23 Financial Business Partner Skills for Your Resume in 2025

As a Financial Business Partner, possessing a diverse skill set is crucial to effectively support decision-making and drive business performance. This role requires a blend of financial acumen, analytical prowess, and strong interpersonal skills to collaborate with various departments. In the following section, we will explore the top skills that can enhance your resume and showcase your qualifications for this pivotal position.

Best Financial Business Partner Technical Skills

In the dynamic role of a Financial Business Partner, possessing strong technical skills is crucial for driving financial performance and strategic decision-making. These skills not only enhance analytical capabilities but also support effective communication and collaboration with stakeholders. Below are essential technical skills that can significantly boost your resume and demonstrate your qualifications for this role.

Financial Modeling

Financial modeling is a critical skill for forecasting and analyzing financial performance. It enables Financial Business Partners to create comprehensive models that support strategic initiatives and investment decisions.

How to show it: Highlight specific projects where you developed financial models that influenced business strategies. Include quantifiable outcomes, such as revenue increases or cost savings attributed to your models.

Data Analysis

Data analysis involves interpreting complex datasets to derive actionable insights. This skill allows Financial Business Partners to identify trends, assess risks, and make informed recommendations based on data-driven evidence.

How to show it: Provide examples of how your data analysis led to improved business decisions. Quantify your contributions, such as percentage improvements in efficiency or accuracy of forecasts.

Budgeting and Forecasting

Expertise in budgeting and forecasting is essential for managing financial resources effectively. This skill enables Financial Business Partners to create realistic budgets and predict future financial performance.

How to show it: Detail your experience in preparing budgets and forecasts, emphasizing any successful outcomes, such as staying within budget or achieving financial targets.

Financial Reporting

Financial reporting involves preparing accurate financial statements and reports. This skill is vital for ensuring compliance and providing stakeholders with essential insights into financial health.

How to show it: List your experience in generating financial reports and any improvements in reporting processes. Mention the frequency of reporting and any significant findings that influenced business decisions.

Variance Analysis

Variance analysis is the process of comparing actual financial outcomes to budgets or forecasts. This skill helps identify discrepancies and understand their causes, enabling better financial control.

How to show it: Describe instances where your variance analysis led to corrective actions or strategic changes. Quantify the impact of these changes on financial performance.

Cost Analysis

Cost analysis focuses on evaluating the costs associated with business operations. This skill is crucial for identifying cost-saving opportunities and enhancing profitability.

How to show it: Provide specific examples of cost analysis projects that resulted in reduced expenses or improved margins. Include metrics such as percentage reductions in costs.

Risk Management

Risk management involves identifying, assessing, and mitigating financial risks that could impact business objectives. This skill is essential for maintaining financial stability and supporting strategic planning.

How to show it: Discuss your experience in implementing risk management strategies. Highlight specific risks you identified and the measures taken to mitigate them, along with the results.

Accounting Principles

Understanding accounting principles is fundamental for Financial Business Partners. This knowledge ensures accurate financial reporting and compliance with regulatory requirements.

How to show it: List relevant certifications or courses in accounting, and describe how your knowledge of accounting principles has improved financial reporting or compliance in your roles.

Excel Proficiency

Proficiency in Excel is essential for performing financial analyses, creating models, and managing data. This skill enhances efficiency and accuracy in financial reporting and analysis tasks.

How to show it: Demonstrate your Excel skills by mentioning specific functions or tools you utilized (e.g., pivot tables, VLOOKUP) and the results of your analyses.

ERP Systems Knowledge

Knowledge of Enterprise Resource Planning (ERP) systems is valuable for integrating and managing financial data across the organization. This skill supports streamlined processes and accurate reporting.

How to show it: Highlight your experience with specific ERP systems and how your expertise contributed to improved data management or reporting accuracy.

Presentation Skills

Strong presentation skills are vital for effectively communicating financial insights and recommendations to stakeholders. This skill ensures that complex financial information is conveyed clearly and persuasively.

How to show it: Include examples of presentations you delivered to management or stakeholders, mentioning the outcomes or decisions influenced by your presentations.

Best Financial Business Partner Soft Skills

In the role of a Financial Business Partner, possessing strong soft skills is essential for success. These skills not only enhance your ability to collaborate with teams and stakeholders but also improve your effectiveness in analyzing financial data and making strategic decisions. Below are some of the top soft skills that can set you apart in this role.

Effective Communication

Clear and concise communication is crucial for a Financial Business Partner, as it enables you to convey complex financial information to non-financial stakeholders effectively.

How to show it: Highlight instances where you successfully communicated financial concepts to diverse audiences. Use metrics to show how your communication led to improved understanding or decision-making.

Analytical Thinking

This skill involves the ability to analyze data effectively to identify trends and make informed decisions, which is vital for providing financial insights.

How to show it: Provide examples of data analyses you conducted that directly influenced business strategies or financial performance. Quantify the outcomes where possible.

Problem-solving

As a Financial Business Partner, you will often encounter complex challenges that require innovative solutions to optimize financial performance.

How to show it: Describe specific problems you faced in previous roles and the strategic solutions you implemented. Include metrics that demonstrate the success of your solutions.

Time Management

Managing multiple projects and deadlines efficiently is critical in this role. Effective time management ensures that financial reports and analyses are delivered on schedule.

How to show it: Discuss how you prioritized tasks and met deadlines in previous positions. Use specific examples to illustrate your ability to manage time effectively.

Teamwork

Collaboration with various departments, including marketing, operations, and sales, is key to aligning financial strategies with business goals.

How to show it: Provide examples of successful collaborations with cross-functional teams. Highlight any joint projects that resulted in significant business improvements and include measurable results.

Adaptability

The financial landscape is constantly changing, and being adaptable allows you to respond effectively to new challenges and opportunities.

How to show it: Share experiences where you successfully adjusted to changes in the financial environment or organizational structure, and quantify the impact of your adaptability.

Interpersonal Skills

Building strong relationships with stakeholders is essential for a Financial Business Partner, facilitating better collaboration and information sharing.

How to show it: Highlight instances where your interpersonal skills led to improved relationships or outcomes with stakeholders. Use specific examples to showcase your ability to connect with others.

Strategic Thinking

This skill involves the ability to think critically and develop financial strategies that align with overall business objectives.

How to show it: Provide examples of strategic initiatives you led or contributed to, detailing the financial impact and how they supported business goals.

Negotiation Skills

Strong negotiation skills are important for securing favorable terms and conditions in financial agreements or contracts.

How to show it: Share specific negotiation experiences where your skills resulted in improved financial outcomes. Quantify the benefits gained from successful negotiations.

Emotional Intelligence

Understanding and managing your emotions, as well as empathizing with others, can greatly enhance your effectiveness in a collaborative environment.

How to show it: Discuss how your emotional intelligence has helped resolve conflicts or improve team dynamics. Provide examples that showcase your ability to connect with colleagues.

Attention to Detail

Being meticulous in your work is crucial for ensuring accuracy in financial reporting and analysis.

How to show it: Provide examples of how your attention to detail has prevented errors or led to successful audits. Use metrics to demonstrate the value of your thoroughness.

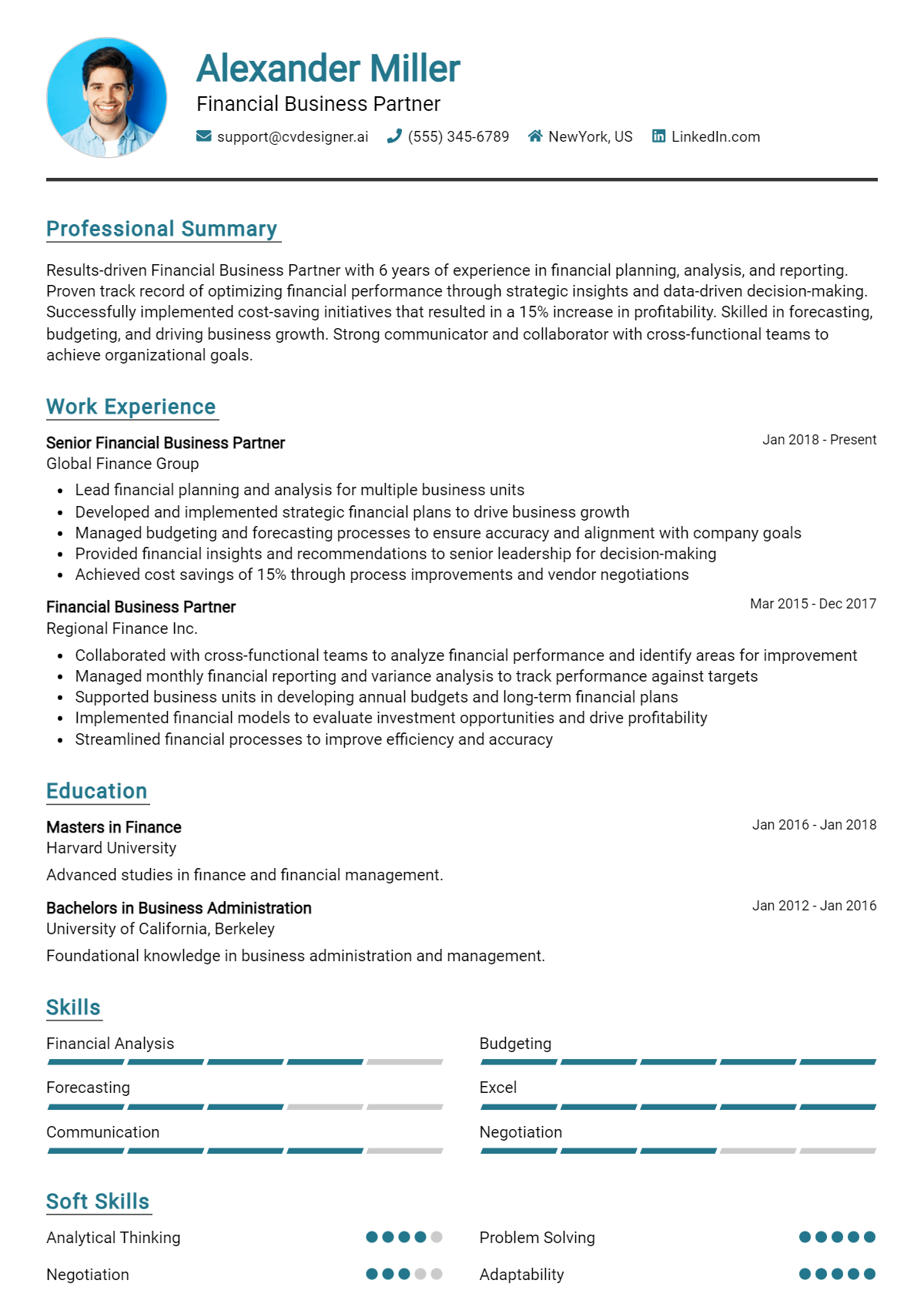

How to List Financial Business Partner Skills on Your Resume

Effectively listing your skills on a resume is crucial for standing out to potential employers. A well-crafted skills section can quickly demonstrate your qualifications and suitability for the role. There are three main sections where you can highlight your skills: the Resume Introduction, Work Experience, and Skills Section.

for Summary

Showcasing Financial Business Partner skills in the introduction section allows hiring managers to quickly grasp your qualifications. A strong summary can set the tone for the rest of your resume.

Example

As an experienced Financial Business Partner, I excel in financial analysis, strategic planning, and stakeholder engagement, enabling organizations to achieve their financial objectives and drive sustainable growth.

for Work Experience

The work experience section provides an excellent opportunity to demonstrate how your Financial Business Partner skills have been applied in real-world scenarios. Use this space to match your experience with specific skills mentioned in job listings.

Example

- Developed comprehensive financial models that improved forecasting accuracy by 20%.

- Collaborated with cross-functional teams to align financial goals with business strategies.

- Conducted in-depth variance analysis to support decision-making processes.

- Facilitated stakeholder meetings to present financial insights and recommendations.

for Skills

The skills section can showcase both technical and transferable skills. It is essential to include a balanced mix of hard and soft skills that strengthen your overall qualifications.

Example

- Financial Analysis

- Budgeting and Forecasting

- Data Interpretation

- Stakeholder Management

- Strategic Planning

- Problem Solving

- Effective Communication

for Cover Letter

A cover letter allows candidates to expand on the skills mentioned in the resume, providing a more personal touch. Highlighting 2-3 key skills that align with the job description can showcase how those skills have positively impacted your previous roles.

Example

In my previous role, my expertise in financial analysis and strategic planning led to a 15% increase in operational efficiency, demonstrating my ability to align financial initiatives with business goals. I am excited to bring this expertise to your organization.

Encourage candidates to link the skills mentioned in their resume to specific achievements in their cover letter, reinforcing their qualifications for the job.

The Importance of Financial Business Partner Resume Skills

Highlighting relevant skills on a Financial Business Partner resume is crucial for candidates looking to make a lasting impression on recruiters. A well-crafted skills section not only showcases a candidate's qualifications but also demonstrates their alignment with the specific requirements of the job. By effectively presenting their skill set, candidates can differentiate themselves from the competition and increase their chances of landing an interview.

- A strong skills section allows candidates to quickly convey their expertise in financial analysis and strategic planning, which are essential for a Financial Business Partner role.

- Emphasizing soft skills like communication and collaboration indicates the candidate's ability to work effectively within cross-functional teams and influence decision-making processes.

- Highlighting technical skills, such as proficiency in financial software or data analytics tools, shows that the candidate is equipped to handle the demands of modern financial environments.

- Including industry-specific knowledge demonstrates the candidate's understanding of market trends and financial regulations, which can be a significant advantage in making informed recommendations.

- Skills related to problem-solving and critical thinking are vital, as Financial Business Partners often need to analyze complex situations and provide actionable insights to improve financial performance.

- A well-defined skills section can help candidates pass through Applicant Tracking Systems (ATS), which often filter resumes based on keyword matches related to required competencies.

- By showcasing a blend of both hard and soft skills, candidates can present themselves as well-rounded professionals capable of bridging the gap between finance and business operations.

- Tailoring the skills section to align with the job description can significantly increase the likelihood of catching the recruiter's attention, as it demonstrates that the candidate has done their homework.

For additional insights and examples, check out [Resume Samples](https://resumekraft.com/resume-samples/).

How To Improve Financial Business Partner Resume Skills

Continuously improving your skills as a Financial Business Partner is crucial in a rapidly changing financial landscape. This role requires not only a solid understanding of finance but also the ability to communicate effectively with stakeholders and make strategic decisions that drive the business forward. Regularly enhancing your skill set can make you more competitive in the job market and help you deliver greater value to your organization.

- Engage in professional development courses focused on financial analysis, business strategy, and stakeholder management.

- Obtain relevant certifications such as Chartered Financial Analyst (CFA) or Certified Management Accountant (CMA) to demonstrate your expertise.

- Stay updated on industry trends and best practices through webinars, conferences, and financial news platforms.

- Network with other financial professionals to exchange insights and learn from their experiences.

- Enhance your technical skills by mastering financial modeling tools and software like Excel, Power BI, or Tableau.

- Seek mentorship or coaching from experienced Financial Business Partners to gain practical knowledge and advice.

- Practice effective communication and presentation skills to convey financial insights clearly and persuasively to non-financial stakeholders.

Frequently Asked Questions

What are the key skills required for a Financial Business Partner?

A Financial Business Partner should possess strong analytical skills, financial acumen, and business insight to effectively collaborate with stakeholders. Proficiency in financial modeling, budgeting, and forecasting is essential, alongside excellent communication skills to present complex financial data clearly. Additionally, experience with data analysis tools and the ability to influence strategic decisions are critical for success in this role.

How important is communication in the role of a Financial Business Partner?

Communication is a vital skill for a Financial Business Partner, as they must convey financial insights and recommendations to non-financial stakeholders. The ability to articulate complex financial concepts in a straightforward manner fosters collaboration and ensures alignment with business goals. Strong interpersonal skills also help build relationships across departments, enhancing teamwork and driving strategic initiatives.

What technical skills should a Financial Business Partner have?

A Financial Business Partner should be proficient in financial software and tools, such as Excel, ERP systems, and financial modeling applications. Knowledge of data visualization tools like Tableau or Power BI can enhance reporting capabilities. Additionally, familiarity with accounting principles and regulations is crucial for maintaining compliance and ensuring accurate financial reporting.

How can a Financial Business Partner contribute to strategic decision-making?

A Financial Business Partner plays a critical role in strategic decision-making by providing data-driven insights and financial analysis to guide business initiatives. They assess the financial implications of various strategies, helping to identify risks and opportunities. By collaborating with other departments, they ensure that financial considerations are integrated into the planning process, leading to informed and effective decision-making.

What role does stakeholder management play in the success of a Financial Business Partner?

Stakeholder management is essential for a Financial Business Partner, as they must engage with various parties, including management, department heads, and external partners. Building strong relationships and understanding the needs and objectives of stakeholders allow the Financial Business Partner to provide relevant financial insights and foster collaboration. Effective stakeholder management ultimately enhances the partner’s influence and ability to drive business performance.

Conclusion

Incorporating Financial Business Partner skills into your resume is crucial for demonstrating your value to potential employers. By showcasing relevant skills such as financial analysis, strategic planning, and stakeholder management, you can set yourself apart from the competition and highlight your ability to drive business success. Remember, a well-crafted resume not only reflects your qualifications but also your commitment to excellence in the field.

As you refine your skills and tailor your application, you increase your chances of landing that coveted position. Stay motivated and embrace the journey of professional growth—every step you take brings you closer to your dream job!

For more resources, check out our resume templates, resume builder, resume examples, and cover letter templates.

Use an AI-powered resume builder and have your resume done in 5 minutes. Just select your template and our software will guide you through the process.