30 Accounts Receivable Specialist Skills for Your Resume: List Examples

As an Accounts Receivable Specialist, possessing the right skills is crucial for effectively managing and optimizing the cash flow of a business. This role requires a blend of financial acumen, attention to detail, and strong communication abilities to ensure timely collections and maintain positive client relationships. In the following section, we will highlight the top skills that are essential for success in this position, enabling you to create a compelling resume that stands out to potential employers.

Best Accounts Receivable Specialist Technical Skills

Technical skills are crucial for an Accounts Receivable Specialist as they enhance efficiency, accuracy, and overall financial management. Proficiency in these skills not only helps streamline processes but also ensures timely collections and effective communication with clients.

Accounting Software Proficiency

Being adept at accounting software such as QuickBooks, SAP, or Oracle is essential for managing accounts receivable efficiently. This skill allows specialists to track invoices, payments, and customer accounts accurately.

How to show it: List specific software you have used, emphasizing your proficiency level and any certifications. Mention how your expertise led to faster invoice processing times or reduced errors.

Data Entry Accuracy

High data entry accuracy is critical in maintaining precise financial records. This skill ensures that all transactions are recorded correctly, minimizing discrepancies and facilitating smooth audits.

How to show it: Quantify your accuracy rate, for example, "achieved 99% accuracy in data entry," and describe how this contributed to the overall efficiency of the accounts receivable process.

Excel Proficiency

Excel skills are vital for data analysis and reporting. Accounts Receivable Specialists use Excel for creating pivot tables, performing VLOOKUPs, and generating financial reports to analyze trends.

How to show it: Detail specific functions you are familiar with and provide examples of how you used Excel to improve reporting efficiency or track collections.

Customer Relationship Management (CRM) Systems

Familiarity with CRM systems enhances customer interactions and helps in managing follow-ups on outstanding invoices. This skill is essential for maintaining positive relationships with clients while ensuring timely payments.

How to show it: Highlight your experience with particular CRM tools, mentioning how you utilized them to improve customer follow-up processes or increase collection rates.

Financial Reporting Skills

Strong financial reporting skills are necessary for preparing and analyzing accounts receivable reports, which provide insights into cash flow and outstanding debts.

How to show it: Indicate your experience in preparing reports, focusing on any improvements in cash flow or reductions in overdue accounts you helped achieve through your reporting.

Invoicing and Billing Knowledge

Understanding the invoicing process is key for timely billing and collections. This includes knowledge of invoice generation, payment terms, and compliance with legal requirements.

How to show it: Discuss your experience in managing invoicing processes and any initiatives you took that led to a decrease in days sales outstanding (DSO).

Regulatory Compliance Knowledge

Knowledge of relevant accounting regulations and compliance standards is essential to ensure that all accounts receivable processes adhere to legal requirements.

How to show it: Mention any specific regulations you are familiar with and how your adherence to compliance has protected your organization from potential risks.

Communication Skills

Effective communication is critical for negotiating payment terms and resolving disputes with clients. This skill helps in building rapport and ensuring clear understanding of payment expectations.

How to show it: Provide examples of successful negotiations or resolutions you've handled, showcasing how your communication skills contributed to successful outcomes.

Analytical Skills

Strong analytical skills enable Accounts Receivable Specialists to assess financial data, identify trends, and make informed decisions regarding collections and credit management.

How to show it: Describe situations where your analytical skills led to identifying issues or opportunities that resulted in improved collection rates or reduced credit risk.

Problem-Solving Skills

Problem-solving skills are essential for addressing payment disputes and finding solutions that satisfy both the organization and the client, facilitating smoother transactions.

How to show it: Illustrate specific examples of challenges you faced and how your problem-solving abilities led to positive outcomes, such as recovering overdue payments.

Best Accounts Receivable Specialist Soft Skills

Soft skills are vital for an Accounts Receivable Specialist as they enhance interpersonal relationships, improve communication, and foster a collaborative work environment. These skills complement technical abilities and are essential for effectively managing client interactions, resolving disputes, and ensuring timely payments. Below are some of the top soft skills that can make a significant difference in this role.

Communication Skills

Effective communication is crucial for conveying information clearly to clients and team members. An Accounts Receivable Specialist must articulate payment terms, follow up on outstanding invoices, and negotiate payment plans.

How to show it: Highlight your experience in managing client communications. Use metrics to showcase the number of accounts you managed or resolved through effective communication strategies.

Problem-Solving Skills

Accounts Receivable Specialists often face discrepancies and payment issues. Strong problem-solving skills enable them to identify the root cause and implement effective solutions.

How to show it: Provide examples of specific challenges you encountered and the steps you took to resolve them, emphasizing positive outcomes and any improvements made to processes.

Attention to Detail

Accuracy is paramount in accounts receivable. Attention to detail helps in ensuring that invoices are correct, payments are processed accurately, and records are kept up-to-date.

How to show it: Demonstrate how your meticulous nature led to fewer errors in invoicing or improved reconciliation processes, ideally quantifying your impact.

Time Management

Managing multiple accounts and deadlines requires excellent time management. An effective Accounts Receivable Specialist must prioritize tasks to ensure timely collections and reporting.

How to show it: Share examples of how you successfully managed multiple deadlines or prioritized tasks to meet collection goals, including any specific timeframes.

Negotiation Skills

Negotiating payment terms and resolving disputes amicably is a key responsibility. Strong negotiation skills can lead to better payment arrangements and client relationships.

How to show it: Include instances where you successfully negotiated payment terms or resolved disputes, highlighting the outcomes and improvements in cash flow.

Interpersonal Skills

Building and maintaining positive relationships with clients and colleagues is essential. Good interpersonal skills foster trust and collaboration.

How to show it: Provide examples of successful collaborations with clients or coworkers that resulted in positive outcomes or enhanced team dynamics.

Adaptability

The ability to adapt to changes in policies, technology, or client needs is crucial for success in this role.

How to show it: Illustrate your experiences in adapting to new systems or processes, including how you effectively managed transitions.

Analytical Thinking

Analytical skills help in assessing financial data and identifying trends that can inform collection strategies.

How to show it: Demonstrate how your analytical abilities contributed to improved collections or better forecasting, using specific data points or outcomes.

Customer Service Orientation

A strong customer service orientation ensures that clients feel valued and understood, which can facilitate timely payments.

How to show it: Provide examples of how you went above and beyond in customer service, leading to enhanced client satisfaction and loyalty.

Team Collaboration

Working effectively with colleagues in finance, sales, and customer service is essential for resolving issues and improving cash flow.

How to show it: Share specific instances of teamwork that resulted in successful projects or problem resolutions, highlighting your role in the collaboration.

Conflict Resolution

The ability to manage and resolve conflicts can lead to better relationships with clients and smoother operations.

How to show it: Discuss experiences where you successfully navigated conflicts, detailing the strategies you used and the outcomes achieved.

How to List Accounts Receivable Specialist Skills on Your Resume

Effectively listing your skills on a resume is crucial for standing out to potential employers. A clear presentation of your qualifications can make a significant difference in catching the hiring manager's attention. There are three main sections where you can highlight your skills: the Resume Introduction, Work Experience, and Skills Section.

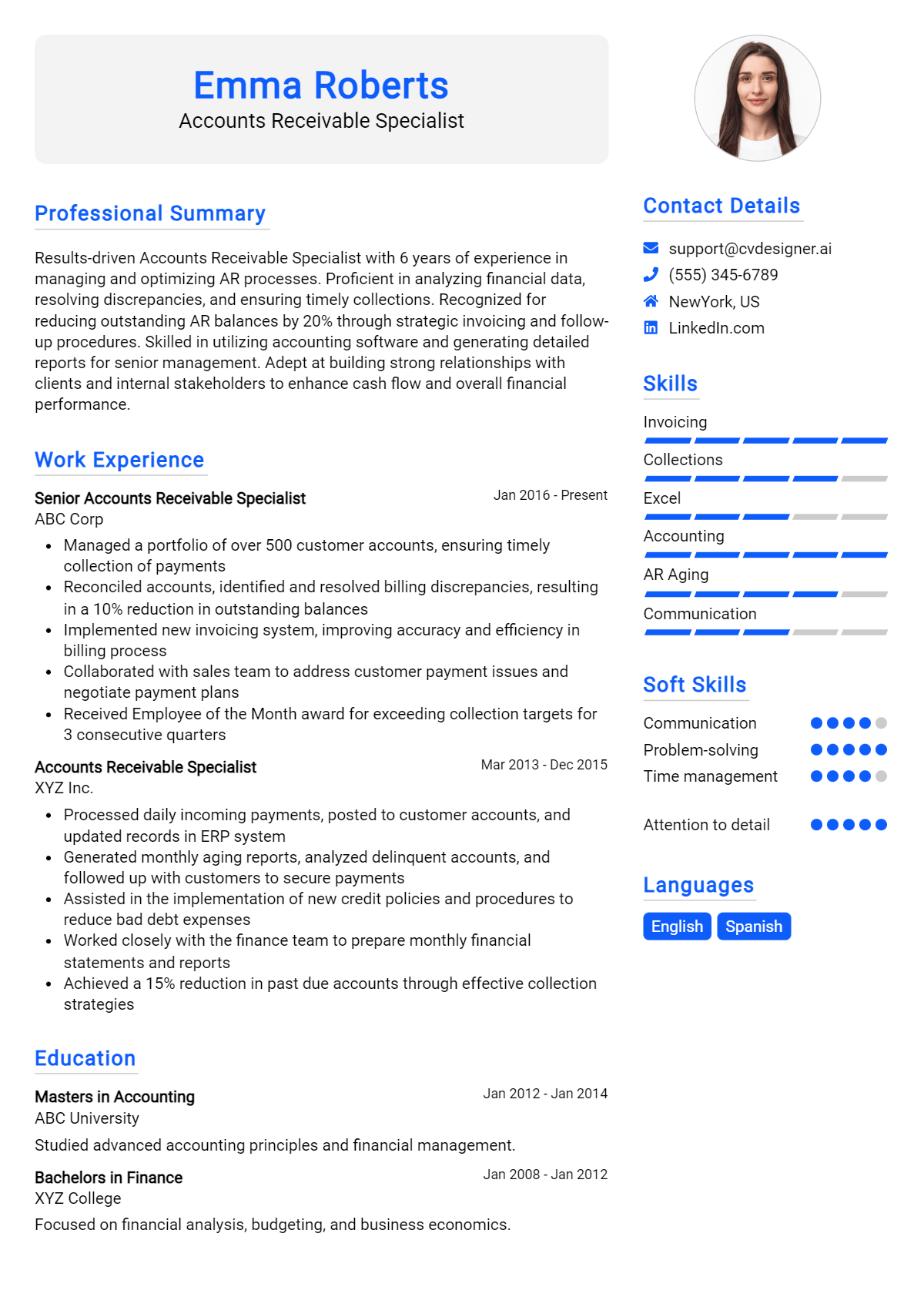

for Summary

Showcasing your Accounts Receivable Specialist skills in the introduction section gives hiring managers a quick overview of your qualifications. This allows you to make a strong first impression.

Example

Results-driven Accounts Receivable Specialist with expertise in invoice processing, collections management, and financial reporting. Proven ability to enhance cash flow and maintain accurate records.

for Work Experience

The work experience section provides the perfect opportunity to demonstrate how your Accounts Receivable Specialist skills have been applied in real-world scenarios. Tailoring your experience to match the job listing will enhance your appeal.

Example

- Managed end-to-end accounts receivable processes, ensuring timely invoicing and collections.

- Utilized strong analytical skills to identify discrepancies and resolve billing issues effectively.

- Collaborated with cross-functional teams to enhance cash flow through improved collection strategies.

- Developed and maintained financial reports to track receivables and assess performance metrics.

for Skills

The skills section can showcase both technical and transferable skills. It's important to include a balanced mix of hard and soft skills to present a well-rounded profile to potential employers.

Example

- Accounts Receivable Management

- Financial Reporting

- Collections Strategies

- Data Analysis

- Customer Relationship Management

- Attention to Detail

- Problem-Solving

- Communication Skills

for Cover Letter

A cover letter allows candidates to expand on the skills mentioned in their resume and provide a more personal touch. Highlighting 2-3 key skills that align with the job description can show how you can contribute to the organization's success.

Example

As an Accounts Receivable Specialist, my strong analytical skills and attention to detail have enabled me to optimize collections processes, resulting in a 20% reduction in overdue accounts. I am eager to bring this expertise to your team and contribute to your financial success.

The Importance of Accounts Receivable Specialist Resume Skills

Highlighting relevant skills in an Accounts Receivable Specialist resume is crucial for standing out in a competitive job market. A well-crafted skills section not only showcases a candidate's qualifications but also aligns their expertise with the specific requirements of the position. By effectively communicating their strengths, candidates can capture the attention of recruiters and increase their chances of securing an interview.

- Demonstrates Proficiency: A strong skills section reflects the candidate's proficiency in essential areas such as invoicing, collections, and payment processing, which are critical for the role.

- Aligns with Job Requirements: Tailoring skills to match the job description shows recruiters that the candidate understands the needs of the organization and possesses the necessary competencies.

- Enhances Credibility: Listing relevant skills enhances the candidate's credibility and reassures employers of their ability to perform effectively in the position.

- Facilitates Quick Assessments: Recruiters often scan resumes for key skills; a clear skills section allows for quick assessments, making it easier for them to identify qualified candidates.

- Highlights Technical Aptitude: In today's digital age, showcasing technical skills related to accounting software and financial systems can set candidates apart from others.

- Reflects Problem-Solving Abilities: Skills in conflict resolution and negotiation demonstrate a candidate's ability to handle challenges effectively, which is vital in accounts receivable roles.

- Indicates Attention to Detail: Including skills that highlight meticulousness and accuracy reassures employers that the candidate is capable of managing financial records with precision.

- Supports Career Progression: A well-defined skills section can also indicate the candidate's readiness for advancement within the field, showcasing their commitment to professional growth.

How To Improve Accounts Receivable Specialist Resume Skills

In the dynamic field of finance and accounting, continuously improving your skills as an Accounts Receivable Specialist is crucial for staying competitive and effective in your role. As businesses evolve, so do the tools and strategies used for managing accounts receivable. By enhancing your skill set, you not only increase your value to potential employers but also improve the efficiency and accuracy of your work.

- Stay updated on accounting software: Familiarize yourself with the latest accounting software and tools, such as QuickBooks, SAP, or Oracle, to enhance your efficiency in managing accounts.

- Enhance communication skills: Practice clear and professional communication to effectively follow up on outstanding invoices and resolve disputes with clients.

- Develop analytical skills: Improve your ability to analyze financial data and reports, which can help in identifying trends and making informed decisions.

- Learn about regulations and compliance: Stay informed about relevant laws and regulations affecting accounts receivable to ensure compliance and mitigate risks.

- Take courses in financial management: Consider enrolling in courses or workshops focused on financial management and accounting principles to broaden your knowledge base.

- Network with industry professionals: Join accounting associations or attend industry events to connect with other professionals and learn about best practices in accounts receivable.

- Seek feedback and mentorship: Regularly seek constructive feedback from supervisors or mentors to identify areas for improvement and develop a tailored growth plan.

Frequently Asked Questions

What are the essential skills needed for an Accounts Receivable Specialist?

An Accounts Receivable Specialist should possess strong organizational skills, attention to detail, and proficiency in accounting software. Additionally, effective communication skills are crucial for interacting with clients and resolving any discrepancies. Analytical abilities are also important for tracking payments and evaluating financial data to ensure timely collections.

How important is experience with accounting software for this role?

Experience with accounting software is vital for an Accounts Receivable Specialist, as it streamlines the tracking of invoices, payments, and customer accounts. Familiarity with programs like QuickBooks, SAP, or Oracle can significantly enhance efficiency and accuracy in managing accounts receivable processes, making it easier to generate reports and analyze financial data.

What role does communication play in this position?

Communication is a key skill for an Accounts Receivable Specialist, as they frequently interact with clients regarding payment inquiries and collection efforts. Clear and professional communication helps to build strong relationships with customers, facilitates the resolution of billing issues, and ultimately contributes to the timely collection of outstanding invoices.

Can you explain the importance of attention to detail in this role?

Attention to detail is critical for an Accounts Receivable Specialist because even minor errors in invoicing or payment processing can lead to significant financial discrepancies. A meticulous approach ensures that all transactions are accurately recorded, preventing issues that could result in delayed payments or customer disputes, thereby maintaining the integrity of the financial records.

What analytical skills should an Accounts Receivable Specialist have?

An Accounts Receivable Specialist should have strong analytical skills to assess payment trends, identify overdue accounts, and evaluate the overall effectiveness of the collections process. This involves using data analysis to make informed decisions, forecasting cash flow, and developing strategies to improve collection rates, which are essential for maintaining a healthy financial position for the organization.

Conclusion

Incorporating Accounts Receivable Specialist skills into your resume is crucial for showcasing your expertise and relevance in the field. By highlighting these skills, candidates can differentiate themselves from the competition and demonstrate the value they bring to potential employers. Remember, a well-crafted resume that reflects your capabilities can significantly increase your chances of landing that desired position.

As you refine your skills and craft your application, take advantage of resources such as our resume templates, resume builder, resume examples, and cover letter templates. Stay motivated and dedicated to enhancing your professional profile, and you will be well on your way to achieving your career goals!

Use an AI-powered resume builder and have your resume done in 5 minutes. Just select your template and our software will guide you through the process.