23 good skills to put on resume for Debt Recovery Specialist in 2025

When crafting a resume for a Debt Recovery Specialist position, showcasing the right skills is crucial to stand out in a competitive job market. This role requires a unique blend of financial acumen, communication prowess, and negotiation tactics. In the following section, we will highlight the essential skills that can enhance your resume and demonstrate your capability to effectively manage debt recovery processes.

Best Debt Recovery Specialist Technical Skills

Technical skills are crucial for a Debt Recovery Specialist as they enhance the ability to effectively manage accounts, streamline processes, and recover debts efficiently. These skills not only demonstrate proficiency in the necessary tools and methodologies but also highlight a candidate's commitment to achieving results in debt recovery operations.

Data Analysis

Data analysis skills are essential for evaluating debt collection trends, identifying delinquent accounts, and strategizing recovery efforts.

How to show it: Include specific examples of how you've used data to improve recovery rates or reduce the time taken to collect debts. Mention any relevant tools or software used for analysis.

Negotiation Skills

Strong negotiation skills are critical for reaching agreements with debtors, ensuring that both parties find a satisfactory resolution.

How to show it: Quantify your success by detailing the percentage of debt recovered through negotiation or the number of successful settlements achieved.

Knowledge of Debt Collection Laws

A thorough understanding of debt collection laws, such as the Fair Debt Collection Practices Act (FDCPA), is vital to ensure compliance and protect the organization from legal issues.

How to show it: Demonstrate your knowledge by mentioning any certifications or training in debt collection laws, and provide examples of how you have adhered to these regulations in your work.

CRM Software Proficiency

Proficiency in Customer Relationship Management (CRM) software enables specialists to track interactions with debtors and manage accounts effectively.

How to show it: List specific CRM tools you are experienced with and describe how you utilized them to improve customer interactions or streamline the debt recovery process.

Financial Acumen

Understanding financial statements and credit reports helps Debt Recovery Specialists assess the financial situation of debtors and make informed decisions.

How to show it: Highlight your ability to interpret financial data and discuss how this skill has led to successful debt recovery in previous roles.

Communication Skills

Effective communication is key to successfully reaching out to debtors and negotiating repayment plans, both verbally and in writing.

How to show it: Provide examples of your communication strategies that led to increased recovery rates, and quantify the impact where possible.

Time Management

Time management skills help Debt Recovery Specialists prioritize tasks and efficiently manage a high volume of accounts.

How to show it: Illustrate your time management abilities by sharing how you successfully handled multiple accounts simultaneously and the results achieved.

Problem-Solving Skills

Strong problem-solving skills are necessary for addressing challenges that arise during the debt recovery process, such as unresponsive debtors or disputes.

How to show it: Describe specific instances where you resolved complex issues and the positive outcomes that resulted from your intervention.

Attention to Detail

Attention to detail ensures that all documentation is accurate and that all regulatory requirements are met during the debt recovery process.

How to show it: Mention examples of how your attention to detail has prevented errors or improved the quality of your work in debt collection.

Negotiation Software Knowledge

Familiarity with negotiation software can streamline the negotiation process and improve communication with debtors.

How to show it: List any specific negotiation tools you have used and describe how they contributed to successful outcomes in debt recovery.

Record Keeping

Efficient record-keeping practices are essential for tracking communications, payment plans, and the status of accounts.

How to show it: Provide examples of how your record-keeping methods improved organization and facilitated better recovery efforts.

Best Debt Recovery Specialist Soft Skills

In the field of debt recovery, possessing strong soft skills is just as important as having the right technical expertise. These skills facilitate effective communication, negotiation, and relationship-building with clients and colleagues, thereby enhancing the overall recovery process. Below are essential soft skills that Debt Recovery Specialists should highlight on their resumes.

Communication

Effective communication is crucial for Debt Recovery Specialists as it helps articulate the terms and processes clearly to clients, ensuring they understand their obligations and options.

How to show it: Provide examples of how you successfully communicated complex information to clients, resolving queries while maintaining a positive relationship. Quantify your achievements, such as the percentage of clients who understood their repayment plans after your explanations.

Negotiation

Negotiation skills are key to reaching favorable agreements with clients who may be reluctant to pay. A Debt Recovery Specialist must navigate discussions tactfully to arrive at mutually acceptable solutions.

How to show it: Highlight specific instances where you negotiated repayment terms that resulted in increased recovery rates. Use metrics to demonstrate your success, such as the number of agreements secured or the amount recovered through negotiation.

Problem-solving

Debt Recovery Specialists encounter various challenges, including unresponsive clients and complex financial situations. Strong problem-solving skills enable them to find effective solutions swiftly.

How to show it: Detail situations where you identified and resolved issues effectively, perhaps by implementing new strategies that improved recovery rates. Quantify the results to give potential employers insight into your problem-solving capabilities.

Time Management

Efficient time management is essential for Debt Recovery Specialists to ensure they prioritize tasks effectively and meet deadlines, particularly in high-volume environments.

How to show it: Demonstrate how you managed multiple cases simultaneously, perhaps by establishing a system that improved your response time. Include metrics such as the average time taken to resolve debts or the number of cases handled within a specific timeframe.

Teamwork

Collaborative skills are vital for Debt Recovery Specialists, as they often work with various departments, including legal and customer service, to achieve recovery goals.

How to show it: Provide examples of successful team projects where your contributions led to improved recovery outcomes. Illustrate your role and the impact of teamwork on meeting organizational objectives.

Empathy

Empathy allows Debt Recovery Specialists to understand clients' situations better, which can lead to more effective communication and negotiation.

How to show it: Share experiences where your empathetic approach led to positive client interactions or successful recovery outcomes. Quantify how this skill improved client relationships or retention rates.

Attention to Detail

Attention to detail is critical in debt recovery to avoid errors in documentation and ensure compliance with regulations.

How to show it: Highlight instances where your attention to detail prevented potential issues or led to significant recoveries. Use specific examples to illustrate your thoroughness and accuracy.

Adaptability

The ability to adapt to changing situations and client needs is crucial in debt recovery, where circumstances can shift rapidly.

How to show it: Detail experiences where you successfully adjusted your strategies in response to new information or client feedback. Emphasize how this adaptability led to improved recovery results.

Persuasion

Persuasion skills help Debt Recovery Specialists encourage clients to fulfill their financial obligations while maintaining a positive rapport.

How to show it: Provide examples of successful persuasive techniques you employed that led to debt resolutions. Quantify your success rate to demonstrate your effectiveness in this area.

Conflict Resolution

The ability to resolve conflicts amicably is essential for Debt Recovery Specialists, as they often deal with clients who may be distressed or resistant.

How to show it: Share specific examples of how you successfully diffused tense situations and reached amicable solutions, highlighting the outcomes achieved.

Customer Service Orientation

A strong customer service orientation ensures that Debt Recovery Specialists maintain positive relationships with clients, even during challenging financial discussions.

How to show it: Illustrate how your customer service skills enhanced client satisfaction and retention, using metrics to quantify your impact on customer relations.

How to List Debt Recovery Specialist Skills on Your Resume

Highlighting your skills effectively on a resume is crucial for standing out to employers in the competitive field of debt recovery. By strategically placing your skills in three main sections—Resume Introduction, Work Experience, and Skills Section—you can provide hiring managers with a clear overview of your qualifications and expertise.

for Summary

Showcasing your Debt Recovery Specialist skills in the introduction section allows hiring managers to quickly assess your qualifications. This brief overview sets the tone for the rest of your resume and emphasizes your core competencies.

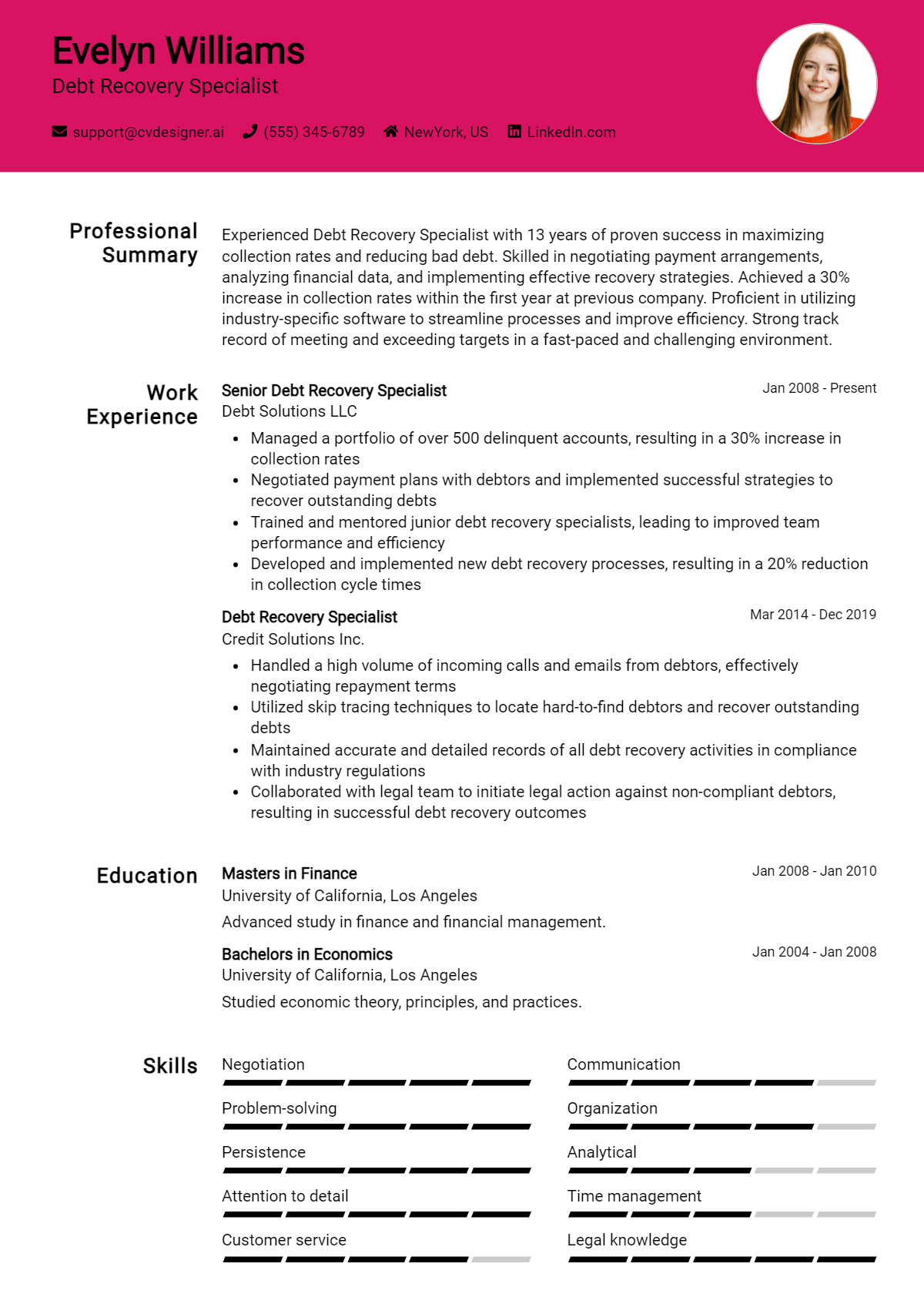

Example

Dynamic Debt Recovery Specialist with a proven track record in negotiating settlements, managing accounts, and enhancing client relations. Committed to utilizing analytical skills to increase recovery rates and streamline processes.

for Work Experience

The work experience section provides an excellent opportunity to demonstrate how your Debt Recovery Specialist skills have been applied in real-world scenarios. This is where you can align your experience with the specific skills mentioned in job listings.

Example

- Successfully recovered 85% of delinquent accounts by employing effective negotiation techniques.

- Utilized data analysis to identify trends in payment delays, leading to a 20% reduction in recovery time.

- Developed strong client relationships through consistent communication and personalized follow-ups.

- Trained and mentored junior staff on debt collection strategies and compliance regulations.

for Skills

The skills section is essential for showcasing your technical and transferable skills. A balanced mix of hard and soft skills should be included to strengthen your overall qualifications as a Debt Recovery Specialist.

Example

- Negotiation Skills

- Analytical Thinking

- Debt Collection Techniques

- Client Relationship Management

- Regulatory Compliance

- Communication Skills

- Time Management

- Conflict Resolution

for Cover Letter

A cover letter allows candidates to expand on the skills mentioned in the resume, providing a more personal touch. Highlighting 2-3 key skills that align with the job description and explaining how those skills have positively impacted your previous roles can make a significant difference.

Example

In my previous role, my strong negotiation skills enabled me to recover over $500,000 in outstanding debts. Coupled with my analytical thinking, I effectively identified accounts requiring immediate attention, resulting in improved recovery rates and enhanced client satisfaction.

Linking the skills mentioned in your resume to specific achievements in your cover letter will reinforce your qualifications for the job.

The Importance of Debt Recovery Specialist Resume Skills

In the competitive field of debt recovery, showcasing relevant skills on your resume is essential for capturing the attention of recruiters. A well-crafted skills section not only demonstrates your qualifications but also aligns your capabilities with the specific requirements of the Debt Recovery Specialist role. By effectively highlighting your skills, you can distinguish yourself from other candidates and increase your chances of securing an interview.

- Demonstrates Expertise: Having a focused skills section allows you to clearly showcase your expertise in areas such as negotiation, communication, and financial analysis. This gives recruiters immediate insight into your qualifications and suitability for the role.

- Aligns with Job Requirements: Many job postings specify certain skills that are essential for success. By mirroring these requirements in your resume, you can demonstrate that you understand the role and possess the necessary competencies to excel.

- Highlights Relevant Experience: Including specific skills from previous roles emphasizes your hands-on experience in debt recovery practices. This not only shows your ability to apply your knowledge but also reinforces the value you can bring to the organization.

- Enhances ATS Compatibility: Many companies utilize Applicant Tracking Systems (ATS) to filter resumes. By incorporating relevant skills, you improve your chances of passing through these systems and getting your resume in front of human eyes.

- Shows Continuous Improvement: A well-rounded skills section can reflect your commitment to professional development. Highlighting skills acquired through training or certifications demonstrates your dedication to staying current in the industry.

- Builds Confidence: A strong skills section can boost your confidence in interviews. When you know you have the necessary skills to perform the job, you are more likely to present yourself effectively during the hiring process.

- Facilitates Effective Communication: Clearly listing your skills allows you to articulate your qualifications succinctly. This aids in discussions with potential employers and showcases your ability to communicate effectively—an essential trait for a Debt Recovery Specialist.

For more guidance on crafting an effective resume, check out these Resume Samples.

How To Improve Debt Recovery Specialist Resume Skills

In the ever-evolving field of debt recovery, continuously improving your skills is essential for staying competitive and effective in your role. As a Debt Recovery Specialist, having a well-rounded skill set not only enhances your performance but also increases your chances of career advancement. Regularly updating your skills can lead to better negotiation outcomes, improved customer relations, and a more efficient recovery process.

- Enroll in workshops or training programs focused on negotiation techniques to enhance your communication and persuasive abilities.

- Stay updated with the latest laws and regulations related to debt collection to ensure compliance and improve your credibility.

- Develop your analytical skills by taking online courses in data analysis, which can help you assess debt recovery strategies more effectively.

- Practice active listening skills in your daily interactions to better understand clients’ situations and tailor your approach accordingly.

- Build proficiency in debt recovery software and tools by participating in training sessions or online tutorials to streamline your processes.

- Network with other professionals in the debt recovery field to share best practices and learn from their experiences.

- Seek feedback from supervisors and colleagues to identify areas for improvement and actively work on them to enhance your overall performance.

Frequently Asked Questions

What are the key skills required for a Debt Recovery Specialist?

A Debt Recovery Specialist should possess strong communication and negotiation skills, as they often interact with debtors to negotiate repayments. Additionally, analytical skills are crucial for assessing financial information and determining the best recovery strategies. Proficiency in various debt collection software and an understanding of relevant laws and regulations are also essential for effective operations in this role.

How important is empathy in the role of a Debt Recovery Specialist?

Empathy is a vital skill for a Debt Recovery Specialist, as it helps them to understand the debtor’s situation and build rapport. Displaying empathy can lead to more productive conversations, as it fosters trust and encourages debtors to be more open about their financial difficulties. This approach often results in higher recovery rates and a more positive experience for both parties.

What role does negotiation play in debt recovery?

Negotiation is a core component of a Debt Recovery Specialist's responsibilities. It involves discussing payment plans and settlements that are acceptable to both the debtor and the creditor. Strong negotiation skills can lead to successful agreements that maximize recovery while still providing the debtor with a manageable path to settle their debts.

How does knowledge of legal regulations impact the effectiveness of a Debt Recovery Specialist?

Knowledge of legal regulations is crucial for a Debt Recovery Specialist to ensure compliance with laws such as the Fair Debt Collection Practices Act (FDCPA). Understanding these regulations not only protects the specialist and their employer from legal repercussions but also helps in maintaining ethical practices when dealing with debtors, which can enhance the company’s reputation and effectiveness in debt recovery.

What technical skills are beneficial for a Debt Recovery Specialist?

Technical skills are increasingly important for Debt Recovery Specialists, particularly proficiency in debt collection software and customer relationship management (CRM) tools. Familiarity with data analysis tools can also assist in tracking debt recovery progress and managing accounts efficiently. Additionally, comfort with using communication technologies, such as email and phone systems, is essential for maintaining effective contact with debtors.

Conclusion

Including Debt Recovery Specialist skills in your resume is crucial for demonstrating your expertise and value in the field. By showcasing relevant skills, you not only stand out among other candidates but also highlight the specific qualifications that potential employers are seeking. A well-crafted resume that emphasizes your debt recovery capabilities can significantly enhance your job prospects.

Remember, the more you refine your skills and tailor your application, the better your chances of landing your desired position. Take the time to explore our resume templates, utilize our resume builder, review our resume examples, and check out our cover letter templates to create a compelling application that showcases your strengths. Stay motivated and invest in your professional journey!

Use an AI-powered resume builder and have your resume done in 5 minutes. Just select your template and our software will guide you through the process.