Equity Research Analyst Core Responsibilities

An Equity Research Analyst plays a pivotal role in analyzing financial data and market trends to guide investment decisions. Key responsibilities include conducting in-depth company evaluations, preparing detailed financial models, and providing actionable investment recommendations. Essential skills encompass technical proficiency in financial analysis, strong operational understanding, and adept problem-solving abilities. This role effectively bridges finance, operations, and strategic planning, contributing significantly to the organization’s goals. A well-structured resume can highlight these qualifications, enhancing career prospects.

Common Responsibilities Listed on Equity Research Analyst Resume

- Conducting comprehensive industry and company research

- Building and maintaining financial models

- Preparing detailed investment reports and presentations

- Analyzing financial statements and key performance indicators

- Tracking market trends and economic indicators

- Collaborating with sales and trading teams for insights

- Presenting findings to stakeholders and clients

- Providing recommendations based on market analysis

- Monitoring news and developments affecting industries

- Assisting in the development of investment strategies

- Participating in earnings calls and investor meetings

- Maintaining a database of financial information

High-Level Resume Tips for Equity Research Analyst Professionals

In the competitive field of equity research, a well-crafted resume is essential for making a strong first impression on potential employers. As candidates often face a crowded pool of applicants, their resume serves as a critical marketing tool to showcase not only their skills but also their achievements in the industry. An effective resume will not only highlight relevant experience but also demonstrate an understanding of key financial concepts and analytical capabilities that are vital for success as an Equity Research Analyst. This guide will provide practical and actionable resume tips specifically tailored for professionals in this dynamic field, helping you stand out in a competitive job market.

Top Resume Tips for Equity Research Analyst Professionals

- Tailor your resume to the job description by incorporating relevant keywords and phrases that align with the specific role you are applying for.

- Highlight your educational background, particularly any degrees in finance, economics, or related fields that are relevant to equity research.

- Showcase relevant experience, including internships or previous roles in finance or investment analysis, demonstrating a clear progression in your career.

- Quantify your achievements by using specific metrics, such as the percentage of returns generated from your analyses or the number of stocks covered successfully.

- Emphasize your analytical skills by detailing specific tools and methodologies you are proficient in, such as financial modeling, valuation techniques, and data analysis software.

- Include any certifications that enhance your credibility, such as the Chartered Financial Analyst (CFA) designation or other relevant credentials.

- Demonstrate your understanding of market trends and economic factors that influence investment decisions, showcasing your ability to analyze and interpret data effectively.

- Highlight your communication skills, as presenting findings and recommendations clearly is crucial in equity research.

- Keep your resume concise and focused, ideally limited to one page, to ensure clarity and ease of reading.

By implementing these tips, you can significantly increase your chances of landing a job in the Equity Research Analyst field. A well-structured and tailored resume will not only showcase your qualifications but also reflect your commitment to the profession, making you a compelling candidate in the eyes of potential employers.

Why Resume Headlines & Titles are Important for Equity Research Analyst

In the competitive field of equity research analysis, a well-crafted resume is essential for standing out among numerous candidates. The resume headline or title serves as the first impression for hiring managers, encapsulating a candidate's key qualifications in a single impactful phrase. A strong headline not only grabs attention but also provides a succinct summary of the candidate's expertise, making it vital to align it with the specific role being applied for. By being concise and relevant, the resume headline can set the tone for the entire application and highlight the candidate's suitability for the position.

Best Practices for Crafting Resume Headlines for Equity Research Analyst

- Keep it concise: Aim for one to two lines that encapsulate your expertise.

- Be role-specific: Tailor the headline to reflect the specific requirements of the equity research analyst position.

- Highlight key strengths: Focus on your most relevant skills or accomplishments that are attractive to potential employers.

- Use industry keywords: Incorporate terminology that is commonly recognized in the finance and equity research sectors.

- Avoid generic terms: Steer clear of vague phrases that do not differentiate you from other candidates.

- Showcase results: If possible, include quantifiable achievements that demonstrate your impact in previous roles.

- Maintain professionalism: Ensure that the tone aligns with the level of professionalism expected in the finance industry.

- Be honest: Ensure that your headline accurately reflects your experience and skills without exaggeration.

Example Resume Headlines for Equity Research Analyst

Strong Resume Headlines

"Results-Driven Equity Research Analyst with 5+ Years of Experience in Financial Modeling and Valuation"

“Detail-Oriented Analyst Specializing in Growth Stocks and Market Trends with Proven Track Record of Successful Recommendations”

“Equity Research Professional with Expertise in Sector Analysis and Investment Strategy Development”

Weak Resume Headlines

“Equity Research Analyst”

“Finance Professional Looking for Opportunities”

The strong headlines are effective because they are specific and convey the candidate’s relevant experience and skills, allowing hiring managers to quickly assess their fit for the role. They highlight accomplishments and areas of expertise, setting a positive tone for the rest of the resume. Conversely, the weak headlines lack specificity and impact; they do not provide any insight into the candidate’s qualifications or what makes them stand out, making it easy for hiring managers to overlook them in favor of more compelling options.

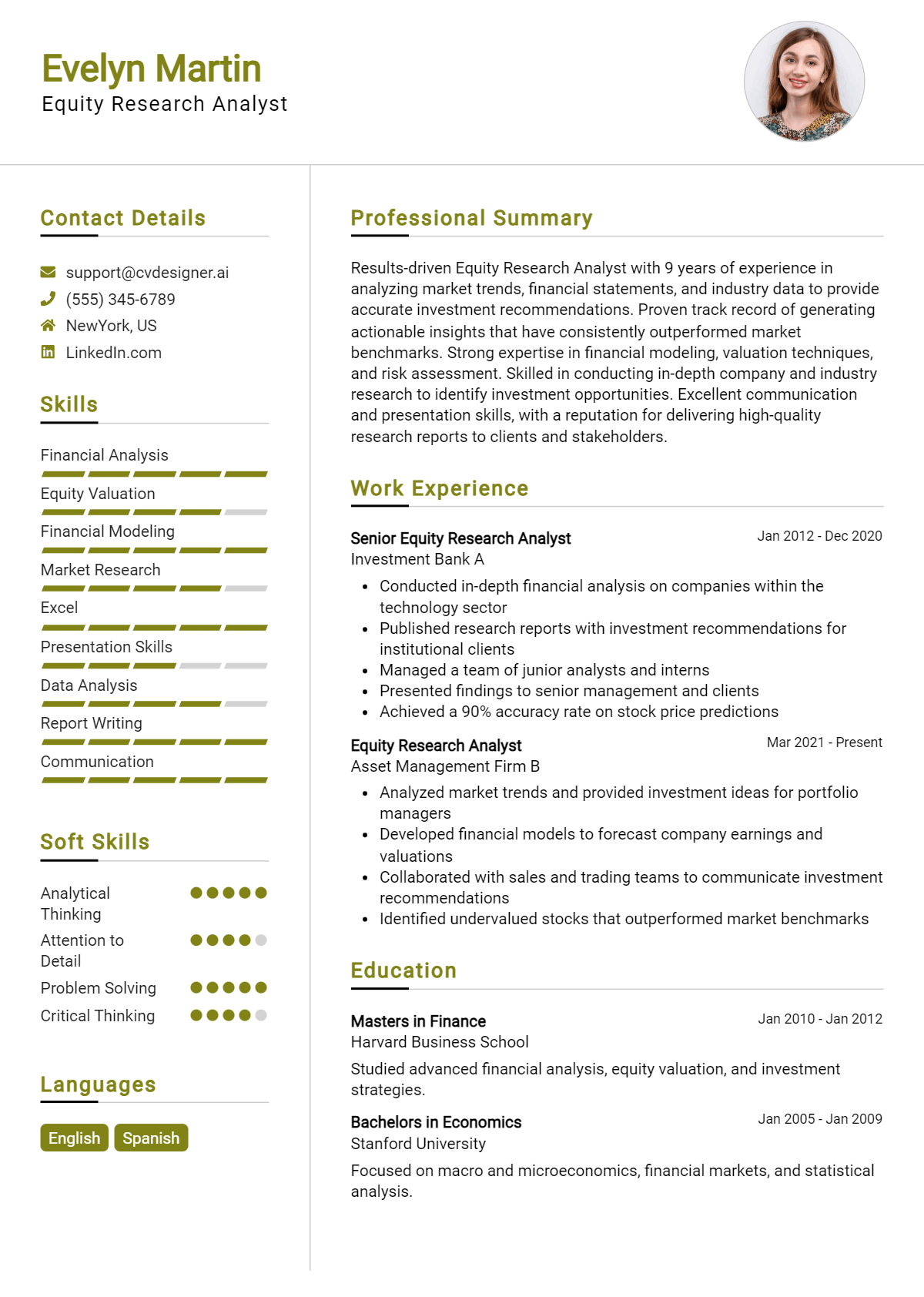

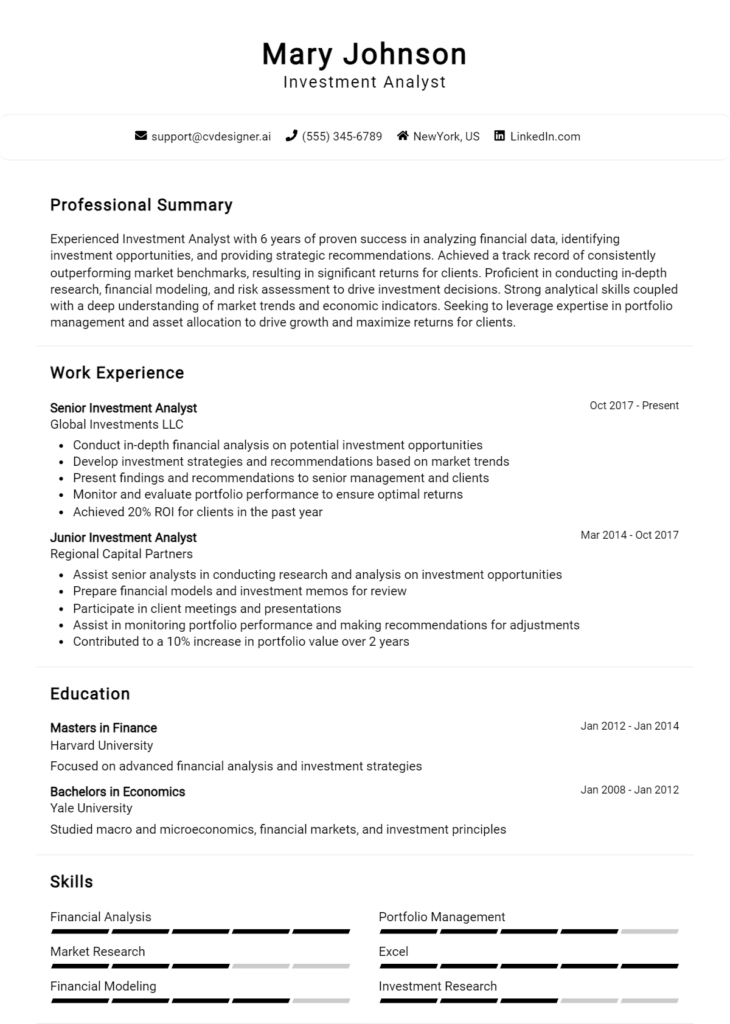

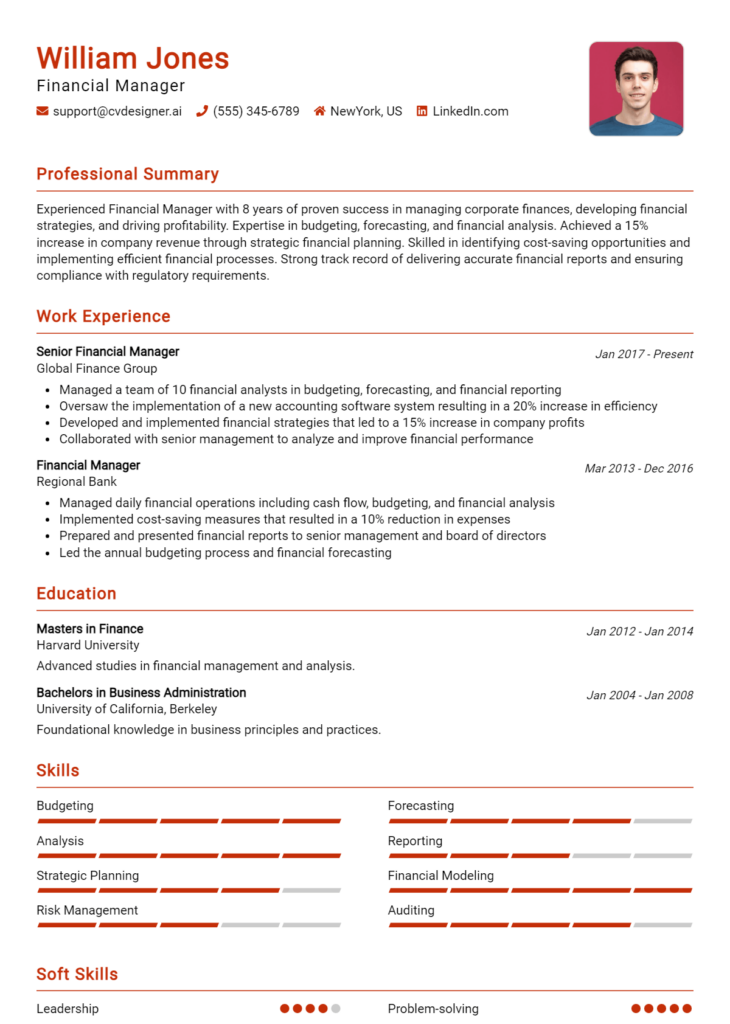

Writing an Exceptional Equity Research Analyst Resume Summary

A well-crafted resume summary is crucial for an Equity Research Analyst seeking to make a strong first impression on hiring managers. This brief yet impactful introduction serves as a snapshot of a candidate's key skills, relevant experience, and notable accomplishments in the financial sector. A powerful summary can quickly capture the attention of decision-makers, highlighting the applicant's ability to analyze market trends, provide actionable insights, and contribute to investment strategies. To be effective, it should be concise, focused, and tailored to align with the specific job description, ensuring that the applicant stands out in a competitive field.

Best Practices for Writing a Equity Research Analyst Resume Summary

- Quantify Achievements: Use specific numbers and data to illustrate your impact in previous roles.

- Focus on Relevant Skills: Highlight skills that are directly applicable to equity research, such as financial modeling and analytical abilities.

- Tailor to Job Description: Customize the summary to reflect the specific requirements and responsibilities of the job you are applying for.

- Keep it Concise: Aim for 3-5 sentences that deliver your key points effectively without being overly verbose.

- Use Strong Action Verbs: Start sentences with powerful verbs that convey confidence and proactivity.

- Highlight Industry Knowledge: Demonstrate familiarity with market analysis, sector trends, and investment strategies relevant to the position.

- Showcase Soft Skills: Include important soft skills like communication and teamwork that complement your analytical abilities.

- Proofread for Clarity: Ensure there are no grammatical errors or typos, as professionalism is key in finance roles.

Example Equity Research Analyst Resume Summaries

Strong Resume Summaries

Results-driven Equity Research Analyst with over 5 years of experience in analyzing market trends and providing actionable investment recommendations, leading to a 15% increase in portfolio performance for key clients.

Detail-oriented financial analyst proficient in building complex financial models and conducting thorough sector analysis, successfully identifying undervalued stocks that yielded a 20% ROI in the last fiscal year.

Dynamic Equity Research Analyst with expertise in technology and healthcare sectors, recognized for delivering insightful reports that improved investment strategies and contributed to a $2 million increase in client assets under management.

Seasoned analyst with a strong track record in equity valuation and risk assessment, achieving a 90% accuracy rate in earnings forecasts, which enhanced clients' decision-making processes.

Weak Resume Summaries

Equity Research Analyst with experience in finance looking for a new opportunity to use my skills.

Motivated professional with knowledge of market analysis and a strong desire to help clients succeed in their investments.

The examples of strong resume summaries effectively demonstrate the candidate's achievements with quantifiable results, specific skills relevant to the equity research role, and a direct connection to the responsibilities of the position. In contrast, the weak resume summaries lack detail, fail to showcase specific accomplishments or skills, and appear generic, making it difficult for hiring managers to see the candidate's unique value proposition.

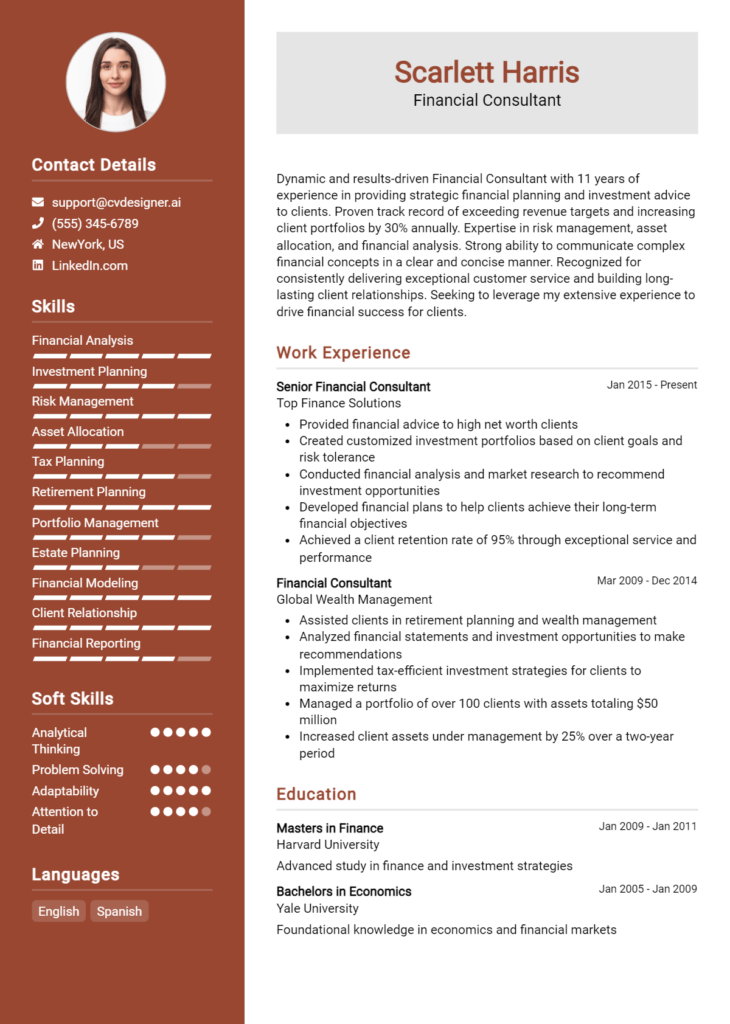

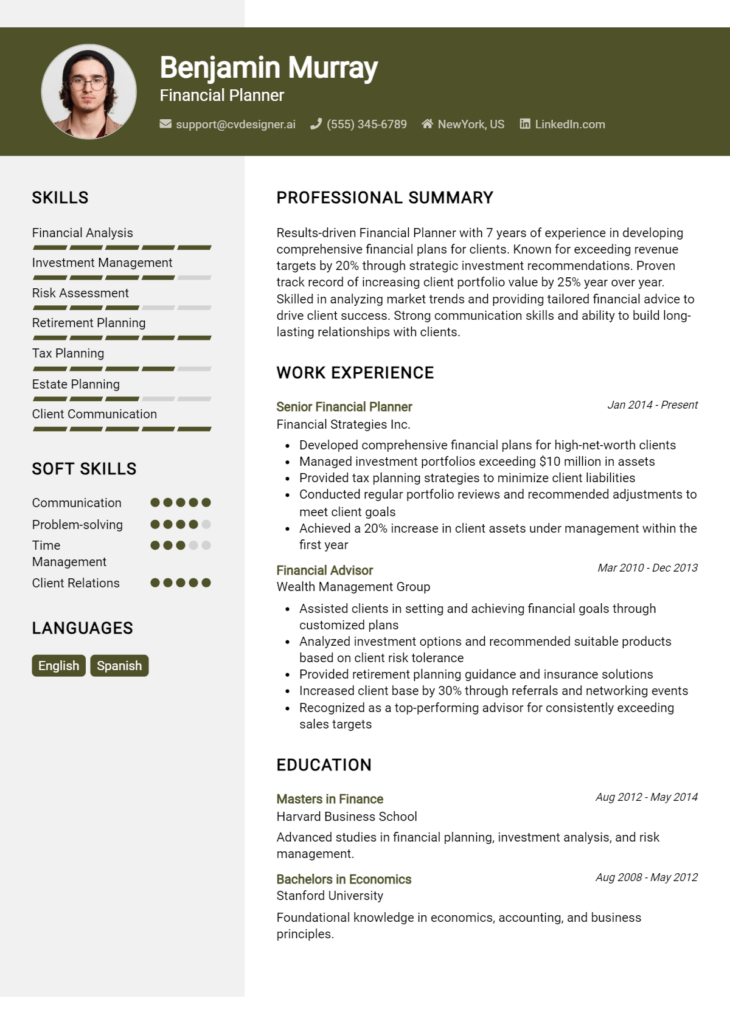

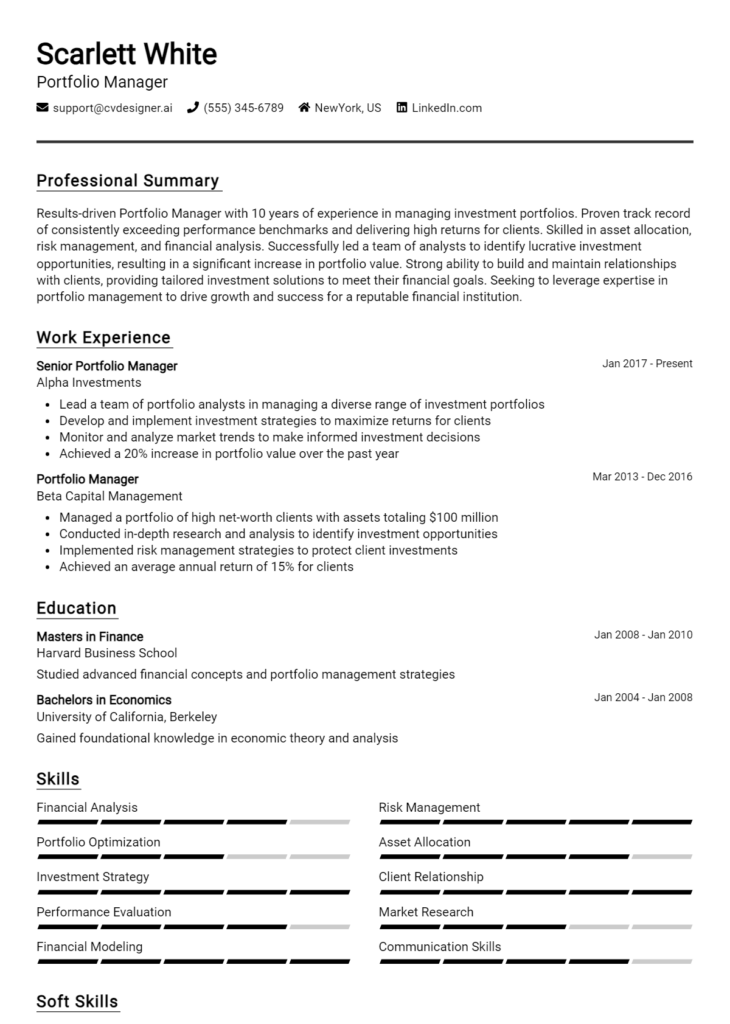

Work Experience Section for Equity Research Analyst Resume

The work experience section of an Equity Research Analyst resume is critical as it serves as a platform to demonstrate the candidate's technical skills, leadership abilities, and the capacity to deliver high-quality research products. This section not only highlights the practical application of financial analysis, valuation techniques, and market research but also emphasizes the importance of collaboration and teamwork in achieving tangible results. By quantifying achievements and aligning experiences with industry standards, candidates can effectively showcase their value to potential employers and distinguish themselves in a competitive job market.

Best Practices for Equity Research Analyst Work Experience

- Use industry-specific terminology to demonstrate your knowledge and expertise.

- Quantify your achievements with metrics, such as percentage increases in revenue or assets under management.

- Highlight your technical skills, including proficiency in financial modeling, data analysis tools, and valuation methods.

- Emphasize teamwork and collaboration by detailing projects where you led or contributed significantly to a team effort.

- Focus on results-driven experiences that align with the expectations of potential employers in the finance industry.

- Tailor your experiences to reflect the requirements of the specific equity research roles you are applying for.

- Incorporate action verbs to convey a sense of proactivity and leadership in your previous roles.

- Avoid jargon that may not be universally understood; keep language clear and concise for a broader audience.

Example Work Experiences for Equity Research Analyst

Strong Experiences

- Led a team of 5 analysts in the comprehensive evaluation of 15 publicly traded companies, resulting in a 30% increase in client investment returns over one year.

- Developed and implemented a financial model that accurately predicted quarterly earnings, achieving a forecast accuracy rate of 95%.

- Collaborated with cross-functional teams to produce detailed sector reports, enhancing client engagement and securing 10 new high-value accounts.

- Streamlined data analysis processes, reducing the time to complete market assessments by 25% while maintaining high-quality outputs.

Weak Experiences

- Worked on various financial projects with little detail provided on outcomes or contributions.

- Performed analysis for different companies without specifying the impact or results of the work.

- Assisted in team tasks and projects without defining specific roles or responsibilities.

- Involved in general market research activities without quantifiable achievements or clear results.

The examples categorized as strong demonstrate clear, quantifiable outcomes and a proactive approach, effectively showcasing the candidate's technical leadership and collaborative efforts. In contrast, the weak experiences lack specific details, measurable results, and clarity regarding the candidate's contributions, making them less impactful in conveying expertise and value to potential employers.

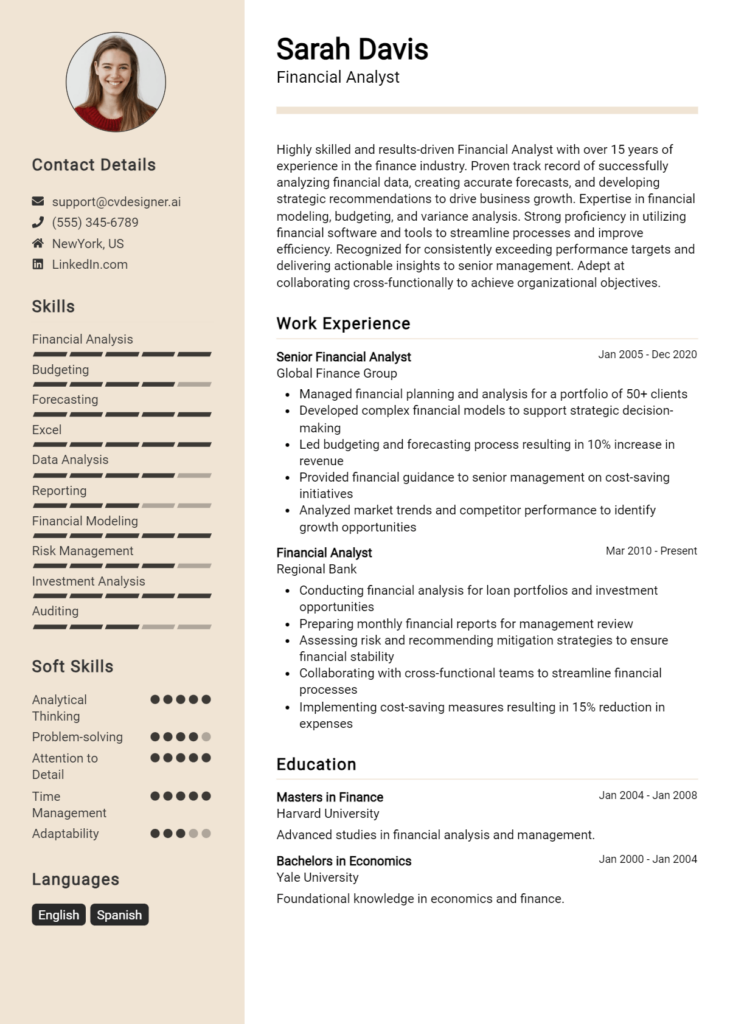

Certifications and Education for a Equity Research Analyst Resume

When crafting a resume for an Equity Research Analyst position, it is essential to highlight both your educational background and relevant certifications. These components demonstrate your expertise and commitment to the field, making you a more attractive candidate.

Education:

Bachelor’s Degree in Finance, Economics, or Accounting: A foundational degree in these fields is often a prerequisite for positions in equity research. This educational background provides essential knowledge of financial markets, economic principles, and accounting practices.

Master of Business Administration (MBA): An MBA, particularly with a concentration in Finance or Investment Management, can significantly enhance your qualifications. This advanced degree helps you develop a deeper understanding of corporate finance, investment analysis, and strategic decision-making.

Master’s Degree in Finance or Economics: If you pursued a specialized master’s degree, it can set you apart from other candidates. Programs focusing on quantitative finance or financial engineering are particularly relevant and demonstrate a strong analytical skill set.

Bachelor’s Degree in Mathematics or Statistics: A background in mathematics or statistics is valuable in equity research, as it equips you with the quantitative skills necessary for analyzing financial data and developing complex financial models.

Certifications:

Chartered Financial Analyst (CFA): The CFA designation is one of the most recognized and respected credentials in finance and investment analysis. Earning this certification demonstrates your expertise in investment management, portfolio analysis, and financial reporting.

Financial Risk Manager (FRM): This certification focuses on risk management and is beneficial for understanding the risks associated with investments, making it valuable for equity research roles.

Chartered Market Technician (CMT): If your focus is on technical analysis, the CMT designation is relevant. It signifies your proficiency in analyzing price movements and trends, which can complement fundamental analysis in equity research.

Certified Public Accountant (CPA): Although more accounting-focused, a CPA certification can be beneficial for equity research analysts, especially those who will analyze financial statements and assess company performance.

When listing your education and certifications, ensure to format them clearly and concisely. Include the degree or certification, the institution or organization, and the date obtained, if applicable. Prioritize the most relevant certifications and degrees at the top of your resume to immediately capture the attention of hiring managers.

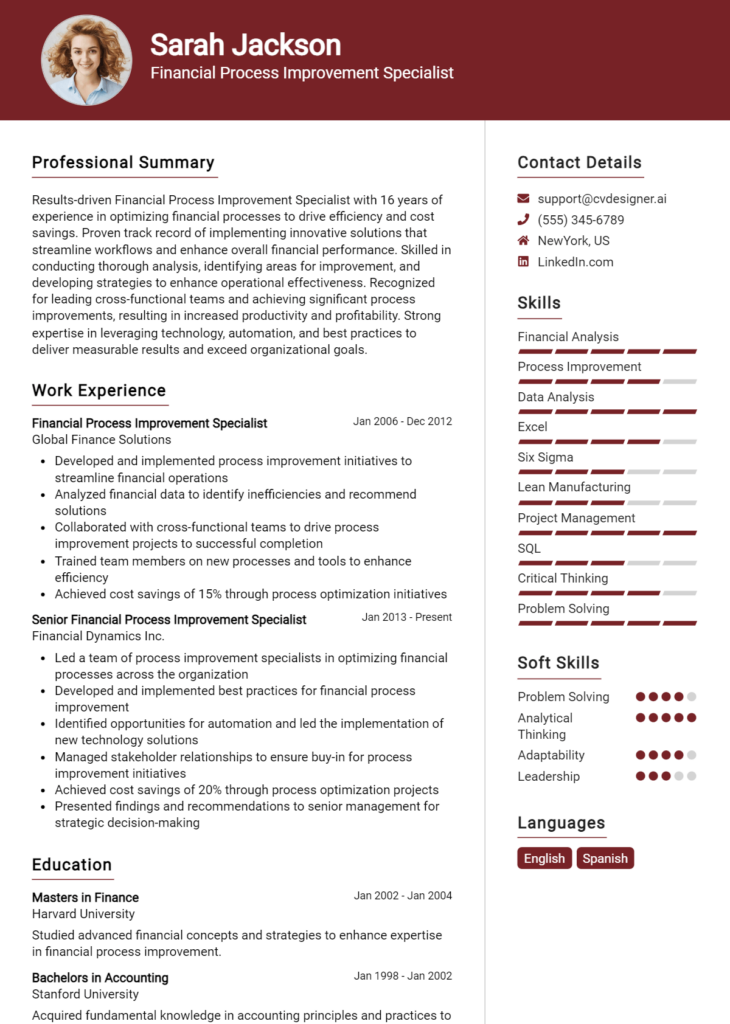

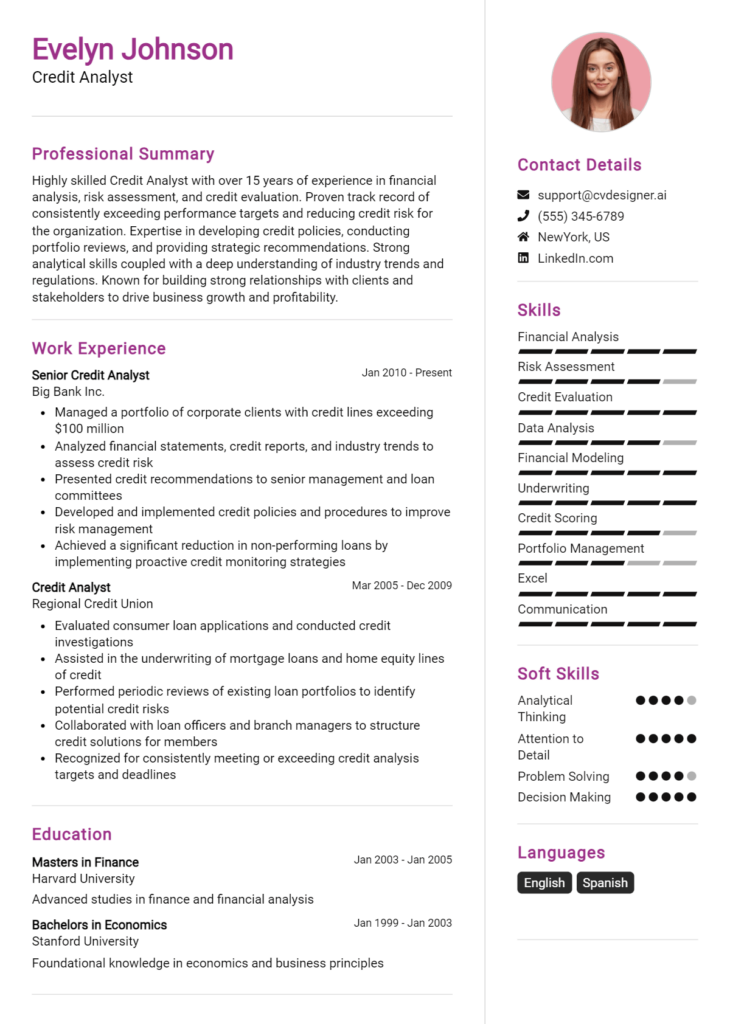

Top Skills & Keywords for Equity Research Analyst Resume

As an Equity Research Analyst, showcasing the right skills on your resume is crucial for standing out in a competitive job market. Employers seek candidates who not only have technical proficiency but also possess the soft skills necessary to interpret data, communicate insights effectively, and work collaboratively within teams. A well-rounded resume should emphasize both hard and soft skills, giving potential employers a clear picture of your qualifications. Tailoring your resume with the right skills can significantly enhance your chances of landing an interview, while also reflecting your ability to analyze complex financial data and contribute to investment strategies.

Top Hard & Soft Skills for Equity Research Analyst

Hard Skills

- Financial modeling

- Valuation techniques (DCF, comparables, precedent transactions)

- Proficient in Excel and other data analysis tools

- Knowledge of financial statements and ratios

- Investment research methodologies

- Statistical analysis

- Proficiency in Bloomberg or similar platforms

- Data visualization tools (Tableau, Power BI)

- Report writing and presentation skills

- Familiarity with regulatory frameworks and compliance

- Understanding of macroeconomic indicators

- Risk assessment and management

- Industry-specific knowledge (e.g., technology, healthcare)

- Database management and querying (SQL)

Soft Skills

- Strong analytical thinking

- Effective communication skills

- Attention to detail

- Problem-solving abilities

- Time management and organizational skills

- Team collaboration and interpersonal skills

- Adaptability to changing market conditions

- Critical thinking and decision-making

- Initiative and self-motivation

- Ability to work under pressure

- Client relationship management

- Negotiation skills

- Emotional intelligence

- Networking abilities

- Research and inquiry skills

Having a balanced combination of these hard and soft skills will not only enhance your work experience but also position you as a valuable asset to any investment firm or financial institution.

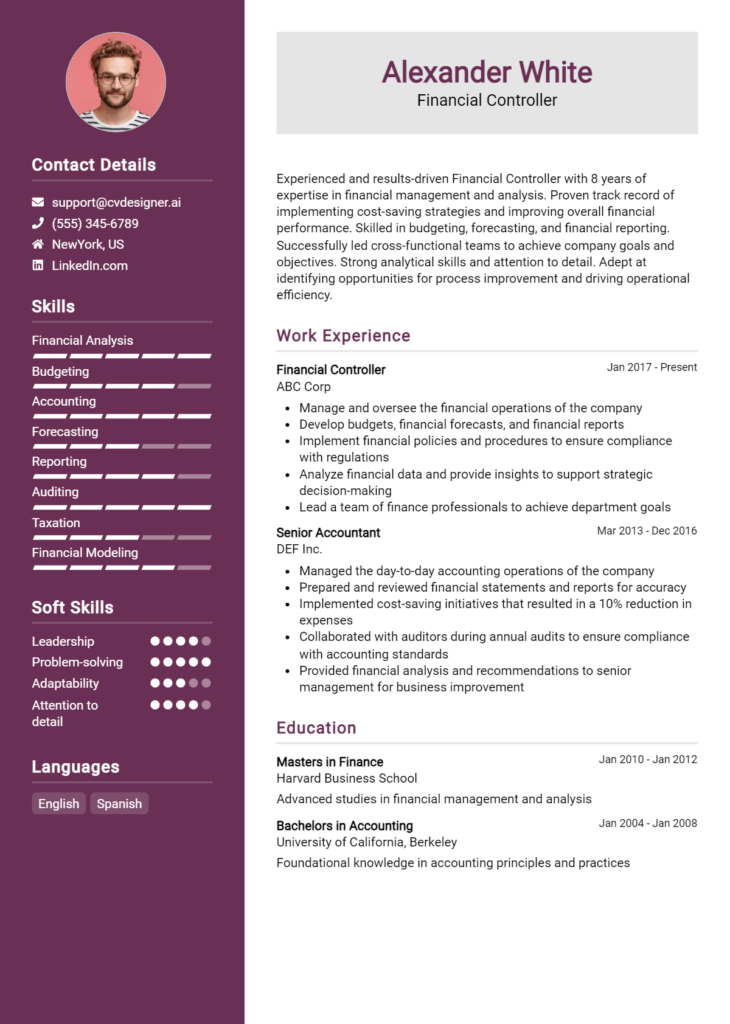

Stand Out with a Winning Equity Research Analyst Cover Letter

As a dedicated and detail-oriented finance professional with a robust background in financial analysis and equity research, I am excited to apply for the Equity Research Analyst position at [Company Name]. With a strong academic foundation in finance and extensive hands-on experience analyzing equity markets, I am confident in my ability to contribute effectively to your team. My proficiency in financial modeling, valuation techniques, and market trend analysis has equipped me with the skills necessary to provide actionable insights and support informed investment decisions.

In my previous role at [Previous Company Name], I successfully covered various sectors, including technology and consumer goods, where I conducted comprehensive analyses of financial statements, industry trends, and competitive landscapes. My ability to synthesize complex data into clear and concise reports allowed senior management to make informed investment choices. I also collaborated closely with portfolio managers to refine investment strategies, which resulted in a notable increase in portfolio performance. Furthermore, my experience with advanced analytical tools and software has enhanced my efficiency and accuracy in generating research reports.

I am particularly drawn to the opportunity at [Company Name] due to your commitment to excellence in equity research and your reputation for innovative investment strategies. I admire your focus on thorough analysis and long-term value creation, which aligns perfectly with my professional philosophy. I am eager to bring my analytical skills and passion for market research to your esteemed firm, where I can contribute to uncovering investment opportunities and mitigating risks.

Thank you for considering my application. I look forward to the possibility of discussing how my background, skills, and enthusiasm for equity research can contribute to the continued success of [Company Name]. I am excited about the opportunity to join your team and support your mission of delivering exceptional investment insights.

Common Mistakes to Avoid in a Equity Research Analyst Resume

When crafting a resume for an Equity Research Analyst position, it's crucial to convey your analytical skills, financial acumen, and relevant experience effectively. However, many candidates make common mistakes that can hinder their chances of landing an interview. By avoiding these pitfalls, you can create a more compelling resume that stands out to hiring managers.

Overly Generic Objective Statement: A vague objective fails to demonstrate your specific interest in equity research or how your skills align with the firm's needs. Tailor your objective to reflect your career goals and the specific position.

Lack of Quantifiable Achievements: Failing to include metrics or specific outcomes in your achievements can make your experience seem less impactful. Use numbers to highlight your contributions, such as "Increased portfolio performance by 15% over 12 months."

Ignoring Relevant Keywords: Many companies use Applicant Tracking Systems (ATS) to filter resumes. Not incorporating industry-specific keywords related to equity research can cause your resume to be overlooked. Review the job description and include relevant terms.

Poor Formatting and Design: A cluttered or unprofessional layout can distract from your content. Use a clean, organized format with consistent fonts and headings to enhance readability.

Neglecting Soft Skills: While technical skills are essential, ignoring soft skills like teamwork, communication, and problem-solving can undervalue your resume. Be sure to include examples that demonstrate these abilities in context.

Detailing Irrelevant Experience: Including unrelated job experiences can dilute the focus of your resume. Concentrate on roles and responsibilities that are directly relevant to equity research to maintain relevance.

Grammatical Errors and Typos: Simple mistakes can signal a lack of attention to detail—an essential trait for an Equity Research Analyst. Always proofread your resume or have someone else review it to catch errors.

Not Tailoring for Each Application: Sending the same resume to every employer can reduce your chances of success. Customize your resume for each application to reflect the specific requirements and culture of the company.