Financial Compliance Officer Core Responsibilities

A Financial Compliance Officer plays a crucial role in ensuring that an organization adheres to financial regulations and standards. Key responsibilities include monitoring compliance with laws, conducting audits, and coordinating with various departments such as finance, legal, and operations. This role requires strong technical skills, operational insight, and exceptional problem-solving abilities to effectively identify and mitigate risks. These qualifications are vital in achieving the organization’s goals, and a well-structured resume can effectively highlight these competencies.

Common Responsibilities Listed on Financial Compliance Officer Resume

- Monitor and ensure compliance with financial regulations and internal policies.

- Conduct regular audits and assessments to identify compliance gaps.

- Develop and implement compliance training programs for staff.

- Collaborate with legal and finance teams to interpret regulatory changes.

- Prepare and submit compliance reports to management and regulatory bodies.

- Investigate compliance issues and recommend corrective actions.

- Maintain up-to-date knowledge of industry regulations and best practices.

- Assist in the development of risk management strategies.

- Support internal and external audits as needed.

- Communicate compliance requirements and changes to relevant stakeholders.

- Implement and oversee compliance monitoring systems and frameworks.

High-Level Resume Tips for Financial Compliance Officer Professionals

In the competitive field of financial compliance, a well-crafted resume is crucial for standing out among a pool of qualified candidates. As the first impression a potential employer has of you, your resume must not only highlight your skills and achievements but also convey your understanding of the complexities of compliance in the financial sector. A tailored resume can effectively showcase your ability to navigate regulatory frameworks, manage risk, and enhance organizational integrity. In this guide, we will provide practical and actionable resume tips specifically tailored for Financial Compliance Officer professionals, ensuring that your application makes a strong impact.

Top Resume Tips for Financial Compliance Officer Professionals

- Customize your resume for each job application by closely analyzing the job description and incorporating relevant keywords.

- Highlight your experience in regulatory compliance, risk management, and financial audits to demonstrate your expertise in the field.

- Quantify your achievements with specific metrics, such as the percentage of compliance adherence improved or the number of audits successfully conducted.

- Showcase industry-specific certifications, such as Certified Compliance & Ethics Professional (CCEP) or Certified Regulatory Compliance Manager (CRCM), to enhance your credibility.

- Include a summary statement at the top of your resume that succinctly outlines your qualifications and career objectives in financial compliance.

- Emphasize your analytical skills and attention to detail, which are critical in identifying compliance issues and implementing effective solutions.

- Utilize action verbs to articulate your responsibilities and achievements, making your contributions clear and impactful.

- Incorporate relevant software and tools you are proficient in, such as compliance management systems or financial analysis software, to showcase your technical skills.

- Maintain a clean and professional format, using clear headings and bullet points to ensure readability for hiring managers.

By implementing these tips, you can significantly increase your chances of landing a job in the Financial Compliance Officer field. A polished and targeted resume will not only reflect your qualifications but also demonstrate your commitment to excellence in compliance, making you a compelling candidate for potential employers.

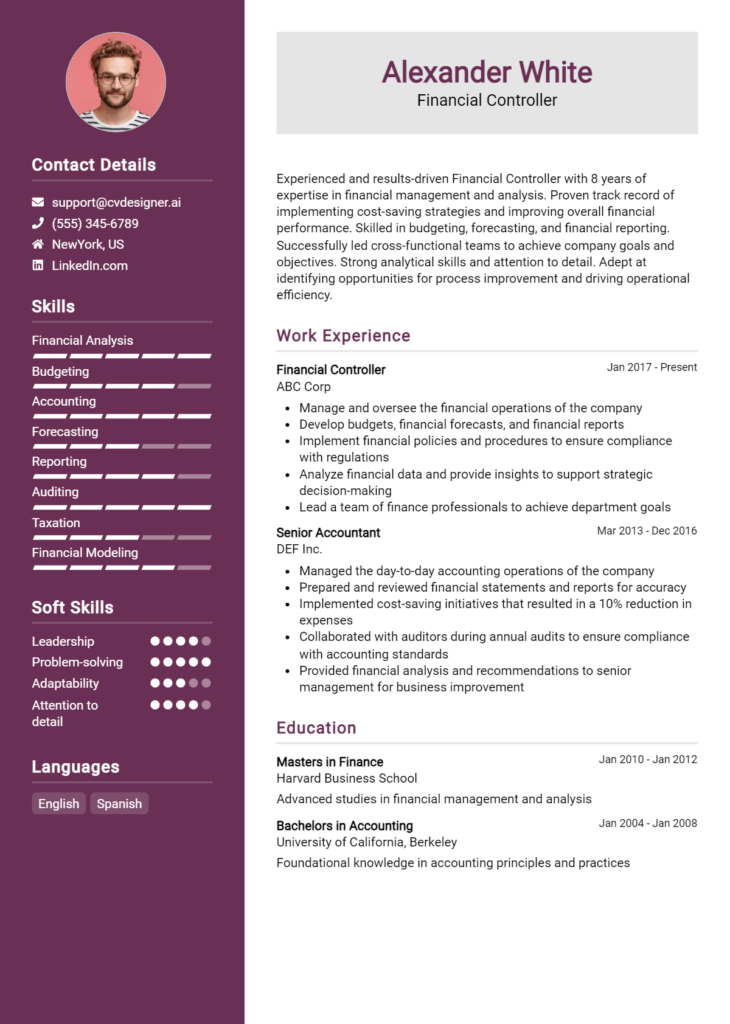

Why Resume Headlines & Titles are Important for Financial Compliance Officer

The role of a Financial Compliance Officer is critical in ensuring that organizations adhere to regulatory standards and maintain ethical financial practices. When it comes to crafting a resume for this position, a compelling resume headline or title can make all the difference. A strong headline immediately captures the attention of hiring managers, providing a succinct summary of a candidate's key qualifications in just a few impactful words. It serves as the first impression, setting the stage for the rest of the resume. Therefore, it is essential that the headline is concise, relevant, and directly related to the specific job being applied for, effectively highlighting the candidate's expertise and alignment with the role.

Best Practices for Crafting Resume Headlines for Financial Compliance Officer

- Keep it concise: Aim for one to two lines that capture your essence.

- Be role-specific: Tailor the headline to reflect the specific position you’re applying for.

- Highlight key skills: Include essential skills or qualifications relevant to the Financial Compliance Officer role.

- Use action words: Start with dynamic verbs to convey a sense of proactivity.

- Incorporate quantifiable achievements: If applicable, mention metrics to demonstrate your impact.

- Avoid jargon: Use clear language that can be understood by any hiring manager.

- Align with company values: Reflect knowledge of the company's mission or values within your headline.

- Revise and refine: Continuously update your headline as you gain new experiences or qualifications.

Example Resume Headlines for Financial Compliance Officer

Strong Resume Headlines

"Detail-Oriented Financial Compliance Officer with 7+ Years in Regulatory Oversight and Risk Management"

“Proven Expert in Financial Regulations and Compliance Audits, Enhancing Organizational Integrity”

"Strategic Financial Compliance Officer Skilled in Developing Effective Compliance Programs and Training"

Weak Resume Headlines

“Financial Officer Looking for Opportunities”

“Experienced Professional in Finance”

The strong headlines are effective because they clearly communicate the candidate's qualifications, experience, and value proposition in the context of the Financial Compliance Officer role. They are specific and impactful, making it easy for hiring managers to see how the candidate aligns with the position. In contrast, the weak headlines fail to impress due to their vagueness and lack of specific information. They do not convey any unique strengths or relevant experience, which can lead to the candidate being overlooked in a competitive job market.

Writing an Exceptional Financial Compliance Officer Resume Summary

A well-crafted resume summary is a crucial component for Financial Compliance Officers, as it serves as the first impression for hiring managers. This brief section effectively captures attention by succinctly showcasing the candidate's key skills, relevant experience, and notable accomplishments. An impactful summary not only highlights qualifications but also aligns closely with the specific requirements of the job being applied for, making it a vital tool in the competitive job market. A concise and tailored summary can set a candidate apart, compelling employers to delve deeper into the resume.

Best Practices for Writing a Financial Compliance Officer Resume Summary

- Quantify achievements: Use specific numbers and percentages to demonstrate your impact.

- Focus on relevant skills: Highlight skills that are directly related to compliance, such as regulatory knowledge and risk management.

- Tailor your summary: Customize your summary for each job application, reflecting the language and requirements of the job description.

- Keep it concise: Aim for 2-4 sentences that pack a punch without being overly verbose.

- Showcase certifications: Mention any relevant certifications, such as Certified Regulatory Compliance Manager (CRCM) or similar qualifications.

- Include industry experience: Specify your background in financial services, emphasizing relevant sectors or roles.

- Use action verbs: Start sentences with strong action verbs to convey proactivity and effectiveness.

- Highlight compliance tools: Mention any specific compliance software or tools you are proficient in, demonstrating technical competency.

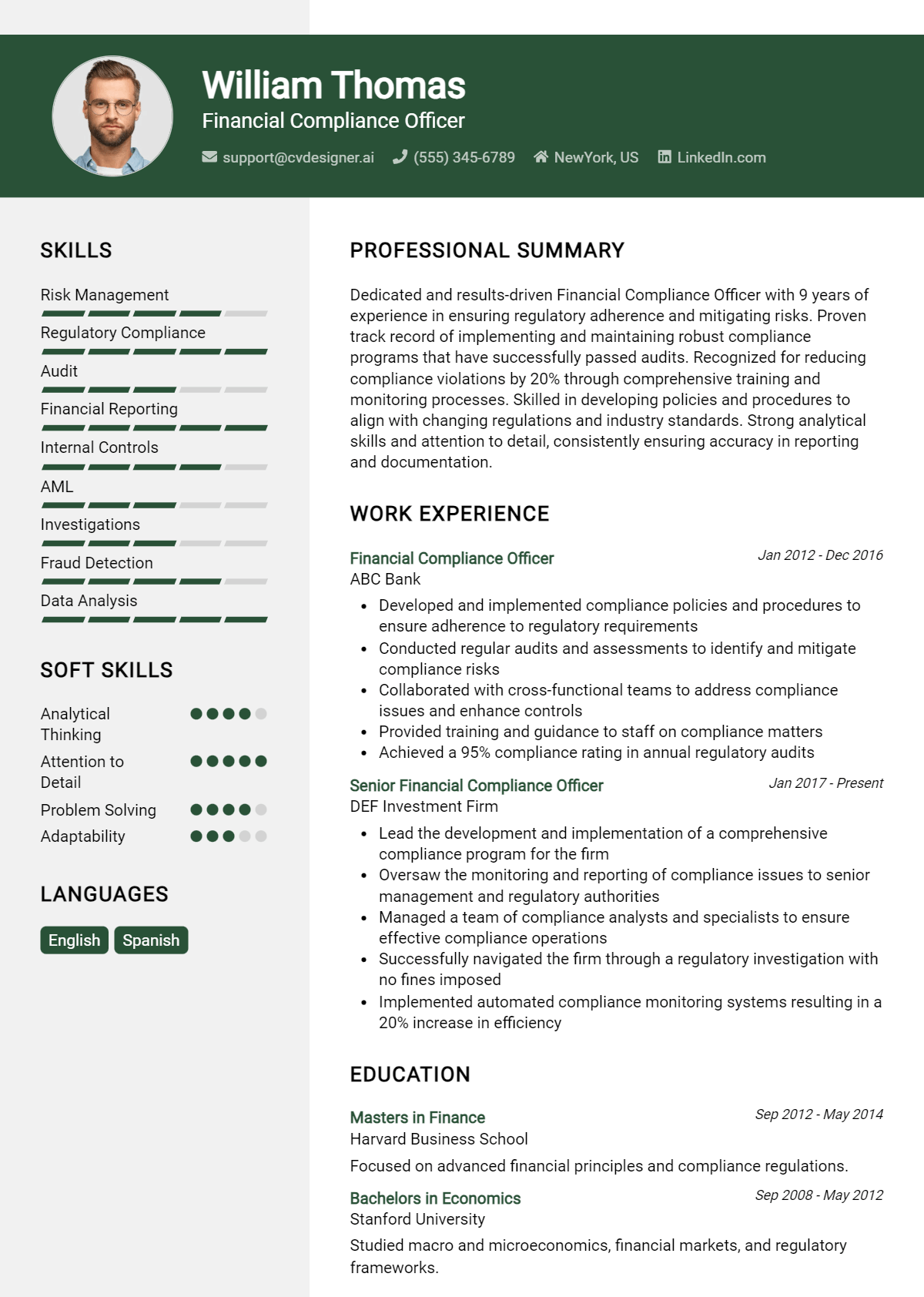

Example Financial Compliance Officer Resume Summaries

Strong Resume Summaries

Results-driven Financial Compliance Officer with over 7 years of experience ensuring adherence to federal regulations and company policies. Successfully led a compliance audit resulting in a 30% reduction in non-compliance issues by implementing streamlined processes and training programs.

Detail-oriented Compliance Specialist with a proven track record of mitigating risks in financial services. Expertise in regulatory frameworks, with a history of reviewing and enhancing compliance protocols that improved audit scores by 25% within one year.

Dynamic Financial Compliance Officer with extensive experience in developing compliance strategies for major banking institutions. Recognized for achieving a 40% increase in compliance training program participation, which led to a significant decrease in regulatory breaches.

Weak Resume Summaries

Experienced professional looking for a position in compliance. I have some knowledge of financial regulations and enjoy working with teams.

Compliance Officer with a background in finance. I want to help companies stay compliant and follow the rules.

The examples above illustrate the difference between strong and weak resume summaries effectively. Strong summaries stand out due to their specificity, quantifiable achievements, and direct relevance to the Financial Compliance Officer role, demonstrating a clear understanding of the job's demands. In contrast, weak summaries lack detail, appear generic, and fail to convey the candidate's qualifications or the impact they could bring to the organization, making them less compelling to hiring managers.

Work Experience Section for Financial Compliance Officer Resume

The work experience section of a Financial Compliance Officer resume is crucial as it serves as a comprehensive showcase of the candidate's relevant skills and expertise. This section not only highlights the technical competencies essential for navigating the complex regulatory landscape but also emphasizes the candidate's ability to manage teams and deliver high-quality compliance products. By quantifying achievements and aligning past experiences with industry standards, candidates can effectively demonstrate their value to potential employers and their readiness to contribute to organizational success.

Best Practices for Financial Compliance Officer Work Experience

- Highlight technical skills related to compliance regulations, risk assessment, and audit processes.

- Quantify achievements with specific metrics, such as reduced compliance violations by X% or improved reporting efficiency by Y%.

- Showcase leadership abilities by detailing team management experiences and successful project outcomes.

- Use industry-specific terminology to align with job descriptions and demonstrate familiarity with compliance frameworks.

- Incorporate examples of cross-departmental collaboration to illustrate teamwork and communication skills.

- Focus on results-driven narratives that emphasize problem-solving and proactive compliance measures.

- Tailor experiences to match the requirements of the role, ensuring relevance and impact.

- Include professional development activities, such as certifications or trainings, to demonstrate a commitment to staying current in the field.

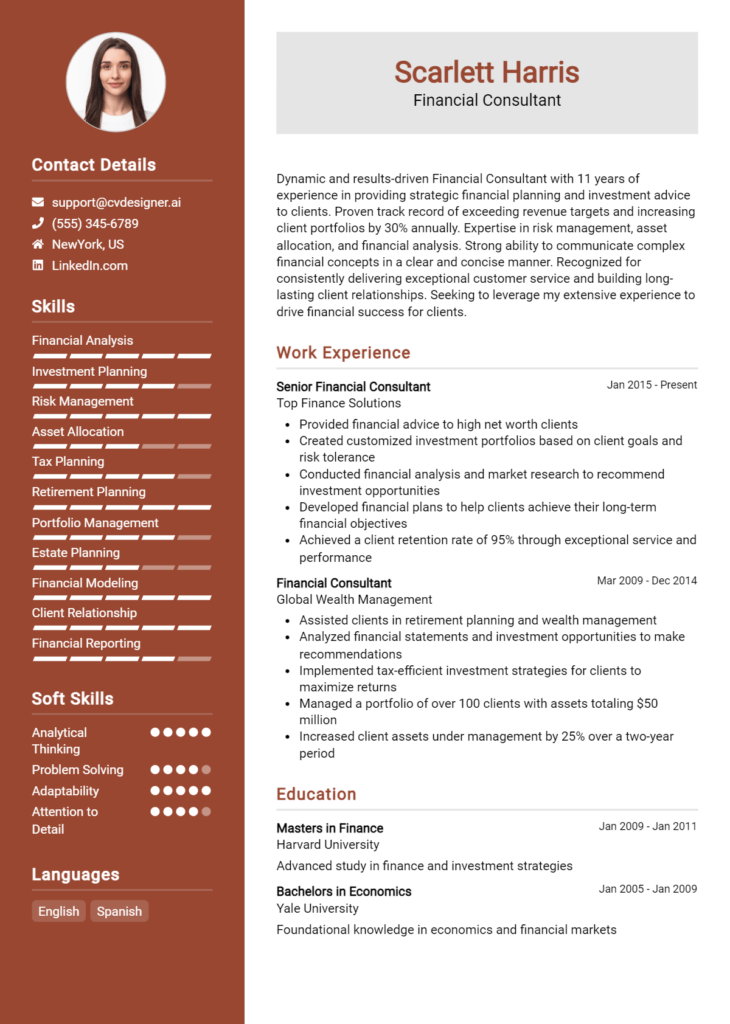

Example Work Experiences for Financial Compliance Officer

Strong Experiences

- Led a team in conducting a comprehensive compliance audit that identified and rectified 15 major regulatory gaps, resulting in a 30% reduction in potential fines.

- Developed and implemented a new risk assessment framework that decreased compliance risk scores by 25% within the first year of execution.

- Collaborated with cross-functional teams to establish a compliance training program that improved employee understanding of regulations, achieving a 95% satisfaction rate in participant feedback surveys.

- Successfully managed a project to streamline compliance reporting processes, reducing preparation time by 40% and increasing accuracy in submissions.

Weak Experiences

- Worked on compliance-related tasks as part of a team.

- Responsible for ensuring the company followed regulations.

- Participated in some compliance training sessions.

- Helped with various compliance projects that were not detailed.

The examples categorized as strong are considered effective because they provide concrete, quantifiable outcomes that demonstrate the candidate's impact in their previous roles. They highlight specific achievements, leadership, and collaboration, which are crucial for a Financial Compliance Officer. Conversely, the weak experiences lack detail and measurable results, making them less compelling and failing to showcase the candidate's true capabilities and contributions in the field of financial compliance.

Certifications and Education for a Financial Compliance Officer Resume

When crafting a resume for a Financial Compliance Officer position, it's essential to highlight your educational background and relevant certifications. This demonstrates your expertise in regulatory frameworks and financial laws, which are crucial for the role.

Certifications to Prioritize:

Certified Compliance and Ethics Professional (CCEP): This certification emphasizes your understanding of compliance and ethical practices within organizations, making it highly relevant for a Financial Compliance Officer.

Certified Regulatory Compliance Manager (CRCM): Offered by the American Bankers Association, this certification focuses on compliance management within financial institutions, covering critical regulations and risk management.

Certified Anti-Money Laundering Specialist (CAMS): Given the increasing focus on anti-money laundering regulations, this certification will showcase your knowledge in detecting and reporting suspicious activities.

Chartered Financial Analyst (CFA): This prestigious designation can enhance your credibility in the financial sector, especially if your role involves investment compliance.

Educational Background Examples:

Bachelor's Degree in Finance: A foundational understanding of financial principles and markets, which is essential for navigating compliance issues in the finance industry.

Bachelor's Degree in Accounting: This degree provides a solid grasp of financial reporting and auditing, which are critical for ensuring compliance with regulatory standards.

Master's Degree in Business Administration (MBA): An MBA with a concentration in finance or compliance can be advantageous, as it combines practical business knowledge with advanced financial concepts.

Master's Degree in Law (LL.M.) with a focus on Financial Regulation: This advanced law degree can give you a deep understanding of the legal aspects of financial compliance, making you a valuable asset in ensuring adherence to regulations.

By strategically listing these certifications and educational qualifications on your resume, you can effectively position yourself as a knowledgeable and capable candidate for a Financial Compliance Officer role.

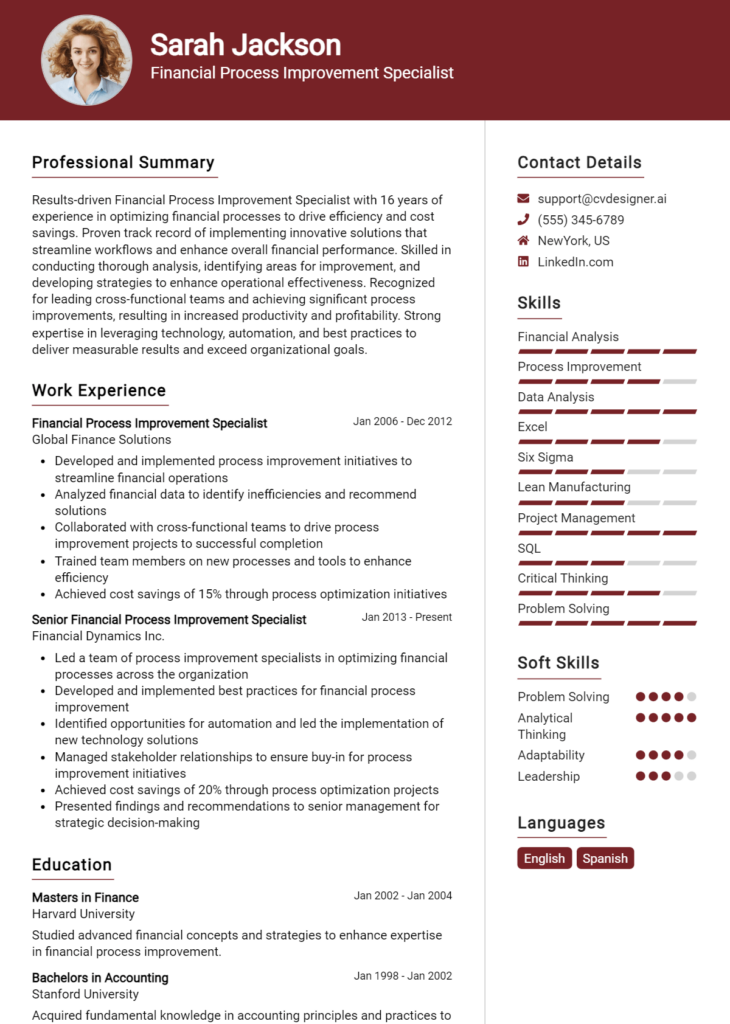

Top Skills & Keywords for Financial Compliance Officer Resume

As a Financial Compliance Officer, possessing the right skills is crucial for ensuring that an organization adheres to regulatory requirements and maintains its financial integrity. A well-crafted resume that highlights both hard and soft skills can significantly enhance your chances of securing a position in this competitive field. Employers seek candidates who not only have a strong grasp of compliance regulations and financial principles but also exhibit the interpersonal qualities necessary to navigate complex organizational dynamics. By effectively showcasing your skills, you can demonstrate your ability to mitigate risks, implement compliance programs, and foster a culture of integrity within your organization.

Top Hard & Soft Skills for Financial Compliance Officer

Soft Skills

- Attention to Detail

- Analytical Thinking

- Communication Skills

- Problem-Solving Abilities

- Ethical Judgment

- Time Management

- Adaptability

- Team Collaboration

- Decision-Making Skills

- Conflict Resolution

- Interpersonal Skills

- Organizational Skills

- Leadership Qualities

- Critical Thinking

- Negotiation Skills

Hard Skills

- Knowledge of Regulatory Frameworks (e.g., SOX, SEC, FINRA)

- Risk Assessment and Management

- Financial Reporting Proficiency

- Compliance Auditing Techniques

- Data Analysis and Interpretation

- Knowledge of Anti-Money Laundering (AML) Laws

- Familiarity with Financial Software (e.g., SAP, Oracle)

- Understanding of Internal Controls

- Proficiency in Microsoft Excel and Data Visualization Tools

- Policy Development and Implementation

- Familiarity with Industry Standards (e.g., ISO, GDPR)

- Regulatory Reporting Skills

- Experience with Compliance Monitoring Tools

- Knowledge of Tax Compliance

- Training and Development Expertise

- Project Management Skills

- Familiarity with Cybersecurity Regulations

For additional insights on how to effectively highlight your skills and work experience, consider tailoring your resume to reflect the competencies most relevant to the Financial Compliance Officer role.

Stand Out with a Winning Financial Compliance Officer Cover Letter

I am writing to express my interest in the Financial Compliance Officer position at [Company Name] as advertised on [Where You Found the Job Posting]. With a robust background in financial regulations and compliance frameworks, coupled with my passion for maintaining the highest ethical standards in finance, I believe I am well-equipped to contribute to your team. My experience in ensuring adherence to both internal policies and external regulations has prepared me to effectively navigate the complexities of financial compliance in a dynamic corporate environment.

In my previous role at [Previous Company Name], I successfully implemented compliance programs that significantly reduced the risk of financial discrepancies and regulatory violations. By conducting thorough audits and risk assessments, I was able to identify key areas for improvement and streamline processes to enhance operational efficiency. My ability to communicate complex compliance requirements in a clear and actionable manner has fostered a culture of accountability and transparency within my team, ensuring that all members understand their role in maintaining compliance.

I am particularly drawn to the opportunity at [Company Name] due to its commitment to innovation and integrity in financial practices. I am eager to leverage my expertise in regulatory frameworks such as Sarbanes-Oxley, Anti-Money Laundering (AML), and the Dodd-Frank Act to help [Company Name] not only meet but exceed compliance standards. I am confident that my analytical skills, attention to detail, and proactive approach to risk management will make a positive impact on your organization's compliance efforts.

Thank you for considering my application. I look forward to the opportunity to discuss how my background and skills align with the needs of your team. I am excited about the possibility of contributing to [Company Name]'s mission and supporting its commitment to financial integrity and compliance excellence.

Common Mistakes to Avoid in a Financial Compliance Officer Resume

When crafting a resume for the role of a Financial Compliance Officer, it is crucial to present qualifications, experiences, and skills in a manner that aligns with the expectations of employers in the finance sector. However, many candidates make common mistakes that can undermine their chances of landing an interview. By avoiding these pitfalls, applicants can create a compelling and professional resume that effectively showcases their suitability for the position.

Lack of Tailoring: Failing to customize the resume for the specific job description can make it seem generic. Highlighting relevant experiences and using industry-specific keywords can significantly improve alignment with the role.

Overlooking Compliance Certifications: Not prominently displaying relevant certifications, such as Certified Compliance and Ethics Professional (CCEP) or Certified Regulatory Compliance Manager (CRCM), can weaken the resume. Certifications demonstrate a commitment to the field and enhance credibility.

Vague Job Descriptions: Using ambiguous language when describing past roles can lead to confusion. It's important to provide clear, quantifiable achievements and responsibilities to showcase your impact in previous positions.

Ignoring Soft Skills: While technical expertise is vital, neglecting to mention soft skills like communication, problem-solving, and teamwork can be a mistake. These attributes are essential for effectively navigating compliance issues and working with diverse teams.

Neglecting to Highlight Relevant Software Proficiency: In today’s tech-driven environment, failing to mention familiarity with compliance management software or data analysis tools can be detrimental. Employers look for candidates who can leverage technology to enhance compliance processes.

Inconsistent Formatting: A poorly formatted resume can distract from your qualifications. Maintaining a clean, consistent layout with proper headings, bullet points, and font sizes makes your resume easier to read and more professional.

Excessive Length: Providing too much information can overwhelm hiring managers. A concise resume that focuses on relevant experiences—ideally one to two pages—is more effective than a lengthy document filled with unnecessary details.

Skipping Keywords: Not incorporating relevant industry keywords can lead to your resume being overlooked by Applicant Tracking Systems (ATS). Researching common terms used in financial compliance roles and including them strategically can help ensure your resume gets noticed.

Conclusion

As we explored the essential responsibilities and skills required for the role of a Financial Compliance Officer, it’s clear that this position is critical in ensuring organizations adhere to financial regulations and standards. Key takeaways include the importance of understanding regulatory frameworks, the ability to conduct audits and assessments, and the necessity of strong analytical and communication skills. Additionally, the role often involves continuous monitoring and training to keep up with evolving compliance requirements.

To ensure you stand out in the competitive job market for Financial Compliance Officers, it’s crucial to have an updated and well-structured resume that highlights your relevant experience and qualifications. We encourage you to take the time to review your resume and make any necessary updates.

Utilize the available tools to enhance your application materials: explore resume templates for inspiration, try the resume builder for a professional touch, and don’t forget to craft a compelling cover letter using our cover letter templates. Taking these steps can significantly improve your chances of landing an interview and advancing your career in financial compliance.