Credit Analyst Core Responsibilities

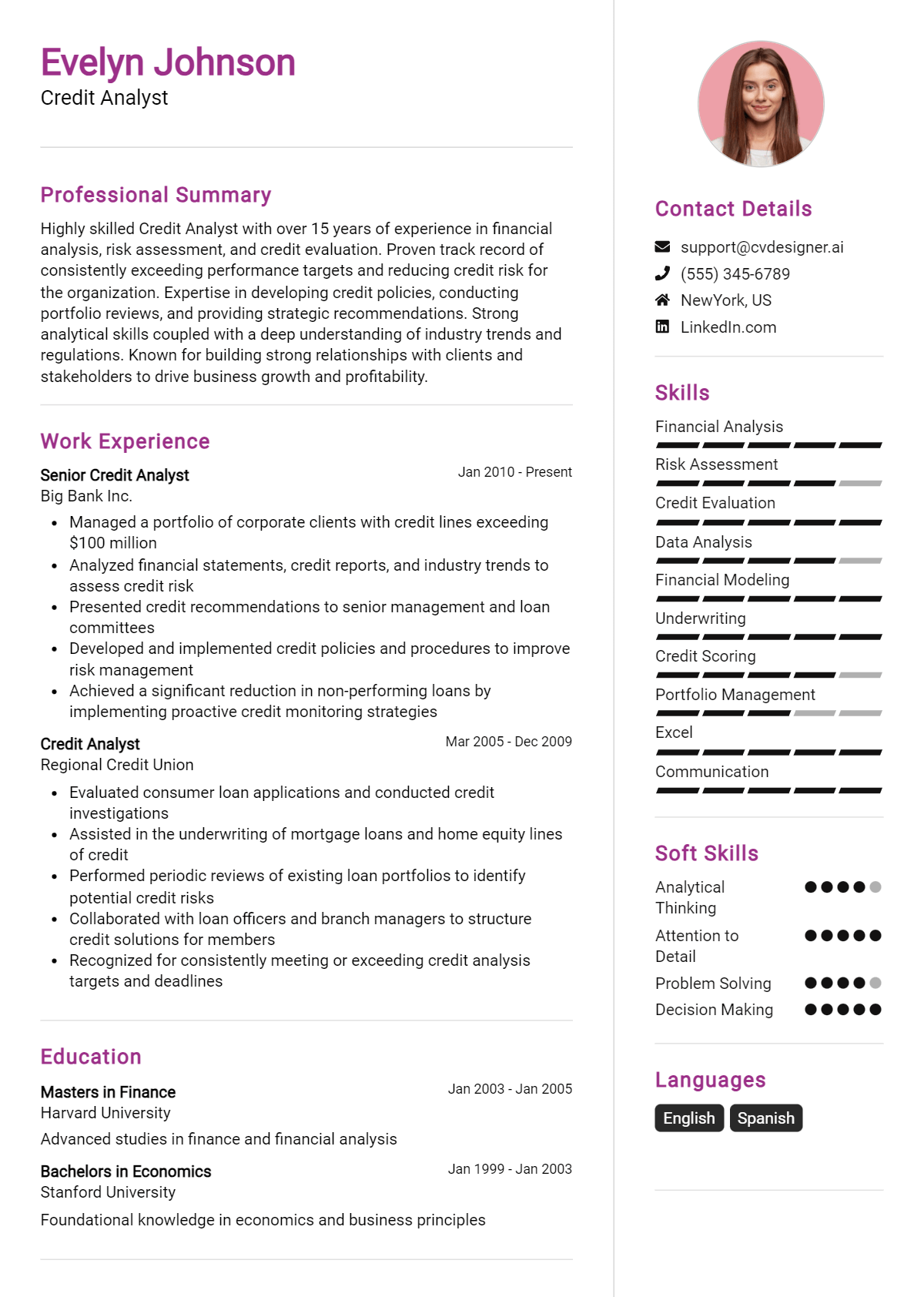

A Credit Analyst plays a crucial role by evaluating credit data and financial information to assess the risk of lending to individuals or businesses. This position requires strong analytical and problem-solving skills, along with technical expertise in financial modeling and risk assessment. The Credit Analyst collaborates with various departments, including finance, sales, and risk management, ensuring that informed lending decisions align with the organization’s goals. A well-structured resume that highlights these competencies can effectively showcase a candidate’s suitability for the role.

Common Responsibilities Listed on Credit Analyst Resume

- Analyze credit data and financial statements to determine creditworthiness.

- Prepare detailed reports and presentations for management review.

- Conduct risk assessments and recommend appropriate credit limits.

- Monitor and evaluate existing loans for ongoing risk management.

- Collaborate with sales and finance teams to support lending strategies.

- Stay updated on industry trends and regulatory changes affecting credit.

- Communicate findings and recommendations to stakeholders effectively.

- Utilize financial modeling techniques to predict future credit trends.

- Develop and maintain credit policies and procedures.

- Assist in the collection and analysis of economic data relevant to credit decisions.

- Participate in training and development initiatives for continuous improvement.

- Support the audit process by providing necessary documentation and analysis.

High-Level Resume Tips for Credit Analyst Professionals

In today's competitive job market, a well-crafted resume is crucial for Credit Analyst professionals aiming to make a strong first impression on potential employers. Your resume serves as the initial point of contact, encapsulating your skills, experiences, and achievements in a concise manner that can set you apart from other candidates. It is essential that your resume not only highlights your analytical abilities and industry knowledge but also effectively communicates your unique value proposition. This guide will provide practical and actionable resume tips specifically tailored for Credit Analyst professionals, ensuring you present yourself in the best possible light.

Top Resume Tips for Credit Analyst Professionals

- Tailor your resume to the specific job description, using relevant keywords to align your experience with the employer's needs.

- Highlight your educational background, particularly if you hold a degree in finance, economics, or a related field.

- Showcase relevant work experience, emphasizing roles that involved financial analysis, risk assessment, and credit evaluation.

- Quantify your achievements with specific metrics, such as "Improved credit risk assessment processes, reducing default rates by 20%."

- Include industry-specific skills, such as proficiency in financial modeling, data analysis software, and knowledge of credit regulations.

- Highlight certifications or licenses, such as CFA or CPA, which can enhance your credibility and demonstrate your commitment to the profession.

- Utilize action verbs to convey your contributions effectively, such as "analyzed," "evaluated," and "developed."

- Keep the format clean and professional, using clear headings and bullet points for easy readability.

- Include a summary statement that captures your career goals and the unique skills you bring to a potential employer.

Implementing these tips can significantly increase your chances of landing a job in the Credit Analyst field. By presenting a polished and focused resume that highlights your relevant skills and accomplishments, you can effectively capture the attention of hiring managers and position yourself as a strong candidate for the role.

Why Resume Headlines & Titles are Important for Credit Analyst

In the competitive field of credit analysis, a well-crafted resume headline or title can significantly impact a candidate's chances of standing out to hiring managers. A strong headline serves as an immediate hook, capturing attention and summarizing key qualifications in a single, impactful phrase. It should be concise, relevant, and directly aligned with the job being applied for, effectively communicating the candidate's unique value proposition at a glance. By emphasizing critical skills and experiences that resonate with the role of a Credit Analyst, a compelling resume headline sets the stage for the rest of the application and enhances the likelihood of securing an interview.

Best Practices for Crafting Resume Headlines for Credit Analyst

- Keep it concise: Aim for one impactful phrase that summarizes your expertise.

- Be role-specific: Tailor your headline to reflect the specific position of Credit Analyst.

- Highlight key skills: Incorporate essential skills relevant to the credit analysis field.

- Use industry keywords: Include terms and phrases that hiring managers are likely to search for.

- Showcase achievements: If applicable, mention any notable accomplishments that set you apart.

- Maintain professionalism: Ensure the tone is formal and reflects your professional demeanor.

- Avoid jargon: Use clear language that can be easily understood by HR personnel and hiring managers.

- Update frequently: Revise your headline for each application to keep it relevant to the specific role.

Example Resume Headlines for Credit Analyst

Strong Resume Headlines

"Detail-Oriented Credit Analyst with 5+ Years of Experience in Risk Assessment and Portfolio Management"

“Analytical Credit Analyst Specializing in Financial Modeling and Credit Risk Evaluation”

“Results-Driven Credit Analyst with Proven Track Record in Enhancing Loan Portfolio Performance”

Weak Resume Headlines

“Experienced Professional Looking for a Job”

“Credit Analyst with Various Skills”

The strong headlines are effective because they clearly communicate the candidate's specific expertise and relevant experience, making it easy for hiring managers to identify their qualifications at a glance. They provide a sense of professionalism and focus that aligns with the role of a Credit Analyst. In contrast, the weak headlines fail to impress due to their vagueness and lack of specificity; they do not convey any meaningful information about the candidate's skills or suitability for the role, which can lead to their application being overlooked in favor of more compelling candidates.

Writing an Exceptional Credit Analyst Resume Summary

A well-crafted resume summary is essential for a Credit Analyst as it serves as the first impression a hiring manager has of a candidate. In a competitive job market, a strong summary quickly captures attention by succinctly highlighting key skills, relevant experience, and notable accomplishments in the field of credit analysis. It should be concise, impactful, and tailored specifically to the job being applied for, effectively setting the tone for the rest of the resume and increasing the chances of progressing to the interview stage.

Best Practices for Writing a Credit Analyst Resume Summary

- Quantify Achievements: Use numbers to showcase your impact, such as percentage improvements or monetary savings.

- Focus on Relevant Skills: Highlight skills that are specifically mentioned in the job description.

- Tailor the Summary: Customize your summary for each job application to align with the employer’s needs.

- Keep it Concise: Aim for 2-4 sentences that deliver maximum information in minimal space.

- Use Action Verbs: Start sentences with strong action verbs to create a dynamic and engaging tone.

- Highlight Industry Knowledge: Mention your familiarity with industry regulations, tools, or methodologies.

- Showcase Problem-Solving Abilities: Emphasize your ability to analyze data and make informed recommendations.

- Include Professional Development: Mention any relevant certifications or training that enhance your qualifications.

Example Credit Analyst Resume Summaries

Strong Resume Summaries

Detail-oriented Credit Analyst with over 5 years of experience in evaluating creditworthiness and risk assessment, successfully reducing default rates by 20% through comprehensive analysis and strategic recommendations.

Results-driven professional with expertise in financial modeling and data analysis, having contributed to a 30% increase in portfolio performance by implementing innovative credit assessment techniques.

Dynamic Credit Analyst proficient in utilizing advanced analytics tools and methodologies; recognized for improving credit evaluation processes, resulting in a $1.5 million increase in approved loans over a fiscal year.

Weak Resume Summaries

Experienced analyst looking for a challenging position in credit analysis.

Motivated individual with skills in financial analysis and credit evaluation.

The examples of strong resume summaries are considered effective because they provide specific achievements and relevant skills that directly relate to the role of a Credit Analyst. They quantify results and demonstrate a clear understanding of the job requirements. In contrast, the weak summaries lack detail and specificity, making them too vague and generic to leave a lasting impression on hiring managers.

Work Experience Section for Credit Analyst Resume

The work experience section of a Credit Analyst resume is a critical component that highlights a candidate's technical expertise, leadership abilities, and commitment to delivering high-quality results. This section serves as a platform to demonstrate how previous roles have equipped the candidate with the skills necessary to assess creditworthiness, analyze financial data, and make informed lending decisions. By quantifying achievements and aligning experiences with industry standards, candidates can effectively showcase their value to potential employers and distinguish themselves in a competitive job market.

Best Practices for Credit Analyst Work Experience

- Highlight relevant technical skills such as financial modeling, risk assessment, and data analysis.

- Quantify achievements with metrics, such as percentage increases in portfolio performance or reductions in delinquency rates.

- Demonstrate the ability to collaborate with cross-functional teams to enhance decision-making processes.

- Use action verbs to convey leadership and initiative in previous roles.

- Tailor job descriptions to align with the specific requirements of the Credit Analyst position you are applying for.

- Include certifications or training relevant to credit analysis, such as CFA or credit risk certifications.

- Showcase experience with credit risk assessment tools and software.

- Detail any involvement in credit policy development or improvements in analytical processes.

Example Work Experiences for Credit Analyst

Strong Experiences

- Led a team of analysts to restructure credit evaluation processes, resulting in a 30% decrease in approval time for loan applications.

- Implemented a risk assessment model that improved portfolio performance by 15%, enhancing overall profitability for the lending department.

- Collaborated with the finance department to create a comprehensive financial reporting system, increasing the accuracy of credit risk assessments by 25%.

- Conducted in-depth market analysis that identified emerging risks, leading to a strategic pivot that mitigated potential losses of over $1 million.

Weak Experiences

- Worked on various credit-related tasks without specifying contributions or outcomes.

- Assisted in analyzing financial statements but did not mention any tools or methodologies used.

- Participated in team meetings and discussions regarding credit policies.

- Responsible for credit reports without detailing the impact or results of the reports created.

The examples provided are considered strong because they showcase specific achievements, quantifiable results, and the candidate’s ability to lead and collaborate effectively. Each bullet point demonstrates how the candidate has made a tangible impact in previous roles, thereby illustrating their readiness for a Credit Analyst position. Conversely, the weak experiences lack detail and fail to highlight significant contributions or outcomes, making them less compelling to potential employers.

Certifications and Education for a Credit Analyst Resume

When crafting a resume for a Credit Analyst position, it's essential to emphasize relevant education and certifications that demonstrate your expertise in financial analysis, credit evaluation, and risk assessment. Here are some guidelines for listing your certifications and education:

Certifications to Prioritize

Chartered Financial Analyst (CFA): This globally recognized certification is highly regarded in the finance and investment sectors. It signifies a deep understanding of investment management and financial analysis, making it a valuable asset for a Credit Analyst.

Certified Credit Professional (CCP): Offered by various credit organizations, this certification focuses specifically on credit management and analysis, equipping you with the skills necessary for effective credit risk assessment and decision-making.

Financial Risk Manager (FRM): This certification is ideal for those looking to specialize in risk management. It covers various aspects of financial risk, including credit risk, which is crucial for a Credit Analyst role.

Certification in Risk Management Assurance (CRMA): This certification is designed for professionals who want to demonstrate their knowledge in risk management and assurance, providing a competitive edge in the credit analysis field.

Educational Background Examples

Bachelor's Degree in Finance: A foundational degree that provides a comprehensive understanding of financial principles, investment strategies, and market analysis, which are essential for a Credit Analyst.

Bachelor's Degree in Accounting: This degree offers in-depth knowledge of accounting practices, financial reporting, and analysis, all of which are critical skills for evaluating creditworthiness.

Master's Degree in Business Administration (MBA) with a Finance Concentration: An MBA program enhances your analytical and strategic thinking skills while providing advanced knowledge in finance, making you a strong candidate for Credit Analyst positions.

Bachelor's Degree in Economics: This degree helps in understanding market trends, economic indicators, and their impact on credit and risk, which is vital for conducting thorough credit analyses.

When listing your education and certifications, ensure they are clearly formatted and easy to read. Consider including the institution's name, degree, major, and graduation date, as well as the certifying body and the date you obtained each certification. This will not only enhance your credibility but also showcase your commitment to professional development in the credit analysis field.

Top Skills & Keywords for Credit Analyst Resume

In the competitive field of credit analysis, showcasing the right skills on your resume is crucial for standing out to potential employers. A well-crafted resume that highlights both hard and soft skills can significantly improve your chances of landing an interview. Hard skills demonstrate your technical proficiency and knowledge, while soft skills reflect your ability to communicate and work effectively in a team. Together, these skills paint a comprehensive picture of your capabilities as a credit analyst, making it essential to carefully curate and present them on your resume.

Top Hard & Soft Skills for Credit Analyst

Soft Skills

- Analytical Thinking

- Attention to Detail

- Communication Skills

- Problem-Solving

- Time Management

- Team Collaboration

- Adaptability

- Critical Thinking

- Decision-Making

- Interpersonal Skills

- Negotiation Skills

- Customer Service Orientation

- Conflict Resolution

- Organizational Skills

- Creativity

- Emotional Intelligence

- Multi-tasking

- Active Listening

Hard Skills

- Financial Analysis

- Risk Assessment

- Credit Scoring Systems

- Data Analysis and Interpretation

- Financial Modelling

- Microsoft Excel Proficiency

- Knowledge of Accounting Principles

- Regulatory Compliance

- Report Writing

- Familiarity with Credit Management Software

- Statistical Analysis

- Economic Research

- Industry Trend Analysis

- Portfolio Management

- Financial Statement Analysis

- Knowledge of Investment Principles

- Forecasting Techniques

- Quantitative Analysis

For more insights on how to effectively showcase your skills and work experience in your resume, consider exploring additional resources and examples.

Stand Out with a Winning Credit Analyst Cover Letter

Dear Hiring Manager,

I am writing to express my interest in the Credit Analyst position at [Company Name]. With a solid foundation in finance and a proven track record of conducting thorough credit assessments, I am excited about the opportunity to contribute to your esteemed organization. My experience in analyzing credit data and financial statements, coupled with my attention to detail and analytical mindset, enables me to provide accurate evaluations that support sound lending decisions.

In my previous role at [Previous Company Name], I successfully analyzed a diverse portfolio of clients, assessing creditworthiness based on financial history and risk factors. By employing advanced financial modeling techniques and leveraging various data sources, I was able to identify trends and potential risks that informed our lending strategies. My ability to communicate complex financial concepts clearly to stakeholders has been crucial in driving consensus on credit-related decisions while ensuring compliance with regulatory standards.

I am particularly drawn to [Company Name] due to its commitment to innovative financial solutions and customer-centric approach. I am eager to bring my skills in data analysis, risk assessment, and financial reporting to your team. I am confident that my proactive approach and strong work ethic will allow me to make a meaningful contribution to your organization’s success. Thank you for considering my application. I look forward to the opportunity to discuss how I can support [Company Name] in achieving its financial objectives.

Sincerely,

[Your Name]

Common Mistakes to Avoid in a Credit Analyst Resume

When crafting a resume for a Credit Analyst position, it's crucial to present your qualifications and experience effectively. However, many candidates make common mistakes that can hinder their chances of landing an interview. Avoiding these pitfalls will help you create a compelling resume that showcases your skills and expertise in credit analysis. Below are several mistakes to steer clear of while preparing your Credit Analyst resume:

Generic Objective Statements: Using a vague objective that doesn’t specify your goals or how you can contribute to the company can make your resume blend in with others. Tailor your objective to reflect your aspirations in the credit analysis field.

Lack of Quantifiable Achievements: Merely listing responsibilities without quantifying your achievements fails to demonstrate your impact. Use specific numbers, percentages, or outcomes to convey your success in previous roles.

Ignoring Relevant Skills: Failing to highlight relevant skills such as financial modeling, risk assessment, or analytical software can leave out critical information that potential employers are looking for. Be sure to include both hard and soft skills relevant to the position.

Overloading with Jargon: While industry terminology can showcase your expertise, overusing jargon can make your resume difficult to read. Strive for clarity and ensure that your language is accessible.

Neglecting Formatting: A cluttered or unorganized layout can distract from your qualifications. Use clear headings, bullet points, and a consistent format to make your resume easy to navigate.

Omitting Keywords from Job Descriptions: Many companies use Applicant Tracking Systems (ATS) to scan resumes for keywords. Failing to incorporate relevant keywords from the job description can result in your resume being overlooked.

Including Irrelevant Experience: Listing unrelated work experience can dilute your credibility as a Credit Analyst. Focus on roles and accomplishments that directly relate to credit analysis or finance.

Not Tailoring for Each Application: Sending the same resume for every job application can signal a lack of interest. Customize your resume for each position to demonstrate your enthusiasm and fit for the specific role.

Conclusion

As a Credit Analyst, your role is pivotal in assessing the creditworthiness of individuals and businesses, analyzing financial data, and making informed recommendations. Key skills include strong analytical abilities, attention to detail, and proficiency in financial modeling and reporting. Staying updated with industry trends and regulations is essential to perform effectively in this position.

In conclusion, if you're looking to advance your career as a Credit Analyst, it’s crucial to ensure your resume stands out. Take the time to review and update your Credit Analyst Resume to reflect your skills and experiences effectively. Utilize available tools such as resume templates, resume builder, and cover letter templates to enhance your application materials. Start refining your resume today and secure your next opportunity in this dynamic field!