23 Insurance Operations Manager Skills for Your Resume in 2025

As an Insurance Operations Manager, possessing a diverse skill set is essential for effectively overseeing the daily functions of an insurance organization. This role demands a combination of analytical, managerial, and interpersonal skills to ensure smooth operations, compliance with regulations, and exceptional customer service. In the following section, we will explore the top skills that can enhance your resume and set you apart in the competitive insurance industry.

Best Insurance Operations Manager Technical Skills

As an Insurance Operations Manager, possessing the right technical skills is crucial for effectively managing processes, analyzing data, and ensuring compliance within the insurance industry. These skills not only enhance operational efficiency but also contribute to better decision-making and improved customer service. Here are some of the essential technical skills to highlight on your resume.

Claims Management Systems

Understanding and utilizing claims management systems is vital for streamlining the claims process, ensuring accuracy, and improving customer satisfaction.

How to show it: Detail your experience with specific claims management software, and quantify improvements in claims processing times or customer satisfaction ratings.

Data Analysis and Reporting

The ability to analyze data and generate reports allows an Insurance Operations Manager to make informed decisions based on trends and performance metrics.

How to show it: Include examples of how your data analysis led to process improvements or cost savings, and specify the metrics you tracked.

Regulatory Compliance

Knowledge of regulatory requirements is essential for maintaining compliance and avoiding legal issues that could impact the organization.

How to show it: Highlight any compliance audits you have led or participated in, and mention how you successfully ensured adherence to regulations.

Process Improvement Methodologies

Familiarity with methodologies such as Lean or Six Sigma helps in identifying inefficiencies and implementing process enhancements.

How to show it: Describe specific projects where you applied process improvement techniques and the resulting efficiencies gained.

Customer Relationship Management (CRM) Systems

Proficiency in CRM systems aids in tracking customer interactions and enhancing service quality, ultimately leading to better retention rates.

How to show it: Mention your experience with CRM platforms and provide statistics on improved customer engagement or retention as a result of your efforts.

Insurance Underwriting Principles

Understanding underwriting principles is crucial for assessing risk and determining appropriate coverage options for clients.

How to show it: List your experience in underwriting and any specific metrics related to risk assessment accuracy or underwriting efficiency.

Financial Acumen

Strong financial skills are necessary for managing budgets, forecasting expenses, and ensuring profitability within the operations.

How to show it: Provide examples of budget management experiences and any financial targets you exceeded during your tenure.

Project Management

Project management skills help in overseeing multiple initiatives, ensuring timely completion and alignment with business objectives.

How to show it: Detail specific projects you have managed, including timelines and outcomes, to demonstrate your effectiveness in this area.

Technology Implementation

Experience with implementing new technologies is vital for improving operational processes and enhancing service delivery.

How to show it: Discuss any technology rollouts you led, focusing on user adoption rates and efficiency gains post-implementation.

Risk Management

Knowledge of risk management practices is essential to identify potential risks and develop strategies to mitigate them.

How to show it: Share specific instances where you identified and managed risks, and the impact of your strategies on the business.

Insurance Policy Knowledge

A comprehensive understanding of various insurance products is crucial for advising clients and ensuring proper coverage.

How to show it: List the types of policies you are familiar with and any sales achievements related to policy placements.

Best Insurance Operations Manager Soft Skills

In the dynamic field of insurance, soft skills play a pivotal role in ensuring that an Insurance Operations Manager not only leads effectively but also fosters a collaborative and productive work environment. These workplace skills are essential for navigating complex challenges, communicating with diverse teams, and driving operational efficiency. Below are key soft skills that are crucial for success in this role.

Communication

Effective communication is vital for an Insurance Operations Manager as it facilitates clear interactions with team members, stakeholders, and clients. Strong communication skills ensure that policies, procedures, and expectations are understood and followed.

How to show it: Highlight your ability to convey complex information clearly. Include examples of presentations, reports, or training sessions you led that resulted in improved team performance or client satisfaction.

Problem-solving

Problem-solving skills are essential for identifying issues quickly and developing effective solutions. An Insurance Operations Manager must navigate challenges ranging from claims processing to regulatory compliance, making this skill indispensable.

How to show it: Demonstrate your problem-solving abilities by sharing specific instances where you identified a problem and implemented a solution that resulted in measurable improvements, such as reduced processing times or increased efficiency.

Time Management

Time management is crucial for balancing multiple responsibilities and deadlines in the insurance sector. An Insurance Operations Manager must prioritize tasks effectively to ensure that operations run smoothly and objectives are met on time.

How to show it: Provide examples of how you managed competing priorities, such as leading multiple projects simultaneously while meeting all deadlines. Quantify your achievements, like completing a major project ahead of schedule.

Teamwork

Teamwork is essential in fostering collaboration among diverse teams within the insurance industry. An Insurance Operations Manager must work effectively with others to achieve common goals and enhance overall operational performance.

How to show it: Include instances where you successfully led a team or participated in cross-departmental collaborations that improved workflow or outcomes. Quantify team achievements to showcase your contribution.

Adaptability

Adaptability allows an Insurance Operations Manager to respond effectively to changes in regulations, market conditions, and company policies. This skill is vital for maintaining operational resilience in a constantly evolving industry.

How to show it: Share experiences where you adapted to significant changes, such as implementing new technology or processes. Highlight outcomes that demonstrate your flexibility and readiness to embrace change.

Leadership

Leadership skills are critical for guiding teams and inspiring confidence in stakeholders. An Insurance Operations Manager must be able to motivate staff, set a vision, and drive performance within the organization.

How to show it: Illustrate your leadership capabilities by discussing your experience in mentoring team members or leading successful initiatives. Provide measurable results, like improved team engagement scores or performance metrics.

Attention to Detail

Attention to detail is crucial for ensuring accuracy in documentation, compliance, and risk assessment. An Insurance Operations Manager must be vigilant to minimize errors that could lead to significant financial implications.

How to show it: Highlight your meticulous approach by providing examples of how your attention to detail improved processes or reduced errors in documentation or claims processing.

Customer Service Orientation

A strong customer service orientation helps an Insurance Operations Manager prioritize client needs and enhance satisfaction. This skill is vital for building long-term relationships and ensuring client retention.

How to show it: Share specific achievements in improving customer satisfaction scores or resolving client issues effectively. Provide metrics to quantify your impact on client relationships.

Negotiation Skills

Negotiation skills are important for resolving conflicts and reaching mutually beneficial agreements with clients, vendors, and regulatory bodies. An Insurance Operations Manager must navigate these discussions skillfully.

How to show it: Demonstrate your negotiation skills by providing examples of successful negotiations that resulted in favorable terms or outcomes for your organization. Quantify the benefits gained through these negotiations.

Analytical Thinking

Analytical thinking enables an Insurance Operations Manager to assess data, identify trends, and make informed decisions. This skill is essential for optimizing operations and improving risk management strategies.

How to show it: Provide examples of how you used data analysis to drive decisions that improved operational efficiency or reduced risks. Include specific metrics to illustrate your analytical contributions.

Conflict Resolution

Conflict resolution skills are crucial for addressing

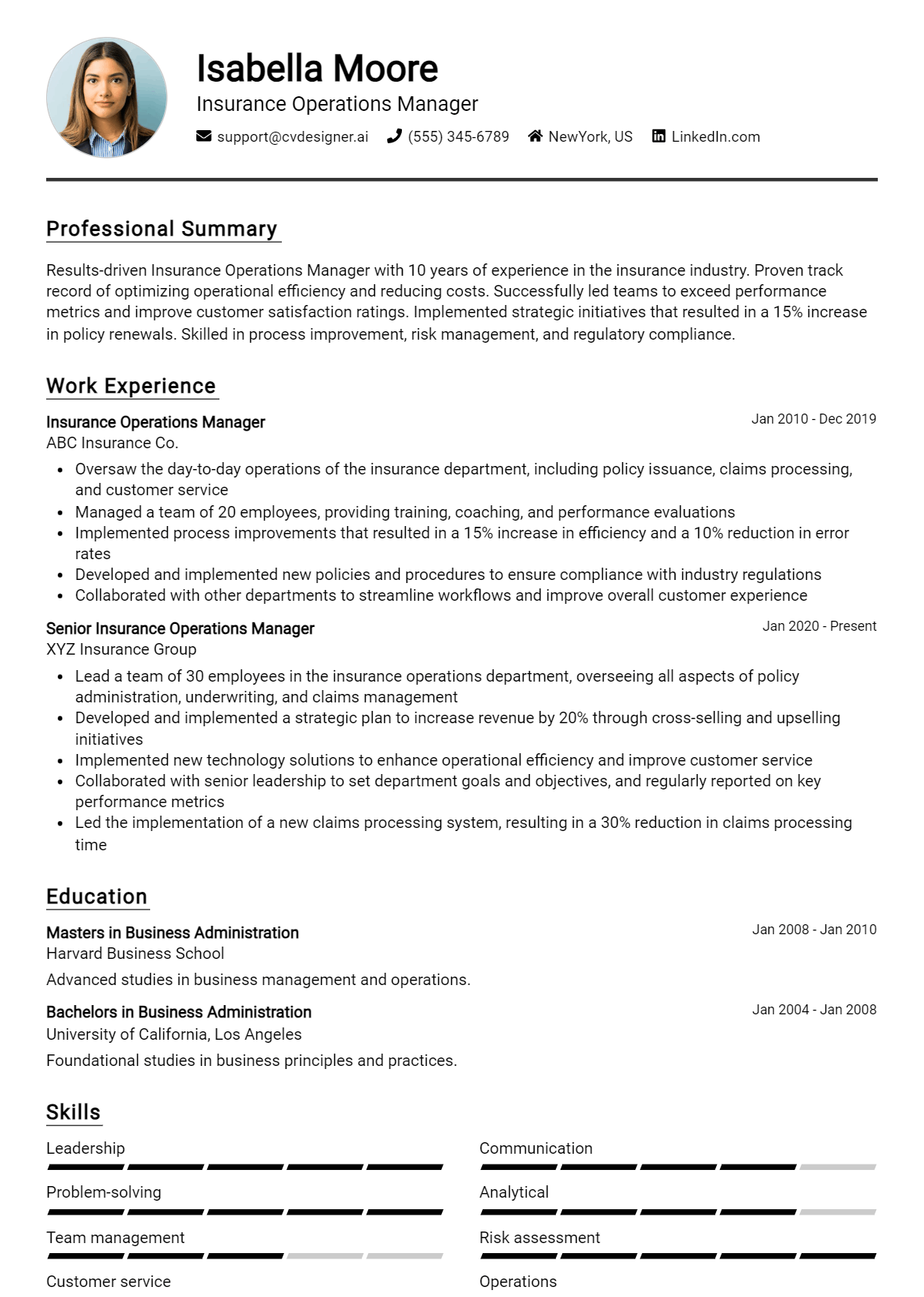

How to List Insurance Operations Manager Skills on Your Resume

Effectively listing your skills on a resume is crucial for standing out to employers in the competitive field of insurance operations. Highlighting your relevant skills can provide hiring managers with a quick overview of your qualifications. You can showcase your skills in three main sections: Resume Summary, Resume Work Experience, Resume Skills Section, and Cover Letter.

for Resume Summary

Showcasing your Insurance Operations Manager skills in the summary section helps give hiring managers an immediate impression of your qualifications and suitability for the role.

Example

Dynamic Insurance Operations Manager with expertise in claims management and risk assessment. Proven track record in process optimization and team leadership, committed to enhancing operational efficiency and customer satisfaction.

for Resume Work Experience

The work experience section provides an excellent opportunity to demonstrate how your Insurance Operations Manager skills have been applied in real-world scenarios, showcasing your impact in previous roles.

Example

- Led a team of 15 in streamlining the claims processing system, resulting in a 30% reduction in turnaround time.

- Implemented a risk management framework that decreased potential liabilities by 25% over two years.

- Conducted training programs focusing on customer service skills, improving client satisfaction ratings by 15%.

- Analyzed operational workflows to identify inefficiencies, introducing process improvements that saved the company $200,000 annually.

for Resume Skills

The skills section allows you to showcase both technical and transferable skills, emphasizing a balanced mix of hard and soft skills that strengthen your qualifications for the Insurance Operations Manager role.

Example

- Claims Management

- Risk Assessment

- Process Optimization

- Team Leadership

- Customer Service Excellence

- Regulatory Compliance

- Data Analysis

- Strategic Planning

for Cover Letter

A cover letter is an opportunity to elaborate on the skills mentioned in your resume while adding a personal touch. Highlighting 2-3 key skills that align with the job description can show how you would positively impact the organization.

Example

In my previous role, my expertise in risk assessment allowed me to identify and mitigate potential issues before they escalated, leading to a 25% decrease in claims-related losses. Additionally, my strong team leadership skills fostered a collaborative environment that increased productivity and customer satisfaction.

Linking the skills mentioned in your resume to specific achievements in your cover letter can reinforce your qualifications for the job.

The Importance of Insurance Operations Manager Resume Skills

In the competitive field of insurance, a well-structured resume is crucial for candidates aspiring to secure the role of an Insurance Operations Manager. Highlighting relevant skills not only enhances a candidate's profile but also aligns their expertise with the specific demands of the job. A strong skills section serves as a focal point for recruiters, showcasing the candidate's qualifications and increasing their chances of being shortlisted for interviews.

- Effective communication skills are essential for an Insurance Operations Manager, as they must liaise with various stakeholders, including clients, team members, and upper management. Highlighting these abilities can demonstrate a candidate's capability to foster collaboration and ensure smooth operations.

- Proficiency in data analysis and management is critical in this role. Candidates who emphasize their analytical skills can illustrate their ability to interpret complex data and make informed decisions that drive operational efficiency and profitability.

- Leadership skills are paramount for managing teams and guiding them toward achieving organizational goals. Showcasing leadership experience and abilities can help candidates position themselves as strong contenders for leadership roles within the insurance sector.

- Knowledge of regulatory compliance and industry standards is vital for an Insurance Operations Manager. By emphasizing their understanding of laws and regulations, candidates can demonstrate their commitment to maintaining ethical practices and minimizing risks for the organization.

- Adaptability and problem-solving skills are key traits in the ever-evolving insurance landscape. Candidates who highlight their capacity to navigate challenges and implement innovative solutions can appeal to recruiters looking for resilient and forward-thinking managers.

- Project management skills are crucial for overseeing various initiatives within the insurance operations. Candidates who can showcase their ability to effectively manage multiple projects simultaneously can illustrate their organizational capabilities and strategic thinking.

- Customer service orientation is essential in ensuring client satisfaction and retention. Candidates who highlight their commitment to exceptional service can position themselves as valuable assets who prioritize client relationships and experiences.

- Technical proficiency with insurance software and tools is increasingly important. Candidates who emphasize their familiarity with industry-specific technology can demonstrate their readiness to leverage these tools for improved operational outcomes.

For more insights and examples, you can explore [Resume Samples](https://resumekraft.com/resume-samples/).

How To Improve Insurance Operations Manager Resume Skills

In the fast-paced world of insurance, an Insurance Operations Manager must continuously enhance their skills to keep up with industry changes, technological advancements, and evolving customer needs. Improving your skill set not only makes you a more effective leader but also increases your marketability and career advancement opportunities. Here are some actionable tips to help you refine your skills:

- Stay updated on industry regulations and trends by subscribing to relevant publications and attending industry conferences.

- Enhance your analytical skills by taking courses in data analysis, which can help you make informed decisions based on performance metrics.

- Improve your leadership skills through workshops or online courses focused on team management and conflict resolution.

- Develop your communication skills by practicing public speaking and writing, ensuring you can effectively convey information to stakeholders.

- Embrace technology by learning to use the latest insurance management software and tools to streamline operations.

- Network with other professionals in the industry to share best practices and gain insights into new strategies and tools.

- Seek feedback from peers and supervisors to identify areas of improvement and actively work on them.

Frequently Asked Questions

What are the key skills required for an Insurance Operations Manager?

An Insurance Operations Manager should possess strong analytical skills, attention to detail, and excellent communication abilities. They must be adept at managing teams, overseeing operational processes, and ensuring compliance with industry regulations. Additionally, proficiency in data analysis and project management is essential for optimizing workflow and improving overall efficiency within the insurance operations.

How important is experience in the insurance industry for this role?

Experience in the insurance industry is crucial for an Insurance Operations Manager as it provides the necessary understanding of industry-specific regulations, products, and challenges. Familiarity with insurance policies, underwriting processes, and claims management enhances the manager's ability to lead teams effectively and make informed decisions that align with organizational goals.

What role does technology play in the skills of an Insurance Operations Manager?

Technology plays a pivotal role in the skills of an Insurance Operations Manager. Proficiency in insurance management software, customer relationship management (CRM) systems, and data analytics tools is essential for streamlining operations and improving customer service. Understanding emerging technologies, such as automation and artificial intelligence, can also help in enhancing operational efficiency and driving innovation within the organization.

How can an Insurance Operations Manager improve team performance?

An Insurance Operations Manager can improve team performance by fostering a collaborative work environment, providing ongoing training and professional development opportunities, and setting clear performance metrics. Implementing regular feedback mechanisms and recognizing individual and team achievements can also motivate employees and enhance productivity, leading to better outcomes for the organization.

What are the challenges faced by an Insurance Operations Manager?

Insurance Operations Managers often face challenges such as regulatory compliance, managing operational costs, and adapting to rapidly changing market conditions. Balancing the need for efficiency with high levels of customer service can also be a challenge. Developing strategies to mitigate these issues, such as process optimization and staff training, is critical for successful management in this role.

Conclusion

Incorporating the essential skills of an Insurance Operations Manager into your resume is crucial for demonstrating your expertise and suitability for the role. By showcasing relevant skills, you not only enhance your chances of standing out among other candidates but also illustrate the value you can bring to potential employers. Remember, a well-crafted resume can open doors to new opportunities, so take the time to refine your skills and present them effectively. Your next great job could be just a polished application away!

For more resources, check out our resume templates, utilize our resume builder, explore resume examples, and enhance your applications with our cover letter templates.

Use an AI-powered resume builder and have your resume done in 5 minutes. Just select your template and our software will guide you through the process.