26 Best Skills to Put on Your Convertible Bond Trader Resume [2025]

As a Convertible Bond Trader, possessing a unique set of skills is crucial for navigating the complexities of the financial markets. This role demands a blend of analytical prowess, market insight, and the ability to manage risk effectively. In the following section, we will explore the top skills that can enhance your resume and elevate your candidacy in this competitive field. From financial modeling to strong communication abilities, each skill plays a vital role in ensuring success as a Convertible Bond Trader.

Best Convertible Bond Trader Technical Skills

Technical skills are crucial for a Convertible Bond Trader as they enable professionals to navigate complex financial instruments, analyze market trends, and execute trades effectively. A strong grasp of these skills not only enhances trading performance but also increases the ability to manage risk and optimize returns in a competitive market.

Financial Modeling

Financial modeling involves creating representations of a company's financial performance. This skill is vital for evaluating convertible bonds and forecasting their potential returns.

How to show it: Highlight specific models you've developed or utilized in your trading strategies, including any software used and the impact on decision-making processes.

Credit Analysis

Credit analysis is essential for assessing the creditworthiness of the entities issuing convertible bonds. This skill helps traders determine the risk associated with various securities.

How to show it: Document instances where your credit assessments led to successful investment decisions or risk mitigation, using quantifiable outcomes.

Risk Management

Effective risk management involves identifying, analyzing, and mitigating risks associated with trading convertible bonds. This skill is crucial to protect investments and ensure long-term profitability.

How to show it: Provide examples of risk management strategies you've implemented, including statistics on losses avoided and overall portfolio performance.

Market Research

Market research is key to understanding trends and potential market movements. This skill allows convertible bond traders to make informed decisions based on current market conditions.

How to show it: Reference specific research projects or analyses you've conducted, along with the resulting trades that benefited from your insights.

Quantitative Analysis

Quantitative analysis involves using mathematical and statistical methods to assess investment opportunities. This skill is particularly valuable for pricing convertible bonds accurately.

How to show it: Detail any quantitative models or algorithms you have developed, including performance metrics and their impact on trading success.

Portfolio Management

Portfolio management encompasses the selection and oversight of investments to achieve specific financial objectives. This skill helps traders balance risk and return in their portfolios.

How to show it: Showcase your experience managing a portfolio, including the size, composition, and performance over time, with specific returns illustrated.

Technical Analysis

Technical analysis involves evaluating securities by analyzing statistics generated by market activity. This skill helps traders identify trends and make timely trading decisions.

How to show it: Include examples of technical indicators you regularly utilize, along with the outcomes of trades based on your analyses.

Derivatives Knowledge

A solid understanding of derivatives is essential for convertible bond traders as they often involve complex structures and pricing mechanisms related to underlying securities.

How to show it: Explain your experience with derivatives products, mentioning any certifications or training that enhance your expertise in this area.

Excel Proficiency

Excel proficiency is crucial for data analysis and financial modeling. This skill allows traders to manipulate and visualize data effectively to support trading decisions.

How to show it: List specific Excel functions or tools you are skilled in, along with examples of how you used them to achieve tangible results in your trading activities.

Regulatory Knowledge

Understanding the regulatory environment is important for compliance and risk management in trading. This skill helps traders navigate legal requirements and avoid penalties.

How to show it: Demonstrate your knowledge of relevant regulations and any instances where you ensured compliance, detailing the benefits to your trading team or firm.

Communication Skills

Strong communication skills are necessary for conveying complex information clearly to stakeholders, whether internally or externally. This skill aids in collaboration and negotiation processes.

How to show it: Provide examples of successful presentations or negotiations you have led, including feedback received and the outcomes achieved.

Best Convertible Bond Trader Soft Skills

Soft skills are essential for a Convertible Bond Trader as they enhance interpersonal interactions, improve decision-making, and foster effective collaboration in a fast-paced trading environment. These skills complement technical expertise, enabling traders to navigate complex market dynamics while maintaining strong relationships with clients and colleagues.

Effective Communication

Effective communication is vital for conveying complex financial strategies and concepts to clients and team members. A Convertible Bond Trader must articulate ideas clearly and persuasively to influence decisions and foster trust.

How to show it: Demonstrate your communication skills on your resume by highlighting instances where you successfully presented investment strategies or negotiated deals. Use metrics to showcase the impact of your communication, such as increased client satisfaction ratings or successful deal closures.

Analytical Thinking

Analytical thinking allows traders to assess market trends, evaluate risks, and make informed decisions based on data analysis. This skill is crucial for identifying lucrative opportunities in convertible bonds.

How to show it: Provide examples of how your analytical thinking led to successful trades or investment strategies. Quantify your achievements by using figures, such as percentage growth in portfolio performance resulting from your analyses.

Problem-solving

The ability to solve problems quickly and effectively is essential in the unpredictable world of trading. Convertible Bond Traders must address challenges swiftly to capitalize on market opportunities.

How to show it: Highlight specific instances where you identified and resolved trading-related issues or risks. Quantify the outcomes, such as profit maximization or loss mitigation, to demonstrate your problem-solving effectiveness.

Time Management

Time management skills enable traders to prioritize tasks efficiently and meet tight deadlines, especially in a high-stakes trading environment where every second counts.

How to show it: Showcase your time management skills by detailing how you effectively managed multiple trades or projects simultaneously. Include metrics that reflect your efficiency, such as completing tasks ahead of schedule or managing high volumes of transactions.

Teamwork

Teamwork is crucial in trading as it fosters collaboration among colleagues, leading to better decision-making and strategy development. A Convertible Bond Trader must work closely with analysts, portfolio managers, and other traders.

How to show it: Include examples of successful collaborations with team members or departments. Quantify your contributions to team projects or initiatives that resulted in improved trading performance or client satisfaction.

Adaptability

Adaptability is essential for responding to rapid market changes and evolving financial landscapes. Convertible Bond Traders must adjust strategies promptly to align with new information.

How to show it: Demonstrate adaptability by highlighting instances where you successfully adjusted trading strategies in response to market shifts. Use specific examples that illustrate your flexibility and the positive outcomes that followed.

Attention to Detail

Attention to detail helps traders avoid costly mistakes in transactions and financial analyses. Ensuring accuracy is critical in the convertible bond market, where small errors can have significant implications.

How to show it: Highlight your attention to detail by mentioning processes you implemented to ensure accuracy in trading or reporting. Quantify your achievements, such as reducing errors or discrepancies in financial documentation.

Emotional Intelligence

Emotional intelligence allows traders to manage their emotions and understand others' feelings, which is critical during high-pressure trading situations. This skill helps in building rapport with clients and colleagues.

How to show it: Provide examples of how your emotional intelligence positively impacted client relationships or team dynamics. Share specific outcomes, such as improved client retention or enhanced team collaboration.

Negotiation Skills

Negotiation skills are crucial for securing favorable terms in bond deals and managing client expectations. A Convertible Bond Trader must effectively negotiate to enhance profitability.

How to show it: Highlight successful negotiations on your resume by showcasing deals you facilitated that resulted in better terms or pricing. Quantify the benefits gained from your negotiation efforts.

Networking Abilities

Networking abilities are important for establishing and maintaining relationships in the financial industry. For a Convertible Bond Trader, a strong network can lead to valuable insights and business opportunities.

How to show it: Demonstrate your networking skills by mentioning professional relationships or partnerships that enhanced your trading capabilities or client base. Use metrics to illustrate the growth in your professional network.

Resilience

Resilience enables traders to cope with setbacks and maintain performance under pressure. The

Best Convertible Bond Trader Technical Skills

Technical skills are essential for a Convertible Bond Trader as they directly impact decision-making, risk management, and overall trading performance. Proficiency in these areas enables traders to analyze complex financial instruments, optimize trading strategies, and achieve superior results in a competitive market.

Financial Modeling

Financial modeling involves creating representations of a company's financial performance to forecast future earnings. This skill is crucial for assessing the value of convertible bonds and predicting their price movements.

How to show it: Include specific models you've developed, such as DCF or scenario analyses, and quantify the impact of these models on trading outcomes, e.g., "Developed financial models that improved valuation accuracy by 20%."

Risk Analysis

Risk analysis is the process of identifying and evaluating the potential risks involved in investment decisions. For a Convertible Bond Trader, understanding market volatility and credit risk is essential to protect investments.

How to show it: Demonstrate your risk management strategies by providing data, such as "Reduced portfolio risk by 15% through comprehensive risk assessments and implementing hedging techniques."

Market Analysis

Market analysis involves studying market trends, economic indicators, and competitor behavior to make informed trading decisions. This skill is vital for anticipating market movements and identifying profitable opportunities in convertible bonds.

How to show it: Highlight your analysis by stating, "Conducted market analyses that identified undervalued bonds, resulting in a 25% increase in trade profitability over six months."

Quantitative Analysis

Quantitative analysis refers to the use of mathematical and statistical methods to evaluate investment opportunities. This skill assists Convertible Bond Traders in pricing bonds accurately and assessing their risk-return profile.

How to show it: Quantify your contributions, such as "Utilized quantitative models to enhance pricing accuracy, leading to a 30% decrease in mispriced trades."

Technical Analysis

Technical analysis involves analyzing price charts and trading volumes to predict future price movements. This skill helps traders identify entry and exit points for convertible bond trades.

How to show it: Provide metrics, such as "Implemented technical analysis strategies that improved timing on trades, resulting in a 40% increase in successful trades."

Portfolio Management

Portfolio management is the art of managing a collection of investments to maximize returns based on risk tolerance. For a Convertible Bond Trader, effective portfolio management ensures balanced exposure to various asset classes.

How to show it: Share results like, "Managed a diversified portfolio that outperformed benchmarks by 10% through strategic asset allocation and regular rebalancing."

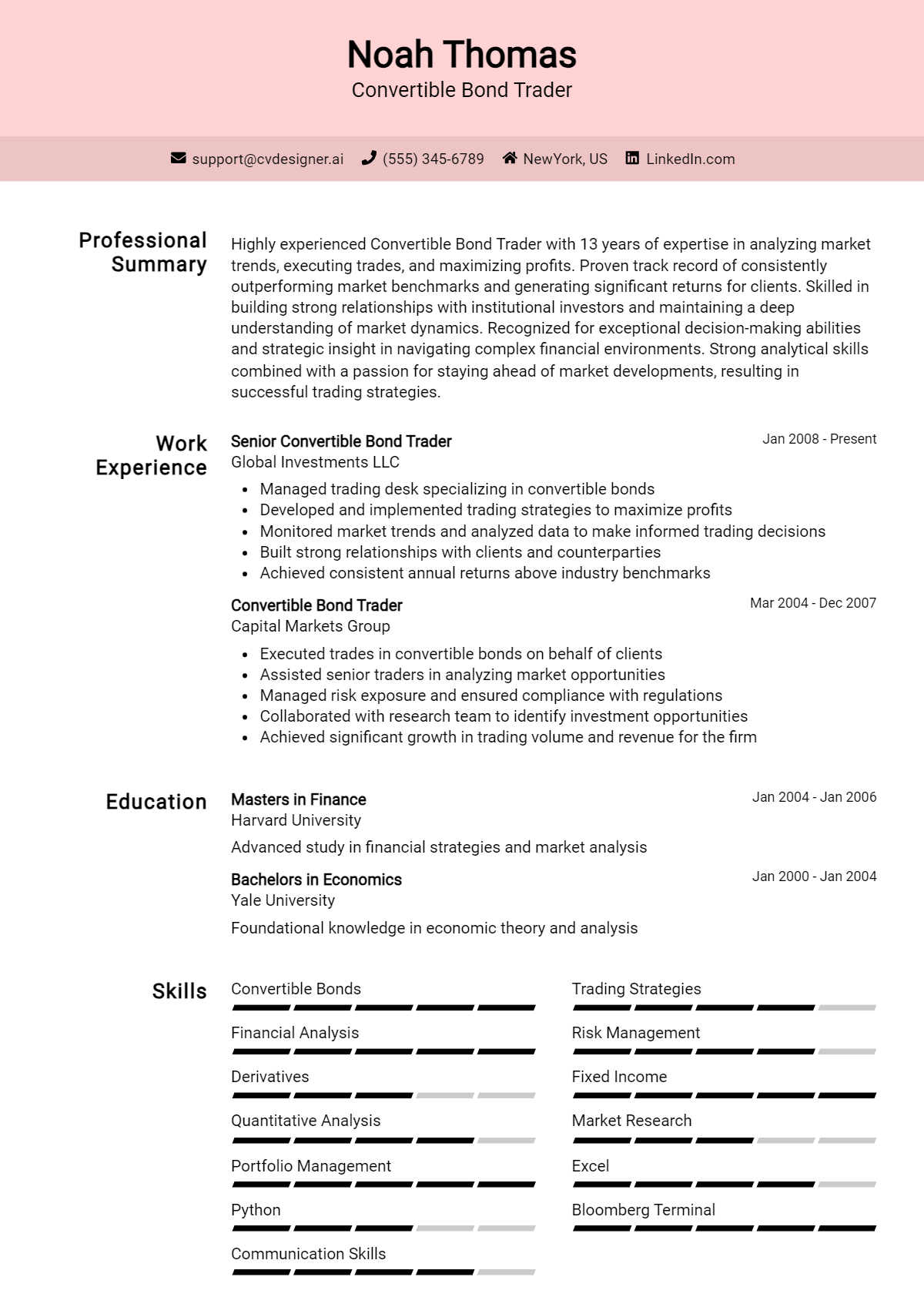

How to List Convertible Bond Trader Skills on Your Resume

Effectively listing your skills on a resume is crucial to stand out to potential employers. Highlighting your qualifications in a clear and compelling manner can capture hiring managers' attention quickly. There are three main sections where you can emphasize your skills: Resume Introduction, Work Experience, and Skills Section.

for Summary

Showcasing your Convertible Bond Trader skills in the introduction (objective or summary) section gives hiring managers a quick overview of your qualifications and expertise in the field.

Example

As a highly analytical Convertible Bond Trader, I leverage my market analysis and risk management skills to drive investment strategies that enhance portfolio performance.

for Work Experience

The work experience section provides the perfect opportunity to demonstrate how your Convertible Bond Trader skills have been applied in real-world scenarios. Use this section to match your experience with the specific skills mentioned in job listings.

Example

- Executed trades in convertible bonds, utilizing strong analytical skills to evaluate market conditions.

- Developed risk assessment models that improved portfolio management efficiency by 20%.

- Collaborated with cross-functional teams to align trading strategies with market trends.

- Maintained comprehensive knowledge of financial instruments to enhance trading decisions.

for Skills

The skills section can showcase both technical and transferable skills. It is essential to include a balanced mix of hard and soft skills that strengthen your overall qualifications.

Example

- Market Analysis

- Risk Management

- Financial Modeling

- Trade Execution

- Portfolio Optimization

- Communication Skills

- Attention to Detail

for Cover Letter

A cover letter allows you to expand on the skills mentioned in your resume, providing a more personal touch. Highlighting 2-3 key skills that align with the job description can demonstrate how those skills have positively impacted your previous roles.

Example

In my previous role, my risk management skills led to a 15% reduction in potential losses, while my market analysis expertise enabled me to identify lucrative trading opportunities. I look forward to bringing these strengths to your team.

Linking the skills mentioned in your resume to specific achievements in your cover letter reinforces your qualifications for the job. For more information on how to effectively showcase your skills and work experience, refer to the provided resources.

The Importance of Convertible Bond Trader Resume Skills

In the competitive field of finance, particularly for the role of a Convertible Bond Trader, highlighting relevant skills on a resume is crucial. A well-crafted skills section not only showcases a candidate's qualifications but also aligns closely with the specific requirements of the job. This targeted approach helps candidates stand out to recruiters, demonstrating their suitability for the role and increasing their chances of being selected for interviews.

- Convertible Bond Trading requires a deep understanding of both equity and fixed income markets. Highlighting skills in these areas shows potential employers that you possess the knowledge needed to navigate complex trading strategies.

- Strong analytical skills are essential for assessing market trends and pricing models. By emphasizing your proficiency in data analysis and financial modeling, you convey your ability to make informed trading decisions that can significantly impact profitability.

- Risk management is a critical component of trading convertible bonds. Showcasing skills in risk assessment and mitigation strategies signals to employers that you can effectively manage exposure and protect the firm’s investments.

- Communication skills are vital for collaborating with teams and conveying trading strategies to stakeholders. Demonstrating your ability to articulate complex financial concepts clearly can set you apart as a candidate who can operate effectively in a team-oriented environment.

- Proficiency in trading software and platforms is a must for any trader. By listing relevant technical skills, you provide evidence of your capability to leverage technology in executing trades efficiently.

- Understanding regulatory environments and compliance standards is crucial in finance roles. Including skills related to regulatory knowledge shows employers that you are aware of the legal frameworks governing trading activities.

- The ability to adapt to rapidly changing market conditions is essential for a successful trader. Highlighting your flexibility and problem-solving skills indicates to recruiters that you can thrive in high-pressure situations.

- Networking and relationship-building are important for sourcing deals and insights. Demonstrating interpersonal skills can enhance your profile, showcasing your ability to cultivate valuable connections in the finance industry.

For more information on how to create an effective resume, visit this link.

How To Improve Convertible Bond Trader Resume Skills

In the dynamic world of finance, particularly in trading, it's crucial for a Convertible Bond Trader to continuously enhance their skills. The market is ever-evolving, and staying updated with the latest trends, strategies, and technologies can significantly impact trading performance and career advancement. By actively improving skills, traders can better navigate complex market conditions and make informed decisions that maximize returns.

- Stay informed on market trends by regularly reading financial news, reports, and research papers related to convertible bonds and fixed-income securities.

- Participate in online courses or workshops focused on advanced trading strategies, quantitative analysis, and risk management in convertible bonds.

- Network with industry professionals through conferences, seminars, and online forums to exchange insights and learn from their experiences.

- Utilize trading simulation software to practice and refine trading strategies in a risk-free environment.

- Enhance analytical skills by studying financial modeling techniques and mastering tools like Excel, Bloomberg, or Python for data analysis.

- Engage in self-reflection and seek feedback from peers or mentors to identify areas for improvement and set specific skill enhancement goals.

- Read books and publications authored by experts in fixed-income trading to gain diverse perspectives and deepen your understanding of the market.

Frequently Asked Questions

What key skills should a Convertible Bond Trader highlight on their resume?

A Convertible Bond Trader should emphasize skills such as financial analysis, risk management, and market research. Proficiency in quantitative analysis and familiarity with financial modeling tools are essential. Additionally, showcasing knowledge of convertible securities, interest rate dynamics, and macroeconomic indicators will strengthen the resume.

How important is experience with trading platforms for a Convertible Bond Trader?

Experience with trading platforms is crucial for a Convertible Bond Trader as it allows for efficient execution of trades and real-time market analysis. Familiarity with specific platforms like Bloomberg or Eikon can set a candidate apart. Highlighting experience with algorithmic trading and automated systems can also demonstrate technical proficiency in managing complex trades.

What role does communication play in the job of a Convertible Bond Trader?

Effective communication is vital for a Convertible Bond Trader, as they must collaborate with other traders, analysts, and stakeholders. Clear articulation of trading strategies, market insights, and risk assessments ensures cohesive decision-making. Strong negotiation skills are also important for executing trades and managing relationships with clients and counterparties.

How can a Convertible Bond Trader demonstrate their analytical abilities on a resume?

To demonstrate analytical abilities, a Convertible Bond Trader can include examples of past projects or roles where they performed quantitative analysis, developed trading strategies, or assessed market conditions. Highlighting specific metrics, such as return on investment (ROI) or risk-adjusted returns, can provide tangible evidence of their analytical capabilities.

What additional qualifications can enhance a Convertible Bond Trader's resume?

Additional qualifications such as a CFA (Chartered Financial Analyst) designation or relevant certifications in fixed income and derivatives can enhance a Convertible Bond Trader's resume. Courses in advanced finance, quantitative methods, or financial engineering can also be beneficial. Continuous education in market trends and regulatory changes demonstrates a commitment to professional growth and adaptability.

Conclusion

Including Convertible Bond Trader skills in your resume is essential for demonstrating your expertise and proficiency in this specialized field. Showcasing relevant skills not only helps candidates stand out in a competitive job market but also presents significant value to potential employers who are seeking individuals capable of navigating complex financial instruments. As you refine your skills and enhance your resume, remember that each improvement not only strengthens your application but also boosts your confidence in pursuing your career goals. Take the time to explore our resume templates, resume builder, resume examples, and cover letter templates to elevate your job application and open doors to exciting opportunities.

Use an AI-powered resume builder and have your resume done in 5 minutes. Just select your template and our software will guide you through the process.