Top 29 Hard and Soft Skills for 2025 Arbitrage Trader Resumes

As an arbitrage trader, possessing a diverse set of skills is crucial for identifying and capitalizing on price discrepancies across various markets. Whether you are trading stocks, currencies, or commodities, the ability to analyze data, manage risks, and execute trades swiftly can significantly enhance your performance. In this section, we will explore the top skills that can help you stand out as an arbitrage trader and improve your chances of success in this competitive field.

Best Arbitrage Trader Technical Skills

Technical skills are crucial for an Arbitrage Trader as they enhance decision-making, improve efficiency, and increase the potential for profit. In a fast-paced trading environment, having a strong foundation in relevant technical skills can set you apart from other candidates and demonstrate your ability to leverage data for strategic trading decisions.

Data Analysis

Data analysis involves interpreting complex datasets to identify patterns and trends that can inform trading strategies. This skill is vital for recognizing arbitrage opportunities.

How to show it: Highlight specific tools you used (e.g., Excel, Python, R) and mention any successful trades that were based on data analysis, including percentages or dollar amounts gained.

Statistical Modeling

Statistical modeling helps in predicting market movements and assessing risks. This skill is essential for developing strategies that capitalize on price discrepancies.

How to show it: Provide examples of models you created, the accuracy of your predictions, and how they directly impacted your trading results.

Algorithm Development

Developing algorithms allows traders to automate their strategies, ensuring faster execution and minimizing emotional decision-making.

How to show it: Detail any algorithms you have built, the programming languages used, and the performance improvements they achieved, such as reduced execution time or increased trade volume.

Risk Management

Risk management involves identifying, analyzing, and mitigating potential losses in trading. This skill is critical for maintaining profitability over time.

How to show it: Quantify your risk management strategies by discussing how you minimized losses during volatile periods or maintained a favorable risk-reward ratio in your trades.

Market Research

Conducting thorough market research is essential for making informed trading decisions. This includes understanding market trends, news, and economic indicators.

How to show it: Include specific instances where your research led to profitable trades and how your insights compared to market movements.

Technical Analysis

Technical analysis involves evaluating securities by analyzing statistics generated by market activity, such as past prices and volume. It is a key tool for traders to forecast future price movements.

How to show it: Discuss your familiarity with technical indicators (like moving averages or RSI) and how they guided your trading decisions, backed by successful outcomes.

Financial Modeling

Financial modeling is the process of creating a representation of a trader’s financial performance and forecasting future performance based on historical data.

How to show it: Share examples of financial models you built, their purpose, and how they contributed to your trading strategy and success.

Execution Strategy

Having a solid execution strategy ensures trades are executed at the most favorable prices, which is crucial for arbitrage trading.

How to show it: Quantify the efficiency of your execution strategies by detailing improvements in trade completion times or cost savings achieved through careful planning.

Programming Skills

Programming skills in languages like Python, C++, or Java are essential for automating trading strategies and analyzing large datasets.

How to show it: List programming languages you are proficient in and describe specific projects or systems you developed that improved trading processes or analysis.

Networking Knowledge

Understanding network protocols and systems can enhance trading performance, especially in high-frequency trading environments.

How to show it: Explain how your knowledge of networking has improved trade execution speed or reduced latency, providing concrete examples of performance boosts.

Regulatory Compliance

Knowledge of regulatory compliance is essential for ensuring that trading practices adhere to legal standards, which can prevent costly fines and reputational damage.

How to show it: Demonstrate your understanding of relevant regulations and how you implemented compliance measures in your trading strategies, possibly including any audits passed.

Best Arbitrage Trader Soft Skills

In the fast-paced and dynamic environment of trading, soft skills play a critical role in ensuring success. For an Arbitrage Trader, being equipped with the right soft skills not only enhances decision-making but also fosters effective communication and strategic thinking. Here are some essential soft skills that can set you apart in this competitive field.

Analytical Thinking

This skill involves the ability to analyze data and trends to make informed trading decisions. An Arbitrage Trader must quickly assess market conditions and identify profitable opportunities.

How to show it: Highlight your experience with data analysis tools or techniques you've used in trading. Quantify your results, such as how your analytical approach led to increased profits or reduced risks.

Attention to Detail

Being detail-oriented is crucial in trading, where even minor discrepancies can lead to significant financial losses. This skill helps ensure accuracy in trades and strategy execution.

How to show it: Provide examples of how your attention to detail has prevented errors in past trading activities. Mention specific instances where your meticulousness led to successful outcomes.

Communication Skills

Effective communication is essential for collaborating with team members and stakeholders. An Arbitrage Trader must clearly articulate strategies and market insights.

How to show it: Include examples of presentations, reports, or meetings where your communication skills made a difference. Quantify the impact of your communication on team performance or decision-making.

Adaptability

The financial markets are constantly changing, and an Arbitrage Trader must be able to adapt quickly to new information and market conditions.

How to show it: Describe situations where you successfully adapted your trading strategies in response to market shifts. Highlight any quick-thinking decisions that led to profitable trades.

Problem-Solving Skills

An Arbitrage Trader often faces unexpected challenges and must devise effective solutions promptly. Strong problem-solving skills are vital for overcoming obstacles and seizing opportunities.

How to show it: Share specific examples of challenges you faced in trading and the innovative solutions you implemented. Quantify your achievements to showcase your problem-solving effectiveness.

Time Management

Time management is essential in trading, where timing can significantly affect outcomes. An Arbitrage Trader must prioritize tasks efficiently to maximize trading opportunities.

How to show it: Illustrate how you manage competing priorities and deadlines in your trading activities. Mention any tools or techniques you use to enhance your time management skills.

Emotional Intelligence

Emotional intelligence enables traders to manage their emotions and understand the emotional states of others, which can be crucial in high-stress trading environments.

How to show it: Provide examples of how your emotional intelligence helped you maintain composure during volatile market conditions or improved team dynamics. Quantify any positive outcomes resulting from your emotional awareness.

Negotiation Skills

Strong negotiation skills can lead to better trading terms and favorable deals. An Arbitrage Trader must often negotiate with brokers and other stakeholders.

How to show it: Detail your experiences in negotiating trading terms or partnerships. Highlight successful outcomes, including any financial benefits achieved through your negotiation efforts.

Critical Thinking

Critical thinking allows traders to evaluate information objectively and make reasoned judgments. This skill is vital for assessing risks and opportunities in trading.

How to show it: Share examples of how critical thinking led to insightful market assessments or strategic decisions. Quantify the impact of these decisions on your trading performance.

Team Collaboration

While trading can often be an individual endeavor, teamwork is essential in many environments. Collaborating effectively with colleagues can lead to shared insights and improved strategies.

How to show it: Discuss your role in team projects or trading groups. Highlight the outcomes of collaborative efforts and any leadership roles you undertook.

Resilience

Resilience is the ability to bounce back from setbacks and maintain focus. The trading world can be unpredictable, and resilience helps traders stay committed to their strategies.

How to show it: Provide examples of past trading failures and how you recovered from them. Highlight any lessons learned and subsequent successes that demonstrate your resilience.

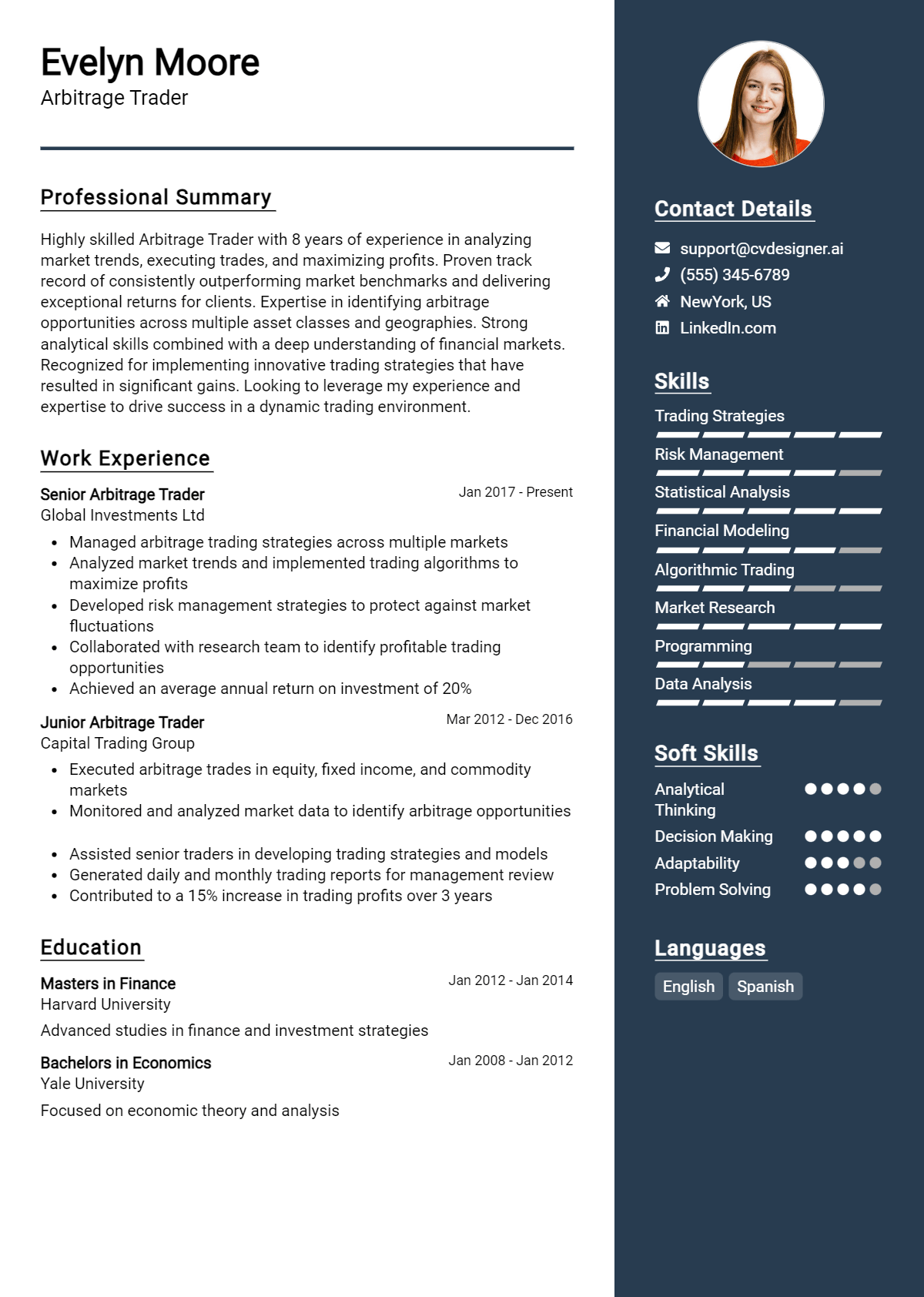

How to List Arbitrage Trader Skills on Your Resume

Effectively listing your skills on a resume is crucial to standing out to potential employers. Highlighting your skills can provide immediate insight into your qualifications and suitability for the role. There are three main sections where skills can be emphasized: Resume Introduction, Work Experience, and Skills Section.

for Summary

Showcasing Arbitrage Trader skills in the introduction (objective or summary) section gives hiring managers a quick overview of your qualifications and sets a strong tone for the rest of your resume.

Example

Dynamic Arbitrage Trader with expertise in market analysis, risk management, and portfolio optimization. Proven track record of identifying profitable trading opportunities and executing strategies that yield significant returns.

for Work Experience

The work experience section provides the perfect opportunity to demonstrate how Arbitrage Trader skills have been applied in real-world scenarios, showcasing your impact and effectiveness in previous roles.

Example

- Executed high-frequency trading strategies, utilizing quantitative analysis to maximize profits and minimize risk.

- Collaborated with cross-functional teams to enhance trading algorithms, resulting in a 30% increase in efficiency.

- Monitored market trends and indicators, employing strategic decision-making to identify and capitalize on arbitrage opportunities.

- Maintained compliance with trading regulations, demonstrating a strong understanding of financial markets and risk management principles.

for Skills

The skills section can showcase either technical or transferable skills. It's essential to include a balanced mix of hard and soft skills to strengthen your qualifications.

Example

- Advanced Quantitative Analysis

- Risk Management

- Market Research

- Financial Modeling

- Data Interpretation

- Strategic Planning

- Negotiation Skills

- Attention to Detail

for Cover Letter

A cover letter allows candidates to expand on the skills mentioned in the resume and provide a more personal touch. Highlighting 2-3 key skills that align with the job description can demonstrate your fit for the role and show how those skills have positively impacted your previous positions.

Example

In my previous role, my proficiency in quantitative analysis and risk management led to a 40% increase in trading efficiency. By leveraging these skills, I successfully identified and executed profitable arbitrage opportunities, which directly contributed to a substantial revenue increase for my team.

Linking the skills mentioned in your resume to specific achievements in your cover letter reinforces your qualifications for the job and makes a compelling case for your candidacy.

The Importance of Arbitrage Trader Resume Skills

In the competitive field of arbitrage trading, showcasing relevant skills on your resume is crucial for capturing the attention of recruiters. A well-crafted skills section not only highlights your qualifications but also demonstrates your alignment with the specific requirements of the role. By effectively communicating your expertise, you can significantly improve your chances of landing an interview and advancing your trading career.

- Demonstrates Technical Proficiency: Highlighting skills such as statistical analysis, programming languages, or financial modeling showcases your technical capabilities, which are essential for success in arbitrage trading.

- Indicates Strong Analytical Skills: Emphasizing your analytical skills signals to employers that you can effectively interpret data, identify market inefficiencies, and make informed trading decisions.

- Illustrates Risk Management Expertise: A solid understanding of risk management techniques is vital for arbitrage traders. Highlighting this skill shows your ability to minimize losses while maximizing profits.

- Reflects Knowledge of Market Dynamics: Skills related to market analysis and awareness of economic indicators demonstrate that you have a comprehensive understanding of market movements, which is critical for successful trading.

- Conveys Attention to Detail: Arbitrage trading requires precision and meticulousness. By showcasing your attention to detail, you assure recruiters of your capability to execute trades accurately.

- Highlights Adaptability and Problem-Solving: The financial markets are constantly changing. Emphasizing your adaptability and problem-solving skills indicates your readiness to navigate challenges in real-time.

- Showcases Communication Skills: Effective communication is key in trading environments, especially when collaborating with teams or presenting findings. Highlighting this skill demonstrates your ability to articulate complex concepts clearly.

- Reinforces Commitment to Continuous Learning: The trading landscape is ever-evolving. Showcasing skills related to continuous education or self-improvement reflects your dedication to staying current in the field.

How To Improve Arbitrage Trader Resume Skills

In the fast-paced world of trading, particularly in arbitrage, it's essential to continuously enhance your skill set to remain competitive and effective. As market conditions evolve and new technologies emerge, staying updated with the latest strategies and tools can significantly impact your success. Here are some actionable tips to help you improve your skills as an arbitrage trader:

- Engage in continuous education through online courses or certifications focused on trading strategies and financial analysis.

- Stay informed about market trends and economic news by following finance-related news outlets and publications.

- Practice risk management techniques to better understand and mitigate potential losses in trades.

- Utilize trading simulators to refine your strategies without the risk of losing capital.

- Network with other traders and join trading forums to exchange insights and experiences.

- Analyze your past trades to identify patterns, mistakes, and areas for improvement.

- Invest time in learning about algorithmic trading and how technology can enhance your arbitrage strategies.

Frequently Asked Questions

What are the essential skills needed for an arbitrage trader?

An arbitrage trader needs a strong foundation in analytical skills, quantitative methods, and financial principles. Proficiency in data analysis tools, programming languages like Python or R, and a deep understanding of market dynamics are crucial. Additionally, effective risk management skills and the ability to make quick decisions under pressure can significantly enhance an arbitrage trader's performance.

How important is programming knowledge for an arbitrage trader?

Programming knowledge is vital for an arbitrage trader, as it allows for automation of trading strategies and analysis of large datasets. Familiarity with languages such as Python, C++, or Java can aid in developing algorithms that can execute trades faster than human intervention, providing a competitive edge in the market.

What role does risk management play in arbitrage trading?

Risk management is a fundamental aspect of arbitrage trading, as it helps traders identify, assess, and mitigate potential losses. Effective risk management strategies, such as setting stop-loss orders and diversifying trades, can protect traders from unexpected market fluctuations and ensure long-term profitability.

How can an arbitrage trader demonstrate their skills on a resume?

An arbitrage trader can showcase their skills on a resume by highlighting relevant experience, including successful trading strategies and outcomes. Additionally, they should list technical skills such as proficiency in trading platforms, data analysis software, and programming languages. Certifications in finance or quantitative analysis can also add credibility to their skill set.

What educational background is beneficial for an arbitrage trader?

A strong educational background in finance, economics, mathematics, or computer science is beneficial for an arbitrage trader. Advanced degrees, such as a Master's in Finance or an MBA, can provide deeper insights into market behavior and trading strategies. Furthermore, courses in statistics and data analysis can enhance their analytical capabilities, making them more effective in their trading activities.

Conclusion

Incorporating the skills of an Arbitrage Trader in your resume is crucial for standing out in a competitive job market. Highlighting relevant skills such as risk assessment, analytical thinking, and market research not only showcases your expertise but also demonstrates the value you can bring to potential employers. By effectively presenting these capabilities, you increase your chances of making a lasting impression.

As you prepare your job application, take the time to refine your skills and tailor your resume accordingly. Remember, a well-crafted resume can be your ticket to landing your dream job. For more resources, check out our resume templates, utilize our resume builder, explore resume examples, and don’t forget to create an impactful cover letter with our cover letter templates. Keep pushing forward, and good luck on your job search journey!

Use an AI-powered resume builder and have your resume done in 5 minutes. Just select your template and our software will guide you through the process.