25 Resume Skills to Use on Your Insurance Broker Resume in 2025

As an Insurance Broker, showcasing the right skills on your resume is essential to stand out in a competitive job market. Employers seek candidates who possess a blend of technical knowledge, interpersonal abilities, and analytical skills that enable them to navigate the complexities of insurance products and client needs. In the following section, we will highlight the top insurance broker skills that can enhance your resume and improve your chances of securing a rewarding position in this dynamic field.

Best Insurance Broker Technical Skills

Technical skills are essential for Insurance Brokers as they navigate complex insurance products, analyze client needs, and provide tailored solutions. These skills not only enhance productivity but also build trust with clients by demonstrating expertise and attention to detail. Here are some crucial technical skills to highlight on your resume:

Risk Assessment

Risk assessment involves evaluating potential risks and determining the appropriate insurance solutions for clients. This skill is crucial in identifying coverage gaps and offering informed recommendations.

How to show it: Quantify your experience by mentioning the number of assessments conducted and the improvement in client risk profiles you achieved through your recommendations.

Policy Analysis

Analyzing insurance policies helps brokers understand the nuances and coverage options available, enabling them to better advise clients. This skill ensures that clients receive the best possible coverage for their needs.

How to show it: List specific policies you have analyzed and the resulting changes made to clients' coverage that positively impacted their insurance costs or protections.

Insurance Regulations Knowledge

Understanding insurance regulations is vital for compliance and ensuring that clients receive accurate information about their policies. This skill protects both the broker and the client from potential legal issues.

How to show it: Mention any training sessions or certifications you've completed related to insurance regulations, and highlight your success in maintaining compliance for clients.

Customer Relationship Management (CRM) Software

Proficiency in CRM software enables brokers to manage client relationships effectively, track interactions, and streamline communication, ultimately enhancing client satisfaction and retention.

How to show it: Specify the CRM systems you have used, including how you leveraged them to improve client communication or increase retention rates.

Data Analysis

Data analysis allows brokers to interpret market trends and client data, leading to more informed decision-making and strategic advice for clients concerning their insurance needs.

How to show it: Provide examples of data analyses you conducted that resulted in actionable insights that benefited your clients or improved your service offerings.

Negotiation Skills

Negotiation skills are critical for Insurance Brokers when discussing terms with insurance providers or advocating for clients' needs, ensuring they get the best possible coverage and premiums.

How to show it: Detail specific negotiations you've led, showcasing the savings or enhanced coverage you secured for your clients.

Claims Management

Managing claims is an essential part of an Insurance Broker's role, ensuring clients understand the claims process and receive fair settlements. This skill builds trust and enhances client loyalty.

How to show it: Describe your role in managing claims, including the volume of claims processed and the outcomes achieved for clients.

Financial Acumen

Financial acumen enables brokers to understand the financial implications of insurance policies, helping clients make informed decisions about their coverage and investment in insurance.

How to show it: Highlight your experience in analyzing financial data related to insurance products and how you've helped clients optimize their financial protection.

Market Research

Conducting market research allows brokers to stay informed about industry trends, new products, and competitor offerings, ensuring they can provide the best advice to their clients.

How to show it: Illustrate your research initiatives and how the insights gained have influenced your recommendations or service strategies.

Technical Writing

Technical writing skills are important for creating clear and concise documentation, including policy summaries and client communications. This clarity aids clients in understanding their insurance options.

How to show it: Provide examples of documentation you have created that improved client understanding or satisfaction.

Client Presentation Skills

Effective presentation skills allow brokers to communicate complex insurance information clearly and persuasively, ensuring clients feel confident in their decisions.

How to show it: Share experiences where your presentations resulted in successful client acquisitions or policy renewals.

Best Insurance Broker Soft Skills

In the competitive landscape of insurance brokerage, possessing strong soft skills is just as essential as technical knowledge. These workplace skills enable brokers to effectively communicate with clients, solve problems, manage time efficiently, and work collaboratively with teams. Highlighting these abilities on your resume can set you apart from other candidates and demonstrate your suitability for the role.

Communication

Effective communication is crucial for insurance brokers, as they need to explain complex policies and ensure clients understand their options.

How to show it: Include specific examples of successful client meetings or presentations where you clearly articulated policy details, and quantify your impact by mentioning client satisfaction ratings or retention rates.

Problem-solving

Insurance brokers frequently encounter unique client situations that require innovative solutions. Strong problem-solving skills help in addressing clients' needs effectively.

How to show it: Describe instances where you identified and resolved client issues efficiently, and provide metrics that showcase your success in reducing claims or enhancing coverage options.

Time Management

Managing multiple clients and deadlines is a key aspect of being an insurance broker. Good time management ensures that all client needs are addressed promptly.

How to show it: Demonstrate your time management skills by detailing how you prioritized tasks, met deadlines, and maintained a high level of client service, possibly including the number of clients managed simultaneously.

Teamwork

Insurance brokers often collaborate with underwriters, claims adjusters, and other professionals. Effective teamwork is essential in providing comprehensive service to clients.

How to show it: Highlight your experience in working within teams to achieve specific goals or complete projects, and mention successful collaborations that led to improved client satisfaction or business outcomes.

Empathy

Understanding clients' emotions and perspectives is vital for building trust and relationships in insurance brokerage.

How to show it: Provide examples of how you listened to client concerns and tailored solutions to fit their needs, showcasing any positive feedback or testimonials received.

Negotiation

Insurance brokers must negotiate terms with clients and carriers, making negotiation skills critical for securing favorable conditions.

How to show it: Share specific instances where your negotiation skills led to better pricing or terms for clients, including any quantifiable savings achieved.

Adaptability

The insurance industry is constantly evolving, and brokers must adapt to changes in regulations, market conditions, and client needs.

How to show it: Illustrate your adaptability by describing how you adjusted strategies in response to industry changes or client feedback, and mention any successful outcomes from these adjustments.

Attention to Detail

Detail-oriented brokers can identify potential issues and ensure accuracy in policy documents, which is crucial in preventing costly mistakes.

How to show it: Emphasize your meticulousness by discussing how you maintained accuracy in documentation and policy administration, and include any metrics related to error reduction.

Customer Service

Providing excellent customer service is essential for retaining clients and fostering long-term relationships in the insurance industry.

How to show it: Detail your customer service approach and provide examples of how you went above and beyond for clients, including satisfaction scores or retention rates.

Persuasiveness

Insurance brokers must be persuasive to effectively advocate for clients and influence their decisions regarding coverage options.

How to show it: Share specific instances where your persuasive communication led to clients making informed decisions, and quantify any resulting business growth.

Networking

Building a strong network of contacts is vital for insurance brokers to generate leads and foster business relationships.

How to show it: Illustrate your networking efforts by mentioning industry events attended, partnerships formed, or referrals generated that contributed to business growth.

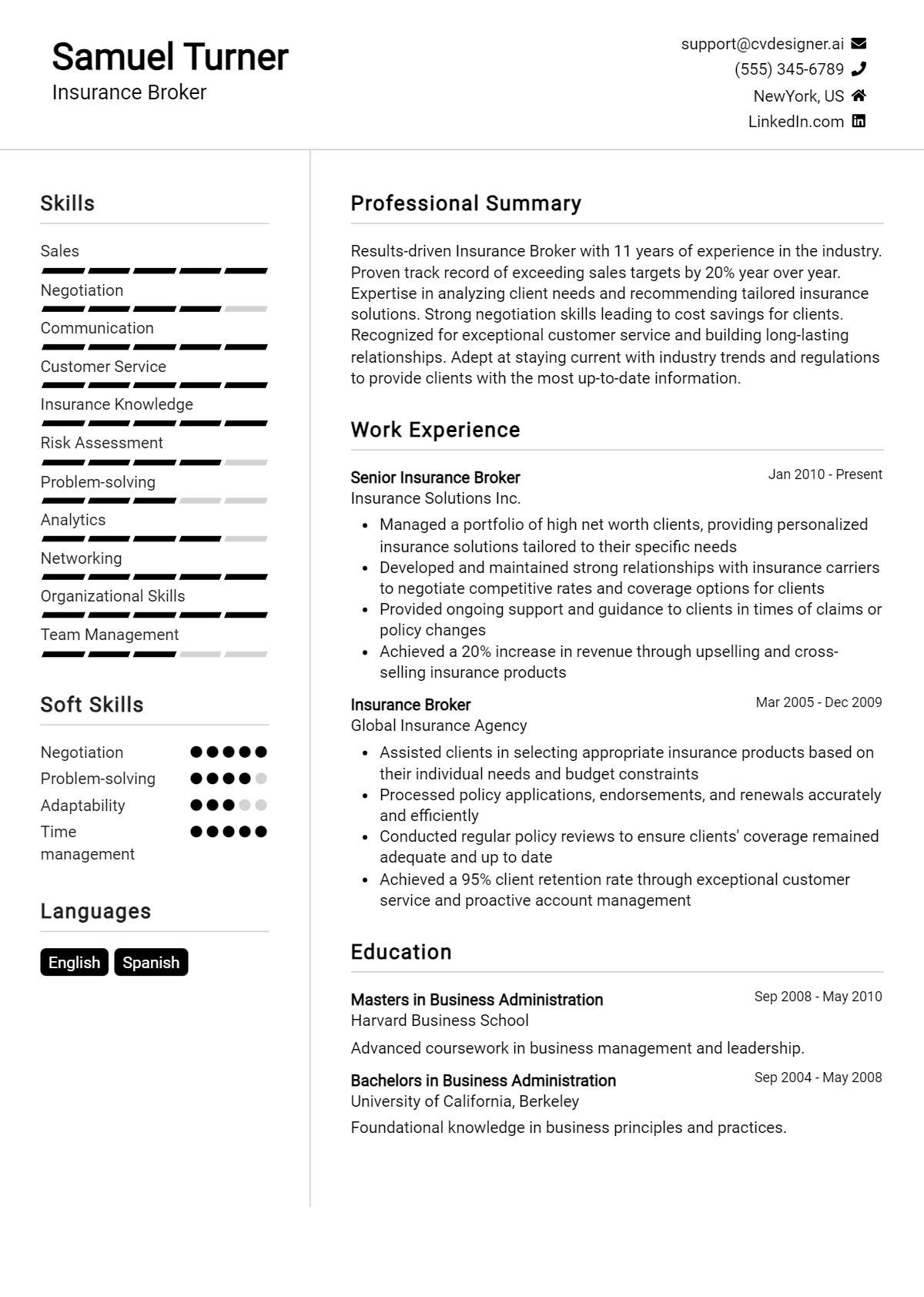

How to List Insurance Broker Skills on Your Resume

Effectively listing your skills on a resume is crucial for standing out to employers in the competitive field of insurance brokering. Highlighting relevant skills in your Resume Summary, Resume Work Experience, Resume Skills Section, and Cover Letter can provide a comprehensive view of your qualifications and make a lasting impression.

for Resume Summary

Showcasing your Insurance Broker skills in the introduction (objective or summary) section provides hiring managers with a quick overview of your qualifications. This can help set you apart from other candidates right from the start.

Example

As a dedicated Insurance Broker with expertise in risk assessment and customer service, I have successfully provided tailored insurance solutions to clients, ensuring their needs are met and expectations exceeded.

for Resume Work Experience

The work experience section provides the perfect opportunity to demonstrate how your Insurance Broker skills have been applied in real-world scenarios. Tailoring your experience to match specific skills mentioned in job listings can make a significant impact.

Example

- Utilized negotiation skills to secure favorable terms for clients, resulting in a 20% reduction in policy costs.

- Developed strong customer relationships through effective communication, leading to a 30% increase in client retention.

- Conducted market research to identify emerging trends, enabling the introduction of new products that enhanced service offerings.

- Collaborated with underwriters to assess risk factors, ensuring comprehensive coverage tailored to client needs.

for Resume Skills

The skills section can showcase both technical and transferable skills. A balanced mix of hard and soft skills will strengthen your overall qualifications and make your resume more appealing to potential employers.

Example

- Risk Assessment

- Customer Service

- Negotiation Skills

- Market Analysis

- Regulatory Compliance

- Communication Skills

- Relationship Management

- Sales Strategies

for Cover Letter

A cover letter provides an opportunity to expand on the skills mentioned in your resume and add a personal touch. Highlighting 2-3 key skills that align with the job description and explaining how they positively impacted your previous roles can enhance your application.

Example

In my previous role, my negotiation skills enabled me to secure lower premiums for clients, which directly contributed to a 15% increase in satisfaction ratings. Additionally, my commitment to customer service fostered long-term relationships, enhancing client loyalty and retention.

Linking the skills mentioned in your resume to specific achievements in your cover letter reinforces your qualifications for the job and increases your chances of being noticed by decision-makers.

The Importance of Insurance Broker Resume Skills

Highlighting relevant skills on an Insurance Broker resume is crucial for capturing the attention of recruiters in a competitive job market. A well-structured skills section not only showcases a candidate's qualifications but also aligns their capabilities with the specific requirements of the role. This alignment helps candidates stand out and increases their chances of securing an interview.

- Demonstrating strong communication skills is essential for an Insurance Broker, as they frequently interact with clients to explain complex policies and coverage options. A well-defined skills section showcases a candidate's ability to convey information clearly and effectively.

- Negotiation skills are vital in securing the best policies for clients. Highlighting this skill indicates a candidate's aptitude for advocating on behalf of clients and achieving favorable terms, which is a key aspect of the role.

- Attention to detail is critical in the insurance industry where minor errors can lead to significant financial repercussions. Including this skill emphasizes a candidate's meticulous nature and reliability in managing documentation and policy details.

- Knowledge of various insurance products and regulations is fundamental for an Insurance Broker. By listing relevant industry knowledge, candidates can demonstrate their expertise and ability to navigate complex insurance landscapes.

- Customer service skills are paramount in building long-term relationships with clients. Emphasizing this skill reflects a candidate's commitment to understanding client needs and providing exceptional support throughout the insurance process.

- Analytical skills are necessary for assessing client needs and tailoring appropriate insurance solutions. Highlighting this ability shows recruiters that the candidate can critically evaluate options and make informed recommendations.

- Time management skills are crucial in juggling multiple clients and policies. Including this skill indicates a candidate's ability to prioritize tasks effectively, ensuring that all client needs are met promptly and efficiently.

- Proficiency in using insurance software and technology is increasingly important in streamlining operations and managing client information. Listing technical skills in this area demonstrates a candidate's adaptability and readiness to embrace modern tools.

For more examples and guidance, check out these Resume Samples.

How To Improve Insurance Broker Resume Skills

In the competitive field of insurance brokerage, continuously improving your skills is essential for standing out and providing exceptional service to clients. As the insurance landscape evolves with new regulations, technologies, and customer expectations, staying current and enhancing your expertise will not only boost your resume but also increase your effectiveness in helping clients find the right coverage. Here are some actionable tips to help you enhance your skills as an insurance broker:

- Attend industry seminars and workshops to stay updated on the latest trends and regulations.

- Pursue additional certifications, such as the Chartered Property Casualty Underwriter (CPCU) or Certified Insurance Counselor (CIC), to enhance your credentials.

- Network with other insurance professionals to share best practices and gain insights into new strategies and tools.

- Invest time in mastering technology, such as customer relationship management (CRM) systems and data analytics tools, to improve efficiency.

- Engage in regular self-assessment and seek feedback from peers or mentors to identify areas for improvement.

- Read industry publications and join relevant online forums to keep informed about market changes and consumer needs.

- Practice effective communication and negotiation skills through role-playing scenarios or public speaking courses.

Frequently Asked Questions

What key skills should an insurance broker highlight on their resume?

An insurance broker should emphasize skills such as communication, negotiation, analytical thinking, and customer service. Strong interpersonal skills are crucial for building relationships with clients, while negotiation skills help in securing the best policies. Analytical thinking is important for evaluating different insurance options and providing tailored solutions that meet clients' needs.

How important is knowledge of insurance products for an insurance broker?

Knowledge of various insurance products is essential for an insurance broker, as it allows them to provide informed recommendations to clients. Understanding the differences between life, health, auto, and property insurance enables brokers to match clients with the best policies that suit their individual circumstances, ensuring they can adequately advise and advocate for their clients.

What role does customer service play in an insurance broker's job?

Customer service is a cornerstone of an insurance broker's role, as it fosters trust and loyalty among clients. Effective brokers prioritize client needs, address concerns promptly, and provide ongoing support throughout the policy lifecycle. Exceptional customer service skills can differentiate a broker in a competitive market, leading to repeat business and referrals.

Are sales skills important for an insurance broker's success?

Yes, sales skills are critical for an insurance broker's success. Brokers must be adept at persuading potential clients to choose specific policies and services. This involves understanding client needs, presenting solutions effectively, and overcoming objections. Strong sales skills can significantly impact a broker's ability to meet sales targets and grow their client base.

How can networking benefit an insurance broker's career?

Networking is highly beneficial for an insurance broker's career as it helps build a strong referral base and establish professional relationships within the industry. By connecting with other professionals, such as real estate agents, financial advisors, and other brokers, an insurance broker can gain valuable leads and insights, ultimately enhancing their business opportunities and career growth.

Conclusion

Including Insurance Broker skills in your resume is crucial for effectively showcasing your expertise and professionalism in the field. By highlighting relevant skills, you not only stand out among other candidates but also demonstrate your value to potential employers who are seeking qualified professionals to manage their clients' insurance needs.

As you refine your skills and tailor your application, remember that a strong resume can open doors to new opportunities. Take the time to explore resume templates, utilize a resume builder, review resume examples, and create compelling cover letter templates. With dedication and the right tools, you can significantly enhance your job application and take the next step in your career journey.

Use an AI-powered resume builder and have your resume done in 5 minutes. Just select your template and our software will guide you through the process.