29 Equity Research Analyst Skills For Your Resume with Exampels in 2025

As an Equity Research Analyst, possessing a robust skill set is essential for effectively analyzing financial data, evaluating investment opportunities, and providing insightful recommendations. The following section highlights the top skills that can enhance your resume and demonstrate your expertise in the field. These skills not only facilitate thorough research and analysis but also enable you to communicate findings effectively to stakeholders, ultimately supporting informed investment decisions.

Best Equity Research Analyst Technical Skills

The role of an Equity Research Analyst demands a robust set of technical skills that enable professionals to analyze financial data, assess market trends, and make informed investment recommendations. Mastering these skills not only enhances analytical capabilities but also boosts employability in a competitive job market.

Financial Modeling

Financial modeling is the practice of creating representations of a company’s financial performance. Analysts build models to forecast future earnings and evaluate investment opportunities.

How to show it: Highlight specific models you have built, such as discounted cash flow (DCF) models or merger models, and quantify the accuracy of your predictions or their impact on investment decisions.

Valuation Techniques

Valuation techniques, including DCF, comparable company analysis, and precedent transactions, are essential for determining the intrinsic value of securities.

How to show it: Provide examples of how you applied these techniques to assess stocks in your previous roles and mention the outcomes, such as improved investment returns.

Statistical Analysis

Statistical analysis involves using statistical methods to interpret data trends and make forecasts. This skill is critical in evaluating stock performance and market movements.

How to show it: Detail the statistical tools and software you have used (e.g., Excel, R, SAS) and any projects where your analysis led to data-driven insights or strategic decisions.

Industry Research

Conducting thorough industry research helps analysts understand market dynamics, competitive landscapes, and sector-specific trends that influence investment opportunities.

How to show it: Include specific industries you’ve researched extensively and the methodologies used, as well as any reports published or presentations given as a result.

Financial Statement Analysis

Analyzing financial statements is crucial for assessing a company's performance and identifying potential red flags in its financial health.

How to show it: List the key metrics you routinely analyzed (e.g., EBITDA, ROE) and any significant findings that influenced investment choices.

Excel Proficiency

Excel is a fundamental tool for data analysis, financial modeling, and reporting. Advanced Excel skills enable analysts to manipulate large datasets efficiently.

How to show it: Specify advanced functions you are proficient in (e.g., VLOOKUP, pivot tables, macros) and how you have used these skills to streamline processes or improve reporting accuracy.

Equity Research Report Writing

Writing comprehensive equity research reports is essential for communicating investment recommendations to stakeholders clearly and effectively.

How to show it: Include the number of reports authored and their impact, such as influencing buy/sell decisions or contributing to client satisfaction.

Database Management

Database management skills are necessary for organizing and retrieving financial data efficiently, enhancing the analyst's ability to conduct research and analysis.

How to show it: Mention specific databases you have managed (e.g., Bloomberg, FactSet) and any improvements you implemented that enhanced data accessibility or accuracy.

Presentation Skills

Strong presentation skills are vital for conveying research findings and investment recommendations to clients and stakeholders persuasively.

How to show it: Describe instances where you presented to senior management or clients, focusing on the feedback received or changes implemented based on your insights.

Understanding of Economic Indicators

A solid grasp of economic indicators and their implications on market trends allows analysts to make informed predictions about stock performance.

How to show it: Share specific indicators you monitor regularly and any analysis you conducted that led to proactive investment strategies.

Risk Assessment

Risk assessment skills are essential for identifying potential investment risks and developing strategies to mitigate them, ensuring a balanced portfolio.

How to show it: Detail risk assessment frameworks you have used and any quantitative measures taken that improved investment safety or performance.

Best Equity Research Analyst Soft Skills

In the fast-paced world of finance, the role of an Equity Research Analyst requires not only technical expertise but also a range of soft skills that facilitate effective analysis and communication. These skills are crucial for building relationships with clients, collaborating with teams, and delivering insightful research that drives investment decisions. Below are some of the essential soft skills that can make a significant impact in this role.

Analytical Thinking

Analytical thinking is the ability to dissect complex information and identify patterns or trends. For an Equity Research Analyst, this skill is vital when evaluating financial reports or market data.

How to show it: Highlight instances where you utilized analytical skills to interpret data and make investment recommendations. Include specific metrics or outcomes from your analyses.

Communication

Effective communication is essential for conveying research findings and recommendations clearly and persuasively to clients and stakeholders.

How to show it: Demonstrate your communication skills by providing examples of presentations or reports you've created that led to successful outcomes or decisions.

Learn more about Communication skills.

Attention to Detail

Attention to detail ensures accuracy in financial modeling and reporting, which is critical in minimizing errors in investment analysis.

How to show it: Provide examples of how your meticulous nature has led to identifying errors or enhancing accuracy in reports that benefited the firm or clients.

Problem-Solving

Problem-solving skills enable analysts to navigate challenges and uncertainties in the market, allowing them to provide innovative solutions to clients.

How to show it: Share specific challenges you've faced and the strategies you implemented to overcome them, emphasizing the positive results achieved.

Explore more about Problem-solving skills.

Time Management

Time management is crucial for balancing multiple projects and deadlines, ensuring timely delivery of research reports and analyses.

How to show it: Illustrate your time management capabilities by detailing how you've prioritized tasks effectively and met critical deadlines in previous roles.

Read about Time Management skills.

Teamwork

Collaboration is key in equity research, as analysts often work in teams to share insights and develop comprehensive investment strategies.

How to show it: Provide examples of successful team projects you've contributed to, highlighting your role and the outcomes achieved through collaboration.

Discover more about Teamwork skills.

Adaptability

Adaptability allows analysts to remain flexible and responsive to changing market conditions and client needs.

How to show it: Illustrate your adaptability by detailing situations where you successfully adjusted your approach based on new information or market shifts.

Critical Thinking

Critical thinking enables analysts to evaluate information objectively and make informed decisions based on comprehensive analysis.

How to show it: Share examples of how you applied critical thinking to assess investment opportunities and the rationale behind your recommendations.

Interpersonal Skills

Interpersonal skills are essential for building rapport with clients and colleagues, which can lead to successful business relationships.

How to show it: Provide examples of how your interpersonal skills have helped you engage effectively with clients or collaborate with team members to achieve common goals.

Negotiation Skills

Negotiation skills can be invaluable when dealing with clients and stakeholders to achieve favorable terms or outcomes.

How to show it: Highlight instances where your negotiation skills led to successful agreements or beneficial outcomes for your team or clients.

Research Skills

Strong research skills are fundamental for gathering and analyzing data necessary for making informed investment decisions.

How to show it: Detail your experience in conducting thorough research and how it has directly contributed to successful investment strategies or reports.

How to List Equity Research Analyst Skills on Your Resume

Effectively listing your skills on a resume is crucial in standing out to potential employers. It helps hiring managers quickly assess your qualifications and fit for the role. There are three main sections where skills can be highlighted: Resume Introduction, Work Experience, and Skills Section.

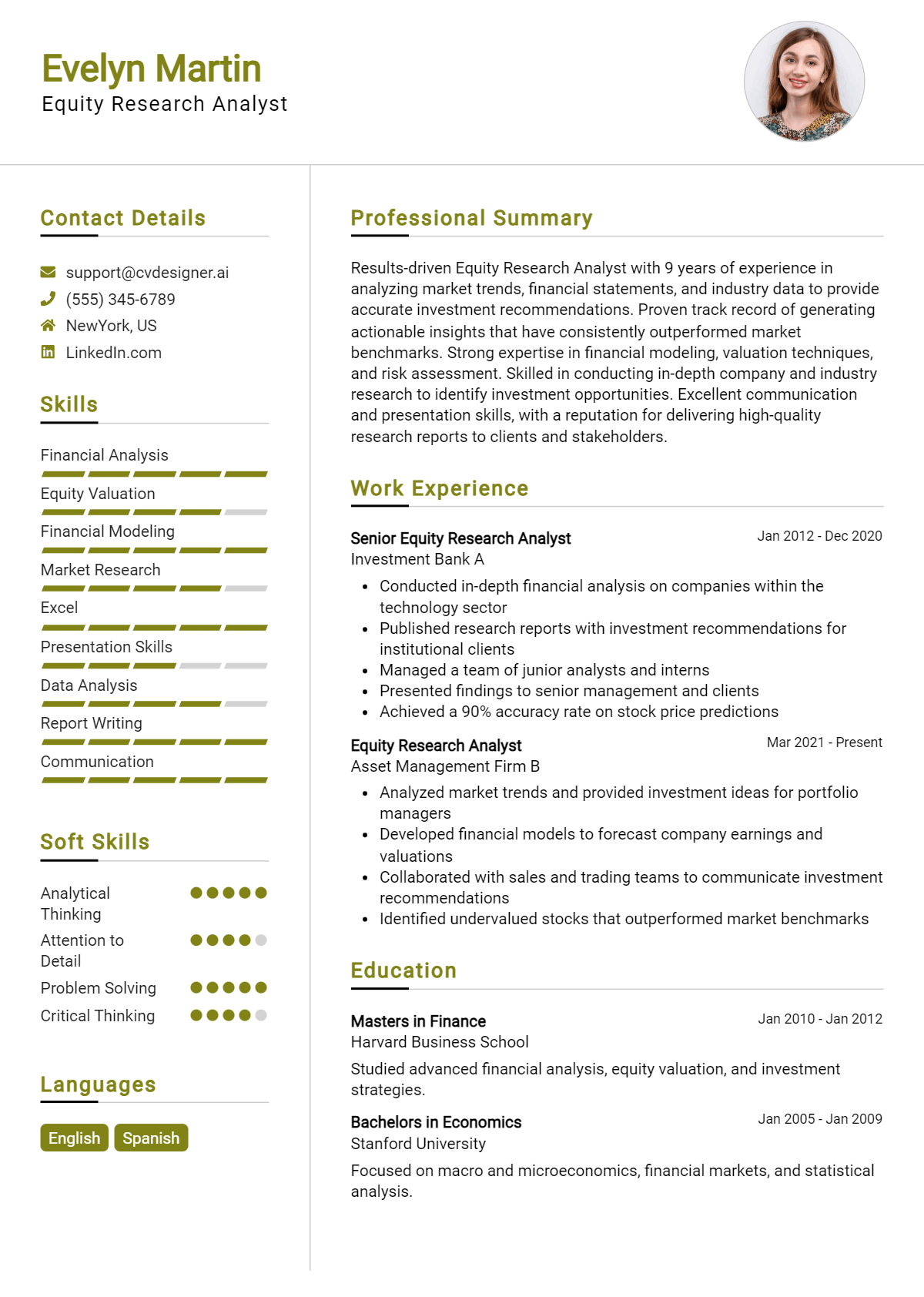

for Summary

Showcasing Equity Research Analyst skills in the introduction (objective or summary) section provides hiring managers with a quick overview of your qualifications, making a strong first impression.

Example

Results-driven Equity Research Analyst with expertise in financial modeling, market analysis, and investment strategies. Proven ability to deliver actionable insights using data analysis and reporting skills.

for Work Experience

The work experience section provides the perfect opportunity to demonstrate how Equity Research Analyst skills have been applied in real-world scenarios. This is where you can showcase your accomplishments and strengths effectively.

Example

- Conducted comprehensive financial analysis and valuation models to support investment decisions.

- Collaborated with cross-functional teams to develop market research reports that improved client investment strategies.

- Utilized quantitative analysis techniques to assess stock performance and forecast market trends.

- Presented findings to senior management, demonstrating exceptional communication and presentation skills.

for Skills

The skills section can showcase both technical and transferable skills. A balanced mix of hard and soft skills will strengthen your overall qualifications and appeal to potential employers.

Example

- Financial Modeling

- Market Analysis

- Data Interpretation

- Investment Strategy Development

- Risk Assessment

- Communication Skills

- Attention to Detail

- Time Management

for Cover Letter

A cover letter allows candidates to expand on the skills mentioned in the resume and provide a more personal touch. Highlighting 2-3 key skills that align with the job description can help illustrate your fit for the role.

Example

In my previous role as an Equity Research Analyst, my strong financial modeling and data analysis skills allowed me to identify profitable investment opportunities, resulting in a 15% increase in portfolio performance. I am eager to bring this expertise to your team and contribute to your firm's success.

Linking the skills mentioned in the resume to specific achievements in your cover letter reinforces your qualifications for the job.

The Importance of Equity Research Analyst Resume Skills

Highlighting relevant skills on an Equity Research Analyst resume is crucial for making a strong impression on recruiters. A well-crafted skills section not only showcases a candidate's qualifications but also aligns their expertise with the specific demands of the job. This alignment helps candidates stand out in a competitive job market, demonstrating their readiness to contribute effectively to the organization.

- Strong analytical skills are essential for an Equity Research Analyst, as they enable candidates to interpret complex financial data and trends. This skill shows recruiters that the applicant can derive meaningful insights that drive investment decisions.

- Proficiency in financial modeling and valuation techniques is key for evaluating companies and predicting their future performance. Highlighting this skill indicates that the candidate can build robust financial models that support investment recommendations.

- Excellent written and verbal communication skills are necessary for conveying research findings clearly and effectively. This competency ensures that the analyst can create compelling reports and presentations that influence stakeholders.

- Familiarity with various financial software and tools demonstrates a candidate's ability to leverage technology in their analysis. Knowledge of platforms like Bloomberg or FactSet can set an applicant apart by showcasing their technical capabilities.

- Understanding of market trends and economic indicators is vital for making informed recommendations. This knowledge reflects an analyst's ability to stay ahead of the curve and recognize potential investment opportunities.

- Attention to detail is a critical skill that ensures accuracy in financial reports and analyses. Emphasizing this trait indicates a commitment to quality and thoroughness, which is essential in the finance industry.

- Teamwork and collaboration skills highlight a candidate's ability to work effectively with colleagues in a fast-paced environment. Demonstrating this capability shows that the applicant can contribute positively to team dynamics and achieve common goals.

- Adaptability and a willingness to learn are important in the ever-evolving field of equity research. This skill suggests that the candidate is open to new ideas and can adjust to changing market conditions, making them a valuable asset to any organization.

For more insights on crafting an effective resume, check out these Resume Samples.

How To Improve Equity Research Analyst Resume Skills

In the fast-paced world of finance, the role of an Equity Research Analyst requires continuous skill enhancement to stay ahead in a competitive market. As an analyst, you need to adapt to changing market conditions, new financial instruments, and evolving analytical techniques. By improving your skills, you not only enhance your resume but also increase your value to employers and your ability to provide insightful analyses.

- Stay Updated with Financial News: Regularly read financial news outlets like Bloomberg, The Wall Street Journal, and Financial Times to stay informed about market trends and economic indicators.

- Enhance Financial Modeling Skills: Take online courses or workshops to sharpen your financial modeling skills, focusing on Excel and other analytical tools that are essential for valuation and forecasting.

- Develop Industry Knowledge: Specialize in specific sectors by studying industry reports, attending webinars, and following key players in that market to deepen your understanding of industry dynamics.

- Practice Writing Skills: Improve your ability to articulate complex analyses clearly by writing research reports, summaries, or blog posts about your findings and insights.

- Network with Professionals: Attend industry conferences, seminars, and local meetups to connect with other professionals and gain insights from their experiences and best practices.

- Obtain Relevant Certifications: Consider pursuing certifications such as the Chartered Financial Analyst (CFA) designation to enhance your credibility and demonstrate your commitment to the field.

- Utilize Analytical Tools: Familiarize yourself with data analytics tools and software commonly used in equity research, such as Bloomberg Terminal, FactSet, or Python for data analysis, to increase your technical proficiency.

Frequently Asked Questions

What are the essential skills needed for an Equity Research Analyst?

Equity Research Analysts should possess strong analytical skills, allowing them to interpret complex financial data and market trends. Proficiency in financial modeling and valuation techniques is crucial, along with a solid understanding of accounting principles. Additionally, effective communication skills are necessary for presenting research findings clearly to clients and stakeholders. Familiarity with various investment strategies and tools, as well as the ability to work under pressure and meet tight deadlines, are also important skills for success in this role.

How important is attention to detail for an Equity Research Analyst?

Attention to detail is paramount for an Equity Research Analyst, as even minor errors in financial analysis or reporting can lead to significant misjudgments in investment decisions. Analysts must meticulously review financial statements, market data, and their own models to ensure accuracy and reliability. This skill helps in identifying trends, anomalies, and potential risks that could affect investment outcomes, ultimately enhancing the quality of their research reports and recommendations.

What software skills are beneficial for an Equity Research Analyst?

Equity Research Analysts should be proficient in financial modeling software such as Microsoft Excel, which is essential for performing complex calculations and creating forecasts. Familiarity with data analysis tools like Bloomberg, FactSet, or Capital IQ is also beneficial for accessing real-time financial data and research. Additionally, knowledge of programming languages such as Python or R can be an advantage, as they allow analysts to automate data analysis and improve efficiency in their research processes.

How does communication play a role in an Equity Research Analyst's job?

Effective communication is a vital skill for an Equity Research Analyst, as they must convey complex financial concepts and findings to clients, investors, and team members clearly and persuasively. This includes writing comprehensive research reports, delivering presentations, and engaging in discussions about investment strategies. Strong verbal and written communication skills help analysts build credibility and trust with their audience, ensuring that their insights are understood and valued in the decision-making process.

What role does critical thinking play in equity research?

Critical thinking is essential for Equity Research Analysts as it enables them to evaluate information from multiple sources, question assumptions, and identify potential biases in their analyses. This skill helps analysts to assess the validity of their research, draw logical conclusions, and make informed recommendations. By applying critical thinking, analysts can better navigate the complexities of the financial markets and develop more robust investment strategies, ultimately leading to improved client outcomes.

Conclusion

Including the skills of an Equity Research Analyst in your resume is crucial for showcasing your expertise and dedication to the field. By highlighting relevant skills, candidates not only differentiate themselves from the competition but also demonstrate the value they can bring to potential employers. This tailored approach can significantly enhance your job application and increase your chances of securing interviews.

As you prepare your resume, remember that refining your skills is an ongoing journey. Embrace the opportunity to develop and showcase your abilities, and let your resume reflect your commitment to excellence. For additional resources, explore our resume templates, utilize our resume builder, check out resume examples, and create a standout application with our cover letter templates.

Use an AI-powered resume builder and have your resume done in 5 minutes. Just select your template and our software will guide you through the process.