26 Treasury Manager Skills for Your Resume: List Examples

As a Treasury Manager, possessing the right skills is essential for effectively managing an organization's financial assets and risks. This role requires a unique blend of analytical expertise, strategic thinking, and strong communication abilities. In the following section, we will outline the top skills that you should consider highlighting on your resume to demonstrate your qualifications and readiness for this critical position in financial management.

Best Treasury Manager Technical Skills

As a Treasury Manager, possessing a solid foundation of technical skills is essential for managing an organization's finances effectively. These skills empower you to analyze financial data, optimize cash flow, and make informed investment decisions. Highlighting these skills on your resume can significantly enhance your appeal to potential employers.

Cash Management

Cash management involves overseeing the company's cash flow to ensure that sufficient liquidity is available for day-to-day operations and strategic initiatives.

How to show it: Quantify your cash flow improvements and highlight specific strategies that enhanced liquidity.

Financial Analysis

Financial analysis includes assessing financial data and metrics to guide investment decisions and identify trends that affect the organization's financial health.

How to show it: Include examples of financial reports you created that influenced key business decisions.

Risk Management

Risk management involves identifying, assessing, and prioritizing financial risks to minimize their impact on the organization's assets and earnings.

How to show it: Demonstrate your success in mitigating risks with specific metrics or case studies.

Investment Strategy

Creating and implementing investment strategies helps optimize the organization's portfolio for maximum returns while aligning with risk tolerance.

How to show it: Highlight your contributions to investment portfolios and the resulting ROI.

Financial Modeling

Financial modeling involves creating representations of a company's financial performance to forecast future results and support decision-making.

How to show it: Share instances where your financial models led to accurate forecasts or informed strategic planning.

Bank Relationship Management

Effectively managing relationships with banks ensures favorable terms for loans, credits, and other financial services essential for the organization.

How to show it: List specific outcomes from negotiations or collaborations with banking partners.

Cash Flow Forecasting

Cash flow forecasting helps predict future cash inflows and outflows to ensure the organization can meet its financial obligations.

How to show it: Provide examples of how your forecasts improved liquidity management.

Regulatory Compliance

Staying compliant with financial regulations and standards is crucial for avoiding penalties and ensuring the organization operates within legal boundaries.

How to show it: Detail instances where you ensured compliance and the impact it had on the organization.

Debt Management

Debt management involves structuring and servicing the organization's debt to optimize costs and repayment terms.

How to show it: Quantify the reduction in interest expenses achieved through effective debt management strategies.

Financial Reporting

Financial reporting provides stakeholders with insights into the organization's financial performance and is essential for transparency and accountability.

How to show it: Highlight your role in preparing reports that were pivotal in executive decision-making.

ERP Systems Proficiency

Proficiency in ERP systems facilitates efficient financial data management and streamlines reporting processes.

How to show it: Mention specific ERP systems you’ve worked with and any efficiencies gained through their use.

Best Treasury Manager Soft Skills

Soft skills are essential in the role of a Treasury Manager, as they enhance collaboration, communication, and problem-solving abilities within financial operations. These skills not only facilitate effective team dynamics but also ensure accurate decision-making in high-stakes situations. Below are key soft skills that can significantly bolster a Treasury Manager's resume.

Communication

Effective communication is crucial for a Treasury Manager to convey complex financial information clearly to stakeholders. This skill enhances collaboration across departments and with external partners.

How to show it: Highlight instances where you successfully presented financial reports or led discussions that influenced strategic decisions.

Problem-solving

Problem-solving skills enable a Treasury Manager to identify financial challenges and develop effective strategies to mitigate risks. This skill is vital for navigating unpredictable market conditions.

How to show it: Provide examples of how you resolved financial discrepancies or improved cash flow management, showcasing your analytical approach.

Time Management

Time management is essential for a Treasury Manager to prioritize tasks effectively and meet critical deadlines, especially during financial reporting periods or audits.

How to show it: Demonstrate your ability to manage multiple projects by quantifying your success in completing tasks ahead of schedule.

Teamwork

Teamwork skills are vital for collaborating with various departments, ensuring everyone is aligned with financial goals, and fostering a cooperative work environment.

How to show it: Include examples of cross-departmental projects where you played a key role in achieving collective financial objectives.

Attention to Detail

Attention to detail is critical for a Treasury Manager to ensure accuracy in financial records and compliance with regulations, reducing the risk of costly errors.

How to show it: Quantify your achievements by mentioning any audits passed without discrepancies or improvements in accuracy after your review processes.

Adaptability

Adaptability allows a Treasury Manager to pivot strategies in response to changing market conditions or organizational needs, ensuring ongoing financial stability.

How to show it: Share experiences where you successfully adjusted financial strategies due to unexpected challenges or changes.

Leadership

Leadership skills are essential for guiding teams and influencing financial strategy while fostering a positive and productive work culture.

How to show it: Provide examples of how you led a team through a financial project, highlighting any improvements in team performance or morale.

Negotiation

Negotiation skills are important for securing favorable terms with banks and suppliers, ultimately impacting the organization’s financial health.

How to show it: Outline instances where your negotiation skills resulted in cost savings or improved contract terms for your organization.

Critical Thinking

Critical thinking enables a Treasury Manager to analyze complex financial data and make informed decisions that align with business objectives.

How to show it: Highlight situations where your critical thinking led to strategic decisions that enhanced financial performance.

Emotional Intelligence

Emotional intelligence is key for managing interpersonal relationships judiciously and empathetically, fostering a supportive workplace environment.

How to show it: Share examples of how you resolved conflicts or improved team dynamics through your understanding of emotional cues.

Networking

Networking skills help a Treasury Manager build relationships with financial institutions and industry peers, facilitating valuable partnerships and insights.

How to show it: Include relevant industry events or professional associations where you established beneficial connections that contributed to your company's success.

How to List Treasury Manager Skills on Your Resume

Effectively listing your skills on a resume is crucial to standing out to employers in a competitive job market. By strategically highlighting your qualifications, you can capture the attention of hiring managers. There are three main sections where you can showcase your Treasury Manager skills: the Resume Summary, Resume Work Experience, Resume Skills Section, and your Cover Letter.

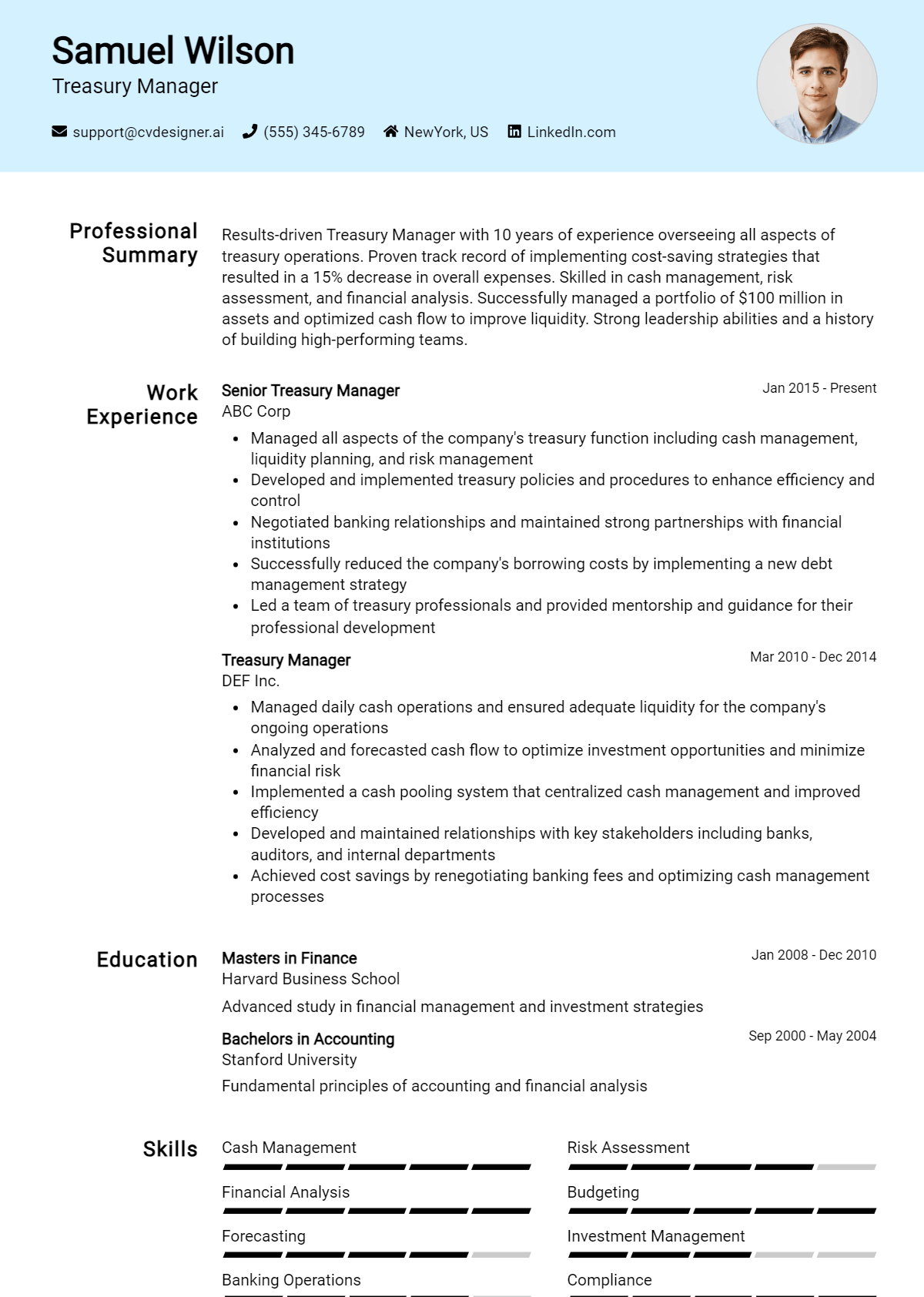

for Resume Summary

Showcasing Treasury Manager skills in the introduction section provides hiring managers a quick overview of your qualifications and sets the tone for the rest of your resume.

Example

A results-driven Treasury Manager with expertise in cash flow management, financial forecasting, and risk assessment. Proven ability to optimize treasury operations and enhance liquidity, contributing to overall organizational growth.

for Resume Work Experience

The work experience section provides the perfect opportunity to demonstrate how your Treasury Manager skills have been applied in real-world scenarios, making your qualifications tangible.

Example

- Managed a team to implement a new cash management system, resulting in a 20% reduction in processing time.

- Conducted financial risk assessments that led to a 15% decrease in exposure to foreign currency fluctuations.

- Developed financial forecasting models that improved decision-making processes and supported strategic planning.

- Collaborated with cross-functional teams to enhance liquidity management strategies, increasing cash reserves by 30%.

for Resume Skills

The skills section is an ideal place to showcase both technical and transferable skills. A balanced mix of hard and soft skills will strengthen your overall qualifications as a Treasury Manager.

Example

- Cash Flow Management

- Financial Forecasting

- Risk Assessment

- Liquidity Management

- Regulatory Compliance

- Team Leadership

- Analytical Skills

- Strategic Planning

for Cover Letter

A cover letter allows candidates to expand on the skills mentioned in their resume and provide a more personal touch. Highlighting 2-3 key skills that align with the job description can effectively demonstrate your fit for the role.

Example

In my previous role, I successfully utilized my financial forecasting skills to develop models that improved our budget accuracy by 25%. Additionally, my proficiency in cash management enabled the organization to enhance its liquidity position, ensuring we met all operational needs efficiently.

Linking the skills mentioned in your resume to specific achievements in your cover letter reinforces your qualifications for the job.

The Importance of Treasury Manager Resume Skills

In the competitive landscape of finance and treasury management, highlighting relevant skills on a Treasury Manager resume is crucial for standing out to recruiters and hiring managers. A well-crafted skills section not only showcases a candidate's qualifications but also aligns them with the specific requirements of the job. This strategic emphasis on skills can significantly enhance a candidate's chances of securing an interview and ultimately landing the desired position.

- Demonstrates expertise in financial analysis and risk management, which are essential for making informed decisions regarding cash flow and investments.

- Highlights proficiency in treasury software and tools, showcasing a candidate's ability to streamline processes and improve efficiency within the treasury function.

- Illustrates strong communication and negotiation skills, critical for collaborating with banks, investors, and other stakeholders to optimize the company’s financial resources.

- Emphasizes knowledge of regulatory compliance and financial regulations, ensuring that the organization adheres to legal standards and mitigates potential risks.

- Indicates an understanding of cash management strategies, enabling the Treasury Manager to effectively manage liquidity and optimize working capital.

- Showcases strategic thinking and problem-solving abilities, which are vital for developing long-term financial strategies that align with the company’s goals.

- Reflects adaptability and project management skills, necessary for managing multiple priorities and leading treasury-related initiatives in a dynamic environment.

- Demonstrates a commitment to continuous learning and professional development, which is essential in keeping up with industry trends and best practices.

For additional guidance on crafting an impactful resume, check out these Resume Samples.

How To Improve Treasury Manager Resume Skills

In the ever-evolving financial landscape, the role of a Treasury Manager is critical to ensuring the financial health and stability of an organization. Continuous improvement of skills not only enhances job performance but also increases employability and career advancement opportunities. By refining your skills, you can better manage cash flow, optimize investments, and mitigate risks effectively.

- Stay updated on industry trends and regulations by subscribing to financial journals and attending relevant webinars.

- Enhance your analytical skills by taking advanced courses in financial analysis and risk management.

- Develop strong communication skills through workshops and practice presentations to effectively convey complex financial information.

- Gain proficiency in treasury management software and tools to streamline processes and improve reporting accuracy.

- Network with other professionals in the field by joining treasury associations and participating in industry conferences.

- Consider obtaining professional certifications, such as the Certified Treasury Professional (CTP), to validate your expertise.

- Engage in cross-functional projects within your organization to gain a broader understanding of how treasury functions interact with other departments.

Frequently Asked Questions

What are the key skills needed for a Treasury Manager resume?

A Treasury Manager should emphasize skills such as cash management, financial forecasting, risk assessment, and investment strategy. Proficiency in financial modeling and analysis, along with strong communication and leadership abilities, are also critical. Highlighting expertise in ERP systems and familiarity with banking regulations can further strengthen a resume.

How important is experience with cash flow management for a Treasury Manager?

Experience with cash flow management is essential for a Treasury Manager, as it directly impacts the organization's liquidity and financial stability. Demonstrating a track record of effectively managing cash inflows and outflows, optimizing working capital, and ensuring that sufficient liquidity is available for operational needs is crucial for potential employers.

Should a Treasury Manager include technical skills on their resume?

Yes, technical skills are important for a Treasury Manager's resume. Proficiency in financial software, such as treasury management systems and advanced Excel capabilities, can greatly enhance a candidate's appeal. Additionally, familiarity with data analysis tools and financial reporting systems is advantageous, as these skills enable the Treasury Manager to analyze financial data effectively and make informed decisions.

What soft skills should be highlighted by a Treasury Manager?

Soft skills are equally important for a Treasury Manager, with leadership, communication, and problem-solving skills at the forefront. The ability to collaborate across departments, influence stakeholders, and navigate complex financial scenarios is vital. Strong analytical thinking and adaptability are also essential, as treasury functions often require quick and strategic decision-making in response to changing market conditions.

How can a Treasury Manager demonstrate strategic thinking on their resume?

A Treasury Manager can demonstrate strategic thinking by showcasing specific achievements related to financial planning and investment strategies. Including examples of how they have identified opportunities for cost savings, improved cash utilization, or optimized the investment portfolio can illustrate their ability to align treasury operations with the organization's long-term financial goals. Quantifying these achievements with measurable outcomes further strengthens this aspect of their resume.

Conclusion

Incorporating Treasury Manager skills into your resume is essential for demonstrating your expertise in financial management and strategic decision-making. By showcasing relevant skills, you not only highlight your qualifications but also distinguish yourself from other candidates, providing substantial value to potential employers. Remember, a well-crafted resume can open doors to new opportunities, so take the time to refine your skills and enhance your job application. You have the potential to make a significant impact in your career!

For additional assistance, explore our resume templates, utilize our resume builder, check out various resume examples, and find guidance with our cover letter templates.

Use an AI-powered resume builder and have your resume done in 5 minutes. Just select your template and our software will guide you through the process.