23 good skills to put on resume for International Tax Manager in 2025

As an International Tax Manager, possessing a diverse set of skills is essential for navigating the complexities of global tax regulations and compliance. This section highlights the top competencies that can enhance your resume and demonstrate your expertise in international taxation. From analytical abilities to strong communication skills, these attributes are critical for effectively managing cross-border tax issues and optimizing tax strategies for multinational corporations.

Best International Tax Manager Technical Skills

In the complex world of international finance, an International Tax Manager must possess a robust set of technical skills to navigate the intricacies of global tax laws and regulations. These skills not only enhance their capability to optimize tax strategies but also ensure compliance with diverse tax systems across different jurisdictions. Below are essential technical skills that should be highlighted on your resume.

Transfer Pricing

Transfer pricing involves setting the prices for transactions between related legal entities. Mastery in this area is crucial for compliance and for optimizing tax liabilities across borders.

How to show it: Detail specific transfer pricing strategies you've implemented, including any adjustments that resulted in tax savings or compliance improvements. Quantify results, such as percentage reductions in tax exposure.

International Tax Compliance

Understanding and ensuring compliance with international tax laws and regulations is vital for any International Tax Manager. This skill helps in avoiding penalties and managing risks effectively.

How to show it: Include examples of compliance audits you’ve managed or international tax filings you’ve overseen, highlighting any successful outcomes or improvements in compliance rates.

Tax Treaty Analysis

Tax treaties between countries can significantly impact tax liabilities. Analyzing these treaties is essential for determining applicable benefits and reducing withholding taxes.

How to show it: Describe instances where your analysis of tax treaties led to strategic benefits, such as reduced withholding tax rates. Use specific figures to illustrate savings.

Cross-Border Tax Strategies

Developing effective tax strategies for cross-border transactions is fundamental to minimizing tax exposure and maximizing profits for multinational corporations.

How to show it: Provide examples of cross-border tax strategies you developed, emphasizing the financial outcomes and benefits achieved for the organization.

Tax Risk Management

Identifying and mitigating tax risks is crucial for protecting the company from potential legal issues and financial losses. This involves a proactive approach to tax planning.

How to show it: Detail specific risk management frameworks or assessments you’ve created or improved, including any quantifiable impacts on risk mitigation.

Accounting Principles (GAAP/IFRS)

A strong grasp of accounting principles, including GAAP and IFRS, is essential for accurately reporting tax obligations and ensuring financial transparency.

How to show it: Highlight your experience in applying GAAP or IFRS in tax reporting, including any projects that enhanced financial reporting accuracy or reduced discrepancies.

Tax Software Proficiency

Proficiency in tax software and tools is critical for efficiency in tax preparation, compliance, and reporting processes.

How to show it: List specific tax software platforms you are adept in, along with examples of how you utilized them to streamline tax processes or enhance data accuracy.

Foreign Tax Credits and Deductions

Understanding how to apply foreign tax credits and deductions effectively can lead to significant tax savings for multinational corporations.

How to show it: Include details about your successful applications of foreign tax credits, such as the amount of tax savings achieved through these strategies.

Global Tax Policy Knowledge

Staying updated on global tax policy changes is essential for making informed decisions and advising the organization effectively.

How to show it: Demonstrate your proactive approach to learning about global tax policies, perhaps by mentioning any training, seminars, or research projects you've undertaken, and the resulting impact on your organization.

Data Analysis Skills

Strong data analysis skills are necessary for interpreting financial data and making informed tax-related decisions.

How to show it: Illustrate your ability to analyze complex data sets for tax implications, including specific tools or methodologies used and the insights gained that benefited the organization.

Communication Skills

Effective communication skills are vital for explaining complex tax concepts to stakeholders and collaborating with various departments.

How to show it: Provide examples of successful presentations or reports you’ve delivered that resulted in better understanding or collaboration on tax issues within the organization.

Best International Tax Manager Soft Skills

In the evolving landscape of international taxation, soft skills play a pivotal role in the success of an International Tax Manager. These workplace skills not only enhance communication and collaboration but also facilitate problem-solving, effective time management, and teamwork. As tax regulations become increasingly complex and global in nature, possessing the right soft skills can differentiate a candidate in a competitive job market.

Communication

Effective communication is essential for an International Tax Manager, who must convey complex tax regulations and strategies clearly to clients, stakeholders, and team members.

How to show it: Highlight instances where you successfully explained intricate tax concepts to non-experts or led presentations that resulted in improved client understanding. Quantify your achievements by mentioning feedback scores or audience sizes.

Problem-solving

The ability to identify and solve tax-related issues is crucial. An International Tax Manager must navigate complex regulations and find solutions that align with business goals.

How to show it: Provide examples of challenges you faced in tax compliance or planning and detail the solutions you implemented. Use metrics to showcase the impact of your problem-solving efforts on the organization.

Time Management

Managing multiple projects and deadlines is a daily reality for an International Tax Manager. Effective time management ensures that all tasks are completed accurately and on time.

How to show it: Demonstrate your ability to prioritize tasks and meet deadlines by sharing examples of successful project completions or instances where you accelerated processes that improved efficiency.

Teamwork

An International Tax Manager often collaborates with various departments and teams. Strong teamwork skills foster a cooperative environment that enhances overall performance.

How to show it: Include experiences where you worked with cross-functional teams on tax strategies or compliance projects. Highlight any collaborative achievements, such as joint presentations or successful audits.

Adaptability

The international tax landscape is constantly changing due to new regulations and global economic shifts. Being adaptable is crucial for responding effectively to these changes.

How to show it: Share examples of how you successfully adjusted strategies in response to new tax laws or international agreements. Highlight specific outcomes or improvements that resulted from your adaptability.

Attention to Detail

Precision is vital in tax management. An International Tax Manager must ensure that all calculations and filings are accurate to avoid costly mistakes.

How to show it: Provide examples of your meticulous work in tax preparation or compliance reviews. Quantify your success by mentioning error reduction percentages or successful audits.

Analytical Thinking

Strong analytical skills are necessary for interpreting complex tax data and making informed decisions that benefit the organization.

How to show it: Detail experiences where your analytical skills led to effective tax strategies or financial insights. Use data-driven results to convey the impact of your analysis.

Negotiation

Negotiation skills can be crucial when dealing with tax authorities and negotiating favorable terms for clients or the organization.

How to show it: Highlight successful negotiations you’ve conducted regarding tax disputes or agreements. Include details about the outcome and how it benefited the organization.

Leadership

Leadership is key for guiding teams and making strategic decisions that align with the company's goals in international tax matters.

How to show it: Describe your leadership roles in tax projects, including mentorship of junior staff or leading a team through complex tax initiatives. Quantify the results of your leadership efforts.

Interpersonal Skills

Building strong relationships with clients and colleagues is vital for success in international tax management. Interpersonal skills foster trust and collaboration.

How to show it: Share examples of how you built relationships that led to successful collaborations or client retention, emphasizing feedback or testimonials from clients or teammates.

Strategic Thinking

Strategic thinking allows an International Tax Manager to align tax planning with the long-term goals of the organization and anticipate future regulatory changes.

How to show it: Provide examples of strategic initiatives you developed that positively impacted the organization’s tax position. Highlight measurable outcomes or improvements in efficiency.

How to List International Tax Manager Skills on Your Resume

Effectively listing your skills on a resume is crucial in standing out to employers, especially for a specialized role like an International Tax Manager. There are three main sections where your skills can be highlighted: Resume Summary, Resume Work Experience, Resume Skills Section, and Cover Letter.

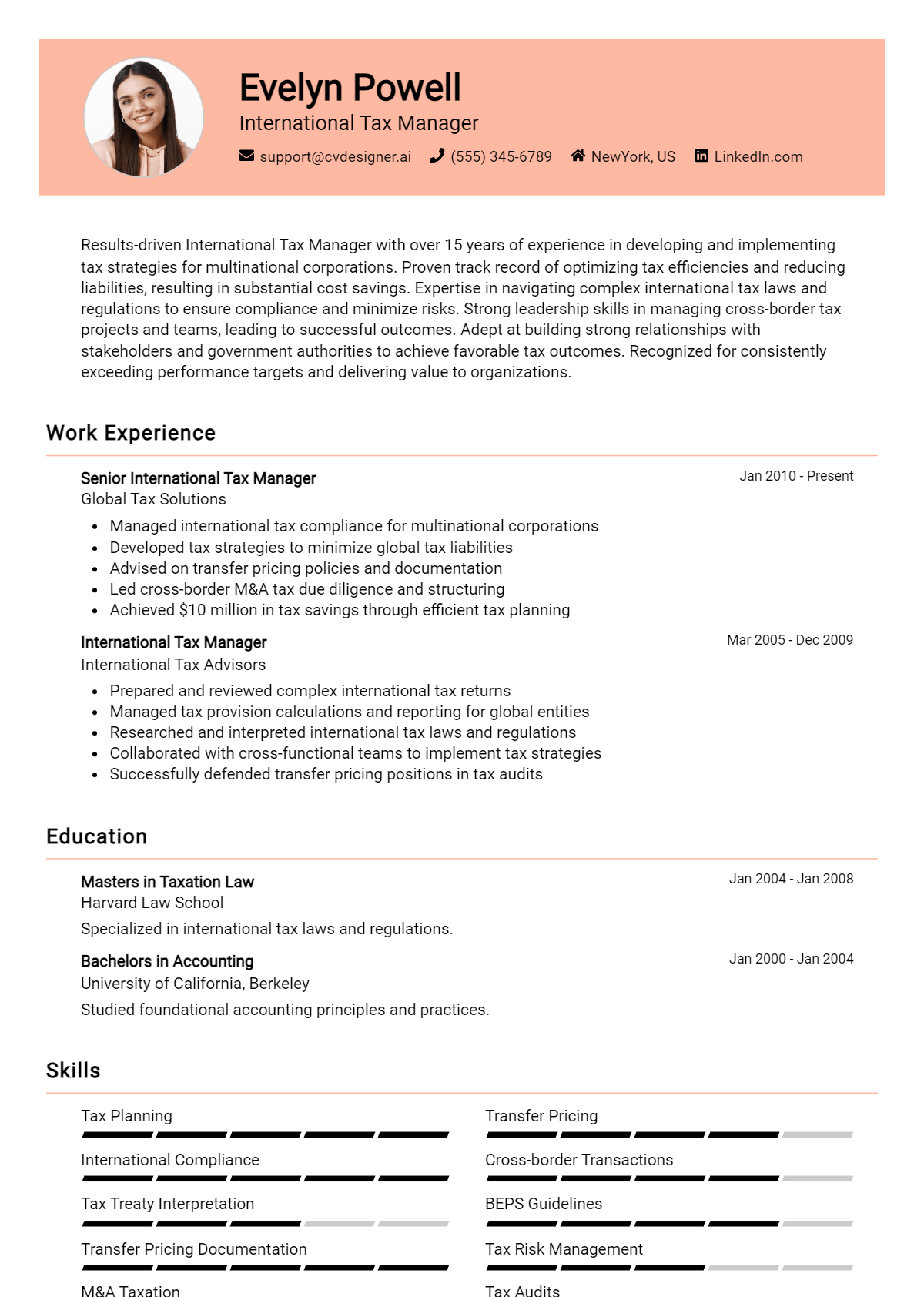

for Resume Summary

Showcasing International Tax Manager skills in the introduction (objective or summary) section provides hiring managers with a quick overview of your qualifications and sets the tone for the rest of your resume.

Example

As an accomplished International Tax Manager with expertise in transfer pricing, compliance regulations, and cross-border transactions, I am committed to optimizing tax strategies and ensuring regulatory adherence while enhancing operational efficiency.

for Resume Work Experience

The work experience section provides the perfect opportunity to demonstrate how your International Tax Manager skills have been applied in real-world scenarios, showcasing your impact and contributions.

Example

- Implemented comprehensive compliance strategies that reduced tax liabilities by 15% across multiple jurisdictions.

- Collaborated with cross-functional teams to streamline transfer pricing documentation, improving accuracy and efficiency.

- Led audits and risk assessments for international operations, ensuring adherence to local and global regulations.

- Developed training programs on international tax laws for staff, enhancing team knowledge and performance.

for Resume Skills

The skills section can showcase both technical and transferable skills, emphasizing a balanced mix of hard and soft skills relevant to the role of an International Tax Manager.

Example

- International Tax Compliance

- Transfer Pricing Analysis

- Cross-Border Transactions

- Risk Management

- Regulatory Knowledge

- Financial Analysis

- Strategic Planning

- Communication Skills

for Cover Letter

A cover letter allows candidates to expand on the skills mentioned in their resume while providing a more personal touch. Highlighting 2-3 key skills that align with the job description can effectively demonstrate your fit for the role.

Example

My experience in international tax compliance and transfer pricing analysis has allowed me to successfully navigate complex regulations, resulting in a 20% increase in efficiency within my previous team. I am eager to bring this expertise to your organization and drive positive outcomes.

Linking the skills mentioned in your resume to specific achievements in your cover letter reinforces your qualifications for the job, making a compelling case for your candidacy.

The Importance of International Tax Manager Resume Skills

In today's competitive job market, showcasing relevant skills on your resume is crucial, especially for specialized roles like an International Tax Manager. A well-crafted skills section not only highlights your qualifications but also helps you stand out to recruiters by aligning your expertise with the job requirements. By effectively communicating your skills, you can demonstrate your value to potential employers and increase your chances of landing an interview.

- Effective communication skills are essential for an International Tax Manager, as you need to convey complex tax regulations and strategies to clients and stakeholders clearly and concisely.

- Demonstrating strong analytical skills is vital, as the role requires assessing international tax implications and identifying opportunities for tax optimization in a global context.

- Proficiency in tax compliance and reporting is paramount, as it ensures adherence to various international tax laws and regulations, helping companies mitigate risks and avoid penalties.

- Project management skills are important for coordinating cross-border transactions and managing multiple tax projects simultaneously, ensuring timely completion and efficiency.

- Knowledge of international tax treaties and their applications is a key skill, as it enables you to leverage beneficial provisions to minimize tax liabilities for your organization.

- Staying updated with the latest tax reforms and global trends is crucial, as it allows you to provide strategic advice and ensure your strategies are compliant with current regulations.

- Technical skills related to tax software and tools enhance your efficiency in data analysis and reporting, making it easier to manage complex tax scenarios.

- Interpersonal skills are necessary for building relationships with clients and colleagues, fostering collaboration, and ensuring a smooth workflow within teams.

For more insights and examples, check out [Resume Samples](https://resumekraft.com/resume-samples/).

How To Improve International Tax Manager Resume Skills

In the ever-evolving landscape of international taxation, it is crucial for an International Tax Manager to continuously enhance their skills to remain competitive and effective. The complexities of global tax regulations, coupled with the need for strategic planning and compliance, demand a commitment to professional development. By refining necessary skills, individuals can not only boost their resume but also increase their value to current and prospective employers.

- Stay Updated on Global Tax Regulations: Regularly review changes in international tax laws and treaties to ensure compliance and strategic advantage.

- Enhance Analytical Skills: Engage in exercises that improve your ability to analyze complex tax structures and financial statements.

- Develop Strong Communication Skills: Practice conveying complex tax concepts clearly and concisely to stakeholders and clients.

- Network with Professionals: Join professional organizations and attend conferences to learn from peers and industry leaders.

- Invest in Continuing Education: Enroll in courses or certifications related to international tax, such as advanced tax planning or transfer pricing.

- Leverage Technology: Familiarize yourself with tax software and data analytics tools that streamline tax processes and enhance accuracy.

- Gain Practical Experience: Seek opportunities for hands-on experience through internships, projects, or volunteer work in international tax settings.

Frequently Asked Questions

What are the essential skills required for an International Tax Manager?

An International Tax Manager should possess a robust understanding of international tax laws and regulations, as well as strong analytical skills to interpret complex tax codes. Proficiency in tax compliance and planning, along with the ability to navigate cross-border transactions, is crucial. Additionally, excellent communication skills are necessary to effectively collaborate with clients and other departments, while leadership abilities are important for managing teams and projects efficiently.

How important is experience in different jurisdictions for an International Tax Manager?

Experience in various jurisdictions is highly valuable for an International Tax Manager, as it provides insights into the diverse tax policies and regulations that can impact multinational operations. Familiarity with the tax implications of doing business in different countries enables the manager to develop effective strategies that optimize tax liabilities while ensuring compliance. This experience also helps in building relationships with local tax authorities and understanding the nuances of international tax treaties.

What software skills should an International Tax Manager have?

An International Tax Manager should be proficient in tax software and tools that facilitate compliance and reporting, such as SAP, Oracle, or specialized tax management systems. Additionally, strong skills in data analysis tools like Excel are essential for managing and analyzing financial data. Familiarity with document management systems is also beneficial for organizing tax documentation and ensuring accuracy in filings.

How can an International Tax Manager stay updated on tax law changes?

To stay updated on tax law changes, an International Tax Manager should regularly engage with professional organizations, attend relevant workshops and seminars, and subscribe to tax publications and newsletters. Networking with peers in the field can also provide insights into best practices and emerging trends. Additionally, leveraging online resources, such as webinars and forums, can help in keeping abreast of global tax developments and regulatory updates.

What role does strategic planning play in the responsibilities of an International Tax Manager?

Strategic planning is a critical component of an International Tax Manager's responsibilities, as it involves assessing the tax implications of business decisions and optimizing tax structures. This includes evaluating potential risks and opportunities related to international operations, mergers, and acquisitions. By developing a comprehensive tax strategy aligned with the company's overall business objectives, the manager can help minimize tax liabilities and enhance global competitiveness.

Conclusion

Incorporating the skills of an International Tax Manager into your resume is vital for standing out in a competitive job market. These specialized skills not only highlight your expertise but also demonstrate your ability to navigate complex international tax regulations, which is invaluable to potential employers. By showcasing your relevant skills effectively, you increase your chances of making a lasting impression and providing significant value to organizations seeking top talent.

As you refine your skills and tailor your application, remember that each step you take enhances your prospects for success. Stay motivated and focused on developing your capabilities to create a compelling job application that truly reflects your potential.

For additional resources, consider checking out our resume templates, utilize our resume builder, explore various resume examples, and craft an impactful introduction with our cover letter templates.

Use an AI-powered resume builder and have your resume done in 5 minutes. Just select your template and our software will guide you through the process.