22 Hard and Soft Skills to Put On Underwriter Resume for 2025

As an underwriter, possessing the right skills is crucial for success in evaluating risks and making informed decisions. A strong skill set not only enhances your ability to assess applications accurately but also improves your overall efficiency and effectiveness in the role. In this section, we will outline the top underwriter skills that can elevate your resume and demonstrate your qualifications to potential employers.

Best Underwriter Technical Skills

Technical skills are essential for underwriters as they ensure accuracy in evaluating risk, analyzing data, and making informed decisions. Highlighting these skills on your resume can significantly enhance your appeal to potential employers, showcasing your proficiency in the underwriting process.

Risk Assessment

Risk assessment is crucial for underwriters to evaluate the likelihood of a claim being made. This skill involves analyzing data and market trends to understand potential risks associated with policies.

How to show it: Detail specific instances where your risk assessments led to successful policy decisions that minimized losses.

Data Analysis

Data analysis enables underwriters to interpret complex information from various sources, allowing them to make data-driven decisions that affect policy terms and pricing.

How to show it: Include examples of analysis projects that resulted in significant improvements in underwriting efficiency or accuracy.

Financial Acumen

Understanding financial principles is vital for underwriters, as they need to assess the financial stability of applicants to determine risk levels and policy terms.

How to show it: Quantify your experience with financial assessments that directly impacted underwriting outcomes.

Regulatory Knowledge

Knowledge of industry regulations is essential for underwriters to ensure compliance and mitigate legal risks when issuing policies.

How to show it: Highlight any certifications or training you have completed that demonstrate your understanding of relevant regulations.

Proficient in Underwriting Software

Familiarity with underwriting software tools enhances efficiency and accuracy in processing applications and managing data.

How to show it: List specific software programs you have used and describe how they improved your workflow.

Attention to Detail

Attention to detail is critical for underwriters to identify discrepancies and errors in applications, ensuring that all aspects of a policy are accurately assessed.

How to show it: Provide examples of how your meticulous nature led to error reduction in the underwriting process.

Communication Skills

Strong communication skills are necessary for underwriters to effectively convey risk assessments and collaborate with agents and clients.

How to show it: Include instances where your communication skills facilitated a successful negotiation or clarified complex information.

Negotiation Skills

Negotiation skills are important for underwriters to establish favorable terms with clients while balancing company policies and risk exposure.

How to show it: Quantify successful negotiations that resulted in advantageous policy terms or conditions.

Market Research

Conducting market research helps underwriters understand industry trends and competitor offerings, aiding in the development of competitive policies.

How to show it: Describe research initiatives that led to improved policy offerings or pricing strategies.

Claims Evaluation

Skills in claims evaluation allow underwriters to understand the claim process better, enabling them to make informed underwriting decisions that align with potential claim scenarios.

How to show it: Share metrics related to claims evaluation that improved risk assessment accuracy.

Problem-Solving Skills

Effective problem-solving skills are essential for underwriters to address challenges that arise during the underwriting process and find viable solutions.

How to show it: Provide examples of specific problems you solved that led to improved underwriting practices.

Best Underwriter Soft Skills

In the role of an Underwriter, possessing strong soft skills can significantly enhance performance and foster effective collaboration within the workplace. These skills not only improve interpersonal relationships but also contribute to more accurate decision-making and efficient workflow, ultimately benefiting the organization and its clients.

Communication

Effective communication is essential for Underwriters, as it involves conveying complex information clearly to clients and stakeholders.

How to show it: Highlight instances where you successfully explained underwriting decisions to clients or collaborated with team members to resolve issues.

Attention to Detail

Underwriters must pay close attention to details to identify risks and ensure that all information is accurate and complete.

How to show it: Provide examples of how your attention to detail improved accuracy in risk assessments or decreased errors in policy documentation.

Analytical Thinking

This skill allows Underwriters to assess information critically and make informed decisions based on data and trends.

How to show it: Include metrics or examples of how your analytical skills led to improved underwriting processes or better risk evaluation.

Problem-Solving

Underwriters often encounter complex situations that require innovative solutions to mitigate risks effectively.

How to show it: Describe specific challenges you faced and how your problem-solving skills led to successful outcomes.

Time Management

Managing time efficiently enables Underwriters to handle multiple cases and deadlines without compromising quality.

How to show it: Quantify your achievements by illustrating how effective time management resulted in meeting tight deadlines or processing a high volume of applications.

Teamwork

Collaboration with colleagues and other departments is vital for Underwriters to gather information and make sound decisions.

How to show it: Share examples of successful projects where you worked as part of a team to achieve common goals.

Adaptability

Being adaptable allows Underwriters to respond to changing regulations, market conditions, and client needs effectively.

How to show it: Demonstrate your adaptability by mentioning specific situations where you adjusted your approach to meet new challenges.

Customer Service Orientation

Understanding and addressing client needs is crucial for building trust and ensuring satisfaction in underwriting processes.

How to show it: Illustrate your commitment to customer service with examples of positive client interactions or feedback received.

Negotiation Skills

Underwriters often negotiate terms and conditions, making negotiation skills essential for successful outcomes.

How to show it: Provide quantifiable results from negotiations you successfully facilitated, showing how they benefited the organization.

Emotional Intelligence

Emotional intelligence helps Underwriters understand and manage their own emotions and those of others, improving interactions.

How to show it: Share instances where your emotional intelligence led to better team dynamics or improved client relationships.

Critical Thinking

This skill enables Underwriters to evaluate situations thoroughly and make sound judgments based on comprehensive analysis.

How to show it: Detail how your critical thinking contributed to more effective decision-making in underwriting scenarios.

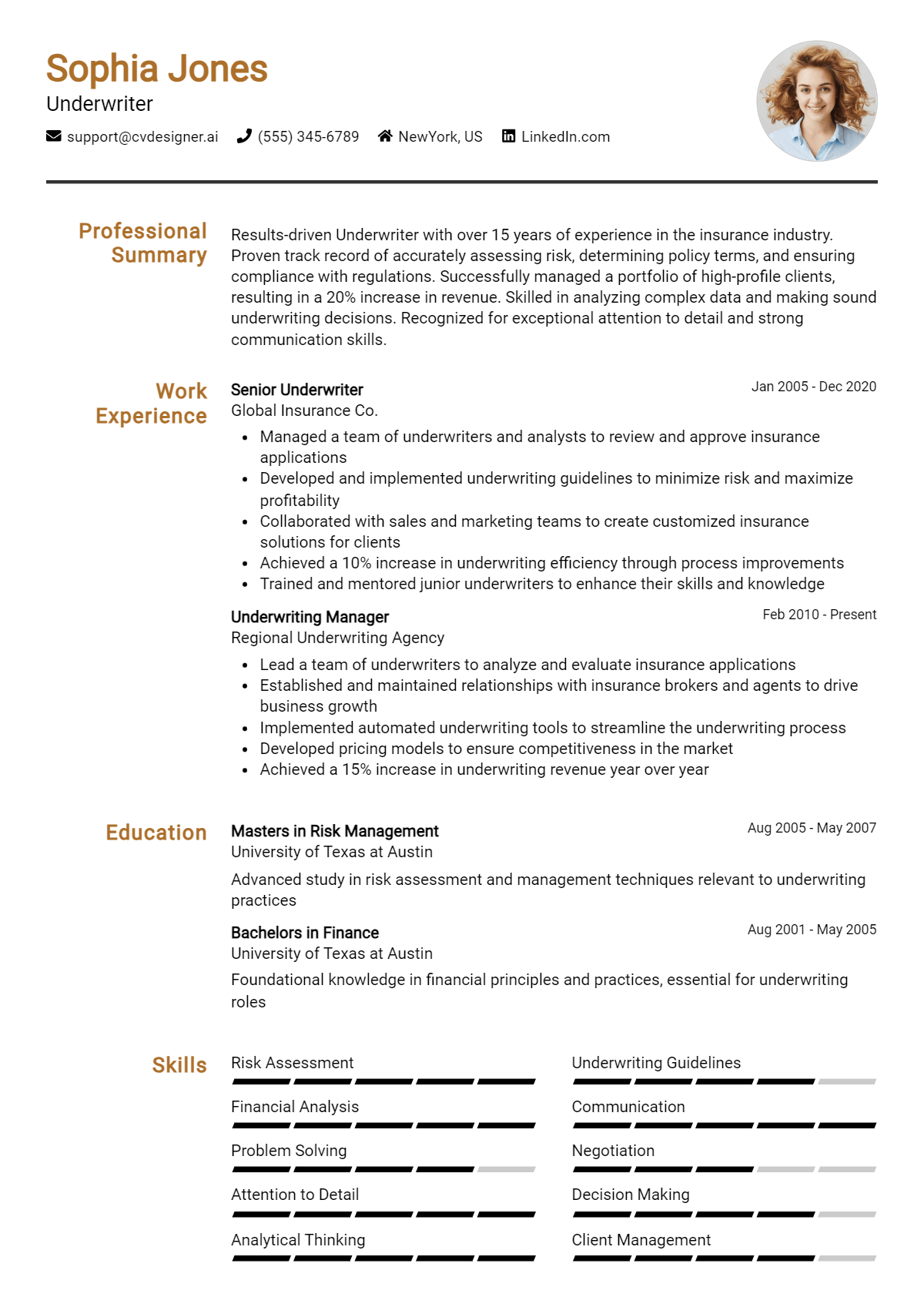

How to List Underwriter Skills on Your Resume

Effectively listing your skills on a resume is crucial to stand out to potential employers, especially in competitive fields like underwriting. Skills can be highlighted in three main sections: the Resume Summary, Resume Work Experience, Resume Skills Section, and Cover Letter. This strategic placement ensures that hiring managers quickly recognize your qualifications.

for Resume Summary

Showcasing Underwriter skills in the introduction (objective or summary) section provides hiring managers a quick overview of your qualifications, setting a positive tone for the rest of your resume.

Example

As an accomplished underwriter with expertise in risk assessment and financial analysis, I have consistently contributed to reducing loss ratios and improving portfolio performance within diverse industries.

for Resume Work Experience

The work experience section provides the perfect opportunity to demonstrate how your Underwriter skills have been applied in real-world scenarios, showcasing your ability to deliver results.

Example

- Evaluated and analyzed over 500 insurance applications, ensuring compliance with company guidelines and regulatory standards.

- Collaborated with cross-functional teams to develop risk mitigation strategies that resulted in a 15% reduction in claims.

- Utilized advanced software tools to assess financial data and improve underwriting efficiency.

- Mentored new team members on best practices in underwriting procedures and risk analysis.

for Resume Skills

The skills section can either showcase technical or transferable skills. A balanced mix of hard and soft skills should be included to present a well-rounded profile.

Example

- Risk Assessment

- Financial Analysis

- Attention to Detail

- Communication Skills

- Regulatory Compliance

- Data Analysis

- Problem Solving

- Time Management

for Cover Letter

A cover letter allows candidates to expand on the skills mentioned in the resume and provide a more personal touch. Highlighting 2-3 key skills that align with the job description can illustrate your relevant experience.

Example

In my previous role, I effectively utilized my risk assessment and financial analysis skills to identify potential issues before they escalated, leading to a 20% decrease in underwriting losses. I believe these skills will greatly benefit your team.

Linking the skills mentioned in the resume to specific achievements in your cover letter will reinforce your qualifications for the job.

The Importance of Underwriter Resume Skills

Highlighting relevant skills on an Underwriter's resume is crucial for capturing the attention of recruiters and hiring managers. A well-crafted skills section not only showcases a candidate's qualifications but also demonstrates their alignment with the specific requirements of the underwriting role. By effectively presenting these skills, candidates can differentiate themselves from other applicants and increase their chances of landing an interview.

- Strong analytical skills are essential for an Underwriter, as they must evaluate risk factors and financial information to make informed decisions. This ability ensures that they can assess applications accurately and mitigate potential losses for the company.

- Attention to detail is critical in underwriting, as even minor oversights can lead to significant financial repercussions. Highlighting this skill shows recruiters that a candidate is meticulous and can handle complex data without error.

- Effective communication skills are vital for Underwriters, as they need to convey their findings and recommendations clearly to clients and other stakeholders. This ability fosters collaboration and builds trust, which is essential in the underwriting process.

- Proficiency in risk assessment allows Underwriters to identify potential hazards and evaluate the insurability of applicants. Demonstrating this skill on a resume indicates that a candidate can contribute to the overall risk management strategy of the organization.

- Knowledge of underwriting software and tools enhances an Underwriter's efficiency and accuracy. Familiarity with industry-standard programs can set candidates apart, showing that they can integrate seamlessly into the existing workflow.

- Understanding of regulatory requirements and compliance is crucial for Underwriters to ensure that their decisions align with legal standards. This knowledge helps safeguard the company against potential legal issues and fosters a culture of accountability.

- Strong problem-solving skills enable Underwriters to navigate complex scenarios and develop innovative solutions. This capability is essential for addressing unique client situations and enhancing overall service quality.

- Time management skills are important for Underwriters, who often work under tight deadlines. Highlighting this skill demonstrates a candidate's ability to prioritize tasks effectively and manage workload efficiently.

For more examples of effective resumes, check out these Resume Samples.

How To Improve Underwriter Resume Skills

In the dynamic field of underwriting, continuous improvement of skills is essential for success and career advancement. The ability to assess risk accurately, make informed decisions, and adapt to changing market conditions can set you apart in a competitive job market. By enhancing your skills, you not only increase your value to employers but also build confidence in your decision-making abilities.

- Stay updated on industry regulations and trends by subscribing to relevant publications and attending seminars.

- Enhance your analytical skills through online courses focused on data analysis and risk assessment.

- Network with other professionals in the field to share knowledge and best practices.

- Practice using underwriting software and tools to increase your technical proficiency.

- Seek feedback on your work from colleagues and supervisors to identify areas for improvement.

- Consider obtaining additional certifications related to underwriting to demonstrate your commitment to professional growth.

- Engage in role-playing exercises to sharpen your negotiation and communication skills.

Frequently Asked Questions

What skills are essential for an underwriter's resume?

Essential skills for an underwriter's resume include analytical abilities, attention to detail, strong communication skills, and proficiency in risk assessment. Underwriters must analyze financial data and evaluate the risk associated with insuring clients, making it crucial to demonstrate these skills clearly on a resume. Additionally, familiarity with underwriting software and regulatory compliance is vital in showcasing one's capability in the field.

How important is experience in risk assessment for an underwriter?

Experience in risk assessment is critical for an underwriter, as it directly relates to the core responsibilities of the role. An underwriter must evaluate the potential risks of insuring individuals or businesses and determine appropriate premiums. Highlighting relevant experience in risk analysis and decision-making on a resume can significantly enhance an applicant's prospects in securing a position in underwriting.

What role does communication play in underwriting?

Communication is a vital skill for underwriters, as they often need to convey complex information to clients, agents, and other stakeholders. Clear communication helps in explaining underwriting decisions and negotiating terms, ensuring all parties understand the rationale behind decisions. Including examples of effective communication skills on a resume can demonstrate an applicant's ability to work collaboratively and effectively in the underwriting process.

How can proficiency in technology enhance an underwriter's skill set?

Proficiency in technology is increasingly important for underwriters, as many processes are now automated or supported by specialized software. Knowledge of underwriting technology, data analysis tools, and customer relationship management (CRM) systems can improve efficiency and accuracy in evaluating applications. Highlighting technological skills on a resume can set candidates apart in the competitive underwriting job market.

Are certifications important for underwriters?

Certifications can significantly enhance an underwriter's credentials and demonstrate a commitment to the profession. Relevant certifications, such as those offered by the American Institute for Chartered Property Casualty Underwriters (CPCU) or the National Association of Insurance Commissioners (NAIC), can provide a competitive edge. Including these certifications on a resume can illustrate expertise and a professional standard that employers value in the underwriting field.

Conclusion

Including Underwriter skills in your resume is essential for demonstrating your expertise and value to potential employers. By showcasing relevant skills, you not only stand out among other candidates but also highlight your ability to assess risk and make informed decisions, which are critical in the underwriting field. Remember, a well-crafted resume can be your key to opening doors in your career.

Take the time to refine and enhance your skills, as this will contribute to a stronger job application and increase your chances of landing your desired position. For more resources, check out our resume templates, utilize our resume builder, explore resume examples, and don’t forget to create a compelling cover letter with our cover letter templates. Your future awaits, so start building it today!

Use an AI-powered resume builder and have your resume done in 5 minutes. Just select your template and our software will guide you through the process.