29 Prop Trader Skills For Your Resume with Exampels in 2025

As a proprietary trader, possessing a unique set of skills is essential to navigate the complex financial markets effectively. Highlighting your expertise in areas such as risk management, analytical thinking, and market knowledge can significantly enhance your resume. In the following section, we will explore the top skills that can set you apart in the competitive field of prop trading, showcasing your qualifications to potential employers.

Best Prop Trader Technical Skills

Technical skills are crucial for prop traders as they significantly enhance trading strategies, risk management, and market analysis. Demonstrating these skills on your resume can greatly improve your chances of landing a position in the competitive world of proprietary trading.

Quantitative Analysis

Quantitative analysis involves using mathematical and statistical methods to evaluate trading strategies and market conditions. This skill helps traders make informed decisions based on data-driven insights.

How to show it: Highlight specific quantitative models or algorithms you developed that resulted in measurable trading performance improvements.

Risk Management

Risk management skills are essential for identifying, assessing, and mitigating potential losses in trading. This ensures sustainable trading practices and protects capital.

How to show it: Provide examples of risk management strategies you implemented that reduced losses or improved overall portfolio performance.

Technical Analysis

Technical analysis involves analyzing price movements and trading volumes to forecast future market behavior. This skill aids traders in making strategic entry and exit decisions.

How to show it: Specify the trading indicators and tools you utilized and the successful trades that resulted from your technical analysis.

Algorithmic Trading

Algorithmic trading refers to using automated systems to execute trades based on pre-defined criteria. This skill enhances trading efficiency and speed.

How to show it: Detail any algorithms you programmed and the performance metrics achieved through their implementation.

Market Research

Market research skills enable traders to gather and interpret data regarding market trends, economic indicators, and competitor behavior, informing their trading strategies.

How to show it: Include any significant insights derived from your research that led to successful trading decisions or strategies.

Data Analysis

Data analysis is critical for examining large datasets to extract meaningful insights that inform trading decisions and strategies. It enhances predictive accuracy.

How to show it: Quantify the impact of your data-driven insights on trading outcomes or overall portfolio performance.

Statistical Modeling

Statistical modeling involves creating mathematical representations of market behaviors to predict future price movements. This skill is key for risk assessment and strategy development.

How to show it: Describe specific models you developed and their effectiveness in predicting market trends.

Portfolio Management

Portfolio management skills encompass the selection and oversight of a collection of investments, balancing risk and return according to investment goals.

How to show it: Demonstrate your success in managing portfolios with quantifiable returns or reduced volatility.

Financial Modeling

Financial modeling involves creating representations of a trader's or firm's financial performance, which aids in decision-making and forecasting future financial outcomes.

How to show it: Highlight any financial models you created that led to successful investment decisions or capital allocation.

Order Execution

Order execution skills are critical for efficiently implementing trades in the market, ensuring optimal pricing and timing for trade entries and exits.

How to show it: Provide statistics on your order execution performance, such as average slippage rates or execution speed.

Financial Statement Analysis

Financial statement analysis involves evaluating a company's financial statements to assess its performance and value, which is essential for making informed trading decisions.

How to show it: Share insights from your analysis that influenced successful trades or investment strategies.

Best Prop Trader Soft Skills

In the fast-paced world of proprietary trading, soft skills are just as crucial as technical skills. They enhance your ability to navigate complex market conditions, communicate effectively with team members, and make informed decisions under pressure. Highlighting these skills on your resume can set you apart from the competition and demonstrate your suitability for a successful career in prop trading.

Analytical Thinking

Analytical thinking enables traders to assess market data, identify trends, and make informed decisions. It is essential for evaluating risk and potential rewards.

How to show it: Provide examples of how your analytical skills led to profitable trades or improved decision-making processes.

Communication

Effective communication is vital for sharing insights and strategies with team members. It ensures alignment and enhances collaboration in trading environments.

How to show it: Highlight instances where clear communication improved team performance or facilitated successful trading strategies. Learn more about Communication.

Problem-solving

Strong problem-solving skills allow traders to quickly address challenges and adapt strategies in real-time, which is crucial in the volatile trading landscape.

How to show it: Share specific examples where your problem-solving abilities led to overcoming obstacles or seizing trading opportunities. Explore more on Problem-solving.

Time Management

Time management is essential for prioritizing tasks and making timely decisions, which can significantly impact trading outcomes.

How to show it: Demonstrate your ability to manage multiple tasks efficiently, especially during high-pressure trading periods. Find more on Time Management.

Teamwork

Teamwork is crucial in prop trading, where collaboration can lead to shared insights and improved performance. It fosters a supportive environment for traders.

How to show it: Include examples of successful collaborations and how they contributed to overall trading success. Learn more about Teamwork.

Emotional Intelligence

Emotional intelligence helps traders manage stress and maintain focus, which is essential when facing market fluctuations and high-stakes decisions.

How to show it: Illustrate how your emotional intelligence has positively influenced your trading performance or team dynamics.

Adaptability

The ability to adapt to changing market conditions is vital for a prop trader. Being flexible allows for quick pivots in strategy when necessary.

How to show it: Provide examples of how you successfully adapted your trading approach in response to market changes.

Attention to Detail

Attention to detail is critical in trading, where small discrepancies can lead to significant financial impacts. It ensures accuracy in analysis and execution.

How to show it: Highlight how your attention to detail has led to successful trades or minimized risks.

Decision-making

Strong decision-making skills enable traders to evaluate options and act promptly, which can be the difference between profit and loss.

How to show it: Share examples of quick, effective decisions that resulted in favorable trading outcomes.

Resilience

Resilience helps traders bounce back from losses and setbacks. It fosters a positive mindset and encourages continuous improvement.

How to show it: Discuss how you have overcome challenges in trading and what you learned from those experiences.

Negotiation Skills

Negotiation skills can enhance a trader's ability to secure favorable terms in trades and partnerships, maximizing potential profits.

How to show it: Provide examples of successful negotiations that positively impacted your trading performance.

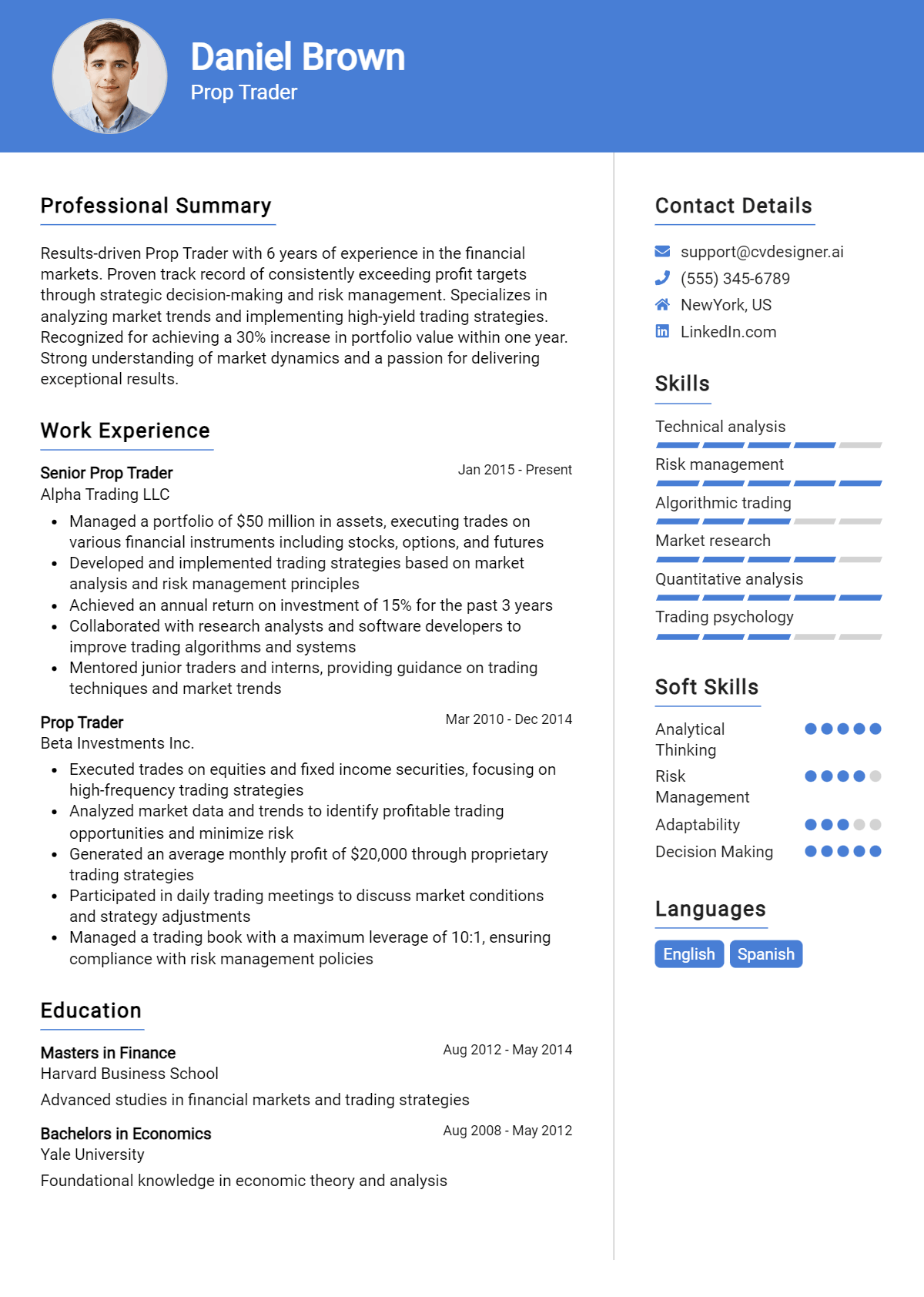

How to List Prop Trader Skills on Your Resume

Effectively listing your skills on a resume is crucial to standing out to potential employers, particularly in competitive fields like prop trading. There are three main sections where you can highlight your skills: the Resume Summary, Resume Work Experience, Resume Skills Section, and Cover Letter.

for Resume Summary

Showcasing your Prop Trader skills in the introduction section gives hiring managers a quick overview of your qualifications, making it essential for grabbing their attention.

Example

Results-driven Prop Trader with expertise in quantitative analysis and risk management, adept at executing high-frequency trades and leveraging market opportunities to maximize returns. Proven track record in developing trading strategies that enhance portfolio performance.

for Resume Work Experience

The work experience section provides the perfect opportunity to demonstrate how your Prop Trader skills have been applied in real-world scenarios.

Example

- Utilized technical analysis to identify profitable trading opportunities, resulting in a 20% increase in portfolio value.

- Executed over 1,000 trades per week while managing risk exposure through effective use of stop-loss orders.

- Collaborated with a team of traders to develop a quantitative trading model that improved execution speed by 30%.

- Maintained up-to-date knowledge of market trends and news events to inform trading decisions.

for Resume Skills

The skills section can showcase both technical and transferable skills. A balanced mix of hard and soft skills will strengthen your qualifications.

Example

- Quantitative Analysis

- Risk Management

- Technical Analysis

- Trade Execution

- Market Research

- Problem Solving

- Communication Skills

- Team Collaboration

for Cover Letter

A cover letter allows you to expand on the skills mentioned in your resume and provide a more personal touch. Highlighting 2-3 key skills that align with the job description can significantly strengthen your application.

Example

My extensive experience in risk management has allowed me to effectively mitigate potential losses, while my strong quantitative analysis skills have enabled me to identify lucrative trading opportunities. In my previous role, these skills led to a 25% increase in returns, demonstrating my ability to drive success in fast-paced trading environments.

Linking the skills mentioned in your resume to specific achievements in your cover letter reinforces your qualifications for the job, making your application even more compelling.

The Importance of Prop Trader Resume Skills

In the competitive field of proprietary trading, showcasing relevant skills on your resume is crucial for capturing the attention of recruiters and hiring managers. A well-crafted skills section not only highlights your qualifications but also aligns your expertise with the specific requirements of the job. By effectively communicating your strengths, you can distinguish yourself from other candidates and enhance your chances of landing an interview.

- Demonstrating analytical skills is vital for a Prop Trader, as it shows your ability to interpret market data and make informed decisions quickly. Highlighting your proficiency in quantitative analysis can set you apart from other candidates.

- Risk management is a key aspect of trading, and showcasing your skills in this area reflects your ability to minimize losses while maximizing gains. Recruiters look for candidates who can strategically assess risks and develop effective trading strategies.

- Technical skills, including proficiency in trading platforms and software, are essential for a Prop Trader. Displaying your familiarity with tools like Python, R, or specialized trading software can enhance your appeal to potential employers.

- Communication skills are often overlooked but are crucial for successful collaboration in fast-paced trading environments. Emphasizing your ability to articulate complex ideas clearly and work effectively within a team can make you a more attractive candidate.

- Highlighting your adaptability is important in the ever-changing landscape of financial markets. Showing that you can quickly adjust strategies in response to market fluctuations demonstrates your resilience and ability to thrive under pressure.

- Attention to detail is paramount in trading, as small errors can lead to significant financial losses. Including this skill on your resume illustrates your thoroughness and commitment to delivering accurate work.

- Lastly, showcasing your knowledge of market trends and economic indicators can demonstrate your commitment to ongoing education and your proactive approach to trading. This skill can position you as a well-rounded candidate who is dedicated to staying ahead in the industry.

For additional insights and examples, check out these Resume Samples.

How To Improve Prop Trader Resume Skills

In the fast-paced world of proprietary trading, continuously improving your skills is essential to stay competitive and effective. The financial markets are dynamic, and traders must adapt to new trends, technologies, and strategies. By enhancing your skills, you not only boost your resume but also increase your chances of success in securing lucrative trading opportunities.

- Engage in continuous education through online courses and certifications focused on trading strategies and market analysis.

- Practice using trading simulators to refine your strategies without risking real capital.

- Stay updated on market trends and economic indicators by following financial news and subscribing to industry reports.

- Network with other traders and professionals through forums, social media, or local trading groups to share insights and strategies.

- Analyze past trades to identify strengths and weaknesses, using this data to inform future trading decisions.

- Develop a strong understanding of risk management techniques to protect your capital and optimize returns.

- Participate in trading competitions or challenges to test your skills against other traders and gain valuable experience.

Frequently Asked Questions

What key skills should a prop trader highlight on their resume?

A prop trader should emphasize skills such as quantitative analysis, risk management, and market research. Proficiency in financial modeling, statistical analysis, and familiarity with trading platforms are also essential. Additionally, showcasing strong decision-making abilities and a track record of successful trades can help demonstrate the candidate's effectiveness in high-pressure environments.

How important is knowledge of financial markets for a prop trader?

Knowledge of financial markets is crucial for a prop trader, as it enables them to analyze trends, understand market dynamics, and make informed decisions based on current events. A solid grasp of various asset classes, trading strategies, and economic indicators can significantly enhance a trader's ability to capitalize on market opportunities and mitigate risks.

What role does risk management play in a prop trader's skill set?

Risk management is a fundamental aspect of a prop trader's skill set, as it involves identifying, assessing, and prioritizing risks associated with trading activities. Being proficient in risk management techniques, such as setting stop-loss orders and diversifying portfolios, allows traders to protect their capital and minimize potential losses while maximizing returns.

How can a prop trader demonstrate their analytical skills on a resume?

A prop trader can demonstrate their analytical skills on a resume by providing specific examples of their analytical processes, such as how they utilized data analysis tools to identify trading opportunities or assess market conditions. Highlighting achievements like successfully forecasting market movements or developing proprietary trading strategies can also showcase their analytical prowess effectively.

What technical skills are essential for a successful prop trader?

Technical skills that are essential for a successful prop trader include proficiency in programming languages such as Python or R for data analysis, as well as familiarity with trading software and platforms like MetaTrader or Bloomberg Terminal. Additionally, understanding technical analysis techniques, such as chart patterns and indicators, is crucial for making informed trading decisions based on price movements.

Conclusion

Incorporating Prop Trader skills into your resume is crucial for highlighting your expertise in a competitive job market. By showcasing relevant skills such as analytical thinking, risk management, and market analysis, candidates can effectively differentiate themselves and demonstrate their value to potential employers. Remember, a well-crafted resume not only reflects your abilities but also shows your commitment to professional growth.

As you refine your skills and tailor your job application, embrace the opportunity to present yourself in the best light possible. Take the first step towards your dream job today!

For more resources, check out our resume templates, utilize our resume builder, explore resume examples, and create compelling cover letters to enhance your application further.

Use an AI-powered resume builder and have your resume done in 5 minutes. Just select your template and our software will guide you through the process.