Financial Analyst Core Responsibilities

A Financial Analyst plays a crucial role in bridging various departments by analyzing financial data and providing insights that inform strategic decisions. Key responsibilities include preparing financial reports, forecasting trends, and conducting variance analysis, which require strong technical skills in financial modeling and data analysis. Operational expertise and problem-solving abilities are essential for interpreting complex financial information and recommending actionable strategies. These skills contribute significantly to achieving organizational goals, and a well-structured resume can effectively highlight these qualifications, demonstrating a candidate's value to potential employers.

Common Responsibilities Listed on Financial Analyst Resume

- Conduct financial forecasting and budgeting activities.

- Analyze financial performance and identify trends.

- Prepare and present detailed financial reports to management.

- Perform variance analysis to assess performance against budgets.

- Evaluate investment opportunities and financial risks.

- Collaborate with cross-functional teams to support strategic initiatives.

- Develop and maintain financial models to support decision-making.

- Ensure compliance with financial regulations and standards.

- Assist in the preparation of annual financial plans.

- Monitor and analyze operational costs and efficiencies.

- Provide insights for cost-saving and revenue-generating strategies.

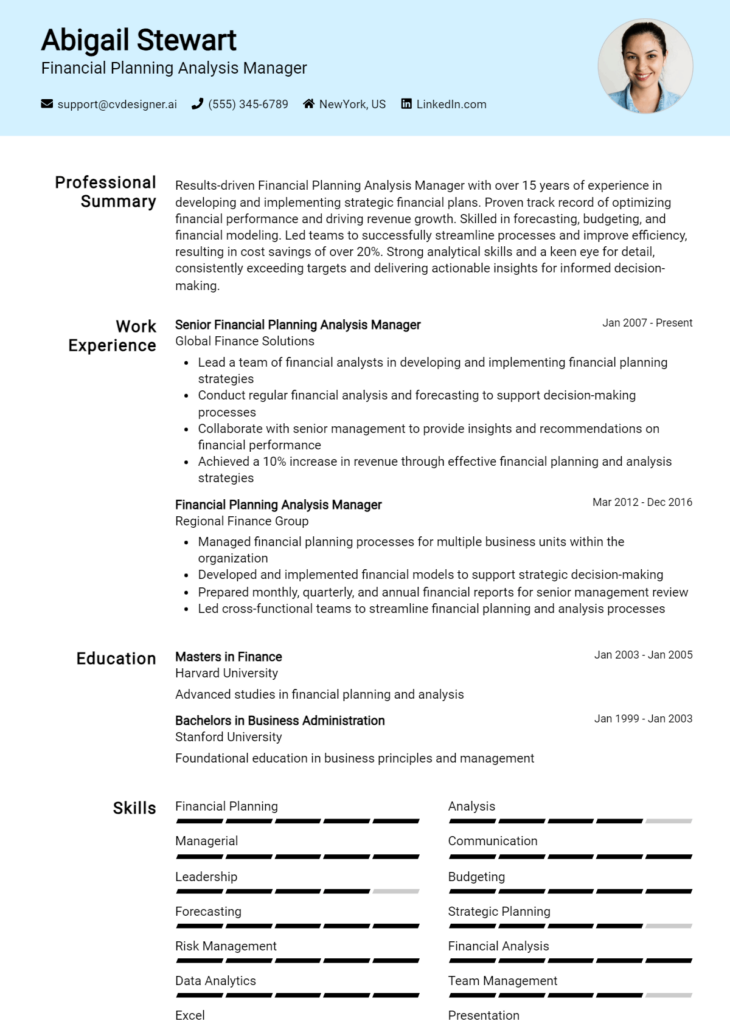

High-Level Resume Tips for Financial Analyst Professionals

In today's competitive job market, a well-crafted resume is essential for Financial Analyst professionals seeking to make their mark. Your resume serves as the first impression you make on potential employers, and it is crucial that it effectively reflects not only your skills but also your achievements in the field of finance. A strong resume can set you apart from other candidates, showcasing your analytical abilities and financial acumen. This guide will provide practical and actionable resume tips specifically tailored for Financial Analyst professionals, ensuring that your application stands out to hiring managers and recruiters.

Top Resume Tips for Financial Analyst Professionals

- Tailor your resume to each job description by incorporating keywords and phrases relevant to the specific Financial Analyst role you are applying for.

- Highlight relevant experience, focusing on positions where you utilized financial modeling, forecasting, and data analysis skills.

- Quantify your achievements with specific metrics, such as cost savings, revenue growth, or efficiency improvements, to demonstrate your impact.

- Showcase industry-specific skills, such as proficiency in financial software (e.g., Excel, SAP, or Tableau) and knowledge of regulatory requirements.

- Include a summary statement that captures your professional identity, emphasizing your analytical strengths and career objectives.

- Utilize bullet points for clarity and conciseness, making it easy for hiring managers to scan your qualifications quickly.

- Highlight any relevant certifications, such as CFA or CPA, to enhance your credibility and showcase your commitment to professional development.

- Keep your resume to one page if you have less than 10 years of experience; ensure it’s easy to read with a clean layout and standard font.

- Incorporate actionable language and strong verbs to convey your contributions effectively (e.g., "analyzed," "developed," "improved").

- Proofread meticulously to eliminate any spelling or grammatical errors, as attention to detail is crucial in the financial industry.

By implementing these tips, you can significantly enhance your resume, increasing your chances of landing a job in the Financial Analyst field. A polished and targeted resume not only showcases your qualifications but also demonstrates your professionalism and readiness to contribute to a potential employer’s success.

Why Resume Headlines & Titles are Important for Financial Analyst

In the competitive field of finance, a Financial Analyst plays a crucial role in interpreting data, forecasting financial trends, and guiding strategic decision-making for organizations. With hiring managers often sifting through dozens of resumes, having a compelling resume headline or title is essential to capture their attention immediately. A strong headline acts as a powerful opener, summarizing a candidate's key qualifications in one impactful phrase. It should be concise, relevant, and directly aligned with the job being applied for, setting the tone for the rest of the resume and increasing the chances of progressing to the next stage of the hiring process.

Best Practices for Crafting Resume Headlines for Financial Analyst

- Keep it concise; aim for one impactful phrase.

- Make it role-specific by including relevant keywords.

- Highlight key skills or accomplishments that set you apart.

- Use action-oriented language to convey confidence.

- Avoid jargon; make it understandable for all readers.

- Tailor your headline to match the specific job description.

- Consider including quantifiable achievements when possible.

- Use a professional tone that reflects the financial industry.

Example Resume Headlines for Financial Analyst

Strong Resume Headlines

"Detail-Oriented Financial Analyst with 5+ Years in Data-Driven Decision Making"

“Results-Driven Financial Analyst Specializing in Budget Forecasting and Risk Assessment”

“Financial Analyst with Proven Track Record in Enhancing Profitability Through Strategic Analysis”

Weak Resume Headlines

“Financial Analyst Seeking Opportunities”

“Experienced Financial Professional”

Strong headlines are effective because they immediately convey specific qualifications and strengths, drawing the reader's attention and differentiating the candidate from the competition. They utilize relevant keywords and highlight achievements that resonate with hiring managers. In contrast, weak headlines tend to be vague and generic, failing to provide any meaningful information about the candidate's skills or experiences. This lack of specificity can lead to immediate disinterest, as hiring managers are looking for clear indicators of a candidate's potential fit for the role.

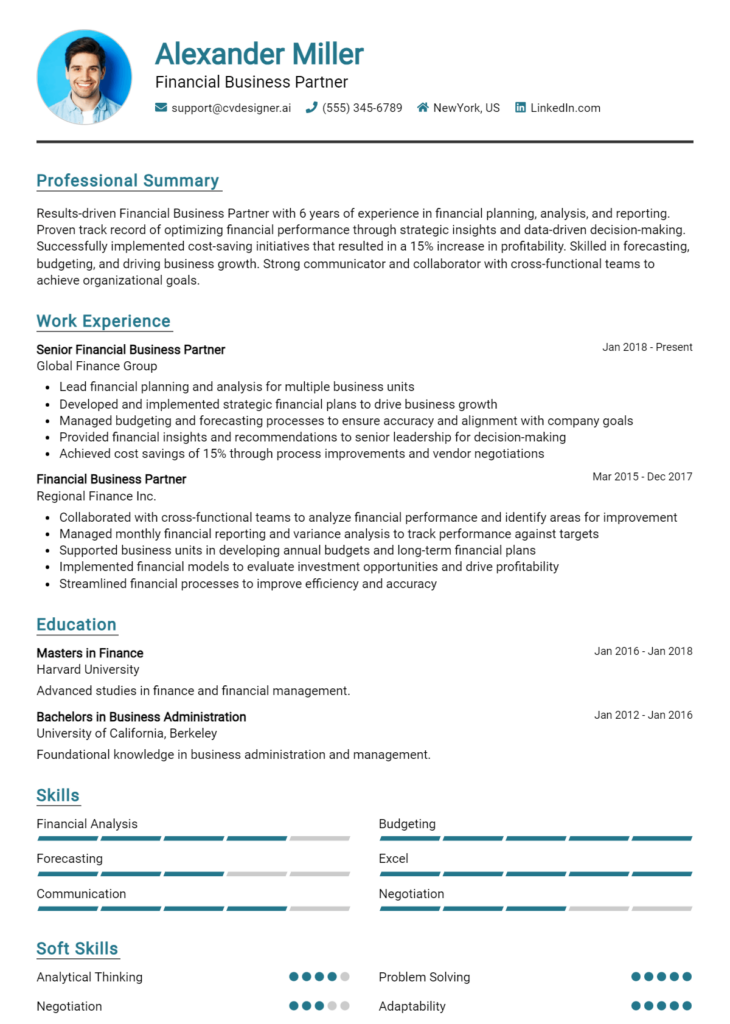

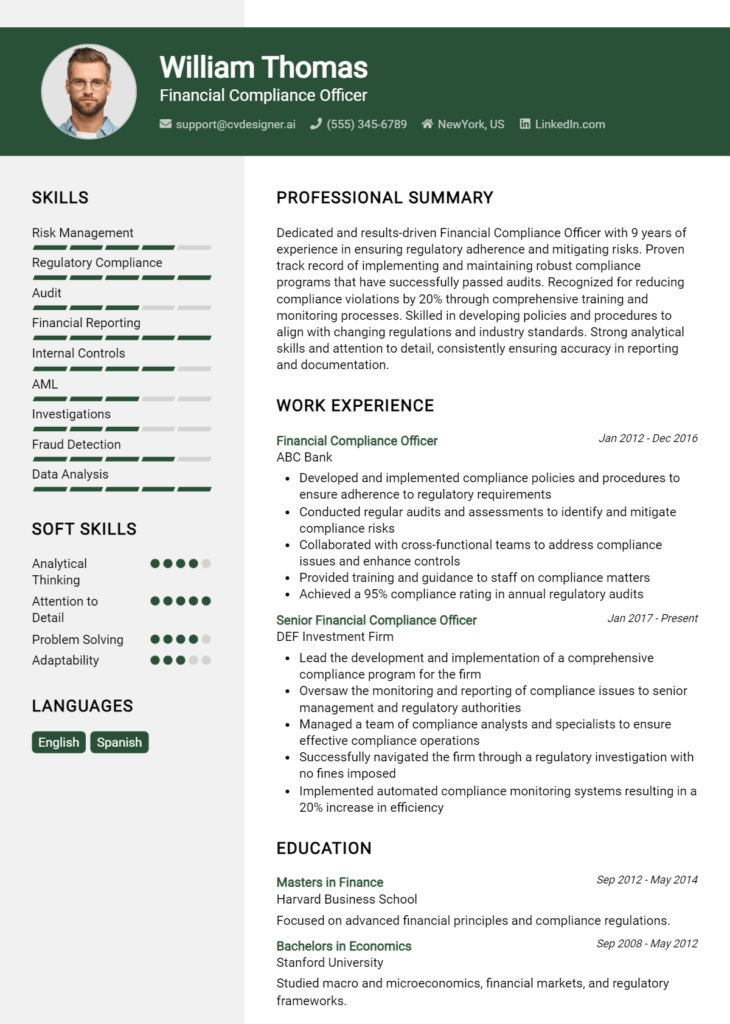

Writing an Exceptional Financial Analyst Resume Summary

Crafting an exceptional resume summary is vital for a Financial Analyst, as it serves as the first impression for hiring managers. A well-written summary quickly captures attention by succinctly showcasing key skills, relevant experience, and noteworthy accomplishments that align with the job role. In a competitive job market, a strong summary can differentiate a candidate from others, making it essential to be concise, impactful, and tailored specifically to the position being applied for.

Best Practices for Writing a Financial Analyst Resume Summary

- Quantify Achievements: Use specific numbers and percentages to highlight your successes and impact.

- Focus on Relevant Skills: Identify and emphasize skills that are directly related to the Financial Analyst position.

- Tailor for the Job Description: Customize your summary to reflect the requirements and responsibilities listed in the job posting.

- Keep it Concise: Aim for 2-4 sentences that deliver maximum impact without unnecessary details.

- Use Action Verbs: Start with strong action verbs to convey a sense of initiative and accomplishment.

- Highlight Technical Proficiencies: Include specific financial software or analytical tools you are proficient in.

- Showcase Industry Knowledge: Mention any relevant experience or knowledge of the industry to demonstrate your expertise.

- Be Professional Yet Engaging: Maintain a professional tone while still being engaging and approachable.

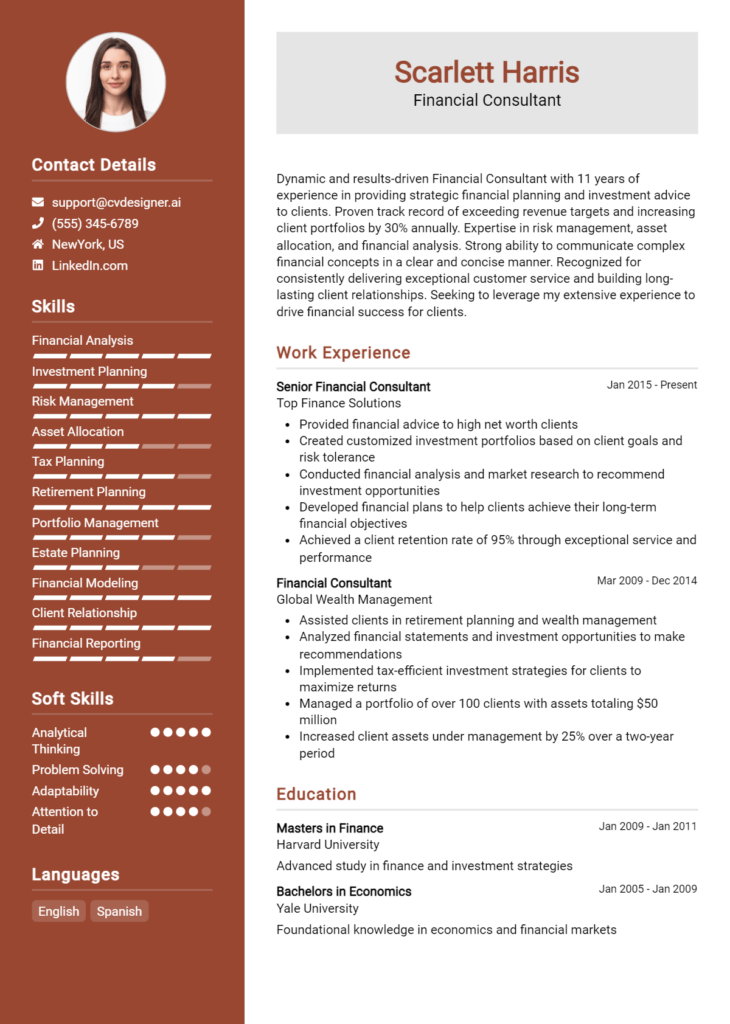

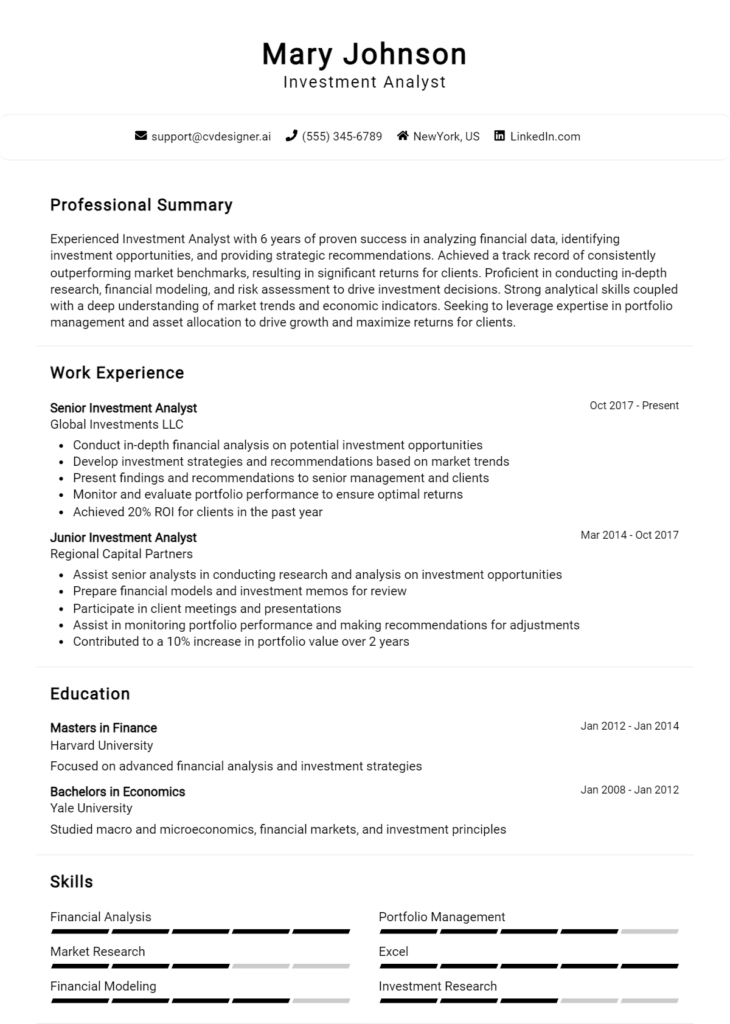

Example Financial Analyst Resume Summaries

Strong Resume Summaries

Detail-oriented Financial Analyst with over 5 years of experience in financial modeling and forecasting. Successfully improved forecasting accuracy by 30% through the implementation of a new budgeting software. Strong proficiency in Excel, SQL, and Tableau.

Results-driven Financial Analyst specializing in data analysis and strategic planning, with a track record of increasing revenue by 15% year-over-year. Adept at using advanced statistical techniques and financial tools to support decision-making processes.

Dynamic Financial Analyst with a proven ability to streamline reporting processes, reducing report generation time by 40%. Experienced in collaborating with cross-functional teams to drive financial performance and deliver actionable insights.

Analytical Financial Analyst with expertise in risk assessment and mitigation, contributing to a 25% decrease in operational costs. Proficient in developing financial models that support corporate strategy and operational efficiency.

Weak Resume Summaries

Financial Analyst with experience in finance and analysis. Skilled in various areas and looking for a challenging position.

Enthusiastic financial professional with a desire to succeed and improve processes. Interested in opportunities in financial analysis.

The examples provided illustrate the distinction between strong and weak resume summaries. The strong summaries are specific, quantifiable, and tailored to the Financial Analyst role, demonstrating clear accomplishments and relevant skills. In contrast, the weak summaries are vague, lack measurable outcomes, and do not effectively communicate the candidate's qualifications or how they align with the job requirements, making them less compelling to hiring managers.

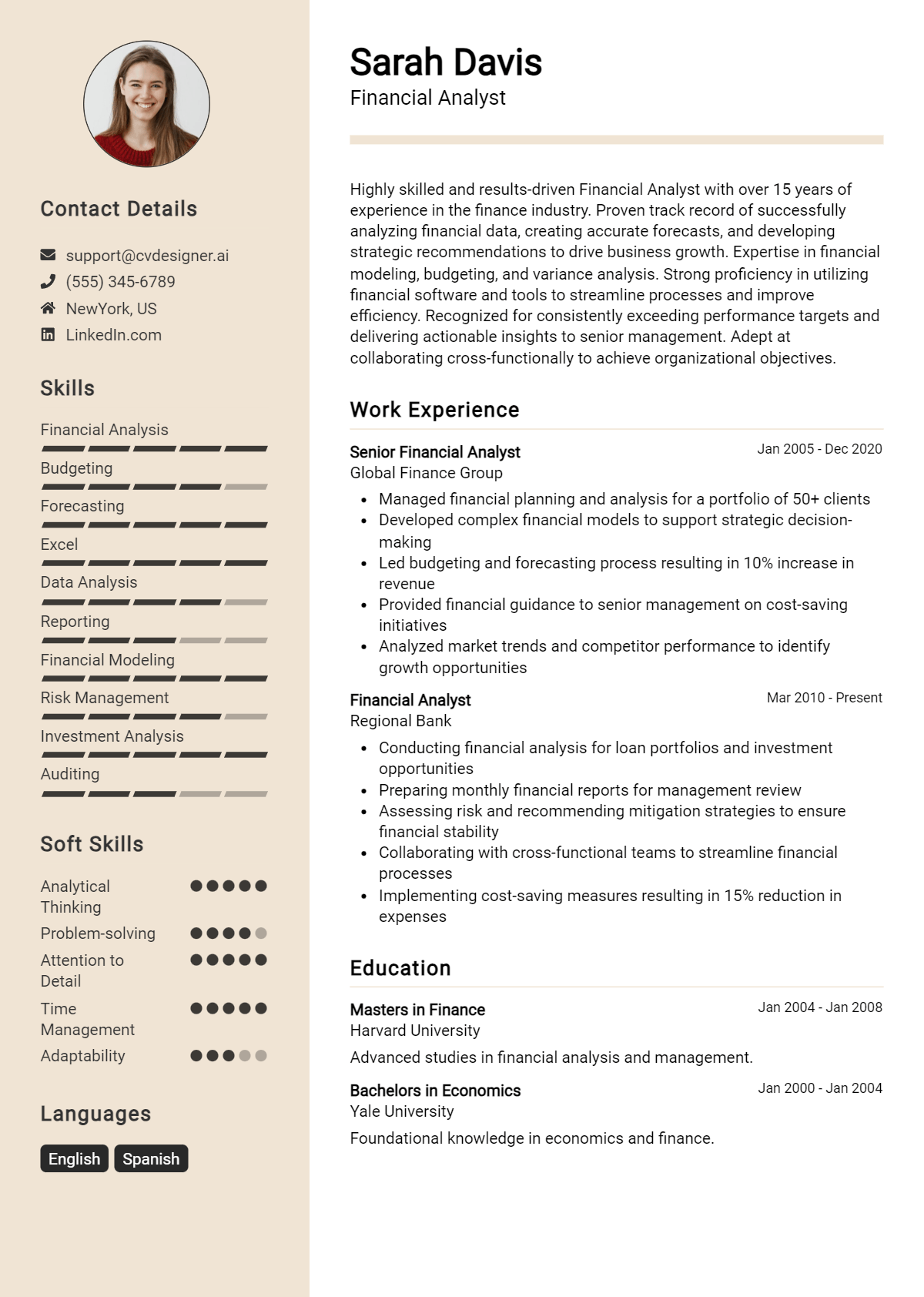

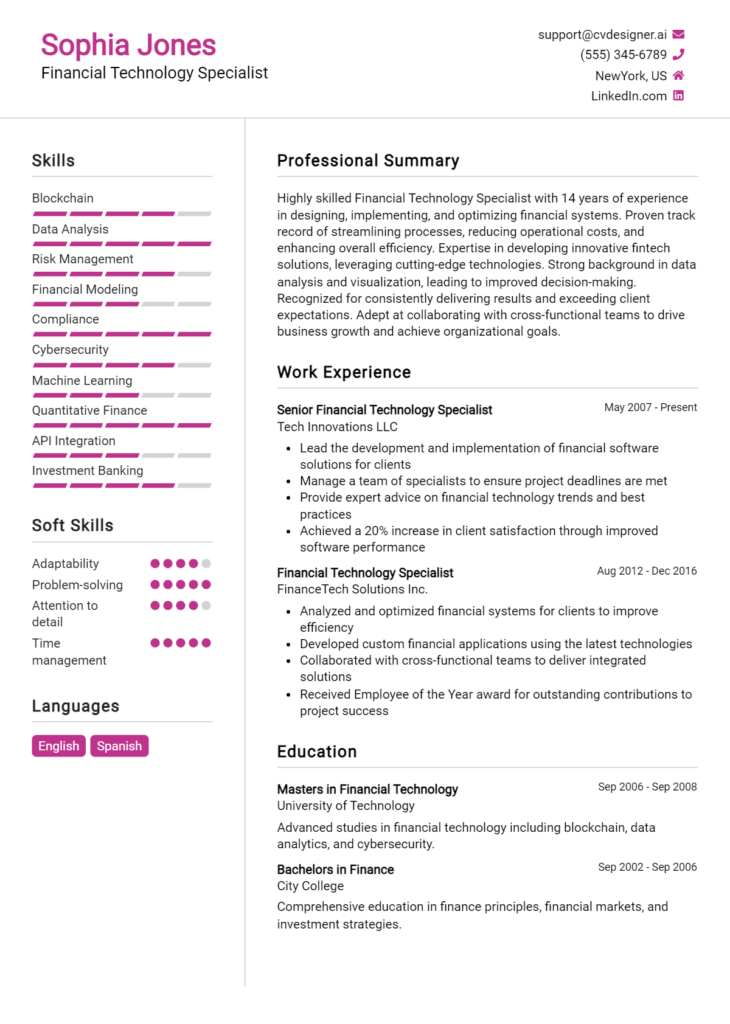

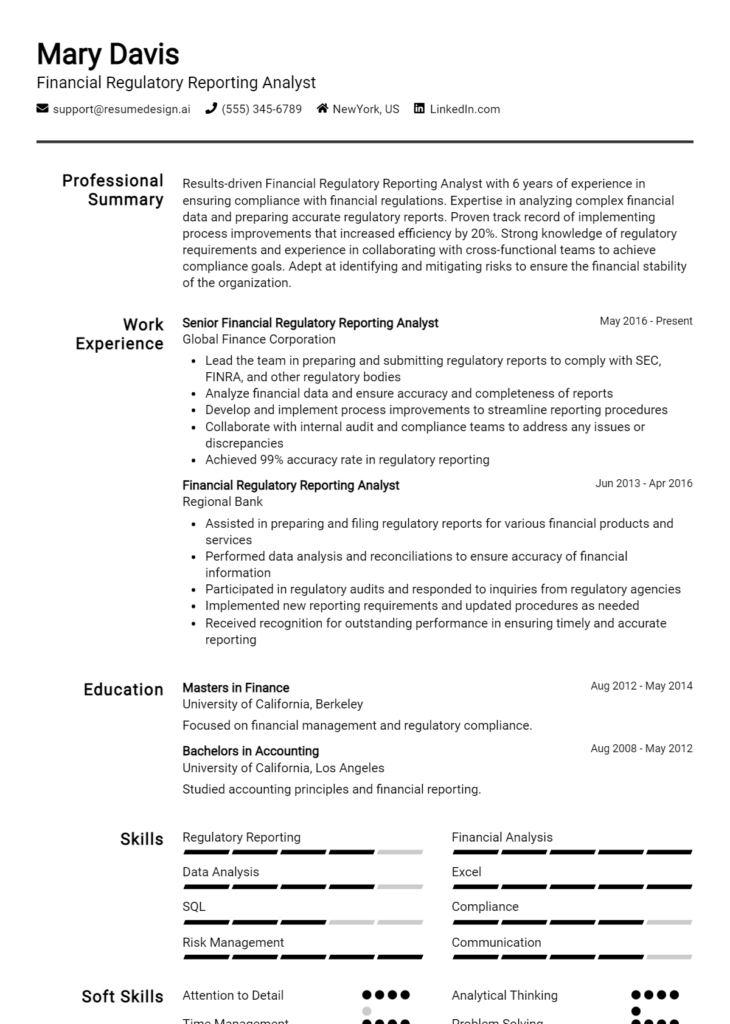

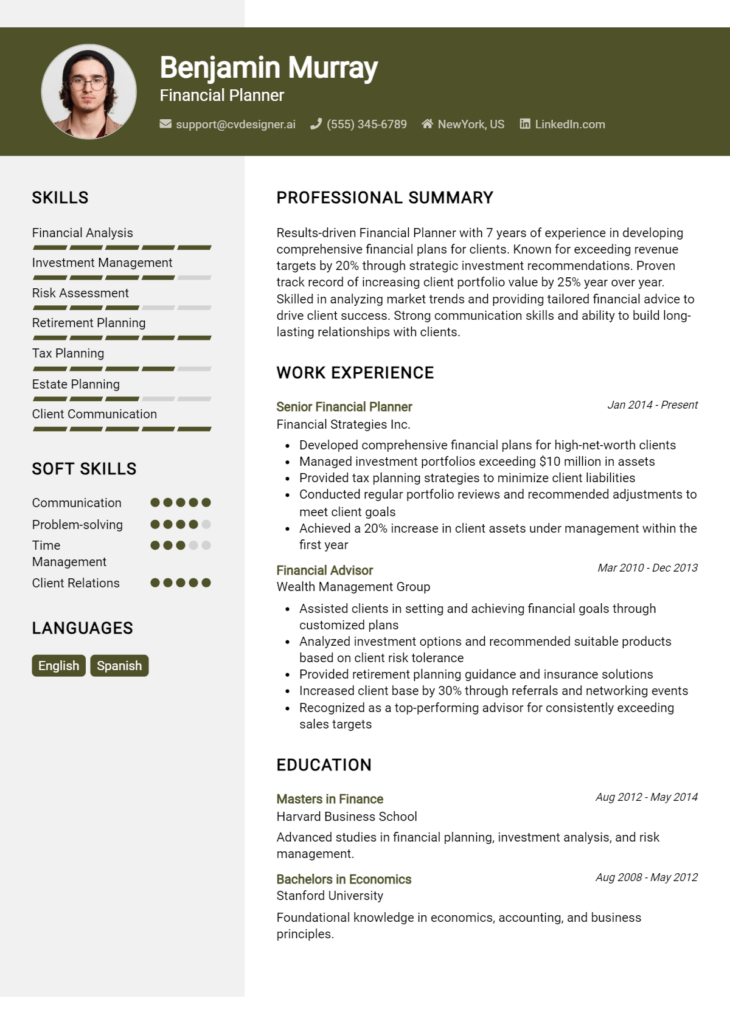

Work Experience Section for Financial Analyst Resume

The work experience section of a Financial Analyst resume plays a pivotal role in demonstrating the candidate's capabilities and accomplishments within the finance sector. This section not only highlights the applicant's technical skills—such as financial modeling, data analysis, and proficiency with financial software—but also showcases their ability to manage teams and deliver high-quality products. By quantifying achievements and aligning their experience with industry standards, candidates can effectively illustrate their contributions to previous employers and their potential value to prospective organizations.

Best Practices for Financial Analyst Work Experience

- Use specific, quantifiable metrics to demonstrate achievements (e.g., “increased revenue by 20%”).

- Highlight technical skills relevant to the role, including software proficiency and analytical methodologies.

- Showcase leadership experiences, particularly in team projects or initiatives.

- Align your experiences with industry standards and best practices to show relevance.

- Use action verbs to convey a sense of proactivity and impact.

- Focus on results-driven narratives that illustrate your contribution to past employers.

- Incorporate keywords from the job description to tailor your experience to the role.

- Include collaborative projects that demonstrate your ability to work effectively within teams.

Example Work Experiences for Financial Analyst

Strong Experiences

- Developed a financial forecasting model that improved accuracy by 30%, resulting in better resource allocation and budget management.

- Led a cross-functional team in the implementation of a new financial reporting system, reducing report generation time by 50%.

- Analyzed market trends and presented findings to senior management, contributing to a strategic decision that increased market share by 15%.

- Managed a portfolio of investments, achieving a 12% annual return, outperforming the benchmark by 3%.

Weak Experiences

- Worked on financial reports.

- Assisted with data entry tasks.

- Participated in meetings about budgeting.

- Helped with various finance-related projects.

The examples of strong experiences are considered effective because they contain specific, quantifiable outcomes and showcase the candidate's technical leadership and collaborative efforts in driving results. In contrast, the weak experiences lack detail and measurable impact, making them less compelling and failing to convey the candidate's true value in a financial analyst role.

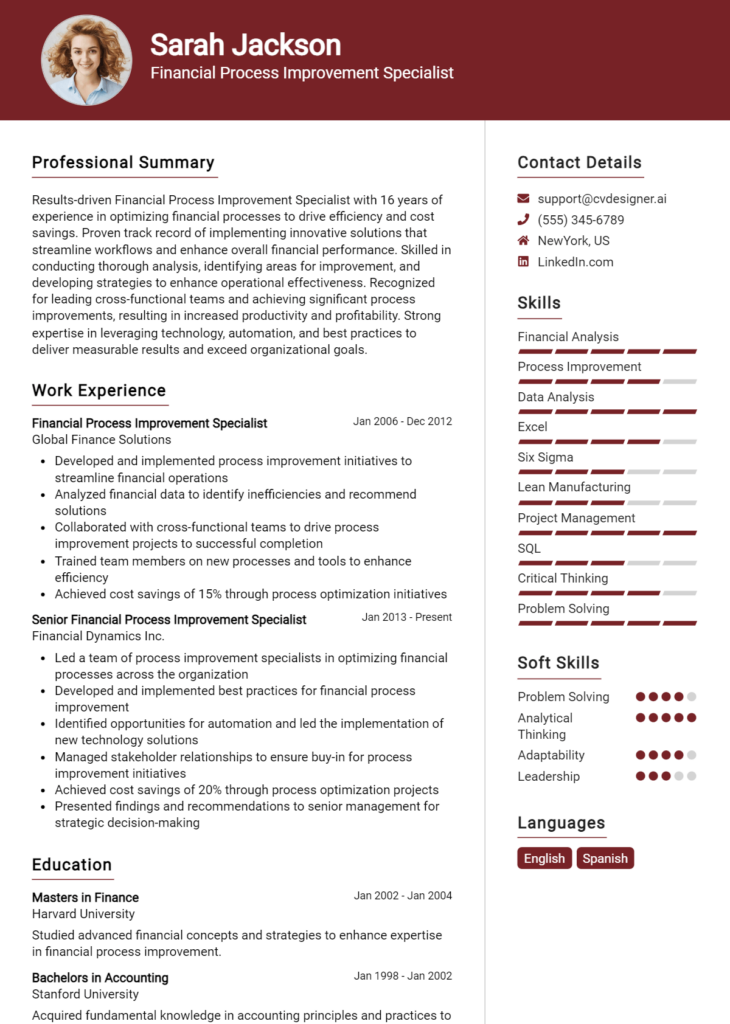

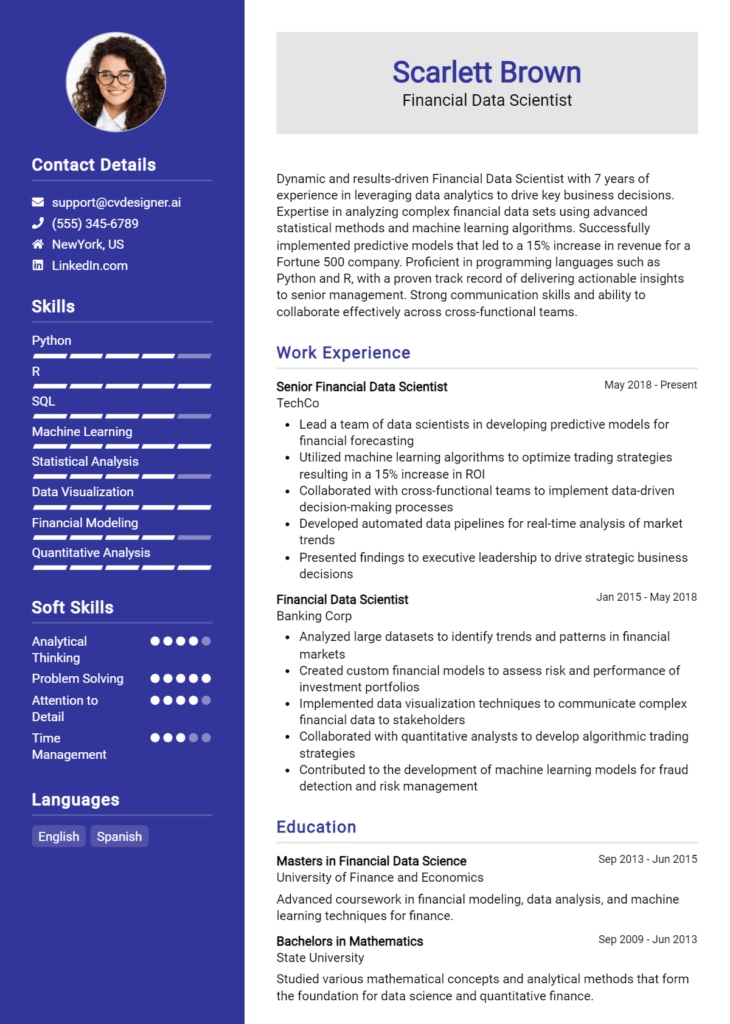

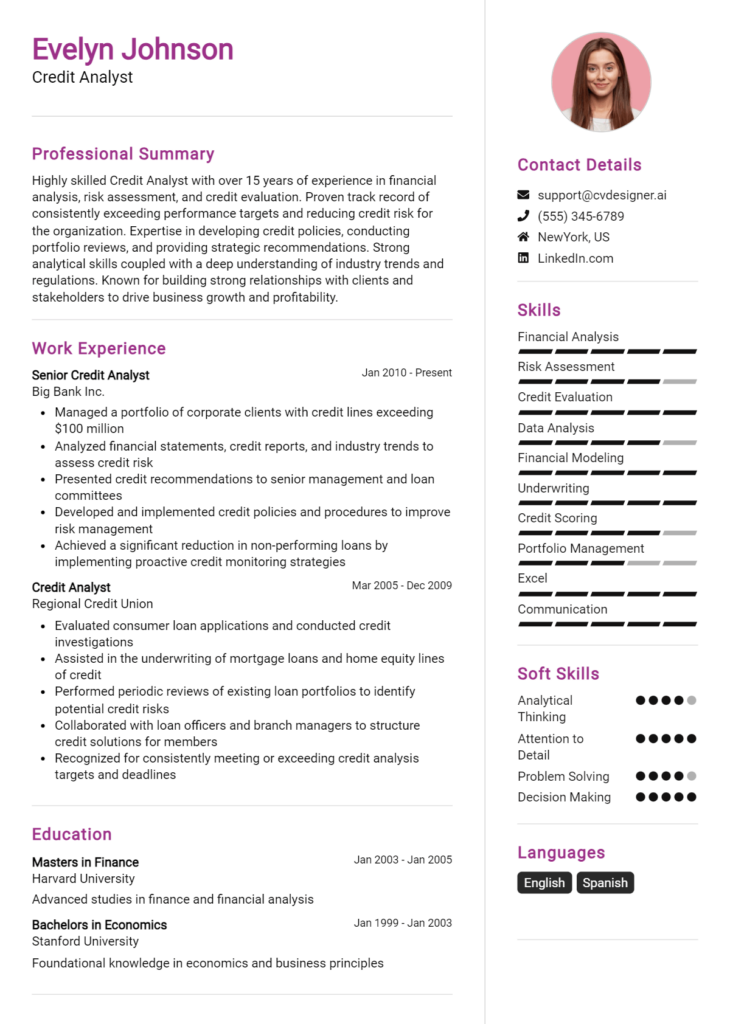

Certifications and Education for a Financial Analyst Resume

When crafting a resume for a Financial Analyst position, it's essential to emphasize both your educational background and relevant certifications. This combination showcases your knowledge and commitment to the field, making you a more attractive candidate. Here are some key points to consider:

Educational Background:

Bachelor's Degree in Finance, Accounting, Economics, or Business Administration: Most financial analyst positions require at least a bachelor's degree. Highlighting a degree in one of these fields demonstrates a solid foundation in financial principles and practices.

Master's Degree (MBA or Master's in Finance): While not always necessary, a Master's degree can set you apart from other candidates. It often indicates advanced analytical skills and a deeper understanding of complex financial concepts.

Relevant Coursework: If your degree included specific coursework in financial modeling, investment analysis, or corporate finance, consider listing these to showcase your specialized knowledge.

Academic Honors: If you graduated with honors or received any awards during your studies, include these accolades to highlight your academic achievements.

Certifications:

Chartered Financial Analyst (CFA): The CFA designation is highly respected in the finance industry and demonstrates a strong understanding of investment analysis, portfolio management, and financial reporting. Prioritizing this certification on your resume can significantly enhance your credibility.

Certified Public Accountant (CPA): While primarily accounting-focused, the CPA designation is valuable for financial analysts, especially those involved in financial reporting and compliance. It indicates a high level of expertise in financial principles.

Financial Risk Manager (FRM): This certification is ideal for analysts focusing on risk management. It demonstrates knowledge in managing market, credit, and operational risk, making it highly relevant in today’s financial landscape.

Certified Management Accountant (CMA): The CMA designation emphasizes financial management and strategy, which can be beneficial for analysts involved in corporate finance and managerial decision-making.

In your resume, be sure to clearly list your educational qualifications and certifications in a dedicated section. For example:

**Education:**

- Bachelor of Science in Finance, University of XYZ, Graduated May 2020

- MBA in Finance, University of ABC, Expected Graduation May 2024

**Certifications:**

- Chartered Financial Analyst (CFA), Level II Candidate

- Certified Public Accountant (CPA), Licensed in State X

By effectively presenting your education and certifications, you can demonstrate your qualifications and readiness for a Financial Analyst role, positioning yourself as a strong candidate in a competitive job market.

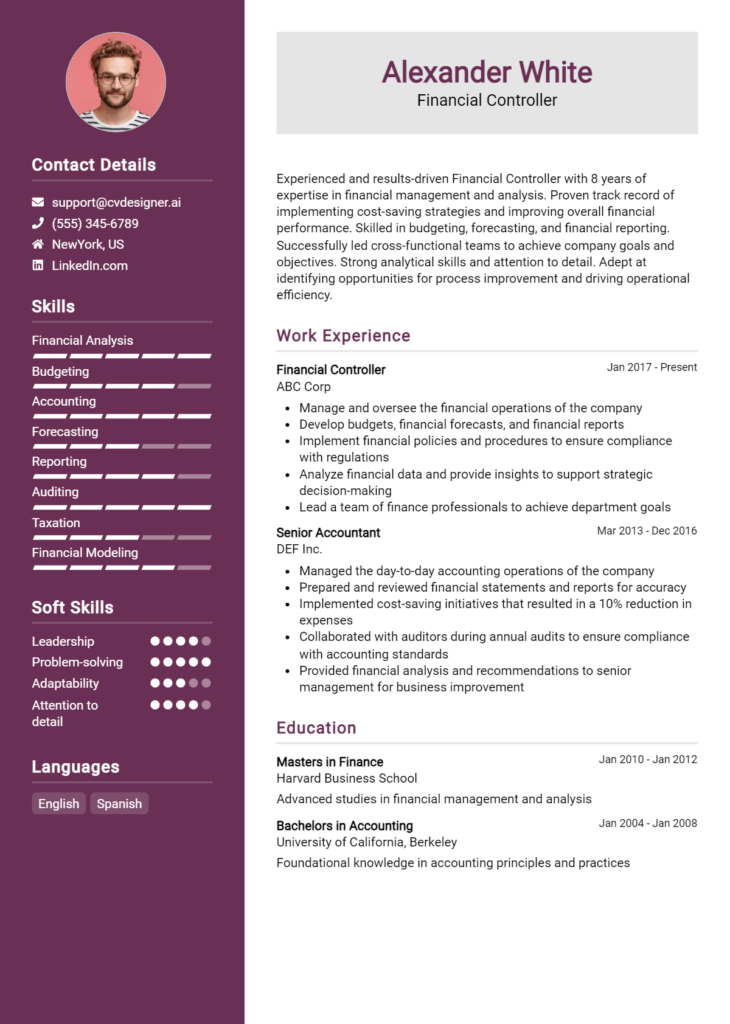

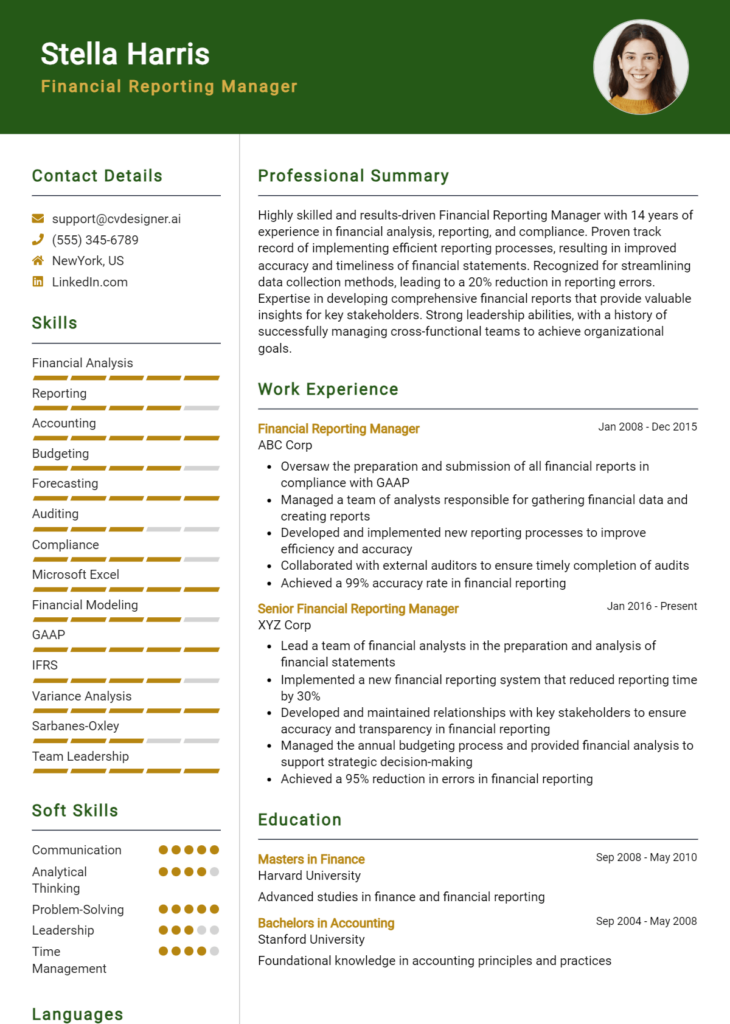

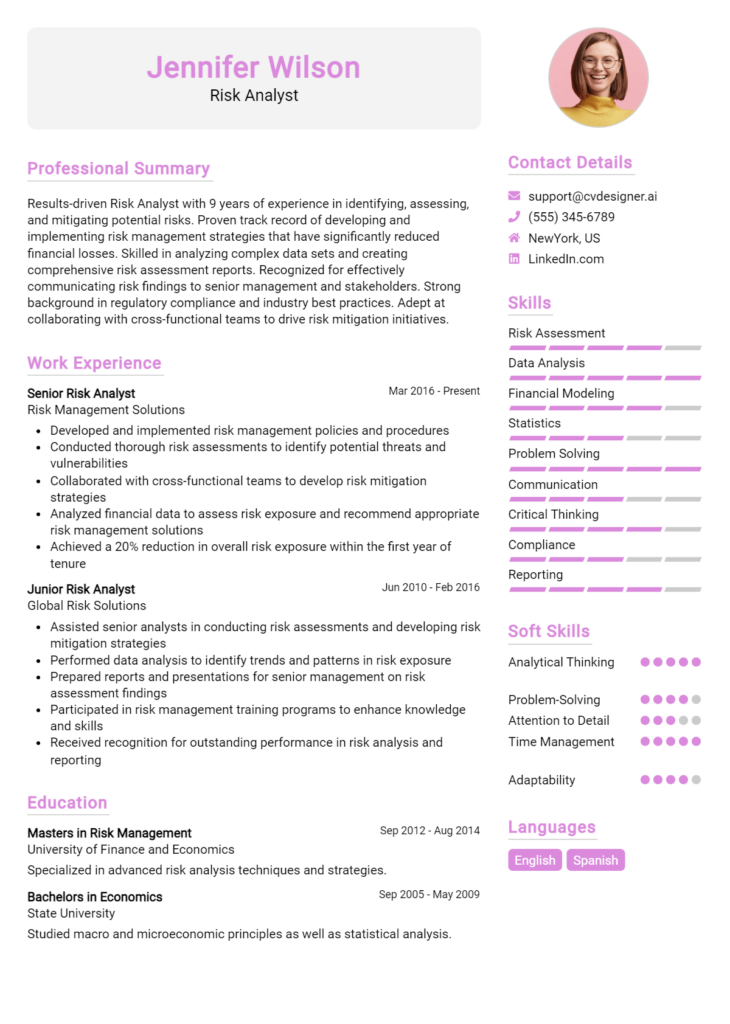

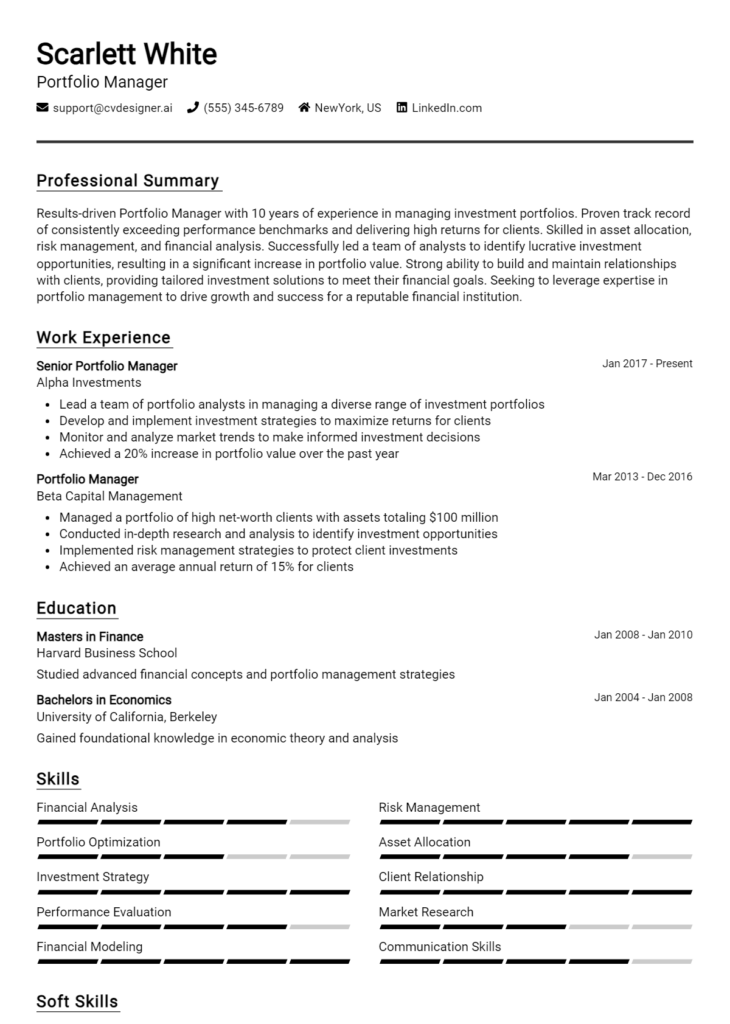

Top Skills & Keywords for Financial Analyst Resume

As a Financial Analyst, possessing the right skills is crucial for demonstrating your capabilities and enhancing your employability. A well-crafted resume not only highlights your technical expertise but also showcases your analytical and interpersonal abilities, which are essential for success in this role. Employers seek candidates who can interpret complex financial data, provide insights for strategic decision-making, and effectively communicate findings to various stakeholders. Thus, emphasizing both hard and soft skills in your resume can significantly set you apart from the competition.

Top Hard & Soft Skills for Financial Analyst

Soft Skills

- Analytical Thinking

- Attention to Detail

- Problem-Solving

- Effective Communication

- Time Management

- Adaptability

- Team Collaboration

- Critical Thinking

- Interpersonal Skills

- Decision-Making

Hard Skills

- Financial Modeling

- Data Analysis and Interpretation

- Proficiency in Excel and Financial Software (e.g., SAP, QuickBooks)

- Knowledge of Accounting Principles

- Budgeting and Forecasting

- Risk Management

- Financial Reporting

- Statistical Analysis

- Understanding of Financial Regulations

- Business Intelligence Tools (e.g., Tableau, Power BI)

By focusing on these skills in your resume, along with showcasing relevant work experience, you can present a compelling case for your candidacy as a Financial Analyst.

Stand Out with a Winning Financial Analyst Cover Letter

I am writing to express my interest in the Financial Analyst position at [Company Name], as advertised on [Job Board/Company Website]. With a Bachelor’s degree in Finance and over three years of experience in financial modeling, data analysis, and strategic planning, I am confident in my ability to contribute effectively to your team. My experience in conducting comprehensive financial analyses and my proficiency in tools such as Excel and SQL have equipped me with the skills needed to provide insightful financial recommendations that drive business growth.

In my previous role at [Previous Company Name], I successfully developed and implemented financial models that improved forecasting accuracy by 25%. By collaborating closely with cross-functional teams, I was able to present complex financial data in a clear and actionable manner, facilitating informed decision-making. My analytical skills have been further sharpened through hands-on experience in budgeting, variance analysis, and expense management, allowing me to identify trends and provide strategic insights that enhance operational efficiency.

I am particularly drawn to this role at [Company Name] because of your commitment to innovation and excellence in financial services. I am eager to leverage my expertise in financial analysis and reporting to contribute to your organization's goals. I am excited about the opportunity to work with a talented team and utilize my skills to help [Company Name] navigate the complexities of financial markets while ensuring sound fiscal management and growth.

Thank you for considering my application. I look forward to the opportunity to discuss how my background, skills, and enthusiasms align with the needs of your team. I am eager to bring my analytical prowess and passion for finance to [Company Name] and help drive your financial strategies forward.

Common Mistakes to Avoid in a Financial Analyst Resume

Crafting a compelling resume as a Financial Analyst is crucial in showcasing your analytical skills and financial acumen. However, many candidates fall into common traps that can hinder their chances of landing an interview. Understanding these pitfalls can help you create a more effective resume that stands out to potential employers. Here are some common mistakes to avoid:

Lack of Specificity: Using vague terms like "responsible for" instead of detailing specific achievements can make your experience seem less impactful. Quantify your contributions with numbers and results.

Ignoring Keywords: Failing to incorporate industry-specific keywords can result in your resume being filtered out by Applicant Tracking Systems (ATS). Tailor your resume to match the job description closely.

Overloading with Technical Jargon: While technical skills are essential, overusing jargon can alienate hiring managers who may not be familiar with all the terms. Strike a balance between technical language and clear communication.

Neglecting Soft Skills: Focusing solely on hard skills can create an incomplete picture. Financial Analysts also need strong communication, teamwork, and problem-solving skills; be sure to highlight these.

Inconsistent Formatting: A cluttered or inconsistent format can detract from the professionalism of your resume. Use a clean, uniform layout with clear headings and bullet points for readability.

Too Much Information: Including every job you've had can overwhelm the reader. Focus on relevant experience and achievements that align with the Financial Analyst role you are applying for.

Lack of Customization: Sending the same resume to multiple employers can be detrimental. Tailor each resume to reflect the specific requirements and culture of the company you’re applying to.

Failure to Highlight Education and Certifications: Neglecting to mention relevant degrees and certifications can be a missed opportunity. Ensure your educational background and any financial certifications are prominently displayed.

Conclusion

As a Financial Analyst, it is essential to present your skills, experiences, and accomplishments in a compelling manner to stand out in a competitive job market. Key points highlighted in our discussion include the importance of showcasing analytical skills, proficiency in financial modeling, and the ability to interpret complex data effectively. Additionally, emphasizing your experience with financial software and tools, as well as your understanding of financial regulations, can significantly enhance your profile.

In summary, a well-crafted resume not only reflects your qualifications but also demonstrates your attention to detail and professionalism. Now is the perfect time to review and refine your Financial Analyst resume to ensure it aligns with industry standards and effectively showcases your strengths.

To aid in this process, we encourage you to explore our valuable resources, including a variety of resume templates tailored for Financial Analysts, an intuitive resume builder that simplifies the creation process, and cover letter templates to complement your application. Take action today—invest time in perfecting your resume and enhance your chances of landing your dream job!