Financial Consultant Core Responsibilities

A Financial Consultant plays a pivotal role in guiding clients towards their financial goals by analyzing financial data, identifying investment opportunities, and developing tailored financial strategies. This position requires strong technical skills in financial analysis, excellent operational knowledge of market trends, and robust problem-solving abilities to navigate complex financial situations effectively. By bridging various departments such as finance, marketing, and operations, a Financial Consultant ensures cohesive strategies that align with organizational objectives. A well-structured resume can effectively highlight these qualifications, showcasing an individual’s ability to contribute significantly to the organization’s success.

Common Responsibilities Listed on Financial Consultant Resume

- Conduct thorough financial analysis and risk assessments.

- Develop and implement customized financial plans for clients.

- Monitor and manage investment portfolios to optimize returns.

- Provide strategic advice on asset allocation and diversification.

- Stay updated on market trends and regulatory changes.

- Collaborate with cross-functional teams to align financial strategies.

- Prepare detailed reports and presentations for clients and stakeholders.

- Assist clients in understanding complex financial concepts.

- Evaluate financial products and services for suitability.

- Build and maintain strong client relationships through effective communication.

- Identify opportunities for cost reduction and efficiency improvements.

- Prepare for and conduct client meetings to assess financial needs.

High-Level Resume Tips for Financial Consultant Professionals

In the competitive landscape of financial consultancy, a well-crafted resume serves as a crucial tool for professionals looking to make a powerful first impression on potential employers. As the initial point of contact between candidates and hiring managers, your resume must effectively showcase your unique skills, relevant experience, and impressive achievements in the field. A thoughtfully designed resume not only reflects your qualifications but also communicates your understanding of the financial industry and your ability to add value to prospective clients or organizations. This guide will provide practical and actionable resume tips specifically tailored for Financial Consultant professionals, helping you to stand out in a crowded job market.

Top Resume Tips for Financial Consultant Professionals

- Tailor your resume for each job application by carefully reading the job description and aligning your skills and experiences with the specific requirements.

- Highlight relevant experience, including internships, previous consulting roles, or projects that demonstrate your financial acumen.

- Use quantifiable achievements to illustrate your impact, such as "Increased client portfolio returns by 15% within one year."

- Include certifications and licenses relevant to the financial sector, such as CFA, CFP, or CPA, to enhance your credibility.

- Showcase your analytical skills by detailing your proficiency in financial modeling, data analysis, or market research.

- Incorporate industry-specific keywords to ensure your resume passes through applicant tracking systems (ATS) and reaches hiring managers.

- Focus on soft skills that are critical for consultants, such as communication, negotiation, and problem-solving abilities.

- Keep your resume concise and focused, ideally limited to one page, while ensuring that it is visually appealing and easy to read.

- Include a professional summary at the top that encapsulates your career objectives and key qualifications in financial consulting.

By implementing these targeted resume tips, Financial Consultant professionals can significantly enhance their chances of landing their desired job. A resume that effectively showcases skills, achievements, and relevant experience not only captures the attention of hiring managers but also demonstrates a candidate's commitment and suitability for the role, ultimately leading to successful career opportunities in the financial consulting field.

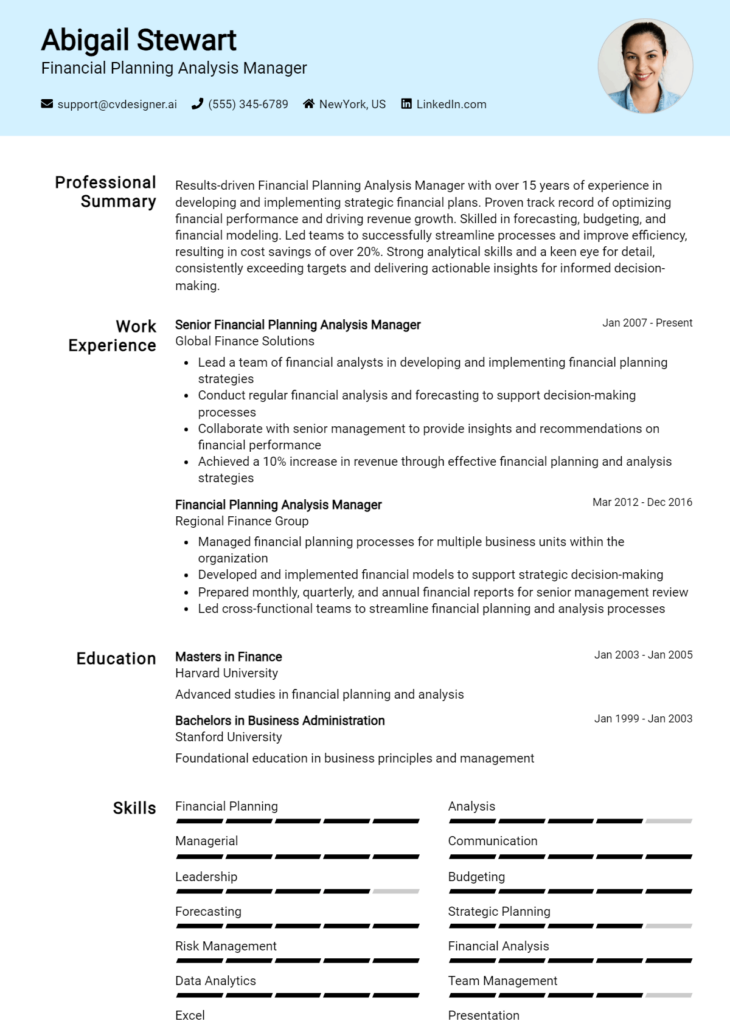

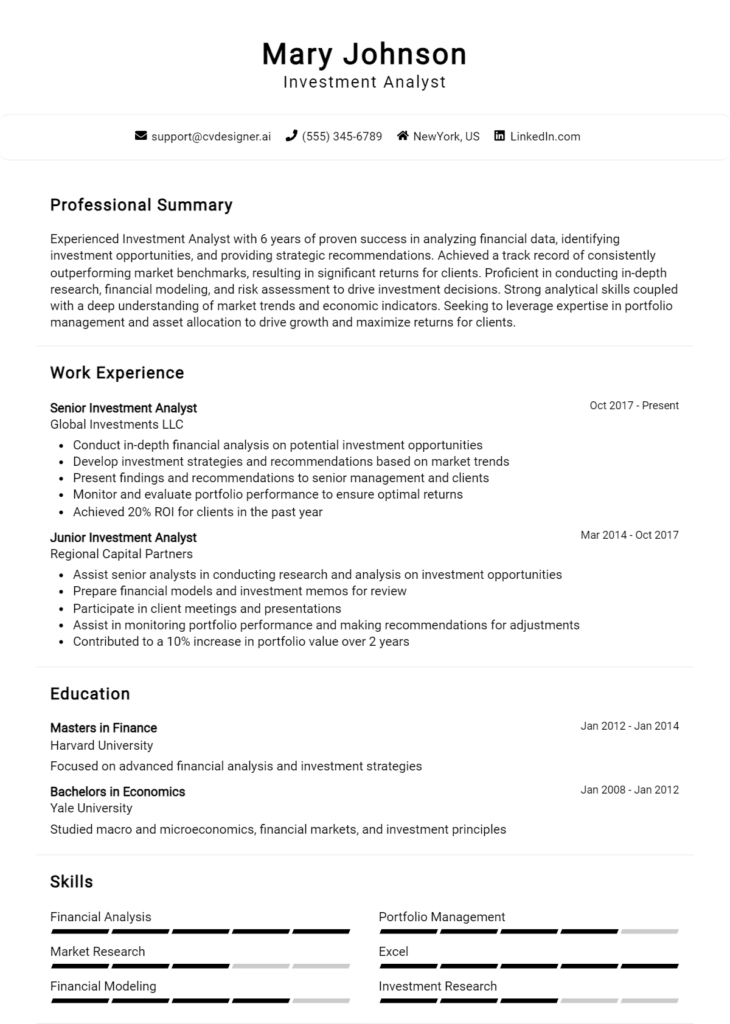

Why Resume Headlines & Titles are Important for Financial Consultant

In the competitive field of financial consulting, a well-crafted resume headline or title can serve as a powerful tool to capture the attention of hiring managers. A strong headline offers a succinct summary of a candidate's key qualifications, allowing them to stand out in a sea of applicants. By encapsulating essential skills, experiences, or accomplishments in a single, impactful phrase, a headline not only piques interest but also sets the tone for the rest of the resume. It should be concise, relevant, and directly aligned with the job being applied for, ensuring that it effectively communicates the candidate’s value proposition at a glance.

Best Practices for Crafting Resume Headlines for Financial Consultant

- Keep it concise—aim for one impactful sentence or phrase.

- Ensure it is specific to the financial consulting role you are applying for.

- Highlight key qualifications or achievements that align with the job description.

- Use industry-relevant keywords to enhance visibility in applicant tracking systems.

- Avoid jargon or overly complex language that may confuse the reader.

- Consider incorporating quantifiable results to demonstrate your impact.

- Make it compelling to evoke interest and curiosity in hiring managers.

- Revise and tailor the headline for each job application to ensure relevance.

Example Resume Headlines for Financial Consultant

Strong Resume Headlines

Seasoned Financial Consultant with 10+ Years of Experience Driving Strategic Growth

Certified Financial Planner Specializing in Investment Strategies and Risk Management

Results-Oriented Financial Consultant with Proven Track Record in Client Retention

Weak Resume Headlines

Financial Consultant

Experienced Professional Looking for Opportunities

The strong resume headlines are effective because they immediately communicate the candidate's unique qualifications and areas of expertise, making it easy for hiring managers to see their potential value. In contrast, the weak headlines fail to impress because they lack specificity and do not highlight any relevant skills or achievements. This vagueness makes it challenging for employers to understand what sets the candidate apart, ultimately diminishing their chances of making a memorable first impression.

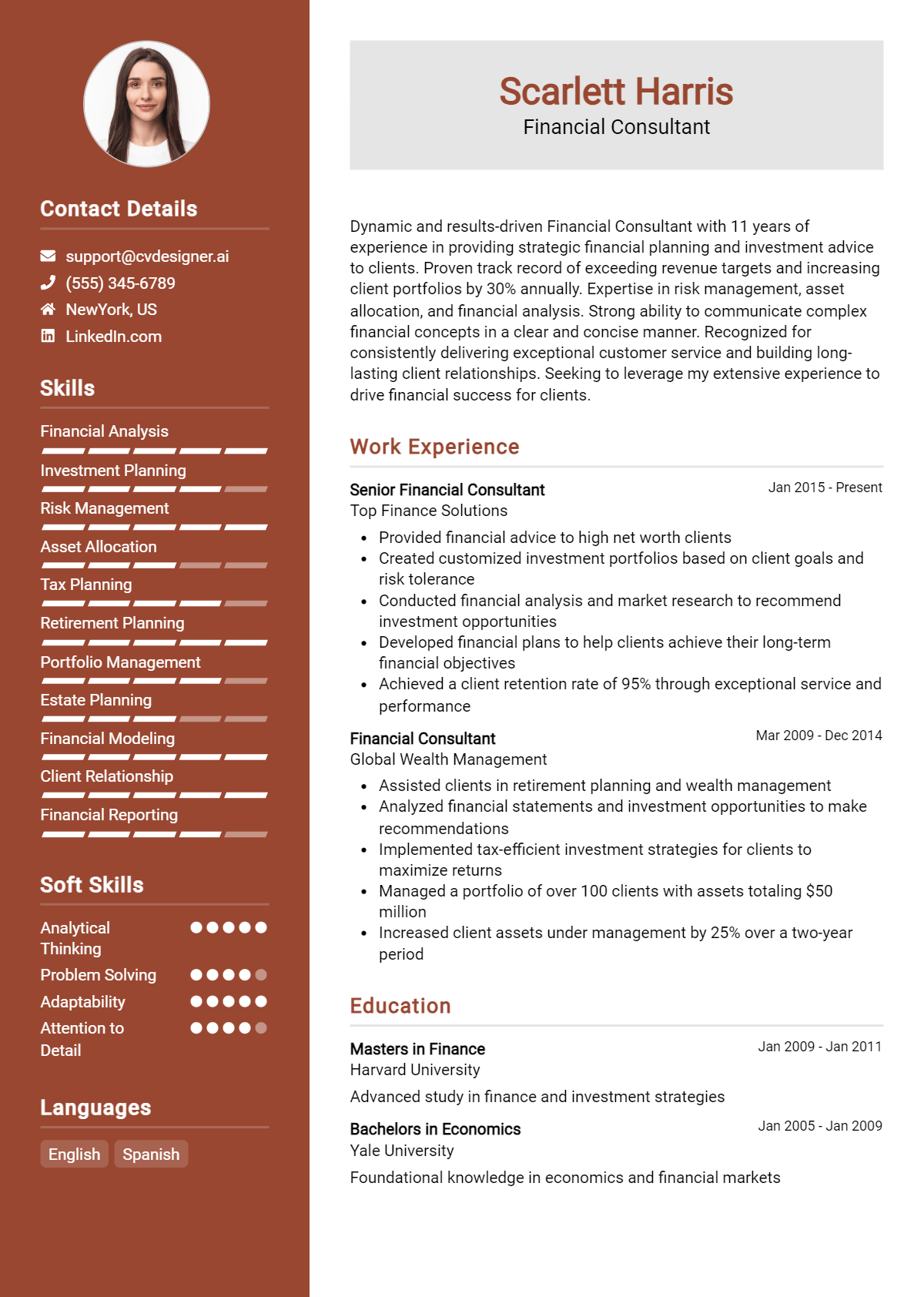

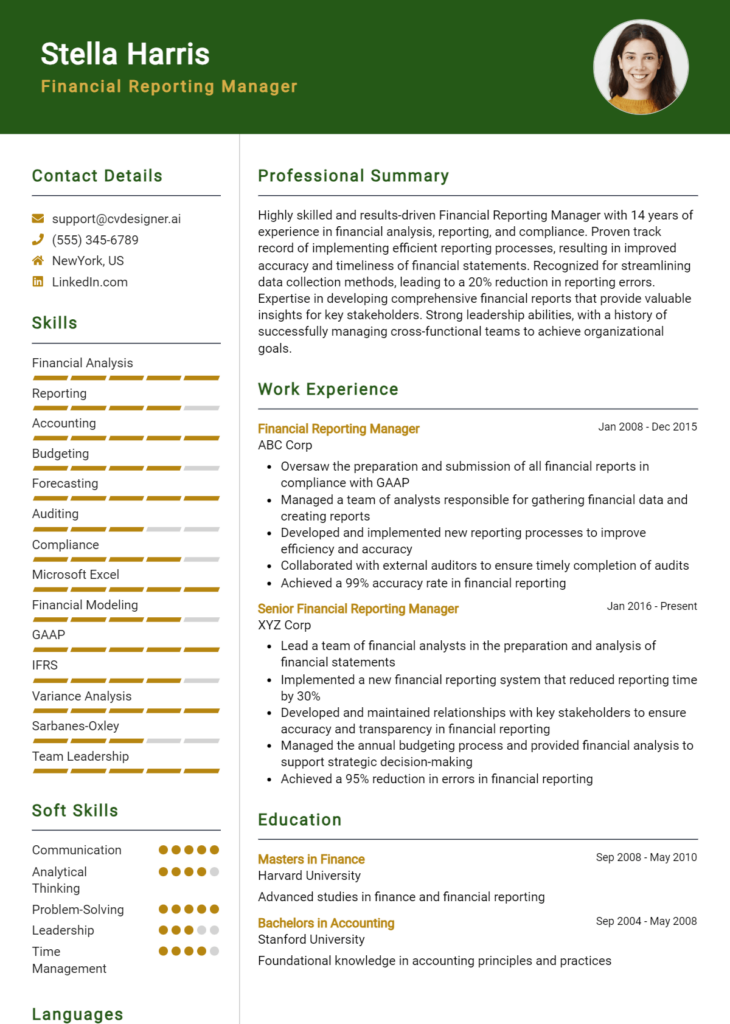

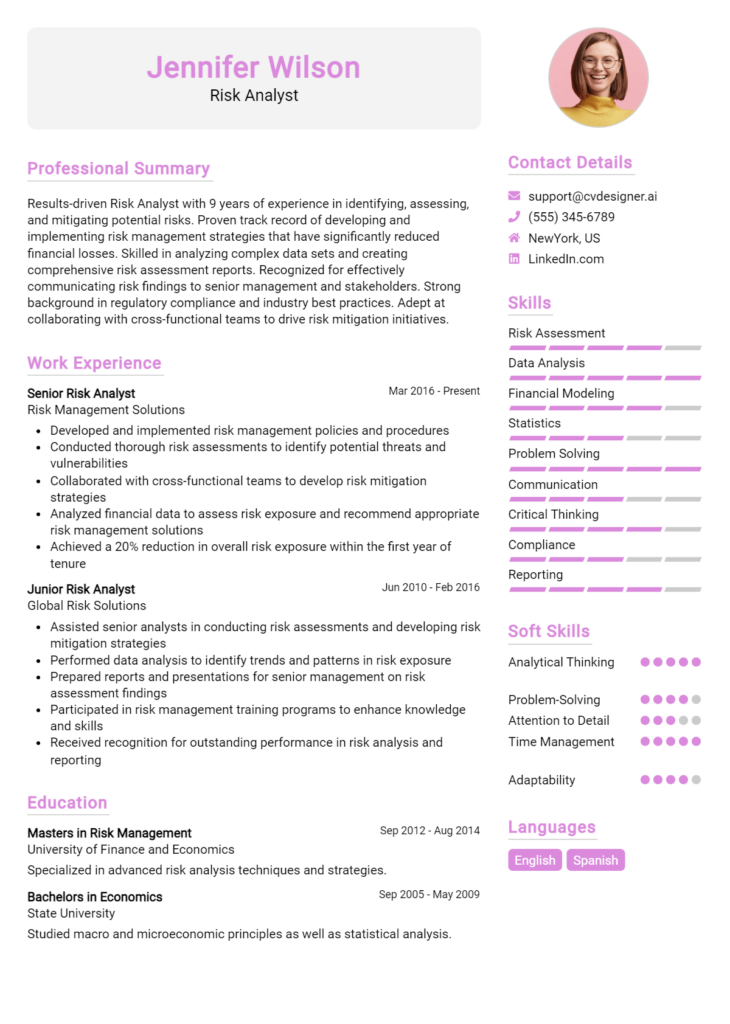

Writing an Exceptional Financial Consultant Resume Summary

A resume summary is a vital component for a Financial Consultant as it serves as the first impression on hiring managers. A strong summary quickly captures attention by succinctly highlighting key skills, relevant experience, and notable accomplishments that align with the demands of the role. It should be concise and impactful, tailored to the specific job the candidate is applying for, thus allowing potential employers to immediately recognize the candidate’s suitability for the position.

Best Practices for Writing a Financial Consultant Resume Summary

- Quantify achievements: Use numbers and metrics to demonstrate your impact and success in previous roles.

- Focus on relevant skills: Highlight key skills that are specifically mentioned in the job description.

- Tailor the summary: Customize your summary for each job application to align with the specific requirements and culture of the company.

- Keep it concise: Aim for 2-4 sentences that deliver maximum information in a clear and direct manner.

- Use action verbs: Start sentences with action verbs to convey confidence and decisiveness.

- Showcase industry knowledge: Mention relevant regulations, tools, or methodologies that demonstrate your expertise in the financial sector.

- Highlight certifications: Include any relevant certifications or qualifications that enhance your credibility.

- Include soft skills: Don’t forget to mention interpersonal skills that are important for client relations and teamwork.

Example Financial Consultant Resume Summaries

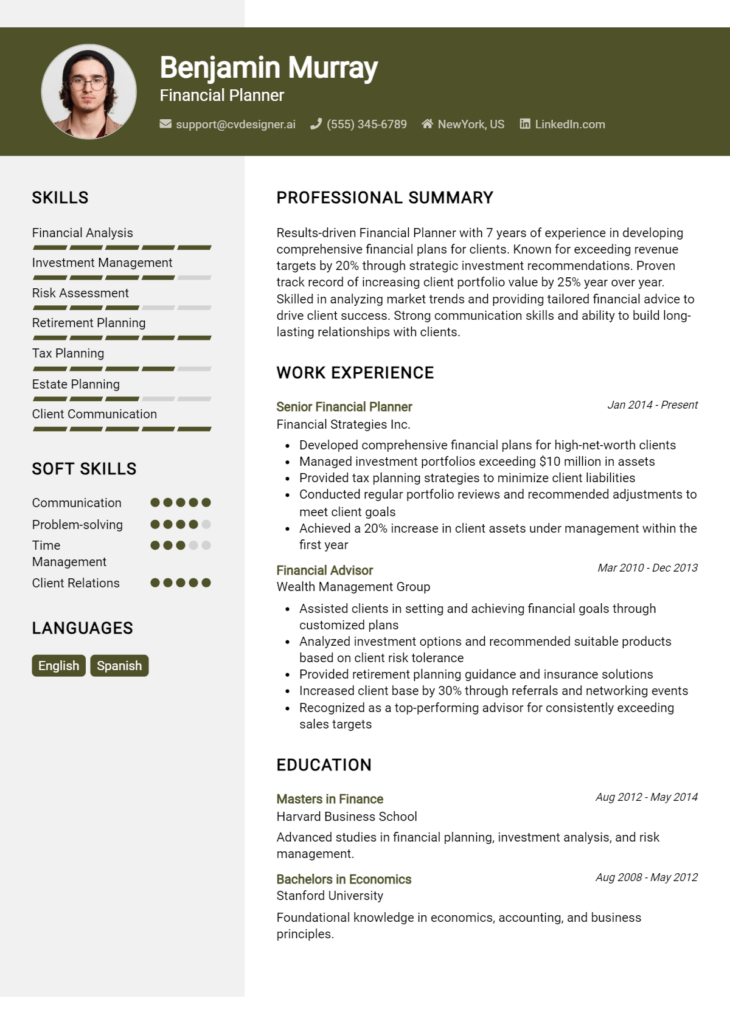

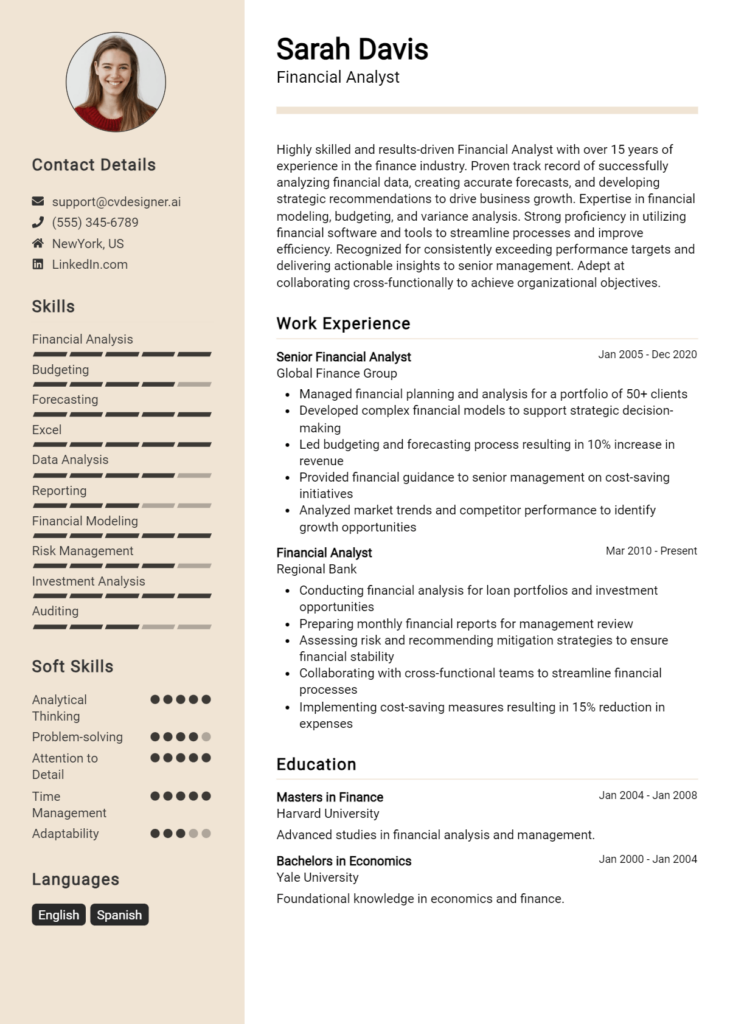

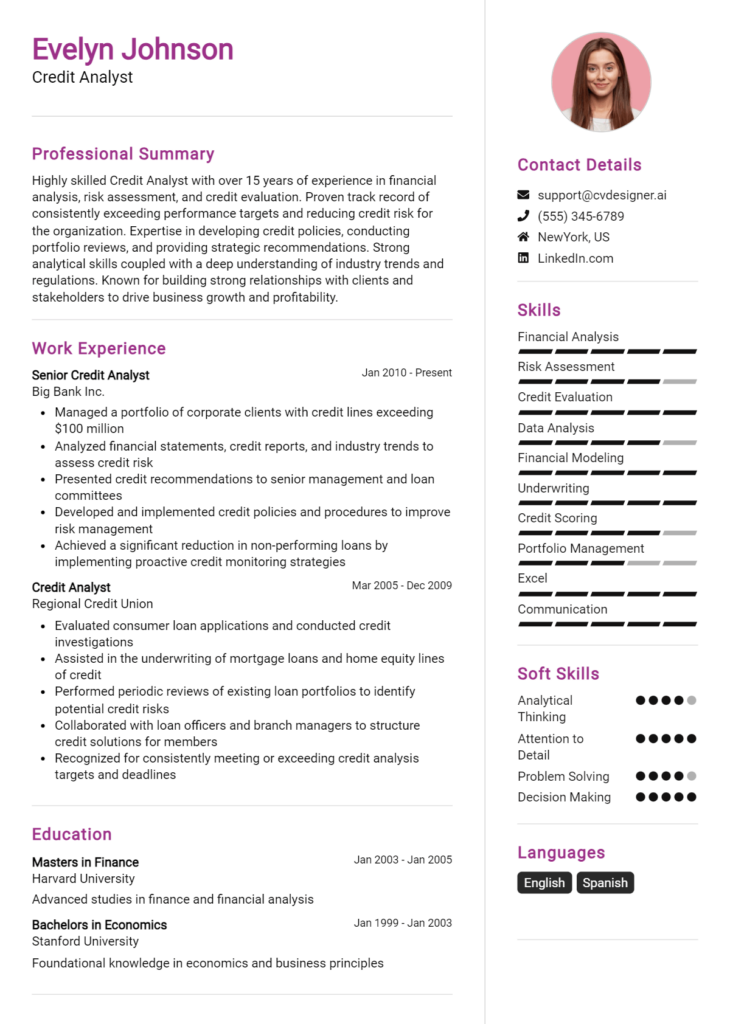

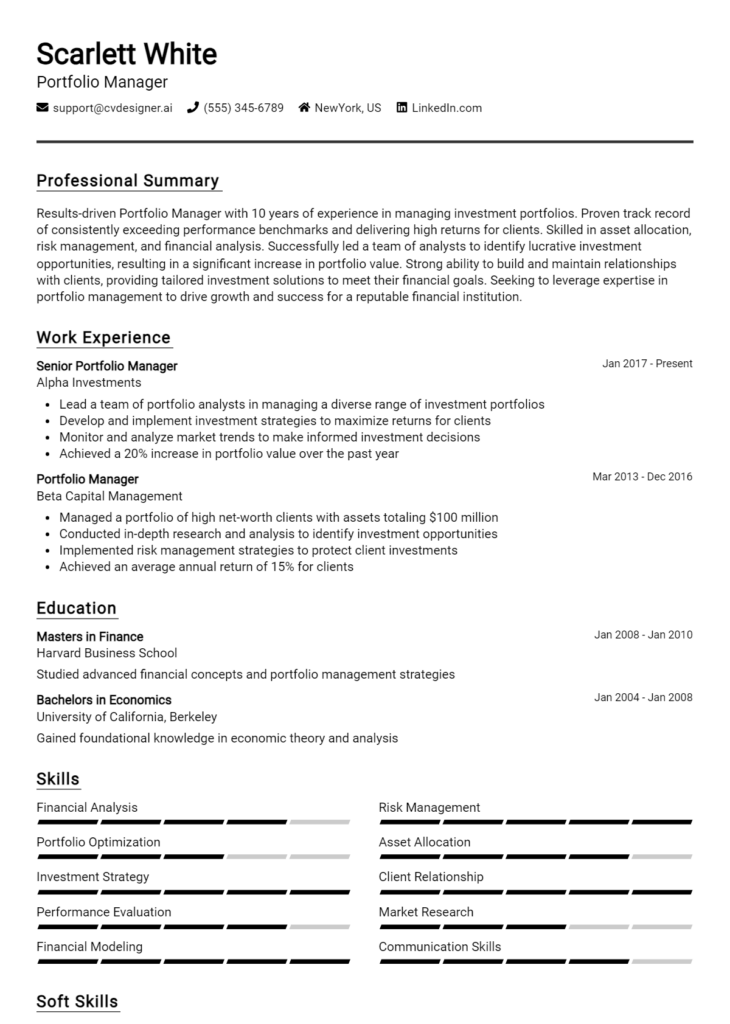

Strong Resume Summaries

Results-driven Financial Consultant with over 8 years of experience in investment strategies, achieving a 30% increase in client portfolio performance through data-driven decision-making and personalized financial planning.

Detail-oriented Financial Consultant with a proven track record of managing assets worth over $100 million, specializing in risk management and compliance, leading to a 15% reduction in client risk exposure over two years.

Dynamic Financial Consultant skilled in developing innovative financial solutions, resulting in a 25% reduction in operational costs for clients. Certified Financial Planner with expertise in wealth management and retirement planning.

Weak Resume Summaries

Experienced financial professional looking for opportunities in consulting. Good with numbers and helping clients.

Financial Consultant with a background in finance and customer service. I want to help clients with their financial needs.

The examples of strong resume summaries are considered effective because they provide specific, quantifiable achievements and relevant skills that directly relate to the financial consulting role. They each present clear outcomes and demonstrate how the candidate can add value to potential employers. In contrast, the weak resume summaries lack detail and specificity, making them generic and unmemorable. They fail to convey the candidate's unique qualifications or measurable successes, which can hinder their chances of standing out in a competitive job market.

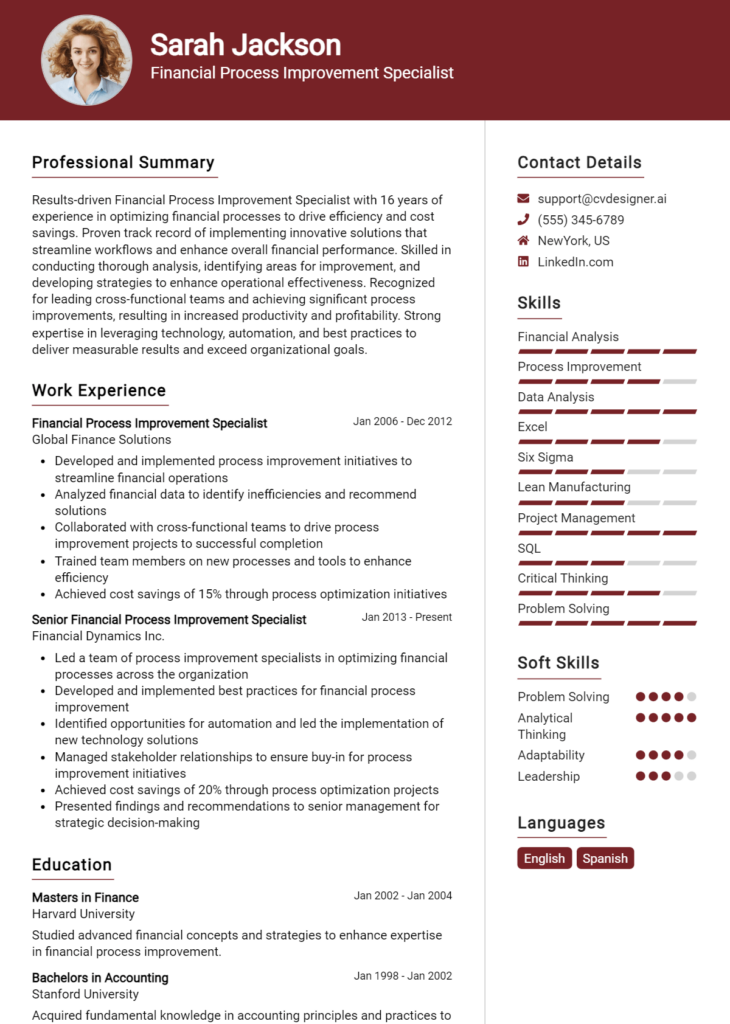

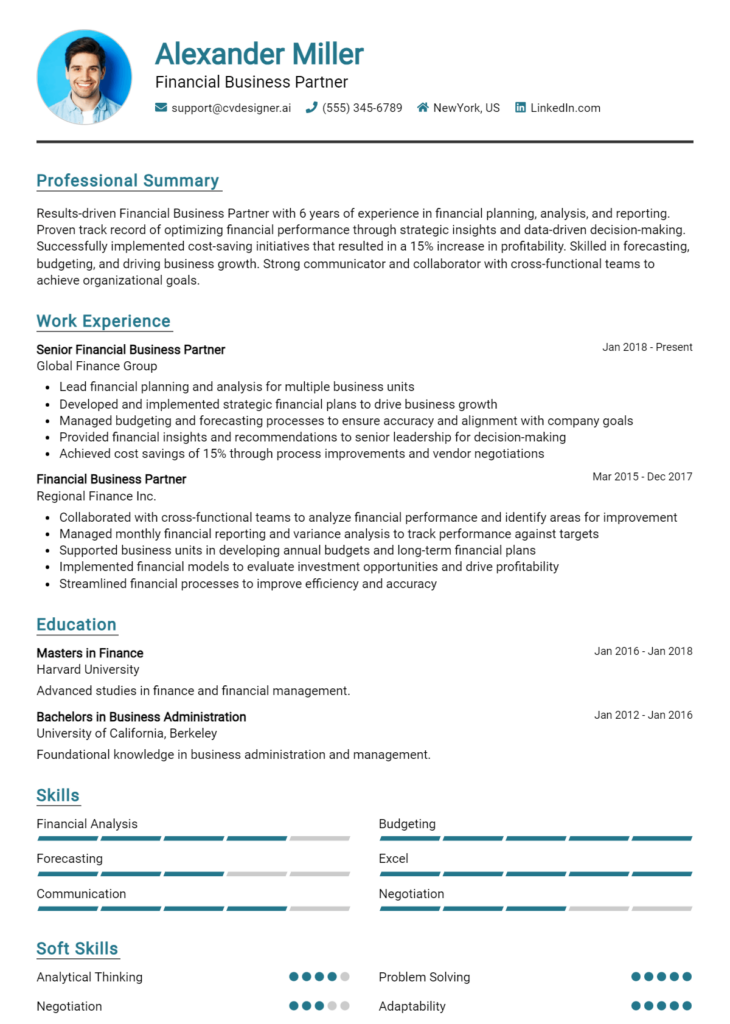

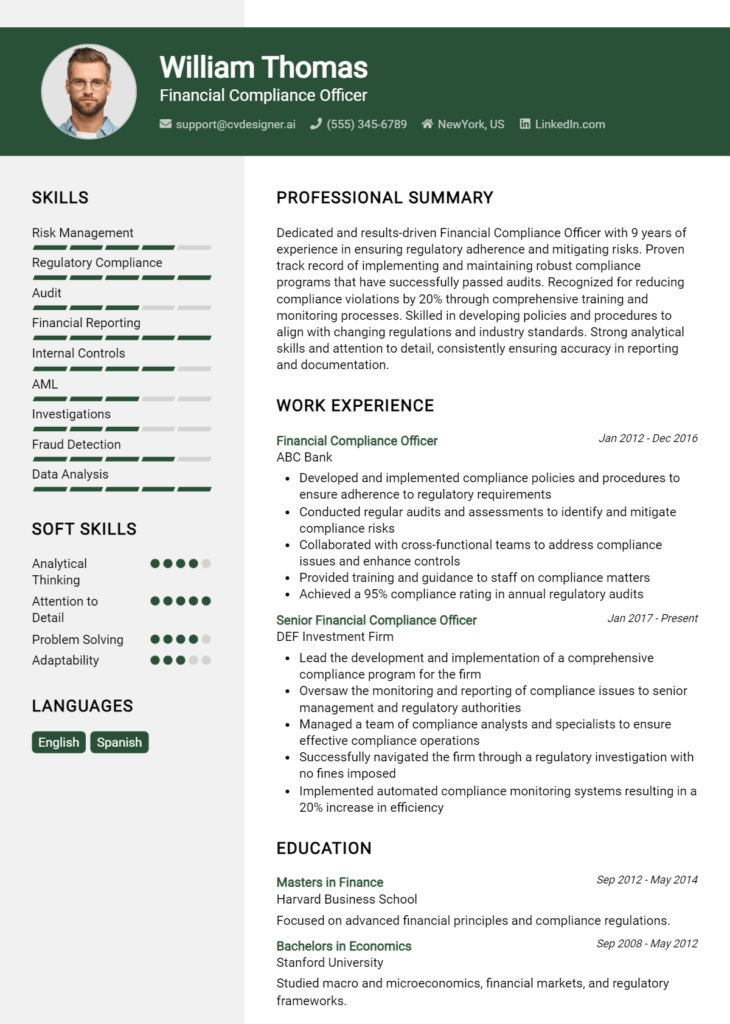

Work Experience Section for Financial Consultant Resume

The work experience section of a Financial Consultant resume is vital as it serves as a testament to a candidate's practical knowledge and expertise within the financial domain. This section not only highlights technical skills but also demonstrates the candidate's ability to manage teams effectively and deliver high-quality financial products and solutions. By quantifying achievements and aligning experiences with industry standards, candidates can present themselves as valuable assets to potential employers, showcasing their capacity to drive results and contribute to organizational success.

Best Practices for Financial Consultant Work Experience

- Focus on quantifiable achievements that demonstrate your impact in previous roles.

- Use industry-specific terminology to highlight your technical expertise.

- Emphasize leadership roles and team management experiences.

- Align your experiences with the specific requirements of the job you are applying for.

- Include relevant certifications or trainings that enhance your qualifications.

- Showcase collaboration with cross-functional teams to achieve financial goals.

- Be concise but detailed, ensuring each bullet point adds value to your profile.

- Utilize action verbs to convey a sense of initiative and accomplishment.

Example Work Experiences for Financial Consultant

Strong Experiences

- Led a team of 5 financial analysts to develop a comprehensive investment strategy that increased client portfolio returns by 15% over a year.

- Implemented a new financial reporting system that improved data accuracy by 30% and reduced processing time by 20 hours per month.

- Collaborated with a cross-functional team to launch a new financial product, resulting in $2 million in sales within the first quarter.

- Developed and executed a financial risk assessment program that identified potential cost savings of up to $500,000 annually.

Weak Experiences

- Worked on various financial projects.

- Assisted in preparing reports for clients.

- Participated in team meetings.

- Helped with general financial analysis tasks.

The examples categorized as strong experiences are considered effective because they clearly articulate specific, measurable outcomes, demonstrating the candidate's direct impact and leadership in financial consulting. They utilize quantifiable results and articulate technical competencies, showcasing the candidate's value to potential employers. In contrast, the weak experiences lack detail and specificity, failing to convey any substantial achievements or skills that would stand out in a competitive job market.

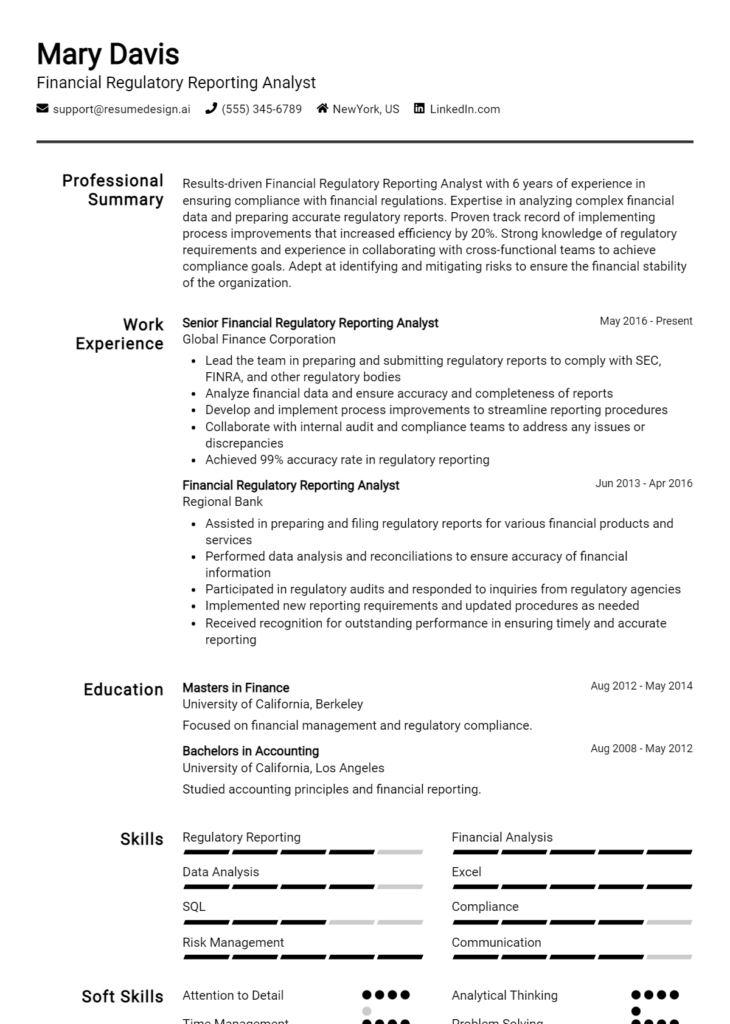

Certifications and Education for a Financial Consultant Resume

When crafting a resume for a Financial Consultant position, it's crucial to highlight both your educational background and relevant certifications to demonstrate your expertise and credibility in the financial industry.

Certifications to Prioritize:

Certified Financial Planner (CFP): This certification is highly respected in the financial planning community and showcases your ability to provide comprehensive financial advice, including investment, retirement, and estate planning.

Chartered Financial Analyst (CFA): The CFA designation is ideal for those focused on investment analysis and portfolio management. It is recognized globally and signifies a high level of investment knowledge and skills.

Certified Public Accountant (CPA): While primarily an accounting designation, a CPA can be advantageous for financial consultants, especially those who provide tax planning services or work closely with small businesses on financial matters.

Chartered Financial Consultant (ChFC): This certification focuses on comprehensive financial planning and is an excellent alternative to the CFP for those who might not meet the eligibility requirements for the CFP exam.

Examples of Relevant Educational Backgrounds:

Bachelor's Degree in Finance: A foundational degree that provides essential knowledge in financial principles, investment strategies, and market analysis.

Bachelor’s Degree in Accounting: This degree is valuable for financial consultants who need a strong understanding of financial statements, tax laws, and accounting practices.

Master’s in Business Administration (MBA) with a concentration in Finance: An MBA enhances your business management skills and provides advanced financial insights, making you more competitive in the consulting arena.

Master’s in Finance or Financial Engineering: These specialized degrees focus on advanced financial theories, quantitative analysis, and risk management, equipping you with the skills needed for complex financial consulting tasks.

When listing your certifications and education on your resume, ensure to include the full name of the certification or degree, the institution or organization that awarded it, and the year of completion. You may also want to include any relevant courses or special projects that relate directly to financial consulting. This structured approach will help potential employers quickly identify your qualifications and expertise in the financial consulting field.

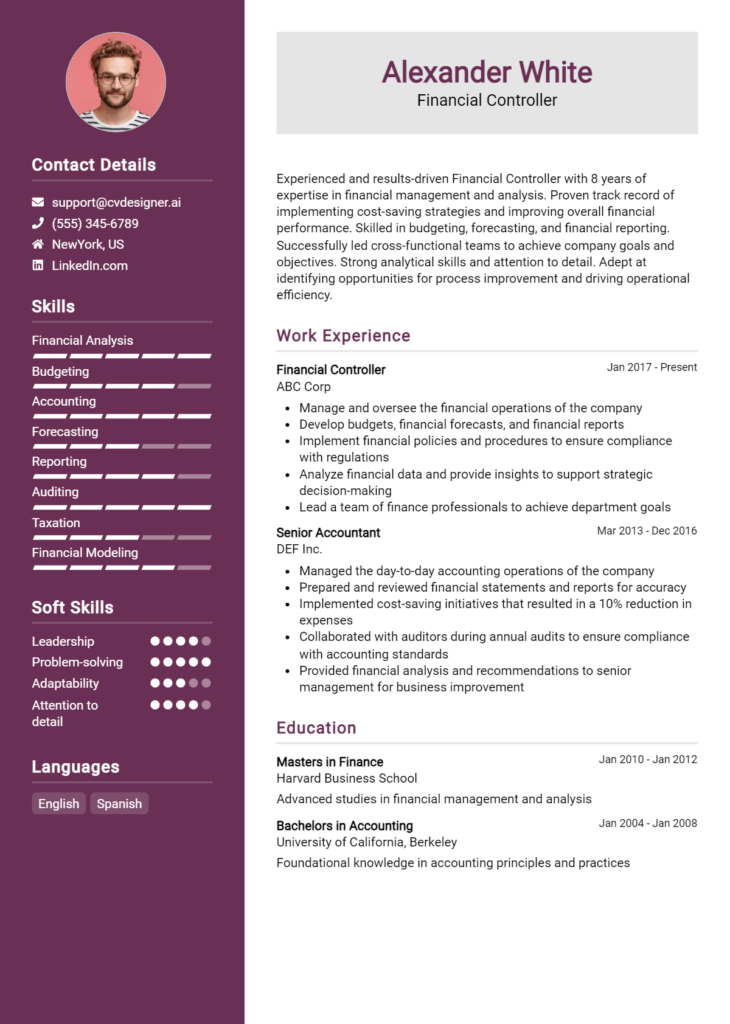

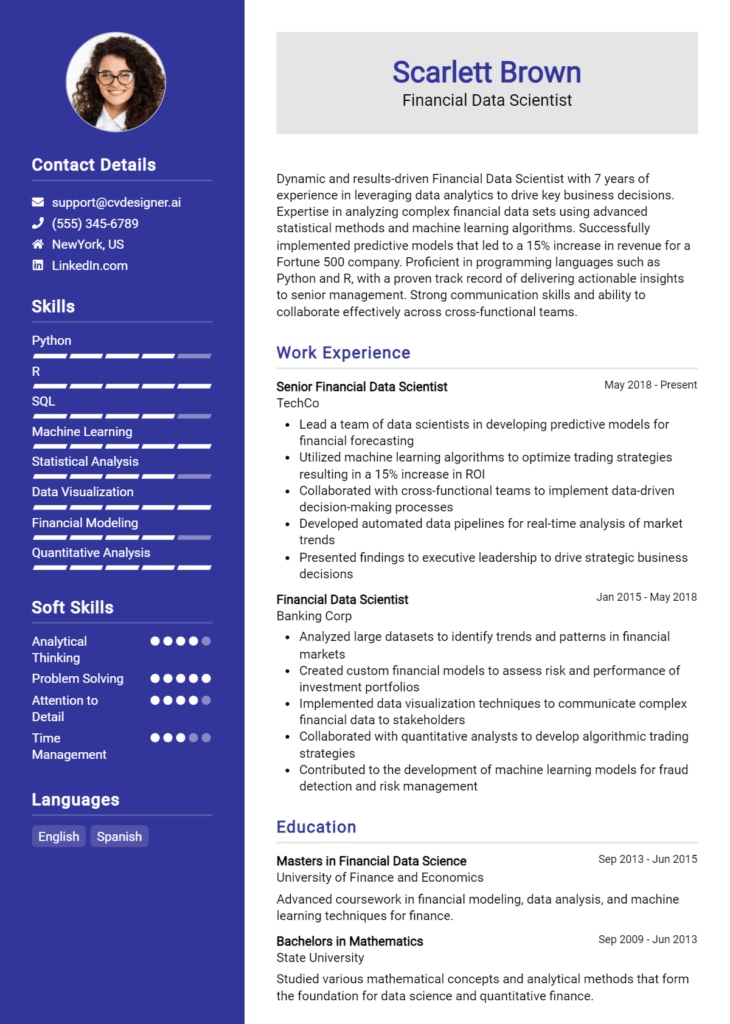

Top Skills & Keywords for Financial Consultant Resume

As a Financial Consultant, showcasing the right skills on your resume is crucial for standing out in a competitive job market. Employers seek candidates who not only possess a robust understanding of financial principles but also demonstrate the ability to communicate effectively, adapt to changing environments, and build lasting client relationships. Highlighting both hard and soft skills can significantly enhance your appeal to potential employers. A well-rounded skill set not only reflects your technical capabilities but also underscores your interpersonal qualities, making you a valuable asset to any financial team.

Top Hard & Soft Skills for Financial Consultant

Soft Skills

- Strong communication skills

- Excellent interpersonal abilities

- Problem-solving aptitude

- Analytical thinking

- Attention to detail

- Time management

- Adaptability and flexibility

- Client relationship management

- Persuasiveness and negotiation skills

- Team collaboration

Hard Skills

- Financial analysis and forecasting

- Proficiency in financial software (e.g., QuickBooks, Excel)

- Knowledge of tax regulations and compliance

- Investment strategies and portfolio management

- Risk assessment and management

- Budgeting and financial planning

- Data analysis and interpretation

- Understanding of financial reporting standards

- Valuation techniques

- Financial modeling and valuation

For a comprehensive guide to enhancing your resume, consider exploring additional skills and detailing your work experience effectively.

Stand Out with a Winning Financial Consultant Cover Letter

As an experienced financial consultant with a proven track record in delivering tailored financial solutions, I am excited to apply for the Financial Consultant position at [Company Name]. My background in finance, combined with my strong analytical skills and commitment to fostering client relationships, makes me a perfect fit for this role. I have successfully helped numerous clients achieve their financial goals by developing personalized strategies that align with their unique needs and aspirations.

In my previous role at [Previous Company Name], I managed a diverse portfolio of clients, conducting in-depth financial assessments and creating customized investment strategies. I utilized advanced financial modeling techniques to identify growth opportunities, ultimately increasing client satisfaction and retention rates by over 30%. My ability to communicate complex financial concepts in an easily digestible manner has been instrumental in building trust and rapport with clients, ensuring they feel informed and empowered in their financial decisions.

I am particularly drawn to [Company Name] because of its commitment to innovation and excellence in financial consulting. I admire your approach to client engagement and believe that my proactive and detail-oriented mindset would complement your team's efforts. I am eager to contribute to your mission by leveraging my expertise in risk management, investment analysis, and financial planning to help clients navigate their financial journeys confidently.

Thank you for considering my application. I look forward to the opportunity to discuss how my skills and experiences align with the needs of your team. I am enthusiastic about the possibility of joining [Company Name] and contributing to the financial success of your clients.

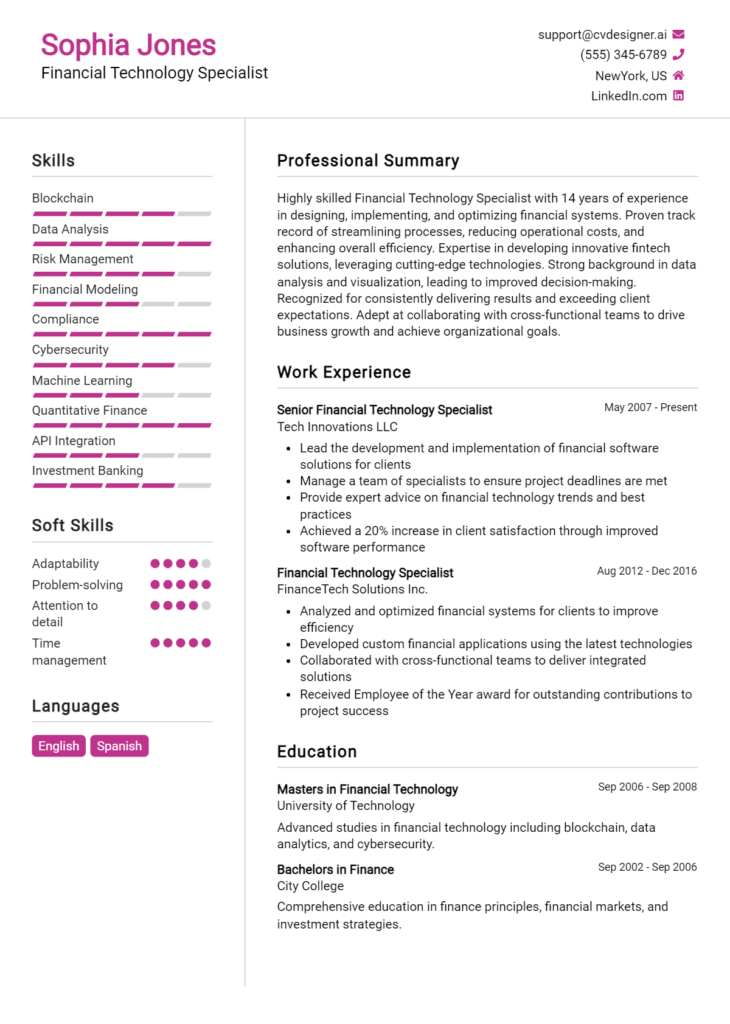

Common Mistakes to Avoid in a Financial Consultant Resume

When applying for a position as a Financial Consultant, your resume serves as your first impression, making it crucial to present your qualifications effectively. However, many candidates make common mistakes that can undermine their chances of landing an interview. Avoiding these pitfalls will help ensure your resume stands out and accurately reflects your skills and experiences in the financial sector.

Overloading with Jargon: Using excessive financial terminology can alienate readers who may not be familiar with the terms. Aim for clarity and simplicity to convey your expertise effectively.

Ignoring Tailoring: A generic resume may not resonate with hiring managers. Failing to customize your resume for each job application means missing out on showcasing relevant skills and experiences that align with the specific role.

Lack of Quantifiable Achievements: Simply listing duties and responsibilities doesn't demonstrate your impact. Including quantifiable achievements, such as percentage increases in revenue or cost savings, can significantly enhance your resume.

Unprofessional Formatting: A cluttered or overly complex layout can make your resume difficult to read. Stick to a clean, professional format that highlights key information and allows for easy navigation.

Neglecting Soft Skills: While technical skills are essential, financial consulting also requires strong interpersonal abilities. Failing to mention skills like communication, problem-solving, and client relationship management may leave a gap in your qualifications.

Using Passive Language: Passive language can make your accomplishments seem less impactful. Use strong action verbs to convey your contributions confidently and assertively.

Omitting Relevant Certifications: Certifications such as CFA or CFP are highly regarded in the financial industry. Not mentioning these credentials can lead to missed opportunities, as they demonstrate your commitment to the profession.

Not Proofreading: Spelling and grammatical errors can create a negative impression of your attention to detail. Always proofread your resume carefully to ensure it is polished and professional.

Conclusion

As a Financial Consultant, your role is pivotal in guiding clients toward achieving their financial goals through strategic planning and analysis. Throughout this article, we’ve explored essential skills such as financial analysis, risk assessment, and effective communication, which are crucial for success in this field.

We also highlighted the importance of tailoring your resume to showcase your unique experiences and qualifications. A well-crafted resume not only reflects your professional journey but also sets you apart in a competitive job market.

To ensure that your resume stands out, we encourage you to take the time to review and refine it. Utilize resources like resume templates and cover letter templates to create a polished and professional presentation of your skills. Additionally, consider using a resume builder to streamline the process and ensure that your resume is formatted correctly.

Now is the perfect time to revisit your Financial Consultant resume. Take action today and make the necessary updates to position yourself for new opportunities!