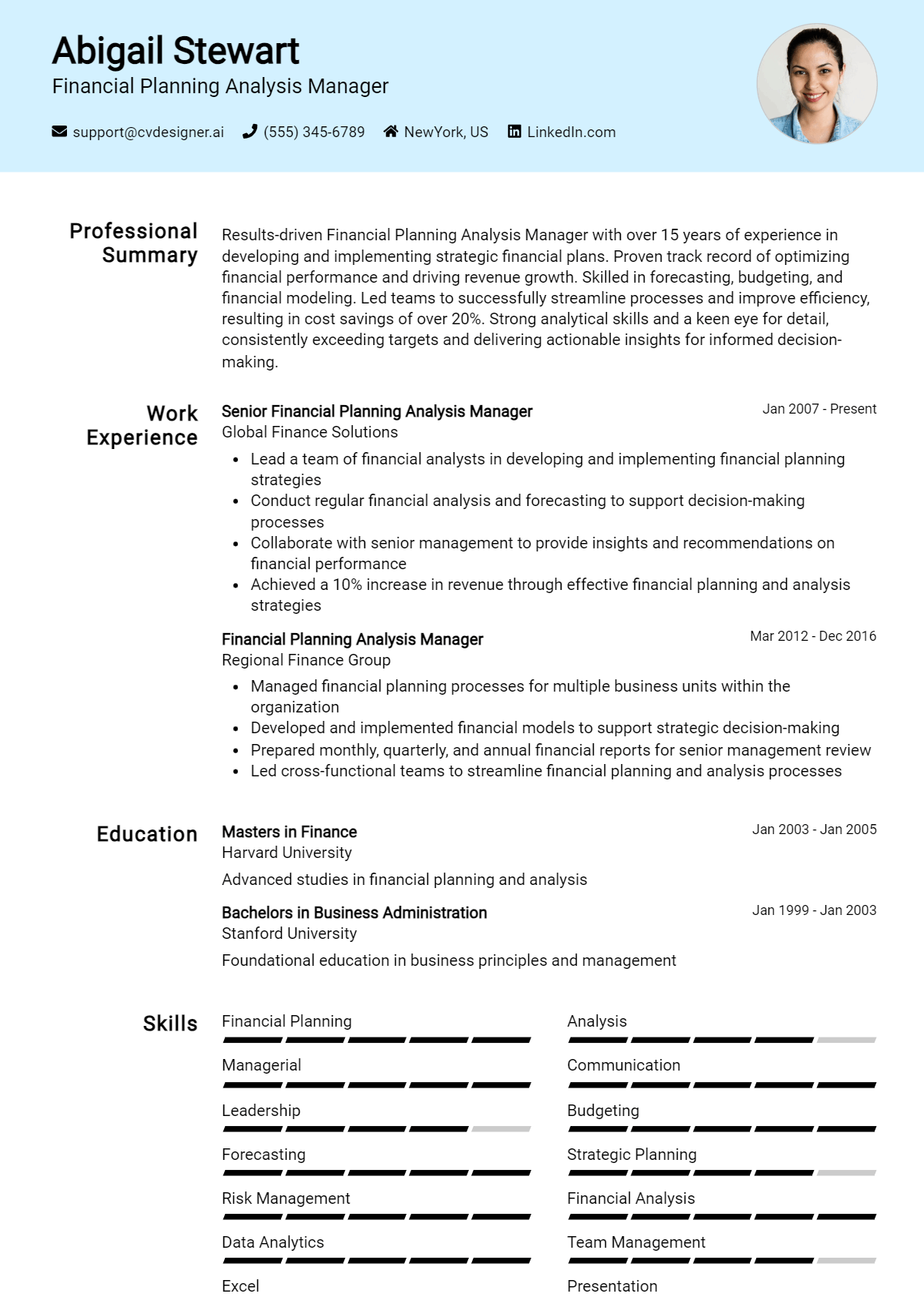

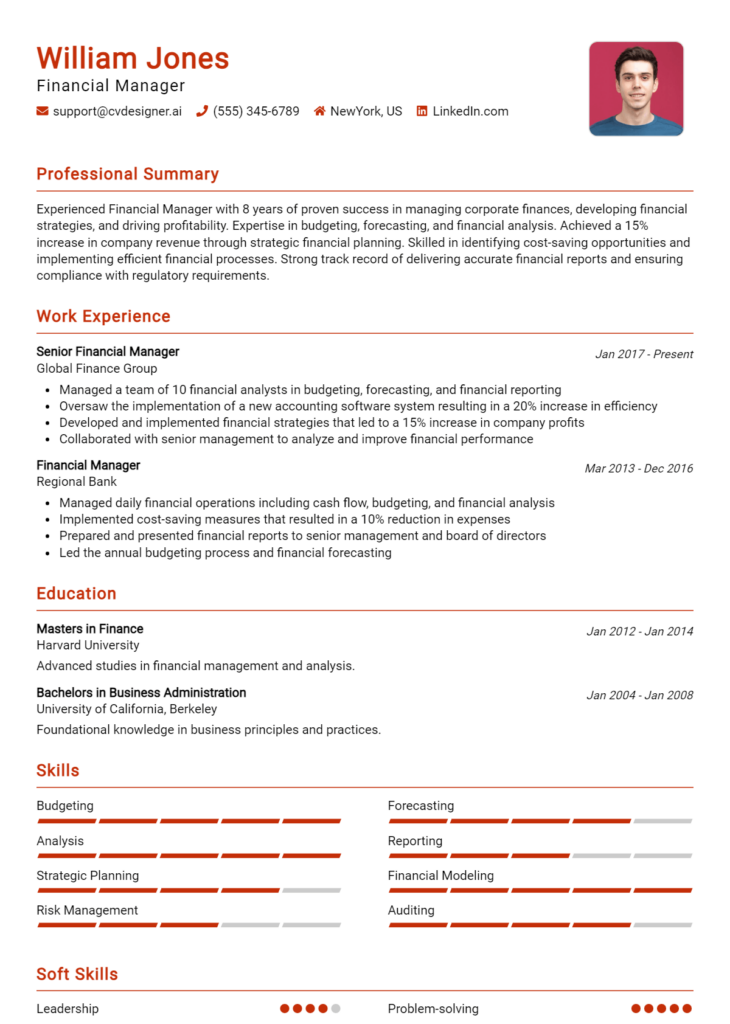

In the competitive landscape of financial services, a well-crafted resume serves as a powerful tool for Financial Planning & Analysis Manager professionals. It is often the first impression a candidate makes on potential employers, making it essential for the resume to effectively reflect both the skills acquired and the achievements earned throughout one’s career. A compelling resume not only showcases your qualifications but also narrates your professional journey, demonstrating how you can add value to an organization. This guide will provide practical and actionable resume tips specifically tailored for Financial Planning & Analysis Manager professionals, helping you to stand out in a crowded job market.

Top Resume Tips for Financial Planning & Analysis Manager Professionals

- Tailor your resume to each job description by incorporating relevant keywords and phrases that align with the specific requirements of the role.

- Highlight your relevant experience in financial planning, analysis, and budgeting, ensuring that it is clearly articulated and easy to find.

- Quantify your achievements wherever possible; use specific numbers and metrics to illustrate your contributions, such as cost savings, revenue growth, or improved forecasting accuracy.

- Showcase industry-specific skills such as financial modeling, variance analysis, and proficiency with ERP systems or financial software.

- Include a summary statement at the top of your resume that succinctly captures your experience, skills, and what you can bring to the role.

- Utilize bullet points for clarity and to make your accomplishments stand out, making it easy for hiring managers to skim through your resume.

- Demonstrate your leadership abilities and experience in managing teams or projects, as these qualities are crucial for a managerial position.

- Incorporate relevant certifications or educational qualifications, such as CPA, CFA, or an MBA, to enhance your credibility in the field.

- Keep the formatting clean and professional, ensuring your resume is visually appealing and easy to navigate.

By implementing these tips, Financial Planning & Analysis Manager professionals can significantly increase their chances of landing a job in their field. A targeted and polished resume not only captures the attention of hiring managers but also effectively communicates your value proposition, making you a strong contender for the role.

Why Resume Headlines & Titles are Important for Financial Planning & Analysis Manager

In the competitive landscape of finance, having a well-crafted resume headline is paramount for a Financial Planning & Analysis Manager. A strong headline or title can serve as the first impression a hiring manager receives, quickly summarizing a candidate's key qualifications in a few impactful words. This brief yet powerful statement should be concise, relevant, and directly related to the specific job being applied for. By capturing attention immediately, a compelling resume headline can set the tone for the rest of the resume and highlight the candidate's suitability for the role, making it an essential component of a successful job application.

Best Practices for Crafting Resume Headlines for Financial Planning & Analysis Manager

- Keep it concise—aim for one to two impactful phrases.

- Make it role-specific by including relevant keywords from the job description.

- Highlight key accomplishments or skills that align with the position.

- Avoid jargon and overly complex language to ensure clarity.

- Use action-oriented language to convey confidence and proactivity.

- Tailor your headline for each application to reflect the specific role.

- Consider including metrics or quantifiable achievements when possible.

- Ensure it reflects your unique value proposition as a candidate.

Example Resume Headlines for Financial Planning & Analysis Manager

Strong Resume Headlines

Strategic Financial Planning & Analysis Leader with 10+ Years of Experience Driving Profitability

Results-Oriented FP&A Manager Specializing in Forecasting and Budgeting Excellence

Dynamic Financial Analyst with Proven Track Record in Enhancing Financial Performance

Innovative Financial Planning Manager Adept at Leveraging Data Analytics for Strategic Decisions

Weak Resume Headlines

Financial Manager

Experienced Professional Seeking Opportunities

Finance Expert

The strong resume headlines listed above are effective because they are specific, highlight relevant experience, and provide insight into the candidate's unique strengths. They immediately communicate what the candidate brings to the table, using action-oriented language and relevant keywords. In contrast, the weak headlines fail to impress as they are vague, generic, and do not differentiate the candidate from others. By lacking specificity and impact, these weak headlines miss the opportunity to engage hiring managers and showcase the candidate's qualifications effectively.

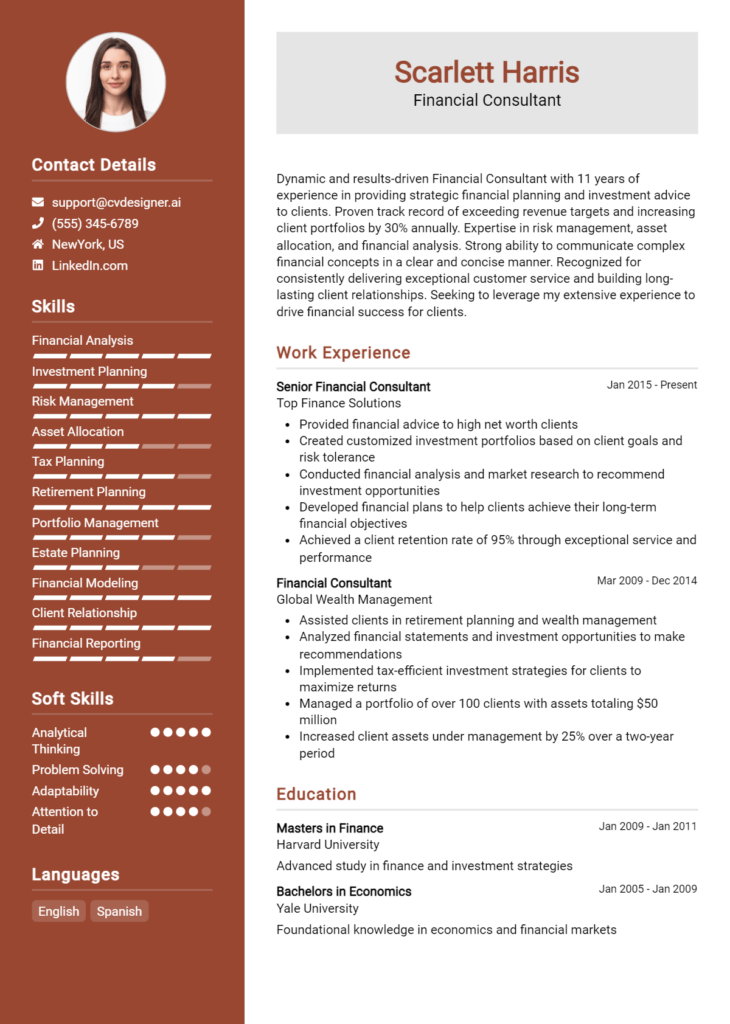

Writing an Exceptional Financial Planning & Analysis Manager Resume Summary

A resume summary is a critical component for a Financial Planning & Analysis Manager as it serves as the first impression to hiring managers. A well-crafted summary quickly captures attention by highlighting key skills, relevant experience, and significant accomplishments that align with the job requirements. It should be concise and impactful, providing a snapshot of the candidate's qualifications that entices the reader to learn more. Tailoring the summary to the specific job for which the candidate is applying further enhances its effectiveness, demonstrating an understanding of the role and the value the candidate can bring to the organization.

Best Practices for Writing a Financial Planning & Analysis Manager Resume Summary

- Quantify Achievements: Use numbers to demonstrate your impact, such as revenue growth percentages or cost savings.

- Highlight Relevant Skills: Focus on key skills such as financial modeling, forecasting, and strategic analysis.

- Tailor to Job Description: Customize the summary to reflect the specific qualifications and responsibilities mentioned in the job posting.

- Use Action-Oriented Language: Start with strong action verbs to convey confidence and proactivity.

- Keep it Concise: Aim for 3-5 sentences that succinctly summarize your qualifications.

- Showcase Industry Knowledge: Mention relevant industry experience or tools that are pertinent to the role.

- Focus on Value Proposition: Clearly articulate how your skills and experience can benefit the employer.

Example Financial Planning & Analysis Manager Resume Summaries

Strong Resume Summaries

Results-driven Financial Planning & Analysis Manager with over 8 years of experience in leveraging financial modeling and dynamic forecasting to drive strategic decisions. Achieved a 20% reduction in operating expenses through comprehensive budget analysis and cost control measures.

Dedicated FP&A Manager with a proven track record of enhancing financial performance through innovative analytics and actionable insights. Increased revenue by 15% year-over-year by implementing data-driven strategies and optimizing resource allocation.

Analytical and detail-oriented Financial Planning & Analysis Manager skilled in developing comprehensive financial reports and forecasts. Successfully led a team that identified $1 million in savings through process improvements and financial restructuring.

Weak Resume Summaries

Experienced finance professional looking for a challenging role in financial planning and analysis.

Detail-oriented individual with some experience in finance and accounting seeking to contribute to a financial team.

The strong resume summaries are effective because they incorporate quantifiable achievements, specific skills related to financial planning and analysis, and a clear value proposition that aligns with the expectations of hiring managers. In contrast, the weak summaries lack detail, are overly generic, and do not provide any measurable outcomes or unique selling points, making them less impactful and memorable to potential employers.

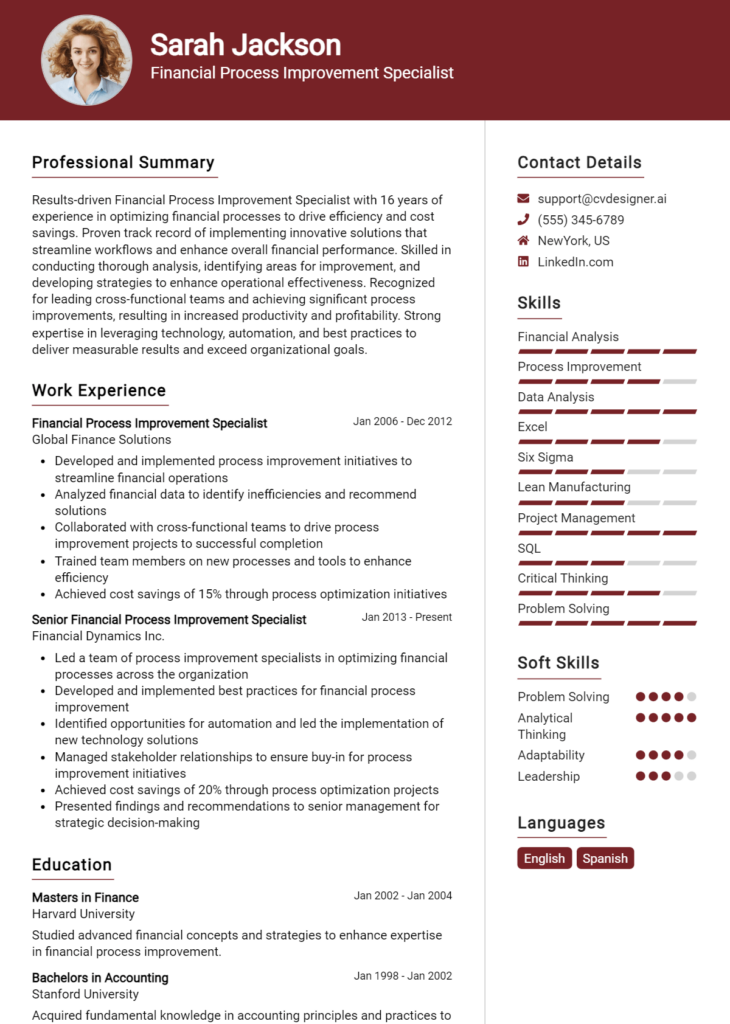

Work Experience Section for Financial Planning & Analysis Manager Resume

The work experience section of a Financial Planning & Analysis Manager resume is critical in demonstrating the candidate's technical skills, leadership capabilities, and the ability to deliver high-quality results. This section serves as a platform to showcase specific achievements that reflect not only the individual’s knowledge of financial principles and analysis but also their experience in managing teams and collaborating with cross-functional departments. By quantifying achievements and aligning experiences with industry standards, candidates can effectively illustrate their value to potential employers, making this section a focal point of the resume.

Best Practices for Financial Planning & Analysis Manager Work Experience

- Highlight relevant technical skills, such as financial modeling, forecasting, and data analysis tools.

- Quantify achievements with specific metrics (e.g., cost savings, revenue growth) to demonstrate impact.

- Showcase leadership experiences, including team management and project oversight.

- Include specific examples of collaboration with other departments to drive financial initiatives.

- Use action verbs to convey a sense of proactivity and responsibility in your roles.

- Align your experiences with industry standards and best practices to enhance credibility.

- Tailor your work experience to the job description, emphasizing relevant accomplishments.

- Keep descriptions concise and focused on results to maintain engagement and clarity.

Example Work Experiences for Financial Planning & Analysis Manager

Strong Experiences

- Led a cross-functional team to implement a new forecasting model, resulting in a 15% increase in accuracy and a 10% reduction in budgeting cycle time.

- Developed and managed a financial dashboard that provided real-time insights, improving decision-making efficiency by 25% across departments.

- Collaborated with IT and operations to streamline financial reporting processes, achieving a 30% decrease in report preparation time.

- Successfully identified and executed cost-saving initiatives that saved the company over $500,000 annually through process optimization.

Weak Experiences

- Responsible for overseeing financial operations without specific details on outcomes or improvements.

- Worked on budgeting tasks with no mention of achievements or contributions to overall company goals.

- Participated in meetings related to financial analysis, but without clear explanation of role or impact.

- Assisted in preparing reports with vague references to "helping the team" rather than quantifiable results.

The strong experiences listed above are considered impactful because they highlight specific achievements, quantify results, and demonstrate technical and leadership capabilities. Conversely, the weak experiences lack detail and measurable outcomes, failing to convey the candidate's contributions effectively. These examples illustrate the importance of clarity and specificity in the work experience section, emphasizing the candidate's value to prospective employers.

Certifications and Education for a Financial Planning & Analysis Manager Resume

When crafting a resume for a Financial Planning & Analysis Manager role, it’s essential to highlight relevant certifications and educational backgrounds that showcase your expertise and commitment to the field. Here’s how to effectively list this information:

Certifications to Prioritize

Chartered Financial Analyst (CFA): This globally recognized certification demonstrates a strong understanding of investment management and financial analysis, making it highly valuable for FP&A roles.

Certified Management Accountant (CMA): The CMA certification focuses on financial management and strategy, providing a solid foundation in financial planning, control, and decision support.

Certified Financial Planner (CFP): While more focused on personal finance, the CFP certification emphasizes financial planning principles, which can be beneficial for understanding broader financial strategies within an organization.

Financial Risk Manager (FRM): The FRM certification is ideal for those looking to specialize in risk management, providing insights into assessing and managing financial risks that can impact planning and analysis.

Educational Background Examples

Bachelor’s Degree in Finance or Accounting: A foundational degree that provides essential knowledge of financial principles, accounting practices, and analytical skills necessary for an FP&A role.

Master’s Degree in Business Administration (MBA) with a focus on Finance: An MBA equips professionals with advanced financial and managerial skills, enhancing their strategic thinking abilities and leadership potential.

Master’s Degree in Finance or Financial Engineering: These specialized degrees focus on advanced financial theories, quantitative methods, and risk management, which are critical for high-level financial analysis.

Bachelor’s Degree in Economics: This degree offers a solid grounding in economic theory and quantitative analysis, essential for understanding market trends and their implications on financial planning.

In your resume, present your certifications and education in a clear, organized manner. List your degrees chronologically, starting with the most recent, and include your certifications in a separate section or alongside your educational background to draw attention to your qualifications.

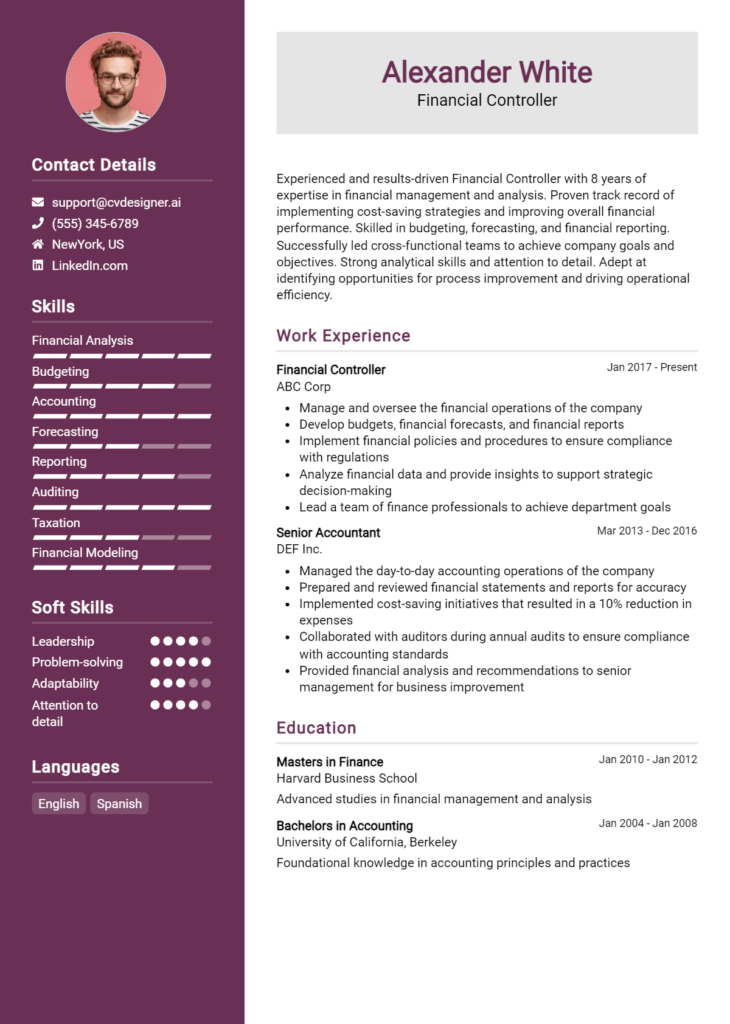

Top Skills & Keywords for Financial Planning & Analysis Manager Resume

In the competitive field of financial planning and analysis, the right skills can set candidates apart and significantly impact their career trajectory. A well-crafted resume for a Financial Planning & Analysis Manager must highlight both hard and soft skills that demonstrate the candidate's ability to analyze financial data, develop strategies, and communicate effectively with stakeholders. These skills not only reflect a candidate’s technical proficiency but also their capacity to lead teams and drive business decisions. By emphasizing these skills, candidates can make a compelling case for their suitability for the role, ultimately enhancing their chances of landing interviews and job offers.

Top Hard & Soft Skills for Financial Planning & Analysis Manager

Soft Skills

- Strategic Thinking

- Communication Skills

- Leadership and Team Management

- Problem-Solving Ability

- Time Management

- Adaptability

- Attention to Detail

- Interpersonal Skills

- Negotiation Skills

- Critical Thinking

- Decision-Making

- Collaboration

- Conflict Resolution

- Emotional Intelligence

- Presentation Skills

Hard Skills

- Financial Modeling

- Budgeting and Forecasting

- Data Analysis and Interpretation

- Proficiency in Financial Software (e.g., SAP, Oracle)

- Advanced Excel Skills

- Knowledge of Financial Regulations and Compliance

- Reporting and Performance Metrics

- Variance Analysis

- Cost Analysis

- Risk Management

- Business Intelligence Tools

- Database Management

- Project Management

- Accounting Principles

- Valuation Techniques

For further exploration of essential skills and work experience needed in the financial sector, consider the specific requirements of the Financial Planning & Analysis Manager role to tailor your resume effectively.

Stand Out with a Winning Financial Planning & Analysis Manager Cover Letter

Dear [Hiring Manager's Name],

I am writing to express my interest in the Financial Planning & Analysis Manager position at [Company Name], as advertised on [where you found the job posting]. With over [X years] of experience in financial analysis and strategic planning, I possess a strong background in delivering actionable insights that drive business growth. My ability to analyze complex financial data and present it in a clear, concise manner has empowered leadership teams to make informed decisions that align with organizational objectives.

In my previous role at [Previous Company Name], I successfully led a team in developing comprehensive financial models that projected revenue growth and cost-saving opportunities. By implementing new forecasting techniques and utilizing advanced analytical tools, we were able to enhance the accuracy of our financial projections by [percentage or metric]. Furthermore, my collaboration with cross-functional teams enabled us to identify key performance indicators and streamline financial reporting processes, resulting in a [specific achievement, such as reduced reporting time or increased financial visibility].

I am particularly drawn to [Company Name] because of its commitment to innovation and excellence in the industry. I am excited about the opportunity to leverage my skills in budgeting, variance analysis, and strategic financial planning to contribute to your team. I am confident that my proactive approach and strong problem-solving abilities will not only enhance the financial planning function but will also support [Company’s specific goals or initiatives mentioned in the job description].

Thank you for considering my application. I look forward to the possibility of discussing how my experience and vision align with the goals of [Company Name]. I am eager to bring my expertise to your organization and contribute to its continued success.

Sincerely,

[Your Name]

[Your Phone Number]

[Your Email Address]

Common Mistakes to Avoid in a Financial Planning & Analysis Manager Resume

Crafting a resume for a Financial Planning & Analysis Manager position can be a daunting task, especially given the competitive nature of the finance industry. Many candidates make common mistakes that can hinder their chances of landing an interview. By avoiding these pitfalls, job seekers can present themselves as strong contenders for the role. Here are some frequent errors to watch out for:

Overly Complex Language: Using jargon or complex financial terms without context can alienate hiring managers. Clear and concise language enhances readability and ensures your expertise is accessible.

Lack of Quantifiable Achievements: Failing to include specific metrics or results in previous roles can make your contributions seem vague. Highlighting accomplishments with numbers (e.g., "increased revenue by 15%") adds credibility to your experience.

Generic Objective Statements: Including a generic objective statement can make your resume blend in with others. Tailor your objectives to reflect your interest in the specific role and company to capture attention.

Ignoring Keywords: Neglecting to incorporate industry-specific keywords can lead to your resume being overlooked, especially in applicant tracking systems (ATS). Analyze the job description and integrate relevant terms.

Inconsistent Formatting: A cluttered or inconsistent format can distract from your qualifications. Ensure uniformity in fonts, headings, and spacing to create a professional appearance.

Too Much Focus on Responsibilities: Listing job duties without showcasing how you excelled in those roles can weaken your resume. Instead, emphasize achievements and outcomes to demonstrate your impact.

Neglecting Soft Skills: Focusing solely on technical skills may overlook the importance of soft skills like communication, leadership, and problem-solving. Highlighting these attributes can set you apart from other candidates.

Omitting Continuing Education and Certifications: Failing to mention relevant certifications or ongoing education can make you appear less committed to professional development. Include any relevant courses, certifications, or workshops to showcase your dedication to the field.

Conclusion

As we conclude our discussion on the essential skills and responsibilities of a Financial Planning & Analysis (FP&A) Manager, it's clear that this role is pivotal to the financial health of an organization. Key points highlighted include the importance of analytical skills, proficiency in financial modeling, and the ability to communicate complex financial data clearly to stakeholders. Additionally, we explored the need for strategic thinking and the capacity to adapt to changing market conditions.

In this competitive job market, having a standout resume is crucial for anyone looking to secure a position as an FP&A Manager. We encourage you to take the time to review your resume, ensuring it effectively showcases your experience and skills relevant to this role.

To assist you in this process, consider utilizing helpful resources such as resume templates to create a professional layout, the resume builder for easy customization, and cover letter templates to complement your application. Taking these steps can significantly enhance your chances of landing that ideal FP&A Manager position.