26 Credit Analyst Skills for Your Resume: List Examples

As a Credit Analyst, possessing the right skills is essential to effectively evaluate creditworthiness and financial stability. In this section, we will outline the top skills that are vital for success in this role, ensuring you highlight your qualifications on your resume. These competencies not only demonstrate your analytical abilities but also your understanding of financial principles, risk management, and communication skills, which are crucial in making informed credit decisions.

Best Credit Analyst Technical Skills

Technical skills are crucial for Credit Analysts as they enable them to analyze financial data, assess creditworthiness, and make informed lending decisions. Mastery of these skills not only enhances analytical capabilities but also improves the overall effectiveness of financial assessments. Below are some essential technical skills that every Credit Analyst should consider including on their resume.

Financial Statement Analysis

This skill involves evaluating a company's financial statements to determine its stability, profitability, and liquidity. Understanding key metrics allows analysts to assess risk and make informed lending decisions.

How to show it: Highlight specific instances where your analysis of financial statements led to successful lending decisions or risk assessments. Use quantifiable data to illustrate your impact.

Credit Risk Assessment

Credit risk assessment is the process of evaluating the likelihood that a borrower will default on a loan. This skill is vital for determining the creditworthiness of individuals or businesses.

How to show it: Describe your experience in conducting credit risk assessments, including metrics or percentages that showcase the accuracy of your predictions and their outcomes.

Excel Proficiency

Excel is a powerful tool for data analysis and financial modeling. Proficiency in Excel enables Credit Analysts to manipulate large datasets, create financial models, and perform scenario analysis.

How to show it: List specific Excel functions or tools you are skilled in, such as VLOOKUP, pivot tables, or macros, and explain how you used them to enhance analysis efficiency or accuracy.

Statistical Analysis

Statistical analysis involves using statistical methods to interpret data and draw conclusions. For Credit Analysts, it aids in forecasting trends and understanding borrower behavior.

How to show it: Provide examples of how you applied statistical analysis to improve decision-making processes, including any relevant metrics or outcomes.

Financial Modeling

Financial modeling is the process of creating a representation of a company's financial performance. This skill is essential for simulating scenarios and assessing potential outcomes.

How to show it: Detail specific financial models you have built and how they influenced credit decisions or investment strategies, including any measurable results.

Regulatory Knowledge

Understanding relevant regulations and compliance requirements is critical for Credit Analysts to ensure that lending practices adhere to legal standards.

How to show it: Discuss your familiarity with specific regulations and how you applied this knowledge in your role to mitigate risks or enhance compliance.

Data Analysis Software

Proficiency in data analysis software, such as SAS or R, allows Credit Analysts to analyze large datasets effectively and derive insights from complex information.

How to show it: Mention the specific software you are skilled in and provide examples of how you utilized it to improve analysis and reporting processes.

Risk Modeling

Risk modeling involves creating models to predict potential credit losses and assess portfolio risk. This skill is vital for making informed lending decisions.

How to show it: Provide details about risk models you have developed, including performance metrics and any improvements made to the lending process as a result.

Portfolio Management

Portfolio management entails overseeing a collection of credit assets, ensuring optimal performance and risk mitigation strategies are in place.

How to show it: Quantify your experience in portfolio management, highlighting the size of the portfolio and the performance improvements achieved under your oversight.

Presentation Skills

Strong presentation skills enable Credit Analysts to communicate complex financial data effectively to stakeholders, aiding in decision-making processes.

How to show it: Include examples of presentations you have delivered, emphasizing the key insights shared and the impact they had on decision-making.

Attention to Detail

Attention to detail is crucial for Credit Analysts to ensure accuracy in data analysis and reporting, as even minor errors can lead to significant financial implications.

How to show it: Share instances where your attention to detail prevented potential errors or led to successful outcomes in credit assessments.

For more insights on enhancing your resume with technical skills, visit Technical Skills.

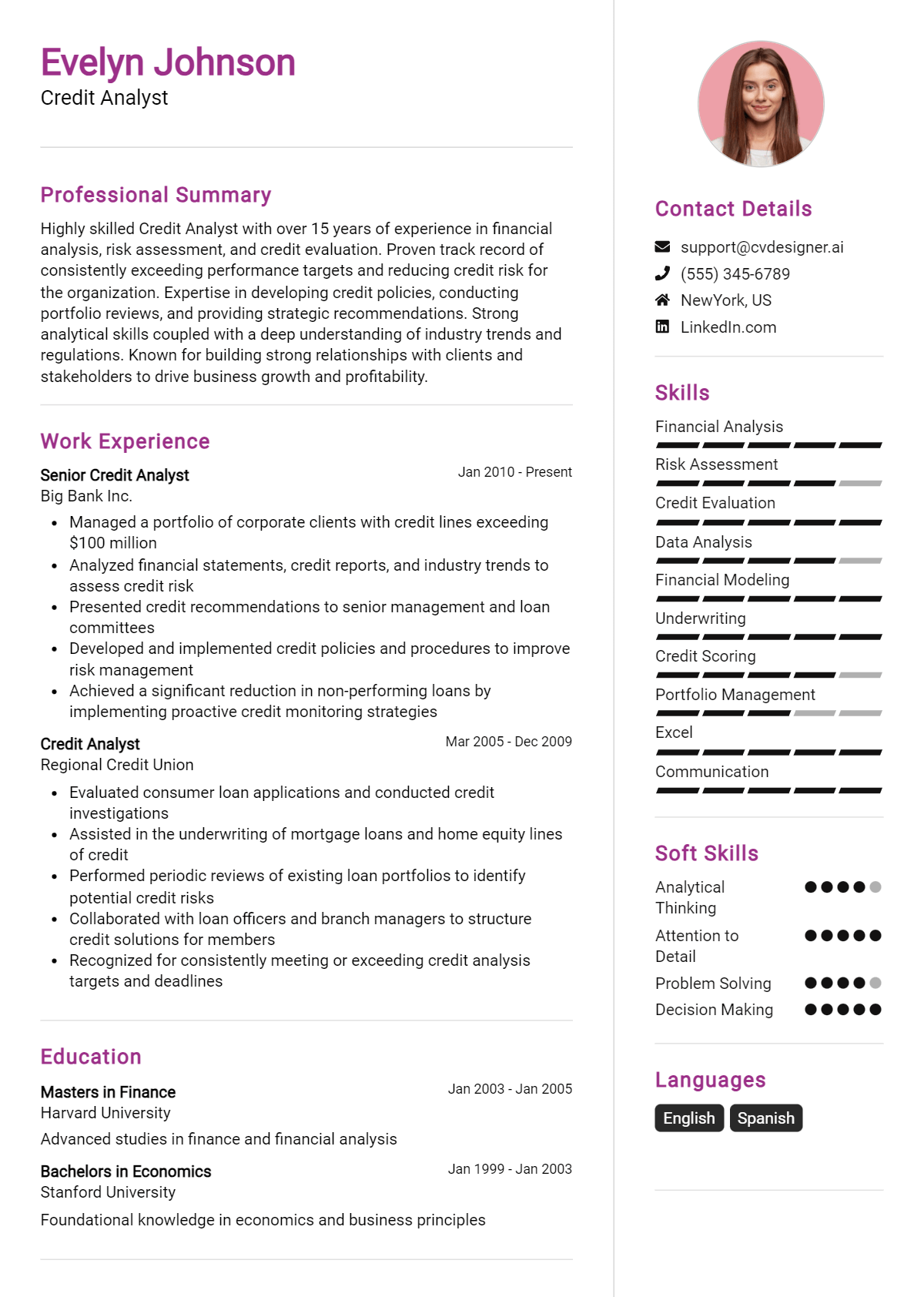

How to List Credit Analyst Skills on Your Resume

Effectively listing your skills on a resume is crucial for standing out to potential employers. A well-structured resume can highlight your qualifications and demonstrate your suitability for the Credit Analyst role. There are three main sections where skills can be emphasized: the Resume Introduction, Work Experience, and Skills Section.

for Summary

Showcasing your Credit Analyst skills in the introduction (objective or summary) section provides hiring managers with a quick overview of your qualifications. This establishes your candidacy from the outset.

Example

Results-driven Credit Analyst with strong analytical and quantitative skills. Proficient in financial modeling and risk assessment, with over 5 years of experience in credit evaluation and portfolio management.

for Work Experience

The work experience section is the perfect opportunity to demonstrate how your Credit Analyst skills have been applied in real-world scenarios. Tailoring your experiences to align with the skills mentioned in job listings will make your resume more impactful.

Example

- Conducted comprehensive credit risk assessments for corporate clients, improving approval rates by 15%.

- Utilized advanced financial modeling techniques to analyze market trends and predict client creditworthiness.

- Collaborated with cross-functional teams to enhance data analysis processes, reducing turnaround time by 20%.

- Developed financial reports that informed strategic business decisions, leading to a 10% increase in profit margins.

for Skills

The skills section of your resume can showcase both technical and transferable skills. A balanced mix of hard and soft skills should be highlighted to strengthen your overall qualifications.

Example

- Credit Analysis

- Financial Reporting

- Risk Assessment

- Data Analysis

- Financial Modeling

- Attention to Detail

- Communication Skills

- Problem-Solving

for Cover Letter

A cover letter allows candidates to expand on the skills mentioned in their resumes while providing a more personal touch. Highlighting 2-3 key skills that align with the job description can show how you've positively impacted your previous roles.

Example

In my previous role, my expertise in credit analysis and risk assessment allowed me to effectively evaluate client portfolios, leading to improved decision-making processes. These skills not only enhanced operational efficiency but also contributed to significant revenue growth for the firm.

Linking the skills mentioned in your resume to specific achievements in your cover letter will reinforce your qualifications for the job.

The Importance of Credit Analyst Resume Skills

Highlighting relevant skills in a Credit Analyst resume is crucial for capturing the attention of recruiters. A well-crafted skills section not only showcases a candidate’s qualifications but also aligns their expertise with the specific requirements of the job. This alignment can significantly enhance the chances of landing an interview and ultimately securing the desired position.

- Demonstrates Financial Acumen: Proficient skills in financial analysis, risk assessment, and credit evaluation showcase a candidate's ability to interpret complex data and make informed decisions, which is essential for a Credit Analyst.

- Aligns with Job Requirements: By emphasizing specific skills that match the job description, candidates can demonstrate their suitability for the role, increasing their chances of being shortlisted by recruiters.

- Highlights Analytical Abilities: Skills in data analysis, forecasting, and modeling illustrate a candidate's capability to analyze trends and predict future performance, which is a key aspect of a Credit Analyst's duties.

- Showcases Technical Proficiency: Familiarity with financial software and tools, such as Excel or credit scoring systems, indicates a candidate's readiness to use industry-standard technology, making them more appealing to employers.

- Reflects Communication Skills: Effective communication skills are vital for a Credit Analyst to convey complex information clearly to stakeholders. Highlighting these skills can set candidates apart in a competitive job market.

- Indicates Attention to Detail: Emphasizing skills related to precision and accuracy can assure recruiters of a candidate's ability to manage critical financial documents and reports without errors.

- Supports Problem-Solving Abilities: Skills in critical thinking and strategic planning show a candidate's ability to navigate challenges and provide solutions, which is highly valued in the field of credit analysis.

- Enhances Professional Credibility: A strong skills section can enhance a candidate's professional image, signaling to potential employers that they are serious and well-equipped for the responsibilities of a Credit Analyst.

For more guidance on crafting an effective resume, visit Resume Samples.

How To Improve Credit Analyst Resume Skills

In the ever-evolving financial landscape, it is crucial for Credit Analysts to continuously enhance their skills to remain competitive and effective in their roles. As financial markets change and new tools and methods emerge, staying updated not only improves job performance but also enhances career prospects. Here are some actionable tips to help you improve your skills as a Credit Analyst:

- Participate in relevant online courses or workshops to learn about the latest financial analysis techniques and tools.

- Stay updated with industry news and trends by subscribing to financial journals and websites.

- Develop proficiency in financial modeling and analysis software, such as Excel, SAS, or R.

- Enhance your understanding of credit risk assessment by studying different credit scoring models.

- Network with other financial professionals through industry events and seminars to exchange knowledge and insights.

- Seek mentorship or guidance from experienced Credit Analysts to gain practical insights and advice.

- Practice analytical writing to improve your ability to communicate complex financial information clearly and effectively.

Frequently Asked Questions

What are the essential skills required for a Credit Analyst?

A Credit Analyst should possess strong analytical skills, attention to detail, and proficiency in financial modeling. Additionally, skills in risk assessment, knowledge of credit reporting systems, and familiarity with financial statements are essential. Effective communication skills are also important, as analysts must present their findings and recommendations clearly to stakeholders.

How important is proficiency in Excel for a Credit Analyst?

Proficiency in Excel is crucial for a Credit Analyst, as it is the primary tool used for data analysis, financial modeling, and reporting. Analysts often create complex spreadsheets to evaluate creditworthiness, analyze trends, and forecast financial outcomes. Advanced Excel skills, including pivot tables, VLOOKUP, and macros, can significantly enhance an analyst's efficiency and accuracy.

What role does risk assessment play in a Credit Analyst's job?

Risk assessment is a core component of a Credit Analyst's responsibilities, as it involves evaluating the likelihood of a borrower defaulting on their obligations. Analysts use various metrics, including credit scores, debt-to-income ratios, and historical payment behaviors, to assess risk. This evaluation helps lenders make informed decisions about extending credit and setting appropriate terms.

Are communication skills important for a Credit Analyst?

Yes, communication skills are vital for a Credit Analyst, as they need to convey complex financial information and analysis to non-financial stakeholders effectively. This includes writing detailed reports, presenting findings, and discussing recommendations with colleagues, management, or clients. Strong verbal and written communication enhances collaboration and ensures that critical insights are understood and acted upon.

What software tools should a Credit Analyst be familiar with?

A Credit Analyst should be familiar with various software tools, including financial analysis software like Bloomberg, Moody's Analytics, or S&P Capital IQ. Additionally, knowledge of database management systems and customer relationship management (CRM) tools can be beneficial. Familiarity with reporting tools, such as Tableau or Power BI, can also enhance an analyst's ability to visualize data and present insights effectively.

Conclusion

In today's competitive job market, including relevant Credit Analyst skills in your resume is crucial for making a strong impression on potential employers. By showcasing your expertise in areas such as financial analysis, risk assessment, and credit evaluation, you not only highlight your qualifications but also demonstrate your value as a candidate who can contribute significantly to their organization. Take the time to refine your skills and tailor your resume accordingly, as this will undoubtedly enhance your job application and set you apart from the competition. Remember, each step you take towards improving your skills brings you closer to landing your desired position.

For further assistance, explore our resume templates, utilize our resume builder, check out our resume examples, and find the perfect cover letter templates to enhance your job application journey.

Use an AI-powered resume builder and have your resume done in 5 minutes. Just select your template and our software will guide you through the process.