23 Treasury Systems Analyst Skills for Your Resume in 2025

As a Treasury Systems Analyst, possessing the right skills is crucial for effectively managing and optimizing treasury functions within an organization. This section outlines the essential skills that can enhance your resume and make you a standout candidate in the competitive field of treasury management. Whether you're analyzing cash flows, implementing treasury software, or ensuring compliance with financial regulations, these skills will serve as a strong foundation for your career advancement.

Best Treasury Systems Analyst Technical Skills

Technical skills are crucial for Treasury Systems Analysts as they enable professionals to effectively manage financial data, optimize treasury operations, and leverage technology for enhanced decision-making. Highlighting these skills on your resume can significantly increase your attractiveness to potential employers.

Financial Modeling

Financial modeling involves the creation of representations of a company's financial performance, essential for forecasting and strategic planning in treasury operations.

How to show it: Include specific models you developed and the impact they had on financial decisions or efficiency.

Data Analysis and Visualization

Data analysis and visualization skills allow Treasury Systems Analysts to interpret complex data and present it in understandable formats for stakeholders.

How to show it: Quantify the improvements in reporting accuracy or decision-making speed gained through your data visualization tools.

ERP Systems Proficiency

Proficiency in Enterprise Resource Planning (ERP) systems is vital for managing financial data and integrating treasury functions with other business processes.

How to show it: List specific ERP systems you have worked with and highlight any process improvements achieved through their implementation.

Cash Management Systems

Understanding cash management systems is essential for monitoring cash flow, optimizing liquidity, and managing banking relationships.

How to show it: Describe how your expertise led to improved cash flow forecasting or reduced banking fees.

Risk Management Techniques

Risk management skills help identify, assess, and mitigate financial risks, ensuring the organization's financial stability and compliance.

How to show it: Provide examples of risk assessments conducted and their outcomes in terms of loss prevention or cost savings.

SQL and Database Management

SQL and database management skills are crucial for querying databases and managing large sets of financial data efficiently.

How to show it: Highlight the complexity of the databases you managed and any efficiency improvements made through your SQL queries.

Excel Advanced Functions

Mastery of advanced Excel functions is key for data manipulation, financial modeling, and performing complex calculations quickly.

How to show it: List specific functions you used and the efficiencies gained in reporting or analysis tasks.

Project Management Skills

Project management skills are essential for overseeing treasury projects, ensuring they are completed on time and within budget.

How to show it: Describe the scope and impact of projects you led or contributed to, emphasizing on-time delivery and budget adherence.

Financial Reporting Standards

Knowledge of financial reporting standards ensures compliance and accuracy in financial statements, which is critical for transparency and trust.

How to show it: Show how your understanding of these standards improved compliance rates or reduced audit findings.

Automation Tools

Familiarity with automation tools streamlines treasury processes, reducing manual work and increasing accuracy in financial operations.

How to show it: Quantify the time saved or error reduction achieved through automation initiatives you implemented.

Compliance and Regulatory Knowledge

A strong grasp of compliance and regulatory requirements is necessary for managing risks and ensuring the organization adheres to financial regulations.

How to show it: Provide examples of compliance initiatives you led and their positive outcomes for the organization.

Best Treasury Systems Analyst Soft Skills

In the dynamic field of treasury management, soft skills play a pivotal role in enhancing a Treasury Systems Analyst's effectiveness. These workplace skills not only facilitate collaboration and problem-solving but also contribute to the overall efficiency of financial operations. Below are some essential soft skills that candidates should highlight on their resumes.

Communication

Effective communication ensures the clear dissemination of complex financial information to various stakeholders, enabling informed decision-making.

How to show it: Include examples of how you've successfully communicated technical concepts to non-technical stakeholders or led presentations.

Problem-solving

The ability to analyze issues and develop strategic solutions is crucial for navigating the challenges that arise in treasury operations.

How to show it: Demonstrate your problem-solving skills by detailing instances where your analytical approach resulted in significant process improvements or cost savings.

Time Management

Strong time management skills help in prioritizing tasks effectively, ensuring that critical deadlines in treasury functions are consistently met.

How to show it: Quantify your achievements by describing how you successfully managed multiple projects simultaneously while maintaining high-quality deliverables.

Teamwork

Collaboration with cross-functional teams is essential for a Treasury Systems Analyst to implement systems that align with organizational goals.

How to show it: Highlight your role in team projects, emphasizing your contribution to achieving collective objectives and fostering a cooperative work environment.

Attention to Detail

A keen attention to detail is vital for ensuring accuracy in financial reporting and system configurations, minimizing errors that could lead to significant issues.

How to show it: Provide examples of how your meticulous nature improved data integrity or enhanced reporting processes.

Adaptability

The treasury landscape is constantly evolving; therefore, being adaptable allows you to thrive in changing environments and embrace new technologies.

How to show it: Share experiences where you successfully adapted to new systems or processes, highlighting the positive outcomes of your flexibility.

Critical Thinking

Critical thinking enables Treasury Systems Analysts to assess complex scenarios and make informed, strategic recommendations based on data analysis.

How to show it: Illustrate your critical thinking abilities by discussing specific instances where your insights influenced key financial decisions.

Interpersonal Skills

Strong interpersonal skills foster positive relationships with colleagues and stakeholders, facilitating smoother collaboration and information exchange.

How to show it: Include testimonials or feedback from peers that highlight your ability to build rapport and work effectively with diverse teams.

Analytical Skills

Analytical skills are essential for evaluating financial data, identifying trends, and making data-driven recommendations to optimize treasury processes.

How to show it: Quantify your impact by detailing analyses you've performed that led to actionable insights or operational improvements.

Negotiation Skills

Negotiation skills are crucial for securing favorable terms with financial institutions and vendors, ultimately benefiting the organization’s bottom line.

How to show it: Describe successful negotiations you've led and the resulting benefits, such as cost reductions or enhanced service agreements.

Organizational Skills

Strong organizational skills facilitate effective management of financial data and ensure systematic processes are in place for treasury operations.

How to show it: Showcase your ability to maintain organized records and streamlined processes that led to improved efficiency.

How to List Treasury Systems Analyst Skills on Your Resume

Effectively listing your skills on a resume is crucial to standing out to employers in a competitive job market. Highlighting your capabilities allows hiring managers to quickly assess your qualifications. There are three main sections where skills can be emphasized: Resume Summary, Resume Work Experience, Resume Skills Section, and Cover Letter.

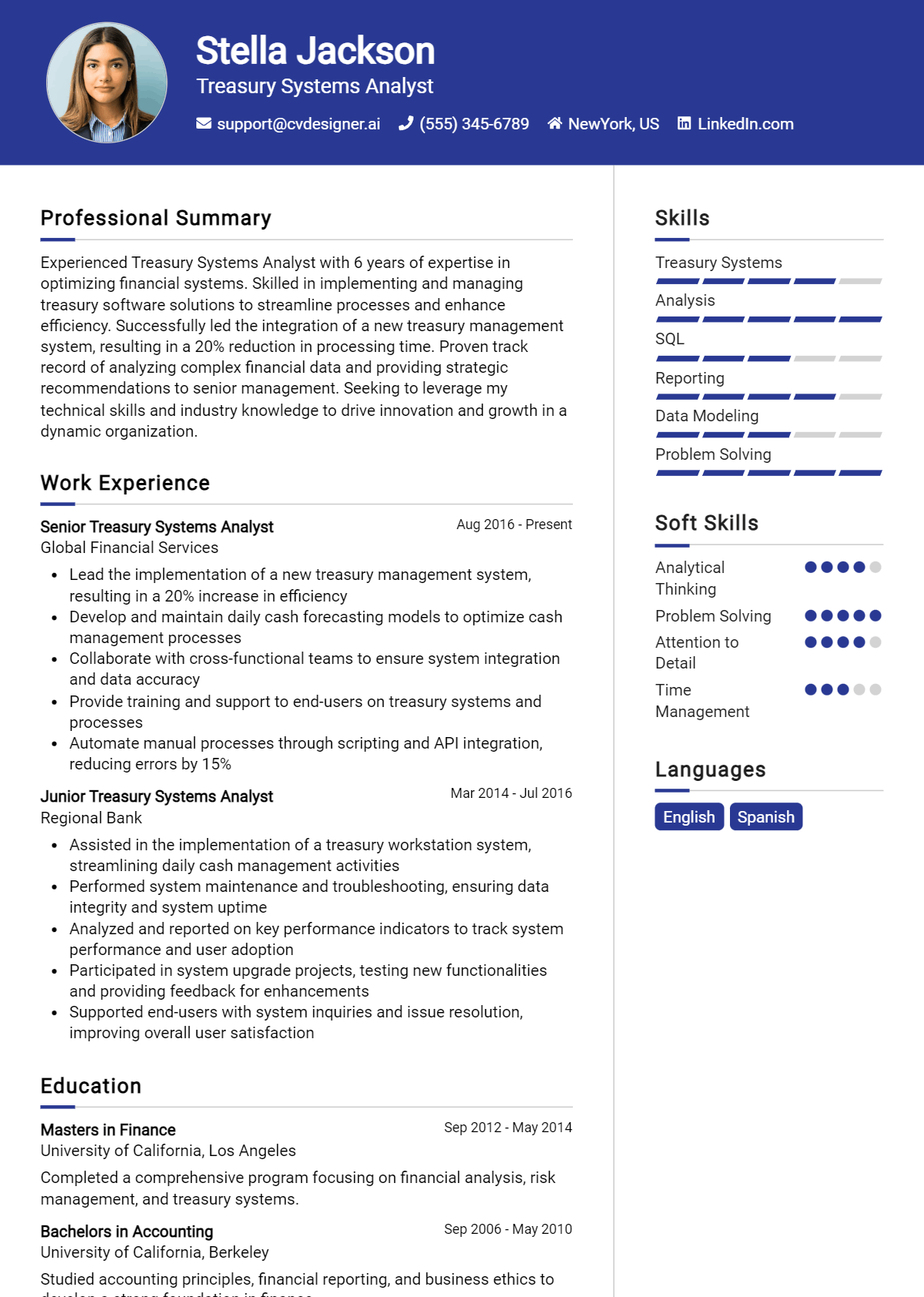

for Resume Summary

Showcasing Treasury Systems Analyst skills in the introduction section helps provide hiring managers with a concise overview of your qualifications, making a positive first impression.

Example

Driven Treasury Systems Analyst with expertise in financial modeling, risk assessment, and systems integration. Adept at utilizing ERP systems to optimize treasury operations and enhance cash flow management.

for Resume Work Experience

The work experience section is the perfect opportunity to demonstrate how your Treasury Systems Analyst skills have been applied in real-world scenarios, enhancing your candidacy.

Example

- Implemented a new cash management system, resulting in a 20% reduction in processing time.

- Collaborated with cross-functional teams to improve financial reporting, enhancing data accuracy.

- Conducted risk analysis that identified potential financial threats and established mitigation strategies.

- Trained team members on ERP software, improving user adoption rates by 30%.

for Resume Skills

The skills section can showcase both technical and transferable skills. A balanced mix of hard and soft skills will strengthen your overall qualifications.

Example

- Financial Modeling

- Cash Flow Management

- ERP Systems (SAP, Oracle)

- Risk Assessment

- Data Analysis

- Team Collaboration

- Process Improvement

for Cover Letter

A cover letter allows candidates to elaborate on the skills mentioned in the resume, providing a more personal touch. Highlighting 2-3 key skills that align with the job description can demonstrate how those skills have positively impacted your previous roles.

Example

In my previous role, my expertise in financial modeling led to a streamlined budget forecasting process, while my ability to conduct thorough risk assessments minimized potential fiscal liabilities by 15%. These skills will be invaluable in enhancing your treasury operations.

Linking the skills mentioned in your resume to specific achievements in your cover letter reinforces your qualifications for the job, making your application more compelling.

The Importance of Treasury Systems Analyst Resume Skills

In the competitive field of treasury management, a Treasury Systems Analyst plays a crucial role in optimizing financial systems and processes. Highlighting relevant skills on a resume is essential for candidates to capture the attention of recruiters and demonstrate their alignment with the job requirements. A well-crafted skills section not only showcases expertise but also provides tangible evidence of a candidate's ability to contribute effectively to an organization's financial health.

- Strong analytical skills are essential for Treasury Systems Analysts, as they must evaluate complex financial data and systems to provide insights that inform strategic decision-making. Highlighting these skills can set candidates apart as problem solvers.

- Technical proficiency in treasury management systems and financial software is critical. Candidates who list specific tools and technologies they are familiar with can demonstrate their readiness to hit the ground running and adapt quickly to new environments.

- Attention to detail is a vital skill for Treasury Systems Analysts, as even minor errors in financial reporting can lead to significant repercussions. Emphasizing this trait can assure employers of a candidate's commitment to accuracy and thoroughness.

- Effective communication skills are necessary for liaising with various stakeholders, including finance teams and IT departments. Candidates who can convey complex information clearly and concisely will have a competitive edge in collaborative environments.

- Knowledge of regulatory compliance and risk management is crucial in treasury functions. Candidates should highlight their understanding of relevant regulations, which can reassure employers of their ability to maintain compliance and minimize risks.

- Project management skills are beneficial for Treasury Systems Analysts involved in system implementations or upgrades. Demonstrating experience in managing projects can showcase a candidate's ability to deliver results within set timelines.

- Adaptability is important in a rapidly changing financial landscape. Candidates who illustrate their ability to learn and apply new concepts quickly can appeal to organizations looking for forward-thinking professionals.

- Collaboration skills are paramount, as Treasury Systems Analysts often work in teams to achieve common goals. Highlighting experiences that showcase teamwork can enhance a candidate's appeal to employers seeking cooperative contributors.

For more guidance on crafting an effective resume, consider exploring various Resume Samples that can inspire your own skills presentation.

How To Improve Treasury Systems Analyst Resume Skills

In the rapidly evolving financial landscape, it is crucial for Treasury Systems Analysts to continuously enhance their skills to stay competitive and effective in their roles. Improving your skill set not only boosts your resume but also equips you with the tools needed to address complex financial challenges, streamline processes, and leverage technology effectively. Here are some actionable tips to help you improve your skills as a Treasury Systems Analyst:

- Stay updated on the latest treasury management systems and technologies by attending workshops and webinars.

- Enhance your analytical skills through online courses in data analysis and financial modeling.

- Gain familiarity with programming languages such as SQL or Python to automate processes and improve efficiency.

- Network with other professionals in the field by joining industry associations and attending networking events.

- Seek feedback on your work from colleagues and supervisors to identify areas for improvement.

- Consider obtaining relevant certifications, such as the Certified Treasury Professional (CTP) designation, to validate your expertise.

- Practice problem-solving by taking on challenging projects or case studies related to treasury management.

Frequently Asked Questions

What technical skills are essential for a Treasury Systems Analyst?

A Treasury Systems Analyst should possess strong technical skills, including proficiency in treasury management systems (TMS), financial modeling software, and data analytics tools. Familiarity with programming languages such as SQL or Python for data manipulation, as well as expertise in Excel for financial analysis, is crucial. Additionally, knowledge of database management and ERP systems can enhance an analyst's ability to streamline treasury operations and reporting processes.

What analytical skills should be highlighted on a Treasury Systems Analyst resume?

Analytical skills are vital for a Treasury Systems Analyst, as they must interpret complex financial data and generate insights for decision-making. Highlighting skills such as quantitative analysis, risk assessment, and the ability to create financial forecasts can demonstrate analytical proficiency. Experience with scenario analysis and stress testing also showcases the candidate's capacity to evaluate the impact of various financial strategies and market conditions.

How important is knowledge of regulatory compliance for a Treasury Systems Analyst?

Knowledge of regulatory compliance is critical for a Treasury Systems Analyst, as they need to ensure that all treasury operations align with legal and regulatory standards. Understanding relevant regulations, such as those related to anti-money laundering (AML) and know your customer (KYC) requirements, is essential. This knowledge helps mitigate risks and ensures that the organization adheres to necessary reporting standards, thereby protecting the company from potential legal issues.

What interpersonal skills are beneficial for a Treasury Systems Analyst?

Interpersonal skills are important for a Treasury Systems Analyst, as they often collaborate with various departments, such as finance, accounting, and IT. Effective communication skills are necessary for conveying complex financial concepts to non-financial stakeholders. Additionally, strong problem-solving abilities and teamwork skills enhance the analyst's capacity to work on cross-functional projects and contribute to strategic decision-making processes.

How can a Treasury Systems Analyst demonstrate their project management skills on a resume?

A Treasury Systems Analyst can demonstrate project management skills by detailing specific projects they have led or participated in, such as system implementations, process improvements, or software upgrades. Including quantifiable outcomes, like reduced processing time or cost savings, can highlight their effectiveness in managing projects. Additionally, mentioning relevant project management methodologies, such as Agile or Waterfall, can further showcase their ability to oversee and deliver successful projects within the treasury function.

Conclusion

Including Treasury Systems Analyst skills in your resume is crucial for demonstrating your expertise and suitability for the role. By highlighting relevant skills, you not only differentiate yourself from other candidates but also showcase the value you bring to potential employers. A well-crafted resume that emphasizes your capabilities in managing treasury systems can significantly enhance your job prospects.

As you refine your skills and update your application materials, remember that preparation is key to achieving your career goals. Take the time to utilize resources such as [resume templates](https://resumedesign.ai/resume-templates/), [resume builder](https://app.resumedesign.ai/), [resume examples](https://resumedesign.ai/resume-examples/), and [cover letter templates](https://resumedesign.ai/cover-letter-templates/) to create a compelling job application that reflects your strengths and aspirations. Keep pushing forward, and you’ll be one step closer to landing your dream job!

Use an AI-powered resume builder and have your resume done in 5 minutes. Just select your template and our software will guide you through the process.