29 Corporate Controller Skills For Your Resume with Exampels in 2025

As a Corporate Controller, possessing the right skills is essential for successfully managing an organization's financial operations and ensuring compliance with regulatory standards. This section highlights the top skills that should be featured on your resume to demonstrate your expertise and value in this crucial role. Whether you are looking to enhance your current skill set or apply for a new position, understanding these key competencies will help you stand out in the competitive job market.

Best Corporate Controller Technical Skills

In the role of a Corporate Controller, possessing the right technical skills is paramount for managing financial operations, ensuring compliance, and driving strategic decision-making. These skills not only enhance efficiency but also contribute to the overall financial health of the organization. Below are essential technical skills that should be highlighted on your resume.

Financial Reporting

Financial reporting encompasses the preparation of financial statements, including balance sheets, income statements, and cash flow statements. Mastery in this area ensures accurate representation of the company's financial position.

How to show it: Include specific examples of financial reports you have prepared or managed, highlighting their impact on decision-making or compliance, and quantify changes in reporting accuracy or timeliness.

Budgeting and Forecasting

This skill involves creating budgets and financial forecasts that guide the organization's financial strategy. Strong capabilities in budgeting help in resource allocation and long-term planning.

How to show it: Demonstrate your experience by detailing budget sizes you’ve managed and any percentage improvements in forecasting accuracy or budget adherence.

Tax Compliance

Understanding tax regulations and ensuring compliance is critical for avoiding penalties and optimizing tax liabilities. A Corporate Controller must stay updated on tax laws and regulations.

How to show it: Quantify your contributions by mentioning the amount of tax savings achieved through compliance practices or process improvements.

Internal Controls

Effective internal controls are essential for safeguarding assets and ensuring the integrity of financial reporting. This skill involves designing and implementing processes to mitigate risks.

How to show it: Provide examples of internal control frameworks you have developed or enhanced, along with metrics that demonstrate reduced risk or fraud incidents.

Financial Analysis

Financial analysis involves evaluating financial data to inform investment decisions and operational improvements. A Corporate Controller must be adept at interpreting complex financial information.

How to show it: Highlight specific analyses you've performed, such as ROI calculations or variance analyses, and include any resulting strategic changes or financial outcomes.

Cash Flow Management

Cash flow management is crucial for maintaining liquidity and ensuring that the organization can meet its financial obligations. This skill entails monitoring and optimizing cash flow cycles.

How to show it: Share quantifiable improvements in cash flow metrics, such as reduction in days sales outstanding (DSO) or increase in cash reserves.

Accounting Software Proficiency

Proficiency in accounting software such as SAP, Oracle, or QuickBooks is essential for efficient financial data management. These tools streamline processes and enhance reporting capabilities.

How to show it: List specific software platforms you have experience with and include examples of how your proficiency led to improved efficiency or accuracy in financial reporting.

Regulatory Compliance

Understanding and adhering to financial regulations such as GAAP or IFRS is critical for maintaining credibility and legal standing. This skill ensures that all financial practices are compliant.

How to show it: Discuss your role in ensuring compliance during audits or regulatory reviews and any measurable outcomes, such as successful audits or reduced compliance issues.

Cost Accounting

Cost accounting provides insights into production costs and profitability. Knowledge in this area aids in pricing strategies and operational efficiency improvements.

How to show it: Include examples of cost-saving initiatives you led and the financial impact they had on the organization, such as percentage reductions in production costs.

Financial Modeling

Financial modeling involves creating representations of a company's financial performance to forecast future earnings and assess financial scenarios. This skill is vital for strategic planning.

How to show it: Illustrate your experience with financial models, including the types of models created and how they influenced business decisions or investments.

Data Analysis

Data analysis skills enable a Corporate Controller to interpret financial data effectively and derive actionable insights. This capability supports better decision-making and strategic initiatives.

How to show it: Provide metrics or examples of data-driven decisions that improved financial outcomes, emphasizing analytical tools or techniques you employed.

For more insight on how to effectively present these skills, visit [Technical Skills](https://resumedesign.ai/technical-skills/).

Best Corporate Controller Soft Skills

In the role of a Corporate Controller, technical expertise is essential; however, soft skills play a pivotal role in ensuring effective management and collaboration within the finance team and across the organization. Proficient soft skills facilitate clear communication, problem-solving, and strategic thinking, making them crucial for success in this role.

Communication

Effective communication allows Corporate Controllers to convey complex financial concepts clearly to non-financial stakeholders, ensuring transparency and understanding throughout the organization.

How to show it: Highlight instances where you successfully communicated financial information to varied audiences, such as presenting reports to executives or leading team meetings. Use metrics to demonstrate improved understanding or engagement from stakeholders.

Problem-solving

Corporate Controllers frequently encounter financial discrepancies and operational challenges. Strong problem-solving skills enable them to identify issues quickly and implement effective solutions.

How to show it: Provide examples of specific challenges you faced and the solutions you implemented. Quantify the outcomes, such as cost savings or increased efficiency, to showcase your impact.

Time Management

With multiple deadlines and a variety of tasks, time management is vital for Corporate Controllers to prioritize effectively and ensure all financial reporting is completed on time.

How to show it: Discuss how you successfully managed multiple projects and deadlines by organizing your tasks. Use specific examples to illustrate how your time management led to timely financial reports or audits.

Teamwork

Collaboration is essential in the Corporate Controller role, as working closely with other departments and team members enhances the accuracy and effectiveness of financial operations.

How to show it: Demonstrate how you have worked collaboratively with cross-functional teams on financial projects. Include metrics or outcomes derived from these collaborations to highlight their success.

Adaptability

The financial landscape is constantly evolving, and a Corporate Controller must adapt to new regulations, technologies, and market conditions to maintain compliance and operational efficiency.

How to show it: Share experiences where you had to adapt to significant changes, such as new accounting systems or regulatory requirements. Emphasize how your adaptability led to smoother transitions and better outcomes.

Leadership

As a leader within the finance department, a Corporate Controller must inspire and guide their team to achieve financial goals and uphold accounting standards.

How to show it: Highlight your leadership experiences, such as mentoring team members or leading projects. Use specific examples of how your leadership contributed to team performance or morale.

Attention to Detail

Accuracy in financial reporting is critical. A Corporate Controller must have keen attention to detail to minimize errors and ensure compliance with accounting standards.

How to show it: Provide examples of how your attention to detail helped identify discrepancies or improved the accuracy of financial reports. Quantify the impact, such as reducing errors by a certain percentage.

Negotiation

Corporate Controllers often negotiate contracts and financial terms with vendors and partners, making negotiation skills essential for favorable outcomes.

How to show it: Discuss specific negotiation experiences, highlighting successful terms you secured. Quantify the benefits achieved, such as cost savings or better terms.

Strategic Thinking

Corporate Controllers need to think strategically to align financial management with the organization’s goals and long-term objectives.

How to show it: Provide examples of how your strategic thinking influenced financial planning or decision-making. Highlight measurable outcomes that resulted from your strategic initiatives.

Conflict Resolution

In any organization, conflicts may arise, and Corporate Controllers must navigate these situations effectively to maintain team harmony and operational efficiency.

How to show it: Share experiences where you successfully resolved conflicts within your team or with other departments. Highlight the positive outcomes and any improvements in collaboration that followed.

Analytical Thinking

Analyzing financial data to draw insights and make informed decisions is a key responsibility for Corporate Controllers, requiring strong analytical skills.

How to show it: Demonstrate your analytical prowess by discussing specific analyses you conducted that led to important business decisions, including quantifiable results.

How to List Corporate Controller Skills on Your Resume

Effectively listing your skills on a resume is crucial for standing out to employers, especially in competitive fields like corporate finance. A well-structured resume can highlight your qualifications in three main sections: the Resume Introduction, Work Experience, and Skills Section.

for Summary

Showcasing Corporate Controller skills in the introduction (objective or summary) section provides hiring managers with a quick overview of your qualifications and sets the tone for your resume.

Example

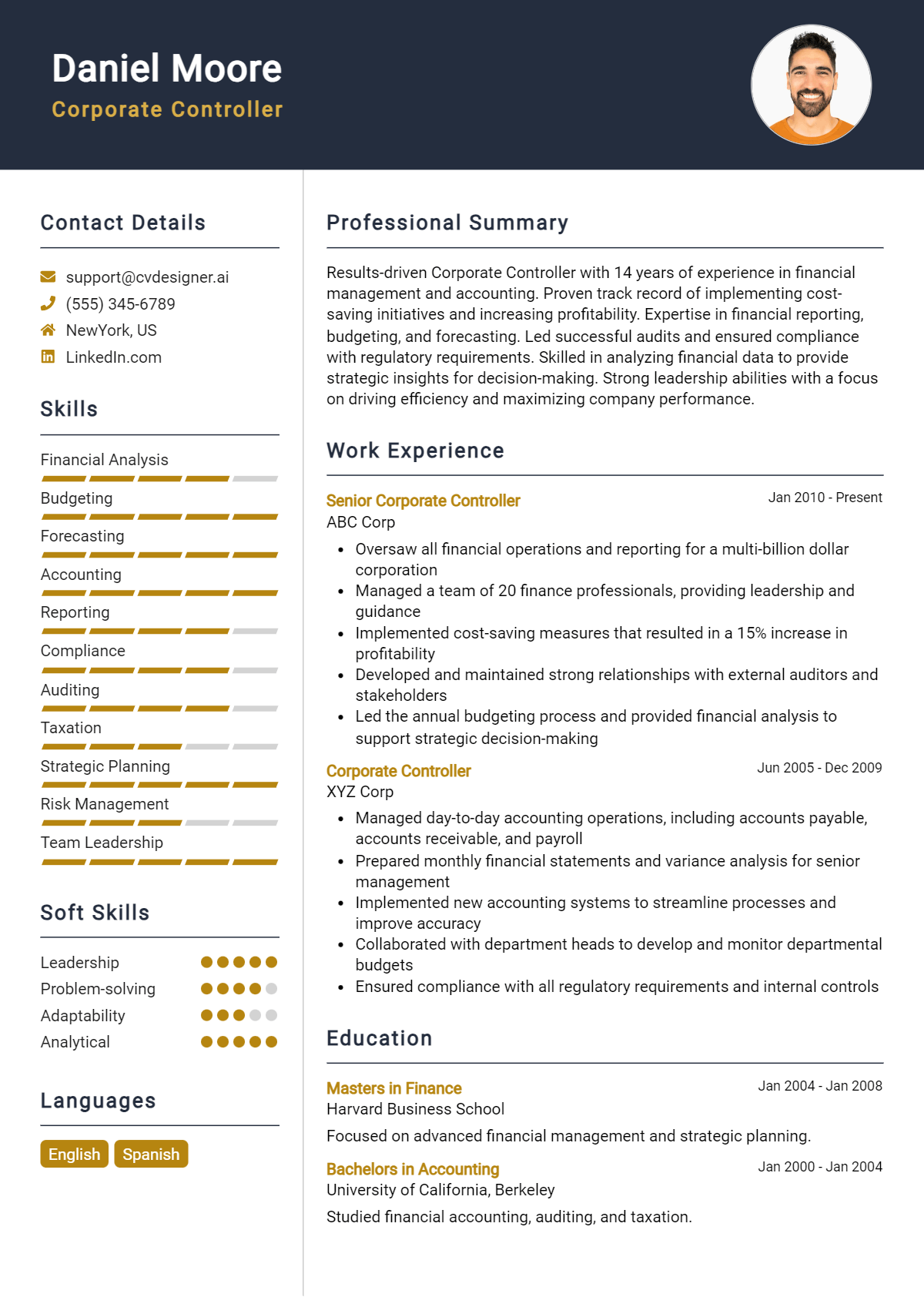

Detail-oriented Corporate Controller with a proven track record in financial analysis, budget management, and regulatory compliance. Skilled in leading teams and implementing effective financial strategies, I am committed to delivering accurate financial reporting and enhancing organizational performance.

for Work Experience

The work experience section provides the perfect opportunity to demonstrate how Corporate Controller skills have been applied in real-world scenarios, showcasing your contributions and achievements.

Example

- Managed a team of accountants to ensure accurate financial reporting and compliance with GAAP standards.

- Implemented a new budgeting process, resulting in a 15% reduction in departmental spending.

- Conducted financial variance analysis to identify trends and recommend corrective actions.

- Led the integration of a new accounting software, improving efficiency and data accuracy by 20%.

for Skills

The skills section can either showcase technical or transferable skills. A balanced mix of hard and soft skills strengthens your overall qualifications and appeals to potential employers.

Example

- Financial Reporting

- Budget Management

- Regulatory Compliance

- Team Leadership

- Data Analysis

- Strategic Planning

- Accounting Software Proficiency

- Communication Skills

for Cover Letter

A cover letter allows candidates to expand on the skills mentioned in the resume and provide a more personal touch. Highlighting 2-3 key skills that align with the job description can demonstrate how they have positively impacted your previous roles.

Example

In my previous role, my strong analytical skills enabled me to identify discrepancies in financial reports, leading to a 10% increase in accuracy. Additionally, my expertise in budget management helped streamline operations and reduce costs by 15%, showcasing my ability to drive financial performance effectively.

Linking the skills mentioned in your resume to specific achievements in your cover letter reinforces your qualifications for the job and highlights your suitability for the role.

The Importance of Corporate Controller Resume Skills

Highlighting relevant skills on a Corporate Controller resume is crucial for making a strong impression on recruiters. A well-crafted skills section not only showcases a candidate's expertise but also aligns their qualifications with the specific requirements of the job, ultimately helping them stand out in a competitive job market. Effective communication of skills can lead to more interview opportunities and a better chance at securing the desired position.

- Demonstrating financial acumen is essential for a Corporate Controller, as it reflects a candidate's ability to manage financial reporting, budgeting, and forecasting effectively. Recruiters look for professionals who can navigate complex financial landscapes with ease.

- Proficiency in accounting software and ERP systems is critical. Highlighting these technical skills indicates a candidate's ability to streamline processes, improve efficiency, and maintain accurate financial records, which are key responsibilities of a Corporate Controller.

- Strong leadership and team management skills are vital for a Corporate Controller. These skills show that a candidate can guide their finance team effectively, fostering collaboration and ensuring that departmental objectives align with overall business goals.

- Analytical thinking and problem-solving capabilities are important for identifying financial discrepancies and developing strategic solutions. Candidates who can demonstrate these skills will appeal to employers looking for proactive financial leaders.

- Excellent communication skills are crucial for a Corporate Controller, as they often need to present financial information to stakeholders at all levels. Candidates should emphasize their ability to convey complex financial concepts in a clear and concise manner.

- Understanding regulatory compliance and risk management is a must for this role. Demonstrating knowledge in these areas assures recruiters that the candidate can navigate the legal landscape and protect the company's financial integrity.

- Strategic thinking is essential for aligning financial goals with broader business objectives. Candidates who can showcase their ability to contribute to long-term planning and decision-making are more likely to attract the attention of hiring managers.

- Experience with financial audits and internal controls is significant, as it illustrates a candidate’s understanding of maintaining organizational integrity and accountability in financial practices.

For additional insights and examples, explore our Resume Samples.

How To Improve Corporate Controller Resume Skills

In the fast-paced world of finance and accounting, the role of a Corporate Controller is critical for ensuring the financial health and integrity of an organization. Continuous improvement of skills is essential not only to stay competitive in the job market but also to effectively manage financial operations, compliance, and strategic planning. By enhancing your skill set, you can position yourself as a valuable asset to your company and increase your chances of career advancement.

- Stay updated on accounting standards and regulations by attending workshops and obtaining relevant certifications.

- Enhance your technical skills by mastering accounting software and financial modeling tools commonly used in the industry.

- Develop strong leadership and management skills by participating in team-building exercises and leadership training programs.

- Improve your analytical skills by taking online courses that focus on data analysis and financial forecasting.

- Network with other professionals in the field through industry conferences and local finance groups to exchange knowledge and best practices.

- Seek mentorship from experienced Corporate Controllers to gain insights and advice on navigating complex financial scenarios.

- Regularly review and refine your resume to highlight new skills and experiences that reflect your growth and achievements in the field.

Frequently Asked Questions

What are the key skills required for a Corporate Controller?

A Corporate Controller should possess strong technical accounting skills, including proficiency in GAAP and IFRS standards. Additionally, expertise in financial reporting, budgeting, and forecasting is crucial. Leadership qualities and the ability to manage a finance team effectively are also important, along with excellent analytical skills to interpret complex financial data and provide strategic insights.

How important is experience with financial software for a Corporate Controller?

Experience with financial software is extremely important for a Corporate Controller as it enhances efficiency in managing financial operations. Familiarity with ERP systems, accounting software, and data analytics tools allows for streamlined financial reporting, improved accuracy in data processing, and effective financial management. Knowledge of software solutions also aids in automating routine tasks, freeing up time for strategic planning.

What soft skills should a Corporate Controller have?

In addition to technical skills, a Corporate Controller should exhibit strong communication and interpersonal skills, as they often interact with various stakeholders, including executives and department heads. Problem-solving abilities are essential for addressing financial challenges, while leadership skills are crucial for guiding and motivating finance teams. Adaptability and a strong ethical framework are also important in navigating the complexities of corporate finance.

How can a Corporate Controller demonstrate their leadership abilities on their resume?

A Corporate Controller can showcase their leadership abilities on their resume by highlighting specific achievements in team management, process improvements, and strategic initiatives. Incorporating metrics that demonstrate successful outcomes, such as cost reductions or efficiency gains, can provide concrete evidence of their impact. Additionally, emphasizing experience in mentoring finance staff and leading cross-departmental projects can further illustrate their leadership capabilities.

What role does strategic planning play in the Corporate Controller position?

Strategic planning is a critical component of the Corporate Controller role, as it involves aligning financial management with the organization's long-term goals. This includes developing budgets that reflect strategic priorities, forecasting future financial performance, and analyzing market trends to inform decision-making. A Corporate Controller must be adept at translating financial data into actionable insights that support organizational growth and sustainability.

Conclusion

Incorporating Corporate Controller skills into your resume is crucial for demonstrating your expertise and suitability for this key financial role. By showcasing relevant skills, candidates can effectively stand out from the competition and illustrate their potential value to prospective employers. A well-crafted resume not only highlights your qualifications but also communicates your commitment to excellence in the financial sector.

Take the time to refine your skills and tailor your application to better reflect your capabilities. Remember, a compelling resume is your first step towards landing your dream job in corporate finance. For further assistance, explore our resume templates, utilize our resume builder, review resume examples, and create impactful cover letters to enhance your job application journey.

Use an AI-powered resume builder and have your resume done in 5 minutes. Just select your template and our software will guide you through the process.