26 Property Tax Consultant Skills for Your Resume: List Examples

As a Property Tax Consultant, possessing the right skills is essential for navigating the complexities of property taxation and delivering valuable insights to clients. Your resume should highlight a blend of analytical abilities, knowledge of tax regulations, and strong communication skills that are crucial in this field. In the following section, we will outline the top skills that can enhance your candidacy and demonstrate your expertise in property tax consulting.

Best Property Tax Consultant Technical Skills

In the competitive field of property tax consulting, possessing the right technical skills is essential for success. These skills enable consultants to navigate complex tax regulations, perform accurate valuations, and advocate effectively for their clients. Here are some of the top technical skills that can enhance your resume and demonstrate your expertise in this area.

Property Valuation Techniques

Understanding various property valuation methods, such as income, cost, and sales comparison approaches, is critical for accurate assessments.

How to show it: Highlight specific properties you have valued and the methods used, along with the outcomes achieved.

Tax Law Knowledge

In-depth knowledge of local, state, and federal tax laws is crucial for advising clients and ensuring compliance.

How to show it: List any relevant certifications or courses completed in tax law, along with the jurisdictions covered.

Data Analysis

Strong data analysis skills enable consultants to interpret large datasets, identify trends, and make informed recommendations.

How to show it: Mention specific software or tools used for data analysis, and quantify the impact of your analyses on client outcomes.

Negotiation Skills

Negotiation skills are essential for advocating on behalf of clients during tax assessments and dispute resolutions.

How to show it: Share examples of successful negotiations, including the financial benefits achieved for clients.

Research Proficiency

Conducting thorough research on property markets, tax regulations, and comparable properties is vital for effective consulting.

How to show it: Detail specific research projects that led to successful tax appeals or strategies.

Client Relationship Management

Building and maintaining strong relationships with clients fosters trust and leads to repeat business and referrals.

How to show it: Quantify your client retention rates and any growth in your client base over time.

Technical Proficiency in Software

Proficiency in property tax software, spreadsheets, and databases enhances efficiency and accuracy in analyses and reports.

How to show it: List specific software tools you are adept in and provide examples of how they improved your work processes.

Report Writing Skills

Effective report writing is crucial for communicating findings and recommendations clearly to clients and authorities.

How to show it: Include examples of reports you have authored and any positive feedback received from clients.

Understanding of Market Trends

Keeping abreast of market trends allows consultants to provide relevant advice and strategies that align with current conditions.

How to show it: Discuss how your insights into market trends have influenced client decisions or tax strategies.

Attention to Detail

A keen attention to detail is essential for identifying discrepancies and ensuring accuracy in all analyses and filings.

How to show it: Provide examples of how your attention to detail has prevented costly errors or led to successful outcomes.

Regulatory Compliance Expertise

Understanding regulatory compliance ensures that clients adhere to all applicable property tax laws and avoid penalties.

How to show it: Outline instances where your advice helped clients remain compliant and avoid potential issues.

Best Property Tax Consultant Soft Skills

As a Property Tax Consultant, possessing strong soft skills is essential for navigating the complexities of property tax assessments and appeals. These skills facilitate effective communication with clients, collaboration with teams, and the ability to solve problems creatively. Highlighting these skills on your resume can significantly enhance your appeal to potential employers.

Communication

Effective communication is crucial for Property Tax Consultants to convey complex tax information clearly to clients and stakeholders.

How to show it: Detail instances where you successfully explained tax concepts or negotiated with tax authorities to resolve issues.

Problem-solving

The ability to analyze situations and develop solutions is vital for addressing challenges in property tax assessments.

How to show it: Provide examples of specific tax-related challenges you resolved and the impact it had on clients.

Time Management

Property Tax Consultants often juggle multiple cases and deadlines, making effective time management a key skill.

How to show it: Highlight how you prioritized tasks and met deadlines while handling various client cases.

Teamwork

Collaboration with colleagues and other professionals is essential for gathering information and providing comprehensive services.

How to show it: Showcase your experience working in teams and how your contributions led to successful outcomes.

Attention to Detail

A keen eye for detail is necessary to ensure accuracy in property assessments and tax calculations.

How to show it: Discuss instances where your attention to detail prevented errors or improved the quality of work.

Analytical Thinking

Analyzing data and trends is critical for developing strategies to minimize property tax liabilities.

How to show it: Provide examples of how your analytical skills contributed to successful tax strategies for clients.

Negotiation

Negotiation skills are important for advocating on behalf of clients during tax appeals and discussions with authorities.

How to show it: Detail successful negotiations that resulted in favorable outcomes for your clients.

Empathy

Understanding clients’ concerns and perspectives can help build trust and foster strong client relationships.

How to show it: Share examples of how you addressed client concerns and built rapport in challenging situations.

Adaptability

The ability to adapt to changing regulations and client needs is essential for success in property tax consulting.

How to show it: Highlight experiences where you successfully adjusted your approach to meet new challenges.

Research Skills

Strong research skills enable Property Tax Consultants to gather relevant information and make informed recommendations.

How to show it: Describe your research processes and how they contributed to successful tax outcomes.

Customer Service

Providing excellent customer service is essential for maintaining client satisfaction and loyalty in the consulting field.

How to show it: Discuss client feedback or metrics that showcase your commitment to customer service excellence.

How to List Property Tax Consultant Skills on Your Resume

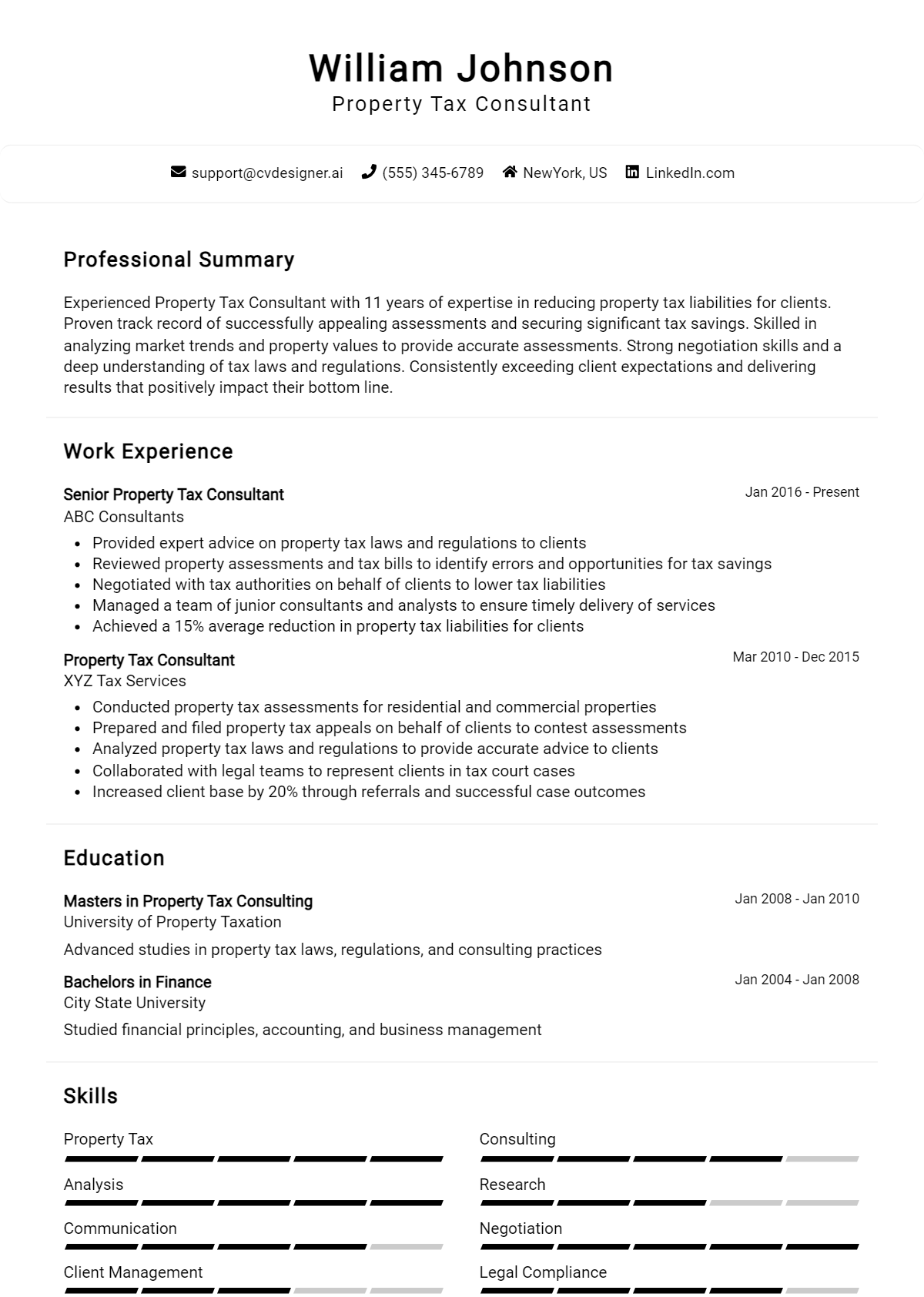

Effectively listing your skills on a resume is crucial in standing out to employers and showcasing your qualifications. There are three main sections where you can highlight your skills: Resume Summary, Resume Work Experience, Resume Skills Section, and Cover Letter.

for Resume Summary

Showcasing your Property Tax Consultant skills in the summary section offers hiring managers a quick overview of your qualifications and sets the tone for your resume.

Example

Detail-oriented Property Tax Consultant with expertise in property valuation and tax compliance. Proven track record of negotiating tax assessments to reduce client liabilities while enhancing client relationships.

for Resume Work Experience

The work experience section is an excellent opportunity to demonstrate how your Property Tax Consultant skills have been applied in real-world scenarios, giving credibility to your expertise.

Example

- Conducted comprehensive property evaluations leading to a 20% reduction in assessed values for clients.

- Collaborated with local tax authorities to resolve disputes, utilizing strong negotiation and communication skills.

- Developed and implemented tax strategies that resulted in significant savings for over 50 clients.

- Maintained up-to-date knowledge of tax regulations and policies, ensuring compliance and accuracy in filings.

for Resume Skills

The skills section can highlight both technical and transferable skills. A balanced mix of hard and soft skills should be included to provide a well-rounded view of your capabilities.

Example

- Property Valuation

- Tax Compliance

- Negotiation Skills

- Client Relationship Management

- Analytical Thinking

- Attention to Detail

- Regulatory Knowledge

- Problem Solving

for Cover Letter

A cover letter allows you to expand on the skills mentioned in your resume and provide a more personal touch. Highlighting 2-3 key skills that align with the job description can significantly enhance your application.

Example

As a Property Tax Consultant, my strong analytical skills and attention to detail have enabled me to streamline tax compliance processes, resulting in a 15% increase in client satisfaction. My ability to effectively negotiate with tax authorities has consistently achieved favorable outcomes for my clients, reinforcing my commitment to excellence.

Linking the skills mentioned in your resume to specific achievements in your cover letter can further reinforce your qualifications for the job. For more guidance, check out our sections on skills, Technical Skills, and work experience.

The Importance of Property Tax Consultant Resume Skills

Highlighting relevant skills in a Property Tax Consultant resume is crucial for capturing the attention of recruiters. A well-crafted skills section not only showcases your qualifications but also demonstrates your alignment with the specific job requirements. By effectively presenting your skills, you can distinguish yourself from other candidates and increase your chances of landing an interview.

- Property tax consultants must possess strong analytical skills to evaluate and interpret complex tax laws and regulations. This enables them to provide accurate assessments and recommendations to their clients, ensuring compliance and optimizing tax liabilities.

- Effective communication skills are essential for property tax consultants, as they must convey intricate information clearly to clients and stakeholders. This ability fosters trust and helps clients understand the implications of tax decisions.

- Attention to detail is a critical skill for property tax consultants, as even minor errors in tax filings can have significant financial consequences. Meticulous attention ensures that all documentation is accurate and thorough, minimizing the risk of audits or penalties.

- Proficiency in tax software and technology is increasingly important in today’s digital landscape. Familiarity with relevant tools not only streamlines processes but also enhances productivity, allowing consultants to serve clients efficiently.

- Strong research skills enable property tax consultants to stay updated on the latest changes in tax laws and industry trends. This knowledge is vital for providing informed advice and ensuring clients benefit from the most current strategies.

- Negotiation skills are invaluable for property tax consultants who may need to advocate on behalf of clients during property assessments or disputes. Effective negotiation can lead to favorable outcomes and significant savings for clients.

- Understanding of local real estate markets is crucial for property tax consultants, as property values can vary significantly by location. This knowledge helps consultants make informed assessments and recommendations tailored to the specific market conditions.

- Project management skills are beneficial for property tax consultants who juggle multiple clients and deadlines. Strong organizational abilities ensure that all tasks are completed efficiently and on time, enhancing client satisfaction.

For more insights and examples, you can explore various Resume Samples.

How To Improve Property Tax Consultant Resume Skills

In the ever-evolving field of property tax consulting, continuously improving your skills is crucial for maintaining a competitive edge and providing exceptional service to clients. As tax laws and regulations change, staying updated and enhancing your expertise not only boosts your resume but also increases your value in the job market. Here are some actionable tips to help you improve your skills as a property tax consultant:

- Attend industry-specific workshops and seminars to stay updated on the latest trends and regulations in property taxation.

- Obtain relevant certifications, such as the Certified Property Tax Advisor (CPTA), to enhance your credentials and demonstrate your expertise.

- Network with other professionals in the field through local tax associations or online forums to exchange knowledge and best practices.

- Engage in continuous education through online courses or webinars focusing on advanced property tax strategies and analytics.

- Gain practical experience by volunteering to assist with property tax assessments or working on pro bono projects for non-profit organizations.

- Utilize software tools and technology designed for property tax analysis to improve your efficiency and accuracy in tax assessments.

- Read industry publications and subscribe to newsletters to keep informed about changes in laws, case studies, and best practices in property taxation.

Frequently Asked Questions

What skills are essential for a Property Tax Consultant?

A successful Property Tax Consultant should possess strong analytical skills to evaluate property values and tax implications accurately. Additionally, excellent communication skills are essential for conveying complex tax information to clients and negotiating with tax authorities. Proficiency in research and data analysis tools is also crucial to ensure comprehensive assessments and strategic planning.

How important is knowledge of local tax laws for a Property Tax Consultant?

Knowledge of local tax laws and regulations is vital for a Property Tax Consultant, as property tax systems can vary significantly from one jurisdiction to another. Understanding these nuances allows consultants to provide informed advice and effectively represent clients in appeals or negotiations, ensuring compliance and maximizing potential savings.

What role does negotiation play in a Property Tax Consultant's job?

Negotiation is a critical skill for Property Tax Consultants, as they frequently engage with tax assessors and local government officials to advocate for their clients. Strong negotiation skills enable consultants to effectively challenge assessments, seek reductions, and ultimately secure favorable tax positions on behalf of property owners.

How can technology enhance a Property Tax Consultant's effectiveness?

Technology enhances a Property Tax Consultant's effectiveness by streamlining data analysis, record-keeping, and communication processes. Utilizing software tools for property valuation, tax calculation, and client management can significantly improve efficiency and accuracy, allowing consultants to focus more on strategy and client service.

What soft skills are beneficial for a Property Tax Consultant?

In addition to technical expertise, soft skills such as problem-solving, adaptability, and interpersonal communication are beneficial for a Property Tax Consultant. These skills enable consultants to handle complex client situations, adapt to changing regulations, and build strong relationships with clients and stakeholders, ultimately contributing to successful outcomes.

Conclusion

Incorporating Property Tax Consultant skills into your resume is essential for demonstrating your expertise and value in this specialized field. By effectively showcasing relevant skills, you not only set yourself apart from other candidates but also highlight your potential contributions to prospective employers. Remember, a well-crafted resume can open doors to new opportunities, and refining your skills is key to making your application stand out. Take the time to enhance your abilities and create a compelling resume that reflects your strengths.

For additional resources, consider exploring our resume templates, utilizing our resume builder, reviewing resume examples, and crafting a strong introduction with our cover letter templates.

Use an AI-powered resume builder and have your resume done in 5 minutes. Just select your template and our software will guide you through the process.