29 Payment Processing Specialist Skills For Your Resume with Exampels in 2025

As a Payment Processing Specialist, showcasing your skills on your resume is crucial to stand out in a competitive job market. This role requires a blend of technical proficiency and attention to detail, as well as strong analytical and communication abilities. In the following section, we will outline the essential skills that can enhance your resume and demonstrate your capability in managing payment transactions efficiently and accurately.

Best Payment Processing Specialist Technical Skills

As a Payment Processing Specialist, possessing the right technical skills is crucial for ensuring accurate and efficient transactions. These skills not only enhance your ability to manage payment systems but also foster trust and reliability with customers and stakeholders. Below are some essential technical skills to highlight on your resume.

Payment Gateway Integration

Understanding how to integrate various payment gateways is vital for facilitating smooth online transactions.

How to show it: Include specific payment gateways you've integrated, along with any improvements in transaction success rates.

Transaction Reconciliation

Proficiency in transaction reconciliation ensures that all payments are accurately accounted for and discrepancies are minimized.

How to show it: Quantify your experience by mentioning the volume of transactions reconciled and any error rate reductions.

Fraud Detection and Prevention

Skills in identifying and preventing fraudulent activities protect the company’s revenue and maintain customer trust.

How to show it: Highlight specific strategies you implemented that resulted in reduced fraud cases or increased detection rates.

Data Analysis

Analyzing transaction data helps in understanding customer behavior and improving payment processes.

How to show it: Provide examples of how your data analysis led to actionable insights or enhanced payment strategies.

Chargeback Management

Efficient handling of chargebacks minimizes losses and enhances customer relations.

How to show it: Discuss the percentage of chargebacks you successfully resolved or reduced during your tenure.

Compliance Knowledge

Familiarity with industry regulations (like PCI-DSS) ensures that payment processes remain secure and compliant.

How to show it: Mention any compliance training or certifications you have, along with how you maintained compliance in your role.

Technical Troubleshooting

The ability to quickly troubleshoot technical issues is essential for maintaining uninterrupted payment processing.

How to show it: Share examples of issues you resolved and the impact on transaction processing times.

API Management

Understanding APIs (Application Programming Interfaces) allows for seamless integration with various financial systems.

How to show it: Detail your experience in API implementations and any efficiencies gained as a result.

Customer Service Skills

Effective communication and problem-solving skills are vital for addressing customer inquiries regarding payment issues.

How to show it: Include metrics related to customer satisfaction or resolution times that improved under your management.

Proficiency in Payment Software

Experience with specific payment processing software enhances efficiency and accuracy in transactions.

How to show it: List the software you are proficient in and any improvements in efficiency or accuracy achieved.

Financial Reporting

Ability to prepare and analyze financial reports helps in strategic decision-making and financial transparency.

How to show it: Demonstrate your contributions to financial reporting processes and any positive outcomes on business strategy.

Best Payment Processing Specialist Soft Skills

In the fast-paced world of payment processing, soft skills play a critical role in ensuring efficient operations and excellent customer service. These interpersonal skills not only enhance communication and collaboration but also help in addressing challenges that arise in processing transactions. Here are some essential soft skills to highlight in your resume as a Payment Processing Specialist.

Communication

Clear communication is vital for effectively conveying information about payment processes and addressing customer inquiries promptly.

How to show it: Use examples that demonstrate your ability to communicate complex information clearly, such as training materials you created or presentations you delivered.

Problem-solving

Being able to identify and resolve issues quickly is crucial in maintaining the integrity and efficiency of payment processing systems.

How to show it: Highlight specific instances where you successfully resolved a payment issue, including the steps taken and the outcome achieved.

Time Management

Effectively managing time allows payment processing specialists to prioritize tasks and meet deadlines, ensuring smooth operations.

How to show it: Provide examples of how you organized your workload to meet tight deadlines or improved processing time metrics.

Teamwork

Collaboration with team members is essential for streamlining processes and enhancing overall efficiency in payment processing.

How to show it: Include examples of successful projects you contributed to as part of a team, emphasizing your role and the results.

Attention to Detail

Accuracy is critical in payment processing to prevent errors and ensure compliance with regulations.

How to show it: Demonstrate how your attention to detail helped identify discrepancies or improved accuracy in transaction processing.

Adaptability

The ability to adapt to changes in technology and regulations is crucial for maintaining efficiency in payment processing.

How to show it: Provide examples of how you quickly learned new systems or adapted to regulatory changes in your previous roles.

Customer Service Orientation

Providing exceptional service ensures customer satisfaction and fosters loyalty, which is vital in the payment processing industry.

How to show it: Share metrics that demonstrate your ability to improve customer satisfaction scores or resolve issues efficiently.

Analytical Thinking

The ability to analyze data and identify trends can help in optimizing payment processes and improving decision-making.

How to show it: Include specific examples of how your analytical skills led to process improvements or cost savings.

Organizational Skills

Staying organized is essential to manage multiple transactions and maintain accurate records in payment processing.

How to show it: Illustrate how your organizational skills contributed to efficiency, such as implementing a tracking system for transactions.

Conflict Resolution

Being able to resolve conflicts effectively is important in addressing customer complaints and internal disputes.

How to show it: Provide examples of situations where you successfully mediated conflicts, focusing on the resolution and positive outcomes.

Interpersonal Skills

Strong interpersonal skills facilitate better relationships with clients and colleagues, leading to a more collaborative work environment.

How to show it: Highlight experiences where your interpersonal skills helped improve teamwork or customer relations.

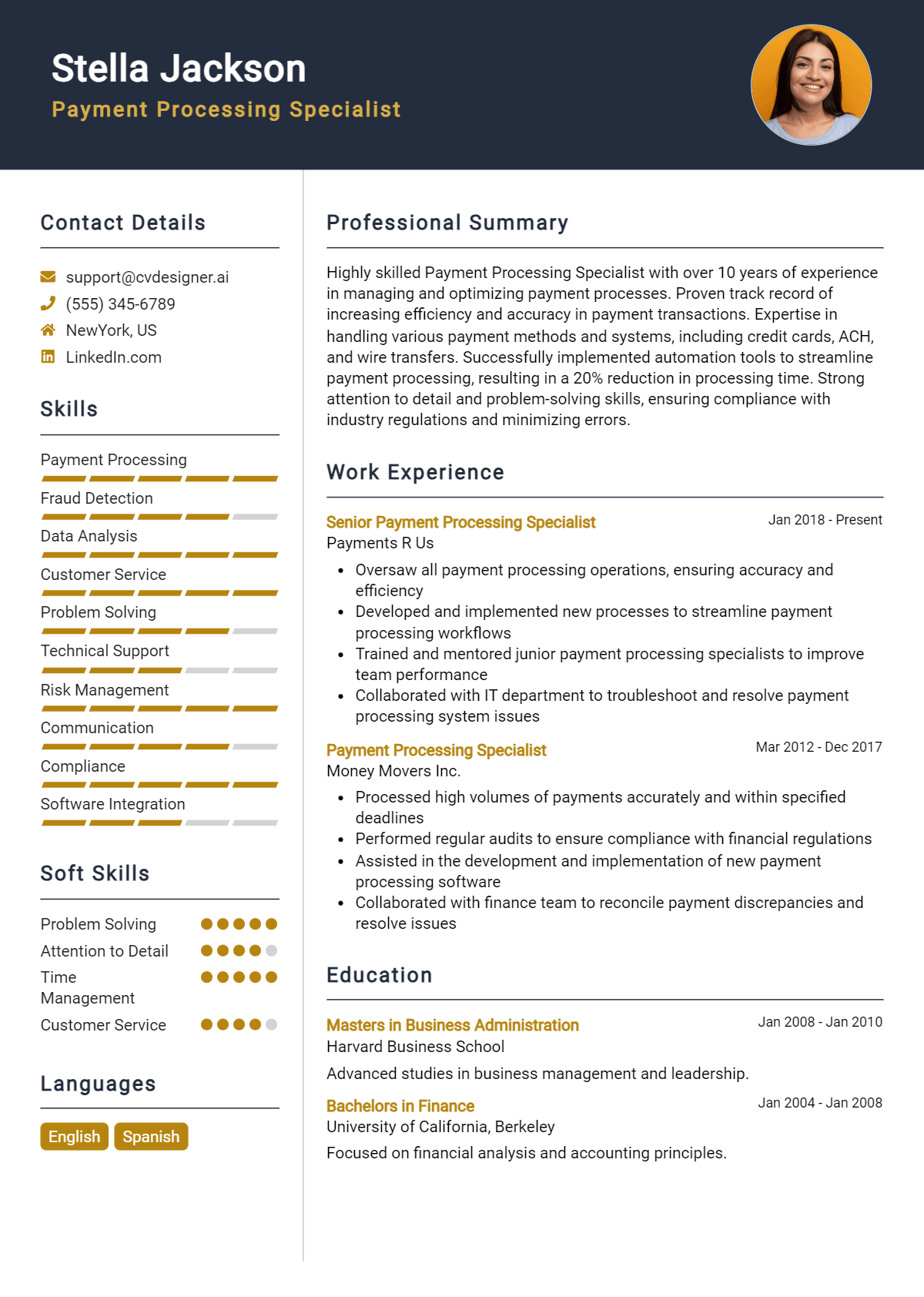

How to List Payment Processing Specialist Skills on Your Resume

Listing your skills effectively on a resume is crucial to stand out to potential employers. A well-crafted skills section can capture the attention of hiring managers and set you apart from other candidates. There are three main sections where skills can be highlighted: Resume Summary, Resume Work Experience, Resume Skills Section, and Cover Letter.

for Resume Summary

Showcasing your Payment Processing Specialist skills in the introduction section provides hiring managers with a quick overview of your qualifications. This allows them to quickly assess your fit for the role.

Example

Results-oriented Payment Processing Specialist with expertise in transaction reconciliation and customer service. Proven ability to enhance payment systems and ensure compliance with regulations, driving efficiency and accuracy.

for Resume Work Experience

The work experience section provides the perfect opportunity to demonstrate how your Payment Processing Specialist skills have been applied in real-world scenarios. Highlighting specific achievements will make your application more compelling.

Example

- Managed payment processing for over 300 transactions daily, ensuring accuracy and timeliness.

- Implemented new software that improved transaction tracking, reducing errors by 20% and enhancing customer satisfaction.

- Conducted training sessions for team members on compliance and best practices in payment processing.

- Collaborated with IT to troubleshoot issues, demonstrating strong problem-solving skills and adaptability.

for Resume Skills

The skills section can showcase both technical and transferable skills. It is essential to include a balanced mix of hard and soft skills to strengthen your overall qualifications.

Example

- Transaction Reconciliation

- Payment Processing Software

- Customer Service Excellence

- Regulatory Compliance

- Attention to Detail

- Data Analysis

- Problem-Solving

- Team Collaboration

for Cover Letter

A cover letter allows candidates to expand on the skills mentioned in the resume and provide a more personal touch. Highlighting 2-3 key skills that align with the job description can demonstrate your fit for the role.

Example

In my previous role, I utilized my transaction reconciliation and customer service skills to streamline payment processes, resulting in a 30% improvement in processing time. I am eager to bring this expertise to your team and contribute to enhancing your payment systems.

Encouragingly, candidates should link the skills mentioned in their resume to specific achievements in their cover letter, reinforcing their qualifications for the job.

The Importance of Payment Processing Specialist Resume Skills

In today's competitive job market, a well-crafted resume is essential for any candidate looking to secure a position as a Payment Processing Specialist. Highlighting relevant skills not only helps candidates stand out to recruiters but also aligns them with the specific job requirements outlined in the job description. A focused skills section can make a significant difference in catching the eye of hiring managers and demonstrating a candidate's suitability for the role.

- Relevant skills showcase the candidate's expertise in payment systems, helping to build credibility with potential employers. This is crucial in an industry where precision and accuracy are paramount.

- Highlighting proficiency in software and tools related to payment processing indicates the candidate's readiness to adapt quickly to the company's existing systems, reducing training time and increasing productivity.

- Strong analytical skills are essential for identifying discrepancies and resolving issues in payment transactions. Employers value candidates who can demonstrate this capability effectively on their resumes.

- Understanding of regulatory compliance and security protocols is vital in the payment processing industry. Candidates who emphasize these skills show their awareness of the industry's legal responsibilities.

- Communication skills are key in collaborating with team members and providing excellent customer service. Illustrating these abilities in a resume can set a candidate apart from others who may focus solely on technical skills.

- Detail-oriented candidates are essential to minimize errors in payment processing. Highlighting attention to detail in a resume can reassure employers of a candidate's thoroughness and reliability.

- By including transferable skills such as problem-solving and time management, candidates can demonstrate their ability to handle the demanding nature of payment processing roles effectively.

- Finally, a well-structured skills section can serve as a quick reference for recruiters, making it easier for them to match candidates with job requirements swiftly.

For more insights and examples, visit our Resume Samples page.

How To Improve Payment Processing Specialist Resume Skills

In the ever-evolving landscape of finance and technology, it's crucial for Payment Processing Specialists to continuously enhance their skills. Staying updated not only boosts your resume but also helps you perform your job more efficiently, ensuring accuracy and compliance in payment transactions. Here are some actionable tips to help you improve your skills in this role:

- Enroll in online courses related to payment processing and financial technology to deepen your knowledge.

- Attend industry webinars and workshops to stay informed about the latest trends and regulations in payment processing.

- Obtain relevant certifications, such as the Certified Payments Professional (CPP), to demonstrate your expertise and commitment to the field.

- Gain hands-on experience by volunteering for projects that involve payment processing systems and software.

- Network with other professionals in the industry through LinkedIn or local meetups to exchange knowledge and best practices.

- Read industry publications and blogs to keep up with changes in payment processing technologies and consumer behavior.

- Practice your analytical and problem-solving skills by working on case studies or simulations related to payment processing scenarios.

Frequently Asked Questions

What are the essential skills needed for a Payment Processing Specialist?

A Payment Processing Specialist should possess strong analytical skills, attention to detail, and proficiency in financial software. Additionally, they should have a good understanding of payment systems, fraud detection methods, and compliance regulations. Effective communication and problem-solving abilities are also vital, as the role often involves interacting with customers and resolving payment-related issues.

How important is experience with payment processing software?

Experience with payment processing software is crucial for a Payment Processing Specialist, as it enables them to efficiently manage transactions and reconcile accounts. Familiarity with various payment gateways and platforms enhances their ability to troubleshoot issues and implement solutions swiftly. This technical proficiency is often highlighted in resumes to demonstrate capability and readiness for the role.

What role does customer service play in payment processing?

Customer service is a fundamental aspect of payment processing, as specialists often serve as the first point of contact for clients experiencing payment issues. Strong customer service skills help them communicate effectively, provide timely assistance, and ensure client satisfaction. Employers value candidates who can handle inquiries and complaints professionally while maintaining a focus on resolving payment discrepancies.

Are analytical skills important in this role?

Yes, analytical skills are vital for a Payment Processing Specialist, as they need to assess transaction data, identify trends, and detect irregularities that may indicate fraud or errors. Strong analytical abilities enable specialists to make informed decisions and implement strategies that enhance the efficiency and security of payment processing operations.

What certifications can enhance a Payment Processing Specialist's resume?

Certifications such as Certified Payments Professional (CPP) or Certified Electronic Payments Specialist (CEPS) can significantly enhance a Payment Processing Specialist's resume. These certifications demonstrate a commitment to the industry and validate the specialist's knowledge of payment processing systems, compliance regulations, and best practices, making them more attractive to potential employers.

Conclusion

Incorporating Payment Processing Specialist skills in your resume is crucial for demonstrating your expertise in a highly competitive job market. By showcasing relevant skills such as transaction management, attention to detail, and proficiency with payment systems, candidates can effectively stand out and convey their value to potential employers. Remember, a well-crafted resume not only highlights your capabilities but also reflects your professionalism and dedication to the role.

As you refine your skills and enhance your resume, take the time to utilize available resources such as resume templates, resume builder, resume examples, and cover letter templates. Embrace the journey of personal and professional growth, and remember that every step you take towards refining your skills brings you closer to landing your dream job!

Use an AI-powered resume builder and have your resume done in 5 minutes. Just select your template and our software will guide you through the process.