Top 29 Hard and Soft Skills for 2025 Financial Manager Resumes

As a Financial Manager, showcasing the right skills on your resume is crucial for standing out in a competitive job market. Employers seek candidates who not only possess strong analytical capabilities but also demonstrate proficiency in financial planning, risk management, and strategic decision-making. In this section, we will explore the essential skills that can enhance your resume and highlight your qualifications for this pivotal role in managing an organization's financial health.

Best Financial Manager Technical Skills

Technical skills are essential for a Financial Manager as they provide the foundation for effective financial analysis, reporting, and decision-making. These skills enable managers to interpret complex financial data, create accurate forecasts, and develop strategic plans that drive business success. Below are some of the top technical skills that every Financial Manager should highlight on their resume.

Financial Analysis

Financial analysis involves evaluating financial data to assess an organization's performance and make informed decisions. This skill is vital for identifying trends, forecasting revenue, and making strategic recommendations.

How to show it: Quantify your analysis outcomes, such as improved profit margins or cost reductions achieved through your recommendations, to showcase your impact.

Budgeting

Budgeting is the process of creating a plan to spend your money, ensuring that resources are allocated efficiently and aligned with business goals. Strong budgeting skills help in resource management and financial planning.

How to show it: Highlight specific budgets you managed, including the size and scope, and any discrepancies you resolved or savings you identified.

Financial Reporting

Financial reporting involves the preparation and presentation of financial statements, such as income statements and balance sheets, to stakeholders. This skill ensures transparency and compliance with regulations.

How to show it: Include examples of financial reports you created, focusing on their accuracy and any positive feedback received from stakeholders.

Tax Planning and Compliance

Understanding tax laws and regulations is crucial for minimizing tax liabilities and ensuring compliance. This skill helps organizations avoid penalties and optimize tax expenses.

How to show it: Detail any tax savings achieved or compliance audits passed, emphasizing your role in the process.

Cash Flow Management

Cash flow management involves monitoring and optimizing the inflow and outflow of cash to ensure sufficient liquidity for operations. This skill is essential for maintaining financial health.

How to show it: Describe specific cash flow improvements you implemented and the effects on the organization’s liquidity.

Financial Modeling

Financial modeling is the construction of representations of a company's financial performance, used for decision-making and forecasting. It requires proficiency in tools like Excel or specialized software.

How to show it: Mention specific financial models you developed and their contributions to strategic planning or investment decisions.

Risk Management

Risk management involves identifying, assessing, and mitigating financial risks. This skill is vital for safeguarding company assets and ensuring sustainable growth.

How to show it: Provide examples of risks you managed and the strategies you implemented to minimize their impact on the organization.

Regulatory Knowledge

Knowledge of financial regulations and compliance standards is essential for ensuring that the organization adheres to legal requirements. This skill helps prevent legal issues and promotes ethical practices.

How to show it: Highlight specific regulations you ensured compliance with and any training or certifications you have completed in this area.

Investment Analysis

Investment analysis involves evaluating potential investments to determine their viability and profitability. This skill is crucial for making informed investment decisions that drive growth.

How to show it: Describe successful investment projects you analyzed, focusing on the returns achieved and your analytical approach.

Cost Accounting

Cost accounting is the process of tracking, recording, and analyzing costs associated with production or service delivery. This skill helps organizations enhance efficiency and profitability.

How to show it: Detail initiatives where you identified cost savings or efficiencies and the financial impact of those actions.

Advanced Excel Skills

Proficiency in Excel is crucial for data analysis, financial modeling, and reporting. Advanced skills include the use of formulas, pivot tables, and macros to streamline processes.

How to show it: Share specific projects where your Excel skills improved reporting accuracy or efficiency, including percentages or time saved.

Best Financial Manager Soft Skills

Soft skills are essential for a Financial Manager, as they bridge the gap between technical expertise and effective leadership. These interpersonal skills enhance collaboration, communication, and problem-solving capabilities, all of which are critical for navigating complex financial landscapes and driving organizational success.

Communication

Strong communication skills enable Financial Managers to convey complex financial information clearly and persuasively to stakeholders.

How to show it: Include examples of presentations or reports you have delivered, highlighting any positive feedback received or decisions influenced by your communication efforts. Use quantifiable metrics, such as the number of stakeholders engaged or the impact of your communication on project outcomes.

Problem-solving

Effective problem-solving skills allow Financial Managers to identify financial issues and develop strategic solutions that align with business objectives.

How to show it: Describe specific challenges you faced and the innovative solutions you implemented. Quantify the results of your problem-solving efforts, such as cost savings or efficiency improvements, to demonstrate your impact.

Time Management

Time management is crucial for prioritizing tasks and meeting deadlines in a fast-paced financial environment.

How to show it: Highlight instances where you successfully managed multiple projects or deadlines. Provide metrics on how you improved efficiency or reduced turnaround times through effective time management practices.

Teamwork

Collaboration and teamwork skills are vital for working effectively with cross-functional teams and fostering a positive work environment.

How to show it: Share examples of projects where you collaborated with others, detailing your role and contributions. Mention any team successes and how your teamwork led to achieving shared goals.

Adaptability

The ability to adapt to changing circumstances and market conditions is essential for Financial Managers to remain effective and relevant.

How to show it: Provide examples of how you have adjusted strategies or processes in response to shifts in the market or organization. Quantify the positive outcomes of your adaptability, such as increased revenue or improved team morale.

Leadership

Leadership skills are necessary for guiding teams, influencing decision-making, and driving financial strategies.

How to show it: Discuss your leadership style and how it has positively impacted your team or organization. Include metrics that reflect your leadership effectiveness, such as employee retention rates or project success rates.

Attention to Detail

Attention to detail is critical in financial management, ensuring accuracy in financial reporting and compliance.

How to show it: Illustrate your meticulous nature by providing examples of projects where your attention to detail prevented errors or identified discrepancies. Quantify the implications of your attention to detail, such as cost savings or improved compliance rates.

Negotiation

Negotiation skills are essential for securing favorable terms with vendors, clients, and stakeholders.

How to show it: Present examples of successful negotiations you have conducted, highlighting the outcomes achieved. Include metrics such as percentage savings or improved contract terms to showcase your negotiation success.

Critical Thinking

Critical thinking skills enable Financial Managers to analyze data, assess risks, and make informed decisions.

How to show it: Detail specific instances where your critical thinking led to strategic decisions that benefited the organization. Use data and metrics to illustrate the effectiveness of your decisions.

Conflict Resolution

The ability to resolve conflicts effectively is vital for maintaining team cohesion and ensuring smooth operations.

How to show it: Share examples of conflicts you have resolved, focusing on your approach and the positive outcomes. Quantify improvements in team dynamics or project delivery as a result of your conflict resolution efforts.

Empathy

Empathy allows Financial Managers to understand the perspectives of team members and stakeholders, fostering better relationships.

How to show it: Include examples of how you have demonstrated empathy in your interactions, and the positive impact it had on team morale or stakeholder engagement. Use feedback or outcomes to illustrate your empathetic approach.

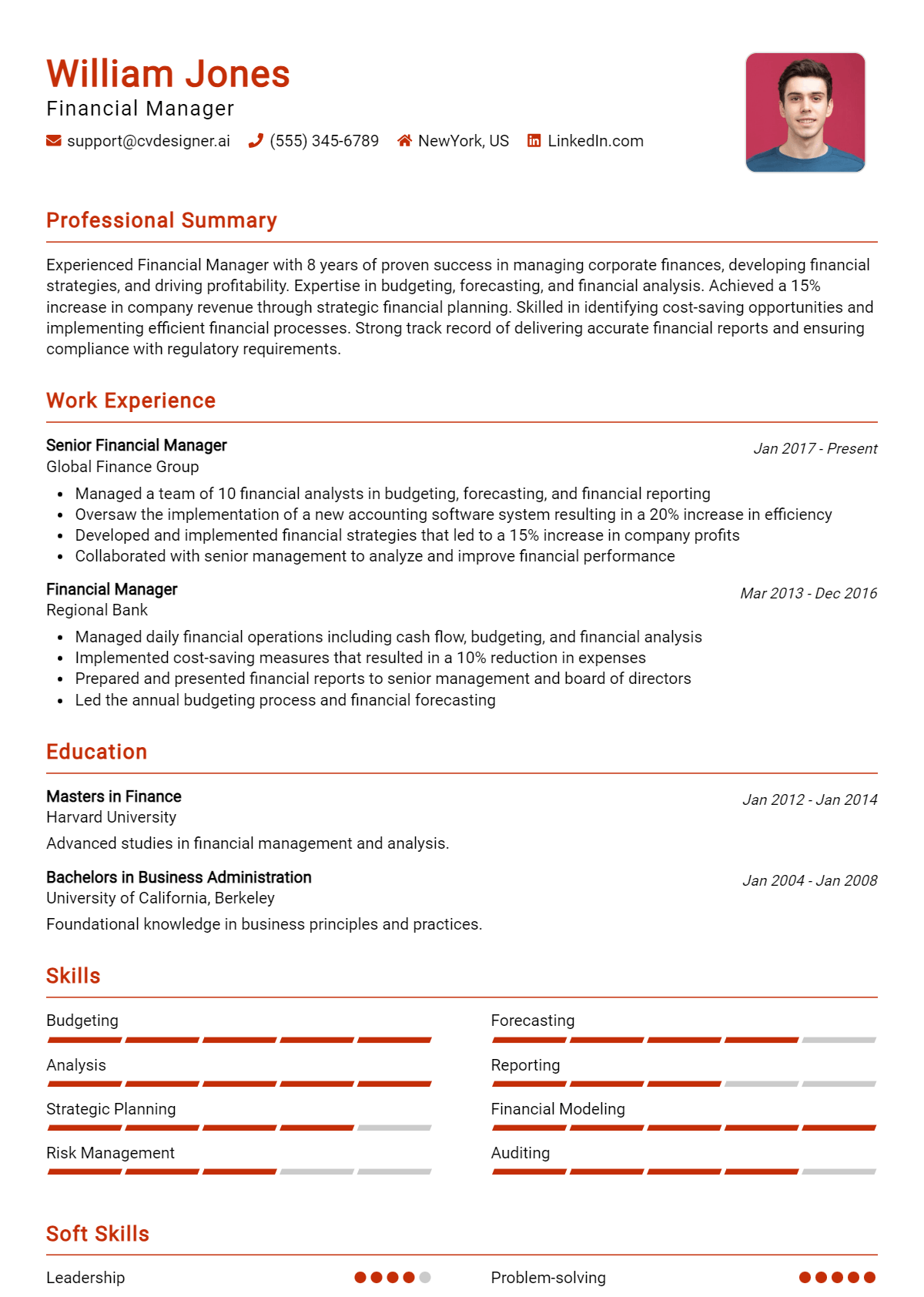

How to List Financial Manager Skills on Your Resume

Effectively listing your skills on a resume is crucial to stand out to potential employers. By showcasing your qualifications clearly, you can grab the attention of hiring managers. There are three main sections where skills can be highlighted: the Resume Summary, Resume Work Experience, Resume Skills Section, and Cover Letter.

for Resume Summary

Showcasing Financial Manager skills in the introduction (objective or summary) section provides hiring managers with a quick overview of your qualifications and sets the tone for the rest of your resume.

Example

Results-driven Financial Manager with expertise in budgeting, financial analysis, and strategic planning. Proven track record in optimizing operational efficiency and enhancing profitability.

for Resume Work Experience

The work experience section offers the perfect opportunity to demonstrate how your Financial Manager skills have been applied in real-world scenarios, allowing you to illustrate your impact effectively.

Example

- Developed and implemented financial strategies that increased company revenue by 15% within one year.

- Led a team to perform comprehensive financial analyses, resulting in a 20% reduction in operational costs.

- Managed annual budgets and forecasts, ensuring accurate cash flow management.

- Facilitated financial reporting to stakeholders, enhancing transparency and decision-making.

for Resume Skills

The skills section can either showcase technical or transferable skills. It's important to include a balanced mix of hard and soft skills to strengthen your qualifications.

Example

- Financial Reporting

- Budget Management

- Data Analysis

- Strategic Financial Planning

- Leadership and Team Management

- Regulatory Compliance

- Risk Assessment

- Stakeholder Communication

for Cover Letter

A cover letter allows candidates to expand on the skills mentioned in their resumes, providing a more personal touch. Highlighting 2-3 key skills that align with the job description can illustrate how those skills have positively impacted previous roles.

Example

In my previous position, my expertise in financial analysis and strategic planning played a pivotal role in driving a 25% increase in profitability. I am excited to bring this experience to your organization and contribute to your financial success.

Linking the skills mentioned in your resume to specific achievements in your cover letter reinforces your qualifications for the job.

The Importance of Financial Manager Resume Skills

Highlighting relevant skills on a Financial Manager resume is crucial for making a strong first impression. A well-crafted skills section not only showcases a candidate's qualifications but also aligns their expertise with the specific requirements of the job. By emphasizing key competencies, candidates can effectively communicate their value to recruiters, increasing their chances of being selected for interviews.

- Financial Analysis Expertise: Employers seek candidates who can interpret financial data to inform strategic decisions. Demonstrating proficiency in financial analysis indicates the ability to guide the organization towards profitability and growth.

- Budgeting and Forecasting Skills: A strong understanding of budgeting and forecasting is essential for a Financial Manager. Highlighting these skills shows potential employers that the candidate can effectively manage resources and predict future financial performance.

- Regulatory Knowledge: Familiarity with financial regulations and compliance is vital in today's business environment. Candidates who showcase their knowledge in this area can reassure employers of their ability to navigate complex regulatory landscapes.

- Leadership and Team Management: Financial Managers often lead teams and collaborate with other departments. Emphasizing leadership skills demonstrates the candidate's capability to motivate and manage personnel towards achieving financial objectives.

- Strategic Planning Acumen: Candidates who possess strong strategic planning skills can contribute significantly to long-term organizational goals. Highlighting this skill shows that the candidate can align financial management with overall business strategy.

- Technical Proficiency: In today's digital age, proficiency in financial software and tools is a must. Showcasing technical skills highlights the candidate's ability to leverage technology for efficient financial operations.

- Communication Skills: Effective communication is key for a Financial Manager, as they must convey complex financial information to non-financial stakeholders. Emphasizing strong communication skills can set a candidate apart in the hiring process.

- Problem-Solving Abilities: Financial Managers encounter various challenges that require innovative solutions. Highlighting problem-solving skills indicates a candidate's ability to navigate financial hurdles and enhance organizational efficiency.

For more insights and examples, you can explore various Resume Samples.

How To Improve Financial Manager Resume Skills

In the rapidly evolving world of finance, it is crucial for Financial Managers to continuously improve their skills to stay competitive and effective in their roles. As financial landscapes change due to technology, regulations, and market dynamics, enhancing your skillset not only boosts your resume but also increases your value to potential employers. Here are some actionable tips to help you improve your skills as a Financial Manager:

- Stay updated on financial regulations and compliance by subscribing to industry newsletters and attending relevant workshops.

- Enhance your analytical skills by taking online courses in data analysis and financial modeling.

- Develop leadership and communication skills through management training programs or public speaking courses.

- Gain proficiency in financial software and tools by seeking out tutorials and certifications in popular platforms like SAP or Oracle.

- Network with other finance professionals through industry conferences and professional associations to exchange knowledge and best practices.

- Regularly review and analyze financial reports to improve your strategic decision-making abilities.

- Consider pursuing advanced certifications such as CFA (Chartered Financial Analyst) or CPA (Certified Public Accountant) to enhance your credibility and expertise.

Frequently Asked Questions

What key skills should a Financial Manager highlight on their resume?

A Financial Manager should emphasize skills such as financial analysis, budgeting, forecasting, strategic planning, and risk management. Proficiency in financial modeling and reporting tools, along with strong analytical abilities, are crucial. Additionally, showcasing leadership, communication, and project management skills can demonstrate the candidate's capability to lead financial teams and drive organizational success.

How important is proficiency in financial software for a Financial Manager?

Proficiency in financial software is essential for a Financial Manager, as it enables them to efficiently manage financial data, perform analyses, and generate reports. Familiarity with tools like ERP systems, Excel, and accounting software such as QuickBooks or SAP can significantly enhance a manager's effectiveness. Highlighting expertise in these applications on a resume can set candidates apart in a competitive job market.

Should a Financial Manager include certifications on their resume?

Yes, including relevant certifications such as Certified Public Accountant (CPA), Chartered Financial Analyst (CFA), or Certified Management Accountant (CMA) can greatly enhance a Financial Manager's resume. These credentials not only validate the individual’s expertise in financial management but also demonstrate a commitment to professional development and adherence to industry standards, making candidates more attractive to potential employers.

What soft skills are valuable for a Financial Manager?

Soft skills such as leadership, communication, and problem-solving are invaluable for a Financial Manager. Effective leadership fosters team collaboration and drives performance, while strong communication skills ensure clear conveyance of financial concepts to stakeholders. Additionally, problem-solving abilities allow managers to navigate complex financial challenges and make informed decisions that align with organizational goals.

How can a Financial Manager demonstrate their impact in previous roles on their resume?

A Financial Manager can demonstrate their impact by using quantifiable achievements in their resume. This includes showcasing specific metrics such as cost reductions, revenue growth percentages, or successful budget management outcomes. Providing examples of how they improved financial processes, increased efficiency, or led successful projects can effectively illustrate their contributions to past employers and highlight their value to prospective organizations.

Conclusion

Including Financial Manager skills in your resume is essential for demonstrating your expertise and suitability for the role. By showcasing relevant skills, you not only stand out among other candidates but also provide significant value to potential employers who are looking for qualified individuals to manage their financial operations effectively. Take the time to refine and highlight your skills, ensuring your job application reflects your abilities and dedication. Remember, a well-crafted resume can open doors to new opportunities, so invest in your future with confidence!

For more resources, check out our resume templates, enhance your application with our resume builder, explore resume examples, and create a compelling introduction with our cover letter templates.

Use an AI-powered resume builder and have your resume done in 5 minutes. Just select your template and our software will guide you through the process.