29 Financial Technology Specialist Skills For Your Resume with Exampels in 2025

As the financial technology sector continues to evolve, a Financial Technology Specialist must possess a diverse set of skills to navigate the complexities of this dynamic field. In this section, we will outline the essential skills that can enhance your resume and set you apart from other candidates. These skills not only reflect your expertise in financial systems and technology but also demonstrate your ability to adapt to the rapid changes in the industry. Whether you are looking to advance your career or enter the field, having a strong skill set is crucial for success in financial technology.

Best Financial Technology Specialist Technical Skills

As a Financial Technology Specialist, possessing relevant technical skills is crucial for navigating the complexities of financial systems and innovations. These skills not only enhance your ability to develop effective solutions but also assure employers of your competence in addressing the challenges present in the rapidly evolving fintech landscape. Below are essential technical skills that can bolster your resume.

Data Analysis

Data analysis is vital for interpreting financial data and making informed decisions. It enables specialists to identify trends, assess risks, and optimize financial outcomes.

How to show it: Include specific projects where you utilized data analysis tools like SQL or Python to improve financial reporting efficiency by a certain percentage or to identify cost-saving opportunities.

Blockchain Technology

Blockchain technology is revolutionizing the financial sector by providing secure and transparent transaction methods. Understanding this technology is essential for implementing innovative financial solutions.

How to show it: Mention any blockchain projects you have worked on, detailing your role and the impact it had on transaction security or efficiency within the organization.

Regulatory Compliance

Knowledge of regulatory compliance ensures that financial technologies meet legal standards, protecting both the company and its clients.

How to show it: Highlight your experience in developing compliance strategies or managing audits, emphasizing any improvements in compliance rates or reduced penalties.

Cybersecurity

Cybersecurity skills are essential for safeguarding financial information against breaches and fraud. A specialist must understand how to implement robust security measures.

How to show it: Detail your experience in implementing cybersecurity protocols and any measurable impact on reducing breaches or incidents during your tenure.

Cloud Computing

Cloud computing enables enhanced data storage, processing capabilities, and scalability for financial technologies. Familiarity with cloud platforms can improve operational efficiency.

How to show it: Specify cloud technologies you have mastered (e.g., AWS, Azure) and quantify the improvements in system performance or operational costs achieved through their implementation.

API Development

APIs are crucial for enabling different software applications to communicate within the fintech ecosystem. Knowledge in API development fosters integration and customization.

How to show it: Describe specific API projects you led, including any integrations that resulted in increased functionality or user engagement metrics.

Machine Learning

Machine learning is increasingly applied in fintech for predictive analytics, fraud detection, and customer personalization. Understanding machine learning algorithms can drive innovation.

How to show it: Illustrate your involvement in machine learning projects, providing metrics on accuracy improvements in predictions or enhancements in customer satisfaction.

Financial Modeling

Financial modeling involves creating representations of a company's financial performance to aid in decision-making. This skill is fundamental for analysis and forecasting.

How to show it: Provide examples of financial models you developed, including results such as revenue growth predictions or costs reductions achieved via strategic recommendations.

Project Management

Effective project management ensures that fintech projects are completed on time and within budget. Skills in this area enhance your ability to lead teams and manage resources.

How to show it: Highlight specific projects you managed, detailing your role in meeting deadlines and budgets, including any recognition received for successful project delivery.

Financial Software Proficiency

Being proficient in financial software (like QuickBooks, SAP, or Oracle) is essential for day-to-day operations and analysis within fintech environments.

How to show it: List the specific financial software you are proficient in, and quantify how your expertise improved reporting accuracy or processing time for financial transactions.

Best Financial Technology Specialist Soft Skills

In the rapidly evolving field of financial technology, possessing strong soft skills is just as crucial as technical knowledge. These interpersonal skills enable Financial Technology Specialists to effectively collaborate with diverse teams, communicate complex information clearly, and adapt to the fast-paced demands of the industry. Here are some essential soft skills that can enhance a Financial Technology Specialist's resume.

Communication

Effective communication is vital for Financial Technology Specialists, as they often need to convey complex financial information to clients and stakeholders. This skill helps in building relationships and facilitating teamwork.

How to show it: Highlight experiences where you successfully communicated technical concepts to non-technical audiences, such as through presentations or reports. Use metrics to demonstrate the impact of your communication, such as improved client satisfaction scores or successful project outcomes. Explore more about Communication.

Problem-solving

Financial technology often presents unique challenges that require innovative solutions. Strong problem-solving skills enable specialists to analyze issues and implement effective strategies swiftly.

How to show it: Provide specific examples of complex problems you resolved, detailing the process and outcome. Quantify your achievements by indicating the time saved or revenue generated as a result of your solutions. Learn more about Problem-solving.

Time Management

With multiple projects and deadlines, effective time management is essential for Financial Technology Specialists to prioritize tasks and ensure timely delivery of solutions.

How to show it: Demonstrate your ability to manage time by discussing how you successfully met tight deadlines or balanced competing priorities. Include metrics like the number of projects completed on time or improvements in efficiency. Check out more on Time Management.

Teamwork

Collaboration is key in financial technology projects, where working closely with cross-functional teams can lead to more effective solutions. Teamwork enhances creativity and problem-solving capabilities.

How to show it: Share instances where you successfully collaborated with team members from different departments. Highlight specific projects and outcomes that resulted from teamwork, and quantify your contributions to the team's success. Discover more about Teamwork.

Adaptability

The financial technology landscape is constantly changing, and being adaptable allows specialists to thrive amidst new challenges and technologies.

How to show it: Provide examples of how you successfully adapted to new technologies or shifts in project direction. Highlight measurable outcomes that resulted from your adaptability, such as reduced downtime or quicker project completion.

Critical Thinking

Critical thinking enables Financial Technology Specialists to evaluate information, make informed decisions, and foresee potential impacts on projects and clients.

How to show it: Include specific instances where your critical thinking led to significant project improvements or risk mitigation strategies. Quantify your success by discussing how your decisions positively affected project timelines or costs.

Attention to Detail

In financial technology, small errors can lead to significant issues. A strong attention to detail ensures accuracy in data analysis and adherence to compliance standards.

How to show it: Discuss your role in ensuring data accuracy or compliance in past projects. Use metrics to showcase how your attention to detail prevented errors or improved quality, such as reduced audit findings.

Empathy

Understanding client needs and concerns is crucial in financial technology. Empathy fosters better client relationships and enhances service delivery.

How to show it: Include examples of how you listened to and addressed client concerns, leading to improved client satisfaction. Quantify the positive feedback received or changes in client retention rates.

Negotiation

Negotiation skills are essential for Financial Technology Specialists when dealing with vendors, clients, or stakeholders to secure favorable terms and outcomes.

How to show it: Provide specific examples of negotiations you successfully managed, detailing the outcomes achieved. Highlight any cost savings or enhanced contract terms that resulted from your negotiation efforts.

Networking

Building a strong professional network can open doors to new opportunities and collaborations in the financial technology sector.

How to show it: Discuss your involvement in industry events, conferences, or online communities where you built connections. Highlight any partnerships or collaborations that emerged from your networking efforts

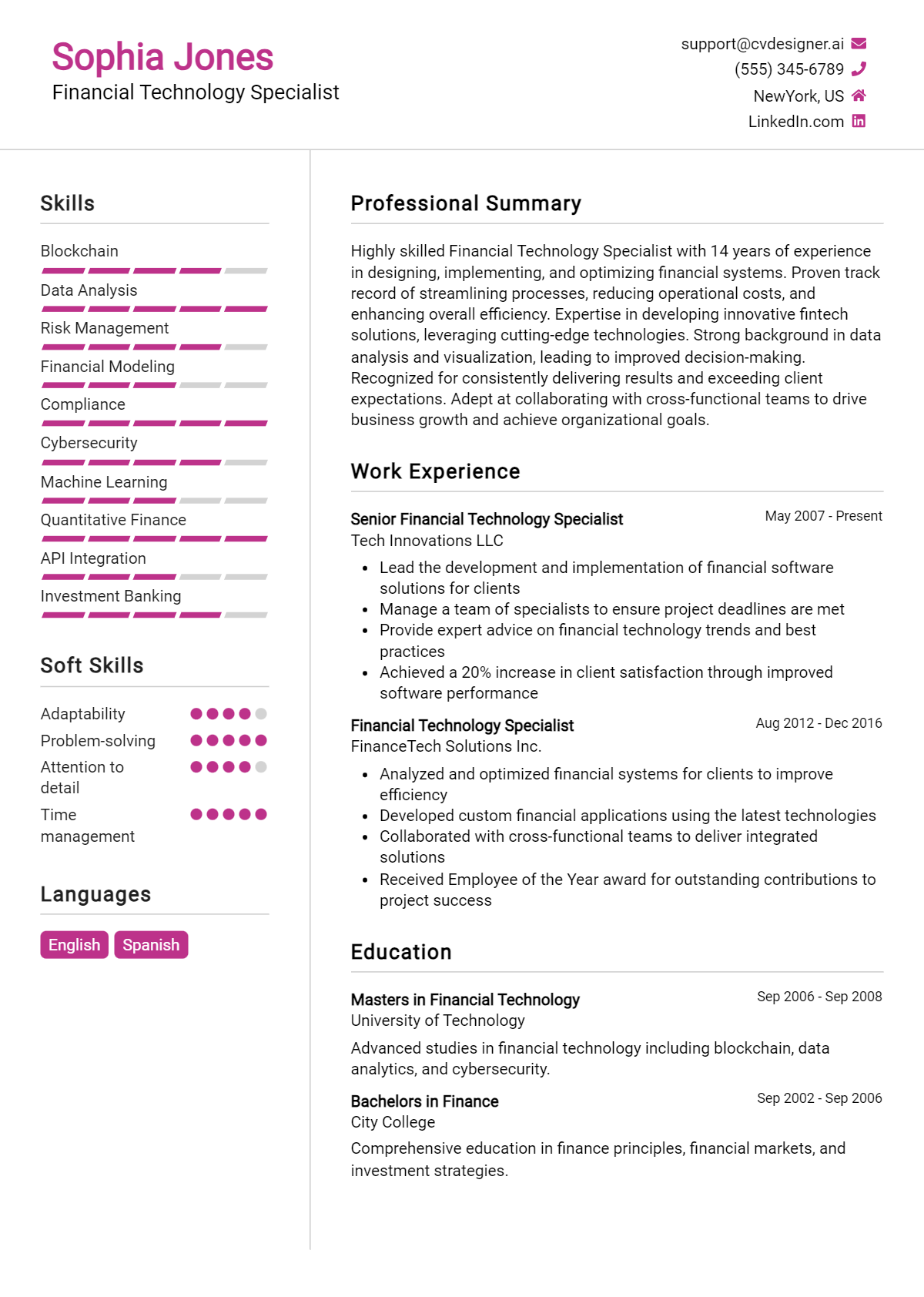

How to List Financial Technology Specialist Skills on Your Resume

Effectively listing your skills on a resume is crucial to standing out to employers in the competitive field of financial technology. By highlighting your capabilities across various sections, you can create a strong impression. There are three main sections where skills can be emphasized: Resume Summary, Resume Work Experience, Resume Skills Section, and Cover Letter.

for Resume Summary

Showcasing Financial Technology Specialist skills in the introduction (objective or summary) section provides hiring managers with a quick overview of your qualifications, making you a more appealing candidate.

Example

Analytical skills and financial modeling expertise honed through years of experience in the fintech sector make me a valuable asset. I have successfully implemented blockchain solutions to enhance transaction security and efficiency.

for Resume Work Experience

The work experience section provides the perfect opportunity to demonstrate how Financial Technology Specialist skills have been applied in real-world scenarios. Highlighting specific accomplishments will help you stand out.

Example

- Developed data-driven financial models to forecast market trends, improving investment strategies by 25%.

- Implemented API integrations to streamline payment processing, resulting in a 30% reduction in transaction times.

- Collaborated with cross-functional teams to enhance user experience, leading to a 15% increase in customer satisfaction scores.

- Conducted comprehensive risk assessments, leveraging machine learning algorithms to identify potential fraud.

for Resume Skills

The skills section can either showcase technical or transferable skills. A balanced mix of hard and soft skills is essential to strengthen your overall qualifications.

Example

- Data Analysis

- Risk Management

- Blockchain Technology

- Regulatory Compliance

- API Development

- Project Management

- Financial Modeling

- Customer Relationship Management

for Cover Letter

A cover letter allows you to expand on the skills mentioned in your resume and provide a more personal touch. Highlighting 2-3 key skills that align with the job description can demonstrate their impact in your previous roles.

Example

My experience in risk management and data analysis has been instrumental in developing strategies that mitigate financial risks. In my previous role, I utilized blockchain technology to enhance security protocols, which led to a 20% decrease in fraudulent activities.

Linking the skills mentioned in your resume to specific achievements in your cover letter reinforces your qualifications for the job.

The Importance of Financial Technology Specialist Resume Skills

Highlighting relevant skills in a Financial Technology Specialist resume is crucial for capturing the attention of recruiters and hiring managers. A well-crafted skills section not only showcases a candidate’s technical and analytical abilities but also aligns them with the specific job requirements of the financial technology sector. In a competitive job market, effectively presenting these skills can significantly enhance a candidate's chances of landing an interview.

- Demonstrates Expertise: A targeted skills section showcases your expertise in key areas such as data analysis, blockchain technology, and financial modeling, proving you are well-versed in the essential tools and practices of the industry.

- Aligns with Job Descriptions: By mirroring the skills mentioned in job postings, candidates can demonstrate their suitability for the role, making it easier for recruiters to see their potential fit within the organization.

- Highlights Technical Proficiency: Financial technology often requires a blend of financial knowledge and technical skills. Highlighting proficiency in programming languages or software applications can set a candidate apart from those with purely financial backgrounds.

- Showcases Soft Skills: In addition to technical abilities, soft skills such as problem-solving, communication, and teamwork are vital in financial technology roles. Including these can portray a well-rounded candidate who can thrive in collaborative environments.

- Facilitates Quick Assessment: Recruiters often sift through numerous resumes quickly. A clear and concise skills section allows them to assess a candidate’s qualifications at a glance, increasing the likelihood of being shortlisted for an interview.

- Indicates Continuous Learning: Demonstrating a commitment to continual professional development through the inclusion of current skills and certifications can reflect a proactive attitude, which is highly valued in the ever-evolving field of financial technology.

- Enhances Overall Presentation: A well-organized skills section contributes to the overall professionalism of the resume, making it visually appealing and easier for recruiters to navigate, ultimately leaving a positive impression.

For further inspiration on how to present your skills effectively, check out these Resume Samples.

How To Improve Financial Technology Specialist Resume Skills

In the rapidly evolving field of financial technology, staying updated with the latest trends, tools, and practices is essential for success. Continuous improvement not only enhances your resume but also ensures you remain competitive in the job market. As a Financial Technology Specialist, refining your skills can lead to better job opportunities, increased responsibilities, and a more fulfilling career. Here are some actionable tips to help you enhance your skill set:

- Engage in online courses or certifications focused on financial technology and related software tools.

- Attend industry conferences and networking events to gain insights into emerging technologies and best practices.

- Participate in webinars and workshops that cover specific financial technology topics, such as blockchain or machine learning.

- Join professional organizations and communities to connect with other professionals and share knowledge.

- Practice coding and data analysis skills through platforms like GitHub or Kaggle, focusing on financial datasets.

- Stay informed by reading industry publications, blogs, and research papers to keep abreast of market trends.

- Seek mentorship from experienced professionals in the field to gain practical knowledge and career advice.

Frequently Asked Questions

What are the essential skills needed for a Financial Technology Specialist?

A Financial Technology Specialist should possess a blend of financial acumen and technical expertise. Key skills include proficiency in data analysis, programming languages such as Python and SQL, familiarity with financial regulations, and experience with financial software and tools. Additionally, strong problem-solving abilities and communication skills are crucial for translating complex financial concepts into actionable insights for stakeholders.

How important is knowledge of programming languages for a Financial Technology Specialist?

Knowledge of programming languages is highly important for a Financial Technology Specialist, as it enables them to develop software solutions, automate processes, and analyze large datasets. Proficiency in languages like Python, Java, or SQL allows specialists to create algorithms, enhance data management, and improve system efficiencies. This technical skill set complements their financial knowledge, making them valuable assets in a technology-driven financial landscape.

What role does data analysis play in a Financial Technology Specialist's job?

Data analysis is a core component of a Financial Technology Specialist's role, as it involves interpreting financial data to inform decision-making and strategy development. Specialists utilize data analysis to identify trends, assess risks, and optimize financial products and services. The ability to analyze data effectively allows specialists to support organizations in making data-driven decisions that enhance operational efficiency and drive business growth.

Are communication skills necessary for a Financial Technology Specialist?

Yes, communication skills are essential for a Financial Technology Specialist. They must articulate complex technical concepts and financial strategies clearly to non-technical stakeholders, such as management or clients. Effective communication aids in collaboration with cross-functional teams and ensures that insights derived from data analysis are understood and actionable. Strong interpersonal skills also foster better relationships with clients and colleagues, facilitating a smoother workflow.

What is the significance of understanding financial regulations for a Financial Technology Specialist?

Understanding financial regulations is crucial for a Financial Technology Specialist, as it ensures compliance with legal standards while developing and implementing financial technology solutions. Familiarity with regulations such as GDPR, AML, and PCI-DSS helps specialists design systems that protect sensitive financial data and mitigate risks. This knowledge not only safeguards the organization from legal repercussions but also enhances the trust and credibility of the financial technology services offered.

Conclusion

In today's competitive job market, including Financial Technology Specialist skills in your resume is crucial for standing out to potential employers. By showcasing relevant skills such as data analysis, software development, and financial modeling, candidates can demonstrate their value and expertise in the rapidly evolving fintech industry. Remember, refining your skills not only enhances your job application but also equips you for a successful career. Embrace the journey of skill development and watch as opportunities unfold before you!

For more resources, consider exploring our resume templates, utilizing our resume builder, reviewing resume examples, and crafting a compelling introduction with our cover letter templates.

Use an AI-powered resume builder and have your resume done in 5 minutes. Just select your template and our software will guide you through the process.