23 good skills to put on resume for Tax Compliance Specialist in 2025

As a Tax Compliance Specialist, possessing a diverse set of skills is crucial for effectively navigating the complexities of tax regulations and ensuring compliance. In this section, we will explore the top skills that can enhance your resume and make you a standout candidate in the field of tax compliance. These skills not only demonstrate your technical expertise but also your ability to adapt to the ever-evolving tax landscape.

Best Tax Compliance Specialist Technical Skills

The role of a Tax Compliance Specialist requires a solid foundation of technical skills to ensure accurate tax reporting, adherence to regulations, and the efficient management of tax-related processes. These skills not only enhance a candidate's effectiveness in the role but also significantly improve their appeal to potential employers.

Tax Software Proficiency

Expertise in tax software such as Intuit ProConnect, H&R Block, or Thomson Reuters UltraTax is essential for preparing and filing tax returns efficiently.

How to show it: List specific software used and mention efficiencies gained or errors reduced while using the software.

Knowledge of Tax Laws

A deep understanding of federal, state, and local tax laws helps in ensuring compliance and minimizing risks associated with audits.

How to show it: Highlight any relevant certifications or courses completed, along with instances where knowledge was applied to save money or avoid penalties.

Financial Analysis

Ability to analyze financial data and tax implications allows for informed decision-making and strategic planning.

How to show it: Provide examples of analyzed financial reports leading to significant tax savings or compliance improvements.

Regulatory Compliance

Staying updated with changing regulations ensures that tax filings are compliant, reducing the risk of audits and penalties.

How to show it: Mention specific compliance initiatives that led to successful audits or reduced compliance-related issues.

Data Entry Accuracy

Precision in data entry is crucial for maintaining the integrity of tax filings and avoiding costly mistakes.

How to show it: Quantify your accuracy rate in data entry tasks or highlight any recognition received for error-free submissions.

Tax Research Skills

The ability to conduct tax research helps in resolving complex tax issues and applying the most beneficial strategies for clients.

How to show it: Include examples of successful resolutions of tax issues through research efforts and the impact on the organization.

Attention to Detail

Meticulous attention to detail is necessary for identifying discrepancies and ensuring accuracy in tax documents.

How to show it: Share instances where your attention to detail prevented potential errors or issues in compliance.

Project Management

Managing multiple tax projects simultaneously requires strong organizational and time management skills.

How to show it: Demonstrate your project management capabilities by detailing the number of projects handled and their successful outcomes.

Communication Skills

Clear communication is essential for explaining complex tax matters to clients and collaborating with team members.

How to show it: Provide examples of successful presentations or client interactions that led to improved understanding and satisfaction.

Excel and Data Analysis

Proficiency in Microsoft Excel is vital for analyzing large data sets and performing complex calculations related to tax obligations.

How to show it: Quantify the size of datasets analyzed and mention any advanced functions used that improved efficiency.

Client Relationship Management

Building and maintaining strong relationships with clients is key to understanding their needs and providing tailored tax solutions.

How to show it: Highlight client retention rates and feedback received as a result of your relationship management skills.

Best Tax Compliance Specialist Soft Skills

Soft skills are essential for Tax Compliance Specialists as they navigate complex regulations, communicate effectively with clients and colleagues, and manage multiple tasks under tight deadlines. These interpersonal skills enhance their ability to analyze tax situations, provide guidance, and foster positive relationships, which are crucial in ensuring compliance and maximizing client satisfaction.

Communication

Effective communication is vital for Tax Compliance Specialists to convey complex tax regulations and strategies clearly to clients and team members.

How to show it: Highlight experiences where you successfully explained tax concepts to non-experts or led presentations.

Problem-solving

This skill enables Tax Compliance Specialists to identify issues and develop effective solutions, especially when interpreting tax laws and regulations.

How to show it: Provide examples of challenges you faced and the innovative solutions you implemented to resolve them.

Time Management

Tax Compliance Specialists often juggle multiple deadlines, making strong time management skills essential for prioritizing tasks and meeting client needs.

How to show it: Quantify how you managed various projects simultaneously and met all deadlines successfully.

Teamwork

Collaboration with colleagues is crucial for Tax Compliance Specialists to ensure comprehensive tax strategies and compliance across departments.

How to show it: Demonstrate your ability to work in teams by describing successful joint projects and your role in achieving team goals.

Attention to Detail

Precision is critical in tax compliance, where small errors can lead to significant financial repercussions.

How to show it: Include specific instances where your keen attention to detail led to error-free reports or compliance.

Analytical Thinking

This skill helps Tax Compliance Specialists assess complex financial data and regulations to make informed decisions.

How to show it: Describe situations where your analytical skills led to insights that benefited the organization.

Adaptability

The tax landscape is ever-changing; being adaptable enables specialists to stay current with new laws and regulations.

How to show it: Provide examples of how you successfully adapted to changes in tax legislation or client needs.

Customer Service

Providing excellent customer service helps build trust and long-lasting relationships with clients in the tax compliance process.

How to show it: Share feedback or metrics that demonstrate your commitment to client satisfaction.

Ethical Judgment

Maintaining integrity and ethical standards is crucial in ensuring compliance and maintaining a positive reputation.

How to show it: Discuss your commitment to ethical practices and any relevant training or certifications.

Research Skills

Strong research skills are essential for staying informed about tax laws and finding necessary information to support compliance efforts.

How to show it: Provide examples of how your research skills led to successful outcomes in tax compliance.

Negotiation

Negotiation skills are important for Tax Compliance Specialists when working with tax authorities or clients to achieve favorable outcomes.

How to show it: Highlight instances where you successfully negotiated terms or resolved disputes.

How to List Tax Compliance Specialist Skills on Your Resume

Effectively listing your skills on a resume is crucial for standing out to potential employers. Highlighting your abilities not only showcases your qualifications but also aligns your experience with the job requirements. There are three main sections where skills can be emphasized: Resume Summary, Resume Work Experience, Resume Skills Section, and Cover Letter.

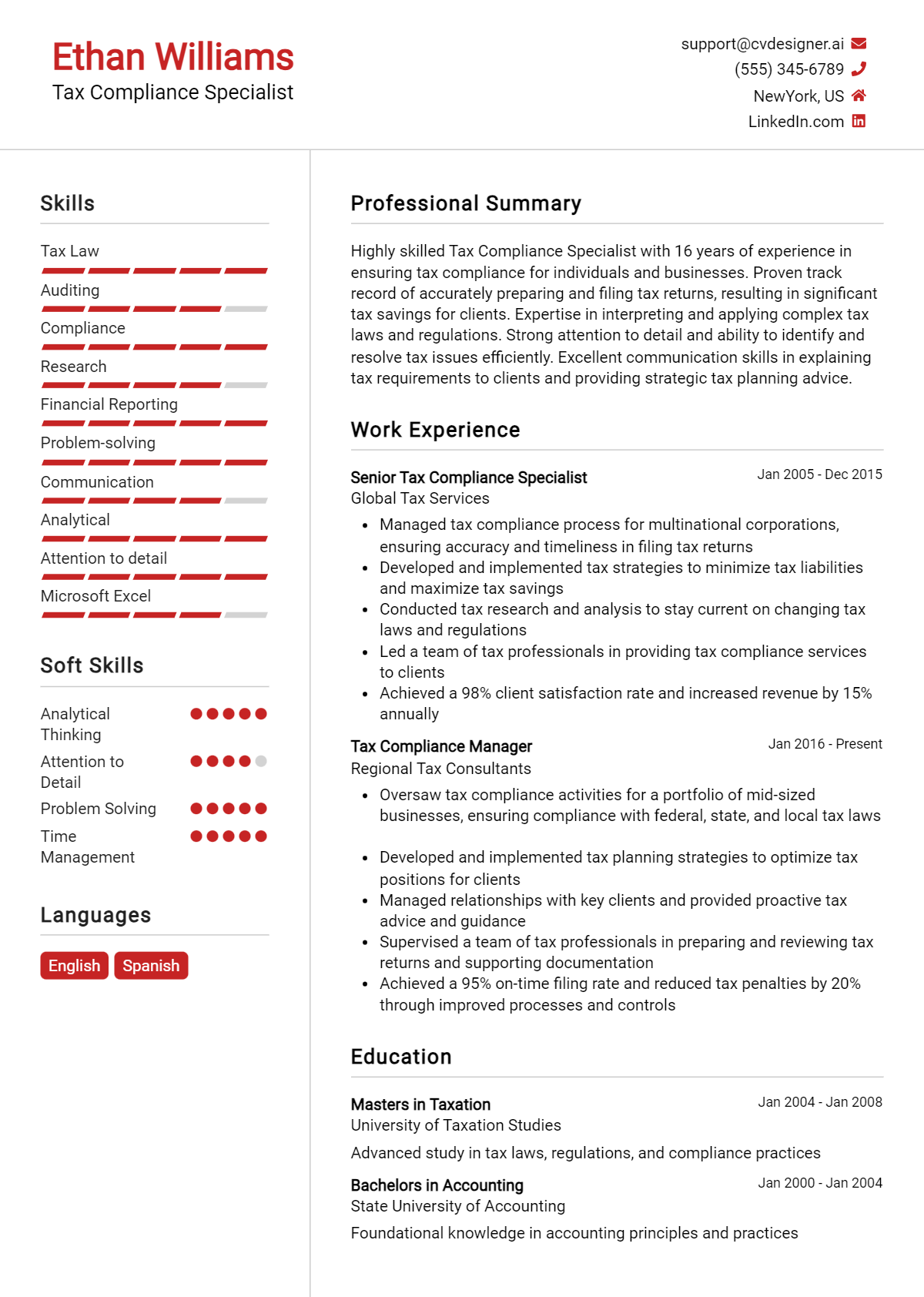

for Resume Summary

Showcasing your Tax Compliance Specialist skills in the introduction section provides hiring managers with a quick overview of your qualifications. This sets the tone for the rest of your resume.

Example

As a dedicated Tax Compliance Specialist, I possess strong analytical skills, a deep understanding of tax regulations, and excellent communication abilities to ensure accurate reporting and compliance with federal and state laws.

for Resume Work Experience

The work experience section is the perfect opportunity to demonstrate how your Tax Compliance Specialist skills have been applied in real-world scenarios. Use this section to provide actionable examples that match the specific skills mentioned in job listings.

Example

- Conducted thorough tax audits to ensure compliance and reduce discrepancies by 30%.

- Developed and implemented tax strategies that resulted in a 15% reduction in liabilities for clients.

- Collaborated with cross-functional teams to streamline the tax filing process, improving efficiency by 25%.

- Provided training sessions for junior staff on tax compliance regulations and best practices.

for Resume Skills

The skills section can showcase both technical and transferable skills. A balanced mix of hard and soft skills will strengthen your overall qualifications and appeal to employers.

Example

- Tax Compliance Management

- Regulatory Knowledge

- Analytical Skills

- Attention to Detail

- Communication Skills

- Problem-Solving

- Client Relationship Management

- Data Analysis

for Cover Letter

A cover letter allows you to expand on the skills mentioned in your resume and provide a more personal touch. Highlighting 2-3 key skills that align with the job description can show how those skills have positively impacted your previous roles.

Example

In my previous position, my strong analytical skills and in-depth knowledge of tax regulations enabled me to identify and resolve compliance issues, saving the company $50,000 annually. My communication abilities helped foster strong relationships with clients, ensuring their needs were always met.

Encourage candidates to link the skills mentioned in the resume to specific achievements in their cover letter, reinforcing their qualifications for the job.

The Importance of Tax Compliance Specialist Resume Skills

In the competitive field of tax compliance, showcasing relevant skills on your resume is crucial for making a strong impression on recruiters. A well-crafted skills section not only highlights your qualifications but also aligns your expertise with the specific requirements of the role. By effectively communicating your abilities, you increase your chances of standing out among a pool of applicants and securing an interview.

- Tax compliance specialists need to possess a deep understanding of tax laws and regulations. Highlighting this knowledge on your resume demonstrates your ability to navigate complex legal frameworks and ensures that you can help clients meet their obligations effectively.

- Strong analytical skills are essential for a tax compliance specialist, as you'll often need to interpret financial data and assess tax implications. Showcasing your analytical abilities can illustrate your capability to provide meaningful insights and solutions to clients.

- Proficiency in tax software and technology is increasingly important in the digital age. Listing your experience with popular tax software not only shows your technical skills but also indicates your readiness to adapt to evolving industry tools.

- Attention to detail is critical in tax compliance, where even minor errors can lead to significant consequences. Emphasizing your meticulous nature can reassure potential employers of your commitment to accuracy and thoroughness in your work.

- Effective communication skills are vital for tax compliance specialists, as you'll often need to explain complex tax concepts to clients. Highlighting your ability to convey information clearly can set you apart as a candidate who can build trust and foster strong client relationships.

- Time management skills are crucial in meeting deadlines and managing multiple clients simultaneously. Demonstrating your ability to prioritize tasks and manage your time effectively can illustrate your organizational skills to potential employers.

- Understanding of financial statements is another key skill for tax compliance specialists. Being able to read and analyze financial reports can enhance your credibility and effectiveness in advising clients.

- Finally, a commitment to continuing education in the field of tax law is essential for staying current with changes and updates. Showing your dedication to professional development can highlight your proactive approach and passion for the industry.

For additional insights and examples, visit our Resume Samples page.

How To Improve Tax Compliance Specialist Resume Skills

As a Tax Compliance Specialist, staying updated with the latest regulations and best practices is crucial for success in this ever-evolving field. Continuously improving your skills not only enhances your professional competence but also makes you more attractive to potential employers. Here are some actionable tips to help you strengthen your resume and expertise in tax compliance.

- Engage in continuous education by enrolling in tax-related courses or obtaining relevant certifications.

- Stay informed about changes in tax laws and regulations by following reputable tax publications and websites.

- Network with other professionals in the field through industry conferences, seminars, and online forums.

- Develop strong analytical skills by practicing data analysis and interpretation related to tax compliance.

- Enhance your software proficiency, especially in tax preparation and compliance software commonly used in the industry.

- Seek mentorship or guidance from experienced Tax Compliance Specialists to gain insights and advice on best practices.

- Participate in workshops and webinars to learn about new tools and techniques in tax compliance and reporting.

Frequently Asked Questions

What skills are essential for a Tax Compliance Specialist?

A Tax Compliance Specialist should possess strong analytical skills to interpret complex tax laws and regulations. Attention to detail is crucial to ensure accuracy in tax filings and documentation. Additionally, proficiency in accounting software and tax preparation software is essential for efficiency. Strong communication skills are necessary to explain tax issues to clients and collaborate with team members. Finally, organizational skills help manage multiple deadlines and maintain comprehensive records.

How important is knowledge of tax laws for a Tax Compliance Specialist?

Knowledge of tax laws is fundamental for a Tax Compliance Specialist, as it directly impacts their ability to ensure compliance and minimize liabilities for clients or their organization. Understanding federal, state, and local tax regulations allows the specialist to provide accurate advice, prepare correct filings, and identify potential tax-saving opportunities. Continuous education and staying updated on changes in tax legislation are also vital components of the role.

What role does technology play in the work of a Tax Compliance Specialist?

Technology plays a significant role in the work of a Tax Compliance Specialist, enabling them to streamline processes and enhance accuracy in tax preparation and compliance. Familiarity with accounting software, tax preparation tools, and data analysis programs allows specialists to efficiently manage large volumes of data, automate calculations, and generate reports. Moreover, technology can facilitate communication with clients and team members, making collaboration more effective.

How can a Tax Compliance Specialist improve their problem-solving skills?

A Tax Compliance Specialist can improve their problem-solving skills through continuous education and practical experience. Engaging in professional development courses, attending workshops, and obtaining certifications can enhance their understanding of tax regulations and methodologies. Additionally, working on real-world case studies and collaborating with experienced colleagues can provide valuable insights into effective problem-solving approaches in complex tax scenarios.

What are the career advancement opportunities for a Tax Compliance Specialist?

Career advancement opportunities for a Tax Compliance Specialist can include roles such as Tax Manager, Tax Director, or even Chief Financial Officer (CFO) within an organization. With experience, specialists may also choose to transition into consultancy roles, advising businesses on tax strategy and compliance. Further certification, such as becoming a Certified Public Accountant (CPA) or obtaining a Master’s in Taxation, can also open doors to higher-level positions and specialized areas within tax compliance.

Conclusion

Including Tax Compliance Specialist skills in your resume is essential for demonstrating your expertise and value in this critical field. By showcasing relevant skills, you not only make your application more compelling but also distinguish yourself from other candidates, making it easier for potential employers to recognize your qualifications. Remember, a well-crafted resume can significantly enhance your chances of landing the job you desire.

Take the time to refine your skills and present them effectively; this investment in your professional development can lead to better job opportunities. For further assistance, explore our resume templates, utilize our resume builder, check out resume examples, and create a standout application with our cover letter templates.

Use an AI-powered resume builder and have your resume done in 5 minutes. Just select your template and our software will guide you through the process.